Key Takeaways:

- No one can legally remove correct information from your credit reports.

- If collection activity on your credit reports is incorrect, there is a formal process you can use to dispute it.

- In many cases, paying off debts in collections can help you have the information removed from your credit reports early.

- With no action taken, collection activity on your credit reports will “fall off” on its own after seven years have passed.

When you default on any type of debt obligation, such as credit card debt or a personal loan, the original creditor will try to collect on the debt for a while. Eventually, though, your creditor may come to a point where they sell your debt to a collection agency. At that point, the additional negative information is reported to the three credit bureaus, which can do considerable damage to your credit score.

Collections stay on your credit report for seven years from the point the account first went delinquent, at which point this information will automatically “fall off” your report. However, you may want to have collections removed from your credit report sooner rather than later — particularly if you’re hoping to improve your credit score in the short term. As a side note, you’ll also want to have collections activity removed from your credit reports if you believe some or all of the information is incorrect.

But, how do you remove collections from your credit report? There are several ways this can happen, although the step you should take depends on your situation.

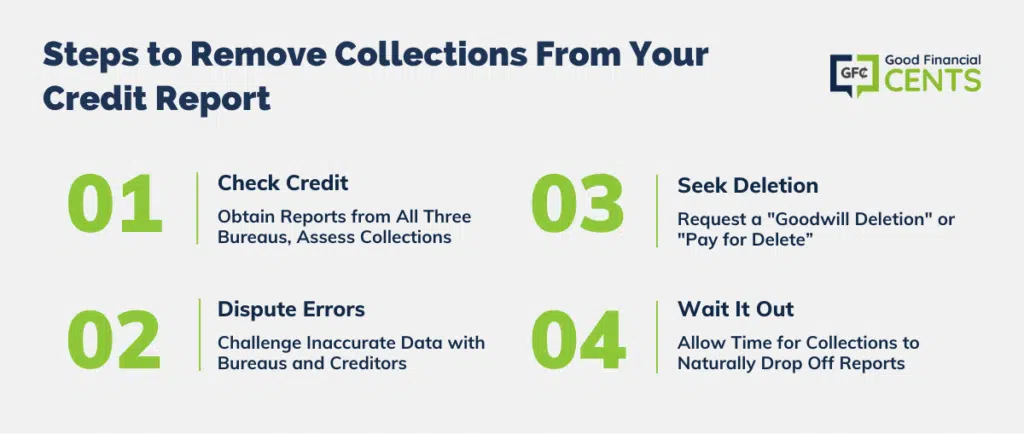

Steps to Remove Collections From Your Credit Report

Table of Contents

If you’re wondering how to get collections off your credit report, you’ll likely need to take at least a few of the steps below:

- Step 1: Check Your Credit Reports

- Step 2: Dispute Incorrect Information

- Step 3: Ask for a Goodwill Deletion

- Step 4: Write a “Pay for Delete” Letter

- Step 5: Wait it Out

Step 1: Check Your Credit Reports

Whether you just think you have collections on your credit report or you know for a fact you do, you have to start the process with the full knowledge of what you’re dealing with. To find out the exact details of the collections activity you’re facing, you have to start by checking your credit reports with all three credit bureaus — Equifax, Experian, and TransUnion.

This part of the process is easy and free thanks to a government-backed website that provides free credit reports — AnnualCreditReport.com. Anyone can head to this website and receive a free look at their credit reports at any time. While free reports are normally only available once every 12 months from each of the credit bureaus, you can currently access all three of your reports weekly due to the COVID-19 pandemic.

Note:

Once you have accessed your collections information and the other details on your credit reports, you can compare the information to your own records to check for accuracy.

Step 2: Dispute Incorrect Information

If you find any incorrect data on your credit reports, you’ll need to dispute it with the credit bureaus and the company reporting the data. This is true whether we are talking about incorrect information regarding your accounts in collections, but it also applies to any other information you find.

According to the Consumer Financial Protection Bureau (CFPB), you can start the process by disputing the incorrect data with both parties in writing. Explain what you think is incorrect about the information, and try to include any documentation you have that confirms your dispute. In your letter to the credit bureaus and the company reporting the false information, you’ll want to include:

- Your Full Contact Information

- Copies of Your Credit Report With the Incorrect Information Highlighted

- A Comprehensive Explanation of Why the Information Is Wrong

- A Formal Request to Have the Information Updated, Corrected, or Removed From Your Credit Report

The CFPB also has several sample letters on its website, as well as contact information for each of the three credit bureaus. Note that you can get the mailing address for the company reporting any incorrect information directly from your credit reports.

After your dispute has been submitted and received, the credit bureaus each have 30 days to investigate your claim. If collections activity on your credit reports is indeed false, they will remove the incorrect information from your reports. If the data is correct, however, the collection activity will remain on your credit reports with no change at all.

Step 3: Ask for a Goodwill Deletion

If you know for a fact the collection activity on your credit reports is correct, there’s no reason to spend time disputing it. In fact, federal law dictates that no one can legally remove accurate information from your credit reports for any reason.

Instead of spending your time trying to get correct information wiped away, you can ask the collection agency to make a “Goodwill Deletion.”

Note that this strategy only works if you’re wondering how to get paid collections off your credit report. If you still owe the money, there’s no chance the collection agency will do anything to make your situation easier.

If you have settled the debt with the collection agency, reach out with written correspondence that explains the circumstances that led to collections, why you would like the information removed from your credit reports, and how your situation has changed.

There’s no guarantee the collection agency will do anything on your behalf, but it never hurts to ask. If the collection agency does indeed remove the collection reporting from your credit reports, you will still see the late payment activity that led up to collections, which is harmful to your credit score. However, having collection activity removed from your credit report while also showing a positive payment history going forward can help you get on the right track.

Step 4: Write a “Pay for Delete” Letter

According to Lexington Law, another strategy involves writing a “Pay for Delete” letter, which they say is “a negotiating tool to have negative information removed from your report in exchange for payment.”

With this type of letter, you’re agreeing to pay the balance you owe in exchange for having the information removed from all three of your credit reports. With that in mind, you’ll want to send this letter before you pay off the debt in collections. After all, you’re using your agreement to pay as a bargaining tool to get collections activity off your reports.

Your letter doesn’t need to be complicated. It just needs to include:

- Your Full Contact Information

- Account Numbers for Your Account in Collections

- The Amount You Currently Owe

- An Explanation That You’re Willing to Pay This Amount in Exchange for Having the Collection Removed From Your Credit Reports

If the collection agency responds positively, you should keep all the correspondence as proof of the agreement. If they reject your request or ignore your letter completely, you’ll have to try another strategy to have the collection information removed from your credit reports.

Step 5: Wait it Out

You can also choose to wait until the collection activity falls off your credit report on its own. This takes place seven years from the date your account first became delinquent, so you could be waiting quite a while if your financial problems were fairly recent.

Although waiting it out may seem like a long and drawn-out option, keep in mind that the impact of collection activity on your credit report will lessen over time. Also note that steps you take in the meantime, such as keeping your credit utilization low and making all monthly payments on time, can help improve your score as well.

Collections Removed? What Happens Next

Once collections activity is removed from your credit reports, either through actions you take or the passage of time, your credit score has the potential to improve fairly quickly. This is mainly due to the fact that your payment history makes up 35% of your FICO score. When negative information regarding your payment history (such as collections) stops having the power to damage your credit score, you may see a pretty big boost to your credit right away.

However, you shouldn’t let your guard down, nor should you become complacent about your credit. While collections activity may be gone from your report, late payments, high balances and other credit mishaps can still hurt your credit score moving forward.

To keep your credit score in the best shape, you should strive to always pay your bills early or on time. Also make sure you keep your credit utilization at a minimum, or below 10% of your available credit for the best results. At the maximum, you should keep your credit balances at 30% of your available credit or less, or $3,000 in debt at the most for every $10,000 you have in available credit. Also refrain from opening or closing too many accounts since either action can impact your credit in a negative way.

The Bottom Line

Having one of your debts in collections can be incredibly stressful, and that’s especially true once you see the impact on your credit score. However, it’s good to know that collections can’t harm your credit forever and that they’ll eventually fall off your reports on their own if you can’t have the information removed.

If collection accounts on your credit report are making your life difficult, however, your best bet is figuring out what steps to take to make it all go away. Most of the time, this is going to involve biting the bullet and actually paying back the money you owe.