If you have struggled to get approved for credit cards and loans in the past, you should probably take a look at your credit score to see where you stand.

In the meantime, you should learn about what is considered a bad credit score in the first place and the thresholds you have to surpass to have “fair” credit or “good” credit instead.

Since lenders can use different credit scoring models and credit score ranges, however, what is a bad credit score number can vary. With that in mind, this guide will explain how a poor credit score looks from the perspective of the FICO scoring model and the VantageScore.

Once you have an idea of how your credit score looks and which credit score range it falls into, you can take appropriate steps to improve it.

Table of Contents

What Is a Bad FICO Score?

FICO credit scores were created by the Fair Isaac Corporation and are the most commonly used credit scores in circulation. In fact, FICO credit scores are used by over 90% of top lenders when making decisions on whether to lend money.

While there are different FICO credit scores in use, it’s important to know that this type of score falls between 300 and 850. From here, scores that fall within different ranges are considered anywhere from bad to excellent, as shown below:

- Exceptional: 800+

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 579 and below

If you’re wondering which range to shoot for, “good” credit is a good place to start. According to myFICO.com, many lenders consider scores above 670 as an indication of good creditworthiness. “Typically, the higher your score, the lower the risk and the more likely creditors are to lend to you,” they write.

What Is a Bad VantageScore?

The VantageScore is another popular type of credit score, and this score’s newest models (VantageScore 3.0 and 4.0) also assign credit scores from 300 to 850.

However, the range of scores is slightly different than the FICO scoring model. As you can see below, there are more ranges to be aware of, and “good” credit requires a slightly lower threshold. In the meantime, “fair” credit requires a slightly higher score.

- Excellent: 781 to 850

- Good: 661 to 780

- Fair: 601 to 660

- Poor: 500 to 600

- Very Poor: 300 to 499

The newer VantageScore models also break down the bad credit score range into “poor” and “very poor” categories. Either way, consumers should strive for a VantageScore that’s considered “good” or better.

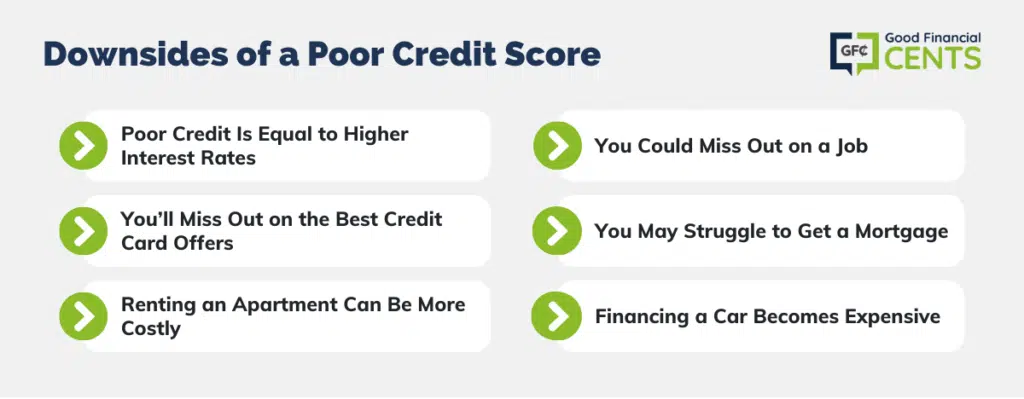

Downsides of a Poor Credit Score

Perhaps you don’t think poor credit is a big deal, but you may quickly change your tune if you need to borrow money, rent an apartment, or even get car insurance. The reality is that a truly “poor” credit score can impact your life in more ways than people realize.

How does a bad credit score affect me? Consider these pitfalls of poor credit:

- Poor credit = higher interest rates. A lower credit score almost always results in higher interest rates, and that’s true whether we are talking about credit cards or other types of loans.

If you are approved to borrow money with any financial product, the cost of borrowing with a high APR can be sky-high.

- You’ll miss out on the best credit card offers. A poor credit score will bar you from qualifying for the best credit cards on the market today, including ones with excellent perks. If anything, you’ll be able to get approved for a credit card for bad credit or a secured credit card.

- Renting an apartment can be more costly. A low credit score can make you seem more risky to potential landlords. As a result, you may need a cosigner to rent a house or apartment, and you may need to put down a larger security deposit.

- You could miss out on a job. Employers can request your permission to see a modified version of your credit report as part of the interview process. If your credit score is very damaged, this will likely hurt your chances of getting the job.

- You may struggle to get a mortgage. Poor credit can make it difficult to qualify for a mortgage. If you do get approved, you could have to come up with a larger down payment or pay a higher interest rate.

- Financing a car becomes expensive. Auto loan rates vary based on your credit score, and a higher score is always better.

According to Experian’s State of the Automotive Finance Report for Q1 of 2023, deep subprime borrowers buying used cars with credit scores between 300 and 500 paid an average interest rate of 21.32% on car loans.

In Q1 2023, the average interest rate for a used vehicle surged to 11.17%, a notable increase from 8.67% in the previous year’s corresponding period.

- Your auto insurance rates are higher. Also, be aware that a low credit score can result in higher car insurance rates. Car insurance companies consider your creditworthiness as a major factor in assessing risk, and they will price your premiums accordingly.

Steps to Improve Your Credit Score

The good news about a bad credit score is that you can always do better. In fact, there are numerous ways to increase your credit score over time and without a ton of work.

You just have to be strategic and disciplined, and you have to avoid making all the poor decisions that got you in the bad credit score range in the first place.

If you need a better credit score for an auto loan or you want to be able to buy your own home one day, the following steps can help you build good credit that lasts.

Step 1: Take a Look at Your Credit Reports

Before you can fix a bad credit score, it’s immensely helpful to look at all the information on your credit reports. Your credit reports store all the information lenders have reported to the credit bureaus about you in the past.

Information found on your credit reports includes but is not limited to balances you owe, your payment history on credit cards and other loans, any accounts you have in default, and more.

We suggest heading to AnnualCreditReport.com, a website that lets you look at your credit reports for free.

While you used to be able to see each of your credit reports once every 12 months through this portal, you can now check your reports for free weekly due to the COVID-19 pandemic.

Once you head to this website, you’ll want to look at your credit reports from all three credit bureaus — Experian, Equifax, and TransUnion. It’s crucial to look at all three reports because the information reported to each bureau can vary.

Look over the information on your credit reports, and you’ll have a general idea of the mistakes you have made with credit in the past.

If you find any errors, you can also follow a formal process to dispute credit report mistakes. In some cases, a corrected error on your credit report can quickly boost your score.

Step 2: Pay All Your Bills Early or on Time

Another important step involves paying all your bills early or on time. While an occasional late payment may not seem like a big deal, it is because your payment history is the most important factor that makes up your FICO credit score.

While on-time or early payments can help prove your creditworthiness and increase your score over time, a late payment can dramatically impact your score in a negative way.

If you’re worried about paying bills late or you’re prone to forgetting your due dates, we suggest setting up your bills on autopay or setting reminders on your phone.

Step 3: Pay Down Revolving Debts

Also, see if you can pay down any revolving debts you have, such as credit card balances.

Because how much you owe in relation to your credit limits (also called your credit utilization) is the second most important factor that makes up your FICO score, paying down debt can result in a higher credit score.

How much debt is safe? Most experts suggest paying down your revolving balances until you owe less than 10% of your available credit, or 30% at the maximum. This means keeping your balances below $500 or below $1,500 at the absolute maximum, with available credit of $5,000.

Step 4: Consider a Secured Credit Card

If you need the chance to prove your creditworthiness and you can’t get approved for other types of credit cards, a secured credit card could be your best bet.

Secured credit cards require you to put down a cash deposit as collateral, which is used to secure your line of credit.

However, these cards report your credit balances and payments to the three credit bureaus, so they can help you increase your credit score and prove creditworthiness over time.

Also, remember that a secured credit card is nothing more than a stepping stone and that you should only use this type of card until your score has increased enough to qualify for better options.

When you cancel or upgrade your secured card while your account is in good standing, you also get your security deposit back.

Step 5: Check Out Credit-Builder Loans

If you don’t like the idea of a secured credit card, you can also consider a credit-builder loan from a company like Self. With this type of “loan,” you actually make payments to a savings account that is held on your behalf.

However, your payments are reported to the credit bureaus, and you get the proceeds of your savings, minus interest and charges, once your loan term ends.

While a credit-builder loan from Self isn’t free, these loans don’t have to be costly, either. As an example, Self says one of their “Large Builder” loans requires a monthly payment of $48 for 12 months.

When the loan ends, you get $539 back and will have paid a total of $46 in interest and fees.

Step 6: Become an Authorized User on a Credit Card

Finally, see if anyone in your life is willing to add you as an authorized user on their own credit card. You’ll want the primary account holder to have a good credit score, of course, but it could be a spouse or partner or a family member.

When you become an authorized user, you can benefit from the responsible credit payments and usage of the primary account holder.

Can a Credit Repair Agency Help?

You may also be wondering if a credit repairs agency like Lexington Law or Credit Saint can help you repair your credit. The answer to this question is definitely “yes,” but there are some facts to be aware of before you sign up.

For example, Credit Saint claims that they can help improve your credit score by challenging incorrect data on your credit reports. In the meantime, they say they can help you learn to “optimize your report using techniques for paying bills and opening or closing credit.”

However, the Federal Trade Commission (FTC) points out that credit repair companies “can’t remove negative information that’s accurate and timely from your credit report.” Not only that, but credit report agencies can’t do anything for you that you can’t do for yourself.

With that being said, you should consider reaching out to a credit repair agency if you need help getting back on track because you can’t seem to handle it yourself.

In that case, having the expertise and support of a third party could mean the difference between improving your credit or staying where you’re at.

Bottom Line: Understanding and Enhancing Your Bad Credit Score

Understanding what constitutes a bad credit score is essential for financial well-being. FICO and VantageScore credit models assign scores between 300 and 850, categorizing ranges from “Exceptional” to “Very Poor.”

Poor credit brings higher interest rates and limits access to favorable financial options, from credit cards to mortgages. It hampers renting, job prospects, and insurance rates. To enhance credit, start by examining credit reports, paying bills punctually, and reducing debts.

Consider secured credit cards, credit-builder loans, and becoming an authorized user. While credit repair agencies can assist, accuracy matters most. Prioritize these steps to secure a brighter financial future.