This is a frequent question for anyone who is carrying an uncomfortable level of debt. Bankruptcy should never be taken lightly since there are consequences. But there are times when it becomes absolutely necessary.

For example, if you’re carrying a level of debt, you can’t hope to repay, or if the monthly payments are impairing your ability to survive, bankruptcy needs to be a consideration.

More than 387,721 people filed for bankruptcy in 2022, which is down significantly from the 500,000+ filing each of the previous several years.

Should you file for bankruptcy, and what are the implications if you do?

Table of Contents

What Happens When You File for Bankruptcy?

Filing for bankruptcy can seem like an intimidating process, but the initial results may be something closer to relief.

Once you file for bankruptcy, your debtors are legally barred from pursuing you for payment. That will not only end the payments that are making your life a financial nightmare but also the harassing phone calls from debt collectors.

What’s more, creditors are also barred from pursuing collection. That can include garnishing your wages or seizing bank assets. In effect, the bankruptcy filing provides you with an immediate dose of breathing room.

That’s the good news. The bad news is that your financial ability to maneuver will be greatly restricted, especially in the near term.

For example, once you file for bankruptcy, you’ll be unable to obtain new credit. You may also be unable to be approved for an apartment lease. And you may not be eligible for certain jobs where credit considerations are a major factor.

You can think of bankruptcy as being something like a financial time-out. You’ll get relief from the immediate stress of your debt burden, but your options will be severely limited.

What Happens to Your Debt When You File for Bankruptcy?

The answer to that question depends on what type of bankruptcy you file. Under a Chapter 7 bankruptcy, most debts will immediately be dissolved. But under Chapter 13, some or even all of your debt may be subject to repayment through an installment plan.

It’s also important to understand that your debts will be discharged only if your bankruptcy is granted and completed. For example, if you file for Chapter 7 and fail to meet the qualifications, the bankruptcy discharge will be dismissed by the court. If you file for Chapter 13 and fail to complete the installment repayment satisfactorily, the discharge will be invalidated.

In either situation, the damage to your credit will be more severe than it would have been had you not filed for bankruptcy. That’s because not only will you have the bankruptcy filing on your credit report, but you’ll also have a bunch of unpaid debts, all reporting as past-due or in the collection.

You should also be aware there are certain types of debt that cannot be extinguished even by filing for bankruptcy.

The list includes the following debts (applying only to Chapter 7):

- Debts not included in your bankruptcy

- Debts that were incurred fraudulently

- Income tax debt under three years old

- Taxes other than income tax (i.e., payroll or sales tax)

- Federal tax liens

- Unpaid child support or alimony

- Debts to government agencies for fines and penalties

- Student loans

- Debts for personal injury caused by driving while intoxicated

- Debts owed to certain tax-advantaged retirement plans

- Court fines and penalties, including criminal restitution

- Attorney fees in child custody and support cases

- Homeowner’s association (HOA) fees

Some of the above debts can be discharged by filing Chapter 13. These include non-criminal government fines and penalties, non-support marital debts pursuant to a divorce or settlement agreement, debts incurred to pay a non-dischargeable tax debt, HOA fees, and loans owed to a retirement plan.

How Many Types of Bankruptcy Are There?

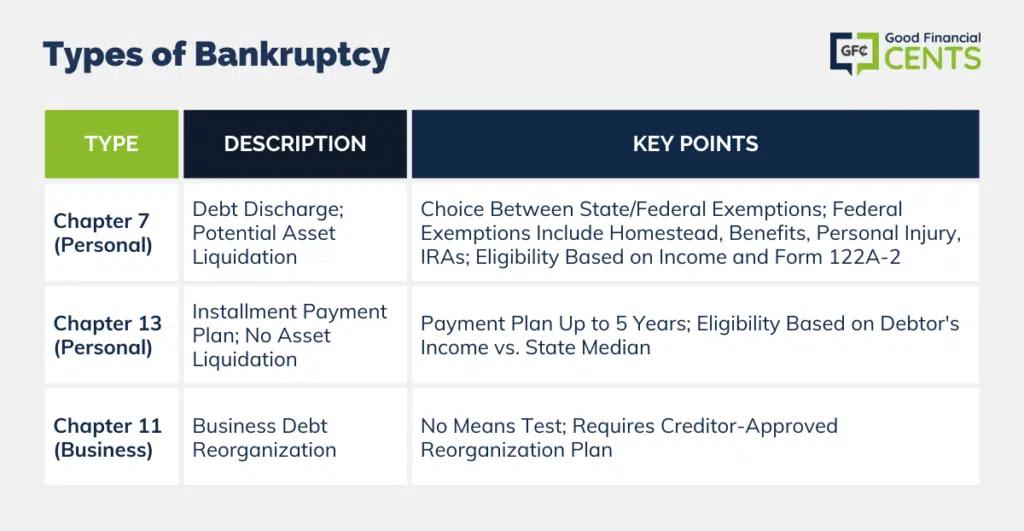

For personal bankruptcy, there are two primary types, which we’ve already discussed briefly. Those are Chapters 7 and 13. Chapter 11 is the bankruptcy of a business entity.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is probably the “TV version” of bankruptcy. That’s where nearly all your debts are discharged but where you may also be required to liquidate assets.

That doesn’t mean you’ll lose every possession you own. Each state sets a limit on Chapter 7 bankruptcy exemptions. This extends to both the type of asset and the dollar limits that will be exempt. The amount will be different in each state.

A number of states give you a choice between the state’s bankruptcy exemption and the federal bankruptcy exemption. You can choose whichever is more beneficial to you.

Examples of property that can be exempt under federal law include:

- Homestead exemption of up to $25,150 (primary residence only)

- Benefit and support, including alimony, child support, life insurance paid to a dependent, Social Security benefits, unemployment compensation, VA benefits, and other government benefits

- $25,150 for personal injury recovery, exclusive of pain and suffering

- Compensation for loss of future earnings necessary for support

- Payments received in connection with the wrongful death of a person you depended on necessary for support

- Compensation as a crime victim

- The value of an employer-sponsored retirement plan

- Up to $1,362,800 for traditional and Roth IRA accounts

- $4,000 for motor vehicle

- $1,700 for jewelry

- $13,400 total for household goods, limited to $625 per item

- $2,525 for professional books, implements, or tools of the trade

- Professionally prescribed health aides

- $13,400 in accrued interest, dividend, or loan value life insurance contract

- A wildcard exemption for any type of property for $1,325, plus $12,575 of any unused portion of your homestead exemption

Individual state bankruptcy exemptions can be more or less generous than any of the amounts above.

Chapter 13 Bankruptcy

The advantage of Chapter 13 is that you typically won’t be required to liquidate personal property to settle your obligations. The disadvantage is that you will be required to pay some or all your outstanding debt.

Under Chapter 13, an installment payment plan will be established for as long as five years. During that time, you’ll be required to make payments toward any debts included in the plan.

Once the payment plan has been completed, the bankruptcy will be discharged. But if you fail to make payments during the plan, the bankruptcy will be dismissed.

Nearly 70% of all bankruptcies are filed under Chapter 7, with most of the rest filed under Chapter 13.

When you file for bankruptcy, one of the forms that will be completed is Form 122A-2, Chapter 7 Means Test Calculation. The form will be used to determine whether you are eligible to file for Chapter 7 or 13. Basically, anyone who can repay at least a substantial portion of their debt will be required to do so by filing Chapter 13.

The debtor’s income – for the previous six months – is matched against the median income level for his or her state of residence based on the number of people in the household. If it’s below, the debtor will qualify for Chapter 7. If it’s above, Chapter 13 will be considered.

Even so, Chapter 7 may still be an option if the information you disclose on Form 122A-2 indicates your necessary living expenses consume all or nearly all of your income. Necessary living expenses include housing, utilities, medical costs, food, and other obligations.

Chapter 11 Bankruptcy

If you own a business that has debt obligations you’ll be unlikely to meet, you can file for Chapter 11 bankruptcy. This is considered “reorganization bankruptcy” because it’s designed to enable the business to continue to operate while working out a debt settlement with creditors. Unlike personal bankruptcy, no means test is required.

If the plan is approved by creditors, the debtor will get an automatic stay, which will prevent further collection activities, as well as judgments, foreclosures, and repossessions. But unlike Chapter 13, which generally limits repayment to five years, Chapter 11 plans may go on for many years.

Ways to Recover Credit After Bankruptcy

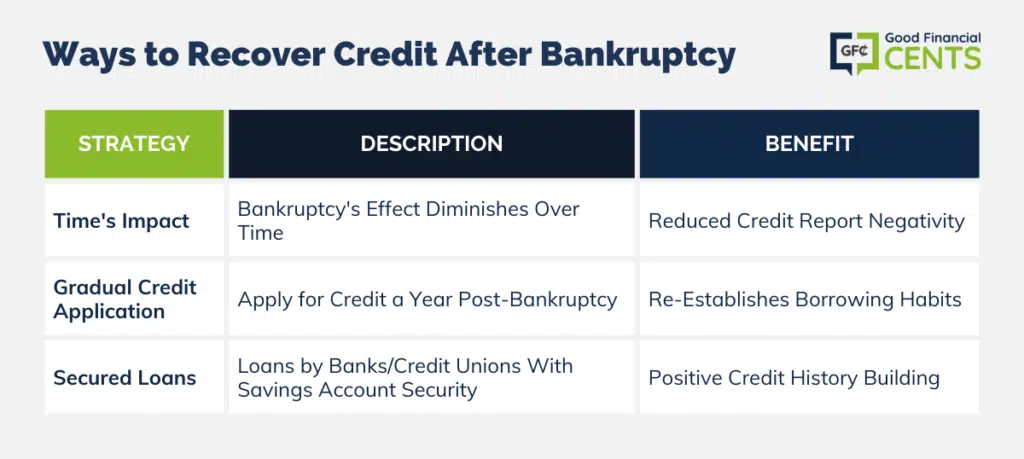

A Chapter 7 bankruptcy will remain on your credit report for up to 10 years. Chapter 13 will remain for seven years after the filing date.

Either timeline creates obvious limits on your ability to borrow, qualify for a mortgage, rent an apartment, or even land certain jobs. But the good news is that bankruptcy, like all other types of derogatory credit, does get better with time.

For example, a bankruptcy entry that’s five years old will have a less negative impact than one filed six months ago. As each year passes, the impact will decline a little bit until, finally, the entry will be removed from your credit report entirely.

That doesn’t mean you should completely avoid debt until the bankruptcy falls off your credit report. A better strategy is to begin gradually applying for credit, starting about a year or so after filing.

The best way to do this is by obtaining a secured loan. Sometimes referred to as credit builder loans, these are loans made available by banks and credit unions, specifically for people looking to rebuild their credit.

The institution will make the loan because the debt will be secured by the loan proceeds, which are deposited into a savings account.

For example, let’s say you take a secured loan for $2,000 at your local credit union. Despite your bankruptcy, the credit union approves the loan, deposits the $2,000 in loan proceeds into a savings account, and sets you up with a regular monthly payment. It may be for a term of between 12 and 24 months.

While you’re making repayments on the loan, you will not have access to the funds in the savings account. Instead, you will either have the credit union deduct monthly payments from the savings account, or you’ll make the payments out of your income.

The credit union will report your on-time monthly payments to all three major credit bureaus, giving you good credit to offset your bad credit. You may be able to take several of these loans, helping you to rebuild your credit faster.

Ways to Avoid Bankruptcy

It may be possible to avoid bankruptcy completely, and that’s a strategy you should employ if it’s possible.

Credit Repair

Though credit repair is most often associated with helping debtors rebuild their credit, it can also be an effective way to work out a debt settlement. Many creditors will cooperate, knowing they’re likely to recover more money through a settlement than they will be if the debtor pursues bankruptcy.

In some cases, the credit repair company may be successful in getting several creditors to reduce the amount of principal you owe.

Credit repair companies like Credit Saint and Lexington Law specialize in exactly this type of settlement. Both companies are well-regarded in the credit repair space and can start the process with a free consultation.

Debt Consolidation Loans

If the factors that might cause you to file for bankruptcy owe mostly to an uncomfortable level of debt, you may want to consider the debt consolidation loan route instead.

As the name implies, a debt consolidation loan is where you take a large loan that will pay off several smaller loans. It doesn’t remove the debt from your life, but it does roll several debts into one, with one monthly payment. In many cases, that single monthly payment will be lower than the total of the multiple payments you’re carrying right now.

Two good sources for debt consolidation loans include AmOne Debt Consolidation and Monevo Debt Consolidation.

Both are online loan marketplaces offering several types of financing. The advantage is that you’ll complete a single online application and get loan offers from several lenders. You can then choose the one that offers the best rate and terms for you.

Debt consolidation loans will typically be handled by a personal loan. These are unsecured loans for up to $100,000 and terms of 3 to 5 years, though they can be longer. They generally accept applicants with credit levels ranging between fair and excellent, though rates will be higher for lower credit profiles.

If you do go the debt consolidation route, be sure to avoid any new debt until the consolidation has been paid. The ultimate goal of a consolidation loan is to lower your debt level, thus avoiding bankruptcy.

Bottom Line

Bankruptcy is a pivotal decision that carries both relief and consequences. For some, it offers a respite from unmanageable debt and creditor harassment, granting a fresh start. However, the restrictions on future financial endeavors and credit implications can be severe.

Different types of bankruptcy suit various needs, from personal to business. While Chapters 7 and 13 are more common for individuals, Chapter 11 is designed for businesses.

Recovery post-bankruptcy is a gradual process, often beginning with credit-building strategies.

Yet, before diving into bankruptcy, exploring alternatives like credit repair and debt consolidation loans can provide paths to avoid such a drastic measure. It’s essential to weigh all options and consult experts before deciding.