Have you caught the entrepreneur bug and want to start your own small business? You’ve heard stories of people who have struck it rich by going out on their own and working for themselves. The thoughts and dreams of running your own business can be intoxicating.

It’s funny that growing up, I never really thought about starting my own business; not as a child, not in high school, not even in college, and frankly, I didn’t think much about it after starting my career.

When I finally got the opportunity and saw what it really meant, starting my own small business was one of the best ideas I’ve ever had.

Table of Contents

- 14 Business Ideas for You to Get Started On Today

- 1. Uber

- 2. Financial Planner

- 3. Insurance Agent

- 4. Freelance Writer

- 5. Make and Sell Clothes

- 6. Say Cheese

- 7. Baby or Dog Sitting

- 8. Virtual Assistant

- 9. Social Media Manager

- 10. Appraisal Service

- 11. Consulting Service

- 12. Start a Blog

- 13. Hairstylist

- 14. Start a Franchise

- Your Next Small Business Opportunity

14 Business Ideas for You to Get Started On Today

If you’re looking to start your own small business, here are some of the best new small business ideas to kick around.

If you’re looking to start a new venture, here are the best small business credit cards to check out.

1. Uber

Uber made the top of this list because it has become one of the most hassle-free ways for people with a relatively clean driving record to get started working for themselves. Getting started requires little training and you can make enough money during non-business hours to provide a livable income for your family. You will not get rich driving for Uber, but you can work during the hours you want to work and it may allow you to pursue a small business idea you are more passionate about.

Once you sign up on their website, you will have a background check done. Once that is complete you have to have a vehicle inspection and then you are good to go.

2. Financial Planner

How could I write a blog post about the best small business ideas and not include my profession? Some of the perks of becoming a financial planner are that you control your own hours, you work with the people you want to work with, and the pay can be very good.

I don’t want to make it sound, though, that becoming a financial planner is easy breezy because it does take a lot of work. It takes a long time, sometimes several years, to build up a client base, and getting hired is oftentimes tough, especially if you don’t have a financial background.

There are independent companies like Primerica and World Financial Group that do allow you to get into the industry, but oftentimes they’ll start you off with you getting your insurance license first. Still, for an awesome profession, it is a nice way to get your foot in the door.

3. Insurance Agent

For some people, the job description of selling insurance is not that appealing, but the fact of the matter is it pays very well. Whether you’re a pure life insurance agent or a property and casualty, insurance agents can make very good money.

To get licensed, you just have to take some basic tests that will cost you a couple of hundred bucks, including studying materials and the actual testing costs. Becoming an independent life insurance agent is really easy nowadays days as there are many independent brokerages that you can connect with.

Getting approved for property and casualty can be tough, especially depending on your geographic location. I’m in the process of adding an insurance division to my financial planning practice, and as of now, we’ve had a few obstacles in getting approved by any carriers for the P&C side.

Nonetheless, if you think you like insurance and you want to help people, it’s definitely a good profession, definitely a good small business idea that you can pursue.

4. Freelance Writer

Even though I have a blog and you’re currently reading one of my blog posts, the irony of that is that I hate to write. Mostly because it’s not a natural gift and it takes a lot of time energy and a lot of extra brain juice to crank out a good post; but if you’re able to knock out solid articles, in your spare time, this freelance writing might be right for you.

Miranda Marquit, who is a freelance writer for my site, has created a full-time small business out of her freelance writing work. You can read an article she shared about how to be a successful freelance writer where she shares her story. Being a freelance writer allows her to work no more than 30 hours a week while working at home, and also to be the breadwinner of her family. Not too shabby for having the skill to crank out 70 words a minute.

5. Make and Sell Clothes

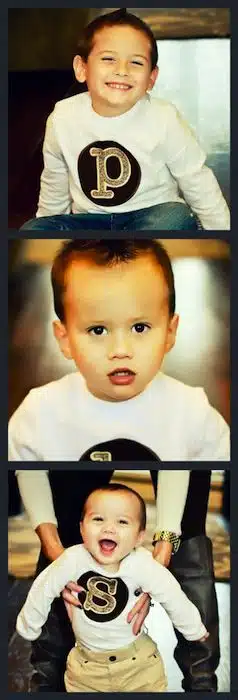

For my son’s first birthday, my wife was proud to show off his birthday shirt that a local seamstress had designed on her own. The next thing I knew, this was a tradition for all my kids’ birthdays, including other various celebrations, too.

Turns out that Angie Congiardo has built up a very nice small business side income by doing what she knows, sewing. She does it on the side and has shared with me that the first full year that she kept track, she was able to bring in $11,000 on the side. Not bad for a small business idea working out of her house.

She does no advertising other than on Facebook Fanpage, but as most of you know, that’s free. If you have a skill in sewing any type of clothing, there’s definitely an opportunity to turn that into a small business.

Those are compliments of Angie herself. Always nice to support local small businesses. 🙂

6. Say Cheese

Do you have a passion for photography? If you do, there’s definitely a market out there for you.

I have two friends who both made great money from being a photographer. My closest friend, Jason York of Jason York Photography, turned his love for taking pictures into a full-time business. He now owns his own studio and has become one of the most recognized photographers in our area.

Another friend of ours, who has a full-time job, has been able to produce a very nice side income by taking pictures in the evenings on the weekends. She has done so by, also like Angie, marketing her business on Facebook as her word of mouth. With the awesome technology that cameras have nowadays and the awesome free editing software programs that exist, taking pictures and getting paid for it has never been easier.

7. Baby or Dog Sitting

Having three young sons, it’s almost a necessity for me and my wife to get out of the house for some “us” time. When we leave, we want to make sure that we’ve hired a babysitter that we know and trust, and I remember one of the first times that we had a babysitter come in, me and my wife had discussed how much we should pay.

The ultimate conclusion was we should pay a little bit more than they may make somewhere else because we didn’t want to be cheap to our babysitters since this was the person who would be responsible for our kids for the few hours that we were away. As long as young families are popping out babies, there’s always going to be a need for babysitting. The same goes for dog sitting as well.

Every time that we leave on an extended trip, we’ll take our pet boxer, Klaya, to a local dog-sitting service. They’ve built up a great reputation in the area of keeping the dogs entertained allowing them to run and play, and also cleaning them up before we arrive home. The point is, that people will always pay top dollar for good care.

8. Virtual Assistant

Prior to reading Tim Ferriss’ 4-Hour Work Week, I had no clue was a virtual assistant was. After reading his book, I was so blown away that I was eagerly trying to figure out how I could incorporate one into my life.

Fast forward to the present day, I currently have a virtual assistant who helps out with some of the behind-the-scenes work on my blog. It’s all the administrative stuff that while yes I can do, it’s definitely worth paying somebody else an hourly wage just to take care of it for me.

So what exactly does a virtual assistant do? Essentially, a virtual assistant can do anything that you want that person to do for you. They can schedule meetings, type out emails, answer phone calls, research items online, and book travel plans. The better question is what a virtual assistant can’t do.

If you often find yourself wasting time on piddly stuff where you would be more productive doing things that you’re more passionate about and make more money on, then definitely look into hiring a virtual assistant. There are sites like onlinejobs.ph and odesk.com where you can find a virtual assistant for cheap.

9. Social Media Manager

As Facebook and Twitter continue to grow and other social networks like Pinterest, Google+, and Instagram continue to gain popularity, being a social media manager has never been in more demand.

Many small businesses, brands, or websites are looking for people who are knowledgeable within a social media space and can help them manage all the different platforms that exist. If you like Facebook, if you like Twitter and can add value to another small business on how they can use these tools, then being a social media manager is right up your alley.

10. Appraisal Service

One of my former coworkers had been in the appraisal service prior to becoming a financial advisor. He still kept his license open because he was always getting calls from people needing commercial appraisal services. Whether it be a home appraisal or commercial appraisal, as long as people are buying and selling properties, there’s always going to be a need.

There’s not a huge barrier to getting in, a few tests to pass, but once you do, it can be a very lucrative small business. As with any new business, you’ll have to shake some hands and make some key connections so people know that you exist, but if you do a good job and build up a good clientele, word-of-mouth referrals will start to stream in.

11. Consulting Service

Are you considered an expert in your field or in a certain niche? If so, then being a consultant might be right up your alley. Many companies prefer to hire consultants as a cheaper alternative to having an employee on the books.

From your standpoint, one of the huge benefits of starting your own consulting small business is that typically start-up costs are very low. You already have the knowledge. Now you just need a fresh-looking website, a game plan, and a marketing strategy that will put you in front of the right people.

12. Start a Blog

Writing a blog post in your pajamas and getting paid for it is a dream for many. Many people can turn their blogs into legitimate small businesses, but they are the minority.

Blogging takes a ton of work. Behind the scenes, on this blog, I spend 20+ hours per week managing the daily aspects of the blog. Luckily, I absolutely enjoy it!

How much money can you make starting a blogging business? The sky is really the limit but it takes time.

It took me over 5 months to get my first Google Adsense check from this blog and that check was a measly $100. Definitely not worth quitting your day job over.

Since then I’ve been able to bring in a consistent nice side income. A few times while my wife was still working she would exclaim, “You’re making more from your blog than I do from my job!”. Hehe… 🙂

If you’re interested in learning more check out this blog post where I share how to make money blogging.

13. Hairstylist

If I ever tried to cut my own hair, I would probably be a few fingers shy of having a complete set. That’s why I go to a professional. 🙂

The lady who has been cutting my hair for the past several years has bounced around a few salons in the area before she finally opened her own shop appropriately named after her first name. She has a good client base because she’s good at what she does and hasn’t looked back since making the giant leap.

To help cut down costs, her iPhone serves as her business phone line and also her credit card machine using some awesome technology by Intuit. But being cost-conscious, her profits are at record numbers and continue to grow while also enjoying the freedom of owning her own shop.

14. Start a Franchise

I had a classmate in high school whose parents owned 4 or 5 McDonald’s franchises in the area. Needless to say, they were loaded! Franchises are great for those who don’t want to worry about creating the idea, they can just run with an already existing business plan and focus their efforts on the business.

A friend of mine who is a serial franchise entrepreneur has opened several Little Caesar’s pizza chains in our area and from what I can tell is doing very well. Not satisfied with his conquests, he decided to open another franchise, Sports Clips, a hair salon that caters to men. At last count, he’s opened 3 of those and continues to grow his empire.

Every franchise is different so it’s extremely important to read all the fine print before embarking on your franchise journey.

Your Next Small Business Opportunity

I love hearing stories of people who get their small business ideas and take the giant leap. Unfortunately, the odds are against you so make sure you do your research and have plenty of cash on hand.

Have you started a small business? What small business idea did you get the work? Are you considering starting your own small business? Share the details!

SECOND HAND AND Antiques

I had invested my savings in mc wealth, which is an innovative investment platform. I managed to earn pretty good returns through it. In fact, my investments became a source of solid second income.

I decided to go ahead and make use of that income to start a franchise. Quit my day job and only concentrating on my business.

I would like to add on to your list by putting “Investing” as one of those opportunities!

Thanks for the suggestion William!

Jeff that’s really a good article. I’m gonna make sure i introduce my friends to this article. Keep it up.

Thanks David!

Thanks for the great article,I am sure this business ideas will be useful for job seekers to start a job,I am going to suggest this article for my friends to get some knowledge,keep doing this great work,keep sharing.

Thanks Harish!

Hi there, finest ideas to start a new small business. Thanks for sharing this post.

I am looking for an online business but I am facing difficulties in choosing the business so I started to google and reached your site, now I got some idea to start my business, I going to become a freelance writer, thanks for the great article its really helped a lot.keep doing this great work.

Glad to have helped in some way Harish!

That’s a nice wide range of business options, something for everyone that’s for sure. Besides starting my own blog a while ago which has become a side gig for me, I also went out and bought a small business along with my siblings and it has been going great so far. Corporate America has been my day job for the last decade, but I can definitely see myself going more toward the small business route in the future.

I have thoroughly enjoyed writing on my non-

traditional Christian blog (mychristianday.org) the past few years. It is a wholly spiritual blog (not political or social) which highlights “love.” I have never viewed my website as a means to make money until recently. I am simply at a point now where I would love to be able to work on my blog “full-time.” I would appreciate any and all suggestions which can assist me in reaching this lofty goal! Thanks!

I am totally agrees with the author information that invoice factoring is very helpful for business. Thanks for helping me, by sharing this and I will share this to my friends and keep it up!

Its good to know the right invoice factoring for your business. I think that being able to know the right invoice factoring to use would mean success to it. I know that every business seek to find the right invoice factoring to use.

I’m one of the few people who would disagree that social media marketing is not an evolving industry. For people looking to make serious money online with little or no capital to start, that’s one idea they should be giving a thought.

I totally agree! I too belong to a telework/WAHM board and those writing gigs are very competitive. You only need two or three eggs (clients) and you’re pretty much set with full time projects.

For a lot of people, being your own boss is one of the American dreams. These resources are amazing.

I belong to a telework forum. Of all the jobs that are posted, the most lucrative ones seem to be the writing opportunities. I try to pursue these as much as possible because I don’t like talking on the phone.

Jeff I found your blog from the results of an internet search. Been thinking about venturing out on my own for quite some time. It’s a scary yet exhilarating feeling. I appreciate you putting in the time to make these resources available. Cheers!

I heard about Odesk on a WAHM (Work At Home Mom) message board. A person gets hired based on reputation and job skills. It’s a great way to build up clientele.

I thought about becoming a financial advisor but in the end it wasn’t for me at this point in my life and where I am located. I did, however, start a blog two weeks ago and have been learning a lot! It is a lot of work but I am really enjoying it.

You’ve covered it all — the main point I get from this is “find what you like, whether that’s going on long walks with dogs or helping people plot their financial future, and just do it.”

I have been doing freelance writing and blogging for three years now and the income has been steady for the past two years. However, when my husband lost his job, he tried his luck with freelance graphics design. He also accepts face painting and event photography jobs during weekends for additional income.

Excellent roundup Jeff. This should be given to graduating high school seniors. My brother is getting his licenses for insurance and some financials – something I’m a bit interested in myself.

Well, I have a P & C insurance agency and want to add financial planning…..do you wanna trade jobs :0)

Instead of trading, it would be better to partner up. I have no desire in starting and learning another small business 🙂

Thanks so much, Jeff. You rock my man!