Veterans United Home Loan Review: #1 VA Home Lender for Veterans

Key Takeaways

- Founded in 2002, Veterans United Home Loans offers unparalleled expertise in the VA mortgage industry. However, potential borrowers should note that Veterans United only offers VA loan products, meaning they do not offer traditional mortgages or home equity loans.

- Veterans United is easily the top lender for veterans seeking VA home loans, which lets veterans and other military members purchase a home with competitive rates, easy credit qualifying, and no money down.

- If you are eligible for a VA home loan, Veterans United makes it easy to begin your mortgage application online or over the phone. Their website also features a useful tool that helps you determine your eligibility.

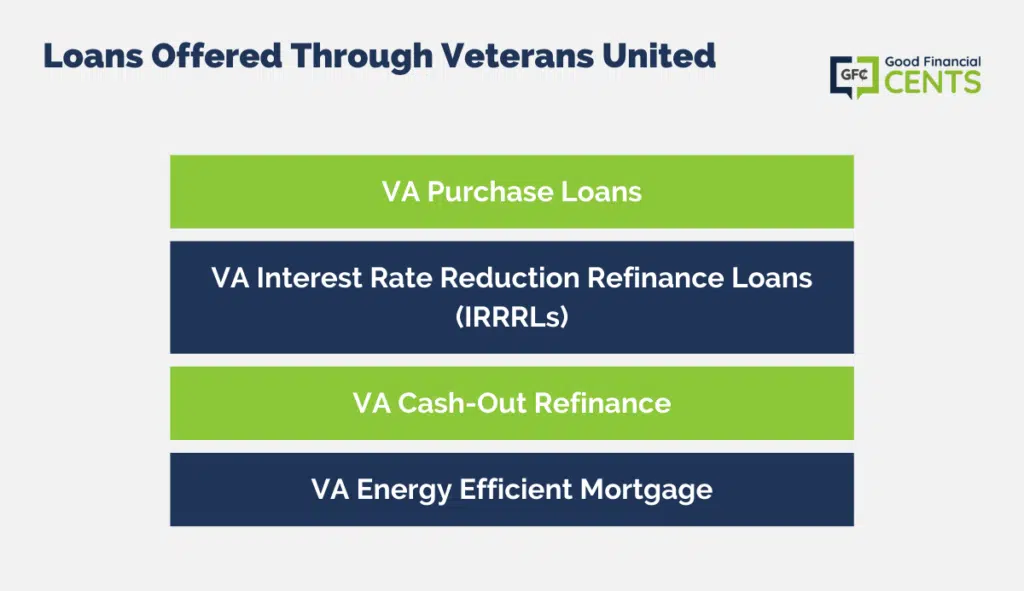

- In addition to traditional VA purchase loans, Veterans United also offers VA energy-efficient mortgages, VA loan cash-out refinancing, and VA interest rate reduction refinance loans (IRRRLs).

According to recent data from the National Association of Realtors, the median existing home sales price nationwide is 0.7% based on the August 2023 result. This means that, if you’re waiting on the sidelines for prices to drop before you buy, you could be waiting a long time — or even forever at this rate.

Fortunately, eligible military members and veterans can use a VA home loan to get into a new home with as little as $0 down, and with preferable interest rates and repayment terms. VA home loans are issued by private lenders, such as a mortgage company or bank, and they come with additional benefits like no private mortgage insurance (PMI), limited closing costs, and easy loan qualification.

With Veterans United, eligible borrowers can pursue a VA home loan for a new home purchase, or take steps to refinance a loan for a home they already have. In fact, Veterans United is a leader in VA home loan refinancing, cash-out refinancing, and VA interest rate reduction refinance loans (IRRRLs).

If you’re in the market for a VA loan or you are hoping to refinance your VA loan to take advantage of today’s low interest rates, read on to learn more about this lender and how it works.

Table of Contents

About the Company

- Unlike other mortgage lenders who offer a broad range of mortgage and loan products, Veterans United focuses its entire business model on offering VA home loans, VA cash-out refinancing, VA interest rate reduction refinance loans (IRRRLs), and VA energy-efficient mortgages.

- Consumers can call the lender on the phone for a free quote, but they can also use their online quote tool to gauge their eligibility.

- Veterans United boasts an exceptional number of excellent reviews, including well over 200,000 positive reviews on their website and an average star rating of 4.9 out of 5 stars across more than 10,400 reviews on Trustpilot.

- Although the bulk of their business takes place online and over the phone, Veterans United Home Loans boasts 25 physical branch locations in 17 different states.

Veterans United Loans and Products

As a mortgage company that aims to serve military members and veterans, Veterans United focuses all of its attention on offering VA home loans. This is good news for potential borrowers who want to use a lender who is knowledgeable about VA loans and their unique features. After all, any government-approved lender can offer VA home loans, but that doesn’t mean all lenders have the same level of expertise when it comes to mortgages for veterans.

Loan types offered through Veterans United include the following:

- VA Purchase Loans: VA home loans let eligible military members and veterans access a mortgage with a down payment as low as $0, limited closing costs, and easy credit qualification. VA home loans are also offered without private mortgage insurance (PMI), although a one-time VA funding fee is required in its place.

- VA Interest Rate Reduction Refinance Loans (IRRRLs): The IRRRL is also known as a VA streamline refinance, and it is the most popular refinancing option for veterans. This refinance loan essentially lets eligible borrowers trade in their existing loan for a new loan with a lower interest rate, and often without credit underwriting, income verification, or an appraisal.

- VA Cash-Out Refinance: This type of VA home loan allows eligible borrowers to refinance their VA loan and take cash out in the process. Homeowners can typically borrow up to 90% of their home’s value in total with this option.

- VA Energy Efficient Mortgage: This VA mortgage option makes it possible for borrowers to finance up to $6,000 in additional costs for qualified improvements such as heat pumps, solar heating and cooling systems, or thermal windows.

For Whom Is Veterans United Best For

Veterans United is a top-rated mortgage lender, yet not everyone is eligible to use this provider. Because Veterans United only offers VA home loan products, individuals need applicable military service to qualify.

According to Veterans United, eligibility for a VA home loan hinges on individuals meeting one of the following requirements:

- 90 consecutive days of active service during wartime.

- 181 days of active service during peacetime.

- Six years of service in the National Guard or Reserves.

- You are the spouse of a service member who died in the line of duty or due to a service-related disability.

While eligibility for a VA home loan may seem cut and dry, there are certain situations where individuals may not know if they are eligible. With that in mind, Veterans United boasts a tool on its website that can help military members determine if their service is sufficient to qualify.

But, why would you want a VA home loan in the first place? There are an array of important benefits, all of which can make getting into a new or existing home considerably easier and more affordable.

VA home loans come with:

- No down payment required

- No private mortgage insurance (PMI)

- Competitive interest rates

- Relaxed credit requirements

- Limited closing costs

- A lifetime benefit

- No prepayment penalties

- Foreclosure avoidance

If these are features you’re looking for in a mortgage, it makes sense to go with a lender that specializes in VA loans instead of all other mortgage products. Veterans United is the top lender in this space, so they are perfectly positioned to offer the most expertise and best service in this niche within the mortgage lending industry.

Veterans United vs. Other VA Home Loan Competitors

While Veterans United is a top lender in the VA home loan market, they aren’t the only mortgage company offering in this space. The chart below shows how Veterans United compares to three other mortgage lenders who offer VA home loans.

| Veterans United Home Loans | Quicken Loans | USAA | Navy Federal Credit Union | |

|---|---|---|---|---|

| Current Mortgage Rates | 30-Year Fixed VA Purchase Loan: 2.841% APR 15-Year Fixed VA Purchase Loan: 2.727% APR | 30-Year Fixed VA Purchase Loan: 3.147% APR 15-Year Fixed VA Purchase Loan: 3.009% APR | 30-Year Fixed VA Purchase Loan: 3.082% APR 15-Year Fixed VA Purchase Loan: Not disclosed | 30-Year Fixed VA Purchase Loan: 2.344% APR 15-Year Fixed VA Purchase Loan: 2.211% APR |

| Customer Reviews and Ratings | 4.9 out of 5 stars on Trustpilot | 4.5 out of 5 stars on Trustpilot | 1.3 out of 5 stars on Trustpilot | 4.7 out of 5 stars on Trustpilot |

| Better Business Bureau (BBB) Rating | A+ | A+ | A+ | A+ |

| Loans Offered | VA Purchase LoansVA Interest Rate Reduction Refinance Loans (IRRRLs)VA Cash-Out RefinanceVA Energy Efficient Mortgage | VA Purchase LoansVA Interest Rate Reduction Refinance Loans (IRRRLs)VA Cash-Out Refinance | VA Purchase LoansVA Interest Rate Reduction Refinance Loans (IRRRLs)VA Cash-Out Refinance | VA Purchase LoansVA Interest Rate Reduction Refinance Loans (IRRRLs)VA Cash-Out Refinance |

| Online Application? | Yes | Yes | Yes | Yes |

What To Know About VA Home Loans

VA home loans come with plenty of benefits for military members and veterans, but there are some nuances with these loans borrowers should take the time to understand. Here are some important facts about VA home loans and how they work:

- VA home loans do not require specific loan limits. Unlike some other types of home loans that are backed by the federal government, such as FHA loans, VA home loans do not have specific loan limits. Borrowers can use a VA home loan for a home purchase at any price point provided the lender approves them based on their income and other factors.

- VA funding fees take the place of PMI. While VA home loans do not require private mortgage insurance (PMI), borrowers are required to pay a funding fee instead. For veterans using a VA loan for a first home purchase, the average one-time funding fee works out to 2.3% of the purchase price. For subsequent VA home loans, the average funding fee goes up to 3.6%.

- Military members and veterans can use their VA loan benefits more than once. The VA guarantee is a lifetime benefit, so eligible veterans can have multiple VA home loans over their lifetime.

- In some cases, mortgage lenders require a down payment for VA home loans. While the VA does not require a down payment to qualify for a VA home loan, individual lenders can require a down payment from certain borrowers based on their credit score, their income, and other factors.

The Bottom Line – Veterans United Mortgage Review

If you’re an eligible military member or veteran who is currently looking for a home, exploring your VA loan options makes a lot of sense. After all, VA home loans can require a down payment as low as $0, and you can avoid paying PMI with an upfront VA funding fee. Not only that, but VA home loans come with competitive interest rates and easy credit qualification.

As you compare VA home loans, it only makes sense to work with a lender who specializes in mortgages for military members. Veterans United Home Loans is easily one of the leading lenders in this space, and they have the reviews and accolades to prove it.

While we always recommend getting a mortgage rate quote from at least three or four different lenders before you move forward with a home loan, military members and veterans should make sure Veterans United is on their list.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Veterans United Home Loan Review

Product Name: Veterans United Home Loan Mortgage

Product Description: Veterans United is a mortgage lender that specializes in helping veterans and active-duty military personnel obtain home loans. They provide specialized services and guidance to veterans so they can purchase homes with VA loans, as well as other loan options. Veterans United also offers financial education and counseling services to help veterans become successful homeowners.

Summary of Veterans United Home Loans

Veterans United Home Loans is a full-service VA-approved home loan lender that specializes in helping active duty military personnel and veterans purchase their dream homes. It offers specialized mortgage programs to help make buying a home easier and more affordable for veterans, including zero down payment options, low closing costs and reduced interest rates. Veterans United also provides resources to inform potential homeowners of the benefits available to them through VA loans, such as no mortgage insurance, no prepayment penalty or origination fees. With its dedicated team of Loan Specialists, Veterans United works with borrowers every step of the way to ensure they get the most out of their VA home loan.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Low Down Payment Options – VA loans require no down payment, and many lenders offer options for down payments as low as 3%.

- Flexible Qualification Guidelines – Veterans United has flexible qualification guidelines, such as lower credit score requirements than most other loan types.

- Easier Pre-qualification Process – Veterans United offers an easier pre-qualification process than many other lenders, which can makes it easier for veterans to get approved for a loan.

- No Private Mortgage Insurance Requirement – Unlike other loan types, VA loans do not require borrowers to pay private mortgage insurance (PMI).

- Competitive Interest Rates – With no down payment requirement and flexible qualification guidelines, VA loans often come with competitive interest rates that can save borrowers money over the life of their loan.

Cons

- Some borrowers have reported long wait times for loan approval, with processing taking more than a month in some cases.

- Limited geographic reach – Veterans United only provides mortgage services to veterans in certain states and territories.

- Homebuyers may not be able to access local incentives through Veterans United due to limited geographic reach.

- Borrowers may not be able to get the lowest interest rate or best deal on their loan because of limited market coverage by Veterans United.

- Veterans United does not provide renovation loans, which means veterans must seek alternative lenders for home improvement projects.