When you leave your job, you have a few options when it comes to your pension. You can take the pension payout over your lifetime, cash it out as a lump sum payout, or you can roll over your pension into an IRA.

But what’s the best option for you? The short answer is: It depends.

I know that’s not the answer you want to hear, but it truly does depend on your unique financial situation.

For most people, rolling over their pension into an IRA is the best choice. In this article, we’ll look at the reasons why rolling over your pension is often the best decision, as well as some situations where it might not be the best idea.

What Is a Pension?

A pension is a retirement savings plan that is typically offered by an employer. Pensions are tax-deferred, which means you don’t have to pay taxes on the money you contribute to your pension until you withdraw it in retirement.

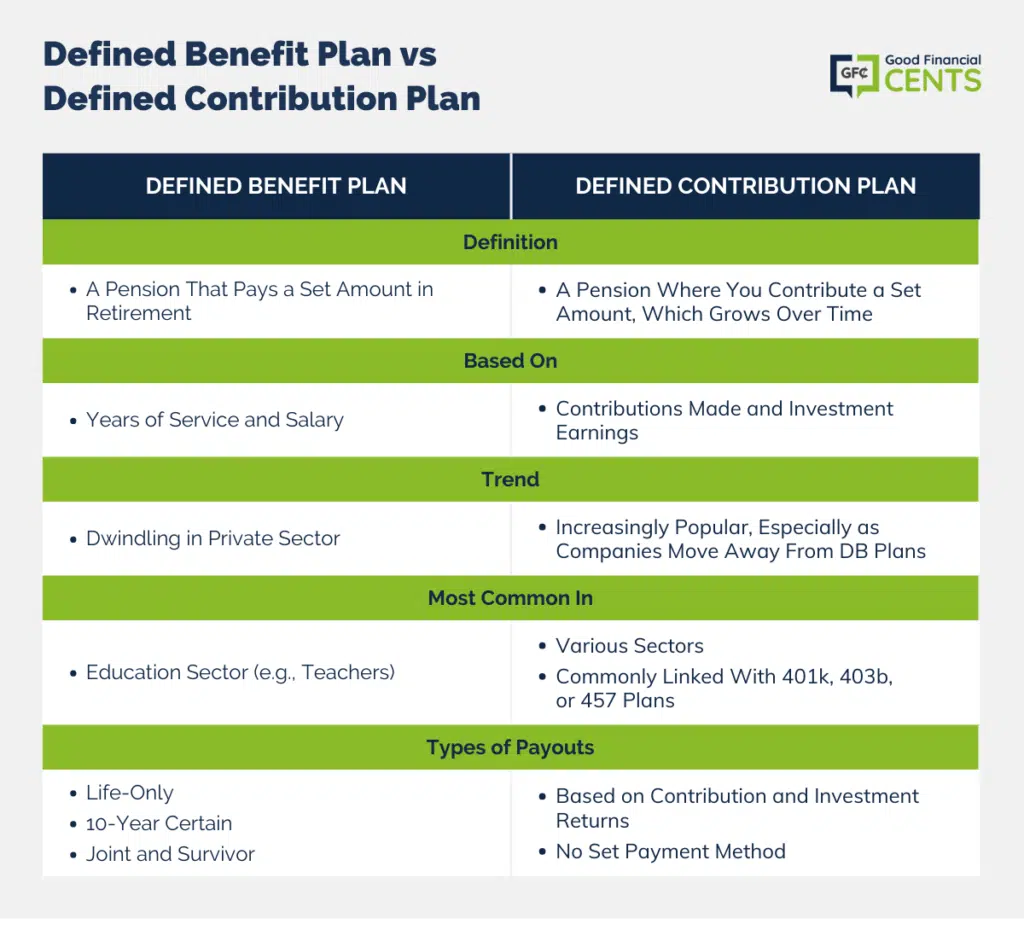

There are two types of pension plans: defined benefit and defined contribution.

What Is a Defined Benefit Plan?

A defined benefit plan is a pension that pays you a set amount of money in retirement based on your years of service and salary. These types of pension plans continue to dwindle as companies increasingly switch to defined contribution pension plans, such as 401(k) plans.

According to the U.S. Bureau of Labor Statistics, only 15 percent of private-sector workers have a defined benefit pension plan.

Public sector employees are more likely to have a defined benefit pension plan. Over 80 percent of state and local government workers have a pension.

The most common type of employment that still offers pensions is education (think teachers).

Types of pension payouts can include:

- Life Only: You receive pension payments for as long as you live.

- 10-Year Certain: You are guaranteed to receive pension payments for at least 10 years, even if you die before then.

- Joint and Survivor: Pension payments continue to be paid to a surviving spouse after your death.

Some pensions may offer additional payout options, but these are the most common. Typically, if the employee chooses the “joint and survivor” option, the monthly payment is reduced because the payments have to last for two people.

For example, I have one client who elected this option and was receiving $2,625 per month for himself and his wife. Had he elected the “life only” option, his payment would have been $3,475 per month.

What Is a Defined Contribution Plan?

A defined contribution plan is a pension that allows you to contribute a set amount of money into the pension, typically through payroll deductions. The pension is then invested, and the money grows over time -the power of compounding interest!

They are more commonly known as 401(k), 403b, or 457 plan. The amount of money you have in retirement depends on how much you and your employer contributed, as well as how much the investments earn.

Also related: Choosing the Best Retirement Plan For You

401(k) plans can also offer a match, which is free money from your employer.

For example, if your employer offers a 50 percent match on 401(k) contributions up to 6 percent of your salary, that means they will contribute 50 cents for every dollar you contribute, up to 6 percent of your salary. So, if you make $50,000 per year and contribute 6 percent ($3,000), your employer would contribute an additional $1,500.

What Is a Pension Rollover?

A pension rollover is when you take the money from your pension and roll it over into an IRA. In essence, you are foregoing the pension payments in retirement and instead opting to manage the money yourself in an IRA.

According to IRS regulations, you have 60 days from the day you receive the pension payout to roll it over into an IRA. If you don’t do a pension rollover within that 60-day window, the money will be considered a withdrawal, and you’ll have to pay taxes on it, as well as a 10 percent early withdrawal penalty if you’re under age 59 1/2.

These rules closely resemble a 401(k) rollover.

The 10% early withdrawal penalty is a big deal but easily avoidable by working with a qualified professional.

Why Should You Roll Your Pension Into an IRA?

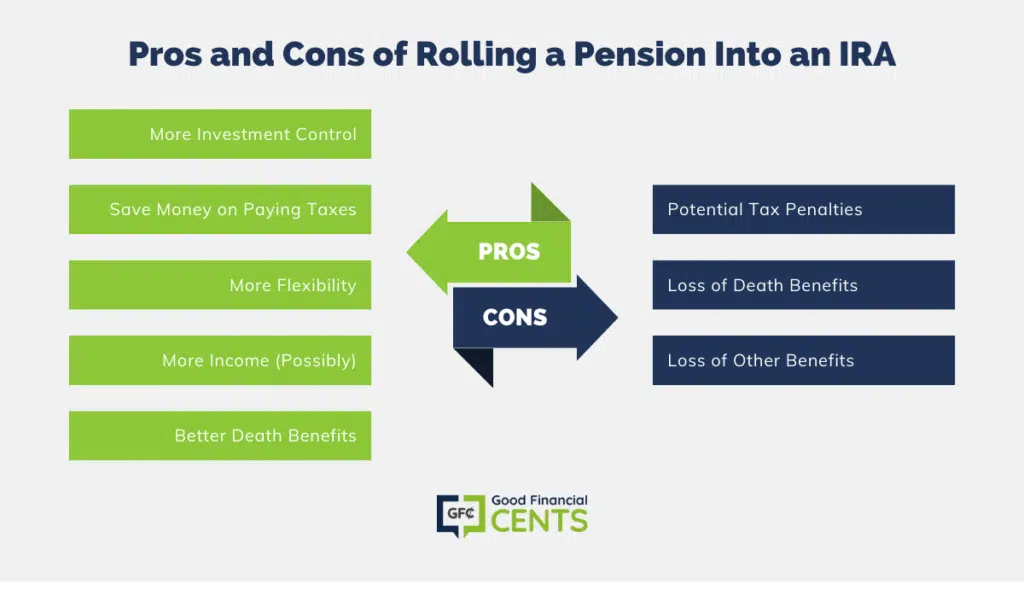

There are several reasons why rolling over your pension into an IRA is a good idea. Here are five to consider:

1. More Investment Control

First, rolling over your pension into an IRA gives you more control over your retirement savings. With an IRA, you can choose how your money is invested. For example, you can choose to invest in stocks, bonds, and mutual funds.

Many of my clients who had pension plans opted to roll over their pension into an IRA so they could invest in a wider variety of investments, including real estate and alternative investments.

2. Save Money on Paying Taxes

Second, rolling over your pension into an IRA can also save you money on taxes.

With a pension, you will have to pay taxes on the money when you withdraw it in retirement. However, with an IRA, you can defer paying taxes on the money until you withdraw it in retirement.

3. More Flexibility

Third, rolling over your pension into an IRA can give you more flexibility in retirement.

With an IRA, you can take out money whenever you want without penalty. However, with a pension, you may have to wait until you reach a certain age before you can withdraw the money.

4. More Income (Possibly)

Fourth, rolling over your pension into an IRA can also provide you with more income in retirement.

With an IRA, you can take out the money as needed in retirement. However, with a pension, you may have to wait until you reach a certain age to start receiving benefits.

5. Better Death Benefits

Lastly, rolling over your pension into an IRA can also provide better death benefits for your beneficiaries.

With an IRA, your beneficiaries will receive the money tax-free. However, with a pension, your beneficiaries may have to pay taxes on the money they receive.

So, what’s the best choice for you? It depends on your situation. Before we answer that question, let’s first look at some of the disadvantages of rolling over your pension into an IRA.

Cons of Rolling a Pension Into an IRA

There are a few potential downsides to rolling over your pension into an IRA.

1. Potential Tax Penalties

First, if you roll over your pension into an IRA and then take a distribution before you reach age 59 1/2, you may be subject to a 10% early withdrawal penalty.

2. Loss of Death Benefits

Another potential downside of rolling over your pension into an IRA is that you may lose the death benefits that are associated with the pension.

Pensions typically have death benefits, which means that your beneficiaries will receive a lump sum of money if you die before you retire. However, if you roll over your pension into an IRA, your beneficiaries will not receive the death benefits.

3. Loss of Other Benefits

If you are a part of a union, then cashing out or rolling over your pension may disqualify you from the perks to which you were previously entitled to. This could be discounts on insurance, local businesses, and other amenities.

Of all these miscellaneous benefits I’ve reviewed, I’ve never seen anything that was crucial enough to leave the pension with the company.

Other Factors to Consider

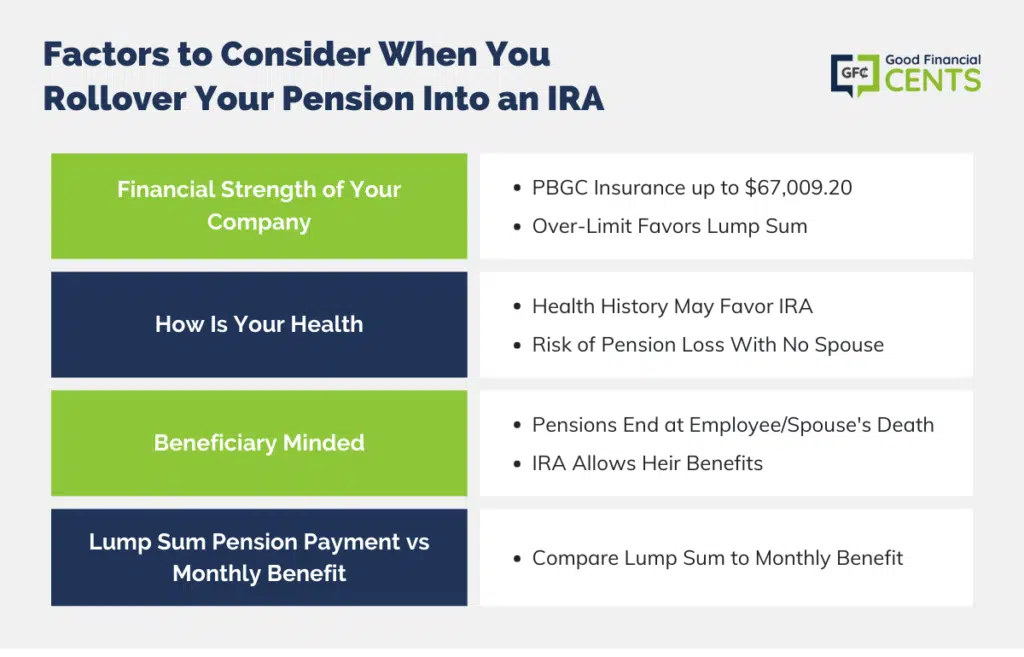

1. Financial Strength of Your Company

Deciding on whether to choose the lifetime income option vs. the lump sum might be as easy as evaluating the overall financial strength of the company you work for.

As I have mentioned before in a previous post, “Company Is Going Bankrupt, What About My Pension,” your pension is insured by the Pension Benefit Guaranty Corporation (PBGC), but it’s only up to $67,009.20, and that’s only if you retire at 65 and select the Joint and 50% Survivor annuity.

Over and above that, then you are out of luck. Any pension amount that is over the $67,009.20 limit will make the decision to take the lump sum more attractive.

2. How Is Your Health?

Does your family have a history of illness? If so, then taking the lump sum and rolling it to an IRA might be the most viable option. What’s the point of having an income for the rest of your retirement if you are only in retirement for a few short years?

I have a client whose never-married friend had worked for a company for almost 30 years. When that person retired, they opted to take the annuity option and receive monthly payments. Just after three months of receiving their checks, they unexpectedly passed away.

Guess what happened to the remainder of the pension benefit? It all went back to the company since they didn’t have a spouse to pass it on to.

If they had rolled the pension into an IRA, they could have elected another family member to receive it or at least donate it to a charity or their church.

3. Beneficiary Minded

Most pensions work in that you (the employee) will receive an income stream for the remainder of your life. When you pass, your surviving spouse will receive half of the amount you received. (Some pensions do allow for your spouse to receive the full benefit, but typically, you would have had to take a lesser amount in the beginning).

If your spouse predeceases you, then there’s no more to be paid. It is the same when your spouse passes- the payment stops with him or her. If you have surviving children, they will not receive a dime from the pension.

By opting to roll over your pension into an IRA, you will at least have the option to pass the remainder (if any) to your heirs. Also, if done effectively, they might be able to stretch the IRA over their lifetime.

4. Lump Sum Pension Payment vs Monthly Benefit

The last determinant is just like the old song lyric goes, “It’s All About the Benjamin’s.” You need to closely analyze how much the lump sum pension benefit option is versus the monthly benefit.

Let me highlight two situations where the choice was fairly obvious.

Pension Rollover Case Study #1

I had one client who was offered an early buyout on his pension. He was almost 55, so he could start taking the payments immediately. The monthly benefit that they were offering was approximately $3,000 per month.

He had elected to choose a lower amount (the $3000) so that his spouse would receive the same amount for her lifetime. That wasn’t a bad option, but just to be sure, let’s look at the lump sum amount.

The pension was an older one that was more beneficial to tenured employees, so the lump sum amount was only around $250,000. I say “only” because assuming no growth on the dollar amount, then the client would have completely exhausted his pension in just under 7 years right before he turned 62.

In this case, it was a no-brainer to select the guaranteed monthly benefit.

Pension Rollover Case Study #2

Another client had just turned 62, and her company was offering her a lump sum amount of $600,000. It’s not too bad, but let’s look at the monthly benefit. The monthly benefit amounted to $4,000 per month ($48,000) per year. Thus far, it’s not such a clear-cut decision.

What made it crystal clear was that the client has had a 401(k) with the same employer for just over $200,000 and had a sufficient emergency fund plus minimal debt. On top of that, they had 3 kids to whom they desired to pass an inheritance. Believing that they would never outlive their retirement nest egg, it may make complete sense to roll over the pension into an IRA.

What if You’re Still Working?

One last point that I should mention is that you don’t have to wait until you officially retire to roll over your pension. Once you reach the IRS’s magic age of 59 1/2, you can elect to do what’s called an “In Service Distribution.”

Even if you plan to continue to work, you can elect to roll over your pension amount into an IRA. Your pension will then continue to accrue with your employer, and you have complete control of your money outside of your employer’s hands. This also works with 401(k) plans as well.

I’ve had several clients execute this strategy flawlessly.

Pension Rollovers – The Bottom Line

Deciding on the fate of your pension is a very important decision. Review your options more than once and seek counsel from different parties. I suggest meeting with a Certified Financial Planner and a CPA to help decide which option is best for you.

3 Cited Research Articles

- U.S. News and World Report (2023, Feb 23) 10 Jobs That Still Offer Traditional Pensions

https://money.usnews.com/money/retirement/baby-boomers/slideshows/jobs-that-still-offer-traditional-pensions - PBGC.gov (2021, Oct 21) Maximum Monthly Guarantee Tables

https://www.pbgc.gov/wr/benefits/guaranteed-benefits/maximum-guarantee - National Institute on Retirement Security (2021, Mar 18) 77% of Americans Support Pensions for All Workers

https://www.nirsonline.org/2021/03/77-of-americans-support-pensions-for-all-workers/

I am 50 years old and I am pension/retirement eligible from my company(yes Verizon). Please don’t judge…I have nothing in my 401k. My monthly pension would be about $2300. My lump sum is $680,000. I do plan on working part time if and when I leave. No debt, and own my house. Monthly pension or lump sum?

I have a pension worth 600,000. Monthly annuity payment is 3200 for single life. I am 65 and have 3 children. I also have debt and a mortgage with 8 years to go before it is paid off. I’ve been living off of my 401k and social security that I had to start drawing on since 63. I’m planning on taking the lump sum and purchasing a private annuity and paying off debt. I will invest some in fixed annuities with 3 to 5 year terms to grow some of the money I want to leave to my kids and use some for investing. I will not pay off mortgage as I plan to relocate soon. My spouse recently passed away but had no insurance or notable assets. Please advise if my strategy is sound. Thank you

Hi

I am a 51 years old and disable.i am receiving social security for disability since March last year.due to my health problem i i was not able to work.i had a 401A pension plan from My previous employer,employer was only able to contributed to the plan.the money still in the plan with Prudential,i have not done anything yet.i was told i could leave the money there as long as i want to,i do not need the money for now,but beside that i am looking to see if there are other options,thanks

Greeting,

Thank you for the excellent explanation.

I have one question,

Do I have to get my spouse consent to roll my pension to an IRA?

Also, can I withdraw monthly payments from my IRA account? and at what age i can withdraw from my IRA account?

Best regards

Nasser

I have a few 403-B accounts, some IRA’s and a pension from a former employer 20yrs ago, I have not filed to take the money out of the pension as yet. I was offered the whole $120000 or get monthly payments. I retired 3 years ago at 65 yrs old. I will be 70 in 2020. I am perplexed in how much should I take out each year by the time it becomes mandatory to take monies out of each accounts. I have saved a lot within the retirement account and I never thought about how I would go about the disbursement.

Thank you for your help

CAN I ROLL 48000 PENSION LUMP SUM INTO IRA

Yes

Many thanks for the information consisted of as well as the pictures, we were looking for particular products today as well as handled to discover your blog, we are leaving these comments to guarantee that you keep writing more info similar to this,

My TIAA-Cref principal is diminishing rapidly–I have been drawing monthly payments for about 20 years.. I am 86 and plan to live 14 more years. Would a roll over be a viable option?

Hi John – Only if you believe you can get a better return on your money in a different account/plan. But be careful not to take on too much risk in getting that higher return.

Hi, I’m 65 retiring next month after 36yrs. I am married. I have a Pension of 450,000 and 401 of 250,000 my annuity payment will be 1800.00 per month before tax/medical expense. I have not decided to take SS payments of 2120,00 per month, I think I will wait until age 66. My husband age 64 laid off has a pension of 700.00 per month with an annuity of around 400.00 after tax/medical expense. His SS 2250,00. I have 3 children. Would it be better for me to roll my funds into an IRA?

Hi Juanita – There’s no easy answer to that question. If you’re satisfied with the returns you’re getting in your current plans, you’ll be better off leaving the money where it is. If you feel you feel you can do a better job investing on your own, then do the IRA rollover. But please discuss this with a few people who know you better before doing anything.

I’m not clear on In ex 2, The couple already have at least 200k to pass to kids, why shouldn’t they take the pension? 8% annual payout seems reasonable. If they end up not spending all (eg social security also contributes to income), that part adds to the investment and for kids later. Thanks.

The variable would be the disposition of the pension upon death. Defined benefit plans have different rules, and may not provide for distribution of undistributed funds. If their heirs don’t get it, the money is lost. Rolling it over to an IRA ensures both the couple and their kids will get the money. With $800,000 total retirement assets, they should be fine. But it is close, due to the 8% effective return on the pension.

I’m 44, US Citizen working in India since last one year.

I’ve Roth IRA and Traditional IRAs in Fidelity and Vanguard.

My pension benefit plan from prev employer (left in 2016) has 25k in balance and fully vested. I noticed that my pension money is getting only 0.5% interest annually.

Is it possible to transfer my pension fund just like how I transfer 401ks.

if not, what options do I have to get better returns?

Thanks

Hi Amit – That is a low return. You’ll have to check with the pension administrator and see what the rollover procedures are, or if they’re even permitted. Pensions are different from defined contribution plans, so it isn’t always possible. But it’s certainly worth a try.

I am 54 years old and have 30 years at Verizon. They are about to offer a package to get us out the door. The package itself is probably an additional $80,000 but the lump sum pension payout will be over $700,000. I also have $350,000 in the company 401(k) which is run by Fidelity and has a whole bunch of fund choices. What should I do with the lump? P.S. I realize I’m a bit young so I will work somewhere for a few more years.

Hi Brian – With a total portfolio over $1 million, and not much investment experience, you probably need to work with a financial advisor. It may take a series of meetings before you come up with a plan that will work for you. It’ll cost you some money, but that will be better than taking chances and losing some of your nest egg.

Can I roll over my company pension plan into a Roth IRA or 401K if I’m 50?

Hi Cheryl – If you roll it over go a Roth IRA, you’ll have to do a Roth IRA conversion, and pay tax on the amount of the rollover. You can roll it over to a 401k IF the employer allows it. Some do, some don’t. If they do, you shouldn’t have to pay any tax on the rollover.

Quick question, I worked in CA for 5 years for a company that participated in the CALPERS retirement program. It’s based on years of service and your highest 12 month salary. So I have 5 years of service at 3% @ age 60 and my highest salary was roughly $50k so my monthly benefit would be $625. It has been 6 years since I worked for that company and I do not plan on ever moving back to CA so I am not hurt by losing my vested years of service in CALPERS but am wondering if it would be a greater benefit for me to roll my CALPERS pension over to my current company’s 401k? I am only 36 years old so my 401k would have 30 years or so to accrue interest and I typically get 12-18% ROI on my 401k. I just feel as though I would be able to accrue a much larger sum by handling it myself through my current 401k. The rollover amount would be $30k so we aren’t talking about a huge sum of money but enough to consider rolling over just for simplicity as well. Any advice one way or another would be appreciated.

I can’t give you a solid answer on that Brad, because it really depends on your comfort level. The advantage of the pension plan is that you get the benefit no matter how your investments perform, so it gives you a guaranteed income. You’ll have to decide how much confidence you have in the market and in your own investment ability. Only you can answer that.

I have a retirement account from a company I no longer work for and no longer contribute to or receive matching contributions.

My new company offers a 401K plan. Can I roll the retirement account money into the 401k plan? If I can, would you recommend doing so or is there a better option for me?

Hi Glyn – I think that’s a good idea since the old plan is a dormant account. But you will have to see if the old plan permits you to move it. Some don’t. It depends on the rules for the plan. Check with the plan administrator.

Hi Jeff

The company I worked for over the last 10 yrs was bought by a new company. My pension plan from my old company is $56000.00. I am 40 yrs and presently working for the new company. I am wondering what to do with the $56,000.00 in my old pension plan. Roth IRA or traditional Ira ?

Hi James – You’re going to have to crunch the tax numbers to make that choice. The traditional IRA means no current tax liability. The Roth will have one, and you’ll have to know what that will be and if it’s worth doing. Sit down with your accountant.

I’m 42 years old, fully vested, but no longer work for the company or in the union, can I rollover my pension trust into an IRA?

It’s generally permitted by the IRS. But you’ll have to check with the pension administrator to make sure that’s an option. There are a lot of different pension plans out there, so the rules may be different for each.

Hello, I am 58 years old. I have pension Lump Sum payment in the amount of $30,000.00 (Payable December 2017) I have 3 choices.

1. Lump Sum a. Rollover the Lump Sum b. Receive a check

2. Begin an Annuity. (Monthly Annuity)

3. Do Nothing (Wait until Retirement – of which I am not sure when that will be)

Any suggestions.

Unless you are happy with the performance of the pension where it is, you might want to take the lumpsum and put it into an IRA. But if you’re not comfortable investing the money yourself, it may be best to leave it where it is, and begin taking benefits when you actually retire.

I have a small amount in a previous employers pension account. I need that money at the moment and was told i could not get it out till i turn 31. Should i always be allowed to put that in an IRA? My friend did and he can get his money whenever he wants. We are the same age. They just tell me I cannot move that money anywhere. A little frustrating!

Hi Seth – You should be able to withdraw the funds of a retirement plan from a previous employer and roll it into an IRA. But while the IRS establishes general parameters for employer-sponsored plans, employers still have a lot of flexibility as to specific rules. If your plan specifically prohibits withdrawals from the plan until you reach a certain age, or until the plan is a certain number of years old, you’re going to be bound by that.

Still, the provisions you’re talking about are unusual. I’d call the plan administrator, and get clarification. Your understanding may not be correct, or you may have been given inaccurate information. It’s certainly worth double checking.

Im offered two lump sum pension payouts. I would recieve 167,000 at age 65 single or can roll over each payout into into a single ira or 401 k . im a single mom with 2 sons suggestiones Or recomendationes 51 and tired

Hi Denise – Since you’re a single mother and only 51, I’d recommend that you discuss this with an accountant or someone who knows your finances and your life pretty well. Everyone’s situation is different, and while general advice may work for most people, it’s not always right for people with very specific circumstances.

Hi,

I’m 55 years old. My Company Pension is frozen (so i believe that means that every day that i work my pension gets smaller). I am vested (and have hit the magic number) but cannot retire for at least 7-10 years since I have high school aged children.

Can I roll my pension (lump sum of about 450,000) into an IRA so that it can continue to grow instead of shrink while i continue to work for the same company?

Thanks,

Chris

You should be able to Chris. But if you’re still working for that employer they may not allow it. Also, be sure that you aren’t giving up any benefits by closing out the pension. For example, if the employer will provide health insurance in retirement, contingent on you being active in the plan, you may not want to close it out. Be sure that you understand all the possibilities before proceeding.

Hi, I am 62 with stage 4 cancer. I’m now on long term disability through my company and Social Security. I have 4 young kids at home from 6-15. We sold our house several months ago to pay off our debt. I have no significant savings to speak of and a pension that has a buyout of 62,000. Can I use some of this money to for a down payment on a home? I would put the rest in some sort of IRA. I have a significant life insurance for my family, But not much else.

Hi Daniel – That’s a question that can’t be adequately addressed online and by a person who doesn’t know your situation more closely. I would think that with four kids you certainly need a home, but then you must be living in a suitable situation now, since you sold your last house. My bigger concern might be for having some cash reserves. You said you have no real savings, so this might be a priority, especially with your illness. But please get advice from someone closer to home. You’ve got a lot going on, and those are some pretty heavy decisions you’re trying to make. They’ll be benefits and drawbacks to whatever strategy you decide to go with.

This was very helpful. I appreciate all the feedback..

I have a pension available at age 55 ( 3 years away ) monthly for life is $300 or pay out of $22,000. It is a small amount but if I live another 20 years I would be receiving $72,000.. I have a 401k now I could roll it in but still undecided which is best!!!

MY CO OFFERING ME 293 K LUMP SUM OR 2100 MONTHLY REST OF MY LIFE,

MY X GETTING HALF/ LEAVE ME 1100.MONTHLY I FEEL 1100 MONTHLY NOT ENOUGH,I DECIDED TAKE LUMP SUM AND ROLL IT OVER INTO IRA ,HOPING THAT IN COUPLE OF YEARS I WOULD INCREASE MY MONTHLY PAYMENT… i hope i made right decision i am 54 years old @ 59 1/2 start withdrawing some money. also my social security @ 70 2,335 monthly

Hi Ernie – It sounds like a good strategy if you can avoid $1100 per month to your ex-spouse for the next 5.5 years. But aren’t you still required to split the proceeds of the distribution as well, under a QDRO agreement in your divorce decree? You might want to look into that first.

Hello, I am 53 years old and a company I use to work for are offering me a lump sum of 157,000 or 1,200 monthly at the at of 60. Should I take the lump sump and roll it over into an annuity or just wait until I am 60 to receive the 1,200 dollars monthly option?

Hi Joseph – Without knowing the specifics of the monthly arrangement or of your financial situation I can’t even venture a guess. You should sit down with someone who knows your situation, preferably a financial professional. But just some quick math here – $1200 per month is $14,400 per year, which is roughly a 9% annual return on your money. That looks pretty solid to me!

I have $46500 in SC state retirement not gaining interest because I no longer work for the state. I am 44 and not retiring anytime soon. What is best choice for this money?

@Kevin You have a few options. What your “best choice” is solely depends on what your goal is. Many people roll their old retirement plans into an IRA so they can decide how they want to invest it. This could be a viable option for you since you have several years before retiring.

i am 55, married and my company is dispersing my pension. I do not plan to retire until 62 or 65. Wondering best plan to do with the 100k dispersement. Maybe an IRA rollover ? ..I am unsure of other options available. My husband (also 55) has 250k 401k and pension ~$1200/month upon retirement. I continue to contribute my company’s new retirement plan (current worth 30k). Thank you in advance for any advice you can give.

Hi Sharyl – Will your employer allow you to roll the old pension into the new one? They usually do when they change plans. If not, just do a trustee-to-trustee transfer of the company plan into an IRA of your choice. You’re too young to take a penalty-free withdrawal and it doesn’t look like you qualify for any of the exemptions, so you’ll have to roll it over to an IRA to avoid a very large tax bill.

My mother turned 70 in January. The company she retired from is offering a lump sum payout. She would receive the payout on November 2, 2015. Given her age can she roll the lump sum into a traditional IRA?

I am 36 and am being offered $27.6K lump or $755.19/mo starting at 65.

I have a 401k with the same company, but iras. Maybe now is the time to start one? (Traditional or Roth!?)

my company is filing for Chapter 11, I’m 65 yrs old and my official retirement is due October 2015 should I retire before they file for Bankruptcy.?

Hi Jeff, I am 55 and currently employed at a Fortune-500 company. My prior employer is also a Fortune-500 and still very solid financially. I worked with them for 16 years and they had a defined benefit pension plan which I was fully vested in. I left in 2000 and joined my current company. Am I still able to collect from the pension earned at my prior company when I retire even though I left and joined my current company 15 yers ago?

I had a 401k at my old job. When I got the new job, I was just getting used to the new routine when I suffered a stroke (age 48 now). I’m just now feeling better and worried about my old pension. I am disabled and have been for the last 3 years. I’m planning to live for the next 10-15 years in “good” health if family history proves the same for me. I want to travel a little and have fears of my dying and my kids would never see a dime of that money. Would that money come to my kids? My Fidelity 401k has $155,000. I’m able to make ends meet on my disability but not much else. I’m not a big spender but want to treat myself to a small vacation once a year. What would you recommend? Fidelity IRA? Taking a lump sum? Thanks in advance.

Jeff,

I have 750k lump…..a 401k that is 650k)….annuity would be 48k a year.

I am 58…..with just a mortgage….what would you advise?

@Mike Quick rule of thumb of getting 4% off all of your investments is $56k per year (before tax). Is the annuity just off the $750k? If so, that’s not a bad deal. Just depends if you want control over your money. If you ever want to setup a free chat to discus more, you can schedule it here.

My former employer is giving the option to take a lump sum of $68K of my pension or roll to an IRA, take an annuity beginning December this year for $366/mo., or wait for the pension at $800 for life. I’m 53 and single. I don’t really need the money right now. What would you suggest I do?

OK, it’s been interesting reading. Let’s see what you got:

I am 60, not working. Making things “work”, so it’s not as much as needing the money but making the best financial decision.

just offered $33,000 buyout of a previous employer. I can begin immediately at $204mth 10 yr certainty. Otherwise, I can just defer to start my pension any year going forward. Each year adds about 7% to my monthly payment. Not bad, and since the company is Boeing, I am not worried about their demise.

The $33k lump looks good, but I need a 7.3% return to net even each year.

Your thoughts?

Hello, I am will be 59 in May 2015. I was just offered $21,163.48 from Aetna, my pension. One time only. I need to make a decision by Oct 3, 2014.

Age 65 Single Life Annuity $232.26 – Immediate Annuity Only $ 120.79

I have a 401 k at my job, American Red cross. $45,000.00 and i also have Lincoln Fin Group Annuniteis $25,000.

What do you suggest that i do with my 21,000.

thank you

@ Doris

With that low of an amount, I would be more in favor of taking the one time payment vs. the single life annuity.

What has happened in Detroit is making me worry about my pension. The city I work in has a defined contribution plan. It is a 25 year retirement at 62.5 percent of base pay when you retire. If I stay the full 25 I start collecting the 62.5 immediately. If I opt for early retirement I would get 2.5 percent for every year I have worked, but do not collect until I am 56. I am 41 and I retire in 7.5 years (17.5 years on). The city I work for just raised the health insurance premiums to 100% for all retirees (effectively losing their insurance). They are then moving anyone with under 10 years on the job to a 401(a) plan, and no one will be paying into the pension once those with 11 years and up retire down the road. The city pension is not in good shape at this point.

I am wondering if it is time to “cut and run” early or stay the further 7.5 years and get the pension. If I do leave I am needing to decide if I should take the early retirement and have something coming in when I turn 56, roll it over to a 401k, or roll it over to another employers plan (one of the new jobs I am looking at does not allow that though). Are city government pensions backed by anyone if the city of Memphis, TN goes the way of Detroit I wonder? Did I mention that I hate my job and count the hours until I leave? I am married with 2 kids, so its not about my happiness in my job, but their future well being. Any advice would be appreciated in regards to pension/retirement options (I know you cant tell me to stay or go). Thanks

@ John One key figure you didn’t mention is what is the lump sum amount that you would be able to roll if you did leave/retire early?

Lump sum is 54,624.00 that I have in pension now. My yearly salary is 53,000. My math has me collecting 35,000 at age 49 if I stay the full 25 at 62.5 and 25,000 if I retire early at 18 years on. I was incorrect with not collecting until age 56, it is actually age 59.5 to get pension after early retirement. I also have 40,000 in a deferred comp plan. The new job is something I’ve always wanted to try but is a pay cut down to 38,000.

Hi, I’m 43 and was offered a cash out on an old pension of $33,000. If i take it I would rollover into an ira. If I do nothing I would receive 800. A month at age 65 for lifetime. I’m trying to decide if I can equal or exceed what the pension would be at 65 or if I should keep in pension. I’m married in good health with kids and an additional ira

@ Sarah $800/mo is really good especially if they are only offering you $33,000 lump sump.

If you have a pension amount around $4400 per month…..was offered $750k lump….and had a 401k of same amount…what would you do?

@ Mike

I’m 36, have a mortgage, and 3 young children, so what I would do is much different that what you should do.

How old are you? Do you have any debt? What’s your monthly expenses? Do you want to travel? Do you have any children?

It’s hard to suggest what you should do without knowing where you’re at in your life.

I am being offered a lump sum of 8k (after 20% Fed tax). I had worked 10 years at a hospital. The other option offered is to roll over the 10k into an Ira, or receive $281 per month after I reach 65. They said I could start taking the monthly penison when I am 55 at a lower rate (which they have not specified). I am 47 years old and not sure what to do. My health is not so great but I am financially fine. Please advise me what I should do? Aside from the above options could I take the life time payout and invest it in stocks? I want to thank you for this wonderful article and sound financial advices you have provided.

@ Brandon I typically advise people to roll it over into an IRA. That way you have control of the money. The pension sounds OK, but if your health is a concern then having access to the money will probably prove to be more valuable.

Jeff, I had a pension with my previous employer of 5 years. I am only 27 and annually make over 60k. The lump sum amount offered to me was 8k. Does this mean aside from the initial 20% federal tax, I will only be taxed for 800? I want to use this lump sum to pay off debts then more aggressively contribute to my Roth IRA. Please share your advice as annuity payments aren’t an option for me.

After the bankruptcies of General Motors and Detroit (with more to follow, I fear) I must join with the others who advocate taking control of your own pension funds.

I had a public school pension of 45% of my salary after age 65. I am 30 & don’t plan return to a public school service, which would be the only way to get the pension to cover 100%.

After the pension manager lost some money by investing it in the market (thus increasing everyone’s mandatory contribution to cover current retiree’s) & reading news about various school districts & states nationwide reducing public school or employee retiement payments or starting to switch the pensions into more of a 401k investment vehicle, I decided cash out & roll the $ into a IRA. I don’t know if I had the right idea, however i feel safer having control of my own money & my retirement fund.

Now if anything happens to me, my spouse gets the funds and if we both go, the kid’s get it. The pension didn’t cover the spouse until over age 60 or 65 and the kids were entiltled to nothing. If I was over 50 I probably would have kept it. I just didn’t want to loose it from poor handling & too many retirees pulling form the fund. Also I noticed the last few years the wording on the pension rules kept changing and i didn’t want ot be restricted out of being able ot pull my $. A freind who still works there said there is a large fee now to take the moeny out of the fund & roll it in to an IRA or other retirement acct.

My Grandpa had a pension. He died 8 years ago & it has been very rough on my Grandma since the pension died with him.

There is no right answer since every pension seems to be unique & each person has a different set of circumstances. I can’t find any fee based fin planners in my area so, I just do what allows me to sleep peacefully at night. So far that has worked, my retirement rollover IRA has performed very very well. I hope that remains the case as I get older.

Jeff,

I have a pension that I can collect at 55 the lump sum at that age is 76,ooo or monthly payment of 515 a month for life. The company I used to work for offered a one time lump sum of 40,000… I am 41 would it be better to wait 14 years or take the 40-G and put in an IRA I was told buy a financial advisor he could double that at 8% every 9 years, not sure? I have 5 rentals that will be paid off when I’m 51 was planning on that for retirement too.

@ Rick I think you can go either way with it. The one thing I wouldn’t believe is the financial advisor that can double your money every 9 years. Yes, there have been instances in the past where this has occured, but to make a blanket statement like that is wreckless and resembles that more of a used car salesman.

Hello Jeff,

I am 581/2 and my former employer has offered me a lump sum of $42,000 from my pension plan. If I elect to stay in the plan, I would receive monthly payments of $404 upon retirement. Two important things: the retail company is not doing very well and has a good chance of going under. The other detail is that my family typically lives to be 80+. Would it make sense to take the lump sum, even if the monthly allotment could amount to $100,000 over my lifetime, or am I possibly going to end up with nothing?

@ Mary The good thing is that your pension should be protected by the PBGC. You will want to verify this.

With such an long life expectancy, it may be wise to go with the guaranteed monthly paycheck.

I am 52, employed and have a 401k with my employer. My husband is laid off at 53 and we have about 1+ year of wages in available savings. We are paying half of the tuition for two kids in college. My employer has been bought out several times by larger companies but has maintained a pension plan from one of the original owners for those of us that were there when it was active, although the fund has been frozen since 2006 . I just received a letter from the corporate office saying the pension is 80% funded and I can now elect to defer receipt to a later date, take a monthly annuity of $442 or take a lump sum of $66,000. I don’t think I want to leave it with the company as I may be restricted from it again in the future and would rather have control over it. Not connected but possibly a factor is that my husband has a pension from a previous employer of about $30,000 which he could access or roll over at any time. What would you suggest as options (IRA?) for my old pension money?

@ Pam Great question. Personally, I’m a fan to taking control of the funds but it really depends on the following items:

1. What is the monthly annuity amount offered? It looks like what they are offering you isn’t a “must keep” offer. It’s decent, but if you’re comfortable investing it, you could be better off.

2. How likely are the individuals going to cash it out and blow it? Having freedom to access the funds at any time doesn’t mean you can cash out your IRA to buy Christmas gifts. Unfortunately, I see this happen all the time. They would have been better off leaving it with in the pension so they at least would have had some sort of income at retirement.

Well, we have no plans to do anything but roll it into another retirement account. Because we have always had something thru our employers I have never looked into an option outside of work. Don’t know if IRA is the best choice but don’t want to be hit with any penalties.

The single life annuity would be $442/month but I don’t know when that would start or how long it lasts.

Wouldn’t investing have penalties? Are there different kinds of IRAs?

I’m 33. My accrued benefit is 333.83 per month as a single life annuity starting at age 65. The lump sum they’re offering is just $6,559.33. What should I do?

They also have an option for immediate annuities:

Single Life 15.92/month for my lifetime and no benefit after death

50% Joint and Survivor Annuity $15.59/month for my lifetime and $7.80/month to joint annuitant after my death

75% Joint Survivor Annuity $15.43/month for my lifetime and $11.57/month to my joint annuitant after my death

@ B Find a future value calculator online and start with $6,559.33 with a 32 year timeline. Try using interest rates between 4-6% and find what the future value is. That’s a starting point to see how much money you could have 3 decades from now.

i am getting a lump sum of $500,000. I am young. Monthly annuity would be about $1,600 a month. I have no debt and no mortgage and no one to support and i have savings/emergency fund. Not married. I plan on college and another job in future. Do i do a lump sum or take it monthly ? HELP !

@ Kathy That’s a tough decision. How “young” are you?

I am only 48 !! I am thinking of the lump sum, but it might be gone in my early 70’s , if I take out 2,000 a month to live on !! If I take the monthly life annuity, it might not be enough to live on, but I would get that cash untill I die. So either 3 choices, lump sum, life annuity, or investing in stocks. I am really conservative and not that knowledgeable on stocks/bonds. I will probabaly need a part time job to supplement. Just don’t know what to do with this pension decision. Please help. thank you.

@ Kathy For those that are uncomfortable investing in the market, it definitely can make sense to play the safe route and take the lifetime annuity.

@ Kathy I would also suggest meeting with a fee-only financial advisor (preferably one that can’t sell you any products) to review your situation and see if taking the pension or the lump sum makes the most sense.

Kathy,

Have you thought about splitting up the distribution? Does your pension offer the potential to specify a certain amount as a lump sum and leave the remainder with the pension? One idea to explore could be taking the lump sum in order to take control of your assets and splitting it up yourself. For example, you could keep half in a traditional IRA purchasing low volatility options or FDIC insured market linked CD’s and put the other half into some type of annuity owned by you that suits your distribution needs. There are some that can provide you with a predictable income schedule at various points in your life, depending upon when you plan on taking withdrawals. This could offer you some guarantee and also some flexibility, all the while knowing your money is in your control. Make sure do do all of your research and factor in what you anticpate your future income needs to be. Many pensions are also a “promise,” not a “guarantee,” so keep that in mind. Great article!

HAROLD, I CHOOSE TO TAKE THE MONTHLY PENSION FROM MY COMPANY. I HAD RESEARCHED BUYING AN ANNUITY WITH A INSURANCE COMPANY BUT DID NOT FEEL COMFORTABLE . NO, MY PENSION DOES NOT ALLOW ME TO SPLIT IT IN 1/2 PENSION, 1/2 LUMP SUM, UNFORTUNATELY. HEARD MY COMPANY IS TRYING TO SELL OFF ITS PENSIONS SO IT WILL LOOK BETTER TO THEIR INVESTORS !! I DID TAKE CONTROL OF MY 401K, AND PUT IT IN A TRADITIONAL IRA AND 1/2 OF IT IN A ROTH IRA.

I was just offered a monthly payment of $233 a month from my pension when I turn 65 in 10 years. Should I roll the small pension over into a Traditional IRA now or something else, to try to increase my payouts later ?

@ Mike

Unfortunately, it’s not as easy to answer that.

What is the lump sum amount they offered?

What are your monthly expenses now. Do you anticipate them to be the same 10 years now. (Hard to say but one big expense may be your home)

If you did roll it over, what would you invest it in?

What’s your risk tolerance?

There are quite a few things to consider before rolling your pension into an IRA or taking the lifetime payout.

The lump sum is only $19,300. My step-son is moving out of my house in Feb., so I will be covering the additional $300 a month for my mortgage, which I was receiving from him as rent.

Plus, I am about to have knee surgery in a month, so I will have more monthly bills from the hospital, doctor, etc.

I am at least enrolled in my current employer’s 401k plan.

I’m not sure yet what I would invest the money into, in a Roth IRA. Or should it go into a Traditional IRA ?

Ford is using a discount rate of 7.5% to determine the lump sum.

Right now, I could buy an annuity to replace that income stream with a return of 2.2%. So basically I would need 3 times the amount that Ford is offering to ensure the same income in retirement.

I would be happy to take a realistic lump sum offer based on Treasury rates under the old rules. A 3% to 4% discount rate would be realistic.

With a 7.5% discount rate, Ford is transferring tremendous market risk to it’s employees and hoping for short term gains for itself. I am completely disgusted with their offer and their mentality.

At least GM is offering a true annuity to it’s employees. Maybe if Ford gets few or no takers, it will come back to the table with a realsitic offer.

Even it’s own pension funds are 60% invested in bonds. There is no prayer that you could get a 7.5% return with conservative investments to last your lifetime in retirement.

You have it exactly what my calculations show. Its not just Ford – since the financial crisis, many other employers have changed over to some kind of discount rates for the lump sum calculations.

After 33 years of working for a Fortune 500 communications company (no, not Verizon), I’m entitled to a pension of $1,900 per month. People who are receiving pensions of $3,000 per month should consider themselves among the elite. You really should get out in the world a little more before writing these kinds of articles. You are catering to the 1% – there are millions and millions of people who might be fortunate to get a pension of $300 per month.

@ Jeff

Hmmmm…..I have dozens of existing clients from various industries as well as plenty of communication from all over the country that ask me questions about their pension. Many of them are entitled to benefits as low as $500 to the high end of $3000 +. I’ve even had a few close to $5000 per month who are not employed by a Fortune 500 company.

Maybe I’m not the one that needs to “get out in the world a little more“, eh?

Ok- His comment was a little harsh and off base, but I thought your reply was a bit heavy handed. You should be able to take rude noise from the audience without being snobby in reply. Just my two cents. If you write articles for the web, expect people to react positively and negatively.

I have to agree with Subs. I am reading to decide on a 16K lump sum or $200 a month in 10 more years. Reading about 4-5K a month just makes me wonder if they worked for the government or something. No private companies have pensions anymore.

A little harsh?

“You really should get out in the world a little more before writing these kinds of articles. You are catering to the 1%”

He’s basically telling a certified financial planner he doesn’t know what he’s talking about just because his one isolated case is different. I think that’s far more heavy handed than the reply was.