Did you know the average bank is paying 0.43% in interest on their savings accounts? That seems crazy enough on its own, but it’s even crazier that my bank is paying even less than that.

That’s right; my own bank is paying a fraction of the average savings interest rate….actually .01%. Even worse, my bank (U.S. Bank) has been paying close to the same paltry rate for years.

I think my bank hates me. Can you relate?

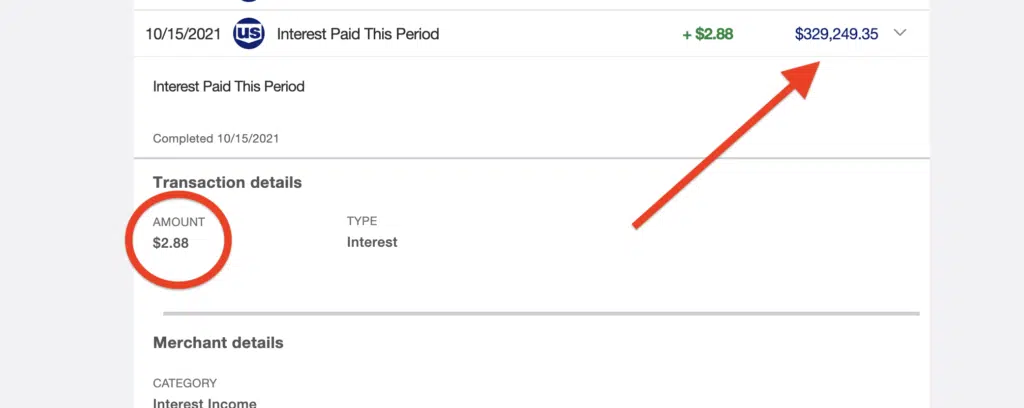

You can see exactly what I mean in the screenshot below. I have more than $329,000 in one of our savings accounts, and I only earned $2.88 in interest during the month I grabbed this photo.

That’s pretty sad when you think about it, but I know I’m not alone. Half the people reading this post are probably earning about that much on their savings, if anything at all.

We all know that interest rates have been hovering at or near record lows for years, and banks can offer almost nothing as a result.

Fortunately, we don’t have to settle for earning next to nothing on our savings accounts. In fact, there are several banking alternatives to earn more on your savings than what a traditional bank will offer.

One of the options I share in this post is paying 850X more than the average traditional bank!

Before we dive into the top banking alternatives, though, I do want to say how important it is to have an emergency fund.

It’s always possible you’ll lose your job or face an unpredictable financial emergency, and your long-term savings could be the only thing that helps you avoid all kinds of financial mayhem (you can check out some of the best savings account rates here).

Some experts say you should have three to six months of expenses stashed away in emergency savings, and I tend to agree. However, I think you need to tailor the size of your emergency fund to your unique situation and needs.

For example, you may want to have a bigger emergency fund if you’re self-employed or you have kids, whereas you can get away with a smaller e-fund if you’re single, you have really low expenses, or your job is extremely secure.

Either way, the banking alternatives I’ll dive into below are not for your core emergency savings. After all, you want your e-fund in a secure account with FDIC insurance. You may not earn a lot of interest with a regular bank, but you won’t lose any money from your savings, either.

Also, note that you can check out my banking alternatives podcast on Spotify if you prefer listening over reading. You can check out the podcast episodes here and here.

Table of Contents

9 Banking Alternatives to Earn More Interest

With that in mind, the banking alternatives I recommend are for any excess funds you have in addition to your true emergency savings. This is money you won’t necessarily need in the next few years, so you can take on more risk.

Which banking alternatives am I talking about? I break down all nine of them below.

#1: Neobank

“Neobank” is somewhat of a hipster term used to describe an online-only bank that doesn’t have any brick-and-mortar locations. This doesn’t mean Neobanks isn’t real; it just means you won’t drive around and run into a physical bank location.

And without a physical location to deal with, these banks have lower overhead. This means they can pay you more interest on your savings.

I recently read that there were more than 300 digital banks around the world. Some of the biggest include SoFi, which started off as a student loan refinancing company.

Lending Club is one more online bank that has been around for a while. Lending Club used to be a peer-to-peer lender, but they now offer an online savings account that is currently paying a 0.60% annual percentage yield.

#2: Treasury Inflation-Protected Securities (TIPS)

If you think inflation is only going up from here, Treasury Inflation-Protected Securities (TIPS) could provide an excellent place to stash your excess cash.

TIPS automatically adjusts based on the CPI Index, which is the Consumer Price Index that measures the prices of different goods and services. This makes it another great banking alternative.

While some may disagree that TIPS is actually keeping up with inflation, you can go to TreasuryDirect.gov to read more about this investment option and other bonds that are issued by the government.

TIPS are issued in increments of $100, so you have to have at least $100 to get started investing. Another major benefit of TIPS is the fact you don’t have to pay state or local taxes on your returns. Note: With TIPS, you do have to pay federal taxes on your gains.

#3: Online Investment Apps

Online investment apps (a.k.a. online brokerage services) are another great banking alternative that includes companies like Robinhood and M1 Finance.

When most people think of these companies, they may automatically think of meme stocks or crypto investing. However, these apps also have a cash management account that pays a decent rate of return.

With Robinhood, for example, the cash management component of the app has a savings component that pays 4.90% APY for gold members. Not only that, but this account from Robinhood comes with no hidden fees.

You can even use your account to get cash at more than 75,000 fee-free ATMs nationwide. Better yet, Robinhood includes FDIC Insurance on its cash management accounts.

M1 Finance also boasts its own finance “super app” that will actually set you back $125 per year. However, this account pays a 1% interest rate, and you get a debit card that pays 1% cashback each time you use it.

While paying $125 per year for an online account and debit card can seem really high, keep in mind that you’ll earn 33X the national average savings rate on your deposits.

Since you get 1% back on debit card purchases, you have the potential to make up for that fee in a hurry and still end up ahead.

#4: High-Yield Bonds

Most people think of bonds as being extremely safe, and they are. However, people purchase bonds a lot differently than they did several decades ago.

The baby boomer generation went out and purchased individual bonds directly from the issuer, whether they were municipal bonds or something else. However, many of today’s investors purchase their bonds through mutual funds or ETFs.

One example of a mutual fund with high-yield bonds is the American Century High-Income Yield Fund (NPHIX). The current yield on this fund is 6.38%, although this fund has more risk. This means it’s likely your balance will go up and down over time.

Another example is the Nuveen High Yield Municipal Bond Fund (NHMRX), which comes with a yield of 5.65%. Once again, this is a high-yield bond with higher risk, so you have the potential to see your balance fluctuate over the long term.

There are also quite a few ETFs with high-yield bonds, including the SPDR High-Yield Bond ETF (JNK), with a yield of 5.65%. This type of bond is considered a junk bond, so the JNK symbol on this one is actually kinda funny.

If you’re wondering where to buy high-yield bonds, you won’t have to look far.

You can invest in high-yield bonds through all the regular online brokerage firms and apps, such as M1 Finance, Robinhood, and E*TRADE. These could all be great alternative banking alternatives for excess funds.

#5: High-Yield Stocks

When it comes to high-yield stocks, they’re structured so they have to pay out a decent dividend, making them a great alternative to traditional banking.

Some of the dividends on these stocks give you a return that is much higher than you’re earning at your bank, although there is more risk involved as well.

For the most part, I’m talking about stocks that are listed within the Dividend Aristocrats. This is a list of 65 dividend stocks that are listed in the S&P 500 with a history of increasing their dividend over the last 25 years.

This mostly includes more established, blue-chip-type companies that have a long history of creating returns.

For example, AT&T is a part of this group with a dividend yield of 7.79%. Another one is McDonald’s, which currently has a dividend yield of 2.11%. Verizon is also included, with a dividend yield of 4.79%.

- Read also: How to Invest in Dividend Stocks

#6: Blended Portfolio

The sixth banking alternative I want to talk about is having a blended portfolio that includes some of the options above.

For example, you can take some of your excess savings and invest in high-yield stocks, then throw another portion of your funds into high-yield bonds.

This strategy is easy if you already have an account with a platform like Robinhood or M1 Finance. Once your cash management account is open and you get accustomed to using these apps, you can start branching off into other types of investments with ease.

Just keep in mind how some apps can work better for creating a blended portfolio. With Robinhood, for example, you would have to choose your own funds and rebalance them over time.

However, M1 Finance offers investment “pies” that are expertly crafted to suit different types of investors based on how much risk they want to take.

Betterment is another online platform that makes it easy to tailor your investment portfolio to your timeline and goals.

However, this company is a robo-advisor that uses technology to help you select investments for your portfolio. For that reason, Betterment is better for people who want access to investment management services they can’t get with a regular investing app.

Whatever platform you decide to use, a blended approach can help you earn a higher rate of return on your savings without “betting the farm” on one specific strategy.

#7: Real Estate Investment Trusts (REITs)

While some individual stocks are classified as REITs, that’s not really what I’m talking about here. Instead, I’m talking about options that let you get exposure to real estate with the promise of a nice yield.

The first option I want to talk about is actually an ETF. The iShares US Real Estate ETF (IYR) has returned 6.17% over the last ten years with a dividend yield of 2.94%.

That’s not half bad at all, especially when you consider that you never have to set foot into the buildings you’re investing in.

And really, that’s the major benefit of investing in real estate ETFs. You get exposure to the real estate market without having to hunt for properties or deal with the grunt work of being a landlord.

You are putting your money at risk, but you have the potential to score a much higher return.

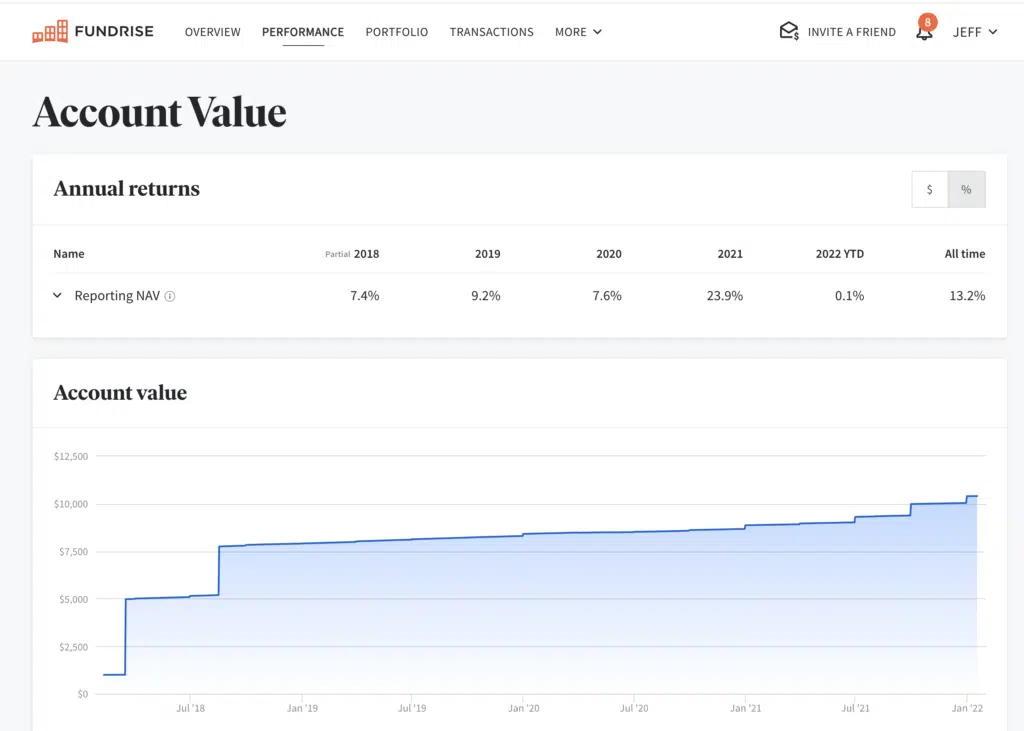

Another option I love and use myself is called Fundrise. With this online real estate platform, you get to invest directly into a REIT without dealing with the middlemen charges involved in ETFs.

I started investing in Fundrise back in 2018, so I have had my account for several years now. Crazy enough, my current all-time return is 13.2%, which you can see in the screenshot below.

Another cool thing about Fundrise is the fact you don’t have to have a huge amount of cash to get started. The minimum investment with Fundrise starts at just $10, and their basic starter level is just $1,000.

This means you can start investing in real estate with a fraction of the cash you would need to invest in physical property.

Better yet, Fundrise makes it easy to get a handle on the actual properties you’re investing in, whether that includes a mall, an apartment building, or some sort of commercial rental property.

If you’re considering this option, make sure to read my Fundrise review.

#8: Short-Term Note

To take advantage of banking alternative #8, you need to be an accredited investor.

This means you need to make $200,000 per year on your own or $300,000 with your spouse, and you need a net worth of more than $1 million dollars, not counting the value of your primary residence.

If you meet these criteria, keep on reading about Short-Term Notes and how they work. If not, feel free to move on to banking alternative #9!

Either way, short-term notes are offered through companies like YieldStreet. With a short-term note from this online platform, you can earn 40X the national average money market yield or an annualized yield of 4%.

These notes come free of fees and expenses, and they’re a short-term product with liquidity offered in as little as six months. Short-term notes from this company also pay monthly interest payments directly to your YieldStreet wallet.

While these investments are targeted at accredited investors with big portfolios, the minimum investment amount in the YieldStreet Short Term Note Series XLIV is just $500. That means you can get started with a relatively small amount and then see how it goes from there.

#9: Crypto Savings Accounts

Finally, let’s talk about how to make money on crypto you have without actually selling it. Crypto savings accounts pay you a yield on your crypto deposits just like you earn interest on a regular savings account.

I heard about this from another investor several years ago, and it almost seemed too good to be true.

In addition to other crypto platforms, I have an account with a company called Celsius, which I opened upon recommendation from a friend.

I currently have just under $200,000 in my account from Celsius, which is paying a yield of 8.5%. Interestingly, Celsius pays out their interest weekly instead of monthly like other exchanges.

Note: On July 13, 2022, Celsius Network and certain of its affiliates filed for voluntary Chapter 11 bankruptcy.

The Bottom Line: 9 Higher-Paying Banking Alternatives to Ditch Your Bank

I hope this list of banking alternatives has you thinking about your money and how to make it grow. After all, it’s only natural to want to earn a higher return on your savings, whether we’re talking about your emergency fund or other cash you have stashed away for the long term.

With that being said, it’s crucial to remember that higher yields always equal a higher level of risk. Alternatives to traditional banks may offer you more interest on your deposits, but you’re giving up some security along the way.

Leave a Reply