The best home warranties can help take some of the hassles out of homeownership, and that’s true whether you’re buying a new home or an existing property.

With a home warranty in place, you get the peace of mind that comes with knowing many of your home’s major components are covered for repairs or replacement. The best part? You can pay a monthly cost or an annual fee, and you can customize your warranty to provide the exact coverage you need.

That said, not all home warranties are equal, and some offer more features or better pricing than others. With that in mind, we compared the top 20 home warranty companies to find ones that stand by their promises and come with a generous list of inclusions.

Select Home Warranty made our ranking due to their robust home warranty plans with many inclusions, but we can also recommend American Home Shield, Choice Home Warranty, and other companies that offer quality home warranty products.

***Monthly plan costs are based on a 3,000-square-foot home in Central Indiana.

Table of Contents

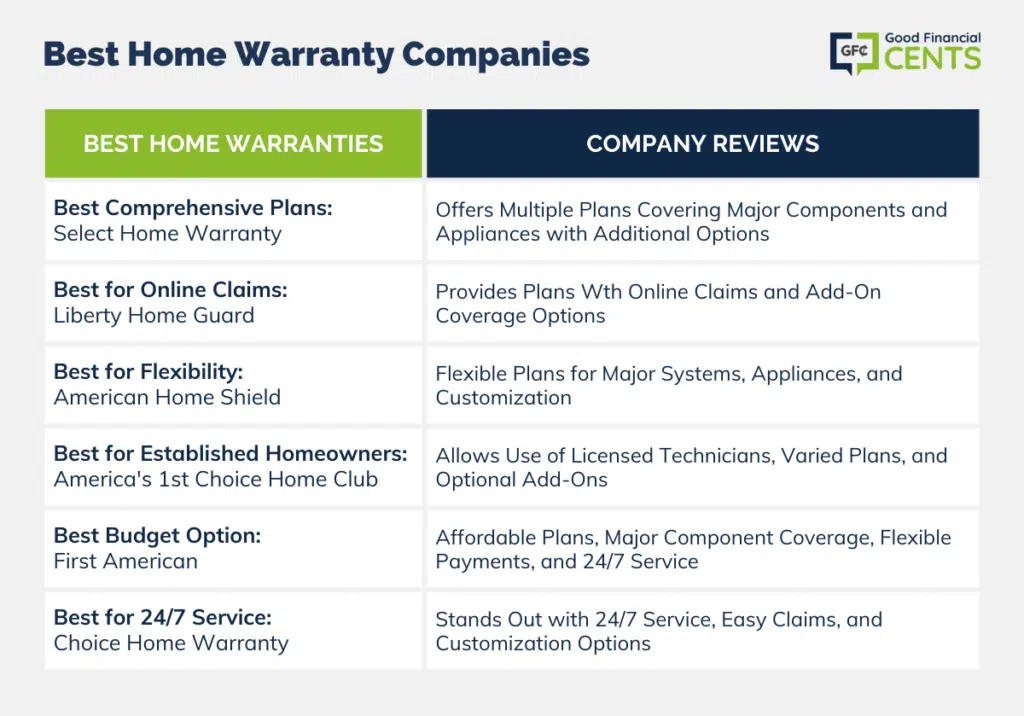

Our Picks for Best Home Warranties in July 2024

- Select Home Warranty: Best Comprehensive Plans

- Liberty Home Guard: Best for Online Claims

- American Home Shield: Best for Flexibility

- America’s 1st Choice Home Club: Best for Established Homeowners

- First American Home Warranty: Best Budget Option

- Choice Home Warranty: Best for 24/7 Service

Best Home Warranties – Company Reviews

While each provider that made our ranking offers high-quality home warranties, some home warranty plans may be better suited to your needs. The following home warranty reviews can help you decide which home warranty plan will provide the coverage you need the most, whether you want comprehensive coverage for every component of your home or you’re mostly seeking a basic warranty plan.

Select Home Warranty offers three different plans that can help you cover unexpected repair bills. Options include a Bronze Care basic plan, a mid-tier Gold Care home warranty plan, and a Platinum Care plan with all the bells and whistles.

With their Platinum plan, you can get all major components of your home as well as all your major appliances covered for one plan fee. Coverage can protect your air conditioner, heating, plumbing system, heating system, ductwork, electrical, water heater, plumbing stoppage, garbage disposal, clothes washer, and all major appliances down to your ceiling fans. Select Home Warranty also lets you add on additional coverage for pools, central vacuums, sump pumps, well pumps, standalone freezers, sprinkler systems, and more.

Liberty Home Guard offers three home warranty plans for consumers — an appliances plan, a systems plan, and a Total Home Guard home warranty plan that provides coverage for nearly every working system and appliance in your house. The company also lets customers choose add-on coverage for components such as a pool and spa, a well pump, a sump pump, septic system pumping, and more.

This home warranty provider also stands out due to their service availability and online claims process. Liberty Home Guard says you can submit your claim by phone or online 24/7, and that they’ll have a technician at your home within 24 to 48 hours in most cases.

American Home Shield has been in business since 1971, so the company has had a long time to build a solid reputation in the home warranty space. This provider made our ranking due to the flexibility of their plans (ShieldSilver, ShieldGold, and ShieldPlatinum), which let you cover your home’s major systems, your appliances, or all of the above depending on your needs.

American Home Shield’s comprehensive Combo Plan provides broad coverage for 21 components of your home, including all the major systems like your electrical system, water heater, home appliances, and more. You can also build your own home warranty plan, which allows you to pay for only the coverage you want and need.

AFC Home Club made our ranking due to the fact you can use any licensed and insured technician for your home repairs. This makes more sense for established homeowners who may already have a network of technicians or companies they are comfortable with.

This home warranty provider also offers a broad selection of plans as well, which can include home appliances like a cooktop as well as major home systems. Customers can also add on additional coverage for components such as a sump pump, a central vacuum, and a standalone freezer. Add-on coverage for roof leaks is also available.

First American Home Warranty made our ranking due to the pricing of their plans, which can range from $38 to $48.50. Their highest-tier plan “Premium” plan covers most of the main components of your home, from your electrical systems to plumbing and major home appliances such as washers.

First American Home Warranty also offers flexible payment options and a network of pre-screened professionals who can perform needed repairs. You can also request service 24 hours a day and 365 days per year.

Choice Home Warranty made our ranking of best home warranties due to their 24/7 service options, as well as the fact customers can quickly and easily file a claim over the phone or online.

This provider offers two main coverage plans to choose from — a basic home warranty that covers appliances and many major home components, and a Total Plan that covers almost all of your home’s components that are prone to breakdowns. Choice Home Warranty also lets you customize your home warranty with additional coverage for pools and spas, septic tank pumping, and more.

Home Warranty Guide

What Is a Home Warranty?

A home warranty works similarly to other kinds of warranties, including extended warranties on electronics. Customers pay an upfront fee or a monthly fee for their service contract, and they receive protection for repairs or replacements of covered items for the duration of their contract term.

As American Home Shield puts it, a home warranty is a “year-long, renewable home service plan that keeps you protected should a covered breakdown occur.”

They add that a home warranty “helps cut the cost to repair or replace many of the systems and appliances in your home and complements your homeowners’ insurance policy by protecting things that your insurance doesn’t.” Of course, your home warranty coverage will only include normal wear and tear, not deliberate sabotage or repairs stemming from a lack of adequate maintenance and cleaning.

What Does a Home Warranty Cover?

The best home warranty plans provide broad coverage you can count on, but they don’t all cover the same components, so it might be a good idea to check out sample contracts on each service provider’s website.

In fact, some home warranties only provide coverage for a select number of items in your home, such as your home appliances. Things like trash compactors, built-in microwave ovens, ranges, refrigerators, and laundry machines are commonly covered, for instance. Other plans provide more robust coverage for major systems like your electrical system and plumbing, as well as your home’s water heater and HVAC system.

Fortunately, the best home warranties will let you customize your plan to suit your needs. For example, you may be able to add on coverage for “extras” or optional add-ons you have around your property, such as a second refrigerator, pool or spa, sump pump, septic tank, and even your ice maker and garage door opener. Some home warranties even provide coverage for roof leaks.

How Much Is a Home Warranty?

The cost of home warranties depends on the specifics of your property, the home warranty provider you select, and the tier of coverage you want. However, our research shows that most home warranties cost between $37 and $70 per month, without including extras such as the service call fee or taking deductibles into account.

Keep in mind that the best home warranties with comprehensive coverage charge monthly fees on the high end of that range. Meanwhile, you can get modest coverage for appliances and some of your home’s systems for less than $40 per month. Cancellation will also carry an associated fee, which can range between $50 to $75 dollars.

Ultimately, you should consider your home warranty as part of the costs of owning a home.

What Is the Difference Between a Home Warranty and Home Insurance?

Where a home warranty provides coverage for the repair and replacement of your home’s systems and appliances, home insurance protection plans provide coverage for the structure of your home. For example, homeowners insurance protects against hail and tornado damage when it occurs. This kind of insurance can also rebuild your home from the ground up if you face a total loss due to fire or other covered events.

Homeowners insurance also comes with liability coverage that can protect you in the event someone is injured on your property and sues you for damages. Our guide to home warranty vs home insurance explains more about how each of these coverage options works in terms of home protection.

[Text Block]

Are Home Warranties Worth It?

Like any other type of warranty coverage, home warranties can be worth it if you need to file a claim. For example, you may find you’re very happy with your home warranty plan if your electrical system needs major repairs, or if your HVAC system breaks down. You may also glean excellent value from your home warranty if several of your home appliances need replacement, or if you have roof leak coverage and actually have to use it. In many cases, a home warranty is a home update worth the money.

That said, even the top home warranty companies can seem like a waste of money if your home’s components never need replacement or repairs, or if the company’s response times and workmanship guarantees aren’t up to snuff. The value of most home warranties is in the peace of mind they provide homeowners. When you have a home warranty in place, you can rest assured you won’t be faced with thousands of dollars in surprise repair bills when you least expect it.

At the end of the day, home warranties can also help you settle the debate between renting vs buying. A home warranty lets you enjoy homeownership without being on the hook for unexpected repair bills, just like you would be able to if you rented.

How We Found the Best Home Warranties

To find the best home warranties for 2024, we compared home warranty plans and their features. Our methodology included getting pricing for a standard, 3,000-square-foot home in Central Indiana to serve as a basis for our comparison, and we looked for companies that offer several plan options with the ability for customers to customize their coverage limits.

In the meantime, we purposely chose home warranty companies that are transparent about their plan inclusions, costs, and fees. We also looked for companies that let customers file a claim online or over the phone with the promise of speedy service thereafter.

Finally, we only included companies in our ranking that have a “B” rating or better with the Better Business Bureau (BBB).

Summary of the Best Home Warranties of 2024

- Select Home Warranty: Best Comprehensive Plans

- Liberty Home Guard: Best for Online Claims

- American Home Shield: Best for Flexibility

- America’s 1st Choice Home Club: Best for Established Homeowners

- First American Home Warranty: Best Budget Option

- Choice Home Warranty: Best for 24/7 Service

Home warranties offer coverage for repairs or replacements of major components, with customizable plans available for a monthly or annual fee. Among the top options are Select Home Warranty, American Home Shield, Liberty Home Guard, and others that provide various features and inclusions.

Homeowners can choose plans based on needs such as comprehensive coverage, online claims convenience, flexibility, established homeownership, budget-friendliness, or 24/7 service. When considering a home warranty, matching needs with plans can bring peace of mind and financial security.

Total Protect is the WORST INSURANCE COMPANY ever – placed claim for garbage disposal issue on MARCH 3, first company they referred me to never called back – second company I requested came, determined piece had to be replaced – PAID THE $125 DECUCTIBLE (used to be $50 now it is $125). The service provider called back Total Protect to have them order the piece – thenI had to wait several days to be called to SCHEDULE a delivery of said piece, for which I AGAIN had to take off work and wait home over a FOUR hour window (tried to have it delivered at my work: IMPOSSIBLE!!!) – piece finally delivered – had to wait yet again SEVERAL DAYS to have a new appointment made with the service provider to come back and replace it – they finally came in this past Friday (THREE WEEKS AFTER CLAIM WAS PLACED!!!) and SURPRISE, Total Protect had ordered the wrong piece (a GE, NOT an Insinkerator, and it would NOT fit in!!!). Called Total Protect, was told that the WRONG piece would have to be picked up at my home (HENCE me again taking off work and waiting for the stupid truck!!) and THEN when they receive it THEN they will order a new one!!! AS of today Tuesday morning (FOUR days after tech came in and determined Total Protect had ordered the wrong piece), still no call to arrange for a pick up, NOTHING! So I had the piece replaced by a local plumber – cost me $425 but was done in less than 24 hours.

Called Total Protect to cancel my account since they perform so badly, and I was talked into not cancelling by the customer service lady on the premises that I have been a customer for 13 years (!!!). She tried to connect me to people to get a refund of the $125 deductible I had to pay initially for the claim – was bounced from place to place for about 2 hours – now being told it is NON refundable. So I called again to really cancel my account this time, and I am now told I will have to pay a $103 cancellation fee!!!! WHAT???? So freaking upset with this company and how difficult it is to process anything with them! UNBELIEVABLY incompetent!!!!! Almost all techs I had to deal with every time I placed a claim were super difficult to get a hold of or would simply not return calls… if you review these techs on line you can see a lot have really bad ratings and reviews.

On the other hand, where the pedal meets the metal, Consumer Reports states, Choice Home Warranty “repeatedly made it difficult if not impossible for consumers to realize the benefits of their so-called warranties,” the New Jersey Division of Consumer Affairs said in a statement announcing the complaint, which was filed in state superior court in Middlesex County. Additionally, 957 complaints earned them an F rating with the Better Business Bureau.