You might be wondering if $2 million dollars worth of life insurance is too much. Well, it could be.

But if you are trying to protect a large estate and need a sizable lump sum to cover funeral expenses, estate taxes, and other expenses in the case of your eventual death, then you understand that importance and cost is not an issue.

Table of Contents

- The Cost of Such a Policy

- How Much Life Insurance Do You Need?

- Sample Rates for a $2 Million Dollar Term Policy

- Customize Your Life Insurance Plan

- What Is Covered Under a $2 Million Dollar Policy?

- Saving Money on Your $2 Million Policy

- Buying $2 Million Dollar Life Insurance

- Bottom Line: Is $2 Million Life Insurance Worth It?

The Cost of Such a Policy

The concept of a $2 million life insurance policy might seem unaffordable. And this might be the case if you have serious health conditions – what life insurance companies would consider “high risk”.

But if you identified a clear need for this type of life insurance coverage, you owe it to yourself and your family to at least explore all your options.

This, of course, comes with the benefit of knowing your family is secure in the event something unfortunate happens.

Larger plans worth more will cover greater expenses, but have greater monthly policy costs in exchange. To be clear, you can expect to pay anywhere between $105 and $223 dollars for your insurance policy.

How Much Life Insurance Do You Need?

You should plan ahead when considering such a serious decision, though plans for policies up to two million dollars can be purchased under the right conditions.

The monthly cost for this type of policy will likely be at least several hundred dollars a month, so budget wisely.

If you compare different life insurance companies, you will likely find a rate you can afford each month. Doing this will allow you to get offers from several providers so you do not end up paying more than you should.

Consulting with your family prior to making any serious purchasing decisions should allow you the chance to explain what will happen in the event this policy is acted upon.

It is an unfortunate situation when they need to be turned in, but it can happen so discuss everything with the people you care about.

Sample Rates for a $2 Million Dollar Term Policy

How much your $2 million dollar policy will cost will depend on a variety of factors such as age, health, term, and the company you choose.

Below are some sample rates of 20-year term policies for both men and women.

$2 Million Term Life Rates for Men

| SEX | AGE | $2,000,000 20 YEAR TERM |

|---|---|---|

| Male | 30 | $66.12/mo |

| Male | 40 | $104.40/mo |

| Male | 50 | $299.28/mo |

| Male | 60 | $846.90/mo |

| Male | 70 | $3,191.13/mo |

$2 Million Term Life Rates for Women

| SEX | AGE | $2,000,000 20 YEAR TERM |

|---|---|---|

| Female | 30 | $55.68/mo |

| Female | 40 | $88.74/mo |

| Female | 50 | $216.27/mo |

| Female | 60 | $577.61/mo |

| Female | 70 | $2,093.44 |

In approximate range of how term premiums can increase by age and also by gender.

I was curious to see how much a $2 million policy cost for a male in good health and decided to use one of our partners, Policy Genius, as my guinea pig.

Once you click on their link, you’ll be taken to this page:

You’ll then go through several prompts that ask you key questions to determine what your goals are by purchasing such a large insurance policy.

Don’t rush through these questions. It’s important for them – and you! – so you know you’re getting exactly what you need.

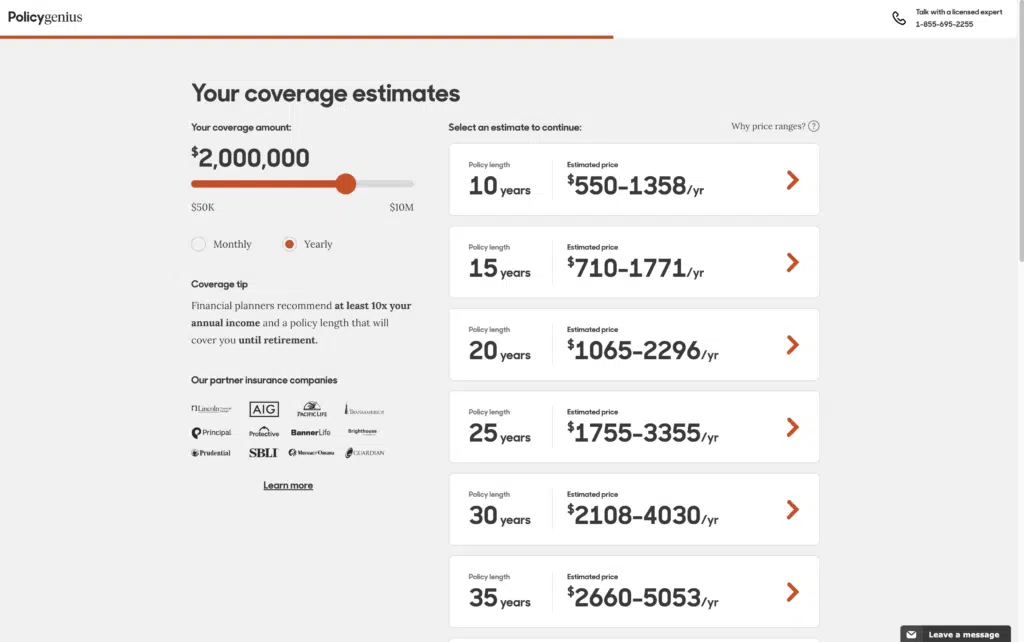

After answering all the discovery questions, I was able to get an approximate cost for a $2 million policy.

Once again I entered information for a 40-year-old male in good health and you can quickly see a few things:

- Policy Genius offers up to $10 million of life insurance – that’s a lot!

- You can choose a shorter term of only 10 years.

- You can also choose a 35-year term policy.

The big takeaway here is you have options!

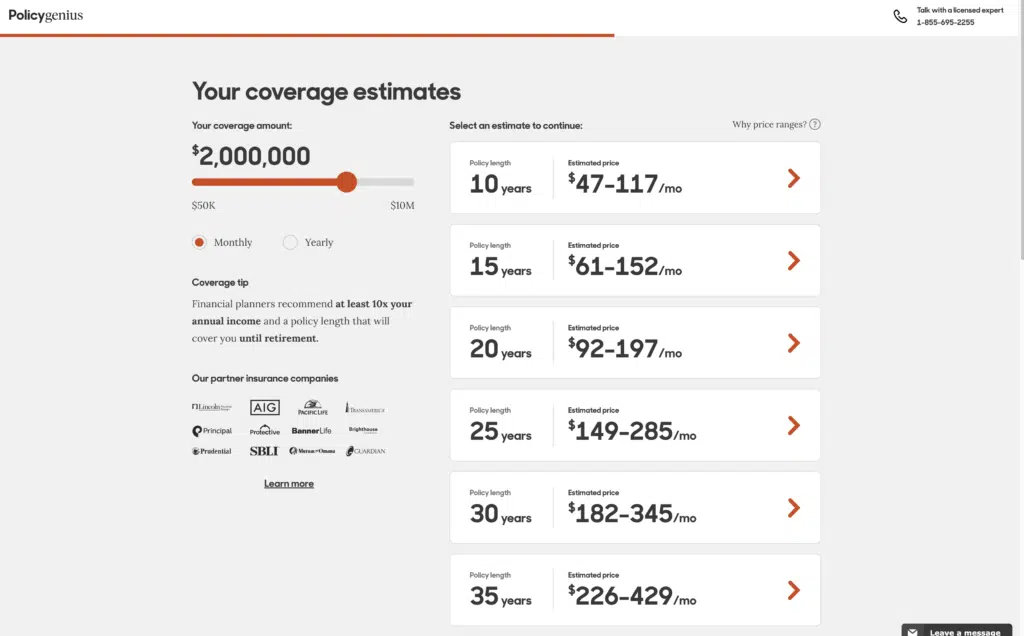

But if you can’t afford the annual premiums you can also choose monthly pay as I show here:

So if you’re a 40-year-old male and are curious how much a 20-year $2 million term life insurance policy costs you can assume it will be somewhere in the range of $92-$197.

Customize Your Life Insurance Plan

Each plan can be customized to the individual who obtains it, so when talking with the people who end up issuing it to you make sure you fully understand the details. Sometimes there can be areas not entirely understood that if ignored may cause problems.

The people you talk with about these plans can help you learn about the nuisances involved, such as your current health status and even financial state.

You will likely end up with a great plan if you do the research needed for the right life insurance policy.

What Is Covered Under a $2 Million Dollar Policy?

For some people, such a large policy might seem ridiculous and a waste of monthly premiums, but there are a lot of people that should consider a large policy.

If it’s just you and your spouse with no children, then these plans probably aren’t the best option, but if you have several young children and thousands of dollars in debt, you should take a serious look at your life insurance plans.

If you have several children, especially young children, that term life insurance policy that you bought 15 years ago probably isn’t enough. Think of all of the expenses that would be left behind if you were to pass away.

Mortgage payments, car loans, credit card bills, student loans, your children’s student loans in the future, it’s all starting to add up pretty quickly, isn’t it? Fortunately, most $2 million policies are not as expensive as one may think.

Saving Money on Your $2 Million Policy

Because the policy is so large, the monthly premiums will cost more, but check out these tips so that you can get better rates and keep more money in your pocket.

When you’re applying for the policy, the company is going to look at your age and health, as well as any dangerous hobbies that you might have. As long as you aren’t a skydiver or extreme rock climber, most hobbies won’t count against you.

Where most people cause their rates to go up is in the health department. Getting the gym a few months before applying for your policy should be a goal.

This means lowering your cholesterol, lowering your blood pressure, and losing a few extra pounds. Being overweight or obese can add hundreds or thousands of dollars to your monthly premiums. Keep steady at hitting the treadmill and watching your carbs.

Aside from hitting the gym and skipping the extra dessert, tobacco usage is the next biggest factor that can cause your premiums to go through the roof.

Being considered a smoker can cause your rates to automatically double or triple. While you can still get a policy if you’re a smoker, it’s going to cost you.

Buying $2 Million Dollar Life Insurance

But the easiest ways to save money is to shop around before you buy a policy. Because each company is different, each of them will have different rates for their policies and all of them will look at your health differently.

More than likely, the first company that you contact isn’t going to have the lowest rates available. It’s important to get quotes from dozens of life insurance companies so the ones you love the most are completely covered.

Some companies have more experience than others with larger policies, these companies can help ensure that you’re completely covered for an affordable price.

We can save you hours of time, frustration, and cost. Simply click on the map above, and the quotes will come to you!

Bottom Line: Is $2 Million Life Insurance Worth It?

In deciding whether a $2 million dollar life insurance policy is worth it, several factors come into play. While the cost might seem steep, it can be essential if you have a significant estate to protect, covering expenses like funeral costs and estate taxes.

The policy’s cost varies based on age, health, and other factors, but it’s important to explore options to ensure your family’s security. Sample rates show that premiums increase with age, and customization is key to finding the right fit.

If you have substantial debts, dependents, and financial obligations, a larger policy could be prudent. Staying healthy, avoiding tobacco, and shopping around are ways to save on premiums.

Ultimately, securing adequate coverage ensures peace of mind for your loved ones in case of unfortunate events.

what company gives the best rates and actually pays if unfortunate death happens? 1 – 2 million plan.

3 dependents.

much appreciated

BT

@ BT

Any big carrier should with an A+ rating should be good. Personally, I have a $2.5 million policy and Banner Life ended up being the cheapest for me (took my policy out when I was 33 years old).

Prior to that, I had a $1.5 million policy with Transamerica.