One of the sad truths about our society is that there are those who financially prey on others. Among the most tragic of cases are those involving the financial abuse of the elderly.

It’s hard to deal with these situations because many seniors prefer to remain in charge of their finances throughout life.

As a result, as their faculties decline, they become easier marks from the unscrupulous who would get them to make outrageously expensive purchases, or involve them in investment fraud schemes.

While these acts of financial elder abuse are discouraging and you need to watch out for scammers from the outside, you also need to be on the watch for signs that caregivers and family members may be perpetrating some forms of financial elder abuse. The MetLife Mature Market Institute found that trusted caregivers/family members are involved in cases of financial elder abuse.

How do you know if you or someone you know has been victimized by financial abuse? There are a lot of free tools you can use. One of the easiest is to use your free credit report.

Check Credit Reports for Elder Financial Abuse >>>

Table of Contents

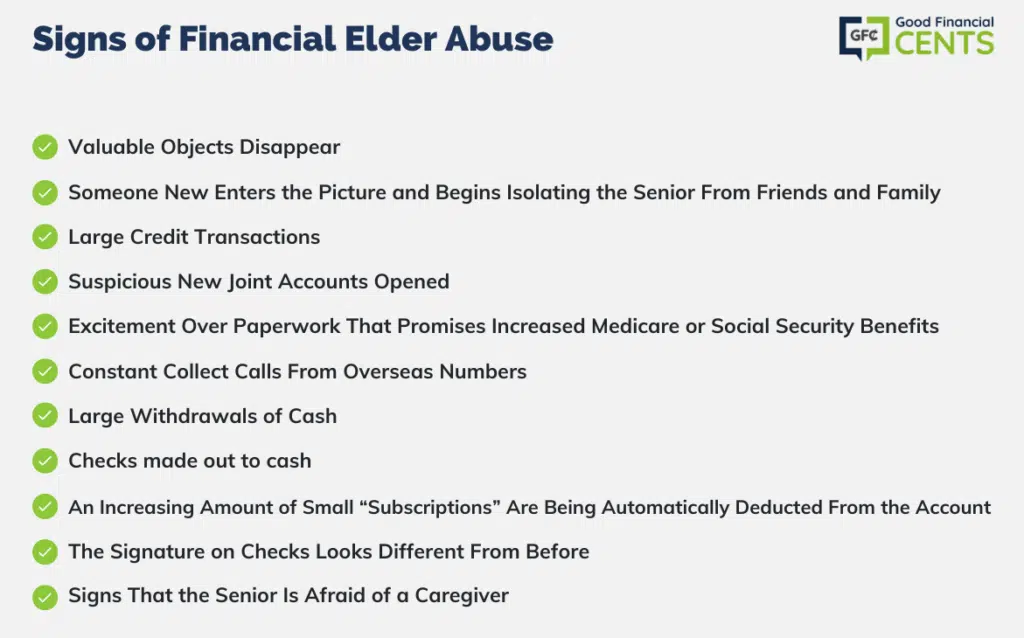

Signs of Financial Elder Abuse

It’s important that you be on the lookout for signs of financial elder abuse. First of all, realize that it can be difficult to pinpoint cases that seem rather innocuous. Some family members may not even think of what they are doing as financial abuse. They may take a valuable object (without permission) that they feel they “deserve” and that will come to them after a parent dies, or they might dip into a joint account a little too often in “emergency” situations and use some of the money that belongs to the senior.

Realize that these actions constitute elder abuse. Here are some of the signs that a senior you know may be a victim of elder abuse:

- Valuable objects disappear;

- Someone new enters the picture and begins isolating the senior from friends and family;

- Large credit transactions;

- Suspicious new joint accounts opened;

- Excitement over paperwork that promises increased Medicare or Social Security benefits once personal information is turned over to a representative (find out how this “representative” contacted the senior);

- Constant collect calls from overseas numbers (we had to change my grandparents’ number since they kept seeing charges for calls from Jamaica, Russia, and Southeast Asia);

- Large withdrawals of cash;

- Checks made out to cash;

- An increasing amount of small “subscriptions” are being automatically deducted from the account;

- The signature on checks looks different from before; and

- Signs that the senior is afraid of a caregiver.

All of these are signs that someone might be abusing a senior financially. Additionally, watch for signs that the senior becomes defensive suddenly, and doesn’t want to talk about his or her financial situation. This can be a sign that he or she is aware — and embarrassed — that he or she fell victim to a scam. While it isn’t pleasant to go through your parents’ or grandparents’ finances and look for signs that something is wrong or watch for signs that someone is taking advantage of them, it needs to be done. You need to stop it as quickly as you can before it gets any worse.

Internet Scams

Sadly, the internet has opened up a million different avenues for crooks to scam elderly people.

Internet scams against the elderly can take a lot of forms, but a lot of them revolve around either health insurance or Medicare. There are millions of Americans on Medicare. Just about anyone over 65 is going to be a part of Medicare. That’s a lot of potential victims.

If any Medicare representative ever needs to contact the policyholder, they will never use email. Do not provide any personal Medicare information through email.

Another common scam is requesting seniors to update their tax or IRS information. These emails could request Social Security numbers claiming financial penalties if the information isn’t updated.

Another avenue scammers take is investments and savings accounts. They could claim to have “investment opportunities” or need bank information to access money.

Regardless of the claim or what the email says, nobody should ever send personal information through email. If you ever receive an email you are worried about, you can always call the BBB. Always do more research before sending financial info.

How to Report Financial Elder Abuse

Once you suspect that financial elder abuse is taking place, it’s time to consider your options. First of all, check with your city or state to find out how to contact Adult Protective Services. Report the abuse to Adult Protective Services, and then complain to the state attorney general’s office. You should also file a police report.

You might also need to check into local courts (probate or some sort of civil court) if someone is abusing power of attorney, or if a trustee is perpetrating the financial abuse. You might need to challenge someone’s role as conservator or guardian in order to get the abuse to stop; it might even be necessary to have a temporary restraining order issued so that the abuse stops while you gather the necessary evidence.

A good resource for understanding elder abuse, including financial abuse, is the National Center on Elder Abuse. You want to ensure that your loved ones are protected and that their money lasts long enough to properly meet their needs over time. As a result, it’s important that you watch for signs that someone is taking financial advantage of the seniors in your life, and take action if there is evidence of financial elder abuse.

Conclusion

The financial abuse of the elderly is a distressing reality, where seniors, desiring independence, become vulnerable targets to both external scammers and, sadly, even trusted caregivers or family members. Monitoring credit reports and being vigilant about sudden changes in a senior’s financial habits are crucial. Internet scams targeting seniors have multiplied, emphasizing the need for caution with personal information. For those suspecting financial elder abuse, timely reporting to Adult Protective Services and legal intervention is essential. Educating oneself, and using resources like the National Center on Elder Abuse, can safeguard our seniors, ensuring their financial well-being and dignity.

My 98 year old mother was exploited and financially abused by my sister. I have dates, wire transactions and a signed affidavit that is notarized. How and where can I report this financial abuse. After electronically transferring almost $40,000 from my mom’s bank account my sister had her husband call me and tell me not to bring her back. My sister stole all of my mother’s jewelry and cut ties with the family. This is a clear sign of exploitation and financial abuse of the elderly. My mother is now living with me. I need help in getting this money back into my mom’s bank. Please help.

Hello,

My mother has been traveling back and forth to Jamaica with no problems. A few months ago she met this young man who is been telling her he is going to marry her, but he need to get a divorce, so she must get $10,000 to help him with his divorce. My father died 7 years ago and my mom is now lonely and vulnerable, so she is infatuated with this 40 year old, she is 87. My sibs and I have tried to secure her funds, but she insists on coming back to Jamaica. Is there anything we can put on place there in Jamaica?

Hi Elrith – This whole thing sounds like a full-fledged scam. Please DO NOT SECURE FUNDS FOR HER! In fact, I’d report this to the police, both in Jamaica and in the US, if that’s where you live. She is about to get scammed out of $10,000!

I was always proud to know that my grand-parents guarded their financials as closely as they did. Even refused to buy a new lawn mower saying the old one could still be used if you tinkered with it a bit 🙂 But alas this is a sad problem that will only grow as the baby boomers age. Knowing that there are 4 kids in my family all with pretty grounded heads on our shoulders is a bit of a relief although transparency between the 4 of us and our parents is key.

Elder financial abuse is disgusting. I mean, what does that say about you if the only way you can make money is praying on Grandmas who aren’t even coherent. Sure you were a loser before, but now you’re a loser that belongs in jail!

It makes me sick to think that people would take advantage of the elderly in this way – or any way for that matter! Thanks for drawing attention to this important issue. The list of “signs” is important to know and watch for.