One of my most favorite questions that I often get as a financial planner is

“What’s your best rates on Roth IRAs?”

Coming in at a close second is,

“What’s the best stock to buy right now?”

Both of those questions are extremely hard, if not impossible, to answer. In addition, the question I get on Roth IRAs makes almost no sense at all. So, how would you explain Roth IRA rates to someone?

Whenever I get that question, I typically start by explaining what an I-R-A stands for:

Individual Retirement Arrangement (emphasis on arrangement).

NOTE:

I have to admit that I even thought that the “A” stood for account at one point in my life. However, I was informed by my readers that the Internal Revenue Service actually refers to them as “arrangement.” (Thanks to my readers for keeping me on my toes!)

Need to Open a Roth IRA?

My favorite online broker is M1 Finance but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses.

There are many good options out there, but I have had the best overall experience with M1 Finance. No matter which option you choose, the most important thing with any investing is to get started.

Another important fact for everyone to realize is that Roth IRAs don’t pay anything or have interest rates attached to them. They are just a type of account – a retirement account.

Table of Contents

Roth IRAs Are Not Investments

The Roth IRA serves as a retirement “account,” but not a retirement investment. Many people have the belief that IRAs are like a CD that pays out interest.

However, this is only true if you invest in an IRA at your local bank. In this case, you are purchasing a CD within the IRA because CDs are typically the only investment option that is available (some banks now do have in-house brokerage firms that allow you to put money into other investments).

So in this case, the best IRA rate you can get on your Roth IRA Account is what the going CD rates are.

IRAs Are the “Investment Vehicle”

I have always explained the IRA as your own personal investment vehicle. Once you open an account, you can then choose which type of passengers go inside your vehicle.

Of course, a mental image of a clown car might be coming to mind at this point. You can have as many clowns in your IRA as you want – or as few as you want. I recorded this YouTube short using my daughter’s Barbies to illustrate this here:

You could have all your money invested into Walmart stock or spread out across 100 different stocks (You would have to have a substantial amount of money in the IRA to do this).

If you open a Traditional or Roth IRA at a brokerage firm, you may invest into CDs just like at your local bank, but you also open the door to many other investment choices. Then, what your IRA pays is determined on the actual return of that investment.

If you had invested into the stock market in 2008, your Roth IRA probably paid closer in the -30% range. (Ouch!)

When somebody asks me what the best Roth IRA rate is, I simply respond with:

“It depends.”

Then I wait for confusion to set in.

What’s the Average Roth IRA Interest Rate?

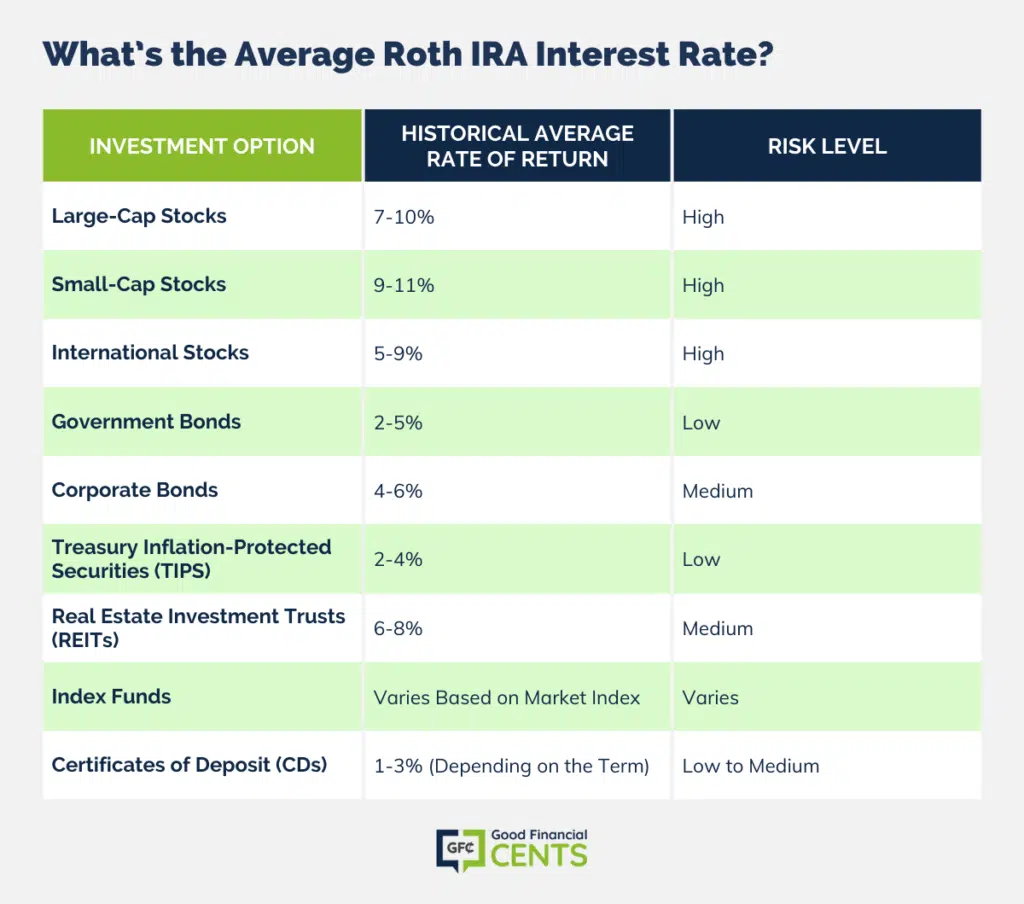

While Roth IRAs don’t pay interest directly, the investments inside of them can pay dividends, capital gains and interest. What you can expect to earn depends on the investments you have chosen for your Roth IRA.

To give you an idea of the potential returns, let’s consider some investment options commonly found in Roth IRAs. Large-cap stocks historically offer average rates of return ranging from 7% to 10%, but they come with higher risks.

Small-cap stocks tend to yield slightly higher returns, averaging between 9% and 11%. On the other hand, government bonds provide lower-risk investments with average rates of return ranging from 2% to 5%.

Certificates of Deposit (CDs), another option for Roth IRAs, offer lower average rates of return, typically ranging from 1% to 3%, depending on the term.

Remember, these figures are historical averages and not guarantees. Your actual Roth IRA returns will depend on the performance of the investments you choose.

Let’s Define a Roth IRA

Now that we have explained how a Roth IRA doesn’t really have “rates” of its own, let’s delve into how Roth IRAs actually work.

In summary, a Roth IRA is a retirement account that is funded with after-tax dollars. As such, many people use a Roth IRA in conjunction with a tax-advantaged retirement account.

For 2024, the maximum amount most people can contribute to a traditional or Roth IRA is $7,000. Those ages 50 and older can make what is known as a “catch-up contribution” and contribute up to $8,000 each year.

Not everyone can open a Roth IRA, however, due to the rules that govern this retirement account. To be able to contribute the maximum amount to a Roth IRA in 2024, for example, you must:

- Be single or head of household with an income less than $146,000

- Be married filing jointly with an income less than $230,000

The income cut-off for Roth IRAs doesn’t come to an abrupt halt. At $146,000 for singles and $230,000 for married couples filing jointly, the maximum amount you can contribute begins to phase-out gradually. For 2024, the phase-outs for retirement savers are as follows:

- Single or head of household begins phasing out at $146,000, and becomes ineligible at $161,000

- Married filing jointly begins phasing out at $230,000, and becomes ineligible at $240,000

Roth Accounts That Handle Investing For You

Traditionally, when a person opened a Roth IRA account all of the interest earned would depend on their ability to invest in stocks, mutual funds, or other investments. With better artificial intelligence that is not the case any more.

A new type of investment advisor has been created by using machine learning to make the investments for us. These new advisors are called robo-advisors and have become a very popular place to open your Roth IRA. Currently there are two main competitors who offer a Roth account:

- Wealthfront – Is a very good service and is top notch on their technology. Their entire platform is designed so you do not have to talk to a person. Once you do the initial risk assessment survey they take it from there.

- You can open an account with Wealthfront with only $500 and there are no fees on the first $10,000 you invest. After the $10k threshold you only pay 0.25% on all additional money invested.

- Betterment – Betterment is the largest of the robo-advisors and has been a personal favorite. They offer their services for a low fee of 0.25% and the back end is really slick. When you open an account with Betterment, you will have a five minute questionnaire that determines your risk tolerance and then they do all the investing and adjusting for you.

Why Are Roth IRAs So Popular?

If you read about retirement strategies at all, you have probably heard all about the Roth IRA and its benefits. Year after year, Roth IRAs remain popular among those serious about saving for retirement, and for myriad reasons.

Here are some of the reasons Roth IRAs continue to pique the interest of retirement savers everywhere:

By contributing with after-tax dollars now, you can save on taxes later. Since Roth IRAs are funded with after-tax dollars, you don’t get a tax break on the front end when you choose to contribute. However, many people see this as much more of a positive than a negative.

By contributing to a Roth IRA with after-tax dollars, you can avoid paying taxes on distributions down the line. That’s right; contributions to Roth IRAs grow tax-free and distributions are also tax-free.

You can contribute to a Roth IRA or traditional IRA in addition to your tax-advantaged retirement accounts. Anyone who is serious about saving for retirement will want to max out as many retirement accounts as possible while they’re still young.

Fortunately, you can contribute to a Roth IRA even if you max out your work-sponsored 401(k) or retirement account.

Diversify your exposure to taxes. Where tax-advantaged retirement accounts let you avoid paying taxes on your contributions now, a Roth IRA provides the opposite experience.

Because of this, many people see having both types of accounts as a way to diversify their exposure to taxes in the future.

Anything you contribute to a Roth IRA will grow tax-free. And once you’re ready to begin taking withdrawals, the money you receive will also be tax-free.

You can withdraw contributions without paying a penalty at any time. Here’s something few people know about their Roth IRA. If you want, you can withdraw your contributions at any time without penalty. Because of this, many people see the Roth IRA as a type of savings account as well.

Just remember, you can withdraw your contributions without penalty at any time, but not your earnings.

You don’t have to begin taking distributions at a certain age. While traditional IRAs require you to begin taking distributions at age 73, Roth IRAs don’t have that requirement. Because of this, they offer more flexibility than most retirement plans.

Since Roth IRAs will let you grow your money indefinitely, you can hold onto them at the last minute and only begin taking money out when you need it.

How to Decide if You Should Open a Roth IRA

So, at this point, we have covered what a Roth IRA is and what it isn’t. We have also talked about who qualifies for one and highlighted the major benefits that come with using a Roth IRA for retirement.

But, is a Roth IRA really right for you?

When deciding whether to open a Roth IRA, it’s important to consider your individual situation and your retirement goals. A Roth IRA might not be right for everyone, but opening one is probably a smart move if you fall into one of these categories:

You should consider a Roth IRA if…

- You want to save as much money for retirement as you can. If you’re serious about saving for retirement, the Roth IRA offers one more place to stash your money away. Even after you max out your work-sponsored 401(k), you can still put $7,000 in a Roth IRA or traditional IRA in 2024 (or $8,000 if you’re ages 50 and older). If you have a lot of discretionary income and want to put it away for future use, the Roth IRA is a no-brainer.

- You think you will be in a higher tax bracket later. Since the Roth IRA is funded with after-tax dollars, the money you invest is allowed to grow tax-free. Then, you’ll get tax-free withdrawals once you begin taking money out – as long as you’re ages 59 ½ or older and your account has been open for at least five years. If you think you might be in a higher tax bracket when you retire – or if you worry taxes will be higher for everyone across the board – investing with a Roth IRA is one way to shelter yourself from higher taxes in the future.

- You want a retirement account that allows you to withdraw contributions without paying a penalty. With a Roth IRA, you can withdraw your contributions at any time without a penalty. This makes this account very different from other tax-advantaged retirement accounts which require you to pay a penalty if you choose to take your contributions out early. This is also the reason many people who want some flexibility choose to invest in a Roth IRA. Since you can withdraw your contributions without a penalty at any time, any money you invest will remain within your reach.

- You want to provide your heirs with some tax-free funds upon your death. If you’re worried about your heirs getting stuck with a huge tax bill, having a Roth IRA might be a smart move. Because these accounts are funded with after-tax dollars, your heirs can generally access this money without paying taxes upon your death. If you hope to save your heirs from paying at least some taxes on their inheritance, the Roth IRA is a smart investment vehicle in that respect.

- You want at least one account you don’t have to touch. If you want at least one retirement account that doesn’t come with a minimum age for distributions, the Roth IRA is an extremely smart choice. By opening this account and funding it for a lifetime, you create a retirement nest egg that won’t need to be accessed once you reach a certain age. Whether you live to be ninety years old, you’ll never have to take a single cent out of your Roth IRA if you don’t want to.

- You want to invest in diverse investment products. While a work-sponsored 401(k) plan might offer limited investment choices, the fact that you can open a Roth IRA anywhere and on your own terms means you get to choose where you invest that money. That could mean investing in stocks, bonds, mutual funds, and more. Of course, you’ll also get to choose a firm to invest that money for you. While Ally Invest is one of our favorite options, you’ll find an array of choices out there.

We also highlighted some other top choices in our guide on the best places to open Roth IRA.

The Bottom Line – Best Roth IRA Rates

I hope you have enjoyed this primer on the fallacy of “Roth IRA rates,” along with a general idea of Roth IRA Rules and guidelines. Now that you know all about this exciting investment vehicle, it’s time to figure out if a Roth IRA is actually right for your situation.

No one can make this decision for you, but I hope we highlighted some of the top reasons a Roth IRA might work in your favor. As a general rule, having more money saved for retirement is better than not having much saved at all.

The Roth IRA is just one more place to stash your money where it can grow over time and be there for you when you’re ready to retire.

Hi,

I was just wondering if you could loose money in a Roth IRA? If not, what is the average rate of return/ interest rate you can expect?

Thank yo very much,

Frances Z

Hi Francis – The rate of return depends on what you invest in. As to losing money, you can if you invest in risk investments like stocks and mutual funds or ETFs. If you invest in bank CDs, you won’t lose money, but your returns will be lower.

Now that I have some knowledge on a Roth IRA account where do I look to open an account? Do you have any suggestions? Should I stay away from big banks?

Hi Caroline – It really depends on your age, your long-term goals and your risk tolerance. For most people an investment brokerage account is the best place, since it enables you to invest in different types of investments – stocks, bonds, mutual funds, etc. Finding the right mix is tricky, so you may want to sit down with a financial advisor who can point you in the right direction. Banks are good if you’re looking for absolute safety, but they’re poor on growth, and that’s what you really need.

Roth IRA sounds like a great idea- but I want a secure place to invest my money. I don’t want to be stressed about losing money. Who chooses where the money is invested within the IRA? I don’t have any knowledge on that- I wouldn’t want the responsibility.

Hi Jessica – Roth IRAs are self-directed, so you would chose the where the money is invested. If you want no risk of losing money, you can invest a Roth IRA in either certificates of deposit at your bank or credit union, or you can also look into short-term US Treasury securities, which you can invest in through Treasury Direct, which is a US government web portal. If you’re willing to take some risk for higher returns, you should look into robo advisor platforms, like Betterment. They will handle all of the investment selection and management for you, and all you need to do is open an account and fund it regularly.

I’m trying to start saving, I’m 25 years old. I want to have a lot of money saved by the time i’m 50-60 years old. What is my best option to do this with the least if not 0 amount of risk if I’m willing to put back 3K a year.

So one can open various for oneself Roth IRAs?

I understand what you’re saying about a ROTH not being an investment vehicle. I totally get it. I think, though, what we mean when we ask our question is: “what kind of returns are the average investors making these days (in 2012) with their investments within their ROTH’s (that they opened through a brokerage firm) and – let’s say they have a “average” assortment of investments – fairly balanced and not too aggressive?? I realize that nobody can answer this exactly. I also realize that nobody can predict the future. But, still… what we mean by our question is: what do you, for instance, expect to earn from the investments within your ROTH over the next 10-15 years? What’s a reasonable wild guess??

@ Joe

That’s the point. You can’t throw out a “reasonable wild guess”. There’s too many factors at play here.

I’m sure most would like to earn an 8-12% rate of return on their Roth IRA, but once again – it all depends on what they are invested into.

I currently have two ira accounts with my bank for my wife and myself. from the time i opened these accounts 5 years ago i have lost money. i would like to retire in 10 years and am looking for the best place to invest my money for retirement. Everyone keeps telling me to put my money into a roth IRA, what is the difference between the IRA I have at fifththird bank and a roth IRA. I currently have 40,000 in my savings account and would like to know where i should be investing this money. i also have 80,00 in my 401K account.

Typically the Roth IRA account you have are the same. The BIG difference, I suspect, is that at your bank, your IRA is invested into CD’s, which is why you’re not losing money. Kind of like my example above. To get a higher “rate” on your Roth IRA, you need to invest into something that has more growth potential, like mutual funds or ETF’s.