Shopping for car insurance can be overwhelming, and that’s especially true when you’re not sure how the different types of car insurance work. Some types of coverage are absolutely essential and required by the state that issued your driver’s license.

Other types of car insurance are optional, but that doesn’t necessarily mean they’re less important.

Before you purchase auto insurance or switch to a new policy from a different carrier, you should take the time to learn about the different types of car insurance coverage and how they work.

You may find some of the “extra” coverage options are worth the additional premiums, either because they provide you with additional financial protection or they give you peace of mind.

Table of Contents

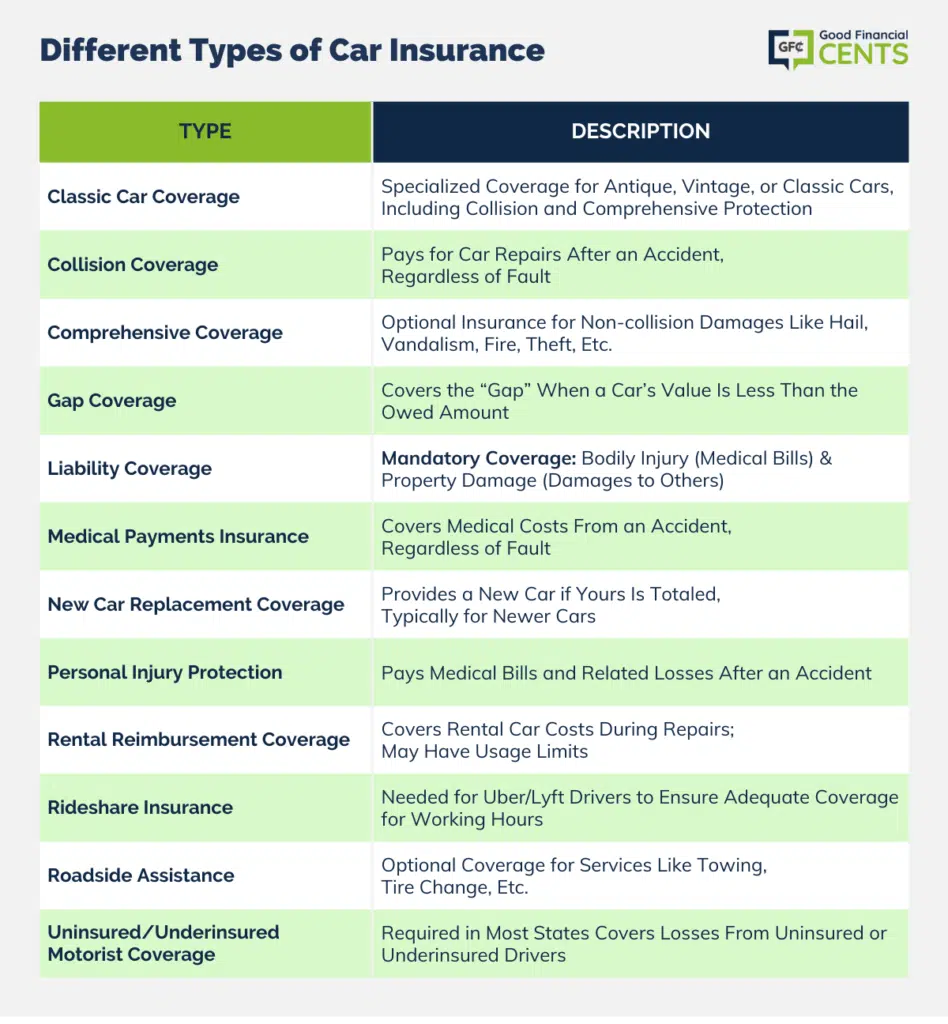

What Are the Different Types of Car Insurance?

Some types of car insurance are designed to cover medical bills and other losses caused by bodily injury, while others will help kick in to pay for repairs or replacement of the car you drive after an accident or a covered event.

The different types of car insurance are described below:

Classic Car Coverage

Individuals with classic or collectible cars need to have specialized auto insurance coverage in place. Cars usually need to be antique, vintage, or classic to qualify for this type of insurance.

You’ll get the same types of auto coverage included in your policy (i.e., liability protection, uninsured and underinsured motorist protection, personal injury protection, and more), yet classic car coverage includes collision and comprehensive protection that pays you an agreed value for your vehicle if you face a total loss or your car cannot be repaired.

Collision Coverage

Collision coverage works exactly how it sounds. This type of insurance pays to repair your car after an accident, regardless of who is at fault.

Generally speaking, collision coverage is purchased by people who have a newer car or a car with an auto loan. If your car is older and not worth very much or you own it outright, this coverage may not be worth the extra cost.

Comprehensive Coverage

Comprehensive coverage is an optional type of auto insurance that pays for damages to your car that are not the result of an accident with another vehicle.

For example, comprehensive coverage would kick in to cover damages caused by hail, vandalism, fire, wind, flooding, theft, falling objects, or even animals on the road.

According to State Farm, comprehensive coverage also covers various glass claims as well as windshield repair.

Gap Coverage

Gap insurance is optional coverage many drivers purchase when they buy a newer car (or a brand new car) with a loan. This type of protection can pay the difference or the “gap” when a car cannot be repaired after an accident, and the driver still owes more than it’s worth.

Buying gap insurance may not make sense if you own your car outright or your auto loan balance is small when compared to the value of your car.

Liability Coverage

Liability coverage is required by states as a condition of owning a vehicle, although minimum requirements vary depending on where you live. The two types of liability coverage include:

- Bodily Injury Liability: This type of coverage pays for medical bills and expenses when others are injured in a car accident.

- Property Damage Liability: This type of coverage pays for other expenses that result from an accident, such as damage to cars, buildings, fences, and mailboxes.

It’s crucial to be careful as you select limits for the liability coverage in your policy, mostly since these limits represent the absolute maximum amount your insurance company will pay.

If losses exceed your liability coverage limits, you’ll have to pay the difference. Also, note that you can be sued by others for losses above your insurance coverage.

Medical Payments Insurance

Medical payment insurance can also be referred to as MedPay. This type of coverage also pays for medical costs that result from an accident, regardless of who is at fault, such as hospital stays, surgeries, and more.

New Car Replacement Coverage

According to Allstate, new car replacement coverage can provide you with a brand-new car when your car is totaled after an accident. This coverage is optional, and it is typically only available for cars that are two model years old or newer.

Personal Injury Protection (PIP)

Personal injury protection (PIP) is another type of insurance that can pay for medical bills after an accident occurs. PIP coverage can also pay for related losses, such as loss of income.

In many states, a certain amount of PIP coverage is mandated by law.

Rental Reimbursement Coverage

Rental reimbursement protection can pay for your rental car when your car is being repaired after a covered accident or event. Note that rental reimbursement coverage may come with daily limits or limits on how many days you can use this coverage after each individual claim.

Rideshare Insurance

If you drive for Uber or Lyft or plan to in the future, it’s important to make sure you have sufficient insurance in place for your working hours.

While rideshare companies are required to provide their drivers some insurance coverage by law, you should strive to make sure you have enough to protect yourself from losses caused by an accident and any injuries that result.

While some car insurance companies offer rideshare riders or endorsements, you can add to your existing auto insurance policy, others offer specific rideshare insurance policies you can buy if you use your car for both business and personal use.

Roadside Assistance

Roadside assistance is another optional coverage you can add to your car insurance plan. With roadside assistance, you’re given access to a hotline you can call if you run out of gas, need a tire change, or need towing services.

Note that the roadside assistance hotline is typically the included benefit, meaning you may have to pay out-of-pocket for the services you require.

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is legally required in 49 different states, mostly because it’s not uncommon for drivers to hit the road without any insurance at all.

With this coverage in place, drivers can use their own insurance to pay for losses after an accident with an uninsured or underinsured motorist.

Uninsured and underinsured motorist coverage includes liability for bodily injury and personal property.

What Is State Minimum Auto Coverage?

Before you buy car insurance, you should also know that each state requires a specific minimum level of auto insurance coverage for anyone who owns a vehicle.

Compulsory coverage typically includes some bodily liability coverage, personal property liability coverage, uninsured or underinsured motorist coverage, and medical payments coverage.

With that being said, the exact coverages required and minimum coverage levels vary widely depending on where you live.

In the state of Alaska, for example, drivers are required to have bodily injury liability coverage worth up to $50,000 per person and $100,000 per accident, $25,000 in property damage liability coverage, $50,000 per person and $100,000 per accident in uninsured and underinsured motorist bodily injury coverage, and an additional $25,000 in underinsured motorist property damage coverage.

In Arizona, on the other hand, drivers can meet state minimum coverage requirements with $25,000 per person and $50,000 per accident in bodily injury liability coverage, $15,000 in property damage liability coverage, and $25,000 per person and $50,000 per accident in both uninsured and underinsured motorist bodily injury coverage.

Understanding Auto Insurance Limits

As you compare types of auto insurance and decide which types of coverage you’re willing to pay for, you’ll also need to decide on the limits you want your coverage to have. In other words, how much auto insurance coverage do you need?

While the state you live in requires a certain amount of liability coverage, the Insurance Information Institute (III) says there’s a good chance you’ll need more liability insurance than your state requires based on the simple fact accidents can be very, very expensive.

“If you’re found legally responsible for bills that are more than your insurance covers, you will have to pay the difference out of your own pocket,” they write. “These costs could wipe you out!”

Generally speaking, most experts recommend having at least $100,000 in liability coverage per person and $300,000 per accident as well as $50,000 or more in personal property liability coverage.

These amounts may not be enough if you’re in a car accident that leads to serious injury or even death, but these limits will provide a lot more protection than whatever your state requires.

The Insurance Information Institute (III) also suggests looking into an umbrella insurance policy that provides excess liability coverage. These policies can easily provide up to $1 million in additional protection for the relatively low cost of $200 to $300 per year.

“If you have your homeowners and auto insurance with the same company, check out the cost of coverage with this company first,” they wrinotee. “If you have coverage with different companies, it may be easier to buy it from your auto insurance company.”

How to Decide on the Different Types of Car Insurance Coverage

Most auto insurance policies do not include every type of car insurance we outline in this guide, mainly because auto coverage is made to be customized to each driver’s unique needs.

For example, someone with an older car worth a few thousand dollars may not need to worry about collision coverage, comprehensive coverage, or gap insurance.

Meanwhile, a driver with a brand-new car will probably want all those coverage options and more in order to protect their investment.

To figure out the types of auto insurance you need, you should think about the car you drive, how much you owe on your auto loan (if anything), and the levels of protection you want in the event of an accident.

If you’re a high net worth individual with plenty of assets to protect, you should make sure you have high coverage levels to reflect your net worth and probably an umbrella insurance policy for additional protection.

In the meantime, make sure you shop around with at least three or four different car insurance companies in order to compare them based on how much coverage you can get for similar premiums.

After spending some time on research and planning, you should strive to buy as much auto insurance coverage as you can for a price you can afford.

Final Thoughts – Different Types of Car Insurance

Navigating the realm of car insurance requires understanding the array of coverage options available. While some types of insurance, such as liability coverage, are mandatory, others, like collision and comprehensive coverage, offer additional protection for your vehicle.

Specialized options like classic car coverage, gap insurance, and rideshare coverage cater to specific needs.

Determining coverage limits is essential to safeguard against potential financial burdens in case of accidents.

Prioritize individual circumstances, vehicle value, and desired protection levels when choosing from the diverse range of auto insurance types, ensuring comprehensive coverage that aligns with your needs and budget.