Do other people’s financial success stories ever make you feel a little… inept?

You’ve heard about them: People like the 28-year-old who made so many wise investments she retired last year. Or that school teacher turned stock trader who now teaches school only because he loves his students, not because he needs the salary.

We could’ve done that, right? If it can happen to them, why not us?

A wise investor simply looks for ways to turn his current and anticipated resources into a more stable future.

A wise investor sees money the way a good gardener sees vegetable seeds: as a tool that — in time and with some tender loving care, can build a more vibrant and secure future for you and your family.

Table of Contents

Why You Need To Invest

This will seem like a no-brainer to a lot of people, but it’s still a good reminder for anyone considering an investment: invested money should be growing money.

It’s a simple formula: money + time = more money, period.

Our money can grow even without us taking an active approach.

Owning a home, for example, can meet the definition of an investment. Homeowners expect the money they spend on their houses to grow over time as real estate values increase. (We’ll get more into this below.)

A savings account is another example of an investment because the bank pays you interest on your saved balance, and while we’re at it, high-yield online savings accounts have the best rates.

Moving Beyond Savings to Unlock Higher Earnings

Even the best savings rates are not enticing enough for some investors. And for good reason: Not only could you earn more money in a more complex investment, but a savings account may also seem a little boring.

It’s a good foundation, sure, but can savings alone pave the way to a smoother financial future? It’s possible, given enough time and enough deposits.

But let’s think about that question. Say you have $10,000 and you deposit it in an online bank paying 1.5 percent interest.

If you did nothing for 10 years — no deposits or withdrawals — your $10,000 would become $11,617.25.

Not bad, right? A free $1,617.25 just for letting the money sit there, untouched, for a decade?

Yes, you could do worse, but you could also do better.

Just think what would happen if you earned 5 percent interest for 10 years on $10,000? (Your $10,000 would become $16,470.09) In 20 years, that ten grand would be $27,126.

Banks don’t tend to pay rates that attractive in savings accounts.

To unlock more investing power, you’ll need to learn about some more active strategies.

How To Start Investing: Top 7 Things You Need To Know

Don’t get me wrong. There’s always room for a solid savings account.

But when you’re thinking about the longer-term — your retirement, your kid’s college, your beach house — more active investments may be in order.

“More active” does not have to mean “risky.” Before handing over any money, find out for sure what you’re getting into. Meet with a financial advisor if you’re not sure how an investment works (or read our Investing for Beginners post if you are really starting from scratch.)

Below you will find helpful information on various investing avenues. However, if you really want to dive into investing a large sum of money, I suggest using a tool such as SmartAsset, which helps connect you with a Financial Advisor.

Before we dive into the details of getting started with investing, here are 7 things you need to know.

1. Start Now and Start Small

The first thing that you need to know when it comes to investing is that you want to start now, and you also want to start small.

The reason that you want to start now is just experience. If you don’t know anything about investing, one of the easiest ways that you can learn is to just do it.

There are many different apps that you can get started with, with no money down. Here are a few of my favorites:

2. Understand the Importance of Compounding Interest

Compounding interest is just the idea of your money growing over a period of time. The more time you have on your side, the longer it has to grow, and the larger it can become. But this is by far the biggest obstacle for most new investors, after they start investing, they simply stop adding to it.

3. Realize That Investing Is Not Gambling Unless…

The third thing that you need to know about investing—investing is not gambling. Investing is not gambling unless you are trying to make a quick return on an investment that you just don’t understand. The two biggest culprits I see with this are penny stocks and crypto.

4. Acknowledge That Inflation Is Real

The fourth thing that you need to know about investing is that inflation is real. When most people think about inflation, it makes them imagine old people talking about gasoline and the price of milk. But really what inflation is, is purchasing power.

What your dollar is worth today, is it going to be the same a year from now, five years from now, or 20 years from now? And let me tell you that inflation is real. Purchasing power is real.

5. Investing is how the rich get richer

The fifth thing that you need to know why you are investing is because this is how the rich get richer. Let’s face it, if you want to build wealth, if you want to hack your wealth, if you want any hope of retiring early or just achieving financial independence, you have to start investing it.

6. Losing Money Is Unavoidable

I won’t say it’s the most important thing, but this is the one that definitely derails a lot of people, but when it comes to investing, it is guaranteed that you are going to lose money. It is unavoidable. You are going to lose money. I don’t care how great of an investor you are.

7. Don’t Get Emotional

Don’t get emotional. Emotions are going to play a huge part when it comes to investing. When fear creeps in, sometimes people act irrationally.

Don’t let emotions get the best of you. Don’t let FOMO creep in and just entice you to jump into different investments like crypto, like penny stocks that you don’t understand. Don’t get emotional.

For more details on how to get started investing, check out this video.

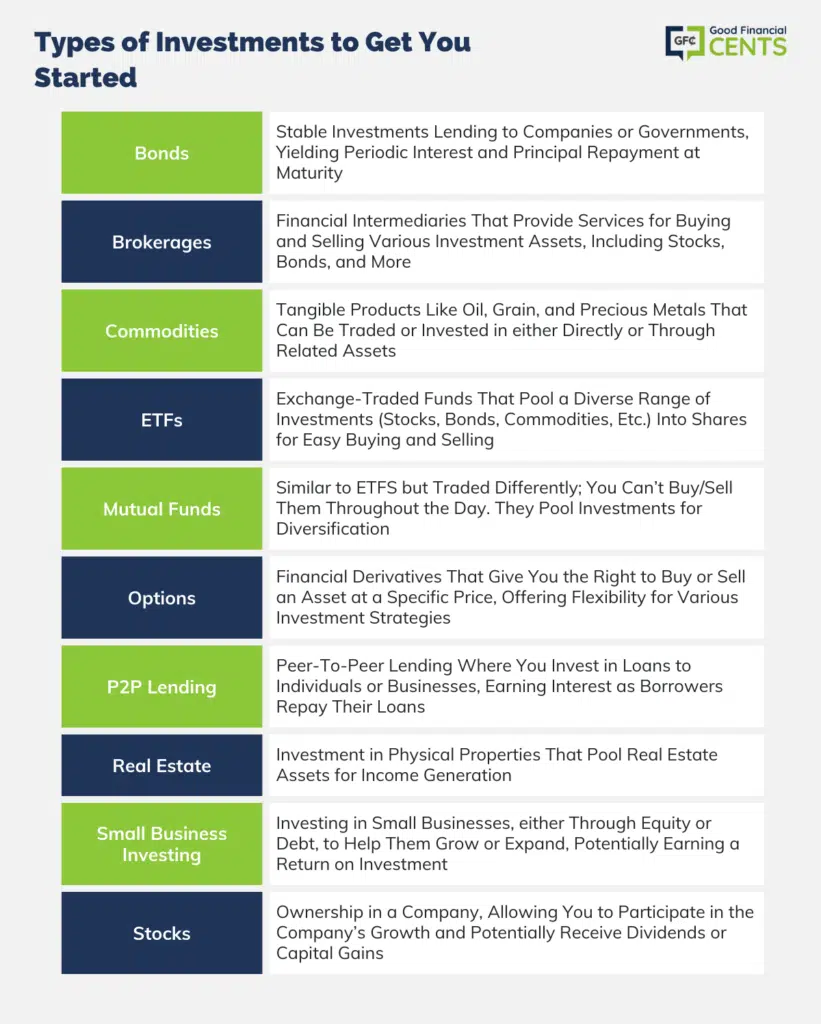

Types Of Investments To Get You Started

Let’s get into some details about the types of investments that are out there, and how to use them.

- Bonds

- Brokerages

- Commodities

- ETFs

- Mutual Funds

- Options

- P2P Lending

- Real Estate

- Small Business Investing

- Stocks

Bonds

Most of us know about buying stocks. That’s when you buy shares of a company in hopes that your investment will increase in value along with the company.

Bonds offer another way to invest in a company, or in a governmental body such as your local school system or the Federal Treasury.

When you buy a $1,000 bond, you’re loaning the bond-issuing company or government $1,000 for a set amount of time.

For this example let’s say you’re buying 10-year bonds. You’ll get the bond’s $1,000 face value back when the bond matures in 10 years.

Until then (or until you sell or trade the bond), you will also earn a yield, which is a term for the amount of interest you’re getting in exchange for giving up your $1,000 for a decade.

So if the bond pays 5 percent interest, your yield would be $50 a year — not an eye-popping figure, I know, but you have to start somewhere.

If you had 20 bonds worth $1,000 each, for example, the collective yield could pay for a 21st bond, whose yield would help pay for a 22nd, and so on. Slow and steady wins the race.

Contrary to what you may read, bonds are not risk-free. Generally speaking, bonds are more stable than stocks, but if you buy bonds from a company that goes bankrupt, you’d still be in trouble.

Try to diversify your holdings, and consider mixing in some lower yield but lower risk options such as Treasury notes. Starting a relationship with a good broker could help keep you on the right track.

Brokerages

You don’t have to work with a brokerage firm.

In our world of crowd-sourced loans and Robo-advising algorithms, sitting down with a broker can feel a little outdated, like afternoon tea or prime-time TV.

If you have an extra couple thousand dollars and would like to see how well you can do investing it yourself, a broker’s fee may erode your earnings and take away a lot of the fun.

But a real-life broker can still offer something the more affordable alternatives cannot: a vision for the big picture.

If you’re serious about taking your current and anticipated resources and using them to build a more vibrant future, a broker can help you build a diverse plan, that addresses your specific needs and challenges.

He or she can see possibilities a Robo-advisor could miss. If so, the brokerage fee would be money well spent.

Keep these ideas in mind when looking for a broker:

- Find someone you like: It sounds overly simple, but you’ll be sharing personal information and talking about your future goals and dreams. You’ll have a better experience when you are comfortable talking with and trusting your broker.

- Ask about broker’s independence: Independent and captive brokers can help you build a portfolio that’s customized to your needs. However, a captive broker will also have a responsibility to sell his or her company’s investment products.

- Mix and match: Having a relationship with a traditional broker doesn’t mean you can’t have a little fun investing online, too.

Commodities

From bartering to the Gold Standard to paper money — finances have grown more abstract over the past several centuries.

Now, of course, a lot of us experience money only as numbers on a screen.

The whole operation can feel a bit flimsy to some people, and those feelings can keep people out of the investment world.

It is usually easier to embrace the idea of trading commodities, though. Commodities are tangible products such as oil, grain, and precious metals.

If you bought, for example, two ounces of gold last year and the price of gold increased this year, you could sell the gold for a profit, maybe without even leaving your neighborhood.

Sounds simple enough with gold, but what about with oil? If you bought 1,000 barrels of oil, where would you store it?

How would you keep it secure?

Where would you find a buyer when you wanted to sell? Who would deliver it to the buyer?

Yes, that sought-after tangibility can create some problems.

So modern traders have made some changes to the age-old process of commodities trading, making it easier to get into the game. You could:

- Buy stocks (or bonds) in companies that produce commodities: steelmakers, rubber producers, energy companies, etc. You’d be connected to the commodities market without having to deal with the actual commodities yourself.

- Buy commodities futures, refer to future fixed prices of a commodity. This is tricky, and it usually takes a lot of up-front money to get going. I’d ask a broker about this.

- Buy into commodities via exchange-traded funds (ETFs). This is the most flexible and accessible approach. Essentially, you’re buying into a wide variety of commodities without taking on the responsibilities of owning the commodities. We’ll get more into ETFs next.

Exchange-Traded Funds (ETFs)

Investors like diversity for good reason: Portfolios with a wide variety of investments can withstand a financial storm more easily than portfolios comprised of similar investments.

When you buy investments gradually, it takes time to build diversity.

Exchange-traded funds offer a shortcut.

ETFs pool a diverse array of investments — as stocks, bonds, commodities, etc. — then split the pool into shares you can buy, sell, and trade throughout the day.

As a result, you can invest a smaller amount of money and still have diversification.

You’d need to set up a brokerage account to buy into an ETF and remember that even though your ETF shares offer immediate diversity, they are not immune from loss.

Your broker or financial advisor can help you customize your purchase to your needs.

If you need more liquidity, for example, stay away from lightly traded ETFs which can be harder to sell.

Mutual Funds

Mutual funds work a lot like ETFs: They pool other investments, giving you easy access to diversification.

The main difference between ETFs and mutual funds becomes clear when you try to buy or sell shares.

You can’t buy, sell, or trade mutual fund shares on an exchange. Instead, you would buy shares through a mutual fund broker.

As a result, the price per share of a mutual fund is set once each trading day and does not fluctuate with the market throughout the day.

As with an ETF, when you’re investing in a mutual fund, check management fees first. They may seem like small inconveniences, but percentage-based fees can cut away at your earnings.

Especially when combined with brokerage fees, management fees can take you by surprise if you don’t know what to expect.

Options

Let’s say you’re booking a flight to New Orleans for Mardi Gras. You’ve found a great deal on a ticket, but you aren’t 100 percent sure you can go because your sister has a baby due about that time, and you’d really like to be around for that.

What would you do?

If you book the flight but decide not to go, you’ll lose the money.

If you wait until the week you’d like to leave before booking a flight, the ticket might cost five times as much.

As you probably know, many airlines offer cancellation insurance for a fee. Buying the insurance gives you the option to cancel your flight and get a refund if your sister goes into labor, or if something else comes up.

The option doesn’t obligate you to cancel the flight, and if you fly to New Orleans as planned, you won’t get the insurance fee back. It has done its job by giving you the option to cancel, even if you didn’t need it.

Options work similarly with investments. Instead of planning for a baby’s arrival or an unexpected emergency at work, you’re planning for uncertain economic conditions.

An option could give you the right to:

- Sell an investment at a certain price despite external market conditions (put option)

- Buy an investment product at a certain price, even it is selling for more at the time (call option)

Options expire, so put those expiration dates on your calendar so you remember to take advantage of them or to pass on exercising the option.

Options help invest more ambitiously since you’re planning for the what-ifs.

P2P Lending

When peer-to-peer (P2P) lending came along 10 or so years back it seemed like a great equalizer — a way to borrow money online without having to sell your idea to a loan officer in a bank.

And despite some occasional bad press because of investors’ losses, I still like the idea.

When you invest in a peer-to-peer lender, you’re investing in borrowers. As the borrowers repay their loans, the interest they pay funds your earnings.

Naturally, if a borrower does not repay, you lose money.

Traditional banking works the same way, which is why lenders use tools such as credit scores and debt-to-income ratios to determine a borrower’s likelihood to repay a loan.

Most P2P platforms also rate loans based on the risk you’d take financing the loan. Riskier applicants pay higher interest rates, so you could earn more by financing riskier loans… if the borrowers come through with repayment.

Lower-risk loans offer more reliable repayment odds, but they tend to earn lower rates of interest.

Like everything else in life, you have to find the right balance when investing in P2P loans. This balance has a lot to do with your personal comfort level.

Real Estate

Like commodities, real estate investing goes back centuries. Records of landowners earning from their landholdings are just about as old as writing itself.

And historically, the land becomes more valuable as time passes, making it a reliable investment.

We’ve enhanced the process in modern times: land developers increase the value of the property more quickly, for example, optimizing its earning potential so they don’t have to wait decades to earn a profit.

Some individual investors do the same thing on a smaller scale by flipping houses.

In a nutshell, you buy a house, improve it (sometimes drastically), and then resell it at a higher price.

Other investors keep and maintain rental properties so they can collect income from tenants.

Land development, house flipping, and becoming a landlord require up-front money. You’ll need to buy, improve, update, and maintain a property, all of which can be expensive. This barrier keeps a lot of would-be investors out of the game.

So how can you get started without coughing up a lot of cash?

Four words: Real estate investment trusts (REITs) which work a lot like mutual funds. You buy shares in pooled real estate holdings and let someone else manage the properties within the fund.

As the properties make money, so do you.

REITs offer a lower bar for entering the real estate market, but a little bit of knowledge will still go a long way. A good broker can help you get in the game and help you understand the risks and fees.

If you need to liquify your assets quickly, a REIT may not be your first choice because sometimes it takes a while to sell your shares.

I’m also a big fan of Fundrise, a website where you can invest in real estate projects online, choosing the properties you’d like to invest in.

Small Business Investing

Most small businesses need money to get started. Other existing small businesses need money to expand, modernize, or buy more equipment.

A business in need of money is a business in need of investors, and there are two traditional ways for investors to get involved:

- Investing for equity: Making an equity investment makes you a partial owner of the business. If the business grows a lot after you invest, you can make a lot of money, depending on how the business splits its profits.

- Investing for debt: When you invest this way you’re giving a small business a loan. Your return comes in the form of interest payments on the loan. Your profits will not be directly connected to the business’s expansion, but you also won’t risk losing everything if the business fails.

(You may have a lien on the company’s office equipment, meaning you could still reclaim some of your investment.)

Which route should an investor choose: The potential for big earnings from equity investing or the more stable approach of investing in debt?

As you already know, no one can answer that question for you. Your answer will depend on the details of the business you’re investing in and on your personal preferences.

It’s easier than ever to invest in debt through peer-to-peer lending. As with other peer-to-peer loans, take the time to read about the loan application and its ratings before investing your money.

And before investing in equity, check out the business’s long-term plans. Find out how the company plans to make money and decide for yourself whether you think the company will use your investment wisely to build future success.

Stocks

To many beginning investors, buying stocks is the go-to method for investing.

Whether working with an in-person broker, an online advisor, or an algorithm-based program, buying stock in a company gets you immediately connected to the larger economy.

Though not always necessary, a good in-person broker can be money well spent if your broker helps you find stocks with higher earning potential.

If you’re not ready for that level of commitment, an online, discount broker may offer what you need.

Whatever route you take, you’ll likely need to open a brokerage account (though some companies do sell stock directly to shareholders.)

Now, you can take an even more passive approach to investing using a robo-advisor. You tell the robo-adviser how aggressive you want it to be, then sit back while it decides how to invest your money. Wealthfront and Betterment are two leading robo-advisors.

Set Aside Some Investment Earnings for Taxes

Like it or not, state and federal governments will get a share of your investment earnings.

You could spend weeks reading about tax laws and still have much to learn, so I won’t try to explain the specifics here.

I do recommend working with a tax professional, either online or in person if you’re concerned about how much you’ll owe in taxes.

In the meantime, here are a few things to know:

- Don’t let taxes influence your investing too much: I’ve known clients who turned down great investment opportunities because they didn’t want to pay the resulting taxes. Sure, taxes are a drag, but they shouldn’t scare you away from making money.

- You’re taxed on your earnings, not necessarily on your account balance: Whether you’re earning interest, stock dividends, or profit from real estate, it’s the money you earn (not what you own) that matters for next year’s income tax returns.

- Interest on some government-issued bonds may be tax-free: On the other hand, their yields are also on the lower end.

- Get free help when you can: Leading robo-advisors can help you keep track of taxes you owe on your current earnings.

- Generally, the tax code favors money set aside for retirement: Tax laws encourage us to set aside money for retirement. We’ll get more into this below.

Investing Specifically for Retirement

As I said above, investing money can help us prepare for a more abundant future. Many people envision a work-free future.

That’s why investing for retirement has become a business in and of itself. It’s also why the federal tax system favors retirement investments by offering tax advantages for retirement-specific investments.

These advantages work only if you take advantage of them, and they work best if you start now.

Even if you’re only 30.

Even if you’re younger than 30.

It’s never too early to start planning for the future.

With that in mind, here are some great investing-for-retirement tools to work with.

- IRAs

- Employer-Assisted Funds

- Annuities

- Social Security

- Other

IRAs

Anyone in the United States old enough to work legally is old enough to open an Individual Retirement Account (IRA).

Depositing money in your IRA gives you tax advantages:

- A traditional IRA lets you deposit up to $7,000 a year tax-free ($8,000 if you’re 50 or older). You pay taxes on the money when you withdraw it later in life.

- A Roth IRA does not give you an immediate tax break, but you can withdraw money tax-free later in life.

Employer-Assisted Funds

Your employer can help you set up a 401(k) retirement account. Contributions by you (and your employer) will be tax-free. You will be taxed on the money when you withdraw it later in life.

Some employers, especially non-profits or government agencies, use 403b plans which work similarly.

Other employers offer pension plans as a benefit to employees. With a pension, you pay into a plan and your employer may invest collective employee contributions to create a healthier pension fund. The fund then makes payments to the company’s retirees.

Annuities

Insurance companies sell annuities, which allow you to save some of your current income for use later in life.

You can contribute to an annuity regularly or pay a lump sum upfront. Some annuities connect your money with other investments, such as stocks, or to an entire stock index such as the S&P 500 to allow for growth.

Healthier annuities lead to bigger annual payments when you’re retired.

Before buying an annuity, check with your insurance agent about early withdrawal penalties, and make sure you’re comfortable with any risks that come along with stock-related annuities.

Social Security

Many retirees rely on monthly income from the federal Social Security program. While you don’t have as much control over your investment in Social Security, you can increase your payment by:

- Working as long as possible before retiring

- Working in a higher-paying field

- Waiting several years (after becoming eligible at age 62) before claiming benefits

- Check your statements to see how you’re doing. (They may look like junk mail and will come every five years if you’re younger than 60)

Other Tools for Retirement

If you can afford to hire an expert, a retirement planner or certified financial planner can help you build a retirement plan to meet your specific needs.

As I said above, starting when you’re young will make a huge difference. If you didn’t start in your 20s or 30s, it’s even more important to get off to a strong start now.

Investing: Not a One-Size-Fits-All Activity

Maybe you’re investing for fun. Maybe you’d like another stream of income. Maybe you’re thinking about the future. Maybe you’re just curious about the way things work.

Whatever has you interested, you can spend decades learning the ins and outs of investing. After that, you’ll still have plenty to learn because, in a dynamic economy like ours, innovations come along regularly.

Yes, it can be intimidating, but here’s the good news: Chances are you can find an investing approach to match your life and your goals.

If you need to start slower, look into bonds or mutual funds. If you like fast-paced investing, consider stocks or ETFs.

Do you like guidance? Look for a good in-person broker. Would you rather go it alone? A discount broker or even a robo-advisor may work for you.

Find your path and monitor your progress so it can lead you to a more stable future.