Do you remember the first time you wrote a check for $100?

The first $100 check I wrote was for my cell phone waaayyy back in 1997. Whoa…that brings back memories. At that point, it hadn’t even occurred to me to invest the 100 dollars – I was just happy to have my cell phone!

What about your first $100 check? Or your first $1,000 check? I bet you weren’t wondering how to invest $1,000 dollars then, were you? Even better, your first $10,000 check?

The first time I wrote a check for $10,000 was to pay off my student loan debt. That was, by far, the best check I ever wrote! For me the choice was clear, but where to invest $10K isn’t always an easy decision. I’m here to help!

If you’re looking specifically for short-term investment ideas, we have suggestions for those, too. Or, if you have more to invest, check out the best ways to invest $20,000 dollars!

Table of Contents

- 1. Invest in a High Yielding Savings Account or CDs

- 2. Auto-Pilot Investing

- 3. Real Estate

- 4. Buy Bitcoin

- 5. DIY Stock Market

- 6. Your Home

- 7. Inflation Hedge

- 8. Coaching Programs

- 9. Getting a Designation

- 10. Going Back to School

- 11. Online Courses

- 12. Starting Your Own Business

- 13. Starting a Blog

- 14. Launching a Podcast

- 15. Resell Products on Amazon FBA

- 16. Your Old Hobby: Sports Cards

- 17. Pay Off Debt

- The Bottom Line – Investing $10,000

- FAQ’s on Investing $10,000

- How to Invest $10,000: Step-by-step Guide

1. Invest in a High Yielding Savings Account or CDs

If you want to be completely safe, you can invest the money in high-yielding CDs or a high-interest savings account. These days the best rates are coming from online banks.

For example, CIT Bank offers its Savings Builder Account. You can open an account with a minimum of $100, and secure an APY of up to 4.05%. Another option is Save Better which is currently paying 5.51% with no minimum deposit.

Online banks have all of the advantages of traditional banks, including debit cards and ATM access.

Your deposits are covered by FDIC insurance for up to $250,000. And you have all of the benefits of dealing with a reputable bank because that’s exactly what these online banks are.

5.51%

Interest Rate

varies

Min. Initial Deposit

2. Auto-Pilot Investing

If you want to put your money into a virtual autopilot situation, a robo-advisor may be exactly what you’re looking for.

M1 Finance

M1 Finance is a brokerage where you can invest in stock and ETFs for no fees. This gives them the largest number of no-fee stocks and ETFs of any brokerage online.

What puts them in the Robo-Advisor category is that they have pre-made and managed portfolios where you can invest your money, still with no fees, automatically. You can also create your own auto investments, making M1 Finance one of the more versatile ways to auto-invest.

- Commission-free investing

- Allows fractional shares in stocks, ETFs

- Small minimum investment: $100

Betterment

What Is Betterment? It’s an online investment management platform, often referred to as a robo advisor, because everything is handled automatically for you. Investment selection, asset allocation, rebalancing, tax-loss harvesting – it’s all done for you, and at very reasonable fees.

For example, the annual management fees are just 0.35% – or $35 – on an account up to $10,000. And it drops to 0.25% when you exceed $10,000, all the way down to 0.15% when you reach $100,000.

$10k won’t buy you much in the way of diversification with individual stocks, but it will be plenty with Betterment.

3. Real Estate

Real estate is an excellent investment, no doubt about it. But $10,000 isn’t enough to make a down payment on the purchase of an investment property these days, not in most markets (unless your my buddy that’s mastered buying real estate with no money down). But that doesn’t mean that you can’t invest in real estate.

One way to do it is through real estate investment trusts (REITs). These investments have several advantages over owning property outright, including:

- High Liquidity: you can buy and sell shares in REITs much the same way you trade stocks

- Diversification: REITs represent a portfolio of commercial properties or mortgages, rather than in a single piece of property or mortgage

- High Income: the dividends paid by REITs are usually well above the dividend yields on stocks, and in a different stratosphere compared to certificates of deposit

- Tax Advantages: REITs don’t sell properties nearly as frequently as mutual funds sell stocks; the net result is much lower capital gains

You don’t have to get your hands dirty – anyone who has ever owned an investment property can appreciate this advantage

There are plenty of REITs to choose from out there. The internet has made it extremely simple to get started in REITs.

One of the most popular is Fundrise. If you want to get investing in real estate, Fundrise is hands-down the easiest way to do it.

They walk you through the application process and then allow you to browse through all of the possible investments you can put your money in.

They have a $500 minimum investment, which is the smallest you’ll find. With just $500, you can get use their Starter Portfolio. With this portfolio, your money will be put into several REITs. It’s a great way to get instant diversification.

One of the key benefits of using Fundrise is the low fees. Most investors pay 0.30 to 0.50 in their invested capital in fees every year. This is a great way to invest your money without your returns being eaten by fees.

If you prefer to own property, you can consider pooling your $10,000 with one or more other investors, and buying an investment property outright.

4. Buy Bitcoin

Whether you are crypto-curious or think that cryptocurrency is the future now might be the right time to finally buy into Bitcoin.

I used to be a crypto doubter but finally relented when Bitcoin dropped to $7,000. Thankfully, every Bitcoin purchase I made in the first couple of years has made me some nice profits.

After reaching a record high of $68,000 Bitcoin has traded up and down ever since for many hardliners this has only created a buying opportunity to get in on a dip.

So if you have been on the sidelines waiting for your chance to finally own some Bitcoin (or any other cryptocurrency for that matter) it’s time to open your account on a crypto exchange and make that first purchase.

5. DIY Stock Market

Most people seem to prefer to invest their money in mutual funds, particularly when it’s a relatively small amount of money. But if you’ve been showing real ability to make money trading stocks on your own, this might be an opportunity to take that up to the next level.

You can open an online discount brokerage account through companies like E*Trade and TD Ameritrade. These platforms have all the tools that you need to become a sophisticated investor – including educational resources if you need them.

And, the low fees are a godsend when you’re trading individual stocks. If you are interested in taking the next step with an online brokerage see our list of the best online brokerage accounts for all types of investors.

6. Your Home

According to CEIC data, home values have increased as much as 18.4% over the past 5 years. Other areas like have seen even more growth such as Nashville, TN, which has seen a 30.6% increase in home prices.

With the cost of materials still at record prices, the housing market doesn’t seem to be slowing down anytime soon.

So how can you take advantage of this? One way is by investing in your home. This could be a basic remodel or finding a clever way to add square footage.

This obviously makes sense only if you are looking to either sell or refinance your current mortgage. It also makes sense if you know the value of your home. Here are some free websites that will give you a good idea of how much your home is worth.

Let’s say that you have the ability to add 1,000 square feet to your current home and a contractor is willing to do the job for $50,000. By adding 1,000 square feet to your home let’s say your home currently attracts a $150 per square foot valuation, you’ve just added $150,000 of potential equity into your home.

Fairly simple way to triple your money!

Once you’re done and you’re interested in refinancing, be sure to shop around for the best mortgage refinance.

7. Inflation Hedge

Inflation hasn’t been a big concern for most investors over the last several years. But after recently the Government passed several economic relief programs many fear that high inflation is just around the corner.

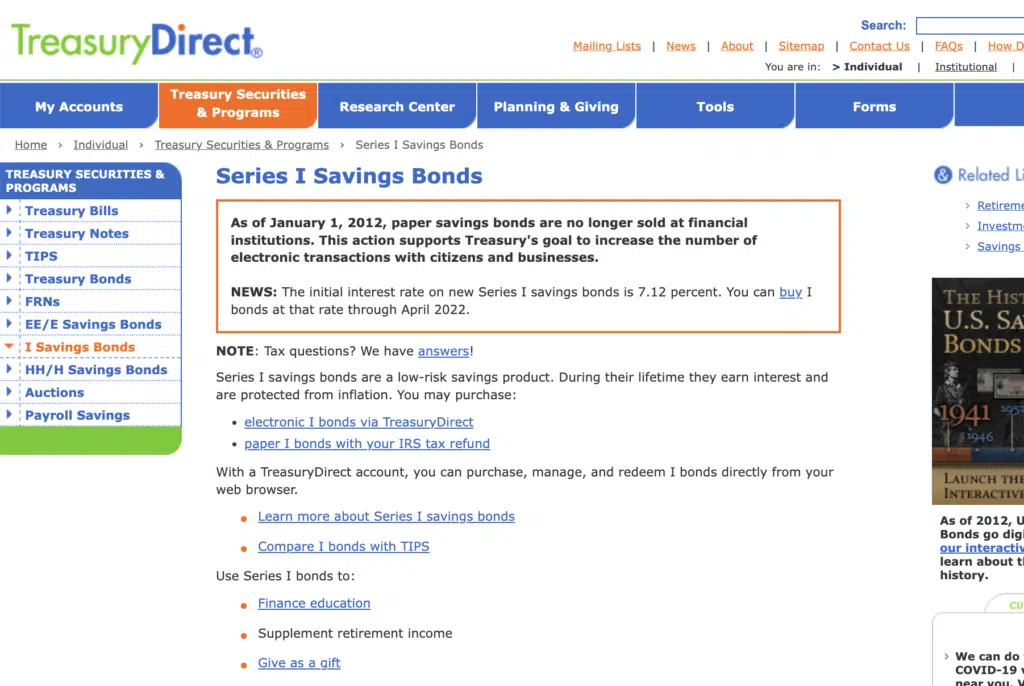

There are several investments that offer an inflation hedge but the one that has become the most popular with investors is the Series I Bond.

Series I Savings Bonds are a low-risk investment issued by the US Treasury that offer protection from inflation. These bonds earn interest by combining a fixed rate with a rate directly tied to inflation as measured by the CPI (Consumer Priced Index).

These are offered directly at Treasurydirect.gov and you can purchase up to $10,000 of these bonds each calendar year.

And don’t be alarmed when you visit the website, because it does look like it was created when the Internet was:

That is the Treasury.gov website – I promise! 😂

For any investor who wants the least amount of risk possible, Series I Savings Bonds should be at the top of your list.

Head on over to Treasurydirect.gov to find out what the latest interest rate is.

8. Coaching Programs

When we think of investing, we generally think of putting money into assets with the hope of getting a return on the investment. But the best investments that you can make are the kinds that you make in yourself. Anything that you can do to improve your knowledge and skills – that will either enable you to live better or to earn more money – is a true investment.

One of the ways to do this is to put some of your money into coaching programs. This is especially valuable if you are about to take on a new venture, but don’t have much in the way of relevant experience.

If you can sign-up for a coaching program with someone who is actually doing what it is you would like to enter, it will save you a lot of time, effort, and money. As the saying goes, never try to reinvent the wheel. There are different coaching programs covering just about any area you can think of.

And while we’re on the topic, check out my Strategic Coaching program to see what it can do for you. I absolutely love it!

9. Getting a Designation

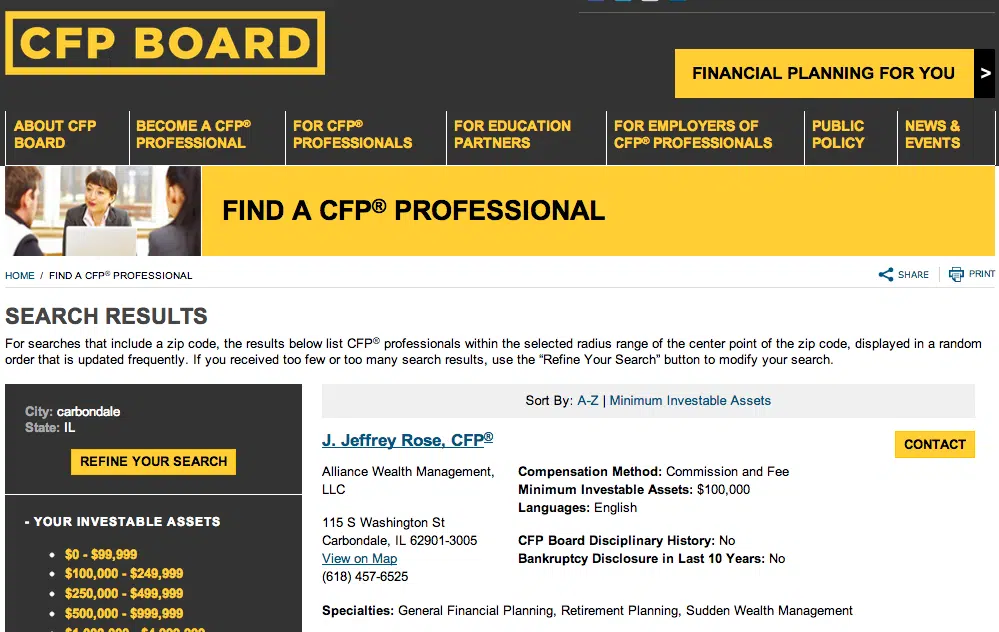

This is another example of investing in yourself. Whatever your career is, you should be looking to add any necessary designations for your field.

They can raise your visibility, your credibility, and the willingness of customers and clients to do business with you.

I acquired my certification as a CFP® or Certified Financial Planner, and it enabled me to launch an entirely new and rewarding career.

Find out what certifications represent the top of your field, and invest some money getting a designation for yourself.

10. Going Back to School

If you feel that your career is stagnating, and a lot of people do these days, going back to school could be the best investment of time and money that you ever make. $10,000 won’t get you a graduate degree at a name university, but it could cover much or even most of the cost of getting an associate’s degree at your local community college.

This money could present the perfect opportunity to retool into a new career and one that is a lot more relevant in today’s economy. According to the U.S. Bureau of Labor Statistics, job openings are expected to increase in 2023. In June 2023, the job openings rate was unchanged at 3.6%. Workers with a college degree can benefit on the increase of openings by standing out from other job applicants.

11. Online Courses

If the idea of returning to school to get a new degree doesn’t appeal to you, or if you are at a point in your life where it’s simply too inconvenient, you should look into taking online courses. There are all kinds of courses available that can help you move into a new career or business.

12. Starting Your Own Business

This is yet another example of investing in yourself. By starting your own business, you put yourself in a position to take maximum advantage of your knowledge, skills, and abilities. That increases the likelihood of your earning a high income.

Leaving my old brokerage firm and starting my own financial planning practice ranks as one of the best business decisions I’ve made. It definitely had its scary moments, but the rewards have been amazing.

Thanks to the Internet, it’s very possible to start your own business with just a few thousand dollars. Heck, I started this blog for less than $500! Choose the business that you want to go into, study how you can market the business through the Internet, then come up with a business plan. $10K should be more than enough to get started with.

In fact, you better not start out with more than a $5,000 investment for an online business. There are plenty of ways to start a home-based business that require very little upfront capital.

One more point in starting a business. When you put money into a given investment, you’re doing so with the idea that it will be worth more money in the future. But when you have a business, it can provide you with an income for the rest of your life. That’s more valuable than just about any other investment that you can make.

13. Starting a Blog

This can be a winning idea on so many levels, and you probably won’t need anywhere near $10,000 to make it happen. Choose a broad topic area – careers, technology, finance, investments, real estate, or just about anything you’re interested in and have at least above-average knowledge – and build a blog around it.

That’s what I did with my blog. As a financial planner, it’s been easy for me to tackle personal finance and financial planning-related articles on an ongoing basis.

My wife had a different beginning with her blog. It started as a way to document our growing family, but after she realized she could make extra money blogging she started focusing on things that she was passionate about motherhood, fashion, home decor, and our pending adoption. I’m still in amazement at how often her home tour page has been shared on Pinterest – over 1 million times!

The idea is to create a website with valuable content that will draw visitors to it. And as it grows, you will have opportunities to monetize it through advertising, affiliate arrangements (essentially, selling other people’s products), or as a platform to sell your own products and services.

This could be a way of building a side business, rather than taking the plunge into a full-time venture. You can do it as a sideline until you are ready to ramp it up to full-time. And you can move at whatever pace is comfortable for you. But once you get going, a blog can be an incredible source of new and exciting opportunities – as well as income.

14. Launching a Podcast

Podcasts are basically blog articles set to audio, but they have the advantage that they can also be placed on other websites for greater exposure. And just as is the case with a blog, there are ways that you can monetize podcasts.

The simplest way is to do a series of podcasts and solicit listener donations. This can work beautifully if you have a loyal following. You can also get advertising sponsors, in much the same way that you would for a blog, who would pay for a mention in your podcast, or on the site where the podcast appears.

John Lee Dumas from the top-rated podcast on iTunes has made a name for himself with his podcast, Entrepreneur on Fire. John launched his podcast in 2012 and since then has made almost $3 million in revenue!

The best part is that he publishes his super highly detailed income reports monthly for those that want to chart his progress. In the beginning, much of his revenue was from advertisers and since then he has offered various courses and products for those interested in monetizing their products. This man is truly on fire! 🙂

15. Resell Products on Amazon FBA

If you have a talent for finding bargains but have never had the inclination to sell some of those bargains for profit, Amazon FBA is probably the most hassle-free way to do it.

FBA stands for Fulfillment by Amazon, and that’s exactly what they offer. You deliver the items you want to sell to Amazon and then market them on the site.

Once they have been sold – in the usual way that sales take place on Amazon – the company will handle the shipping for you. It’s one of the easiest ways to run an online business.

16. Your Old Hobby: Sports Cards

Remember that old shoebox you’ve had stuffed in your closet with all your baseball cards from when you were a kid?

It’s time to pull them out because you may have a collectible that a sports enthusiast is willing to pay top dollar for.

After the pandemic, the sports card industry blew up. Cards from when I was a kid, like Michael Jordan’s rookie card, were selling for record prices such as this one for $840,000.

I was a collector as a kid but didn’t think much about the hobby until my older boys started collecting. That’s what I discovered how much money was pouring into sports cards.

Before you dive in and start throwing hundreds if not thousands of dollars opening packs or trying to find rare rookies, educate yourself on how much sports cards are worth end where is the best place to park your money.

17. Pay Off Debt

This is the most risk-free way to invest $10K – or any amount of money – and it provides a virtually guaranteed rate of return.

Let’s say that you have a credit card with an outstanding balance of $10,000, that has an annual interest rate charge of 19.99%. By paying off the credit card, you will not only get rid of the debt permanently, but you will also lock in what is effectively a 19.99% return on your money.

No, it won’t mean that you’ll be collecting a 19.99% rate of interest as a cash income on your money, but it will mean that you are no longer paying it – which is virtually the same thing.

Here’s another plus: the 19.99% that you will earn on your money (by not having to pay it out every year) is income that you will not have to pay any tax on. If you were receiving 19.99% on $10,000 directly, a large chunk of the income would have to go to pay income taxes every year.

The Bottom Line – Investing $10,000

With inflation, $10K to invest may not seem like a lot of money these days, but it’s plenty if you want to get into some interesting and imaginative investments.

You can use them as an opportunity to grow your nest egg into something much, much larger. It’s even enough for you to get into three or four of these investment ideas, which will give you an opportunity to really grow your money.

Give a couple of these a try and see if they’ll work for you!

FAQ’s on Investing $10,000

Assuming you want to invest 10,000 in 2023, there are a few things you could do.

You could buy stocks, which may give you a return on your investment (ROI) if the company you choose performs well. However, stock prices can also go down, so there is a risk that you could lose money on your investment.

Another option would be to invest in bonds, mutual funds, or ETFs. With these options, your money is typically invested in a variety of different places, which reduces your risk if one of those investments performs poorly.

You could also invest in real estate. You can make money by buying and selling real estate, or you can make money by renting out property that you own. Another popular options is crowdfunding real estate platforms like Fundrise or Realty Mogul.

Finally, you could also save your money in a high yield savings account or CD. These options typically offer low-risk returns, but they may not be as high as what you could get if you invest in stocks or bonds.

Ultimately, the best option for you will depend on your individual goals and risk tolerance. Speak with a financial advisor to get more specific advice about what would work best for you.

Yes, $10000 is enough to start investing. Mutual funds, stocks, real estate, and ETFs are all potential investments that someone could make with $10,000.

However, it’s important to remember that you should always consult with a financial advisor before investing any money, in order to get the best advice for your specific situation.

How much interest you earn depends on what investments you choose for your $10,000 investment.

A savings bond paying 4% would yield much less than a dividend stock portfolio that made over 11% return. But that also assumes the dividends stocks did not drop in value which is a potential risk investing in the stock market.

How to Invest $10,000: Step-by-step Guide

Time needed: 1 hour and 30 minutes

How to Invest $10,000

- Determine Your Investing Goals

Before you invest $10,000, it’s important to have a clear idea of what you want to achieve with your money. Are you saving for retirement? A down payment on a house? Or just trying to grow your wealth over time? Knowing your goals will help you make better investment decisions.

- Identify Your Risk Tolerance

Investing involves risk, and different investments carry different levels of risk. It’s important to understand how much risk you’re comfortable taking on. If you’re more risk-averse (don’t want to big swings in your portfolio), you may want to consider investing in less risky assets like bonds or index funds.

If you’re comfortable with more risk, you may want to consider investing in stocks, real estate or even crypto. - Choose Your Investments

Once you’ve identified your goals and what you’re most comfortable, it’s now time to choose your investments and investment account. If you need access to the funds, you’ll want to keep it in a taxable brokerage account. If investing for retirement is your goal, then consider a traditional or Roth IRA and let compound interest do its thing!

- Create a Diversified Portfolio

Diversification means spreading your money across different types of assets, such as stocks, bonds, real estate, and cash. A sample $10,000 portfolio may look like 50% stocks, 30% bonds, 10% real estate and 10% cash. This helps to reduce the risk of losing all of your money if one type of investment performs poorly.

- Consider Dollar-cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price of the investment. This can help you avoid buying at the top of a market cycle.

- Be Patient

Investing is a long-term game. Don’t panic when the market experiences short-term downturns, and stick to your investment plan.

- Review Your Portfolio

Regularly monitor your portfolio, but try not to be swayed by short-term fluctuations in the market. Online tools like Empower (formerly Personal Capital) make this super convenient. It is important to keep a long-term perspective, and avoid making impulsive decisions based on emotions.

Great info Jeff. I’ve just retired and am looking to make my money, well, make money. I’m off to a great start with high yield/short term CDs as well as a high yield savings account. My “Nest Egg”(Mutual funds) have taken a beating but I’ll weather this storm as it’s a long term ride. Ty for the time you put into this article. Best of luck to you!

Isn’t it better to just buy a product(s) for 10k and sell it with 30% margin ? This 0.5-3% is just nothing unless you want to “invest” for the next 30 years. With average product the risk of reselling is small.

Great post! I went onto the Lending club site to check into being an investor, but as of December 31, 2020, you can no longer invest in notes. Just wanted to let you know so that you may want to update to a new peer to peer company on your blog. Thanks for all the great ideas on how to invest. It’s just an extremely scary thing to do…lol.

As you stated above, this blog only cost you 500$ to create however I am just curious on if you have made profits from your articles. Other than the ad at the top of your page is there any other ways you are making the money back?

This is by far one of the best straight to the point, easy to follow articles I’ve read on what to do with $10K, I’ll definitely try some of these steps! Thank you so much!

Good luck Nancy!

No fu

Nothing about US Treasuries, bonds, Index funds, or finding a few friends to start an investing club?

Most of your items fall more into “how to explore new streams of income” and not “how to invest 10,000 dollars.”

Hi Jason – You may have a valid point. The idea of finding friends to start an investing club is a good one. But USTs and bonds are mostly capital preservation holdings, not investments that will grow your money. As to index funds, we were just going for some strategies that are a bit different.

Great article! I’ve always been interested in investing and every now and again I’ll search for helpful tips or suggestions online but this is by far the best one I’ve seen so far. You go over a lot of options, most I’ve heard of but never researched them in depth. You’ve given me some motivation to look into some things a little further tonight. Thanks

Thanks Erik!

I liked your article and I have read many similar articles. This one stood out for me..

Thanks Anita!

I would strongly suggest steering very clear of lendingcorp. Shares started in 2015 at $25.00. Less than three years later today, $2.70. I don’t know enough about it to say that it won’t bounce back, but I did read the company is facing FTC suit for hidden fees.

Thanks for the heads up Mantis.

Hello Jeff, I like your article and the advice that you provide. I’m looking for a good short term investment for about 8 months or so and was wondering what my best option would be to gain at least 10% on the investments. Thank You

Hi Paul – No one can guarantee you’ll make 10% on your investment in 8 months. Nor can anyone guarantee you won’t lose money on said investment. Anything you invest in with that type of goal will be a high risk investment, where you’ll be just as likely to lose money. If you’re looking to invest for 8 months, I’d go with something safe, like a CD, so you don’t lose money.

Great article!! A great starting point for someone who is new to this platform.

Hello I just read your blog and have been looking for some advise. I have no risk tolerance and have a large sum of money in savings accounts. I am close to retirement and do not want to loose any of my money. I have had investments before and have lost a lot of money, at my age I do not want risk.would there be anything more you could help me with other than the obvious, savings accounts or cds? Thanks Sue

Hi Sue – There’s no way to earn higher than average rates without taking on some risk. But since you don’t want any risk, your options are pretty much limited to either high yield bank investments (online banks pay the highest) or US Treasury securities, which pay close to 3%, but you’ll have to tie up your money for 5 – 10 years to get that kind of rate. You can look into Treasuries at Treasury Direct, the US government’s portal.

15 should be #1. No debt=happier life. Trust me.

(unless YOU’RE my buddy that’s mastered buying real estate with no money down).

great article and I love how you broke down the debt as an investment payoff that you don’t have to pay out by year-end. Brilliant way to look at credit card debt, truly a great investment to pay yourself first.

Also have enjoyed hosting a podcast about my touring band Sweet Little Bloodhound, “SLB Indie Trailer,” and have appreciated your nod to John Lee Dumas’s podcast, truly a great listen. As well as “Start-up” for businesses looking to grow with investors. Thanks Jeff.

Great article! I prefer to combine investments. Do not put all eggs into one basket. Invest some money into stock market: open an account on etrade or interactive brokers and subscribe to some one good stock newsletter with investment ideas, such bulltips.com, but other part invest in small local business.

Great article. I will certainly be exploring some of these options

Nice list. I think people forget they can invest in themselves. I spent the time and money to finish the CFA.

Good afternoon. Great post!! I totally agree with all of the tips on your post. I was wondering what is your opinion about purchasing CDs from institutions based in some countries that may lack stability in the Middle East and South America. I know some of them have great rates of return. Thank you in advance for your response.

WOW, great article Jeff and thank you for the kind mention…I am honored!