Let’s start with the basics, your FICO score. It’s a number created by the Fair Isaac Corporation. Your FICO score is a combined number that helps credit companies and lenders know how much risk you are and how well you’ve handled loans in the past.

FICO scores range anywhere from 300 to 850. Typically, any score above 650 is considered “great.” On the other hand, if your score is under 620, then you’re going to have problems getting good rates on loans.

Let’s talk about what goes into your FICO score. There are several parts, and each of them has a different weight. It’s made of the number of open accounts you have, how long you’ve had a credit history, new credit accounts you have, and if you make payments on time.

Table of Contents

What Is the FICO 8 Credit Score?

Even though it was introduced in 2009, it has taken almost two years to really be adopted by lenders and other creditors.

However, now the FICO 8 model is catching on more widely, and you can expect to see some changes in what is important to your credit score.

The major credit bureaus have been using it, and now a number of banks, credit card issuers, and others are using it. FICO 8 is picking up steam, and this means that you should be aware of what has changed.

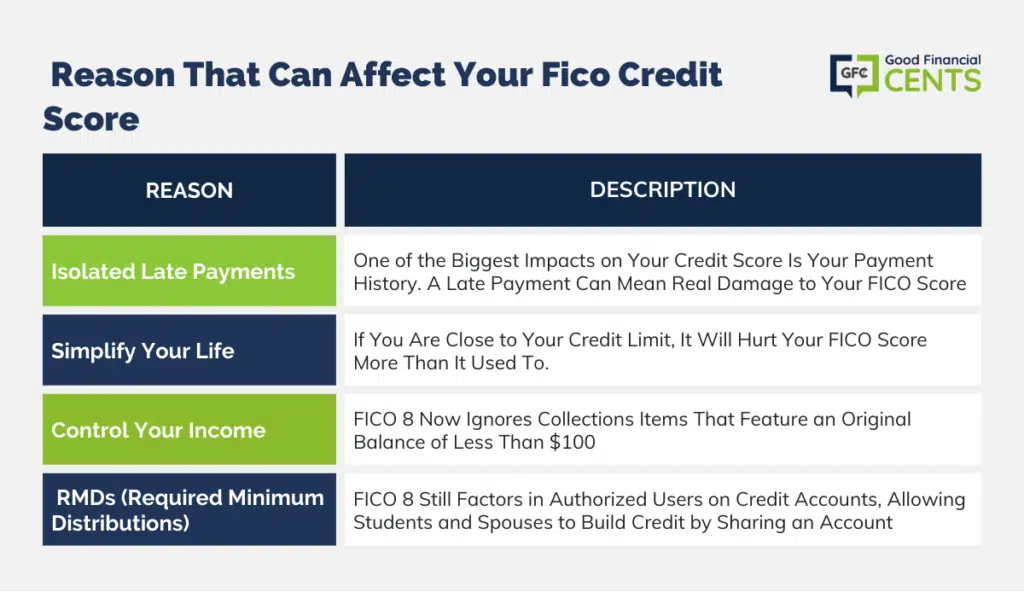

According to myFICO.com, there are four main changes to the formula that can mean a change to your score:

1. Isolated Late Payments: One of the biggest impacts on your credit score is your payment history. A late payment can mean real damage to your FICO score.

The new system, though, accounts for aberrations in what is normally a good payment history. If your other accounts are in good standing, the FICO 8 score will not be as negative as it might have been before.

2. High Credit Utilization: If you are close to your credit limit, it will hurt your FICO score more than it used to.

3. Collections Account with Small Balances: Instead of dinging you for small collections accounts, FICO 8 now ignores collections items that feature an original balance of less than $100.

4. Authorized User: Continues to look at authorized users on credit accounts. This helps students and spouses build a credit history through the shared management of a credit card account. If one person has a great credit card with little usage they can pass some of that history off to their family member.

Lenders and other creditors (as well as insurance companies) sometimes make their own tweaks to the scoring formula created by FICO. The FICO 8 score may used as a foundation, but if a lender has some items that are considered more important, they may be emphasized more.

Get Your Credit Report For Free >>>

What’s the Difference?

Unlike the original FICO score, the range is slightly different. The score ranges from 250- 900 (FICO is 300 – 850). According to several studies, both scores TEND to be pretty similar, but there are some cases when they can vary.

Just because you have a poor FICO score doesn’t mean your FICO 8 score will be just as bad, but there is a high chance.

As a consumer, this can be very beneficial. Back in the day, if you missed one credit card payment, it could put a serious dent in your FICO score, even if the rest of your record is spotless.

Pinpointing Consumer Behaviors

The point of FICO 8 is, of course, to better profile consumer credit behaviors.

FICO 8 is designed to emphasize different behaviors more accurately than in the past, and it is also designed to take more information into account, supposedly building a more accurate picture of your consumer credit behaviors for use by lenders and others.

It is worth noting that FICO (and other credit scoring models) are constantly changing. Different tweaks are added regularly so that the vast amounts of information available about financial habits can be used to create a profile that can be reduced to a single three-digit number.

In addition to having the FICO 8 scoring model in use now, there are additional credit scoring models.

These include formulas aimed at mortgage borrowers, bank deposit behaviors, and even a score that takes into account that you might not use credit very much.

Be aware of what FICO 8 means for you, as well as what future changes to the FICO scoring model might mean. Even if you don’t pay close attention, there are some things you can do, in general, to help your credit score — whether the FICO 8 model is used or not.

Make your payments on time and in full, pay down your credit card balances, and be careful about applying for additional credit.

Bottom Line: FICO 8 Score Explained

The FICO 8 credit score, introduced by the Fair Isaac Corporation, offers a more nuanced assessment of credit behaviors than its predecessor.

Notable changes include less penalty for isolated late payments, greater impact from high credit utilization, and leniency for small collections balances.

The FICO 8 scale ranges from 250-900, different from the original 300-850. It’s designed to paint a clearer picture of consumer credit habits, so it’s essential to understand its implications and maintain healthy financial behaviors.