The journey to financial stability and wealth is often misunderstood. Many see it as a sprint—something that requires a sudden burst of effort followed by relaxation.

However, in reality, it is a marathon that demands consistent pacing, foresight, and, most importantly, an early start. The purpose of investing is not just to increase your wealth over time, but also to secure your financial future.

Table of Contents

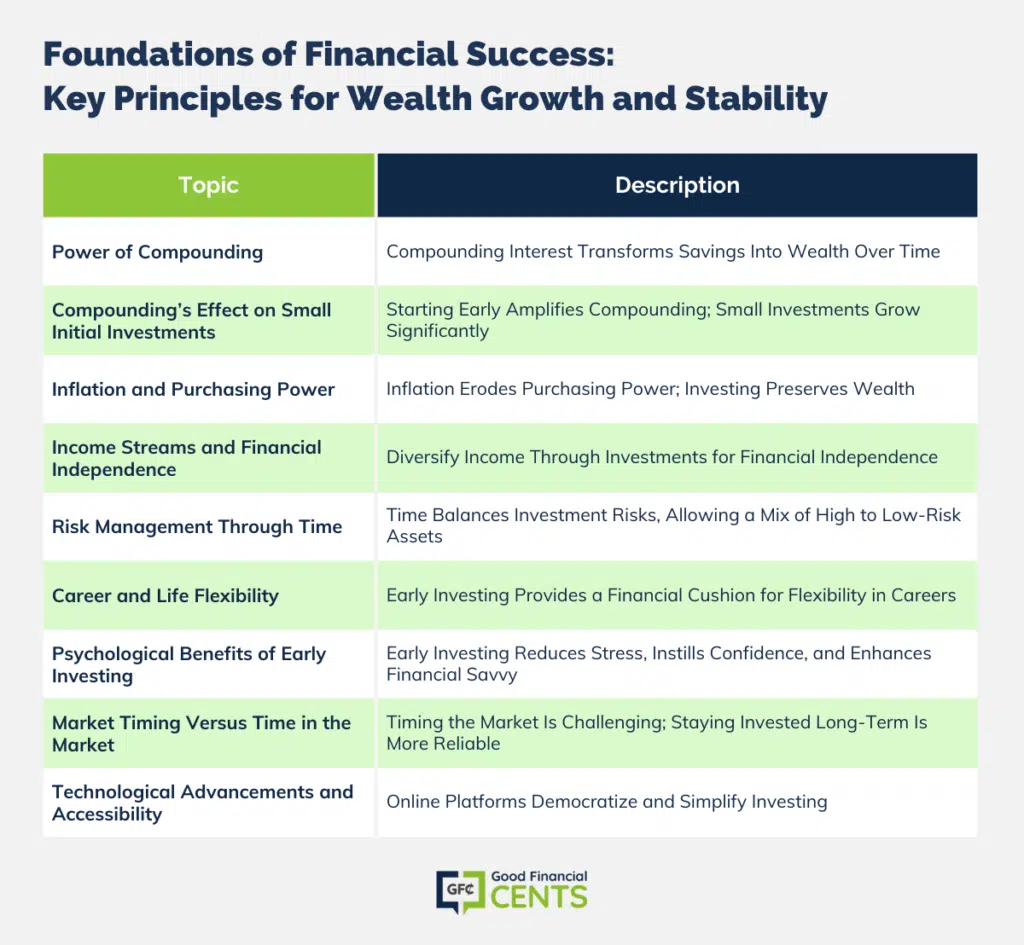

- Power of Compounding

- Inflation and Purchasing Power

- Income Streams and Financial Independence

- Risk Management Through Time

- Career and Life Flexibility

- Psychological Benefits of Early Investing

- Market Timing Versus Time in the Market

- Technological Advancements and Accessibility

- Bottom Line: Importance of Early Investing

Power of Compounding

What Is Compounding Interest?

Compounding interest, often hailed as the eighth wonder of the world, is the process where the earnings on your investments begin to earn returns of their own. This snowball effect can transform modest savings into significant sums over time.

The concept is simple—the returns you earn are reinvested to generate their own earnings, leading to exponential growth of your initial investment.

Compounding’s Effect on Small Initial Investments

The earlier you begin to invest, the more profound the potential impact of compounding. Even small amounts can mushroom into substantial wealth over the decades.

This financial phenomenon is why those who start investing in their 20s or even earlier can end up with a larger portfolio by retirement than those who invest larger sums but start later in life.

Inflation and Purchasing Power

What Is an Inflation?

Inflation is the gradual increase in prices and the corresponding decrease in the purchasing power of your money over time. It’s an economic reality that can silently chip away at your savings if they’re not invested wisely. Essentially, what a dollar buys today, may not be able to buy tomorrow, and this is a vital concept to grasp for those holding cash reserves.

Investing as a Hedge Against Inflation

By investing your money in assets that have the potential to appreciate or provide returns above the rate of inflation, you effectively shield your purchasing power.

Investments such as stocks, real estate, and certain types of bonds offer avenues to outpace inflation, making early investing not just a growth strategy, but a necessity for maintaining your wealth’s value.

Income Streams and Financial Independence

Different Types of Income Streams From Investments

Investments can create several income streams beyond the traditional paycheck. Dividends from stocks, interest from bonds, and rental income from properties are just a few examples.

These passive income sources can grow over time and provide financial stability independent of your primary employment.

Role of Passive Income in Early Retirement

The pursuit of financial independence is becoming increasingly common, and early investment is a cornerstone of this movement.

With the growth of passive income streams, you can reach a point where your investments fully cover your living expenses, affording you the possibility of early retirement or the freedom to pursue other passions without financial worry.

Risk Management Through Time

Time as a Tool for Mitigating Investment Risks

Investing is not without risk, but time can be your greatest risk management tool. Volatility is a feature of financial markets, yet over longer periods, the highs and lows can average out, resulting in a general upward trend.

By starting early, you grant your investments the time needed to ride out the market’s fluctuations and harness its potential for upward growth.

Benefit of a Longer Investment Horizon

A longer investment horizon also allows you to be more aggressive in your early years, taking on investments with higher risk and potentially higher returns, such as stocks.

Career and Life Flexibility

Financial Cushion to Change Careers or Start a Business

Early investing can provide the financial cushion needed to explore different career paths or entrepreneurship with less financial strain. This flexibility is invaluable in today’s rapidly changing job market, where pivoting to new opportunities can be crucial for career growth and satisfaction.

Emergency Funds for Unforeseen Life Events

Life is full of uncertainties, and early investments can serve as an emergency fund for unforeseen events such as medical emergencies or unexpected job loss. This safety net ensures that you’re prepared for life’s twists and turns without derailing your financial goals.

Psychological Benefits of Early Investing

Reduced Financial Stress Over Time

One of the less talked about but equally significant benefits of early investing is the reduction in financial stress. Knowing that you are actively working towards your financial future can provide peace of mind and reduce the anxiety that often accompanies financial uncertainty.

Confidence That Comes With Financial Savvy

Furthermore, early investors often become more financially savvy over time. This knowledge and confidence can empower you to make better financial decisions across all areas of life, from everyday spending to long-term planning, enhancing your overall quality of life.

Market Timing Versus Time in the Market

Difficulty of Timing the Market

Attempting to time the market is a common mistake made by many investors. Predicting the best times to buy and sell is incredibly challenging, even for professionals.

The market’s unpredictability means that attempting to time it can often lead to missed opportunities and potential losses.

Advantages of Time in the Market

Conversely, time in the market is a more reliable approach to growing wealth. It involves staying invested for long periods, allowing your investments to grow through market cycles.

This method has historically proven to be a more successful investment strategy than trying to outguess market movements.

Technological Advancements and Accessibility

Growth of Online Investment Platforms

The last decade has seen a revolutionary change in how individuals can invest. Technological advancements have birthed a myriad of online investment platforms, putting the power of investing at everyone’s fingertips.

These platforms have democratized investing, making it accessible to a wider audience than ever before.

How Technology Makes Investing Simpler and More Accessible

Not only has technology made investing more accessible, but it has also simplified the process.

With user-friendly interfaces, comprehensive educational resources, and automated tools, these platforms have lowered the barriers to entry for novice investors, enabling them to start their investment journeys with confidence and ease.

Bottom Line: Importance of Early Investing

Investing early harnesses compounding interest and inflation hedging, fostering wealth and financial independence through diverse income streams. It affords the luxury of early retirement and career flexibility while mitigating risks through time.

The rise of online platforms has revolutionized access and simplicity in investing, making it imperative to start now. Embrace the steady path of long-term growth over market timing, and secure a resilient financial future with reduced stress and enhanced life quality.

@free and @Mark- The benefit of starting early, no matter how much you invest, cannot be underestimated.

Barbara, I know what you mean about Ohio. I have moved many times to different places, from my home state of Ohio and have found the spending habits of them to be very different.

In regards to your article, would you say that starting early is even more important that what one invests in? For example, is it better to start earlier even if one is picking the wrong stocks?

Hi Scott, There is no better investing strategy than starting early and investing regularly in a diversified portfolio of index mutual funds. The compounding of reinvested dividends and capital gains is the most powerful contributor to a fat retirement portfolio.

I found this post inspirational on two counts:

#1. Investing early pays off big and the sacrifices are more than worth it.

#2. If you could do it, anyone can save and invest some money starting today, no matter how small the sum.

Investing early can really give you a lot of advantages like earning more over time. I’m glad I’m still young enough, and that I learned about investing early in my life. Great post, by the way.

Hi Kieth and Jeff, Compound interest is like magic. Obviously, no one is going to get 100% return every day, as Jeff pointed out, the chart is illustrative. But you can invest in a diversified portfolio of stocks and bonds, receive an average annual return of 7% and over the years end up with hundreds of thousands of dollars.

Specifically, start at age 25 and invest $300 per month in a retirement account (Roth IRA or 401(K). Continue for 40 years until age 65. At an average annual return of 7%, your $3600 annual contribution will grow to approximately $770,000.

Hi Barbara, i understand the advantage of compounding and i am looking at it as illustration but we got confused because here we are hearing an account and we thought that its illustrating what you gone through

i am trying to make sense of the article and see how it motivates folks but i cannot put that chart out of my mind where suddenly in 2-3 short years the money balloon from less than 2 mil to 10 mil. how the heck can a savings that is not 100% equities do something like that?

@ Kyith It’s just to illustrate a point. If you asked someone, “Would you rather have $5 million dollars or a penny that doubles every day for 31 days?”, I’m sure 98% of people would choose the $5 million. Simply because the don’t get the power of compounding interest.

It’s the same reason when I meet with younger clients and encourage them to start saving $50-$100/month and, at first, they don’t see the point. I have to run then numbers to show what they are missing out on if they don’t start now.

i understand the benefits of compounding but the illustration is strange.