It may not seem so on the surface, but obtaining life insurance as a smoker is actually super easy.

Since this habit carries so many health risks, smokers generally need to pay more for their coverage; and they could have a more complicated application process.

If you handle your application properly though, you can minimize the extra costs you’ll need to pay.

Life insurance is the best safety net you can buy. It’s one of the only ways you can ensure your loved ones will be taken care of.

If you’re a smoker, you may think you won’t be able to get an affordable life insurance plan. I’m here to tell you how to do it.

Table of Contents

- Can You Get Life Insurance as a Smoker?

- How Much Higher Are Life Insurance Rates for Smokers?

- Tobacco Variants and Their Impact

- Life Insurance as a Smoker – A Case Study

- Quitting Smoking Helps

- Great Companies for Smokers Life Insurance

- Get Life Insurance

- The Bottom Line – Life Insurance for Smokers vs. Non-Smokers

Can You Get Life Insurance as a Smoker?

You can absolutely get life insurance if you are a smoker of any kind.

In fact, you can even get instant approval through some life insurance companies. Beware– If you smoke, it’s going to hurt your rates.

Since smoking has been proven to increase the risk of various ailments, smokers will pay higher rates than non-smokers who otherwise have the same risk factors.

If you have two men, both are in good shape, both have similar family histories, and both pass their exams, but one is a smoker, and the other is a non-smoker, then the smoker is going to have a higher premium.

According to LifeInsuranceForSmokers.com, even if you have poor health, on top of smoking, you could get as much as $50,000 in life insurance, guaranteed. So, no matter your condition, you can find insurance.

It’s just about how much you’re willing to pay.

How Much Higher Are Life Insurance Rates for Smokers?

Most smokers realize their life insurance rates will be more expensive, but many are shocked by just how high their rates actually are.

Life insurance for an individual in their 30s can expect to pay two to three times as much as a nonsmoker. A smoker in their 40s can expect to pay three to four times as much.

Insurance companies charge this massive price increase because smokers have a higher risk of death than nonsmokers.

In addition, smokers often have other health problems like a poor diet or an inactive lifestyle. This is just one more example of how it pays to quit smoking.

Some of the best life insurance rates for smokers can be found at Transamerica.

Sample Life Insurance Quotes for Smokers

| 20 YR $500K POLICY | 30 YO MALE | 40 YO MALE | 50 YO MALE |

|---|---|---|---|

| Preferred Plus Non- Smoker | SBLI $20.88/Mo | SBLI $30.45/Mo | SBLI $81.35/Mo |

| Preferred Smoker | SBLI $77.00/Mo | Banner $134.31/Mo | Transamerica $337.75/Mo |

Testing for Tobacco During the Life Insurance Application

If you are a smoker, you won’t be able to hide this fact.

First of all, your life insurance application will ask you directly about whether you smoke. You need to be honest and say “yes” because if you don’t, it’s a form of insurance fraud.

Most policies also require you to see a nurse or doctor for a medical exam. As part of this exam, you’ll need to give your blood and urine for testing.

The insurance company will check to see if tobacco shows up in either. If you test positive for tobacco but report that you didn’t smoke, your odds of getting a fair insurance rate plummet.

Some companies view tobacco usage more favorably than others, so this is going to be one of the main things you’ll want to be on the lookout for.

Even if you can hide your smoking from the insurance company, you’re still taking on a big risk.

The first two years of a life insurance policy are known as a contestability period. If you die during this time and the insurance company discovers that you were smoking, it can deny paying out your death benefit.

Being honest is the best way to deal with smoking.

Through the years, I’ve heard a lot of crazy ways people have tried to hide their smoking from insurance companies. I’m here to tell you none of them work. You can try all you want, but you’re going to be found out. Lying on your application is going to make the process much more difficult and trickier.

As an added note, no exam life insurance is an option for smokers. But be warned, the premiums are going to be MUCH higher.

Not only are you a smoker, but the company isn’t getting the info they need to add up your rates. I rarely advise smokers to go the no-exam route.

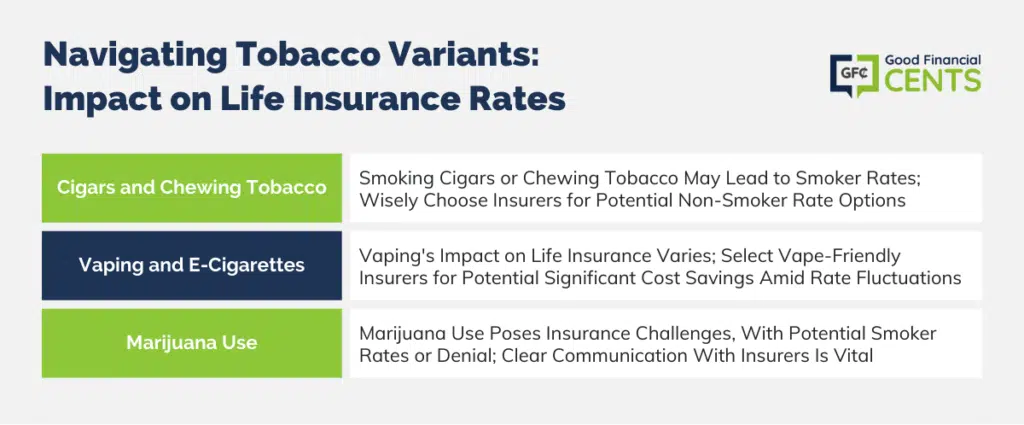

Tobacco Variants and Their Impact

The world of tobacco is diverse, with each variant carrying its own set of risks, perceptions, and implications for life insurance. Whether you’re puffing on a cigar during special occasions, chewing tobacco at a ballgame, or trying the latest e-cigarette, your choice of tobacco product can significantly influence how insurers view your application.

It’s crucial to understand the distinctions and the ramifications each variant holds for your premiums and coverage options.

Cigars and Chewing Tobacco

If you smoke cigars or chew tobacco, you should make sure to note this distinction with your insurance agent. All these forms of tobacco would show up on your blood test and could get you rated as a smoker.

However, insurance companies are sometimes more lenient with these types of tobacco use. For example, some companies give a non-smoker rating to applicants who only use smokeless tobacco. If you only smoke cigars a few times a year, you might also be able to qualify for a non-smoker rating by not smoking for several weeks before your application.

Each company looks at different forms of smoking with various medical underwriting. Some companies will still give you preferred rates if you smoke electronic cigarettes, but other companies are going to lump you with smoker’s rates, regardless of what kind of smoking you do.

This is just one example of why you need to find a company that is more favorable towards your specific tobacco use. Not every carrier views cigars and vaping the same. Picking the wrong company can cost you thousands of dollars.

Vaping and Electronic Cigarettes

Vaping has completely changed the way that life insurance companies must look at smoker’s rates.

There are thousands and thousands of people who are starting to vape or are switching from traditional cigarettes to vaping.

In fact, a lot of smokers are using vaping to kick their tobacco habit, which can work wonders on your health, but how is it going to impact your life insurance rates? When you’re applying for life insurance coverage, you may wonder how vaping is going to impact your rates, and the answer is, “It depends.”

Just like with other kinds of smoking or tobacco, every insurance company is different. Some companies are going to automatically give you smoker’s rates if you vape, but other companies will give you non-smoker rates or have a separate category. Finding the perfect companies for people who vape could save you hundreds of dollars on your insurance plan.

Because the idea of vaping is new, there is little research on how it will impact smokers in the long run, which means that insurance companies don’t know how to rate it.

As more studies come out on the impact of vaping, life insurance companies can accurately calculate the risk associated with vaping, but until then, you can expect to get rates that vary drastically from company to company.

Marijuana

Marijuana is kind of a different animal altogether. Some companies are okay with it, others are not.

There’s also a little nuance with how and why you use it.

- Are you using it for recreation?

- How about as a minor treatment for a health condition?

In either case, you’ll be dealing with some particulars every agent and every insurer aren’t equipped to handle.

Long story short, you can get coverage. However, it might qualify you as a smoker.

In addition, you actually can get denied, too.

Life Insurance as a Smoker – A Case Study

I had a 34-year-old male client who was seeking $250,000 of term life insurance coverage. He had been smoking for most of his adult life but was determined to quit. He had two young children, so getting some life insurance coverage was a major concern of his.

He had stopped smoking for just 4 months, so he would have still been subject to smoker rates.

What I suggested was to take out a shorter-term policy (10 years vs. 30 years) to make sure he had the coverage he needed while not having to pay a fortune to have it.

The only reason I suggested this was because I knew my client was serious about quitting. If you’ve been trying to kick the habit for years and have been unsuccessful, get the full term of life insurance you need. If you’ve been wanting to kick the cigarettes once and for all, the thousands of dollars that you would save is a great incentive.

Not only will quitting smoking work wonders for your health, but it will also work wonders for your bank account as well.

Quitting Smoking Helps

You can use your life insurance bill as one more motivation to quit smoking. If you smoke now and can only get a smoker rate, you could still qualify for a discount later on. You need to quit smoking for at least one year.

At this point, you can request another health exam. If you come through clear as a nonsmoker, your insurance company will start charging you the lower nonsmoker rates.

I would never suggest waiting a year to buy life insurance, even if you’re going to pay smoker-sized premiums. Go ahead and buy your policy, and then commit to quitting.

There are HUNDREDS of ways you can increase your chances of quitting. More than likely, you’ve tried before.

Grab a partner. Use gum or patches. Do whatever you have to do to quit.

If you do, you’ll find hundreds of dollars in your wallet at the end of the year.

Once you’ve quit smoking for good, all you have to do is call your insurance agent and tell them you’ve quit smoking and want to retake the medical exam. They will be happy to set up another appointment. You can enjoy those lower premiums in no time.

Great Companies for Smokers Life Insurance

Each insurance company has a different process and different rates for smokers. In addition, some treat all forms of tobacco the same, while the best life insurance companies for smokers make a distinction between cigars, electronic cigarettes, and/or chewing tobacco. Taking the time to find the right match for your situation could make a big impact on your insurance premiums.

We regularly work with smokers, so we are experts in this market. We can show you how to put together a smart application and match you up with the best companies for your needs.

Unlike a traditional insurance agent, independent brokers represent dozens of insurance companies across the nation, which means they can bring all of the lowest rates directly to you. Don’t waste your time calling dozens of insurance companies and answering the same questions over and over again.

Working with an independent insurance agent is going to save you both time and money on your life insurance policy.

Get Life Insurance

Aside from picking the right kind of policy, it’s vital that you get enough insurance coverage to protect your family.

When calculating your insurance needs, there are different factors that you’ll need to take into account. The first thing that you should calculate is your debts and final expenses.

Your family would be left with your mortgage payments, car loans, and much more. All of those can put your family under a mountain of debt.

The next thing that you should account for is your paycheck; you will want your life insurance policy to be able to replace your income. Your family would struggle financially if they no longer had your salary, but that’s where your policy comes in.

These are only two of the things that you should consider when adding up your life insurance needs. I can help you make sure that you’re getting the coverage that you need at an affordable price.

Just because you’re a smoker doesn’t mean that your life insurance plan has to break your bank every month.

The Bottom Line – Life Insurance for Smokers vs. Non-Smokers

Life insurance is a critical safety net, ensuring your loved ones are financially protected, regardless of your smoking habits. Smokers may face higher premiums, but with the right approach, affordable rates are within reach.

By being transparent during the application process, understanding the nuances of various tobacco products, and seeking out insurers who specialize in policies for smokers, you can secure a plan tailored to your needs.

Furthermore, quitting smoking not only improves your health but can significantly reduce your premiums, making it a win-win decision for your well-being and wallet. Always prioritize adequate coverage and seek expert advice to navigate the insurance landscape effectively.

Hi There,

Would be glad to consult with you folks on the right life insurance plan for me.

571.524.8519.

Thanks,

Arnab

insurance is a must just sad it cost so much you pay and pay when you make a claim denied and they never want to refund when they deny a claim

The tests they use to see if you’re smoking detect a compound called cotinine, which is a metabolite of nicotine. So if you’ve consumed anything with nicotine (cigarettes, cigars, chewing tobacco, etc), it will be detected. Cotinine sticks around in your body for a while so you’d have to go cold turkey for a couple of weeks if you wanted to cheat the system.

Also, if you take nicotine gum or use the nicotine patch, you can expect positive tests. So you should be honest about this when filling out your life insurance forms.

I never smoked although I tried once. Smoking will do more than just get you a higher insurance rate! It will affect your health and ultimately shorten your life.

In college I used to smoke, however once I graduated and was accepted at my first job, I needed to pass a drug test. I originally thought that they were only testing me for drugs but my company was also testing for tobacco use for health insurance reasons. It took a few months but for 5 years, I have been tobacco free!