If you ask your grandfather what he is invested in, he will probably say stocks, bonds, and possibly precious metals.

These days, there are a lot of assets you could potentially invest in.

New-age investors are testing the waters with investments like cryptocurrencies, peer-to-peer lending, crowdfunded real estate investing, micro venture capital investments… The list goes on!

Each year, there are more and more options when it comes to what you can do with your hard-earned money.

Table of Contents

Today I’ll be unpacking some of your best investment options and helping you decide how much to invest in stocks.

Traditional Investments

When you are investing in any asset, you should look for a long history of returns from that investment.

You want to make sure you’re choosing an asset that has been making people money for decades if not centuries.

While you may not see these returns every year, you want to make sure your investment is consistently generating returns over a long period of time, which is one of the cons of new-age investments.

While they are exciting, these options have a very limited operating history compared to old-school investments like stocks and bonds.

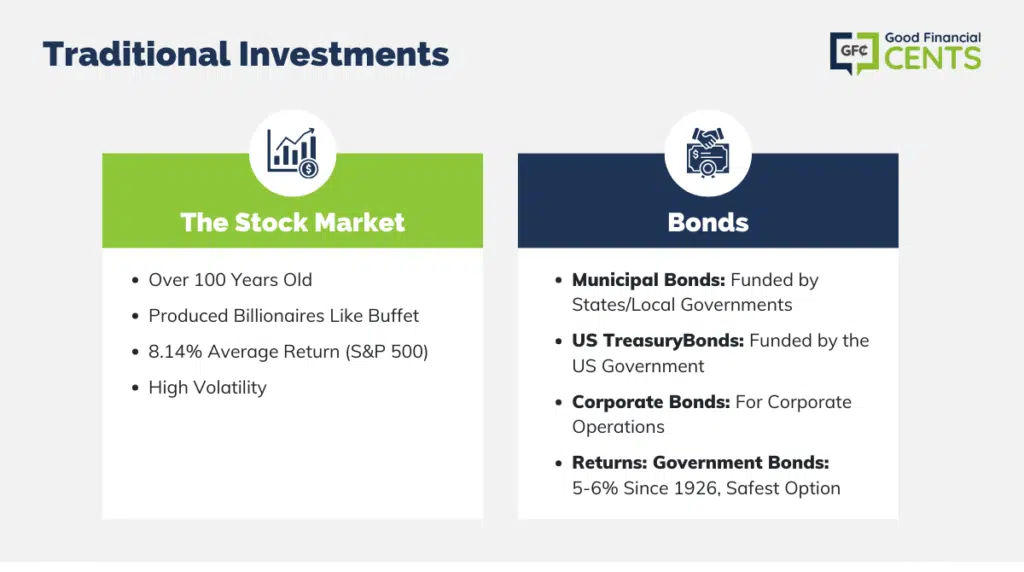

The Stock Market

Let’s take the stock market, for example.

The stock market has been making people rich for over 100 years, creating billionaires like Warren Buffet.

Long-term buy-and-hold investors can expect an average annual 8.14% return from the stock market over time, based on the S&P 500.

It is important to understand, however, that 10% might not be your experience every single year.

Some years you could yield a 15% return, while others could see a loss of 20% or more.

Higher-risk investments like stocks are going to have more volatility and fluctuations with the price.

Bonds

Now, let’s take a look at bonds.

When it comes to investing in bonds, there are three categories:

- Municipal Bonds: debt securities issued by states or local governments used to fund projects such as road construction or other public services.

- Government/US Treasury Bonds: debt securities issued by the United States Government used to fund government spending.

- Corporate Bonds: debt securities issued by corporations to fund ongoing operations.

Of these three categories, government bonds are considered to be the safest and lowest-risk investment, but each of them can be a good short-term investment option at the very least.

On average, CNN reports government bonds have returned around 5 to 6% per year since 1926.

Since stocks have historically had some of the highest returns among the assets mentioned, people often think about investing all of their money in stocks, but this is where you should follow the advice of a qualified investment professional.

Most investment portfolios include a mix of stocks and bonds, but maybe you should consider investing 100% in stocks.

Here are a few reasons why you might (or might not) want to throw all your investments into stocks.

First of all, let’s consider when people typically consider investing everything in stocks.

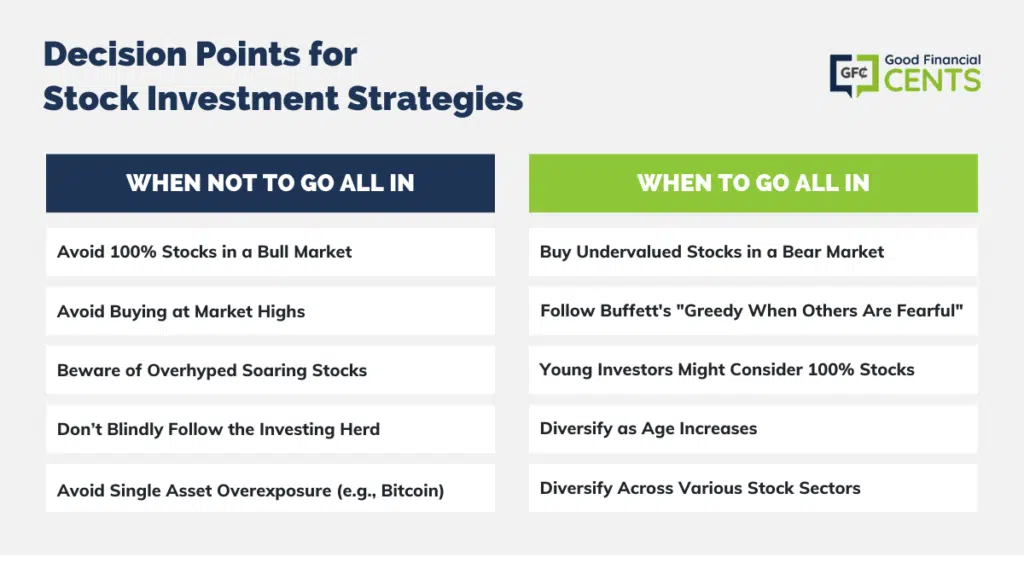

When Not to Go All In

People want to buy whatever asset is doing the best.

They hear about friends and family members making a killing in the stock market, and they want a bigger piece of the action.

The problem is, that stocks are typically roaring ahead in the late stages of a bull market.

In the stock market, there are times when stocks are going up in price (bull market) and times when stocks are falling in price (bear market).

The unfortunate truth is, that the worst time to move into 100% stocks is during a bull market.

People who do so are often doubling down on an asset that is due for a correction.

What you will find when you become a seasoned investor is that the right move often feels wrong.

Your best bet is to go against the prevailing trend of the market.

Here is one of my favorite expressions about the stock market:

Bulls make money from rising stock prices. Bears make money from falling stock prices. Sheep follow the herd to the slaughterhouse. If everyone else is doubling down on the stock market going all in, and you do the same, you are following the herd.

The same is true for people who buy individual stocks.

People tend to focus on the stocks hitting 52-week highs, not 52-week lows.

They will pile in on a market high flyer expecting it to keep on soaring!

The saying is “buy low, sell high,” not “buy high, sell higher.”

In this situation, novice investors are often taught a valuable lesson: it is rarely a good idea to invest in stocks at all-time highs.

Why?

These soaring stocks are being discussed by all the news outlets. They are getting the most exposure, and as a result, more money is being directed toward them.

As more and more people pile into these high flyers, the price climbs higher and higher, giving investors the false perception that this stock has nowhere to go but up.

Oftentimes, the exact opposite is true, and the stock has nowhere to go but down!

When to Go All In

If there is ever a time to move into 100% stocks, it is when stocks are undervalued in a bear market.

In the words of Warren Buffett, be greedy when others are fearful!

As a general rule of thumb, you typically want to do the exact opposite of what everyone else is doing.

If your friends are talking about selling bonds and putting all that money in the stock market, it might be a good time to sell some stocks and buy bonds.

When everyone is getting in, you should be getting out!

Another option, which is often the best, is to do nothing.

Here’s what I mean: If you have a diversified portfolio of stocks, bonds, and other assets, consider just holding on to what you have.

It does not matter what everyone else is doing!

When it comes to investing, activity is the enemy. Activity results in commission costs, and this takes money out of your account that would originally have remained invested.

Now, here is one scenario where you might consider investing 100% in stocks:

If you are a young investor, you have many years ahead of you to allow investments to trend upward, and you have a significantly higher risk tolerance.

As a young person, you might decide to invest all of your money in stocks due to the higher returns.

Your portfolio will be more volatile, but overall you should see a greater return in the long run.

Then as you get older, you can diversify and allocate some of your money into bonds or other investments.

Age Matters

If you follow the conventional asset allocation model, you will subtract your age from 100 to get the percentage of the money you should place in stocks.

If you are 20 years old, you should have 80% in stocks and 20% in bonds.

But there is one problem with this model; people are living longer!

Since people are living longer, the asset allocation model needs to be adjusted.

The traditional model is likely too conservative for most people these days.

Following the updated model, a 20-year-old would have 100% allocation into stocks and 0% in bonds.

So for a young person, most would say it is acceptable to have 100% of your money in stocks.

The goal of investing is to have security in the future.

You are probably working now, maybe one you don’t wish to stay at for the rest of your life.

For most people, this security is the ability to retire one day.

As you grow older and get closer to retirement, you want to have less money involved in stocks and more money involved in lower-risk investments like bonds.

Once you reach retirement age, the goal of your portfolio shifts from growing your wealth to primarily preserving your wealth.

If you are a 20-year-old and you have decades ahead of you, investing 100% in stocks makes sense.

As an older person, that level of risk is excessive and, in some cases, dangerous.

So Does Your Risk Tolerance

Here is something else to consider: If you are going to go 100% in stocks, you will need to have very thick skin.

While it is true that investors will see better returns from stocks if they stay the course, it is far easier said than done.

During a stock market crash, you could see a 20% or higher correction take place with your portfolio.

Everyone around you will be selling stocks and moving into different assets. You could possibly see your account decline week after week for a year or more.

Consider the bear market of 2007 to 2009. In this 17-month period, the S&P 500 lost about half of its value.

How would you react in that situation?

If you were like some people who were 100% invested in stocks at the time, you shot yourself in the foot by selling out of fear of greater losses going forward.

Think of it this way: If your portfolio could take a 50% drop and you would be unaffected, you could invest in a 100% stock portfolio to maximize your returns. Would you be able to do that?

For most people, a blend of stocks, bonds, and cash will suit them well.

Others may decide to diversify into other assets like real estate, precious metals, or even new-age investments like cryptocurrencies.

The case for this type of diversification is that you want the assets in your portfolio to be doing different things at different times.

Maybe your stocks are down 20%, but the gold in your safe is going up!

The goal of diversification is to maximize returns and minimize risk by investing in a number of different assets. Don’t put all your eggs in one basket!

For those who do decide to invest 100% in stocks, apply these same rules of diversification to your stock investments.

Rather than investing all of your money in one stock or a few stocks, consider investing in funds that give you exposure to the whole market.

Beyond that, you should consider exposure to different markets entirely, like international markets or emerging markets.

Spread your money out!

Breaking Down Bitcoin

Let’s consider the Bitcoin investors for a moment.

In 2017, Bitcoin was the hottest asset you could own. You could buy Bitcoin and see a 100% return that week!

All over the internet, you were hearing about people making drastic moves to place an all-in bet on Bitcoin.

Believe it or not, a number of people even mortgaged their homes to buy as much as they could!

These Bitcoin investors were not following the basic rules of diversification because they had all their eggs in one basket. They were placing an all-in bet on a new asset with a very limited history of generating returns.

Bitcoin hit a peak of just under $20,000 in 2017.

By January of 2018, it was trading at $13,500, and $7,500 by February.

These unfortunate late-stage Bitcoin investors experienced as much as a 60% loss or more in the course of two months.

For many people, this was a valuable lesson on why you need to diversify. And new data reported by Forbes suggests the crash is continuing in 2019.

Remember, people tend to double down on an investment at the worst time!

Bottom Line

Every investor is going to have a different level of risk tolerance.

A young person with a high-risk tolerance might decide to go the route of investing 100% in stocks, but this is probably not the best idea for everyone.

As you get older, you want to lower the risk you are exposing yourself to with your investment portfolio, typically by allocating more money into bonds as you grow older.

While bonds have historically had lower returns, they are significantly less risky than their alternatives.

It is important to remember one of the goals of diversification is to prop your portfolio up in a bear market.

When stocks sell off, investors often flee to bonds and precious metals, inflating the price.

Perhaps a 100% stock portfolio idea is not as glamorous as it seems on paper.

This is a post from Ryan Scribner, author of the blog Investing Simple where he aims to keep personal finance and investments, well, simple. He’s also the face of his own popular YouTube Channel, where he’s got a massive library of videos for you to watch; I recommend you check him out.