I just had my third son, the reality that I’ll be shipping my kids off to college sooner than later is sinking in. I had already started a 529 College Savings Plan for my first and will plan on doing another one for the second and now third.

Recently, I had a client in a similar boat and inquired about the difference between a Coverdell Education Savings Account vs the 529 plan.

ESA’s (formerly known as the Education IRA) had been a popular planning tool for college up until the creation of the 529 plan and I very seldom ever come across them.

Actually, I have never opened one for a client and only hold a few for clients who have transferred them in from other institutions.

Let’s see if we can look at the differences between the Coverdell ESA and the 529 plan and see what might be best for you.

Table of Contents

- Similarities Between Coverdell ESA’s and 529 Plans

- What About Gift Taxes?

- Differences Between Education Savings Accounts and 529 Plans

- Want to Switch from a Coverdell Into a 529?

- Time For School

- The Bottom Line – What’s the Differences Between Coverdell Education Savings Accounts vs 529 College Savings Plans?

Similarities Between Coverdell ESA’s and 529 Plans

ESAs and 529 plans let you, the account owner, set up investment accounts for a beneficiary, or recipient, that you designate. This differs greatly from a custodial account where the child takes over at 18 and can do with the money whatever they want.

Go ahead and let your imagination run rampant here parents. Within these investment plans, your earnings and any capital gains accumulate tax-deferred, which means you put off paying taxes until your money is withdrawn.

And you can withdraw your money tax-free, or free of federal and sometimes state income taxes, as long as your beneficiary uses the money to pay for qualified education expenses, which may include tuition, books, fees, and room and board.

There is still some gray area on “qualified expenses” but items such as laptops and cellphones may qualify. Double check with your tax preparer to make sure.

How You Spend The Money

If you don’t spend the money on college-related expenses, prepare to get burned. Not only will you owe taxes on any earnings within the amount you withdraw, but you’ll have to pay the federal penalty—10% of your earnings.

Plus, certain states may impose an additional 10% penalty, bringing the potential fee as high as 20% of the amount you withdraw. Ouch!

Contributions to tax-free accounts must be made in cash. So rather than move investments you already own into the account, you would have to liquidate your assets and then deposit the money.

Doing so could trigger capital gains tax on any increase in value.

Keep It In the Family

One nice plus is that with both of these accounts you can switch the beneficiaries among other members of your family.

That includes the beneficiary’s spouse, child, grandchild, stepchild, sibling, step-sibling, parent, grandparent, stepparent, niece, nephew, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, sister-in-law—or any of these relatives’ spouses—as well as any first cousins.

This is also nice in case one child doesn’t use all their savings, You can then just transfer to the other child.

What About Gift Taxes?

When you contribute money to an account in another person’s name, your contribution is considered a gift.

You can give away up to $13,000 per year—or $65,000 once in five years to a 529 savings plan—before you may have to file a gift tax report and eventually pay gift taxes. But gift taxes apply per donor and per beneficiary.

So, in one year you could contribute $13,000 to one child’s 529 account, and then contribute another $13,000 to another child’s account without owing gift taxes.

Or, you and other relatives could each contribute $13,000 a year to one child’s account. Remember, though, that ESAs limit contributions to $2,000 a year.

Differences Between Education Savings Accounts and 529 Plans

The ESA and 529 have some key differences:

1. In the ESA, the total contribution for any one beneficiary can be no more than $2,000 a year. You can contribute $2,000 to an eligible beneficiary’s ESA if you meet the adjusted gross income (AGI) requirements. That is, your AGI must be less than $110,000 if you’re single—or $220,000 if you’re married and filing a joint return. The 529 plan has no maximum contribution limit.

2. In an ESA, as your AGI increases above these levels, the amount you can give is phased out until your AGI reaches $110,000—or $220,000 if you’re married—at which point you are no longer eligible to contribute. The 529 plan has no income restriction.

3. Anyone who’s younger than 18 when an ESA is opened and younger than 30 when the money is spent is eligible to be a beneficiary. In a 529 plan, there are no age restrictions.

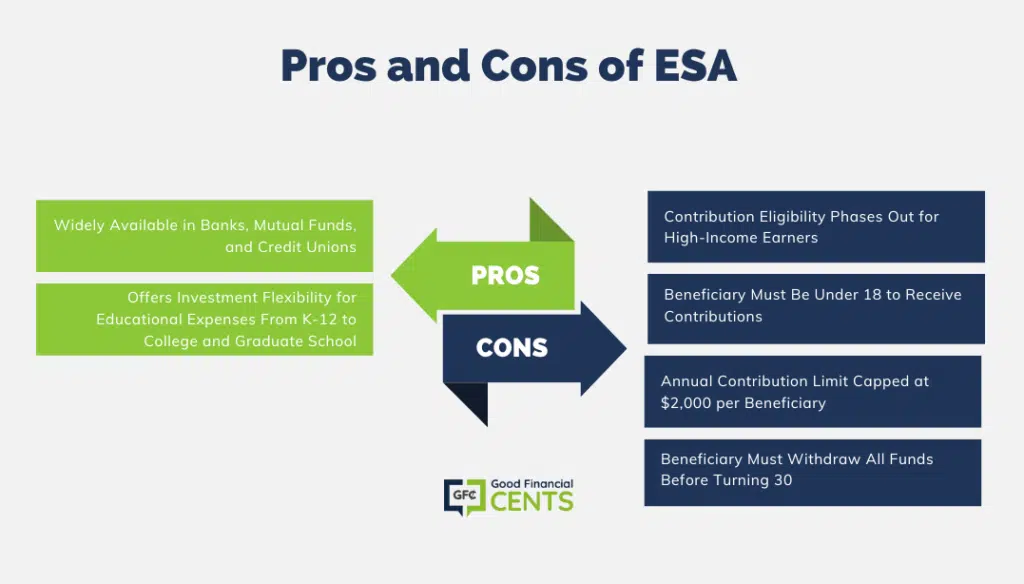

Coverdell Education Savings Accounts (ESA’s)

How it Works: You invest your account assets in any combination of assets available through the financial institution handling your account

PROS

- Accounts Available in Most Banks, Mutual Fund Companies, and Credit Unions

- Investment Flexibility Qualified Withdrawals to Cover Grades K Through 12, as Well as College and Graduate School

CONS

- Eligibility for Making Contributions Phases Out Once AGI Exceeds $110,000 (Or $220,000 if You’re Married and Filing a Joint Return)

- Beneficiary Must Be Under 18 to Receive Contributions

- Beneficiary Can Only Accept $2,000 in Contributions per Year

- Beneficiary Must Make All Withdrawals Prior to Turning 30

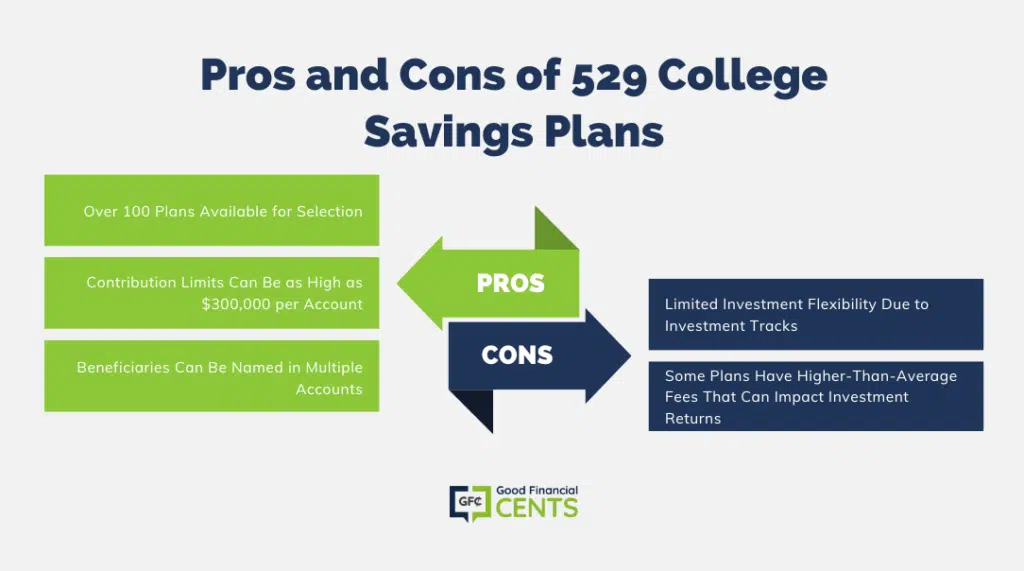

529 College Savings Plan

How it Works: You contribute to an account that’s typically invested in age- or risk-based investment tracks, which are provided by your plan manager.

PROS

- Over 100 Plans Available to Choose From

- Contribution Limits Can Run as High as $300,000 per Account

- Beneficiaries Can Be Named in Multiple Accounts

CONS

- Less Investment Flexibility Due to Investment Tracks

- Some Plans Have Higher Than Average Fees That Affect Investment Return

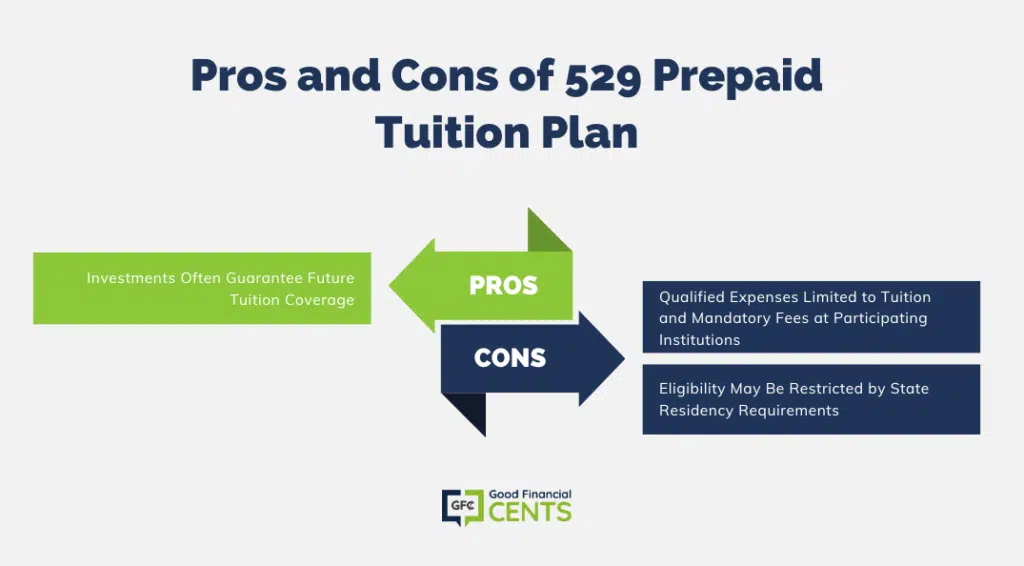

529 Prepaid Tuition Plan

How it Works: Your contributions purchase tuition credits at current rates, and the plan invests your contributions to meet future college costs.

PROS

- In Many Cases, Investments Are Guaranteed to Cover Future Tuition Credits

CONS

- Qualified Education Expenses Include Only Tuition and Mandatory Fees at Participating Colleges and Universities

- Eligibility Sometimes Restricted by State Residency Requirements

Want to Switch from a Coverdell Into a 529?

You can do a rollover from a Coverdell ESA to a 529 plan without incurring any tax penalties as long as the 529 plan will have the same beneficiary as the present Coverdell account.

Earnings from a 529 plan can be distributed tax-free (assuming they are used for qualified education expenses). Contributions are taxed.

You can go one of two ways with a 529:

- You can prepay tuition at today’s rates (at a qualifying college or university) through a 529 prepaid tuition program.

- You can save to pay tomorrow’s college tuition through a 529 savings plan which gives you tax-deferred growth. Most people prefer this option for its flexibility and asset accumulation potential.

Time For School

When I considered how much I would have paid for school had I not joined the National Guard, I know it makes absolute sense to start early.

The beauty of these plans is that other family members and friends can contribute to these accounts or open additional accounts, as well.

We like to add a large portion of our son’s birthday money to his 529 plan. I know I’ll only get away with that for a few more years. 🙂

Before I know it, they’ll be off to school and thankful their parents started saving when they did.

The Bottom Line – What’s the Differences Between Coverdell Education Savings Accounts vs 529 College Savings Plans?

As the realization of sending my children off to college dawns, I reflect on the importance of financial planning. Coverdell Education Savings Accounts (ESAs) and 529 College Savings Plans are valuable tools for this endeavor. While both offer tax advantages, they differ significantly. ESAs have a $2,000 annual contribution limit with income restrictions, while 529 plans have no maximum limit or income restrictions. ESAs have age limits for beneficiaries, but 529 plans do not. Understanding these distinctions allows you to make informed choices when securing your child’s future education. Starting early and involving family members can make a significant impact on your child’s educational journey.

Dear Jeff,

Great info but you did not make clear whether or not ESA contributions are tax deductible for the Donor on their Federal tax returns. Are they deductible?

I know that 529 contributions are deductible on CO State returns but NOT

On Federal returns- correct??

Thanks!

Steve Smith

Hi Stephen – They’re not tax deductible, but the investment income does accumulate on a tax-deferred basis.

Thank you!!!

Great info on ESA’s and 529 college funds!!!!

Jeff and Michael,

This is a very helpful article! I know it was written a year and a half ago, but it is very relevant.

I had a client with a 529 UTMA/UGMA account this past year, that was having difficulty filling out the financial aid forms, due to the way some colleges will choose to categorize 529 accounts.

I wrote a couple of blog posts that may be of interest to you both, as well as your clients.

http://www.collegesearchgameplan.com/are-all-529-college-savings-plans-equal-in-the-eye-of-the-financial-aid-office-not-necessarily

http://www.collegesearchgameplan.com/feedback-on-our-post-on-college-529-utma-savings-plans-could-this-happen-to-you

I hope they are helpful!

Hi Jeff. Great article, but I am wondering if the 2013 Coverdell changes you were referring to didn’t take place? According to this article, they didn’t: http://www.forbes.com/sites/ashleaebeling/2013/01/14/new-tax-law-resurrects-competitor-to-529-college-savings-plans/. Is it a good idea to use both plans, especially if you use a Coverdell for k-12 private tuition then a 529 for college?

@ Carina I just this update from the IRS that might answer your question: http://www.theslottreport.com/2013/02/revised-ira-publication-addresses-key.html

What about when the benficiary fills out FAFSA do both the ESA and the 529 plan count againt the expected family contribution?

Hey Jeff,

My daughter is starting my granddaughter in private school; kindergarten. I started a Coverdell about 4 1/2 years ago so I can utilize those funds for the granddaughters tution, including expenses. But I read that in 2013 that the Coverdell may have some changes done through Congress?

@ Joseph Yes, there is a possibility that some changes may occur with the Coverdell 529 that make it not as attractive. Check out this post that summarizes some of the potential tax changes: http://blog.heritage.org/2012/03/26/changes-to-coverdell-education-savings-account-unwise-and-unfair/

Can either the ESA account or 529 plan be used for a down payment on a home for a grad student?