The US Bureau of Labor Statistics has reported the most recent inflation rate is at 3.4%. The problem is compounded by the Russian invasion of Ukraine and a chain of supply shortages affecting everything from food to energy to computer chips.

Meanwhile, the Federal Reserve is attempting to turn back the tide by increasing interest rates. The combination of rising inflation and interest rates is putting a serious squeeze on investment portfolios and household budgets across the nation.

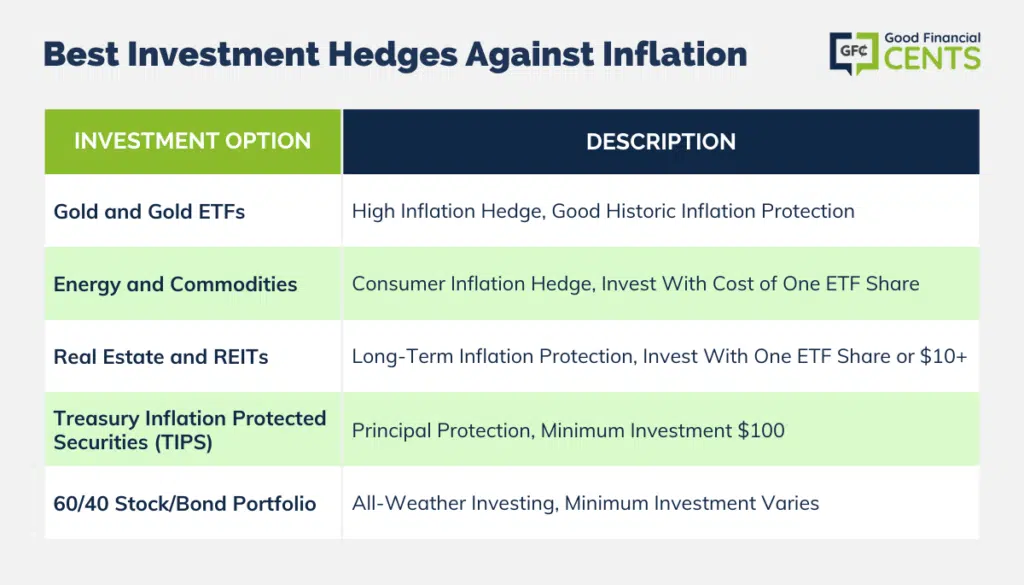

Dealing with rising prices at the budget level is an individual decision. But we’re here to offer some help with what we believe to be the five best investment hedges against inflation to help protect your portfolio.

Table of Contents

We’re going to go into each of the five in some detail, but the table below will give you a high-altitude view of each and the specific features that make it a good inflation hedge.

| Investment Hedge / Feature | Minimum Investment | Historic Inflation Protection Level | Overall Risk Level | Fees | Where to Invest |

|---|---|---|---|---|---|

| Gold & Gold ETFs | Cost of One ETF Share or Small Denomination Bullion Coin ($50 – $200) | Good to Excellent | Moderate to High | None for ETFS, 5% To 10% On Bullion Coins | Bullion: Online Precious Metals Dealers; ETFs: E*TRADE, TD Ameritrade, and M1 Finance |

| Energy & Commodities | The Cost of One ETF Share | Good to Excellent | Moderate to High | None | Investment Brokers Like E*TRADE, TD Ameritrade, Robinhood and M1 Finance |

| Real Estate & REITs | The Cost of One ETF Share, or $10 and up for Real Estate Crowdfunding | Good to excellent | Moderate | ETFS, None; Real Estate Crowdfunding 2% – 3% | Fundrise, Zacks Trade, E*TRADE, and TD Ameritrade |

| Treasury Inflation Protected Securities (TIPS) | $100 | Good | Low | None | Treasury Direct |

| 60/40 Stock/Bond Portfolio | Varies From $1 and Up | Poor, Short-Term; Moderate, Long-Term | Moderate | None | Robo-Advisors: Betterment, M1 Finance; Investment Brokers: Zacks Trade, E*TRADE, and TD Ameritrade |

Our Picks for 5 Best Investment Hedges Against Inflation

Below is our list of the five best investment hedges against inflation:

- Gold & Gold ETFs: Best for High Inflation With General Instability

- Energy & Commodities: Best for Consumer Level Inflation (Food & Energy)

- Real Estate & REITs: Best for Long-Term Inflation Protection

- Treasury Inflation-Protected Securities (TIPS): Best for Protection of Investment Principal

- 60/40 Stock/Bond Portfolio: Best for All-Weather Investing

Now let’s do a deeper dive into each investment to see both what’s involved with investing in each, as well as what each asset class does best in an inflationary environment.

1. Gold and Gold ETFs: Best for High Inflation With General Instability

- Minimum Investment: Cost of one ETF share or small denomination bullion coin ($50 – $200)

- Historic Inflation Protection Level: Good to excellent

- Overall Risk Level: Moderate to high

- Fees: None for ETFs, 5% to 10% on bullion coins

- Where to Invest: Bullion: online precious metals dealers; ETFs: E*TRADE, TD Ameritrade, and M1 Finance

Based on its outstanding performance during the inflation of the 1970s and the economic and financial turmoil during the 2008 Financial Meltdown, gold looks to be a hands-down winner against inflation. But it really depends on the level of inflation. During times of low, predictable price increases, gold can languish. But it performs especially well during times of high inflation.

You can invest in gold even if you only have a little bit of money. For example, you can invest $100 in a gold ETF or invest $1,000.

or even less, in small denomination gold bullion coins, like ½ or 1/10 of an ounce coins.

2. Energy and Commodities: Best for Consumer Level Inflation (Food & Energy)

- Minimum Investment: The cost of one ETF share

- Historic Inflation Protection Level: Good to excellent

- Overall Risk Level: Moderate to high

- Fees: None

- Where to Invest: Investment brokers like Robinhood, M1 Finance, E*TRADE, and TD Ameritrade

There was a time when investing in energy and other commodities meant playing the commodities markets. No more. Even if you know nothing about commodities, you can invest in a portfolio of them through a diversified ETF.

For example, the Invesco DB Commodity Index Tracking Fund (DBC) holds positions in energy, metals, and agricultural commodities. It’s returned more than 55% for the one year ended May 31.

If you prefer to invest specifically in energy, an example is the iShares U.S. Oil & Gas Exploration & Production ETF (IEO). The fund has provided a return of more than 86% for the one year ended May 31.

You can easily invest in either of these funds or other energy and commodity funds through one of the best online stockbrokers, and do so for not more than the cost of one share of an ETF.

3. Real Estate and Real Estate Investment Trusts (REITs): Best for Long-Term Inflation Protection

- Minimum Investment: The cost of one ETF share, or $10 and up for real estate crowdfunding

- Historic Inflation Protection Level: Good to excellent

- Overall Risk Level: Moderate

- Fees: ETFs, none; real estate crowdfunding 2% – 3%

- Where to Invest: Fundrise, Zacks Trade, E*TRADE, and TD Ameritrade

Investing in real estate is probably the single best long-term inflation protection, because it tends to increase in value in all types of economic environments. Real estate also offers multiple investment options. For example, you can invest in individual properties. That’s proven to be a solid investment for millions of Americans, but it does involve a lot of upfront capital as well as hands-on responsibility.

A better way for most may be to invest in REITs. Those are like mutual funds for commercial real estate, like apartment complexes, office buildings, and retail space. A single trust will hold multiple properties, and you can participate in the entire portfolio by purchasing a single share.

Another option is real estate crowdfunding. It’s come on the scene in the past decade or so and gives investors an opportunity to choose specific properties to invest in. One of the best in the space is Fundrise. Not only do they have multiple investment options, but you can also invest with a minimum investment of $10..

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

4. Treasury Inflation Protected Securities (TIPS): Best for Protection of Investment Principal

- Minimum Investment: $100

- Historic Inflation Protection Level: Good

- Overall Risk Level: Low

- Fees: None

- Where to Invest: Treasury Direct

TIPS are the best low-risk investments that also provide inflation protection. With as little as $100, you can invest your money for terms of five, 10, or 30 years. Not only will you earn interest on the bonds, but the Treasury will make an additional contribution to the principal value based on changes in the Consumer Price Index (CPI). It’s an excellent strategy for providing absolute protection for at least a portion of your portfolio.

Another option is I Bonds, which is currently paying 4.30%. They can be purchased electronically in denominations as little as $25. However, you are limited to purchasing no more than $10,000 in I Bonds per calendar year.

5. 60/40 Stock/Bond Portfolio: Best for All-Weather Investing

- Minimum Investment: Varies from $1 and up

- Historic Inflation Protection Level: Poor, short-term; moderate, long-term

- Overall Risk Level: Moderate

- Fees: None

- Where to Invest: Robo-advisors: Betterment, M1 Finance; Investment brokers: Zacks Trade, E*TRADE, and TD Ameritrade

There’s often a debate about bonds vs stocks or at least the proper allocation between the two. The 60/40 portfolio eliminates that tension by making portfolio allocation automatic. It works with the basic concept of providing the right mix of both short-term investments and long-term investments but with an overall bias in favor of long-term portfolio performance.

But the advantage of the 60/40 stock/bond portfolio is that it does tend to provide consistent returns over the long term, and in that way, it outperforms – or at least keeps up with – inflation. But a better way to use the strategy may be to add some of the investments listed above.

For example, part of your stock portfolio may include gold, energy, and commodity-based ETFs, while you may move a large percentage of your bond holdings into TIPS. For even greater diversification, you can add a small allocation in real estate through either REITs or real estate crowdfunding.

You can create a 60/40 portfolio (or something similar) either by setting it up with a self-directed brokerage account or doing it automatically through a robo-advisor, like Betterment or M1 Finance.

What Is Inflation?

Loosely speaking, inflation describes two events: rising prices and the decline in the value of the dollar. Actually, the two are single events. It’s just a matter of looking at the same situation from two different angles. But either way, you look at it, it means two things – most of the things you want to buy cost more than they did a year ago, and the value of your investments may be declining.

According to the International Monetary Fund, the definition of inflation is as follows:

“Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year.”

In the opening paragraph, we quoted the BLS inflation figure of 8.6% over the most recent year. That’s certainly high by historic standards, but it gets even worse when you look over the long term.

Using the Bureau of Labor Statistics CPI Inflation Calculator, we see that it took $1,625.67 in May 2022 to pay for what $1,000 bought in May 2002. That’s an increase in the cost of living of nearly 63% in the last 20 years.

Meanwhile, the CPI doesn’t tell the entire story. For example, a gallon of gasoline cost an average of $1.36 in 2002. At roughly $5 per gallon in the middle of 2022, the price of this all-important commodity and consumer goods has risen by nearly 300%!

The impact of these increases is tough enough on a household budget. But they also have a negative impact on investments.

First and foremost, your investment portfolio must have increased by at least 63% over the past 20 years just to keep up with inflation. It would have to rise by substantially more to achieve real gains in wealth.

That’s why a strategy of holding most or all your money in cash, paying very little interest, is a losing strategy. Even if you can preserve the nominal value of your portfolio, its true value is dropping in real terms. That’s been a real problem over at least the past decade when interest on savings has been well below 1%.

That’s why it’s so important to invest your portfolio with inflation in mind. Simply staying even isn’t enough – it actually means you’re falling behind!

Are We Headed for a Recession?

We’re not in the business of predicting economic shifts here at Good Financial Cents, but just a couple of weeks ago, Bloomberg reported on the high likelihood of an impending recession:

“Bloomberg Economics says there’s close to a three-in-four probability there will be a recession by the start of 2024. Economists at Deutsche Bank AG, one of the first major banks to forecast a recession, now expect one to begin in mid-2023; Wells Fargo & Co. predicts the same. Nomura Holdings Inc. expects one even sooner, starting at the end of 2022. The likelihood of a recession could climb even higher if gasoline prices continue to rise and the Fed opts for another 75-basis-point rate hike in July.”

Are the investment banks right? Will we have a recession this year, next year, or the following year?

No one knows for certain, not even the supposed experts. We are, after all, still coming off a brief but very severe economic downturn in 2020 from the COVID-19 pandemic shutdown. Whether that momentum will carry us past the twin threats of rising inflation and higher interest rates remains to be seen.

But what we do know for certain is that the combination is taking its toll on our household budgets and our investment portfolios. Whether or not we’re heading into a recession is less important than adjusting and preparing our portfolios for more of the same, at least in the next couple of years.

How Can I Protect My Portfolio?

That’s been the topic of this entire article. Exactly how you position your portfolio will largely depend on its size. If you are investing for beginners and/or investing small amounts of money, you may want to maintain your existing portfolio positions and wait for a change in the current economic/financial situation.

But if you’re an intermediate or advanced investor with a larger portfolio, you’ll certainly want to make some changes that are likely to improve your investing outcome.

All anyone can do is make investment decisions based on previous performance. However, the performance of any single investment or collection of investments can be short-circuited by rising interest rates or a change on the national or geopolitical fronts.

Summary of the 5 Best Investment Hedges Against Inflation

Let’s recap the five best investment hedges against inflation and what each is best for:

- Gold & Gold ETFs: Best for High Inflation with General Instability

- Energy & Commodities: Best for Consumer Level Inflation (Food & Energy)

- Real Estate & REITs: Best for Long-term Inflation Protection

- Treasury Inflation-Protected Securities (TIPS): Best for Protection of Investment Principal

- 60/40 Stock/Bond Portfolio: Best for All-Weather Investing

To say the economy and financial markets are in a state of flux is a serious understatement. Investors are trapped between surging inflation and rising interest rates. That’s one of the most difficult investment environments possible.

But in this type of situation, it’s important to maintain your long-term perspective. Your portfolio should continue to be focused on long-term growth, regardless of what’s happening in the short term. But you can at least lower the impact of inflation on your portfolio by moving at least some of your money into the investments covered in this guide.