Buying a home is probably the most complicated financial transaction the average person makes. Because the home-buying process has so many moving parts, it will help to have a home-buying checklist. A good one—like the one presented below—will let you know what to look for and in the right order.

Let’s start at the top—making the decision to buy a home—then work down to the closing at the very end.

Table of Contents

- 1. Make Sure You’re Ready to Buy!

- 2. Get Prequalified for Financing

- 3. Start a Workable Savings Plan for Your Down Payment

- 4. Improve Your Credit Score

- 5. Decide What Kind of Home You Want

- 6. Get Pre-approved for a Mortgage

- 7. Find the Right Real Estate Agent for You

- 8. Start Looking at Homes

- 9. Making an Offer

- 10. Schedule a Home Inspection

- 11. Hire a Closing Attorney

- 12. Get Ready for Closing

- 13. Set Up Your Move

- 14. Closing Day

- 15. Try to Relax!

1. Make Sure You’re Ready to Buy!

Most people are pretty sure when they’re ready to buy. Or are they?

This is a more important consideration than most people give it. Often, the motivation to buy a house comes from what we might call external sources. These include well-meaning family and friends, as well as a culture that emphasizes buying a home.

But before you pull the trigger, ask yourself a few important questions:

- Am I ready to take on the long-term obligation that a house requires?

- Will I be okay with performing needed maintenance, like landscaping, snow removal, and, sometimes, an endless run of repairs?

- Do I plan to be in the home for at least five years, or is it likely my career or my internal compass will have me looking to make a move in a year or two?

- Do I really have the financial strength to own a home, or will I be stretching my budget to an uncomfortable level?

Answer these questions honestly. If there are too many “no” answers, you may be better off renting for a while longer. Ownership requires commitment, and you shouldn’t be buying if you feel you can’t make that commitment.

2. Get Prequalified for Financing

This involves contacting a mortgage lender and completing an application. The prequalification will be based on the information you supply, and the lender doesn’t normally require you to provide documentation to support your income, employment, or savings.

It’s not an approval, and it shouldn’t be construed as one. But it does give you valuable insight into how much financing you can qualify for. By adding the amount of your anticipated down payment to that financing, you’ll get an idea of how much house you can afford.

3. Start a Workable Savings Plan for Your Down Payment

Unless you plan on getting a zero down payment mortgage, like a VA loan or an FHA or conventional loan with down payment assistance, you’ll need to have a down payment of at least 3%–5% of the purchase price of the home.

If you make a larger down payment, especially 20% or more, you may be able to eliminate the need for costly private mortgage insurance (PMI). In addition, a larger down payment can enable you to qualify for a higher-priced home.

Begin working now to accumulate your down payment funds. That may include a long-term savings accumulation program, or banking windfalls, such as from the sale of personal items or receipt of your income tax refund.

4. Improve Your Credit Score

When you get prequalified for a mortgage, the lender will likely pull your credit report. Request a copy of that report to see what your credit score is.

How much loan you will qualify for, as well as the price it will involve, are closely connected to your credit score. A higher score will enable you to qualify for a larger loan at a lower rate.

Take advantage of the time between prequalification and formal loan application to increase your credit score. Improving a score by 40 or 50 points can lower your rate and result in a lower monthly payment.

5. Decide What Kind of Home You Want

This is where the home-buying process becomes fun. Make a list of what you want your new home to have.

For example, do you want a one-story home or a two-story one? Three bedrooms or four? Two bathrooms or three? Large property (plenty of growing room) or small property (low maintenance)? Detached home or condominium? Fixer-upper or move-in ready?

Also, spend time considering the location. In fact, the “three rules of real estate” are location, location, and location. Though that “rule” is somewhat tongue-in-cheek, it’s also very valid. The location will determine the price you pay for the home, the school district you’ll be located in, proximity to shopping and recreational amenities, and even how long your commute to work will be.

Location should generally be the first consideration because it’s the one factor that cannot be changed once you buy the home. You can expand the home, upgrade its features, and add amenities, but you can’t change the location.

6. Get Pre-approved for a Mortgage

In Item #2 I recommend getting prequalified for financing. While prequalification and pre-approval may sound similar, they are actually very different.

With prequalification, you’re consulting with a mortgage lender to determine the amount you may borrow, based on your income and credit standing. The pre-qualification is mainly for your own information.

Pre-approval is the more substantial version of prequalification. Just as the name implies, you’ll actually be making an application for your mortgage. In the process, you provide all necessary income, employment, and savings documentation.

Where prequalification is primarily for you in the shopping process, pre-approval is mostly for real estate agents and property sellers. The lender will issue a pre-approval letter, which will ensure agents and property sellers of your ability to qualify for the financing. It’s often required by property sellers before they’ll even accept a contract offer.

With a pre-approval in hand, you’ll already have your mortgage in place. It’ll be just a matter of shopping for and finding the right property.

Choosing the Right Lender

It can be confusing to decide which mortgage lender to choose from the many hundreds that are available. If so, you may want to choose one of the four lenders below. These are some of the most popular mortgage lenders in the country, and for good reason.

- Rocket Mortgage is the online face of Quicken Loans, the largest retail mortgage lender in the country. They provide all types of loans to consumers across the country. Their online process makes for a quick and easy application, often with less time to close than other lenders.

- loanDepot offers lending across the country, including conventional, Jumbo, FHA, and VA loans. Similar to Rocket Mortgage, they offer an all-online application to speed the loan application process.

- Veterans United is the top source of VA loans in the country. They work primarily with veterans and even have a real estate network with veteran-friendly real estate agents and brokers.

- Credible is an excellent choice because it’s an online mortgage marketplace. By filling out a brief online application, you get rate quotes from several lenders. You can then choose which one offers the best program and pricing.

7. Find the Right Real Estate Agent for You

The real estate agent is the person who is going to act as your guide on your journey to find a home. Choosing that person shouldn’t be taken lightly.

You’ll want to be certain the agent you work with is not one who is only concerned with closing “deals.” Those are “numbers people” who only want to make as many sales as possible. But you’re not a “deal”; you’re a person or couple who are looking to buy the right home.

That will require the services of a real estate agent who has the right motivation. The agent should spend a good deal of time asking you questions upfront about the type of property and location you want. He or she should also get to know you a bit, understand your preferences, and build trust.

The best way to find the right real estate agent is to ask people you know who had a successful home buying experience with an agent. Ask family, friends, neighbors, and coworkers. If the name of an agent is recommended more than once, there’s a good chance you have found the right person.

8. Start Looking at Homes

At this point, you’ll have three critical parts of the home buying process in place: your financial qualifications, the type and location of the home you want, and a real estate agent you’re comfortable working with. That’s when it’s time to begin looking at homes.

You can do an online search of available properties through websites like Realtor.com and Zillow. Since properties on both sites are commonly listed through real estate agents, your agent should be able to help you visit those properties.

Be sure to look at several properties before making your choice. Even if the perfect home turns out to be the first one you look at, you owe it to yourself to look at several more. Sometimes the perfect home only becomes perfect once you’ve investigated the alternatives.

9. Making an Offer

Once you’ve found the right home for you, it’ll be time to make an offer. Fortunately, your real estate agent will handle the details of that offer. Even so, be sure the agent explains all provisions in the offer to you. Though it may be called an offer, it will become the contract of sale once it’s accepted by the seller.

An offer should have multiple provisions you should be aware of:

- Most obviously, the offer price.

- The anticipated closing date.

- A financing contingency that will enable you to withdraw the contract if you fail to obtain mortgage approval (which shouldn’t be a problem if you’ve been pre-approved).

- Whether or not the seller will be paying part of or all your closing costs.

- A home inspection provision (see below).

- A list of any non-realty items that will be included in the sale, such as a refrigerator, washer or dryer, or property amenities, like a gazebo or an above ground pool.

- Any repairs you want to have completed prior to closing.

These are standard provisions included in most real estate offers and contracts. But since you’re making the offer, you can include or exclude any provisions you like.

It’s very important to remember that an offer is just that, an offer. It’s your first indication of interest in the property. The property seller may accept your offer as is (unlikely), counteroffer (most likely), or reject the offer entirely. If the seller’s terms are unacceptable, you’ll also need to be prepared to move on to another property.

10. Schedule a Home Inspection

A home inspection can cost between $200 and $500, but it will be money well spent. You should not overlook this step, either. The home inspection protects your interests, even if it might threaten the sale.

A detailed home inspection will assess the structural integrity of the home, as well as the functionality of its components. If any items are found to be deficient, it will be an opportunity to have the seller make needed repairs. If the seller refuses, and you purchase the home anyway, you’ll pay the cost of those repairs after closing.

It’s common for contract offers to include a dollar threshold on repairs revealed by the home inspection. For example, the seller might want to limit repair costs to no more than, say, $2,000. If required repairs exceed that limit, the seller will have the option to void the contract.

However, if you want to purchase a home anyway, you can continue with the closing and pay the cost of the repairs yourself.

11. Hire a Closing Attorney

This largely depends on your state of residence. In some states, attorney representation for both buyer and seller is the norm. In others, a single closing attorney represents both parties for the closing. And in still others, title companies perform the closing function, and no attorneys are involved at all.

Even if you live in a state where a single closing attorney or title company is the norm, you can still choose to have an attorney. If nothing else, you can pay an attorney to review the final contract. This will give you an opportunity to learn if there are any provisions that may not be in your best interest.

12. Get Ready for Closing

This is mostly a matter of complying with any requirements from the mortgage lender. For example, the lender will require you to supply any documentation related to the conditions of the loan approval. They will also require you to obtain an acceptable homeowners insurance policy on the home you’re purchasing.

To make the closing process as stress-free as possible, be sure to comply with any lender requests quickly and completely. That will include having any remaining down payment funds ready for the closing date. Be sure to allow yourself time for this function, since you will typically be required to provide a cashier’s check to ensure the funds are available at closing.

13. Set Up Your Move

Determine whether you will do a self-move or if you will hire a professional moving company. This should be done as soon as your offer is accepted by the seller. At that point, it’ll be time to begin arranging the logistics of the move.

In addition to contacting a moving company, you’ll also need to begin notifying family, friends, and vendors of your change of address. That will include informing banks, brokers, retirement plan trustees, insurance companies, and lenders of your new address, as well as the date of the transition.

In each case, you’ll need to coordinate the change with the property seller and utility company. If the utility company is one you have never done business with in the past, they may require you to provide a security deposit to ensure payment.

14. Closing Day

If you faithfully completed all the steps above, the closing should be little more than a signing ceremony. All you’ll need to do is show up—with your cashier’s check—and sign a bunch of papers. Once you do, the property will be yours, and the closing agent will turn the keys over to you.

One step to be aware of on closing day is the walk-through inspection. That’s where you do a final walk-through of the property to make sure everything is as you expected it to be. It will be much easier to make this determination on closing day when the seller has removed all his or her possessions.

15. Try to Relax!

That’s easier said than done when you’re going through what is likely the biggest financial transaction of your life. But if you’ve been following through with all the steps in this checklist, it’ll just be a matter of letting the process go forward.

As much as possible, try to enjoy the entire process. It’s a unique experience, and one you’ll remember for the rest of your life.

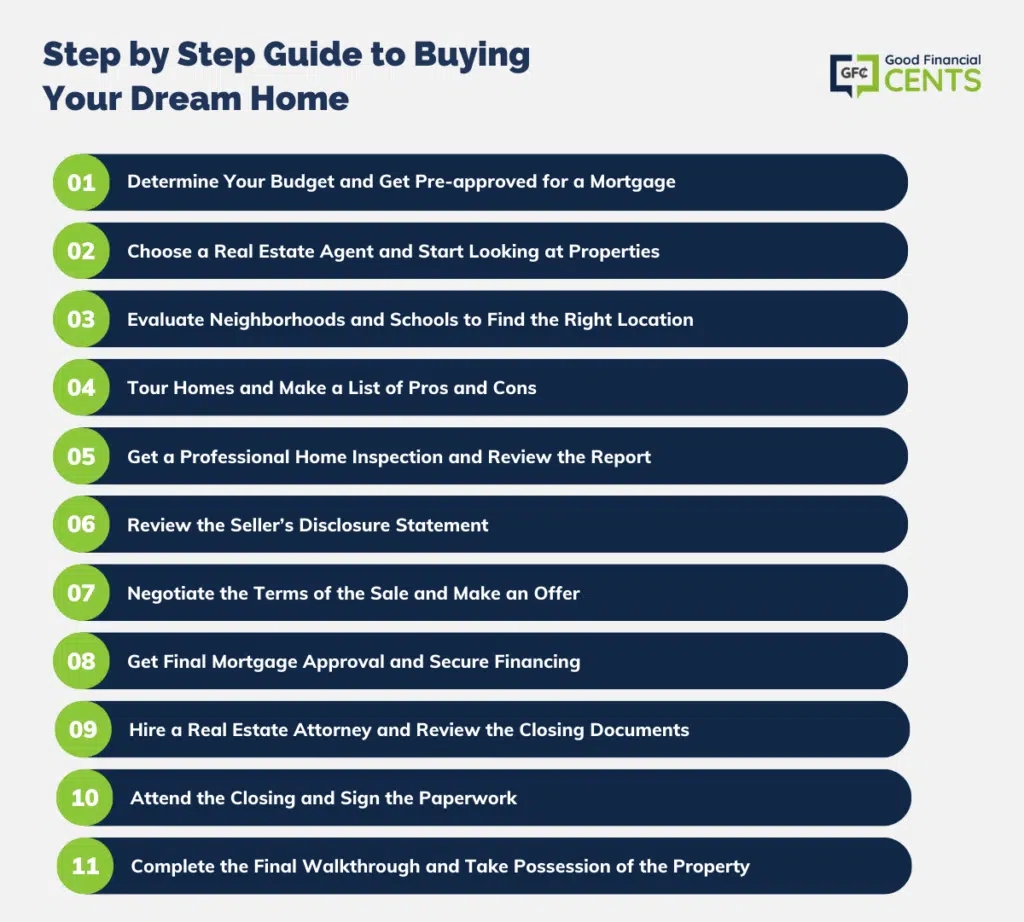

Time needed: 30 days

How to Buy a Home (Step by Step)

- Determine your budget and get pre-approved for a mortgage

Figure out how much you can afford to spend on a home and get pre-approved for a mortgage to help you stay within your budget.

- Choose a real estate agent and start looking at properties

Find a reputable real estate agent to help you navigate the home buying process and start looking at properties that meet your criteria.

- Evaluate neighborhoods and schools to find the right location

Consider factors like safety, accessibility, and schools to help you identify the best neighborhood for you and your family.

- Tour homes and make a list of pros and cons

Visit potential homes and create a list of pros and cons to help you compare different properties and make an informed decision.

- Get a professional home inspection and review the report

Hire a professional home inspector to evaluate the property and provide a detailed report on its condition.

- Review the seller’s disclosure statement

Review the seller’s disclosure statement to learn about any known issues with the property or its history.

- Negotiate the terms of the sale and make an offer

Work with your real estate agent to negotiate the terms of the sale and make an offer that is fair and competitive.

- Get final mortgage approval and secure financing

Once your offer is accepted, work with your lender to finalize your mortgage approval and secure financing for the purchase.

- Hire a real estate attorney and review the closing documents

Hire a real estate attorney to review the closing documents and ensure that all legal requirements are met before closing on the property.

- Attend the closing and sign the paperwork

Attend the closing and sign all necessary paperwork, including the mortgage agreement and the deed to the property.

- Complete the final walkthrough and take possession of the property

Do a final walkthrough of the property to ensure that everything is in order before taking possession of your new home.