Long gone are the days of grabbing a legal pad, a calculator, and a pen to handle big personal finance tasks.

You can now manage your budget, monitor your investments, execute your debt payoff plan, and build for a better future with technology.

We’re highlighting some of the best personal finance software available, whether you need to manage your money on your smartphone or on a computer.

Most of these personal software options are free (yeah, baby!) and are compatible with most Macs and PCs.

Are you ready to get your personal finance swag on?

Let’s take a look at some of the best (and mostly free) personal finance software to help manage your money.

Table of Contents

Great Personal Finance Software

There are five major areas of personal finance software to help you manage your money.

Everyone needs to have a budget, a way to manage their investments, a plan to eliminate their debt, the ability to keep tabs on their credit score, and the option to handle their taxes without help from an expensive accountant.

Here are some of the best of the best software tools to help you do just that.

Budgeting Software Tools

Call it a budget, a spending plan, or just spending less than you earn. No matter the name, managing your day-to-day finances well will enable the rest of your financial plans to come to fruition.

You can’t pay down debt or save for retirement if you can’t stop spending more than you earn. Start here and get this step right before moving on.

Mint

The standard bearer for budgeting software, Mint has outlasted the likes of Wesabe and Microsoft Money (both defunct) and surged in popularity among users.

The company was purchased by Intuit and has pumped out high-quality apps for both the iOS and Android platforms.

You can manage your money at mint.com directly or on any device that lets you run smartphone apps from Apple and Google, like the iPad, iPhone, and their Android equivalents.

One of the biggest features of Mint is you get a snapshot of what your spending looks like.

It’s common to think, “There’s no way I spend $75 per month on lattes and mochas!” but then the analysis pops up and shows how much you’re spending at coffee shops.

With Mint, you track not only your spending but what your goals are.

The software then helps you manage your life toward those goals and keep your spending on plan with your budget.

The best part? It’s free! Category-leading software to help manage your life for free?

Manilla

Handling your monthly bills is a hassle. Normally, you’re getting 4-8 different bills mailed to you at different times of the month. They have different due dates.

Some of them let you pay them online for free, while others charge for using a credit card to pay off the balance (this makes my airline miles credit card strategy useless).

Managing this process each month isn’t easy. You’ve got to go to the post office to keep a supply of stamps and find that old dusty checkbook that you only use for writing checks for bills. Isn’t it time for a more modern approach to paying your bills?

That’s where Manilla comes in. Pure and simple, Manilla lets you import all of your bills to their web, smartphone, or tablet interface. You can log in and see all of your bills, the amounts due, and the due date in one location.

No more having to open up envelope after envelope. Plus, you’ll get handy features like email and text message reminders about due dates to help you completely avoid late fees.

You Need a Budget

Everyone hates budgeting, including our very own Jeff Rose. (What’s up with that, Jeff?)

Thankfully, there’s a tool that aims to make the often complicated process of budgeting both simple and fun. That tool is You Need a Budget or YNAB.

The software had a humble beginning: it was something that the founder of the company developed for his own personal use, then realized there was a huge swath of people who hated the task of budgeting.

He’s developed it into something useful and profitable, a great entrepreneurship story.

YNAB takes budgeting and breaks it down into four manageable steps. The slick software has iOS and Android apps and even has a 34-day free trial to try it out.

(Why 34 days? So you can install it, implement it for a full month, and see results at the end of the month.)

The software costs $60, but if you sign up with our link, you’ll get $6 off the cost. Some may balk at the service, but if paying $54 gives you a tool that will help you save more money, pay off debt, and avoid late fees… I think it is worth it.

Take your 34-day test run of YNAB and save $6 with our link.

Investment Management Software Tools

Now that you’re managing your monthly finances well, you might set up some money to be automatically invested for your retirement. Here are some tools to help you manage your investment accounts.

Personal Capital

Some of the other tools mentioned in this post have an investment section to let you look at your investments. Unfortunately, those tools aren’t built solely for investment management, so the look you get is just surface-level.

When you’re talking about something as important as your investments for the future and retirement, a specific tool is needed to keep you on track.

We just did an in-depth review of Personal Capital, but here’s a snapshot.

Personal Capital is an online tool (with iPhone and iPad apps) that runs an initial analysis of your investment accounts to look for flaws in your plan or costs that could be trimmed from expensive investments.

After the initial check-in, you can monitor all of your investments in real-time and get unbiased advice for your future.

If you are somewhat confused about how this differs from a budgeting software like Mint, check our comparison of Personal Capital vs Mint to get a full understanding of the strengths and weaknesses of each free service.

Personal Capital also believes they have a fiduciary duty to their users. Check our review for more on why those two words are so important.

Fortunately

While Personal Capital can monitor your investments and let you know if you are paying too much in fees, it won’t actually tell you where and how to invest your money (at least not with their free version).

For that, you need a company like Fortunately – a financial planning tool that’s particularly valuable for young families.

As the father of a few young kids myself, I know that a bunch of important financial decisions come quickly after starting a family.

What sets Fortunately apart is how it lets you see how your mortgage, spending habits, and tax-advantaged accounts all interact with each other and affect your chances of meeting your goals.

This is unusual in the personal finance space, as most tools deal only with your investment portfolio and your retirement – not your life goals.

Fortunately, it gives you a clear, actionable roadmap that shows how much you need to save to hit your goals, what accounts you should be saving in, and how much to save in stocks, bonds, and cash. This type of guidance would normally cost $1,000+ with a financial advisor.

You can get a free, personalized financial plan in less than 5 minutes with Fortunately. They also offer a 30-day free trial of their upgraded service (normally $5/mo) that links your financial accounts with your plan so you can ensure you’re staying on track.

Quicken

Microsoft Money fought an epic war with Intuit’s Quicken, and Quicken won. The software has been around for a long time, developed quite the following, and drastically changed over the years.

You are no longer forced to just use a PC, as options for Apple and Android devices now exist.

Quicken comes in several varieties that do everything from helping you budget your funds to tracking loan payments, setting saving goals, and managing your investments.

The investment tool helps you see how you are performing compared to the market, make comparisons, and track your gains and losses for tax purposes.

Your Broker’s Tools

We really like Personal Capital and how it can track multiple accounts at multiple companies in real time. But what if you just have one Roth IRA with one broker?

Try using your broker’s tools first.

Stockpile and many more have great tools for their customers to use to track their investments, manage for better results, and get documentation for showing gains and losses at tax time.

(Check out our lists of the Best Brokers for Beginners and Best Brokers to Open an IRA With.)

Debt Reduction Software

Getting out of debt is one of the best things you can do to stabilize your finances. Being debt-free helps you endure rainy financial days and frees up cash for other important items like investing and saving for your college expenses.

Ready for Zero

One of the newest players on the block, Ready for Zero, is poised to be a big player in helping consumers pay down debt in an effective manner.

The company publicly says they are a technology company dedicated to helping you achieve financial success. That’s an interesting take, but the iPhone and iPad apps look very slick.

Ready for Zero lets you import your debts like credit cards, student loans, and mortgages.

The software analyzes your situation and gives you payoff options to help you get out of debt as quickly as possible. It adjusts based on your cash flow to make sure you stay on track.

As you make progress, Ready for Zero will start finding other options for you to save even more money, like finding better banks to work with and getting lower interest rates. The firm has data that shows its users pay off debt twice as fast as non-users.

Just like some of the other fine software on this list, Ready for Zero is free. And considering it will help you pay off debt faster than trying it on your own, there is no reason not to give it a try. Set up your free debt payoff plan today.

Credit Sesame

Credit Sesame is somewhat similar to Ready for Zero. Instead of building a plan to pay off your debt, reminding you to make payments, and so on, the company connects you with better credit offers that will help you pay down your balances faster.

The idea is to make sure you have the best credit cards, mortgages, and loans for your situation.

After you import your information, the firm will do an analysis, and if you aren’t using the best products, they will connect you with offers that you are pre-approved for to better your situation.

(For example, if they find you’re sitting on a 5% interest rate on a 30-year loan, you will probably find a refinance offer for something in the 3.25% to 3.5% range.) Plus, when you sign up, you get a free Experian credit score.

Credit Sesame is a great tool, but I highly recommend you combine it with Ready for Zero.

You want to use the best of both worlds: make sure you have the best financial products that will automatically save you on interest, then work a debt payoff plan to pay those products off as quickly as possible.

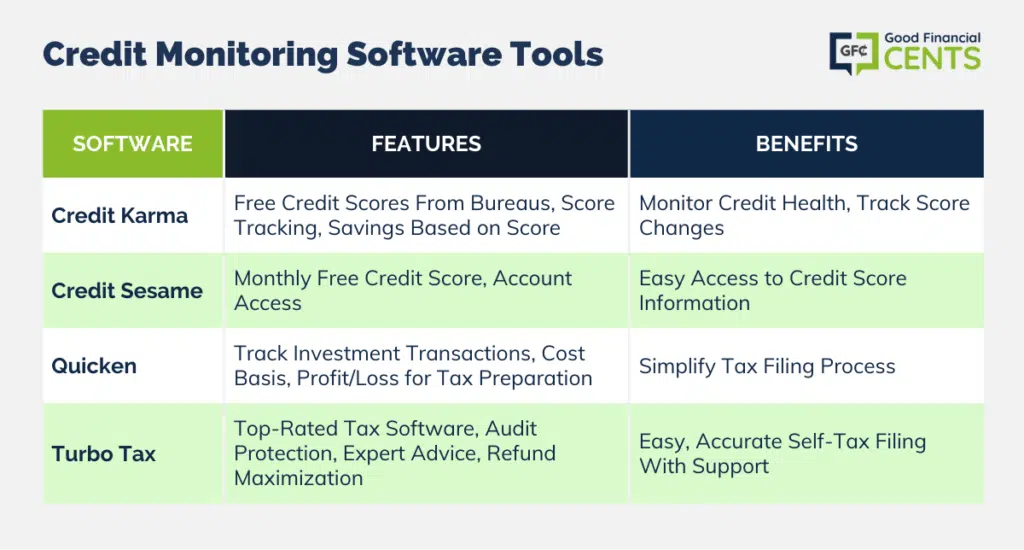

Credit Monitoring Software Tools

Your credit score is an asset that you should protect. The easiest way to do that is to consistently monitor your credit reports and scores.

Credit Karma

This software is almost too good to be true. You get consistent free credit scores from the credit bureaus. You can track the ups and downs of your score and connect with savings based on your score.

NOTE:

However, being able to keep tabs on these scores is a decent substitute for your MyFICO score, especially as you watch the score go up and down. The higher your score on any rating system, the better.

Start tracking your credit scores for free with Credit Karma.

Credit Sesame

This is just a short addition to what we’ve already said about Credit Sesame. When you open an account, you get access to a free credit score every single month.

Tax Software Tools

Benjamin Franklin is often quoted as saying, “…in this world, nothing can be said to be certain, except death and taxes.”

Since that is absolutely true, why not use some software tools to manage your taxes? It sure can make the process of filing out page after page of forms a lot easier.

Quicken

Quicken, as mentioned above, is a good tool to help you prepare to enter your information into your tax software.

Being able to track when you bought and sold specific investments in terms of cost basis, profit/loss, and date of transaction makes life a lot easier when you’re trying to file your taxes.

Turbo Tax

The standard bearer in the tax category is Turbo Tax. Popular (the #1 tax software), inexpensive, and available online.

You get audit protection, the ability to get one-on-one tax advice from an advisor, and a guarantee that your refund will be maxed out as high as it legally can be.

Don’t be overwhelmed by the idea of doing your own taxes. With great software, the process can be … well, not enjoyable, but really not that bad.

The software will ask you all of the right questions to help you find money and deductions in your taxes, and assuming you are answering accurately, you’ll be able to send in your return electronically in no time.

What did we miss? What do you consider to be the best personal finance software to manage your household?

Bottom Line: Top 11 Personal Finance Software for Financial Success

In today’s digital age, managing personal finances has evolved beyond pen and paper. A plethora of powerful software options enable effective budgeting, investment management, debt reduction, credit monitoring, and tax preparation, all at your fingertips.

These tools facilitate financial success while being compatible with both Macs and PCs. Mint, a budgeting stalwart, offers insights into spending patterns and goals.

You Need a Budget simplifies budgeting into manageable steps, making it a valuable resource. For investment management, Personal Capital stands out with real-time monitoring and unbiased advice.

To conquer debt, Ready for Zero offers tailored payoff plans, while Credit Sesame helps optimize credit offerings. And when tax season arrives, TurboTax simplifies filing with expert support. Embrace these tools to unlock your financial potential and secure a prosperous future.

Years ago i had the 2007 Quicken program but when my computer crashed I lost it becuase it wasn’t backed up. All I want to do is keep track of my everyday expenses in my personal checking and credit card account.\ Two years ago I developed Macular Degeneration and I can see well enough with one eye to enter information but the old Quicken made it possible for me to calculate all my donations when tax time comes around, ;how much I’m spending each month on auto fuel and groceries, for example. Also monthly mortgage and utilities. I set up a plan manually but it doesn’t allow me to do the simple calculations i could do on Quicken. I don’t need a program like a business owner would use and and I don’t need one for investments. (I can hardly read what I’ve written here because it’s so light and hard to see.) I hope it makes sense to you because it takes me too much time to manually keep track of my expenses.. I hope you can recommend something that will be secure and efficient. Thank you.

Has anyone used Mevelopes from Finicity? I like the concept of the envelope system and debt repayment strategy, videos and helps they offer and that it works for a couple. When I looked at Mint years ago, it was only for one user. Has this changed?

www.neobudget.com is also a fantastic source. Especially for the daily ins and outs of tracking where you spend your budget. We spend only about 10 minutes a week updating it. We’ve used it for several years now and love it.

I would recommend http://www.portfolio-hub.com

I’d recommend www.SavingsMap.com

It’s similar to many of the budgeting tools you listed, but I find it more useful because of it’s cash flow forecasting capability. It calculates all the state/federal taxes, as well as factoring in how various savings accounts are taxed. The interface makes it easy to run trade studies, seeing how changing any of your assumptions affects your forecasts in real time.

I think that “Personal Capital” would be the best personal finance software to manage my household as after the initial check in I will be able to monitor all of my investments in real time and get unbiased advice for my future.

Mint and Ready For Zero appear to offer great services. However, the problem I have is that both sites don’t seem to support GE Capital and Citibank branded credit or retail cards. It’s difficult to see the big picture when all accounts are not present.

Those are some great tools. My wife and I are huge fans of YouNeedABudget to manage or day to day budgets.

Credit Sesame and Credit Karma are great to keep a pulse on our credit. I think I may have to write a piece on those tools.

Even with YNAB, I will still use Mint.com to play around with their reports.

I haven’t tried some of the tools mentioned here, but I’m definitely going to give Credit Karma a try. As to our family finances, my wife and I are using https://www.inexfinance.com/ for budgeting and tracking household expenses. It’s free and quite useful.

Microsoft excel should deserve an honorary mention. I still use ot for simple budgeting and tracking my expenses.

Thanks for the list. Although I have been comfortable using the traditional calculator, it is always great to test out new tools that can increase accuracy and efficiency. I am excited to give them a try.

I’ve used Quickbooks for small business accounts and it’s been useful, especially at tax time.

@ Brent I need to try and use Quickbooks but I just have my secretary do it for me. 🙂 One day I may try and figure it out….

I have used QuickBooks for small biz account sin ’92; however it does not provide an investment tool as to how you are performing compared to the market, make comparisons, and track your gains and losses for tax purposes. Recently bought Quicken 2013 Home & Business to begin transitioning small biz records & personal together.

Needing to prepare a Statement of Assets & Liabilities; hopefully this will provide what I need better than calculator & paper!

Great tools, Kevin. I use several of these personally. I especially like the advice to check out your broker’s tools. That space is so competitive that they nearly all offer pretty robust choices.