The best mortgage lenders offer a variety of benefits that help them stand out, from low-interest rates to reasonable closing costs.

Most of the top lenders also make it easy to shop around and compare mortgage rates online and from the comfort of your home, and many specialize in mortgage loan products that help first-time buyers ease their way into homeownership.

If you’re shopping for a new home or you need to refinance the mortgage for a property you already own, you should find out which mortgage lenders offer the best loans and terms.

Keep reading to find out which lenders beat out the others to get on our list of the best mortgage lenders for 2024.

Table of Contents

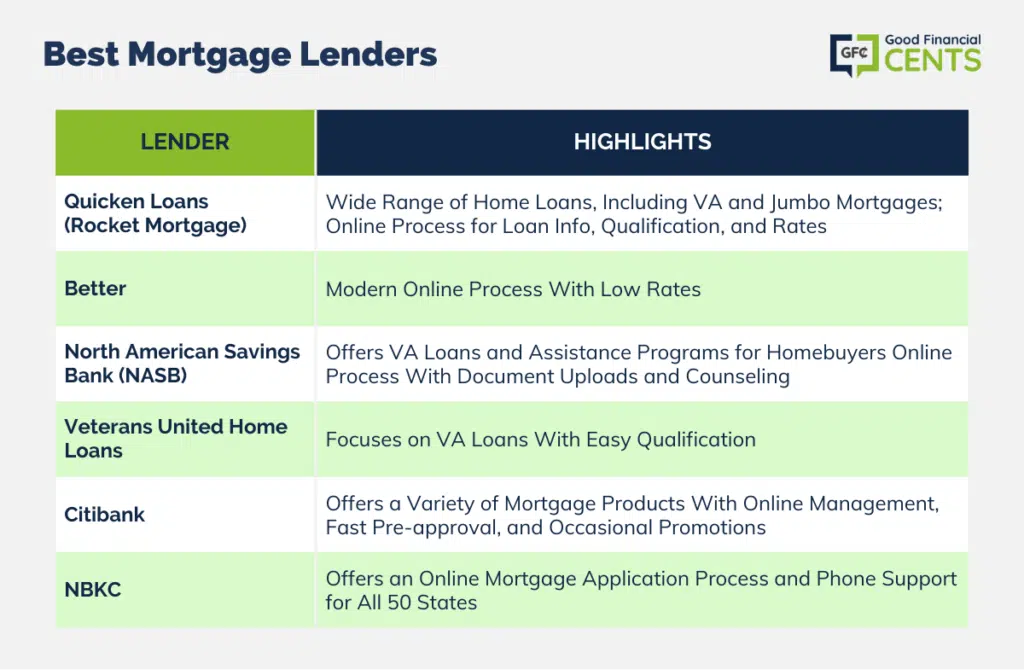

Our Picks for Best Mortgage Lenders of July 2024

- Quicken Loans (Rocket Mortgage) – Best Overall

- Better – Best for Streamlined Process

- North American Savings Bank (NASB) – Best for First-Time Homebuyers

- Veterans United Home Loans – Best for VA Loans

- Citibank Mortgage – Best for Citibank Customers

- NBKC Bank – Best for Subsidized Loans

Best Mortgage Lenders – Company Reviews

Quicken Loans (Rocket Mortgage) – Best Overall

Founded in 1985, Quicken Loans has grown to become one of the largest mortgage originators in the United States. Be aware that the company officially changed its name to Rocket Mortgage in 2021, so both names are used interchangeably.

Either way, Quicken Loans (Rocket Mortgage) offers a wide variety of home loans of all sizes, and they specialize in both purchase loans and home refinancing products. They’re authorized for VA mortgage lending and other federal loan programs, jumbo mortgages, and adjustable or fixed-rate plans.

The Quicken Loans website makes it easy to find out what kind of loan fits your needs, how much you can qualify for, and what kind of interest rate you’ll pay. However, you can also call in to speak with a customer service representative who can answer your questions and give personalized mortgage advice.

The best part? Borrowers can complete the entire mortgage process online from start to finish. Quicken Loans (Rocket Mortgage) also earned the top spot in J.D. Power’s 2023 U.S. Primary Mortgage Origination Satisfaction Study.

Better – Best for Streamlined Process

Better was originally founded in 2014, and the company stands out from the crowd as a modern solution to a complicated process. The entire mortgage process is completed online when you choose Better, so you don’t have to work with a mortgage representative or visit an office in person.

While Better doesn’t offer some products, such as HELOCS or VA loans, its rates are quite low, thanks to investor-matching technology. Further, Better received above-average customer satisfaction scores from J.D. Power. Finally, it also has an average star rating of 4.13 out of 5 stars among more than 1,100 customer reviews shared with the BBB.

North American Savings Bank (NASB) – Best for First-Time Homebuyers

North American Savings Bank (NASB) was originally founded in 1927, and the company maintains its headquarters in Kansas City, Missouri. They have since grown to become a major provider of various home loan products, including VA loans for eligible military members and veterans.

NASB offers several mortgage assistant programs geared to first-time homebuyers as well, including a program called Home Buying Advantage and a Zero Down Home Loan Program. The company also offers a seamless online mortgage process with the option to monitor your loan through an online dashboard and upload your required documents through their portal.

Once you negotiate a successful offer on a home you want to buy, North American Savings Bank even offers personalized counseling to help guide you through the process.

Veterans United Home Loans – Best for VA Loans

Veterans United Home Loans is a highly rated mortgage company that focuses on VA home loans, which are only available to veterans, certain active-duty military, and qualifying spouses. These loans let you qualify for some of the lowest mortgage rates available today with easy qualification requirements. Borrowers can use their VA home loan benefit to purchase a home or to refinance into a home loan with better rates and terms.

Veterans United also boasts some of the best rankings of all mortgage companies in J.D. Power’s 2022 U.S. Primary Mortgage Origination Satisfaction Study.

In fact, it scored 905/1,000 possible points, earning the second spot only behind USAA. Veterans United also boasts an average star rating of 4.82 out of 5 stars across more than 1,900 reviews shared with the BBB, where the company is accredited with an A+ rating.

Citibank Mortgage – Best for Citibank Customers

Citibank is known for its checking and savings accounts as well as its top credit card offers, but this bank also offers a variety of mortgage products. Not only does it offer purchase loans for buyers who are looking for a new home, but it also offers refinance loans for homeowners who want to trade their mortgage for a new one with better terms.

The company lets customers manage the bulk of their mortgage process online, even making it possible to qualify for a $500 credit at their mortgage closing. It also promises fast pre-approval with its SureStart® program, which can help you secure a deal on a home when you make an offer.

Citibank also offers periodic promotions for its mortgage products, which may include a specific amount of your closing costs and lower interest rates for existing Citi customers.

Overall, Citibank is worth exploring — particularly if you bank with it already.

NBKC Bank – Best for Subsidized Loans

NBKC was originally founded in 1999 as the National Bank of Kansas City, yet the company has changed its focus to online banking since its early days. The bank currently focuses on subsidized loans, plus VA loans for military members, veterans, and eligible family members.

While in-person customer service is available only in Kansas and Missouri, the bank’s phone support makes its services available to customers in all 50 states. NBKC also promises a fully online mortgage application process, although you may need to speak with an agent to get a rate quote based on your home’s value and where you live.

Finally, it’s worth noting that NBKC has an average star rating of 4.85 stars out of 5 across more than 1,400 user reviews with the BBB. The company is also accredited by said agency, and they have an A+ rating to boot.

Mortgage Loan Guide

As you take the time to compare the best mortgage lenders, it’s smart to learn as much as you can about the application process, the different lenders, and your various loan options. Read on to learn more about mortgage products and how they work.

How Do Mortgages Work?

When consumers take out a mortgage, they borrow a specific amount of money and agree to pay it back over time. Generally speaking, buyers need to have a down payment to purchase a home, and they’ll be charged an interest rate on their mortgage that’s based on an annual percentage rate (APR).

The mortgage loan is backed by the equity in the home they’re purchasing, so borrowers can lose their home to foreclosure if they fail to keep up with their monthly payments. That said, homeowners also build equity in their homes as they make payments over time, and they will own their property outright once the final mortgage payment is made.

Mortgages come in many different forms and may include fixed-rate mortgages, adjustable-rate mortgages, and other home loans geared to veterans and first-time homebuyers.

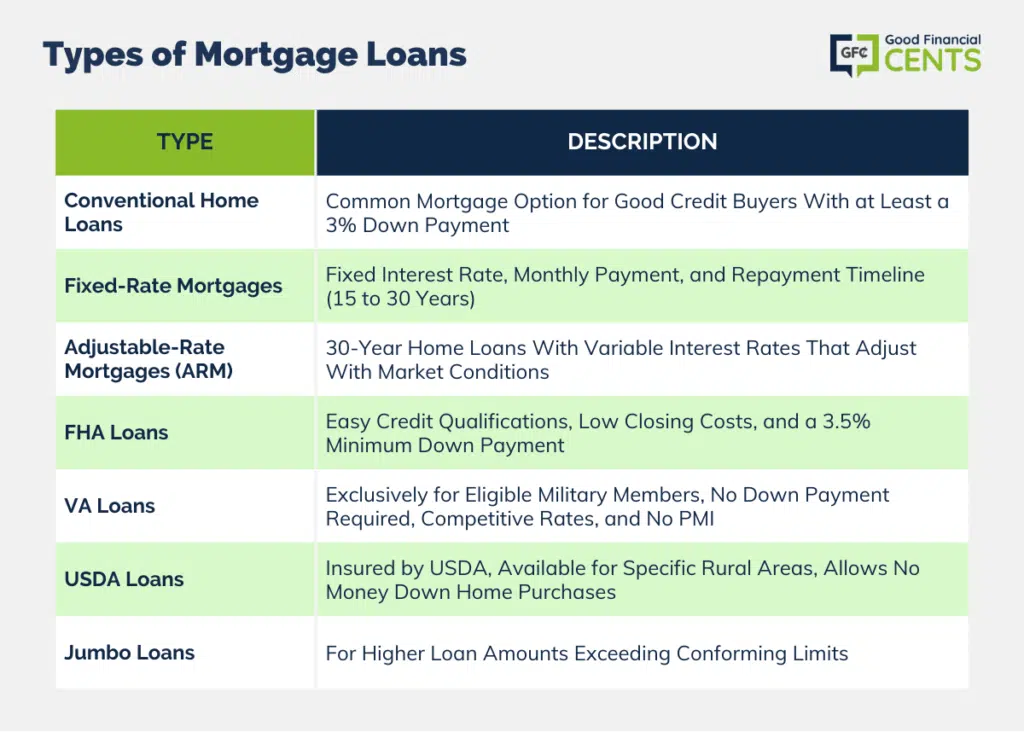

Types of Mortgage Loans

There are many different loan products for potential homeowners, with some geared specifically to certain types of homebuyers. The main loan options available for a home purchase or refinance are highlighted below:

- Conventional Home Loans: Conventional home loans are the most common type of mortgage, and they are geared toward consumers with good credit and a down payment of at least 3%.

- Fixed-Rate Mortgages: Fixed-rate mortgages offer borrowers a fixed interest rate, fixed monthly payment (principal and interest), and a fixed repayment timeline that usually lasts 15 to 30 years.

- Adjustable-Rate Mortgages (ARM): ARMs are 30-year home loans that come with interest rates that can change with market conditions. With a 5/1 ARM, for example, you pay a competitive fixed interest rate for the first five years, followed by an interest rate that adjusts with market conditions.

- FHA Loans: Federal Housing Administration home loans let borrowers get a mortgage with easy credit qualifications, low closing costs, and a down payment as low as 3.5%.

- VA Loans: Veteran’s Authority home loans are only for eligible military members, and they come with no down payment requirement, competitive rates, low closing costs, and no requirement for private mortgage insurance (PMI).

- USDA Loans: United States Department of Agriculture loans are insured by the United States Department of Agriculture, and they help eligible borrowers purchase homes with no money down in specific rural areas.

- Jumbo Loans: Jumbo loans are mortgages that are for higher amounts than conforming loan standards in your area. In most parts of the country, the 2024 conforming loan limits are set at $766,550 for one-unit properties.

How to Apply for a Mortgage

Whether you’re buying a home or hoping to refinance a mortgage you already have, there are several steps required to move through the process. Once you check your credit score and confirm you can get approved for a mortgage, follow the steps below to apply.

- Step 1: Research Mortgages to Find the Right Type. The first step in the process is figuring out the type of home loan you want, as well as which type you can qualify for. While you can research on your own, speaking with a mortgage expert to find out which type of loan is suited to your needs can help.

- Step 2: Compare Multiple Lenders. Once you decide on the type of home loan you want, you should take the time to compare multiple mortgage companies and lender offers. Not only should you read over user reviews and rankings, but you should also compare lenders based on their advertised interest rates and loan fees.

- Step 3: Get Pre-Approved. Next up, take the time to get pre-approved for a mortgage. This step can be completed entirely online, although you’ll need to provide some information, such as your employment history, your income, and your credit score.

- Step 4: Start Shopping for a Home. Once you’re pre-approved for a mortgage, make sure you have a preapproval letter handy as you begin shopping for a home. This letter should clearly state the loan amount you’re pre-approved for, and it can help you stand out from other buyers when you’re making an offer on a home.

How to Get the Best Mortgage Loan Rates

Several steps can help you qualify for the best mortgage rates and loan terms, including the following:

- Improve Your Credit Score: If you are able to improve your credit score so it falls into the “good” range or better, you’ll be in the best position to qualify for competitive mortgage rates. Having good credit typically means having a FICO score of 670 or higher.

- Pay Down Debt: Paying off unsecured debts can help lower your debt-to-income ratio, which is a major factor involved in qualifying for a mortgage.

- Compare Multiple Lenders: Shopping around with more than one lender is one of the best ways to find the best rates. If you want to save time, consider comparing mortgage rates with a comparison site like LowerMyBills.com.

- Shorten Your Loan Term: Generally speaking, you’ll qualify for lower mortgage rates if you choose a shorter loan term, such as a 15-year fixed-rate mortgage instead of a 30-year home loan.

- Pay Discount Points: In some cases, you may be able to pay discount points that let you lock in a better mortgage rate. These points require a flat upfront fee, and each point can lower your mortgage rate by 0.25% on average.

How We Found the Best Mortgage Lenders

To find the best mortgage lenders of 2024, we compared companies based on features such as their online functionality, customer service options, and third-party ratings from organizations such as J.D. Power and the Better Business Bureau. We also looked for mortgage companies that offer several loan options, including conventional mortgages, VA loans, FHA loans, and more.

Last but not least, we sought out lenders that offer competitive interest rates and loan terms, as well as those that are upfront and transparent about their fees and processes.

Summary of the Best Mortgage Lenders of 2024

- Quicken Loans (Rocket Mortgage) – Best Overall

- Better – Best for Streamlined Process

- North American Savings Bank (NASB) – Best for First-Time Homebuyers

- Veterans United Home Loans – Best for VA Loans

- Citibank Mortgage – Best for Citibank Customers

- NBKC Bank – Best for Subsidized Loans

Leave a Reply