One of the best things that my mom ever did for me as a young adult was to start an investment strategy for me.

She wanted to get me started with investing, so she set up an investment account with her financial advisor for my benefit. At the time, I was young, clueless, and completely indifferent.

But when I began my career as a financial advisor, I finally became very interested in what investments I had. So I did some inquiring.

Turns out, my mom’s financial advisor was purely an insurance agent, and the “investment” I had was a fixed annuity paying 4.5%.

I remember thinking to myself, “Why does a 24-year-old need a fixed annuity?” Turns out it was a very legitimate question.

Table of Contents

What Is an Annuity?

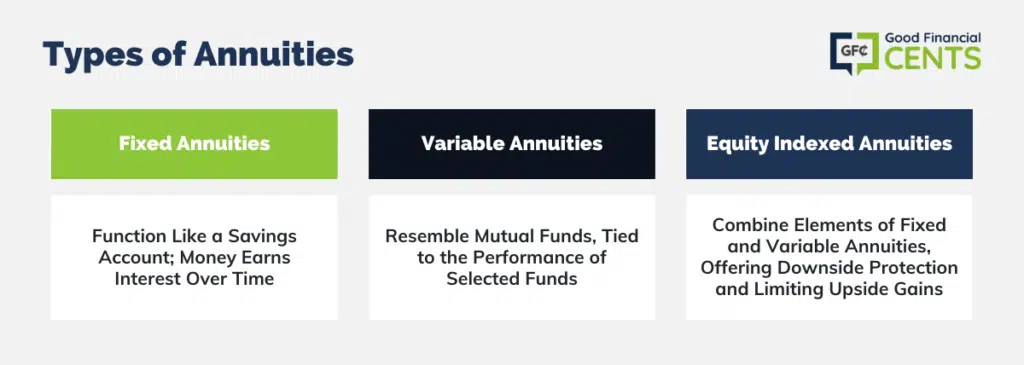

Annuities are another form of retirement savings, just like IRAs, 401(k)s, stocks, bonds, mutual funds, and savings accounts. They’re tax-deferred and come in a variety of types, with fixed, variable, and equity-indexed being the most common.

- Fixed Annuities act like a savings account. There is a certain amount deposited in the account, and that money earns interest. The interest is added to the value of the account and helps the account grow over time.

- Variable Annuities act more like a mutual fund. The annuity holder selects the accounts they want to fund the annuity and puts a certain amount of money into each of those accounts. They make money based on how well those funds do.

- Equity Indexed Annuities act like a hybrid of fixed annuities and variable annuities. They offer downside protection by protecting your principal but also limit your upside gains.

Annuities are thought of as being best for people who have large amounts of money and who can afford to diversify their retirement portfolio. Typically, this describes older individuals who have accumulated some nice savings. But is that the only demographic that can benefit from an annuity?

Young People and Annuities

Whether a young person should purchase an annuity or not really depends on their financial situation and long-term goals. For young people who have short-term financial goals and not a lot of liquid assets, an annuity doesn’t make any sense at all.

Because of the penalties described below, a young person would be better off with a regular savings account for short-term investing.

However, if a young person is financially stable and looking to have diversity in their retirement accounts, the equity index annuity or variable annuity could be a viable option. Notice I say “could be,” not “most definitely.” A fixed annuity, on the other hand, doesn’t make sense at all.

NOTE:

Annuity Penalties – Read the Fine Print!

There are some penalties involved for using funds from an annuity, either for early withdrawal or withdrawal before age 59 ½. Most annuities have a surrender period ranging anywhere from 5 to 10 years.

The penalty for withdrawing before the surrender period has passed varies with each annuity, so make sure you understand the surrender charges that are written into your contract.

The federal government also charges a 10% penalty if you withdraw any of the returns/profits of your annuity before the age of 59 ½. If you plan to leave your money in the annuity until retirement age, then these penalties are not an issue.

SOMETHING TO BE AWARE OF:

Why I Cashed Out My Annuity

The thought of only making 4.5% of my money was all I needed to cash out my annuity. I was too young, and there was too much time on my side to be capped at such a low rate. (Ironically, many investors drool over making 4.5% nowadays).

When I called the insurance company to inform them of my decision, they warned me about the penalties that I would have to pay and how I may not ever get such a high rate.

It didn’t matter. The decision was made. I was taking the money and opening a Roth IRA.

Should You Buy an Annuity?

If you’re young and don’t mind some fluctuation in your investments, it’s hard for me to make the case that an annuity makes sense. Especially now since interest rates are so much lower.

Now, if you absolutely hate the market and you love everything about the word “guaranteed,” then annuities might be right up your alley, and we can help you obtain quotes for different annuity plans to best meet your needs.

REMEMBER:

The Bottom Line – Is an Annuity the Worst Investment a Young Person Can Make?

The decision to invest in an annuity as a young person hinges on individual financial circumstances and long-term objectives.

While annuities provide a traditional route for older individuals with substantial savings to secure additional retirement funding, they may not offer the same advantages for younger investors. Particularly, fixed annuities seem to lack appeal due to their limited growth potential.

The appeal of Roth IRAs and 401(k)s due to their tax benefits and flexibility often outweighs that of annuities.

However, if a young individual has a solid financial footing and has already significantly funded other retirement accounts, exploring variable or equity-indexed annuities as part of a diversified retirement strategy might be a consideration.

Nonetheless, the associated penalties with early withdrawal from annuities underline the importance of thorough understanding and careful contemplation before venturing into such long-term commitments.

Question- I’m 30. Financially stable. Was told I need to put money into some type of retirement fund other then my 401k (maxed out) to reduce my taxes. I dont have an IRA however this tax accountant is pushing for the BCA elevate FIA. Am not familiar with this. But at such a young age is this a good investment?

It’s a very good discussion. We always want some security of income if market goes down when we are ready to retire. Some part of retirement money should be in annuity to have peace of mind. How much , mostly the base income we need to live on in addition to social security income. What is the youngest age one can buy annuity with income rider?

Hi Raghu – There’s no age limit on the annuity with an income rider. But how much of your assets you want in the annuity is up to you. Start by deciding how much income you’ll need, but then also consider how much you want to have that isn’t in the annuity.

My aunt passed away and had an

Equi-vest

Asset Allocation 41.60%

AXA Moderate Allocation

Large cap 58.40%

EQ/Com Stck Index

Acct value 13,667

The broker told my cousin(beneficiary) that if he were to close it out and take the money he would be assessed taxes and said it would be best if he moved the annuity into his name. When he told me what he did, I told him that didn’t sound right. Now reading this article, I really think he needs to move the money. If he was also told misinformation is there something we can do about that too? Thanks in advance

Hello,

I just left my old employer and had a 401k with them. The current amount in the 401k and I am trying to decide what to do with it. Should I leave it there, or moved it with my new employer. I have someone telling me to do a premier variable annuity with a policy type of traditional IRA with a charge of 1.3% and surrender charge. Does this make sense? I am currently 28 years old and trying to figure out what to do with my 401k

Hi Bryan – Since the annuity has a fee and surrender charge, you’re probably better off with the rollover to the new employer plan. Failing that, look into a rollover to a traditional IRA that doesn’t involve an annuity.

Hi

It was great reading about annuity.

Though there are some people who would really like to have a guaranteed return on investment,at the expense on low interest.

But for young people, some risk is OK.

What about funding a Roth IRA with a lost cost variable annuity? The problem I have with this post is that you are acting like a Roth IRA is a actual investment when its not. It’s just a wrapper individuals to put around other investments to keep the government from taxing them. To me if you have a good lost cost variable annuity and a client stuffing the max in every year, your client will wake up a nice chunk of cash with the ability to have a guaranteed income stream for life. THAT IS HUGE! When talking to my clients who are under 30 the majority of them are seeing an unrealistic retirement. Working for 45 years and retiring for another 25-30. So Guaranteed Income makes a ton of sense to my clients and I when trying to find way for them to be able to retire at 65.

@ Drew A “low cost variable annuity”. Sounds like a unicorn. Does that even exist?

Why would you put an annuity in an IRA in the first place? Both annuities and IRAs are tax deferred. The only reason I can think is that annuities growth is taxed as income, vs Roth IRAs not charging tax for qualified distributions.

But putting a poor investment vehicle inside a great one will only end in mediocrity. I don’t see the point of buying a Vanguard Total Stock Market Variable Annuity when you can just go to your IRA and buy VTI.

I’m probably not your target market. A young person will save more in taxes alone by investing in a taxable brokerage vs a variable annuity, assuming a “modest” 1% in total fees. In one you’ll pay capital gains, in the other you pay income tax on your earnings.

If they’re under thirty they can max out their IRA first, get the deferred taxes there. When they hit 50 they can decide to move everything over to an immediate or deferred variable annuity. There’s no need to pay for any guaranteed minimums over that many years.

Annuity is a good product, because it gives a man the financial freedom even after his retirement. But selecting an annuity product is not always very easy. I think a specific annuity product might not be equally useful for people of all ages. Fixed annuity should be useful for persons reaching the retirement. And all the young people may select Equity indexed annuity as it secure the investment as well as allows getting some extra interest.

Nice post Jeff.

Like Roger I usually 1035 my clients’ old annuities into low cost/no-load annuities, as some of the annuities they’ve been in have had outrageous fees (3-5% range.)

It’s always been interesting to speak with new clients and learn about their experience with annuity salespeople. It seems most salespeople just don’t know how the annuities they sell actually function, especially when they speak about the guaranteed rates and long term returns. I don’t think these salespeople mean to mislead their clients, they just don’t know any better.

A few months ago I spent a couple of days programming out some excel sheets to demonstrate to my clients what the long term rate of return would be based on the fees and riders. It seems to take between 19-22 years for a 65 year old to break even on most fixed index/variable annuities with lifetime income guarantees. After 30 years they usually would have about a 2-3% return. It’s been a great way to show clients how an annuity might pan out for them, after seeing the breakdown they usually want to go in a different direction.

I’ve posted a couple of the breakdowns on my blog if you want to check them out. I think the fixed index annuity sheet with all of its crediting methods is the most complicated excel sheet I’ve ever coded.

I’m a wholesaler and have been selling Variable Annuities to Advisors for 10 years.

In today’s market environment I would say a person who is within 10 years of retirement may want at a VA . They, unlike younger folks, don’t have time on their side to recover from a market downturn. Furthermore, they can get a guaranteed roll-up for income purposes and be guaranteed a life-time income stream – all while participating in the upside of the market. It may makes sense for a portion of someones money.

I don’t think they are the best fit for folks more than 10 years away from retirement 10 becasuse they have time on their side, the benefits may bot be as strong and VA’s can get expensive.

.

Jeff good post and great job of laying out the basics. I hate Equity Index Annuities the prior post you linked to is one of the better explanations I’ve seen of them. You are right it’s not always the product that’s bad (though it usually is) but the sales people peddling them. I’ve seen very few that I could recommend and the fees are often astounding.

I generally have only used annuities for clients that already have them and where we’ve done a 1035 exchange to a better product (usually one with far lower expenses) or as the last tax-deferred savings option after 401(k)s (or other retirement plan), IRAs, etc. I do feel the right annuity can be a viable retirement tool as part of an overall plan.