The average cost of car insurance can vary depending on the car you drive, where you live, your age, and plenty more. In the meantime, the auto insurance company you buy coverage from will also play a huge role in how much you pay — for better or for worse.

With that in mind, it always makes sense to shop around with at least three or four different companies offering the type of coverage you need the most. By comparing car insurance rates among multiple providers, you can make sure you are getting a great price for the best car insurance policy you can find.

Table of Contents

What Is the Average Cost of Car Insurance?

Still, it’s good to have an idea of the average cost of car insurance per month. With this information readily at hand, you can have an idea if you’re being asked to pay more or less than the average consumer.

Unfortunately, there are a significant number of factors that go into average car insurance rates — including the type of coverage you buy. For example, the average cost of full coverage car insurance is much higher than the average cost of state minimum coverage.

The cost of auto insurance premiums also varies based on the company you buy from. For example, an internal study we did on car insurance rates led to getting quotes for a 23-year-old male, a 23-year-old female, a 53-year-old male, and a 53-year-old female in Houston, Texas. All of our sample quotes were for a 2018 Toyota Camry, and for around 12,000 in driving miles per year.

You can see below how the average cost for car insurance for six months of premiums varied based on the provider.

| STATE MINIMUM – 30/60/25 – LIABILITY ONLY | WITH UN/UNDER-INSURED MOTORIST AND COLLISION & COMPREHENSIVE | |

|---|---|---|

| Progressive Auto Insurance | $364 to $552 | $838 to $1,356 |

| State Farm Auto Insurance | $273 to $434 | $685 to $1,083 |

| Esurance Auto Insurance | $142 to $186 | $283 to $485 |

| Geico Auto Insurance | $278 to $456 | $714 to $1,113 |

| Allstate Auto Insurance | $372 to $462 | $858 to $1,632 |

Note that the car insurance quotes above are only estimates and that they don’t take additional factors like the insured’s driving history into account. They also do not take credit scores or any auto insurance discounts the driver could be eligible for into consideration.

Either way, estimates from The Zebra show that the average cost of car insurance for all drivers works out to $1,759 per year or $147 per month. However, some states tend to charge considerably higher auto insurance premiums due to various local factors including state-mandated coverage requirements.

For example, a study from Insure.com shows that the average cost (per year) of car insurance premiums worked out to $2,909 in Louisiana and $2,691 in Michigan. However, average rates in the two least expensive states (Maine and New Hampshire) worked out to $941 and $1,262 per year, respectively.

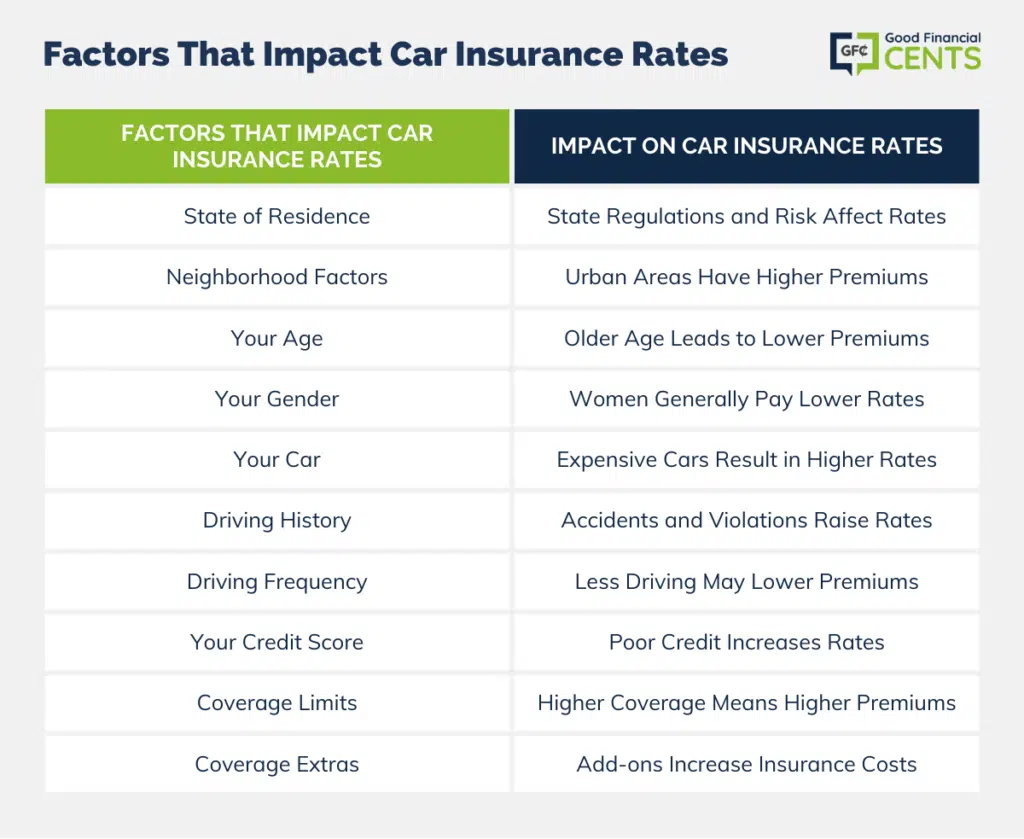

Factors That Impact Car Insurance Rates

As you can probably surmise based on the car insurance estimates above, car insurance rates really can be all over the place. This is mostly because rates are based on an array of factors that can also vary widely, such as:

- State of Residence: The state you live in plays a significant role in the average cost of auto insurance rates. For example, some states have significantly higher rates due to having a higher state minimum coverage requirement. Other states have more accidents and more uninsured and underinsured drivers in general, so rates climb higher as a result.

- Neighborhood Factors: According to the Insurance Information Institute (III), your local area could also play a role in how much you pay for coverage. Specifically, they say consumers in urban areas tend to pay higher premiums due to higher rates of vandalism and theft.

- Your Age: Because mature drivers tend to have fewer accidents and moving violations, older individuals get to pay less for their car insurance premiums.

- Your Gender: The Insurance Information Institute (III) reports that women tend to pay lower auto insurance rates since they have fewer accidents and a lower overall incidence of driving under the influence (DUI).

- Your Car: More expensive cars are pricier to repair and replace, so car insurance rates for new vehicles are higher as a result.

- Driving History: Consumers with accidents or moving violations on their driving record will inevitably be asked to pay higher auto insurance rates.

- How Often You Drive: You may qualify for lower auto insurance rates if you drive your car infrequently. The cut-off for savings in this category is usually between 5,000 to 7,000 driving miles per year.

- Your Credit Score: Auto insurance companies use your credit score to gauge your overall reliability. If your credit is poor, this could have a devastating impact on your car insurance rates.

- Coverage Limits You Select: Keep in mind that you’ll pay more for robust coverage with higher limits than you will for state minimum coverage based on where you live.

- Coverage Extras: There is a broad range of upgraded insurance options you can add to your auto insurance policy, which will result in higher premiums. Common add-ons include gap insurance that pays the difference if your car is totaled and you owe more than it’s worth, roadside assistance, and rental car coverage.

Save Big With Car Insurance Discounts

If you’re able to qualify for car insurance discounts, you may be able to reduce your monthly premiums dramatically. Also, note that auto insurance companies let you bundle multiple discounts within a single policy for even more savings.

How much you’ll save with auto insurance discounts varies by quite a bit, but the following estimates can give you an idea.

Equipment Discounts

Having certain types of equipment can help you save money on car insurance, although the discounts vary by company and the type of equipment you have in place. With Geico Auto Insurance, for example, individuals can save up to 23% off their car insurance premiums if they have airbags, as well as 5% for having anti-lock brakes, and another 3% for having daytime running lights.

Anti-Theft Discounts

Consumers can also save money if their car has certain anti-theft devices installed. For example, savings of up to 23% may be available for consumers who have an anti-theft alarm in place to protect their vehicle.

Good Driver Discounts

Individuals who have a clean driving record will always pay lower car insurance premiums. Most car insurance companies extend their good driver discounts to customers who have had a clean record with no accidents or violations for at least five years.

Affiliation Memberships

Some auto insurance companies offer discounts for customers who have military service on their record, as well as those who work for certain corporations or industries. For example, Geico Auto Insurance extends a 15% discount for military members and veterans and a 12% discount for federal employees.

Bundling Discounts

One easy way to save on all your insurance expenses involves bundling multiple policies with the same insurance company. For example, you can pay lower auto insurance premiums by insuring multiple cars with one provider. Meanwhile, you can also save on auto insurance premiums by using the same company to purchase homeowners insurance, renters insurance, boat insurance, motorcycle insurance, and other types of coverage you have.

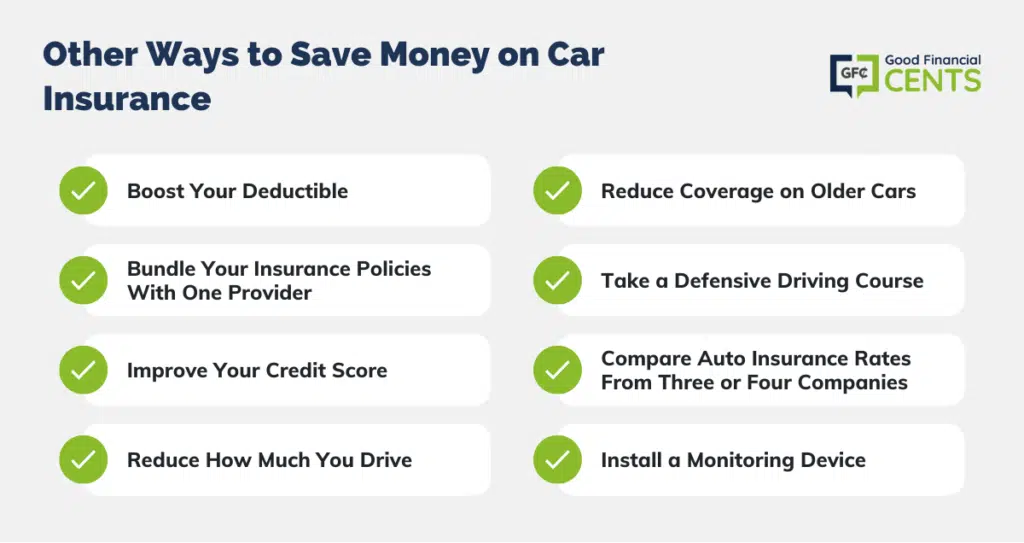

Other Ways to Save Money on Car Insurance

Seeing if you can qualify for car insurance discounts can help you pay lower premiums, but there are plenty of other ways to lower your insurance costs. Consider the following tips to lower the amount of your car insurance premiums this year, or to secure a higher level of coverage for a price you can afford.

Boost Your Deductible

Auto insurance policies let you select a deductible that fits your budget and your needs, with common deductibles falling between $500 and $2,500. If you are willing to increase the deductible required to use your auto insurance policy, you can pay lower premiums overall.

Bundle Your Insurance Policies With One Provider

Once you find an insurance company you like, consider bundling all your insurance policies with them. Doing so can help you qualify for multi-policy discounts and multi-car discounts if you insure more than one vehicle.

Improve Your Credit Score

Since your credit score can play a role in the average monthly cost of car insurance, you should take steps to improve yours if you can. Common moves that can help boost your credit include paying all your bills early or on time, paying down debt to decrease your credit utilization, and refraining from opening or closing too many lines of credit in a short amount of time.

Reduce How Much You Drive

Many car insurance companies offer discounts for people who drive less than 7,000 or 5,000 miles per year. If you’re working at home now or you frequently use public transportation, see if you can qualify for low mileage discounts that can reduce your rates.

Reduce Coverage on Older Cars

If you have had your car for a long stretch of time, it can make sense to drop pricier coverage options like collision and comprehensive to save money. You could opt to pay for liability coverage only instead, or for enough insurance to meet your state minimum coverage requirements. Either way, you would pay lower auto insurance premiums as a result.

Take a Defensive Driving Course

You may be able to qualify for lower insurance premiums if you’re willing to take a defensive driving course.

Compare Auto Insurance Rates From Three or Four Companies

Because auto insurance rates vary so widely from company to company, you’re doing yourself a disservice if you don’t take the time to shop around and compare policies with at least three or four insurers. If you don’t want to take the time to speak with multiple insurance agents, it’s fairly easy to compare multiple quotes in one place using a platform like Gabi.

Install a Monitoring Device

Some auto insurance companies let you install a device that monitors your driving habits in order to save on premiums. With Allstate Drivewise, for example, you can secure significant auto insurance discounts based on your driving performance.

Also check out Root Insurance, a company that bases your auto insurance premiums on your driving habits with the help of a mobile app.

The Bottom Line

Finding out the average cost of car insurance can help you see if you’re paying a fair price. However, your car insurance premiums can be more or less depending on factors like where you live, how often you drive, and the car insurance discounts you’re eligible for.

If you want to save on car insurance premiums without sacrificing coverage, your best bet is shopping around across several of the best car insurance companies to see how rates compare. By comparing quotes among multiple insurers, you can know for sure whether you’re getting a good deal.

Frequently Asked Questions (FAQ)

How is car insurance calculated?

Car insurance premiums are determined based on a wide range of factors, some of which are beyond your control. For example, rates are based on factors like your age, your gender, and where you live. Other factors taken into consideration include the car you drive, the types of coverage you select, policy limits you settle on, your driving history, and more.

What does “state minimum coverage” mean?

State minimum auto insurance coverage is the amount of coverage each individual state requires drivers to have. State minimum coverage can apply to liability coverage, uninsured motorist coverage, personal injury protection, and more.

How can you get a quote for car insurance?

Consumers can get a quote for car insurance in person (with an agent), online, or over the phone. You can also use a platform like Gabi to compare auto insurance rates among multiple providers in one place.