Most people recognize that a 401(k) is one of the very best retirement programs available. If your company offers one, you should definitely take advantage of it.It allows for more generous contributions than most other plans available to employees and often comes with an employer matching contribution. But what most people are less aware of is that there are 401(k) limits for highly compensated employees.

Understanding 401(k) Contribution Limits

Table of Contents

The main attraction of 401(k) plans is the amount you can contribute; for 2024, the contribution limit is $23,000. You can also make a “catch-up” contribution if you’re 50 or older. That adds another $8,000 to the contribution. If your employer has a matching contribution, it turns into a serious wealth accumulation scheme.

For example, let’s say you make the full $23,000 contribution. But you’re 50 years old, so you can add another $8,000. That’s $30,000 coming from you. Your employer has a 50% match and contributes another $11,250, and you’re already fully vested in the plan. That brings your total contribution for the full year up to $41,250.

That’s the kind of money that early retirement dreams are made of. It’s also why 401(k) plans are so popular.

Additional Limits for Highly Compensated Employees

As attractive as that looks, there are serious limits on the plan if you fall under the category of highly compensated employee, or “HCE” for short.The thresholds defining you as an HCE are probably lower than you think. I’m going to give the definition in the next section, but suffice it to say that if you fall into this category, your 401(k) plan suddenly isn’t as generous.

In the simplest terms, contributions made by HCEs can’t be excessive when compared to those of non-HCEs. For example, if the average plan contribution by non-HCEs is 4%, then the most an HCE can contribute is 6%. We’ll get into why that is in a bit.

But if you make $150,000 and you’re planning to max out your contribution at $23,000, you may find that you can only contribute $9,000. That’s 6% of your $150,000 salary. This is how the HCE provisions can limit 401(k) plan contributions by highly compensated employees.

The excess will be refunded to you and not retained within the plan. An important tax deduction will be lost. Here’s another little wrinkle: an HCE isn’t always obvious. The IRS has what’s known as family attribution, which means you can be determined to be an HCE by blood.

An employee who’s a spouse, child, grandparent, or parent of someone who is a 5% (or greater) owner of the business is automatically considered to be a 5% (or greater) owner. Let’s dig down a little deeper…

What Determines a Highly Compensated Employee?

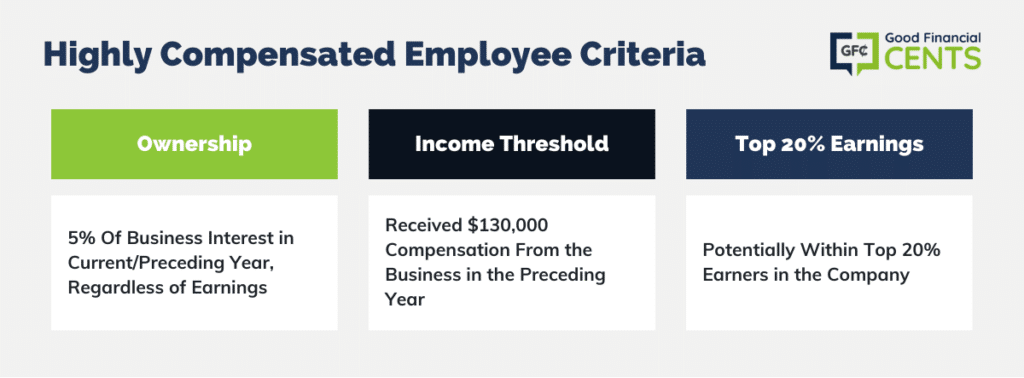

The IRS defines a highly compensated employee as one who…

- Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much compensation that person earned or received.

- For the preceding year, an employee received compensation from the business of more than $130,000, and, if the employer so chooses, was in the top 20% of employees when ranked by compensation.

Boiled down then, there are three numbers to be aware of:

- 5% (ownership),

- $130,000 (income), AND

- 20% (as in, you are among the 20% highest-paid people in your company).

Right away, I think I know what’s going through your mind: $130,000 is highly compensated?

I know, right? In much of the country, particularly the big coastal cities like New York and San Francisco, that’s barely enough to get by. But this is just where the IRS drew the line, and we’re stuck with it. If I were to guess, I’d say the base is probably a number set years ago, and it’s never been adequately updated.

The whole purpose of the highly compensated employee 401(k) (HCE 401(k)) is to prevent higher-paid workers from getting most of the benefit from employer-sponsored retirement plans. After all, the higher your income, the more you can pay into the retirement plan.

An employee being paid $150,000 per year can contribute a lot more than someone making $50,000. The IRS regulation is designed to reduce this imbalance.

Non-Discrimination Tests

I may be guilty of giving you more information here than you want to know. But this gets down to the mechanics of the whole HCE thing. If you’re an employee, you don’t have to worry about this – your employer will perform these tests.

But it might be important if you are the owner of a small business and need to actually perform the test yourself.

If you don’t have an appetite for the technical, feel free to skip over this section. To make sure all goes according to regulation, the IRS requires that employers perform non-discrimination tests annually. 401(k) plans must be tested to make sure the contributions made for lower-paid employees are “proportional” to those made for owners and managers who fit under the category of highly compensated employees.

ADP and ACP Tests

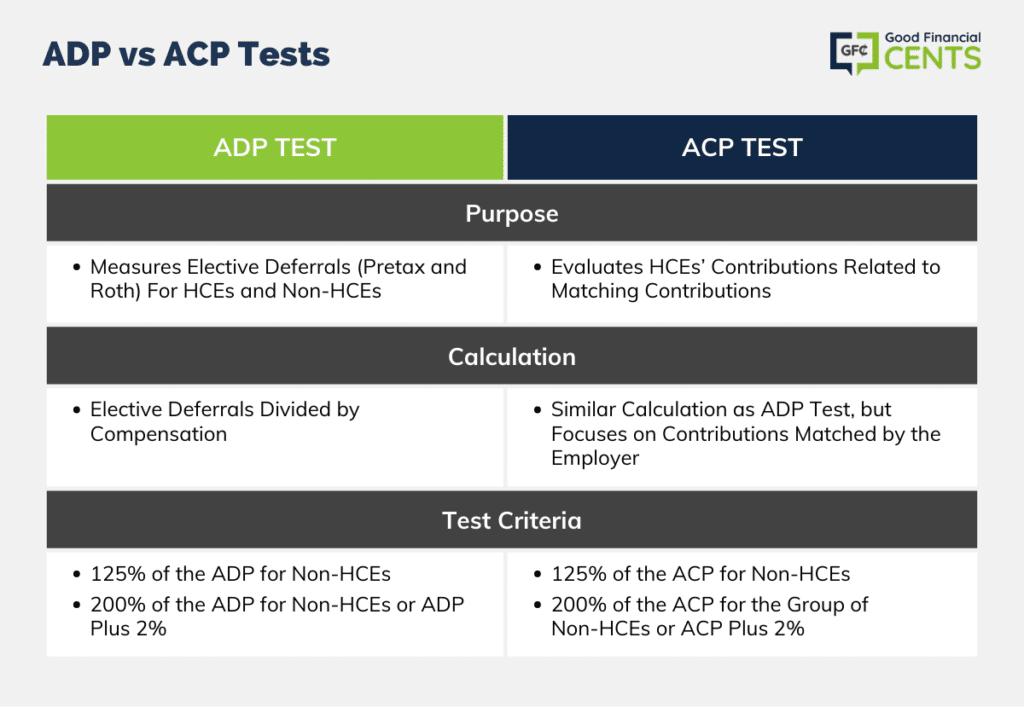

There are two types of tests: Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP).

ADP measures elective deferrals, which include both pretax and Roth deferrals, exclusive of catch-up contributions, of both highly compensated employees and non-HCEs. Using this method, the participants’ elective deferrals are divided by their compensation, which produces the actual deferral ratio (ADR) as calculated for both HCEs and non-HCE employees. (Stay with me now!)

The ADP test is met if the ADP for eligible highly compensated employees doesn’t exceed one of the following:

- 125% of the ADP for non-HCEs, OR

- The lesser of 1) 200% of the ADP for non-HCEs, or 2) the ADP for the non-HCEs, plus 2%.

The ACP test is met if the ACP for highly compensated employees doesn’t exceed the greater of:

- 125% of the ACP for non-HCEs, OR

- The lesser of 1) 200% of the ACP for the group of non-HCEs, or 2) the ACP of non-HCEs, plus 2%.

Are you still with me???

The 2% Rule

Notice that on each test, there’s the provision of “plus 2%”. That’s significant. The average 401(k) contributions of HCEs in the plan cannot exceed those of non-HCEs by more than 2%. In addition, collective contributions by HCEs cannot be more than twice the percentage of non-HCEs contributions.

One of the biggest problems with non-discrimination tests is that the results can be exaggerated if non-HCEs make relatively small percentage contributions or if few participate in the plan. As a highly compensated employee, you might max out your contributions every year.

But employees who earn more modest incomes may opt for minimal contributions. That can skew the results of the testing. Unfortunately, there’s no easy way around that problem.

What Happens if Your 401(k) Plan Fails the Test?

This is where the situation gets a bit ugly. The test can be performed within 2 ½ months into the new year (March 15) to make the determination. They’ll then have to take action to correct it within the calendar year.

If the plan fails the test, your excess contribution will be returned to you. You’ll lose the tax deduction, but you’ll get your money back, and life will go on.

There’s a bit of a complication here too. The excess contribution to the plan during the last tax year will be refunded the following year as taxable income to the HCE. That means that when you get your excess contribution refund, you’ll need to put money aside to cover the tax liability.

Better yet, make an estimated tax payment to avoid penalties and interest. That’ll be important if the excess refunded is many thousands of dollars. What happens if the problem isn’t identified and corrected within that time frame? It gets really ugly.

The 401(k) plan’s cash or deferred arrangement will no longer be qualified, and the entire plan may lose its tax-qualified status.

There’s a bit more to this, but I’m not going to go any further. This is just to give you an idea of how serious the IRS is about an HCE 401(k). If you are a small business owner and there’s even a slight chance you might be bumping up against HCE limits, consult with a CPA.

Manage Your 401(k) With Blooom

Even though you will encounter contribution limits to your 401(k) if you meet the criteria above, you can still benefit from contributing to one. While multiple robo-advisors can help you manage your 401(k), Blooom is the only platform built solely around 401(k), meaning they do it really well.

Your employer never has to play a part in the process. You also get access to living, breathing financial advisors, even though Blooom is a robo-advisor.

All of these services come at a cost of $10 a month, with no minimum balance requirement. Your contributions may be capped due to your earnings, but with Blooom, you can rest easy knowing you aren’t losing money elsewhere.

Highly Compensated Employee 401(k) Workaround Strategies

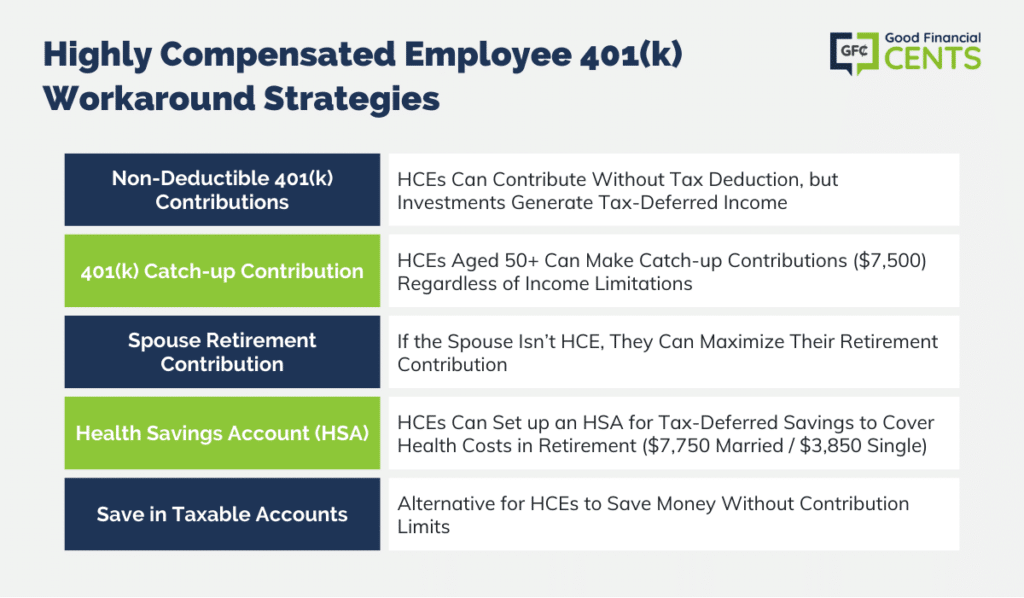

If you’re a highly compensated employee, are there any strategies to reduce the impact? Yes, none are as good as being able to make a full tax-deductible 401(k) contribution, but they can minimize the damage.

- Make non-deductible 401(k) contributions. You can still make contributions, you’ll just lose the tax deduction. That isn’t a complete disaster though. Those contributions will still generate tax-deferred investment income.

- Make a 401(k) catch-up contribution. 401(k) catch-up provisions aren’t restricted by highly compensated employee rules. This offers potential relief, provided you’re 50 or older.

401(k) plans come with a catch-up provision of $8,000 if you’re 50 or older. If you’re considered highly compensated, you can still make this contribution. - Have your spouse max out his or her retirement contribution. That is, if they’re not also considered a highly compensated employee.

- Set up a Health Savings Account (HSA). This isn’t a retirement plan, but it will provide tax-deferred savings. That will help you build up a plan to pay for health costs in your retirement years. For 2024, you can contribute up to $8,300 (married) or $4,150 (single). You get a tax break on your contribution.

- Save money in taxable accounts. Naturally, some sort of tax-sheltered savings plan is always preferred, especially if you’re seriously limited in your 401(k) plan. But this option should never be ignored.

If you’re a highly compensated employee but your retirement contributions are limited, you’ll need to do something to make up the difference.

Saving money in taxable accounts is a solid strategy. There are no limits on how much you can contribute. And even though you don’t get a tax break on the contributions or the investment earnings, you’ll be able to take money out as you need it, without having to worry about paying taxes on it.

3 Ways to Make an IRA Contribution

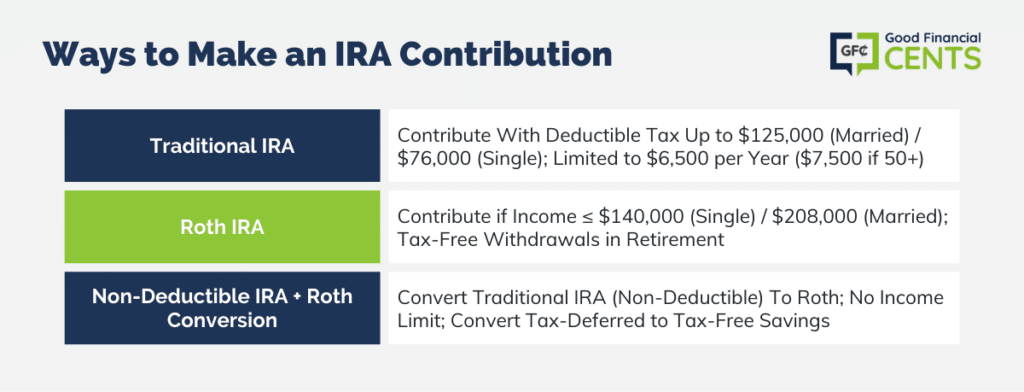

An even simpler option is to just make an IRA contribution. There’s nothing fancy here, but if you’re a highly compensated employee, never overlook the obvious. There are three ways you can do this:

Make a Contribution to a Traditional IRA

Virtually anyone at any income level can make a contribution. But the tax deduction for a contribution – if you’re already covered by an employer plan – phases out at $116,000 for married couples and $73,000 for single filers. But if HCE status limits your 401(k) contributions, this will be a way to take advantage of tax deferral on investment income.

Contributions aren’t nearly as generous as they are for 401(k) plans, at just $6,500 per year (or $7,500 if you’re 50 or older), but every little bit helps.

Make a Contribution to a Roth IRA

You can make a contribution if your income doesn’t exceed $153,000 (single) or $228,000 (married). There’s no tax deduction with Roth IRA conversions, but you will have a deferral of investment income. Best of all, once you retire, withdrawals can be taken tax-free.

Make a Non-Deductible Traditional IRA Contribution, Then Do a Roth Conversion

If you do, you can avoid the tax liability of the conversion. But you’ll be converting tax-deferred savings into tax-free ones with the Roth. One of the biggest benefits of this strategy is that there’s no income limit. Even if your income exceeds the thresholds above, you can make a nondeductible contribution to a traditional IRA and then convert it to a Roth IRA.

Final Thoughts on 401k Limits for Highly Compensated Employees

If you’re an employee of a large organization, your employer has probably figured out how to avoid the HCE problem. It’s more of an issue for smaller employers. If you are the employer, this is a situation you’ll need to monitor closely. Your plan administrator should be able to help.

There are two ways to fix the problem:

- You can offer a safe harbor 401(k) plan, which is not subject to the discrimination tests.

- Otherwise, you can provide a generous employer match. The match can boost employee participation in the plan to well over 50%, which often fixes the HCE problem.

But if you’re a highly compensated employee in a small company, you won’t know it’s a problem until you get notification from your employer. That will come in the form of a return of what is determined to be your excess contribution and a potential tax bill as a result.

Are you considered to be a highly compensated employee, or have you been in the past? Did you get hit with a refund and a subsequent tax bill? What are you or your employer doing to fix the problem?

Jeff,

The catch-up allowance is not automatically granted to age 50+ highly-compensated employees. Excess HCE deferrals for this group are reclassified as catch-up only to the extent that this is done on an equitable basis within the group. After that, any remaining excess catch-up deferrals are required to be refunded.

Jeff,

Check with some TPAs and you’ll find that the catch-up allowance for HCEs age 50+ is not a slam dunk. The catch-up dollars can be used to satisfy plan testing, but there is a pecking order for allocating excess contributions between HCE group members and some refunds may still be required.

As an HCE in my small company plan, I’ve never been able to contribute 100% of the annual catch-up.

I expected a check for the excess 401(K) contribution but my LARGE company issued a check that included all earnings on said contribution. That caused a much larger taxable distribution than expected. Is this legally necessary or is my company being overly cautious so they don’t get penalized, even if all of its HCE do get penalized?

Hi Linda – You need to speak with an accountant about that situation first. It’s a very specific situation, and you may need research to prove your point. If you can, I’d then go back to the plan administrator and see about getting it changed.

If the contributions were in excess of the limit, it follows reason that any earnings (net income attributable) on those excess contributions should be removed with them.

I am an employee.

I would like to get a friend of mine started with an investment plan here at PPD.

She is an employee here.

What steps should she take to get started for the year?

Hi Gwendolyn – Since she’s an employee she should just contact the human resources department, they should be able to get all the paperwork completed for her.

Really enjoyed your article. A good explanation of the consequences – and possible workarounds – of HCE’s.

Hi,

I am curious – my husband and I own a small business,(S-corp) of which my husband is the only full time employee, and I am sometimes (when we can afford to pay me) also a W2 employee, and our expenses are about to go way down in a few years when the kids graduate college – we are both over 50 – can we both draw salaries and contribute the max,into a 401K and match it from the corporation, since we would plan to only cover FT employees in any retirement plan we would set up? Is this allowed? We currently only offer health insurance to full time employees and our agent has said this is legal.

Thanks,

L

Hi Lisa – It sounds like the agent is talking only about the health insurance. The 401k plan is another matter shouldn’t matter since your husband is the only full-time employee. But talk with a CPA about it if you’re worried.

Hello, and thank you for writing up this article. It’s difficult to find information to determine what HCE really means.

One difficulty is salary vs AGI. Is HCE a simple test of salary, or is it determined by the “wages, tips, and other compensation” number on the W-2? For a number of years my salary has been over 100K but the final number that comes on my W-2, which I use to do taxes is below 100K.

This year, my salary is getting close to $120K, but that number on the W-2 is still likely to be lower. Am I on the verge of becoming an HCE based on salary alone, or do I still have some room left?

Thankfully, my wife is a teacher, so she has the option of both 457 and 403b, so we at least have the ability to fully fund both of those plans if mine suddenly becomes unavailable. Thanks for your help!

Hi Michael – It also depends on how you rank in you company by salary. It may not apply if your not considered an HCE in your company.

Thanks for the suggestion, I’m sure it will help a few people. But you can also make a non-deductible IRA contribution. You won’t get the tax deduction in the year made, but you will get the benefit of tax deferral of investment income, and that’s even bigger. Plus, you can eventually do a Roth conversion of the IRA account, which will make even more sense with the non-deductible contributions to the traditional IRA.

I feel doubly screwed.

I am a HCE at my company and my max 401(k) contribution is 2%.

In addition my wife and I make over 199k, which the IRS say makes us ineligible to contribute to our Roth and regular IRAs.

Should I just start investing on my own?

Hi Mark – Yes you should. You’re in a tough spot, with all the usual retirement options off the table. Invest in taxable accounts, but also look into annuities. I don’t usually recommend them, but in your case it’s a chance to get tax deferral in investment earnings, which is a critical part of long-term investing success. Just watch out for the “gotcha provisions”, like high fees, surrender charges, and forfeiture of funds upon your death. (Those are why I don’t recommend annuities for most people.)

I am considered a HCE. This 6% contribution isn’t going to help me for my retirement by the time I need it as I started late in the retirement savings game. My company has never matched me so the amount has always been my own with no match. Yes this is not good. What are my options?

Hi May – You should start an IRA to build more funds that way. Also save money in non-retirement accounts. No matter what your company is or isn’t doing, you’re responsible for your own retirement. It sounds like your employer doesn’t have much interest.

Hello, My husband is considered an HCE as he earns around 130K a year as a home health physical therapist. At 51 we got started late and attempted to open a 401K with his company. They flat out refuse to open one, even if we have to make smaller contributions. My assumption is that the company just doesn’t want to deal with the problems that could come about if contributions exceed yearly allowances. Does this happen? Not getting much info/help from HR either. Thanks

Hi Mary – I don’t know if it happens, but I do know that it’s up to an employer to offer a 401k, or to provide certain provisions if they do. You might look into an IRA, Roth or traditional as an alternative.

This Highly Compensated rule is questionable? I would not need the 401k “Catch Up” at 50 if the Highly Compensated rule didn’t existed. Why have two rules that contradict each other? The catch up is aimed at helping ALL individuals save enough for retirement (i.e for those who did not save enough earlier in life). Yet the reason why I didn’t save enough was due to a rule that limit how much I can save prior to 50? Would I not be better off if I could have saved more earlier especially with compounding interest?

Does the rule really impact those truly highly compensated? Quick math…Executives pay still allows them to max their 401k at 2% (not hard for them to save $18,500 pre-tax when pay packages exceed $1M). Middle management is left determining how to save for retirement based on all the bureaucracy.

How is the HCE rule helping me save for retirement?

I agree on all counts Brandon. Part of the reason is the income thresholds were set years ago, and haven’t been updated to recognize current salary levels. Similar situation with the alternative minimum tax, more middle class people have been pulled into it in recent years. But congress doesn’t get around to adjusting the income numbers to more realistic ones. Write your congresssman/woman and demand action.

We are currently experiencing this for the first time at my work, so we’re all trying to figure this thing out. Can someone explain the “safe harbor” option for a company to attempt to get around the ACP and ADP tests? How does an employer 401K plan qualify for safe harbor? If under safe harbor are employees allowed to make max contributions? Are safe harbor plans subject to the ADP and ACP tests? Etc.

Hi Michael – Try this explanation.

Does a highly compensated employee pay a penalty on the excess contribution or just add it to his W-2 wages the year he receives the refund

Hi Neal – The excess contribution is taxable to you in the year it’s refunded. There is a 10% penalty, but it’s paid by the employer if they fail to perform the required test and issue refunds by March 15.

Hi Jeff

I had my excess contribution returned to me. You mentioned in the article that it is refunded as taxable income. Mine is a Roth – 401-k so surely the refund would not be taxable income as the contributions were already taxed.

Hi Ryan – I think you’re right, but there may be a liability on any investment earnings on the contributions. It all depends on how the refund is reported by your employer, but I think it will play out the way you expect.

I am a HCE employee and for the last 3 years have had part of my 401k contribution returned. This year I turn 50 in December and I should be able to make a catch up contribution. I understand that the catch up contribution is not subject to be returned for HCE employee. So how does that work? Do I have to max out my 401k contribution at $18,500 and then the $6,000 above that is a catch up contribution or given the likelihood that some of my investment will be returned can I do my catch up contribution first and then contribute less that $18,500 so less of that money will be returned at the end of the year?

Thanks in advance.

Hi Todd – The catch up contribution is the amount in excess of the $18,500, so I don’t think that will be the work-around you’re hoping for. You may be OK on the $6,000, but the basic $18,500 may still be an issue. Have you discussed this with the plan administrator?

Can I still have fund an IRA or Roth IRA at 70 1/2?

Hi Veron – You can fund a Roth IRA, but not a traditional IRA past 70.5. But for the Roth, you must have earned income of at least enough to fund the contribution.

I was refunded contributions from my 401k as a highly compensated employee in a top heavy plan for almost 20 of my over 30 year career. It always occurred late, usually making me file amended returns. Finally the company went safe harbor and fixed it but it was a royal pain! Great explanation of a little known issue.

Great explanation Jeff this makes a lot more sense to me now.

The first company I was with had a match of 100% on the first 3% of contributions for all employees, but my total contribution was usually limited to around 4% since not many people contributed to the plan apparently. That was frustrating since this company actually had some good low cost plans from Fidelity.

My current company doesn’t offer a match to HCE’s but does allow us to contribute up to the IRS limit. I’m OK with this since they have some good low cost Vanguard funds and I can max out my 401k. A match would be nice though.

Even though these limits seem annoying, being a HCE means you are in the top 10% of incomes in the country. So be grateful it’s not all bad! And there are some alternative places to save like you listed in your post.

Hi I’m an HCE for the first time and trying to plan for next year. I currently put in 6% pretax and 4% post tax (my company offers a 401k and Roth 401k). My question is I believe I will be limited to 6% for my 401k. Am I still able to contribute to my Roth 401k? If not, do you know why? I thought the limit was to prevent HCE from having tax savings. Thanks, David

Hi David – I THINK you can, since I don’t THINK that the HCE rules distinguish between regular and Roth contributions. Or put it a better way, I haven’t found any information that distinguishes between the two. But that’s an excellent question for a CPA. Or better yet, I’d contact the plan administrator since each employer/plan has somewhat different rules.

I was a first time HCE due to some bonus money that put me barely over the limit in 2015. I missed the notification from HR while on maternity leave in early 2016 and tried doing my own research when I stumbled on this topic in July 2016. I lowered my contributions significantly until my benefits department incorrectly told me I was not impacted. I then ended up changing back to catch up to max contribution in Sept 2016, but just in case I was actually impacted (I suspected I was from what I had read on the topic), I split contributions between 401k and new Roth 401k. I ultimately ended up with a refund split between both. Outcome was 10% fed and state 6% tax withholding on only the gain from the Roth, but same withholding on the FULL amount from the regular 401k. Not sure if this would have been different if I had started the Roth in 2015, but at least I received most of the Roth money back!

Hi Andrea,

I’ll be in a similar situation this year if I overcontribute. Do you mind sharing what your split was between 401(k)/Roth 401(k) contributions and if the refund was the same ratio or something different?

I am 73 and work full time, and have a 401(k) via employer. Based on income (above 160K) , I am likely ineligible to put cash into my existing Roth IRA that was created years ago, unless there is some tax law I have missed that allows it. Can I make contributions (e.g. 20K) into my 401(k) then simply do a “20K distribution/rollover” from the 401(k) as a deposit directly into my existing Roth IRA, and because I would then be taxed on that amount the same as if received in salary, the net benefit is that the 20K of earnings got into the Roth by another path to circumvent the cash deposit limit caused by high income.

I think so Ken. But some employers won’t do a distribution until you leave the company. Check with them to see if this is allowed. On the other hand, if the 401k funds are from the plan of a previous employer, you can do what it is you’re planning.

I am a HCE , 56 yrs old. I have been told I can only contribute 17% this year. I anticipate that I will not make as much money this year, so may not have the opportunity at the 17% cap to contribute the full allowance of 18,000 plus $6,000 catch up. I am trying to save as much as possible before retirement. Isn’t EVERYONE allowed to contribute up to the maximum allowed limits? This way, it looks like if others in my company choose not to save, then I am prevented from doing so. Any advice please?

Hi Sue – One thing you might be able to do is make a tax deductible IRA contribution, or a Roth IRA contribution, which isn’t tax deductible. If your income has fallen below the threshold for either type of IRA, you may be eligible. It will make up for a least some of the lost contribution due to your HCE status. You may also want to discuss this with the 401k plan administrator, and see what they recommend.

I earned $109,000 and have been told I will not receive my match of $2500?

Is this fair and correct?

Thank you

Hi Mark – Employers do have a considerable amount of latitude in how they administer retirement plans. Yours may have made a decision to cap employer matches for employees at a certain income level, like $100,000. But it may also be what I reported in the article:

Have you asked the specific reason why you were excluded?

I am an HCE Employee and only able to invest 3.5% into my 401k. This was the first year that I have had to do this. I used to contribute 10-15% up to the allowed limit. Is there another tax deferred vehicle I can invest in while investing in my 401k?

Unless you have some sort of self-employed income, there’s no pre-tax option available to you. A few things you can do:

1. Fund a non-deductible IRA. Doesn’t sound like you’ll get a tax deduction for doing so, but I encourage my higher wage earners to fund them. It will grow tax-deferred and it leaves the door open for later on converting to a Roth IRA.

2. Annuities. There are several different types but all will allow your investment to grow tax-deferred.

3. Cash Value Life Insurance. Typically I’m a big fan of term insurance. But some types of cash value life insurance provide a potential tax-free wealth accumulation strategy. I would never lead in with this, but if a 401k and Roth IRA are NOT an option, this is one worthy exploring.