Typically, most people automatically assume they should roll over their old 401(k) into a traditional IRA. However, a lot of people have been asking about another option lately – and that’s whether you can roll your 401(k) over into a Roth IRA instead.

Fortunately, the definitive answer is “yes.” You can roll your existing 401(k) into a Roth IRA instead of a traditional IRA. Choosing to do so just adds a few additional steps to the process.

Whenever you leave your job, you have a decision to make with your 401k plan. Most people don’t want to let an old 401(k) sit idle with an old employer and could benefit immensely by moving those funds somewhere that could benefit them more in the long run.

Let’s see if I can help you make “cents” of the situation.

But first, let’s look at the rules behind the strategy of rolling over your 401k into a Roth IRA.

Table of Contents

Need to Open a Roth IRA?

My favorite online broker is Ally Invest, but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses.

There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose, the most important thing with any investment is to get started.

Roth IRA Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. It’s permitted by the IRS, but not all employers participate.

Before January 1, 2008, you weren’t able to roll your 401(k) into a Roth IRA directly at all. If you wanted to do so, you had to complete a two-step process. (Keep in mind that this would also apply to old Simple IRAs, SEP IRAs, and 403bs, 457, and qualified pensions, too).

- Open a Traditional IRA.

- Convert the Traditional IRA to a Roth IRA.

However, the law changed shortly after, and this option became available. Still, just because the law has made this option available doesn’t mean you can definitely roll your old 401(k) into a Roth IRA, no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently, I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan (TSP) – and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA (the instructions had been added to make sure you had a Roth IRA already established). However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

However, this man’s state retirement plan is not the only one I’ve encountered with these extra “rules.” Many 401(k)’s and 403(b)’s come with the same “No-Roth IRA Rollover” option. This option was supposed to be mandatory in 2010, but some still do it on a voluntary basis.

At the end of the day, this means you should explore this option thoroughly before automatically assuming it would work in your case. Ask questions, consult your financial advisor, and read through all of your rollover paperwork carefully before you begin moving in this direction.

Recap on Roth IRA Conversion Rule

These days, nearly anyone can take all of their traditional IRAs and old retirement plans and convert them to a Roth IRA. The amount you convert will be taxed, but it still can be an attractive move for those who feel that taxes are going nowhere but up.

How Do I Rollover if I Receive the Check?

If you receive a distribution check from your 401(k) rollover to a Roth IRA, then chances are good they will hold around 20% for taxes.

If you want a direct 401(k) rollover to a Roth IRA, you may want to send that check back to your employer 401(k) provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account (not as a check, or they will just give you 80% again).

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So don’t procrastinate on this one.

What About the Roth 401k?

If your employer offers a Roth 401k and you are savvy enough to take part, the path to a rollover will be much easier.

When you’re converting one Roth product to another, there is simply no need for conversion. You would simply roll the Roth 401(k) directly into the Roth IRA with the help of your plan provider.

Roll Your 401(k) By Following These Steps:

- You have to have a Roth IRA open/established before you can do any of this.

- Ask your plan provider about the paperwork required to roll your plan over, then complete the paperwork in a timely manner.

- Enjoy the tax-free growth of your Roth IRA!

4 Signs It Makes Sense to Roll Your 401(k) Into a Roth IRA

If you’re thinking of rolling your 401(k) into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so.

Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

1. You Expect to Pay Higher Taxes in the Future

Since Roth IRAs use after-tax dollars, you’ll have to pay taxes upfront on any funds you roll over. However, you won’t have to pay taxes on your distributions, which could be extremely beneficial if you’re taxed at a higher rate when you reach retirement. You’ll pay taxes either way – now or later.

But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

2. You Want to Take Withdrawals When You’re Ready and Not a Minute Before

While traditional IRAs force you to begin taking withdrawals at age 73, Roth IRAs do not have this stipulation. Because of this, you can squirrel your Roth IRA funds away until you’re ready to use them.

3. You Expect to Earn More Money in the Future

If you plan to earn lots of money in the future – or earn a high income now – you should consider rolling your funds into a Roth IRA instead of a traditional IRA.

For single filers in 2024, the maximum income allowable for contributions to a Roth IRA starts at $146,000 and ends at $161,000. Learn more about Roth IRA rules and contribution limits here.

| FILING STATUS | MAGI | CONTRIBUTION |

|---|---|---|

| Married Filing Jointly / Qualifying Widow(er) | <$230,000 | Up to the Limit |

| Married Filing Jointly / Qualifying Widow(er) | ≥$230,000 but ≤ $240,000 | Reduced Amount |

| Married Filing Jointly / Qualifying Widow(er) | ≥$240,000 | Zero |

| Married Filing Separately, Lived With Spouse During the Year | < $10,000 | Reduced Amount |

| Married Filing Separately, Lived With Spouse During the Year | ≥ $10,000 | Zero |

| Single, Head of Household, Married Filing Separately, Did Not Live With Spouse During the Year | < $146,000 | Up to the Limit |

| Single, Head of Household, Married Filing Separately, Did Not Live With Spouse During the Year | ≥$146,000 but ≤ $161,000 | Reduced Amount |

For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $230,000 and halts completely at $240,000 for 2024. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

4. You Want to Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you won’t pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed upfront but offer tax-free withdrawals after the age of 59 ½.

If you’re unsure how your tax and income situation might pan out in the future, having both types of accounts – a traditional IRA and a Roth IRA – is a smart move in terms of diversifying your future tax exposure.

| 401k to Roth IRA Rollover Rules | Details |

|---|---|

| Eligibility | You can roll over a 401k to a Roth IRA if you have left the employer sponsoring the 401k and are no longer contributing to the plan. Some plans also allow in-service rollovers, but it’s best to check with your plan administrator for details. |

| Taxes | When you roll over a 401k to a Roth IRA, you will owe income taxes on the amount you convert. This is because contributions to a 401k are made with pre-tax dollars, while contributions to a Roth IRA are made with after-tax dollars. |

| Conversion Limitations | There is no limit on the amount you can convert from a 401k to a Roth IRA. However, the amount you convert will be added to your taxable income for the year in which you made the conversion, which could have tax implications. |

| Timing | You can convert a 401k to a Roth IRA at any time, but it’s important to consider the timing of the conversion carefully. If you convert when your income is higher, you will owe more in taxes. |

| Penalty-Free | If you are 59 ½ or older, you can convert a 401k to a Roth IRA penalty-free. If you are younger than 59 ½, you may be subject to a 10% early withdrawal penalty on the amount you convert. |

The Bottom Line – Rolling Over 401k into a Roth IRA

Rolling your 401(k) into a Roth IRA is a smart decision for many investors, but it may not be right for everyone.

Some financial advisors may suggest rolling over your 401k into a Roth IRA to take advantage of the tax-free growth the account offers.

While this can be a great option for some, it’s important to consider if you’ll be able to afford to pay the taxes on your contributions and earnings when you eventually withdraw them.

Before you pull the trigger, make sure to investigate all of your options and consider speaking with a tax professional. When it comes to complex investment vehicles and taxes, what you don’t know can hurt you.

Hi Jeff. My company was acquired recently and the new owners have replaced Insperity (and their 401(k) option) with their own inhouse HR and Voya financials. I would like to roll my 401(k) from Insperity to my TD Ameritrade IRA but Insperity is refusing to release my account saying I still work for the same underlying company. I technically was terminated from the old entity and signed an offer sheet from the new. Isn’t that enough to clear me for transfer??

Rolling your 401(k) into a Roth IRA is looks like smart move. Thanks for this informative post, it’s very helpful. It’s true that before making any kind of decisions you need to weigh all the pros and cons and see if it really fits into your plan or not. Good work, keeping posting.

Good article. I have read several similar ones online and none address a question I have. I am, 66, retired, and looking into rolling my 401k into my Roth IRA ( which I have opened a while ago) over a period of years, to minimize the tax hit. The 401k and the Roth IRA are with different institutions. All of the articles I have found point to using a financial institution to facilitate the rollover. I can’t tell if this is a recommendation or a requirement. This seems to me to be unnecessarily complicated and also not very efficient, as it leaves the funds in limbo for a considerable amount of time. Why can’t I just take a 401k withdrawal yearly and then put that amount into my Roth IRA ?I just don’t see the need to make it any more complicated than that.

Also, I plan to do the withdrawal and deposit on the same day. Does anyone one care if I use other funds ( i.e not wait for the withdrawal check to clear) for the deposit, as long as the withdrawal and deposit are the same amount and the deposit does not supersede the w/d?

Finally, should I tell my 401k administrator that I’m planning to rollover the withdrawal to a Roth IRA so they can label the withdrawal properly in their system and send me the correct data for tax purposes?

Thanks for your response.

Hi Tom – I always advise a direct rollover from one plan to another to a) avoid withholding by the issuing administrator, and b) to completely avoid the possibility of your missing the 60 day rollover window. If you have the funds to make the rollover, you should be fine. As far as notifying your administrator, I can’t tell you how they’ll classify the distribution on the 1099, and if they’ll accept your explanation. One thing you have in your favor no matter what is that at 66 you don’t have to worry about the 10% early withdrawal penalty.

Are you able to use any of the amount that you transfer from the 401K to the Roth IRA rollover to pay the taxes you’ll owe for withdrawing that 401K?

Would it make sense to withdraw it all the way, keep some of the money to pay for taxes, and then deposit the rest into a Roth IRA as if it wasn’t even a rollover? I don’t have savings other than this, so wouldn’t be able to pay the additional taxes when come tax-filing season.

Hi Anthony – You can do that, but you’ll have to pay tax on the amount withheld to pay the tax. If you’re under 59.5 you’ll also have to pay the 10% early withdrawal penalty. Let’s say you’re moving $100,000, and holding back $20,000 to pay the tax. The $20,000 becomes fully taxable and also subject to the 10% penalty if you’re under 59.5. Also, you’ll lose a part of your retirement asset for good. You really should go over the numbers with a tax preparer to see if this makes financial sense. It might not in this case.

Just before 4 PM eastern time on December 29, 2017 I executed an online request for 401K money to be transferred into a ROTH IRA for the 2017 tax year and followed it up with a phone call to the 401K institution. I did it specifically because I needed to owe more money in 2017 in order to take advantage of a tax credit. Now I find that the rollover was coded for 2018 and the 401k institution claims that it should have been requested by 12/22/2017 – something that wasn’t specified in the documentation or by the person who assisted me over the phone. Because of my unique circumstance, this this error will be extremely costly for me in both tax years. I am told that there is nothing they can do. They cannot code it to 2017 or reverse the transaction. Do I have any recourse?? What are the IRS rules about coding a transferring from 401K to ROTH IRA to a particular year? Thank you!

Hi Sally – That’s an institutional problem, meaning you have to go by the institutions proceedures. You can check with a CPA to find the specific rules and code section, and see if you can get written proof that they made a mistake. That MIGHT get it resolved in your favor, and it might not. The IRS gives institutions and employers some flexibility with retirement plans, and this may be one of them. It looks like the set a deadline of 12/22 to avoid last minute issues. They may be able to do that.

Hi,

I am under 59 1/2 yrs and moved out of the US last year. I have a sizeable 401k and wish to take it out. From what i know i have 2 options

1. Close the 401k and withdraw it early facing a 10% penalty

2. Roll it over into a Roth IRA and withdraw after 5 years. This means paying tax >10%

Based on this it is better to just close the IRA and take the 10% hit.

What is your recommendation? is there a third option?

Either way, you’re paying tax and the penalty. You’ll have to pay the penalty on the Roth if you’re under 59.5, at least on the earnings portion, plus regular income tax on the amount converted. You might want to discuss which is better with your tax preparer, based on your personal tax situation.

Will you please clarify the “5 year” rule regarding Roth IRA’s. Does that 5 year rule go away the day I turn 59 1/2?

Hi Steve – When you do a conversion you can withdraw your contributions without paying tax, since you already paid it on conversion. But in order for the investment earnings to be tax free, you have to wait five years. If you’re over 59.5, the tax on investment earnings still applies within five years, but the penalty is waived.

Hi Jeff, Planning on retiring next year at 57. My wife (56) and I both have a 401k from the same employer. We also will have pensions coming in. Will be in a 100,000/year bracket with pensions. I opened a roth to add any monthly savings to for future so would you suggest that we convert the 401k to individual roths now or wait? We have a plan that we can take 401k distributions without the 10% fee before we turn 59 1/2. If we do open roth accounts, do we have to wait 5 years before we can start pulling anything out of them? If so, perhaps we would be better just pulling out of the 401k’s and paying the taxes? Your thoughts? Thanks.

Hi Delwyn – I’m sensing two issues here. The first is “I opened a roth to add any monthly savings to for future…” Once you retire you won’t be able to contribute to a Roth IRA. It can only be funded with earned income. Second, “…would you suggest that we convert the 401k to individual roths now or wait?” From a tax standpoint you’d be best to wait. Presumably your tax bracket will be lower in retirement, and that’s the time to do a rollover. Oh, and to your third point, the taxability of Roth withdrawals, you’ll still have to wait for 5 years to pass for the investment income to be tax-fee. Contributions can be withdrawn tax free, and the penalty is waived on investment income, but the tax still applies until five tax years have passed since conversion.

Jeff, you need to correct and update this website. Starting off this site with “As a reminder, you must be separated from your employer to roll your 401k into a Roth IRA. You CANNOT do this if you are still working for the same company and/or employer, unless you’re already older than 59 ½.” is not only wrong it is legally wrong. ERISA allows an active service early rollover to ANY married couple. It is in the code AND IRS approved. AND I have already done this.

You’re correct Dane, and the change has been made in the article. Please accept my apologies – there are dozens of provisions connected with retirement plans, particularly rollovers and conversions, and it’s impossible get all the details right. Thanks for your input!

I am 66, single and still working. Making $75,000, contributing $5,000 to 401k with a balance of $95k. I have moved another 401k ($800k) to an individual IRA, but am wondering whether it makes sense to convert to a Roth, and the best way to do that. Live pretty frugally and want to leave as much nontaxable income as possible to my child.

Hi Brenda – There’s a few things to consider here. With an income of $75,000 and $800,000 to potentially convert to the Roth IRA, you could be looking at a very BIG tax bite. It would be best to do it over several years, or even to wait until you retire, when your tax liability will be lower. You really need to sit down with a CPA and crunch the numbers. A Roth conversion accepts the tax liability now in exchange for tax-free income later. But in your case, the tax liability now might be so large that it seriously reduces your retirement savings. Please be very careful!

Anyone can roll over a 401k OR Traditional IRA to a Roth IRA with little to NO tax consequence using a hybrid annuity. I can back up what I am stating with proof.

I feel it’s important to say-hire a CPA and Fee based financial planner. Fairly inexpensive for sound advice before anyone makes a costly mistake.

Hi Jeff,

I am confused as to how to apply Roth-related rollover rules to rolling over a Roth 401K to a Roth IRA upon retirement. I am 62 years old, and am planning to retire in 4+ years. I have a sizable pre-tax 401K, no Roth 401k.

Does the following strategy make sense?

1. Add After-Tax accounts by:

– opening a Roth 401K and allocate maximum after-tax (6,500?) yearly

– Invest an additional amount in After-Tax 401K.

2. Upon retirement,

– rollover the Roth 401K to a Roth IRA.

– distribute the After-Tax investment to the Roth IRA as a direct rollover and distribute the pre-tax earnings to Traditional IRA

QUESTIONS REGARDING 5 YEAR RULES

– Does rolling the Roth 401K to a new Roth IRA restart the 5 year clock (to qualify for a tax-free distribution of earnings)?

– If so, if I open a Roth IRA now, and do a direct rollover of the Roth 401K in 4 +years to the 4 year-old Roth IRA, then does the Roth IRA’s clock re-start?

Also, after retirement,

– if I convert Traditional IRA amounts on a yearly basis (paying lower tax rates) into the same Roth IRA, do all subsequent earnings qualify for tax-free distributions?

– After rolling the after-tax investments into the Roth IRA (opened this year), will all subsequent earnings quality for tax-free distributions?

Thanking you in advance for your kind consideration, Mike.

I am trying to ensure any Roth investments and related earnings I make become qualified distributions in 5 years time.

–

– Do I have to open a Roth IRA now to start the 5 year clock

Hi Michael – I don’t mean to blow you off but you have a lot of very specific questions and I’m going to refer you to your 401k plan trustee and your accountant. I will say that rolling over the Roth 401k to a Roth IRA will be a simple affair and will not start the five year rule, since it’s a Roth-to-Roth rollover and not a conversion. I also think you’re on solid ground rolling the pretax 401k funds to a traditional IRA, since there will be no tax liability, and no restrictions on withdrawals. But please at least discuss your concerns with an accountant since the answers will largely depend on your overall financial situation, which I know nothing about. Fair enough?

I am 66 and have been retired for over two years. I still have an employer 401-k with a value of around $308,000. Can I convert all or part of this to a Roth IRA? Is this dependent on my plan document? If only part, what do you suggest I do with the non-convertible balance?

Hi Tom – You should be able to do a conversion if it makes sense for you from a tax standpoint. Just be careful though. $308k will put you into a high tax bracket, which may offset the benefit of creating a tax-free income account. You’ll probably be better off doing the conversion over several years. Sit down with an accountant and crunch the numbers. It may be to your benefit, but then it might not.

Hi –

I have a good chunk of money in my previous employer 401K. I had it set up with 50% Roth and 50% traditional. I’d like to move everything to a Roth IRA but want to ensure I don’t get double taxed for the 401 I have in Roth. Do I need 2 IRA’s? One Roth and another traditional so I can move the 2 chunks seperately? And then convert the traditional into Roth? What makes the most sense?

Also, I exceed the income limits for IRA’s. Will this impact the transaction in any way?

best,

angel

Hi Angel – First off there’s no income limit to do a Roth conversion so you’re OK there. You can handle the conversion either way. You can simply do a rollover of the Roth 401k to a Roth IRA. Then you can do a Roth conversion directly from the 401k. You could first move the non-Roth 401k to a traditional IRA then do the conversion, but that just adds an extra step. I’d do it direct.

I recently did Direct Rollover of my former employer’s 401(k) balance to Roth IRA (Monster Trade). When I received 1099-R form, it had a Distribution Code as “G” and the box “2a. Taxable Amount” as zero. During direct rollover, my previous employers plan administrator did not withheld any money and rolled-over all money from 401k to Roth IRA. I was under impression that, it is plan administrator’s responsibility to withhold the tax amount, any penalty amount (if application) and only rollover the balance amount.

When I tried to file for taxes with one of the known tax software, it says I need to pay taxes on 401k to Roth IRA direct rollover amount, but another known tax software do not consider this rollover amount for tax purpose. I am confused, do I need to pay taxes on this direct rollover or not? And why both the software’s are considering this transaction differently?

Hi Jason – Code G means direct rollover. It may be that your employer was not aware that it was a rollover to a Roth IRA, and therefore showed it as non-taxable. I’d consider having your return prepared by a CPA this year. You can’t afford to make a mistake on this. And without seeing your returns I’m not in a position to give concrete advice here. But it does look like something is wrong.

Excellent article. I am 70-1/2 years old. I continue to work but stopped contribution to my 401k about 1-1/2 years ago. I am told by my employer’s 401 administrator that since I am listed as active by my employer, I do not have to do any required minimum withdrawal until I severe my employment with my employer. I am told there is no tax penalty in continuing to leave my money in the 401k. Is this true?

To my knowledge that’s correct. 401k RMDs are only required if you are no longer employed by the sponsoring company.

My 401k plan was terminated . I have 19000 in there . I want to roll over 13,000 to an Ira Roth . Will I have to claim that on taxes for next year. I know they will take 20 percent of the distribution (6000). Does the 13000 get taxed when I roll over

Hi Ron – You will have to pay tax on the Roth conversion next year, unless the 401k included non-tax deductible contributions. In that case the non-deductible portion will be pro-rated and excluded from the tax.

Hi. I am 53 years old and left my job in a reorg. I was given 1 year severance paid over 52 weeks. I have about 500k in my 401k to rollover. Can I roll part of it (100k) into a Roth and the remainder into a traditional IRA, I will use outside funds to pay the tax on the $100k rolled to the Roth. My income this year will exceed the cap for joint filers to contribute to a Roth because of the severance, does this prevent me from doing the Roth portion rollover? Does it even make sense to rollover the 100k to a Roth now considered I am in a higher tax bracket now then I expect to be when I start withdrawing from the IRA’s.

Hi Richard – You can do the Roth conversion no matter how high your income is – there is no income limit on that. I think it does make sense, because you will be moving at least some of your money into what will be a tax-free income source for retirement. That’s an excellent tax diversification strategy for retirement. Once you turn 59.5 and you’ve been in the Roth for at least five years, the withdrawals will be tax-free. You’re doing it just in time!

Jeff – Thanks for the information. I just want to confirm my recent actions…………

I’m 51 yoa and separated from a governmental position. I took a distribution from my 457b account on December 29, 2016 with the intention of placing that money into a different brokerage’s Roth IRA. In essence, an indirect rollover. Taxes were removed and the money was deposited with the new entity. I am planning on doing a portion of my 457b funds each year in this fashion in order to control my tax burden.

Now, a couple of questions……

-Since I’m eligible to receive the 457b funds with no penalties, do I have to abide by the 60-day turnaround (distribution to deposit)?

-Since this was an indirect rollover, do I have to wait 365 days to do my next 457b portion?

-Since this was an indirect rollover, how is the deposited money identified as a rollover and not as an excessive 2017 contribution to a new Roth, which would draw penalties because its over the $6500 limit?

Thank you in advance for your help.

Hi Tim – Let’s take them one at a time…

60 day turnover rule: If I understand it correctly, you must deposit the money into the Roth account within 60 days or it will be deemed an outright distribution, and you will lose your ability to convert the funds. (It’s always best to do a direct rollover.)

Wait 365 days for the next rollover: Yes, the rule is one conversion per 12 month period. (Another good reason to do a direct rollover, rather than waiting 60 days!)

Identifying the rollover for tax purposes: Complete IRS Form 8606.

Hope this helps!

Hi. Jeff,

What could I do?.. I took a loan out my my 401k… and then I did not Rollover into the new company’s 401k and now i am owing taxes big time( 401k Newbie mistake)…what can I do right now to try and save myself from paying high taxes before I file my Tax Refund? Is there a strategy I can do to try and lower my taxes right now? I am still trying to pay down my 401k loan still. Please help.

Hi Tony – Your question is really beyond the scope of this article. It’s kind of a done deal, so there may be no way to reverse it. But I’d suggest talking with the administrators of both plans to see what they can offer. If that doesn’t work, you’ll need to talk to an accountant to review your taxes and see what might be done to lower your tax liability elsewhere.

What you’re experiencing is a “dirty little secret” of 401k loans that almost never gets discussed. When you leave your employer, you have 60 days to repay the loan. If you can’t, it’s considered a premature distribution, subject to regular income tax and the 10% early withdrawal penalty on the amount of the unpaid balance. That’s one of the reasons 401k loans aren’t as harmless as everyone thinks. But if it’s any comfort, most people don’t know this, and fall victim to it. The best you can do now is work to minimize the damage.

Thanks for a great article Jeff.

I am currently a graduate student and I have $25000 in old (last employer) 401k retirement. Growth been stagnant at 2.5% – 5%, which I am not pleased with. I want to transfer it to Roth IRA to avoid paying 10% penalty. I do realize that I will have to pay income tax on that money, but since I am a student and have no income it will be best time to do it. I can also use that as emergency fund or to pay off my higher interest credit cards. Do I understand this correctly? Will there be no penalty and I can pull out that money anytime I want to because I already paid income tax on it?

Thanks

Hi Dimitri – There is a 5 year rule on conversions, so if you make withdrawals to pay off credit cards, you will be subject to the 10% early withdrawal penalty on that amount (however you will have already paid the regular income tax on the conversion). You will be subject to the penalty for the first five years after the conversion.

What are the rules on withdrawals from the Roth IRA once you’ve rolled over a Roth 401(k)/403(b) into it? I’ve have a Roth IRA for over 5 years that I know I’m allowed to withdraw principal from tax-free at any point, even though I’m under 59 1/2. Is the principal from the employer-based Roth account also immediately withdrawable once it’s been rolled over, or are there limitations? I’m working out how feasible an early retirement would be, given where my various assets are.

Hi Emily – Unfortunately, since you’re under 59.5, you’ll be subject to the 10% early withdrawal penalty on your withdrawn contributions, as well as an earnings on the Roth since conversion. You may have paid the tax on the conversion, but it will still be an early withdrawal. Each Roth conversion has to stand on it’s own with regard to the 5-year rule. That means that the money converted must remain in the Roth for at least five years from the year of conversion in order to avoid the penalty. Of course, if you’re over 59.5, it becomes a moot point, and the penalty no longer applies.

Thank you for your reply, Jeff!

Ok, so once that money from the Roth 401(k)/403(b) has been in the Roth IRA for five years, then it’s accessible penalty-free even for those under 59.5? Or, that can’t be right… surely it’s just the parts that were actually contributions to the original Roth 401(k)/403(b), not everything that’s rolled over: contributions, interest and all. Do I have that right now though, that after 5 years in the Roth IRA, the principal from the Roth 401(k)/403(b) will then be accessible penalty-free even if I’m still under 59.5 at that point?

Are contributions from me vs. contributions from my employer treated differently here?

Is the principal that was in the Roth IRA and past its own 5-year mark pre-rollover still accessible penalty-free in the 5-year waiting period post-rollover, or does that action somehow trigger the whole percentage-interest rule on the whole account rather than just the converted portion?

Hi Emily – The contribution portion is available penalty/tax free after five years, but any portion representing investment earnings is subject to both tax and penalty if taken prior to 59.5, even if you’ve been in the plan for five years. The contributions from you and your employer don’t matter once you do the conversion – it’s all the same funds.

As to the last part, if I understand your question correctly, money held in the Roth originally, and past the five year period can be accessed penalty free, but contributions only, not investment earnings. Again, each conversion stands on it’s own, so the converted balance doesn’t affect the original funds in the Roth. I hope that makes sense.

I was recently laid off, but expect to go back to work. I have 2 separate IRA accounts, as well as 3 old 401K accounts that were never rolled over or closed. My wife also has an old Roth IRA. Can I convert some of my individual 401K accounts into Roth IRA’s ? My accountant said I could not convert portions of my IRA or 401K accounts individually. She said I could only convert IRA’s/401K’s to Roth IRA’s, if I convert all of them and pay tax on them. I do not expect my wife and I to earn near $194K this year, combined. We are both 62 years old. THX

Hi Mike – That sounds complicated. You might want to get a second opinion from another CPA. She may be referring to the pro-rata allocation of the rollovers if the accounts include both deductible and non-deductible contributions. But this article from the IRS says that you can do separate conversions.

I have a sole proprietor bizness and have a Individual 401k. I am the plan sponsor. I would like to roll the 401k funds into s Roth 401k or into my existing roth Ira. I understand that taxes will need to be paid and to keep your tax brackets in mind when considering how much to bring ovet to keep you from a higher taxes bracket. My question is can I run my bizness at a loss (buy Capitol assets, company vehicle) and deduct those from the taxable income from the rollover? Effectively alowwi g me to but more of the 401k into the roth without a higher tax bracket. Im well overdue for a new van.

Hi Eric – That’s a good accounting question, so I’ll refer you to your CPA for that answer. I don’t see how you can make 401k contributions from your business if it turns a loss, unless you’re a corporation and paying yourself a salary? In that case the 401k contributions can be based on the salary.

So I was laid off in Dec., had about $55K in 401K. I immediately transferred that to my Vanguard account and they put it in a regular IRA account. I already have a Roth IRA with them, can I add the $55K to my already existing Roth (conversion I would assume)? Will I face some taxes if I do? Little confused why I would get penalized any amount of my own 401K money? Kinda of newbie obviously.

Hi Teri – You sure can, and since the conversion will be between two accounts with the same trustee it will be as simple as it gets. Talk to Vanguard about the conversion. You will have to pay ordinary income tax on the conversion (since you got a tax break on the contributions and investment earnings) but there should be no early withdrawal penalty from the traditional IRA.

I am 66 and got laid off from my job. I now live on SS. I have a 401k with the former employer, and was wondering if I should roll the 401k into a Roth 401 k. What penalties would I acquire by doing this? It is all so confusing to me. Also, would I be able to get monthly payments from the Roth? Thank you for your time.

Hi Sandra – I don’t know if you can do a conversion to a Roth within the 401k plan since you’ve been laid off (I think probably not). You can do the conversion to a Roth IRA, and you will have to pay regular income taxes on the conversion. Since you are over 59.5, you won’t have to pay the 10% penalty on early withdrawals. Now depending on your tax bracket – which should be low if all of your income is Social Security – you may want to just roll the 401k over into a traditional IRA. There will be no tax on the conversion, but there will be tax on the income distributions that you later take. But again, if you’re in a low tax bracket, that may make more sense than doing a lump sum rollover of the 401k into a Roth at a higher tax rate. Please sit down with a tax preparer or CPA to crunch the numbers.

I have a 401k plan from my employer (retired, age 63) that has a “tax paid” component. Can I apply the tax paid amount to Net Unrealized Appreciation (NUA) to withdraw my company stock (at cost) and place in a Roth IRA, AND then place the remaining taxable funds in my traditional IRA? Is it an “all or nothing” situation” If so, is the ability to do that determined by a government regulation or a function of my employer’s plan rules?

Hi Bruce – An NUA is a different animal from a standard 401k rollover, and whether or not it will be to your advantage will depend on your tax bracket and any accumulated capital gain. Sometimes the NUA is the better course, sometimes it’s better to do a rollover, but it will all come down to specifics, which is to say that there are no general answers to the question. I’d recommend that you sit down with a CPA and consider your options.

This article does a number of people a disservice by first claiming that you must be separated from your employer, and second by claiming you must be 59.5. These rules do apply to many 401k plans, but many plans, like my Individual 401K, specifically allow in-service, non-hardship distributions, and distributions of employer contributions that have been held for two years without age restrictions.

Search “in-service, non-hardship distribution”.

I’m 59 yeas old with a 401k I left behind for years with an old employer (250k). Thinking about rolling it to a Roth IRA slowly to stay in the 15% tax bracket. I currently make 70k a year but contribute to my current 401k and with the married filing jointly exemption, pay taxes on about 50k. Current tax rates for 2016 Married filing jointly at 15% ends at 75,300. Should I roll over roughly 25k a year to a Roth year over year until it’s all moved? Realize this will take time but just trying to avoid taxes. Am I thinking correctly?

Hi Rob – I think you’re thinking absolutely the right way. You’re moving the money, while at the same time keeping a lid on the taxes, which is the way to do it. It’ll take you at least 10 years, but if you retire within that time, you should be able to move larger amounts as your tax liability falls. In the meantime, you will be knocking out at least some of the conversion in the next few years. Excellent strategy!

Hello- looking for a bit of advice as I have a traditional 401k of roughly 50k thats has been accumulating and losing next to nothing for about 3 years. Wondering if I may be better off rolling into a Roth IRA or just keep it holding at where it is at. I am 39 and this is just one avenue of retirement savings I have but one that I always scratch my head with. I do predict to earn more money as I age so wondering what a professionals outlook would be on getting this 50K to start earning more in returns year over year? Thanks

Hi Eric – The problem here isn’t the 401lk, but what it’s invested in that isn’t working. It will make sense to move it to another account if the investment options in the 401k are poor or very limited. Moving the money to a traditional or Roth IRA that’s self-directed, and where you can invest in wider investment options. Before making the move, first identify the reason the 401k isn’t performing well.

My wife had her $44,000 employer retirement plan, rolled over to a roth IRA in 2016, when the company was sold.She did not understand that now we would have to pay $11,000 in taxes on it this year. She already had a roth set up. Is it possible to transfer it to a traditional IRA taxes now?

I meant to say “transfer to a traditional IRA in order to avoid paying taxes now”

Hi Fred – You should first discuss that with a CPA, since it’s a delicate situation. There are provisions for Roth IRA rollover reversals known as “recharacterizations”. You have until the last filing date of the tax year of the conversion to do it, so please move quickly.

I’m a little late to preparing for retirement. I’m 29 and have about 7k in my 401k from my old employer that I was thinking of rolling over into a Roth IRA. Also have about 26k just sitting in savings that I’m planning on moving over to a high yield savings account. I just started a new job about 5 months ago making 95k yearly, so I really want to start preparing for retirement. What steps should I take and in what order?

Hi Josh – Nothing complicated here. With the new job, take the maximum 401k contribution you can, which should be 18k per year. That’s about 20% of your income so it’s a good foundation. Rolling over the 7k is a good strategy, since you will be able to withdraw the money if needed, or let it grow into tax free income at retirement. I’d say you’d be on your way at that point.

Thank you. Is it smart to make the Maximum contribution into my 401k even though my employer is not matching any percentage of what I contribute?

Josh,

Yes. The money that you contribute to your 401k is not subject to income tax, so it will be advantageous for you to contribute the entire $18,000/yr if possible.

I hope this helps.

Hi Josh – It can be, because in the end you’re still accumulating savings. However, if there’s no match, I’d also put some of the money into an IRA or a Roth IRA, if you qualify. That will help to give you investment diversification, and in the case of the Roth, income tax diversification. As the saying goes, never put all your eggs in one basket.

Josh, I am slow to replying but my suggestion would be first to contribute to your company match. Then I would evaluate your situation to see if you can lower your federal tax bracket. If that is not an option, then I would contribute to a roth-ira. Contributing to a roth after your company match gives you all the tax advantages. Right now, tax rates are very low and there is no telling how high they will be in the future, so paying tax now will benefit you now. But, make sure you get all your company match.

Is it possible to complete a 401K rollover to a Roth IRA piecemeal for a better tax advantage? For instance, is there say an advantage if you roll over less than $5,000 at a time as in no tax liability created?

Hi Jen – I don’t think so. Your tax liability is based on the amount rolled over annually, so you’ll have to add them all up at the end of the calendar year anyway.

This article is exactly what I was looking for–thank you. I need some some help in deciding whether to go Roth or tax deferred 403(b) and 457 plan. Here are some factors to consider:

(1) I’m in a high income-tax state,

(2) the withdrawals in tax-deferred 403b and 457 after retirement will be state/local tax-free,

(3) both 403b and 457 offer Roth and tax-deferred options (can also mix, x% and y%, but I don’t feel like mixing, for simplicity).

Currently I have an existent tax-deferred 403b account, but no 457 yet–planning to enroll ASAP.

(4) I am about 15 years before retirement but am far from my accumulation goal.

For each of the 403b and 457, is Roth or tax-deferred better for me?

[Another issue is, if in future I am to rollover a tax-deferred 403b to IRA and to Roth, it will not be state/local tax free any more, correct?]

Thanks in advance.

Hi Jean – Unfortunately there’s no quick answer here. It will all depend on your income and marginal tax bracket. If you’re at 30% or so the Roth will make sense. But if you’re at 50% you’re probably better off staying with the tax deductible plans. Personally, I like a mix of both, since it will give you mix of tax deductions now and tax-free later. Please sit down with your tax preparer to crunch numbers and see if this makes sense.

Very good article. I’m trying to figure out what tax implications would happen from rolling my 401k with $50,000 into a Roth. I think there will be crash so I want to just sit the money on the sideline then use it toward my advantage to buy stocks cheap in the IRA.

Hi Pat – The tax implications are that you will owe ordinary income tax on the amount that you convert from the 401k to the Roth IRA. Since we’re very close to the end of the year, you might want to split the rollover between 2016 and 2017, to spread the tax liability. Another reason this is a good idea is that $50,000 has real potential to move you into a higher tax bracket, where cutting the distributions in half over two years will be less likely to make that happen.

I have about 60,000 in “Post 86 after Tax” money in my 401K. Can I roll that into a Roth IRA without paying any income tax to the IRS? Since it is already been taxed, I should be able to just move it into a Roth IRA, right?

Hi Arthur – The amount of the contributions should be able to be converted without tax consequences, but the investment earnings will be taxable. The 401k trustee should be able to separate out the two numbers so you can correctly reflect them on your tax return.

My 401k is with Fidelity funds. Will i be allowed to rollover to my Roth IRA? Also, there is a limit of $5,500 for single people to contribute to Roth IRA each year. Thus, if i have 29k in my 401k and leave my job, then i will have to rollover the other 23,500 to traditional IRA? Thanks.

Hi Zylan – You should be able to convert the 401k into a Roth IRA, as long as you have been separated from the employer (though you have to check with the plan administrator to see if there might be restrictions). You should be able to covert the entire 401k. The $5,500 limit applies only to new contributions, not to rollovers.

Jeff Rose, your previous comment says, “The $5,500 limit applies only to new contributions, not to rollovers.” Do you mean conversions as well?

Hi Scott – Yes, rollovers and conversions have no dollar limit. The $5,500 limit is just on new IRA contributions.

I recently went back to school to train in a new field and have been out of work for the last 2 yrs, so I’ve had zero income. My partner filed me as his dependent as head of household these last 2 tax years. My old 401k from the previous employer is at Fidelity. I’ve had zero income so far for 2016 and I plan to re-enter the workforce sometime in the next month or 2 now that I’ve graduated. I want to move my funds to another company, possibly one like Betterment or Schwab Intelligent Portfolios, and have been thinking of moving to a Roth IRA instead of a traditional IRA. As I don’t want to pay taxes on that kind of conversion, is there anything about my current income & tax situation that would suggest now is a good time to consider such a move? My current 401k is valued around $130K.

Hi Anthony – It won’t be possible to convert $130k without creating a tax liability. But since you have no other income, now will be the best time. What you may want to consider is converting only as much of the 130k to a Roth as your prepared to pay taxes on, then moving the rest to a traditional IRA where you won’t have to pay taxes on the rollover. You may want to crunch some numbers with an accountant to find an acceptable amount to put into the Roth.

Thanks for all the great info. I have a 401K at a previous employer~$300K. I’m 37yrs old but was unemployed for 7 months of 2016. I now have a higher paying position which puts me beyond the Roth IRA contribution ability. So does it make sense to rollover the 401K into a Roth IRA to take advantage of the lower tax bracket this year (from being unemployed). How can I calculate the tax liability from conversion? Appreciate the help!!! Denis

Hi Denis – There’s no easy answer to this. A $300k rollover will create a large tax liability, despite the 7 months of unemployment. You might want to sit down with a CPA and get a tax projection based on the full rollover, then work from there. You may decide after careful analysis that you only want to convert a portion of it.

Hi Jeff,

I have a Roth 401k & a Roth IRA. I have a lil over $85,000 right now. I’m 30 yrs old. My company will allow me to roll over $48,000 into my Roth IRA. I was told I will be about to withdraw from it without penalty or taxes after has been there in the Roth IRA for 5 yrs. Does that sound correct? I have Fidelity

Thanks!!

Yes and no. The contributions you’ve made can be withdrawn tax free, but the portion that represents investment earnings will be subject to both regular income tax and the 10% early withdrawal penalty. The exception is if you are at least 59.5 at the time of the withdrawal, which you aren’t close to right now. Sorry it isn’t better news!

Jeff, I just reached 59 1/2 and am ready to start moving my 401K/IRA money to Roth IRA.

1) From all the notes from you, I gathered that I can ask an institute to institute rollover without withholding taxes(?). Does that mean that I will have to file taxes myself at year end, and would that cause any penalties?

2) Most of my money in 401K is in various funds. Do I need to sell the funds first, liquidate it to cash, then rollover?

Hi SP – You can pass on withholding, but yes, you will have to pay the tax when you file. If the rollover is large, you’ll be looking at a lot of taxes, and that may result in penalties. For that reason, you’re probably better off having the 401k plan withhold taxes for you.

As to needing to sell the funds, it will all depend on the policies of the Roth IRA trustee. Most will let you move securities, but it will take longer (than moving cash), and may involve higher fees. You’ll want to verify all of your questions with your 401k trustee and the Roth IRA trustee.

I just turned 61 in March. I was also just fired from my previous employer after 35 years on the job (long story). I have over 300k in the company 401K policy. Am I at risk to penalties or fees when rolling over to a Roth IRA or traditional IRA. I want to do so immediately. Also what IRA is best for me at this point in time? Id like to have access to those monies in the near future to gift to my children or even purchase some land. I have no mortgage to pay and can manage on $2,000 a month living.

Hi Thomas – You can always roll the 401k balance over to a traditional IRA, and there will be no fees, regular taxes, or penalties. If you roll it over to a Roth IRA you will pay regular income taxes on the amount of the rollover, but no penalties and fees. Since you are 61 (over 59.5) there will be no penalties no matter how you roll the money over. If you go with the Roth IRA, the taxes will be paid, and you can withdraw the money at any time. If you go with a traditional IRA, you’ll have to pay regular income tax when the money is taken out. Either way, you’ll have to pay income tax.

As to where to invest the money, if you’re looking to take it out in the next year or so, you’ll probably be better off with a fixed income investments. That will provide you with some income, but keep your principal balance completely safe. If you plan to withdraw it in less than five years, maybe go with a mix of fixed income and index funds. Just be careful with the index funds, as of there is risk of loss of principal if the market turns down.

Hi Jeff,

Will I have to pay tax in 2016 if I rollover $16k from a 401(k) from my former employer into a Roth IRA in 2016?

Does it make more cents for me to roll this 401(k) over into a Roth IRA or to leave it in the former employer’s 401(k) until I retire?

I’m 27 years old and expect to earn more in the future.

Dan

Hi Dan – Yes you will have to pay tax if you roll the 401k over to a Roth IRA. You can avoid the tax by keeping the money in the 401k. But since you’re only 27, you might be better off laying up some tax free income for your retirement by paying the tax now and moving the money to the Roth. Also, since you’re so young, you may need to withdraw the money early. You can withdraw your Roth contribution tax free, but not the 401k funds. It makes sense to go with the Roth.

Hi Jeff,

I’m 42 and didn’t invest like they told me to in my 20’s, so I only have about 10 grand saved from 2 previous employers’ 401(k)’s. I don’t really know if I’ll be earning much more in the future, since in my career path I’ve been barely keeping up with cost of living raises. My present employer offers a 401k and gives me 3% even if I don’t put money in, and I’m eligible for that soon, but I’ve heard it doesn’t do so good anyway. I’m the sole provider for my family and I’ve been working hard to pay down my mortgage and should be debt free in my early to mid-50’s.

Would it make better sense to just roll my previous 401(k)’s into a traditional one? Thanks!

Hi Gene – Yeah, I think I’d favor the traditional IRA over the Roth here. Since you’re talking about $10,000, the last thing you want to do is pay a tax on the rollover, further reducing the amount. Maybe when you can look to starting a side business, where you can use a solo 401(k) to fast forward your savings. It won’t replace savings not made since your 20s, but it will be the next best thing from where you’re at. Other alternative is to get a part-time job, and use the extra income to enable you to direct some of your full time salary into the 401k. This is a good time for creative thinking!

In a company sponsored 401k, can I do an in-service rollover to a Roth? Or does it depend on the Plan?

I do not qualify for a hardship withdrawal. If I can convert to a Roth, can I then withdraw the funds?

Hi Julie – It really depends on if the plan allows it. I actually did a post on the topic, but here are the highlights:

Rules on 401k In-Service Distribution:

1.First things first, you HAVE to be 59 1/2. No matter how much you dislike your current plan and you want to withdrawal it all, it’s not an option until then.

2.This doesn’t just apply to 401k’s. Any types of retirement plans will work, too. This includes 403b’s, 457″s and pensions, too.

3.Be sure to rollover the money to an IRA if you don’t need it. By doing a 401k in-service withdrawal you will taxed.

Check with the plan administrator to see if it’s permitted.

Jeff, My job played out in 2014. I had 5,450 dollars in a company 401k that i rolled into a roth in december of that year. New to the game, I thought the taxes were due after the next year 2015. Now i have to go back and amend the 2014 tax return to pay the taxes. Using the turbo tax, it looks as if my amount due is 1450 dollars on just 5,450 dollars. Our salary for 2014 was around 60,000 and the 401 of course was not included in the 2014 taxes. Does the tax amount -1450- sound correct to you, and do you have a % formula for calculating amended tax amounts? Thx

Hi Jim – $1,450 looks high to me too. At $60k, you’d be in no higher than the 15% marginal tax bracket. $1,450 looks more like 25% at least. Is it possible that TurboTax is including the 10% penalty on the distribution? Review the return carefully and see if that’s the case. You might want to contact TurboTax and get help with this. Otherwise you may want to have the 2014 amendment filed by a professional tax preparer. Something doesn’t sound right.

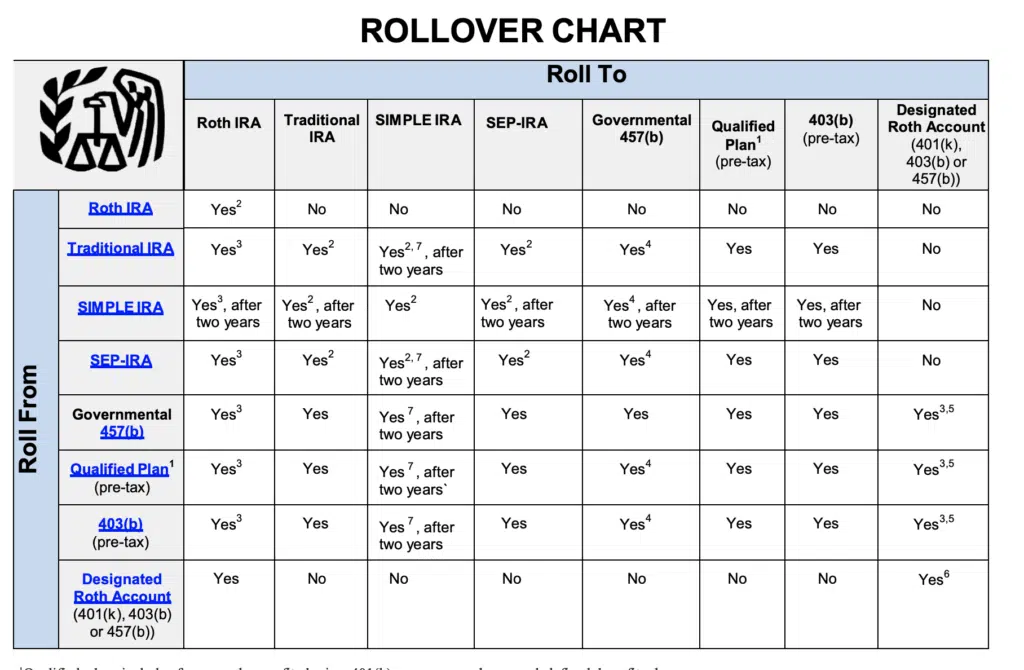

I became 70 years old this January, although I retired in 2008 I still have a 457 Retirement Account. Can I roll over the account into a Roth IRA? Do I have to pay taxes on the total amount of the rollover (not much $65.000). Thank you

Hi Indie – According to this IRS roll over chart you can roll the 457 over into a Roth IRA. But you will have to pay taxes on the amount of the rollover.

Remember that the contributions to the 457 were tax deductible, and that’s why you have to pay taxes on them when moving them to the Roth.

I am an independent consultant and have a Individual 401k. I am the plan sponsor. Can I cancel the plan, then roll the funds into s Roth 401k or Roth IRA. Then waiting 365 days, open a new Individual 401K for my business. Just want to know if this is legal in the eyes of the IRS. I really do not want to set myself up for an audit.

Hi Tony – In theory it sounds right, since you’re terminating the 401(k). But since it’s a solo 401(k), there may be different rules. After all, the plan is entirely within your control. This is a question you want to raise with a CPA, since it will require extensive tax research. Please don’t take this the wrong way, but it appears like a tax dodge (canceling then restarting your 401(k) plan), and that’s why you’ll have to tread lightly and legally. The penalties for making a mistake are substantial, so you’ll need verifiable evidence from an expert that you’re proceeding within IRS regulations.

Also, unless the funds are currently held in a Roth 401(k), you will have to pay regular income taxes on the amount of the rollover. There’s a lot to think about here, especially if the amount of the rollover is substantial.

i am 69 have started a roth ira i understand i have to wait 5 years to draw

i have a considerable amount in my 401 k , can i roll some after i am 70 1/2

to ease my cash burden in paying income tax

I’m 69 years old and still working. I have a 401K with present employer and have a 401K with previous employer. I’m in the 25% tax bracket. Should I consider rolling the 401K from previous employer to a Roth IRA or wait until I retire probably in two or three years.

Jeff, 2 months ago I contributed $11,000 to traditional IRA and right now I have around $20,000 – I made a profit of $9,000 – I am thinking about transferring money to Roth IRA.

Question: would I have to pay income tax on $11,000 or $20,000 if I

decide to do that?

Also I heard about some rule about changing my mind within 6 months if that is applicable.

Thank you

I have an old 401K with a former employer. I am working with a new job with a new 401K. My old 401K is thru Vanguard and gets a pretty good return however I need about $6,000 of the money to use towards needed expenses. My former employer will not allow me to withdraw any money unless I have a hardship withdrawal or unless I do a Roth IRA or request a check for the amount MINUS a heft tax balance is cut. I am currently 62 yrs of age. How can I access part of the money, without paying a hefty tax amount? Would I be able to roll my old 401K into a Roth IRA and NOT be taxed the enormous amount and just withdraw the $6,000 I need from the Roth-only to be taxed on that. I am just confused as to the rules and how to do things.

Is there ever a case when rolling over a 401k to a Roth IRA would not be a taxable event?

@Jessi If you have a Roth 401k and rolled into a Roth IRA then it wouldn’t be.

@JeffRose, Thank you very much!

I rolled over about 14k from a work 401k into my Roth last year. I still work for the company, but they were doing away with the 401k so I had to either cash out or roll it over. I have heard from a couple of people that you can divide the taxable amount over 2 years, is this true? My tax bracket right now is 28%, but next year it might possibly be only 25% so it might make a bit of a difference, although the amount isn’t all that much.

Great article but I wanted to point out: you mention in the article that if the former employer issues a check the money is taxed. This is not necessarily the case. Most administrators issue a check to make distributions from 401(k) and they are often sent to the participant. They are not taxed and the participant is not obligated to deposit the check within 60 days if the participant requests a rollover and the check is payable to the rollover institution (For Benefit Of/FBO) the participant. This is still a direct rollover as the check is not payable to the participant but the rollover institution and the participant would be unable to cash the check.

I want to convert my 401K from my former employee to a ROTH IRA. Can I pay the income tax on the conversion using funds from the 401K without getting a 10% early withdrawal penalty?

Also, it seems like the 20% the former employer withholds and sends as a check back to me needs to be deposited into the newly opened ROTH within 60 days. Can that money just be used to pay for the income taxes or does the money need to come out of my savings, etc.

Basically I’m trying to figure out whether I can pay for the income taxes on converting to a ROTH with the principal I contributed to my 401K without having to pay an additional penalty for what may seem like early withdrawal.

I was told if I rollover my 401k to a Roth IRA I can not make a withdrawal for 5 years without paying a penalty. I can not find this information anywhere. Is it true?

Hi, Jeff. Sorry for such a late question but I can’t figure this out for sure anywhere (and I’m a financially-savvy guy!) and you seem like you like to teach this stuff.

If I’m doing a traditional 401k to Roth IRA rollover, what’s the deal tax wise?

It makes sense that you’d owe taxes since you’re going from pre-tax to post-tax, and everyone talks about either having the 401k plan withhold OR transferring the full 401k balance and paying the taxes out of pocket.

However on the other hand, I’ve seen people saying rolling over the full balance is not a “taxable event”. And you said in a comment above for someone rolling over 45k and withdrawing 5k: “You would be taxed just on the portion you pulled out of the IRA. So in your example, the $5000.” These seem contradictory, unless they’re assuming traditional IRAs.

So how does it work? And is it possible at to pay the taxes from the existing balance so your current cash isn’t affected (say by having the 401k withhold 20% and only putting 80% into the IRA)? Or would you have to pay a 10% penalty on the tax portion?

I had $300.000 ($100,000 after tax, $300,00 pre tax) in my company 401 plan. I was originally told that I could rollover the 100,000 after tax dollars directly into a Roth Ira and the $200,000 of the pre tax dollars directly into an IRA, which I did. I now have serious doubts that I was legally able to do it that way. At this point what should I do?

I have a rollover Ira. Can I do a Roth IRA with this and then start contribution to it?

I have been drawing from my 401k montly payment after been inform I could not get all at one time. Can I have it put into a Roth IRA and draw out some money because of hardship

I have 401k from employer that I need roll over

to a traditional IRA. In this plan there are after-tax monies that I would like

to roll over to a Roth IRA. What would tax penalties be if I roll the after tax

monies to a Roth. My company will send separate checks to differentiate

the pre-tax from the after tax funds.

I am 30 years old, just left my job and have about $40k in the 401k plan. While funding the 401k to the company match, I have also been fully funding my Roth IRA. Can I rollover the 401k plan to an IRA since I already fund it? If not, what other options do I have?

@ Harvey If you rollover your 401k to the Roth IRA you are in essence doing a conversion. That means you’ll have to pay tax on the $40k that you rollover. (note: not all 401k plans allow you to do a direct rollover to a Roth IRA. You might have to open a traditional IRA first then convert to a Roth)

My current job will end soon. I have two retirement accounts with my current employer, one is a mandatory retirement plan (401K) and the other is a voluntary retirement plan (403b). Can I do a rollover IRA for both of them to the same new rollover IRA account?. Will this have any penalties or fees?. I have this doubt because I read at the IRS web page that “only one rollover is allowed every 365 days”.

Thank you!

@ Maria What you read refers to “IRA to IRA rollovers”. Since you are rolling over from a 401k and a 403b, this would not apply. Plus the new rule does not take place until Jan 2015.

I rolled over my Roth 401K into a Roth IRA in October 2013. I was then laid off from my company with a great severance which drastically pushed up my income for 2013 and consequently my taxes for 2013. I want to recharacterize my Roth contributions (initially made to the Roth 401K and then rolled over to the Roth IRA). Can someone help me with how to do that? Specifically I’m wondering what is the ‘date’ on which the contribution is considered to be made? Since it was through payroll contributions throughoutthe year into my Roth 401K and then rolled over.

@ Sam Your custodian where you have the Roth IRA should be able to assist with that.

I am 66 years old and have a $500K IRA account balance. Want to roll it to Roth IRA and be able to make annual withdrawals of appox $50K for next 15 years. Is a Roth IRA right for me?

@ Rusty

Hard to say without knowing more on your situation (current tax rate, your projected tax rate, your investment strategy, goals with the money, etc). If this is purely for income for you to live off of, then most likely not. If this is more for legacy planning, then possibly.

I am 36, and leaving my current employer with $55k vested dollars. My new employer will be contributing 5% of my salary once a year to their pension plan. My understanding is that I will be 100% vested from day one. My concern is that I will not be able to roll my 401K into my new company’s pension plan. If this is the case, should I roll my $55k into a Roth IRA?

@ Laura It’s really hard to say without knowing your age, your tax bracket, investment strategy, etc. Use the Roth IRA Conversion calculator in this post and it should give you some guidance.

My company closed on dec 28, 2013

I have a 401k worth about 160k.

What should I do next.

I’m 50 yr old.

I will be getting future employment.

@ Don If you’re asking if you should convert your 401k into Roth IRA, my initial thought is no. I think the taxes would be too much and since your company just closed, you should keep as much cash on hand as possible.

I would definitely consider rolling your 401k into a traditional IRA, though.

Nice video… both ROTH IRAs and Traditional 401ks have benefits. I like to use both to provide some flexibility in the future.

Jeff good post, especially when you say there is no right answer.

There are a few young people in their 20’s who I encourage to do the Roth because they should be saving at least a little bit (form the habit). Their income will go up. Some of these will be paying no tax now, but if they put it in the 401k now they will be paying at least 25% later.

The other advantage is they can take out their contributions. My son almost needed to do this for a down payment on a house. It could also come into play if you retire early, and need to withdraw cash without penalty.

I like your videos. I wonder if a chart or some sort of listing (visual) would help emphasize your points. Good work keep it up.

Nice point on double checking with a CPA. Generally I agree that taxes will likely be higher in 20-30 years, especially because I expect my income to be higher…which is why I contribute to a ROTH IRA. Having said that, it may make sense to bring taxable income levels down via traditional 401k contributions. thanks for the video!!!

Jeff, that is a great quality video! I’m really impressed. All of the different cuts with different zoom factors make it a little distracting though…

That is a really awesome calculator above, how did you get it into wordpress?

Hey Jeff I think its great that more people in their 20’s are thinking about their retirement. Every little bit helps like you mentioned even a 20,50, or 100$ is a lot when you are in the early stages. Really enjoy the Dollars and Cents reader questions!

I wanted to throw in a short blurb about the Roth 401k. While they’re a new animal (only around since 2006), they’ll likely become popular quickly. The differences between a 401K and a Roth 401K are nearly the same as the differences between an IRA and a Roth IRA. If your employer offers one, remember that the Roth 401K will give you much more flexibility around withdrawing money and will also allow you to withdraw tax free distributions at retirement. For the record don’t withdraw money until retirement! But it’s nice to have the option in case of emergencies. Obviously you also lose the tax deduction advantage up front, but most people finish their careers in a higher tax bracket than they started anyway. This is a particularly strong option for career minded people that are likely climb the corporate ladder getting raises all along the way, you’ll definitely finish in a higher tax bracket so this should be a no brainer for you.

Hi Jeff, I will be 67 in coming August and plan to retire as of August 1. I am an union member and have annuity account ($38,000), all money have been contributed by my current employer. Additionally I have 401k ($21,000) with my former employer. I already have established Roth IRA account for over 8 years. If I roll over annuity and 401k to Roth IRA what are the tax consequences. My 401k and Roth IRA accounts are held by the same bank.

Thank you for your advice.

@ Alex

The annuity total plus your 401k total would be added to your AGI for the year and that’s how much tax you would pay. If you plan on doing this, I would wait until next year when you have no income from your current job.

If you rollover a 401k into an IRA is this amount subtracted from what you are able to contribute that year? So if I rollover my 401k next year if I leave my current employer, will I still be able to contribute to my IRA as usual up to the limit or will the rollover affect this?

Hey Faith,

Finally got a chance to answer your question here: https://www.goodfinancialcents.com/does-rolling-over-401k-affect-roth-ira-contrbutions/

I’m really confused about one thing here.

Say I have $30k in a 401k and choose to convert to a Roth IRA.

Do I end up with $30k in the Roth IRA and then pay taxes at the end of the year on $30k I converted.

OR

Do I pay taxes on the $30k I converted and end up with ($30k-tax bill) in the Roth IRA?

To me that seems to be a pretty important distinction that nobody mentions.

Hi. I am 64 earning approximately$86k; I plan to retire in 6 months for health reasons.

Here are two scenarios I am looking at:

1. Keeping 401(k) balance from my job after they take mandatory 20% for taxes. How much in taxes do you figure I would have to pay Uncle Sam when I next file my return?

2 . Transfer my 401(k) currently worth approximately $165k to a Roth IRA, but keep around $25k before transferring to Roth. Will the $25k be considered salary and I would need to declare on my tax return? Unfortunately I could use the extra cash for bills. Thank you.

Naomi – withdrawals from 401(k) or (traditional) IRA are taxed at your marginal rate. 25% for taxable income over $36,250 in 2013. The same tax is due when converting to Roth.

I strongly suggest you do neither of these this year. 6 months puts you at the end of October. This year, transfer (directly to a broker, do NOT have the employer withhhold tax or send yo a check) the 401(k) to an IRA. That’s it.

In Jan 2014 you start from zero income, and have a standard deduction and exemption adding to $10,000. So waiting till January puts the tax bill on a $46,250 withdrawal at $4,991, vs the $11,500 you’d pay this year.

Last – if you don’t need that money, say you only take out $26,000. You can convert some more (up to $20K, staying with the numbers above) and it’s a 15% marginal tax bracket you’re in.

Of course this answer depends on what other income you have, such as a pension, or investment income, etc. A generic nswer based on how much info you shared.

A person has a Roth 401K from his previous employer that contains contributions and gains from an employer match that he is vested in. He wants to rollover the entire account to a Roth IRA. How are the employER matches and gains treated?

HI,

I have an exiting 401k from both my ex employers and wanted to convert it to a roth ira. Is there a fee involved on this?? Also, do I need to open a traditional ira first then transfer to a roth ira? Please help me

I am 42 and recently left my former company and am looking at rolling my Fidelity 401k into an IRA. The current amount is 260k and my contributions were all before-tax dollars. From the research that I’ve done so far, it looks like my best options at this time would be a Traditional IRA (because I don’t have the funds to pay taxes right now out of pocket) or possibly a Solo 401k as I am now self-employed. It is a partnership and the only other “employees” are my self-employed partners. If there would be a possibility of actual employees down the road, would that rule out the Solo 401k now? And if I went the Traditional IRA route now, could I convert that slowly into a Roth IRA by paying the taxes out of pocket in smaller amounts? Any advice would be greatly appreciated.

Hi Keith. Congrats, first, that’s a nice chunk of change, and I’m glad you’re carefully reviewing your options.

There are pros and cons to either choice. If the Solo 401 doesn’t have a Roth option, the slow conversion you suggest may not be possible. Based on that, the flexibility the IRA transfer gives you may make this option the right one for you.

Note – even if the 401(k) offered a Roth 401(k) side for conversions, the ‘recharacterization’ is not available. For someone in your situation, I suggest a bit of strategic planning. If you think you wish to convert $20K this year, open two Roth IRA accounts, convert a different asset into each one. Next year, recharacterize the one that underperformed. Unless they both went down in value, in which case, you might reverse both conversions. (Of course, if they both shot up in value, you might wish to leave both converted. Nice to pay tax on $20K, but see $30K in the Roth account)

I rolled my 401k (Pre-tax) to my Roth IRA. I rec’d a 1099-R showing the full distribution as taxable in Box 2a and Distribution Code “7”. This code indicates a rollover of Pre tax $$ from a qualified plan to a “traditional”IRA therefore when I filed my taxes using a tax software it doesn’t “tax”the amt shown in box 2a. Shouldn’t the distribution code be “2” so that the software will recognize that I owe taxes and prep my taxes correctly? I know I owe these taxes and if I ignore the fact that my 1099-r wasn’t done correctly, I’m sure it’ll catch up w/ me eventually.

Thanks for your thoughts,

Sandy

i would like to know if this is my best option to reduce my taxes. i have 150k in an old 401k. i make less than 20k and i’m in the 15% tax bracket. i would like to have this in a roth ira. i would need to transfer the 401k to a traditional ira. then covert enough money to a roth ira, being careful not to enter the 25% bracket (roughly36k). so i could convert about 16k, right? also, i will be starting a new 401k. will the amount i put into the new 401k reduce my taxable income and can i transfer that difference as extra money from my converted ira into the roth ira?

James –

From an IRS Q&A –

How can I recharacterize an amount rolled over to a Roth IRA from an employer-sponsored retirement plan?

You can only recharacterize amounts rolled into a Roth IRA from an employer-sponsored retirement plan by transferring them to a new or existing traditional IRA, and not back into the plan from which they were distributed.

Hopefully, you did the conversion in 2012, not 2011. If so, you are golden. You can recharacterize to a traditional IRA, and the result is the same as if you simply transferred the 401(k) to the IRA as you wished you had done.

Hi Jeff. I lost my job in Dec 2011 and had left my 401k with my old employer until i heard the company was tanking and would either sell or fold. Because of this i decided to move my money until i could put it in my new company’s 401k. Unfortunately i guess i didnt do enough research and moved it into an ING Roth IRA. I guess i should have moved it into a traditional IRA because now I cant transfer it into my new 401k and I just got a 1099R to pay taxes on it ugh. I wish i just left it where it was but is there anything i can do to move it without paying taxes?

Jeff

I’m 62 and have an active 401k at work, I also have a Roth with another financial company that is now in it’s 5th year. I would like to start converting $6500 of my 401k to my Roth every year for the rest of my employment so I can start paying taxes on the pre-taxed 401K funds and move the funds trustee to trustee. I am fully vested. can I do this.

thanks.

Thanks! I feel more educated on my options now!

Chanel – a transfer from like-status accounts produces no tax issue. i.e. a transfer from a pre-tax 401(k) to a traditional IRA results in no tax due. It’s only when a pre-tax flavor is converted to a Roth Flavor there’s a tax bill.

Hi Jeff,

I am 26 yrs old and have a little over 20k in my 401k with my company (who matches). I have two questions:

1.) I am currently in the midst of starting a new job in Feb (this company does NOT match) should I utilize a ROTH IRA instead of contributing to their 401k?

2.) Should I rollover my current 401k into a ROTH IRA?

@ Chanel

Congrats on getting a head start on your future. Keep it up! 🙂

It’s tough to answer your questions, but here’s some initial thoughts that come to mind.

1. How are the investments in your new 401k? If they are solid, I would lean that way. If not, go towards the Roth IRA. You could also do a combination of the two so that you have some pre-tax money and tax-free money. There really isn’t a wrong or right answer.