If you’ve been maxing out your employer-sponsored 401(k) plan, a Solo 401(k), or any other tax-advantaged retirement plan, you’re doing way better than the vast majority of workers. After all, the average retirement savings by age is absolutely paltry with most workers under the age of 35 having barely $6,000 in savings.

By contrast, individuals saving for retirement could contribute up to $20,500 to a 401(k) plan in 2022, which was increased to $23,000 for 2024.

Meanwhile, self-employed workers and entrepreneurs could save up to $61,000 in a Solo 401(k) in 2022, including both the employer and the employee contribution. Amazingly, this maximum was increased to $69,000 for 2024.

Not only that, but these maximums don’t include the “catch-up” contributions those ages 50 and older can save. In 2024, catch-up contributions let individuals save another $7,500 in either of these accounts!

If you’ve maxed out your 401k or retirement account, you probably feel like you’ve made it. But, what do you do to grow wealth after you’ve maxed out your 401(k)?

Recently, a reader named Luke submitted this question to my podcast. If you want to hear my complete answer to his question, you can listen to the podcast here.

Also, feel free to submit your own questions on my contact page!

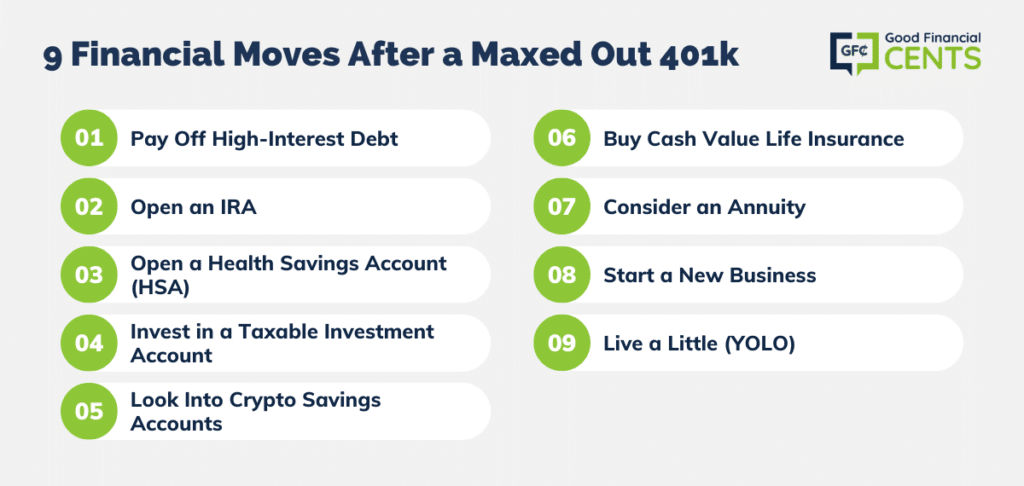

9 Financial Strategies for a Maxed Out 401(k)

Table of Contents

- 9 Financial Strategies for a Maxed Out 401(k)

- #1: Pay Off High-Interest Debt

- #2: Open an IRA

- #3: Open a Health Savings Account (HSA)

- #4: Invest in a Taxable Investment Account

- #5: Look Into Crypto Savings Accounts

- #6: Buy Cash Value Life Insurance

- #7: Consider an Annuity

- #8: Start a New Business

- #9: Live a Little (YOLO)

- The Bottom Line – What to Do After Maxing Out 401k

Believe it or not, this scenario is fairly common among high earners and super savers. Sometimes you do everything right and max out your 401(k), and you still have money left over to invest.

What should you do in this case? I’m going to break down nine different strategies to consider after you’ve maxed out your 401(k).

Just keep in mind that some of these strategies may work better for some than others and that your best options depend on your situation.

#1: Pay Off High-Interest Debt

If you have already maxed out your 401k or retirement account or you plan to this year, your next step is taking a closer look at all the debts you have. This includes debt like car payments and student loans of course, but I’m mostly talking about any high-interest debt you have, such as credit card debt.

While there is so much focus on investing to build wealth, people don’t realize that paying off debt can be just as helpful. After all, the average credit card interest rate is currently well over 16%, and that’s a much better return than you’ll get with most investments.

By paying off credit card debt, you are essentially getting the equivalent of your credit card’s APR on your investment. In the meantime, paying off debt can help you simplify your financial life and sleep better at night, so why not?

After you pay off any high-interest or unsecured debt, you can move on to options like your student loans and your car loans. While the interest rates on these debts are probably lower than you’re paying on credit cards, you should still try to wipe these debts out of your life. After all, both car loans and student loans can prevent you from getting where you want to be — even if these debts feel “normal.”

And when it comes to student loans, it’s easy to fall into a state where you have D.D.S. or Debt Denial Syndrome. This happens all the time with student loans because borrowers convince themselves they’ll “outearn” their loans one day.

Maybe you’re in school to be a doctor or a lawyer, and you think the amount of student debt you have doesn’t matter as a result. That could be true, but student debt could still prevent you from achieving different life goals you don’t even know you want.

For example, student debt could prevent you from starting your own business or embarking on a new path altogether.

Believe me — I have seen this happen to hundreds of people over the years!

Next up is your mortgage, which is more controversial. While some believe you should never pay off your mortgage due to today’s low interest rates, I think it can make sense to prepay the mortgage on your forever home. My wife and I are doing exactly that, mostly because we don’t want to spend the next 30 years or our lives making mortgage payments.

While prepaying a low-interest mortgage doesn’t make a lot of sense on paper, the strategy we’re using is going to save us more than $450,000 in mortgage interest. That’s some serious cash! If you’re curious why we’re paying off our home and how we’re saving so much, make sure to check out Episode 114 on my podcast.

#2: Open an IRA

If you’re debt-free or at least satisfied with the amount and types of debt you have, you can consider this next step after you’ve maxed out your 401k.

With a traditional IRA or a Roth IRA, you have the chance to save additional funds for your future retirement. However, this option can be tricky since earning too much can prevent you from maximizing this option.

First off, you should know that eligible savers can contribute up to $7,000 to a traditional IRA or a Roth IRA in 2024. However, the tax treatment of your savings depends on the type of account you choose, your income, and potentially even whether you have a retirement plan through work.

Let’s start with the Roth IRA, which is one of my favorite investment accounts of all time. With the Roth IRA, you make contributions with after-tax dollars and your money is able to grow tax-free over time.

The best part?

The Roth IRA even lets you withdraw your contributions (but not earnings) before age 59 ½ without any penalties, which is why many people use this account to save for college and other financial goals.

Unfortunately, Roth IRAs come with phase-out limits that limit who can contribute and how much. For 2024, phase-out limits are as follows:

- Single taxpayers and heads of household: $146,000 to $161,000

- Married, filing jointly: $230,000 to $240,000

- Married, filing separately: $0 to $10,000

Next up is the traditional IRA, which lets your money grow on a tax-advantaged basis. While anyone with earned income can contribute to a traditional IRA, the deductibility of your contributions depends on a range of factors including your income.

For 2024, phase-out limits for traditional IRAs are as follows:

- Single taxpayers covered by a workplace retirement plan: $77,000 to $87,000

- Married couples filing jointly when the spouse making the IRA contribution is covered by a workplace retirement plan: $123,000 to $143,000

- A taxpayer not covered by a workplace retirement plan married to someone who’s covered is making a contribution: of $230,000 to $240,000 –

- $0 to $10,000 – Married filing a separate return and covered by a workplace retirement plan: $0 to $10,000

Not to make things too complicated, but there’s another option here that may be more exciting. By contributing to a traditional IRA and turning it into a Roth IRA, you’re executing what is called a Roth IRA conversion or a backdoor Roth IRA. A lot of people don’t even know this option exists, but it’s completely legal for now.

The backdoor Roth IRA can make sense for high earners who can’t contribute to a Roth otherwise. While they won’t get a tax deduction when they contribute to a traditional IRA, converting to a Roth comes with long-term tax advantages.

If you want to know more about the backdoor Roth, make sure to watch my YouTube video on Roth IRA secrets!

Before you consider a backdoor Roth IRA, you should consult with a tax professional to see if it makes good financial sense for you.

#3: Open a Health Savings Account (HSA)

Option number three after maxing out your 401k is the Health Savings Account or HSA. This type of account is available for individuals who have a high deductible health plan, or HDHP.

In 2024, an HDHP can include any health insurance plan with a minimum deductible of $1,600 for an individual and $3,200 for a family, as well as a yearly out-of-pocket amount that is no more than $8,050 for individuals and $16,100 for families.

The awesome fact about HSAs is that you get a tax credit for your contributions up to specific annual limits each year. In 2024, these limits are set at $4,150 for individuals and $8,300 for families.

Not only that, but your HSA funds can grow tax-free, and you can use them for eligible healthcare expenses without paying any taxes.

Some HSA administrators even let you invest your funds so they can grow and compound for the long term. For example, Fidelity has an HSA that lets you invest your HSA funds into Fidelity ETFs, stocks, bonds, mutual funds, and more.

Another option to check out is the Lively HSA, which comes with updated features like its own mobile app. Lively HSAs are popular because there are no hidden fees and there is no minimum cash balance to get started.

Lively also lets you invest your funds through a self-directed account that is run through TD Ameritrade. You also get a Lively debit card, so you can easily pay medical bills directly from your account.

Expert Tip:

Lawrence Delva-Gonzalez CFE, who is also known as The Neighborhood Finance Guy, says this tip can help the average American household reach millionaire status in less than 20 years.

“Like a lot of people, I didn’t know that I could use all three at the same time,” said Delva-Gonzalez. “Even a single person can invest up to $32,850 in tax-advantaged accounts which includes $23,000 in a 401k, 403b and 467b, $7,000 in a traditional or Roth IRA, and $4,150 in a Health Savings Account. For families with dual earners, this can mean as much as $65,700.”

#4: Invest in a Taxable Investment Account

Next up, you should absolutely consider investing in a taxable brokerage account. This option is smart because you get the chance to build wealth you can access before the standard retirement age of 59 ½. Plus, any number of online brokerage accounts can help you get started.

You can also choose to invest in stocks, bonds, mutual funds, index funds, ETFs, and pretty much any other type of investment you’re interested in once you’ve maxed out your 401k.

Some brokerage firms even offer tailored portfolios you can choose from based on your investment timeline and goals. For example, M1 Finance offers investment “pies” that let you invest with ease without picking individual stocks.

You can even use a brokerage account to invest in dividend stocks, which is one of my favorite strategies for building a passive income.

Either way, a brokerage account lets you invest for the future all on your own terms, and it can be a great financial tool if you’re hoping to retire early.

Plenty of experts agree, including Robert Farrington from The College Investor.

“After your 401(k), taxable investing in a brokerage is a great way to go. You can’t beat long-term capital gains rates (which are low), and qualified dividends (which are also very low),” notes Farrington.

“And if you have a long-term buy and hold strategy anyway, you shouldn’t be encountering too many taxable events. Plus, it does give you the potential to add other things to the mix, such as charitable giving of appreciated stock.”

Outside of brokerage accounts, you can also look into government bonds that help you save for retirement with excellent returns. With Series I Savings Bonds, for example, the current return is 7.12%.

#5: Look Into Crypto Savings Accounts

Another investment option comes into play when you already have some crypto in your portfolio. With a crypto savings account, you get the chance to store your crypto assets and earn a really awesome return along the way.

Here’s a screenshot that shows how much interest my Celsius account earns every month:

Note: On July 13, 2022, Celsius Network and certain of its affiliates filed for voluntary Chapter 11 bankruptcy.

Also, remember that you’re not even selling your crypto to get this type of return. You’re just storing your assets in a crypto savings account and earning “interest” like you would with a high-yield savings account.

With that said, keep in mind that investing in crypto can be risky in general and that these types of accounts don’t come with any FDIC insurance.

Separately, it’s also worth noting that you may have a crypto option if your 401(k) account. Brian Harrington of the Bitcoin is Hard podcast says his retirement account lets him invest in Bitcoin:

#6: Buy Cash Value Life Insurance

The sixth option I’m going to recommend is cash-value life insurance, but this option is not right for everyone. In fact, I have a whole video on why I hate whole life insurance.

Despite what your local Northwestern Mutual life insurance salesman tells you, cash-value life insurance only makes sense for people in very specific circumstances.

If you have maxed out your 401(k) and taken other steps like opening a Roth IRA and an HSA, for example, cash value life insurance can help you stash away more of your assets in a tax-advantaged way.

However, there are a few things you should know. First, the “dividend” these policies pay is a net dividend and not a gross dividend, so the dividend only comes into play after you cover the cost of your life insurance and fees.

And of course, cash value life insurance does come with some pretty hefty fees, most of which go to the salesperson who gets you to buy this type of policy.

However, these policies can pay off over time since the dividend yield will eventually start moving more in your direction and away from the life insurance component of your policy. You can also borrow against the cash value of your policy, and your heirs are guaranteed a death benefit no matter how long you live.

Number seven is another investment option that only makes sense in specific situations. You can consider an annuity in some situations, particularly if you want to secure another income stream for retirement after maxing out your 401k.

#7: Consider an Annuity

However, I want to point out that I would always avoid variable annuities, which come with super high costs and all kinds of volatility. If you want to know more, I did a whole video on why you should never invest in a variable annuity.

Either way, the first thing you should know about annuities is that you should only invest money that is absolutely earmarked for retirement. That’s because, once you invest in an annuity, you’re getting tax-deferred growth just like you would with a 401(k).

This means you can’t access this money until age 59 ½ without paying surrender charges, tax penalties, or both. If you choose to invest in an annuity, it should be with money you won’t need until you’re almost in your 60s at the earliest.

Also, keep in mind that there are all types of annuities out there. This includes the fixed annuity, which is probably the most attractive option out there. With a fixed annuity, you earn a fixed return that won’t change over time.

Then there are indexed annuities, which promise returns that are based on a specific index such as the S&P 500. However, there are always fees involved in these types of accounts, so you have to read the fine print.

If you’re curious whether an annuity could work for you, make sure to read about the 5 real-life scenarios where annuities make sense.

#8: Start a New Business

Another option is one you should consider if you’re looking for a change, and if you have some free time to invest. After all, having extra cash isn’t enough to get a business up and running. You also need to pour yourself into getting your business off the ground, which can take months or years. It’s possible you’ll be able to outsource most tasks and have your business running on its own after a while, but it takes time to get there.

Either way, your new business could be almost anything. You could invest in a rental property and try to build passive income that way, or you could start a fitness company, a T-shirt business, or a carpet cleaning firm.

You could also use your skills to start a solo business as a freelance writer, an editor, or even a blogger. When it comes to starting your own venture, the sky really is the limit!

Obviously, this option won’t work for a lot of people, including those who just aren’t wired to be a business owner or an entrepreneur. However, a new business done right could be the highest returning investment you have ever made.

What kind of business should you start? If you’re looking for some ideas, check out these posts from yours truly.

#9: Live a Little (YOLO)

Finally, let’s not forget that life isn’t all about money. After you’ve maxed out your 401(k) and made other smart financial moves, you can always stop and smell the roses for a while.

Don’t you love how this guy took a year off in Maui for his mental health? Even though I’m a Certified Financial Planner (CFP), I still think taking some time for yourself makes a lot of sense. Why? Because YOLO! In other words, you only live once.

No matter how much we hate to hear it, we all know we can’t take our money to the grave. And since none of us know how long we’re going to live, it definitely makes sense to spend money on experiences we really want to have before we die.

Is there a vacation that you’ve always wanted to plan? Or, is there something that you haven’t given yourself permission to do?

If you’re waiting for the right time, you should know that there is never a “right” time to splurge on experiences. It’s the same with having kids. If you wait for the right time to do it, you’ll spend your entire life missing out. Then, at some point, it’s too late.

If you’re maxing out your 401(k) and financially solid otherwise, don’t forget the reason you’re working hard in the first place. You want to enjoy life.

You want to feel secure in retirement and I understand that, but you shouldn’t sacrifice everything on your journey to get there. If you focus too much on retirement and not enough on enjoying this gift of life you have been given, you could live to regret it.

The Bottom Line – What to Do After Maxing Out 401k

After maxing out your 401k, it is important to continue to save and invest in other retirement vehicles. Consider opening a Roth IRA or Traditional IRA if you have not done so already, as these can be great options for further supplementing your retirement savings.

You may also want to look into investing in stocks, mutual funds, and other financial products that can help you reach your long-term financial goals.

No matter what kind of investments you choose to pursue, it is essential to create a diversified portfolio that will give you the best chance at reaching your retirement dreams.

Leave a Reply