While it’s easy to focus on the hazards of using credit cards, we believe that the best credit cards can serve as essential tools in your wallet.

Not only do the best credit cards let you earn cash back or travel rewards for your everyday spending, but some cards offer additional perks such as no interest for up to 21 months, free trip interruption/cancellation insurance, primary auto rental coverage, and more.

Credit cards can also help you build credit when your credit profile is too thin to qualify for a home loan, car loan, or business loan.

In summary, credit cards can be as useful and valuable as you make them – but only if you find a way to maximize their advantages while minimizing their inherent downside.

Table of Contents

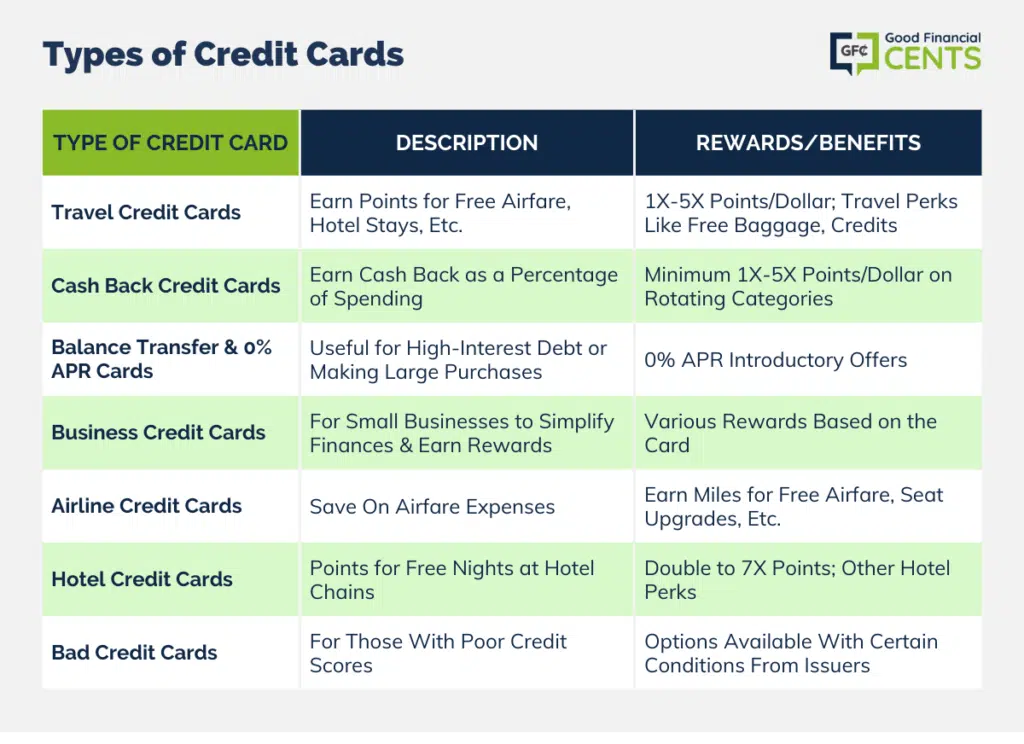

Types of Credit Cards

To help you find the right credit card for your needs, we created several credit card guides.

These guides highlight the top cards in every credit card niche with the goal of pointing you toward the perfect credit card for your goals.

Before we dig into the details, here is a listing of our current guides and what type of information and credit card offers each resource includes:

Travel Credit Cards

The best travel credit cards will help you earn points you can redeem for free airfare, hotel stays, and more.

Most of these cards offer anywhere from 1X to 5X points per dollar spent.

Also, some offer additional travel perks such as special airline or hotel status, free checked baggage or lounge access, or credits you can use for travel incidentals.

Cash Back Credit Cards

Cash back credit cards help you earn cashback as a percentage of your spending.

If you’re going to use credit for your purchases anyway, it’s smart to sign up for a card that will reward you for buying everything from groceries to gas.

You can expect to earn a minimum of 1X points per dollar spent, but some cards offer up to 5X points in categories that rotate every quarter.

Balance Transfer and 0% APR Credit Cards

If you’re carrying high-interest credit card debt or simply want a 0% APR credit card to make a large purchase, there are plenty of offers available.

By signing up for a 0% APR introductory offer, you can ditch debt for good and save money on interest as you pay down your balances.

Business Credit Cards

Having a business credit card for your small business is a smart move for both bookkeeping purposes and your pocketbook.

By having a special card just for your business expenses, you can simplify your finances and earn amazing rewards in one fell swoop.

Learn more about the top business credit cards available, plus the amazing rewards they offer their loyal users.

Airline Credit Cards

If you fly frequently and want to save money, an airline credit card might be the perfect fit.

By signing up for flexible rewards cards that allow you to transfer to your favorite airline or for a co-branded airline credit card, you can earn miles good for free airfare, seat upgrades, and more.

Since airfare can be the most expensive component of any travel itinerary, rewards earned in this category are generally fairly valuable.

Hotel Credit Cards

Similar to their siblings in the travel and airline rewards, the best hotel credit cards give you points that can earn you free nights at various hotels within a chain or family of hotels.

They can also be used for other perks at hotels on the higher end of the hotel industry.

The points can be pretty plentiful, with many cards offering double, triple, and some offering 7x points.

Bad Credit Cards

Not everyone starts with a perfect credit score, and many have seen their scores get slashed due to financial trouble.

While getting credit cards for poor credit may be difficult, there are still options if you’re willing to accept a little give-and-take from the credit card issuer.

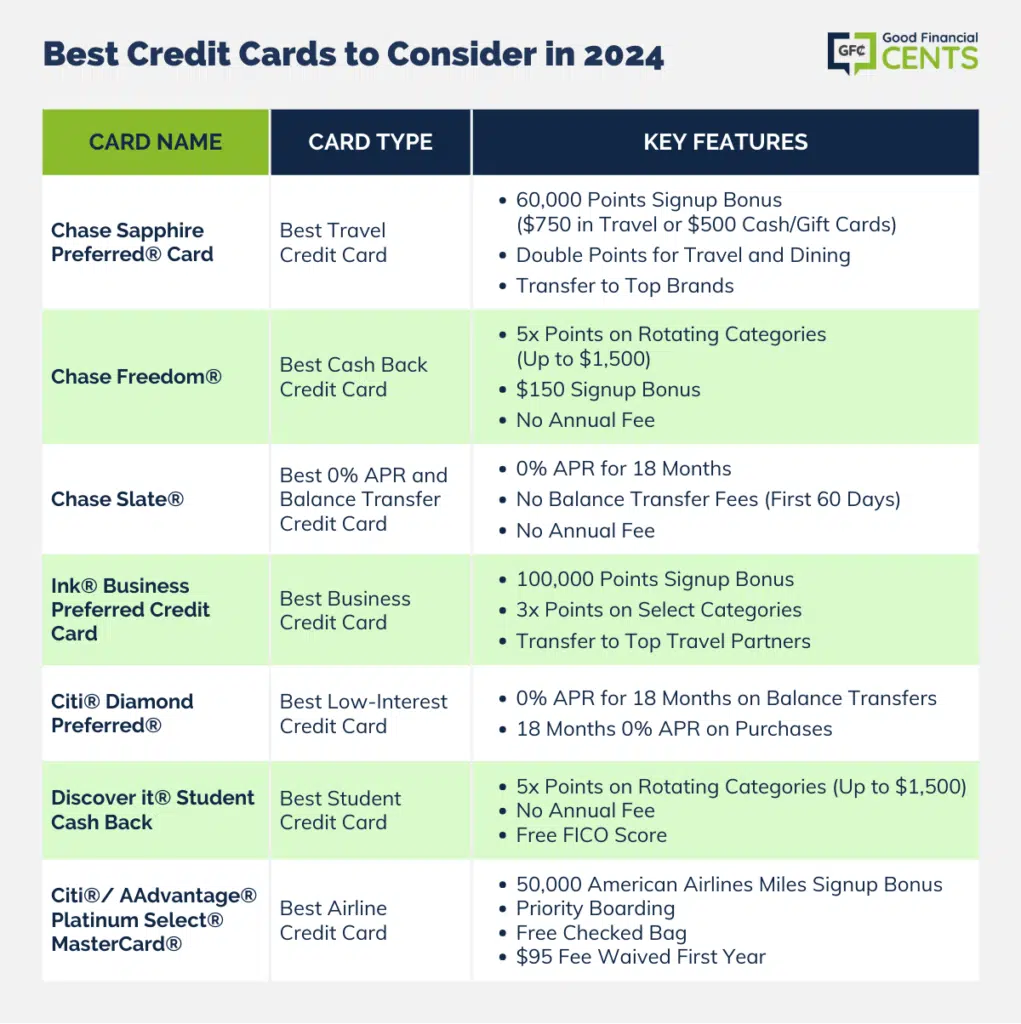

Best Credit Cards to Consider in 2024

While there are almost too many best credit cards to name, each niche has a few standout cards that are clearly the best in their class.

Here are our top cards to consider among each of the major “card types” – travel credit cards, cash back credit cards, 0% APR and balance transfer cards, business credit cards, low-interest credit cards, student credit cards, hotel credit cards, and airline credit cards.

Chase Sapphire Preferred® Card – Best Travel Credit Card

Due to its epic rewards program, generous perks, and affiliation with the top travel brands in the business, the Chase Sapphire Preferred® Card has taken the travel rewards market by storm.

The current signup bonus, which is 60,000 points after you spend just $4,000 on the card within three months of account opening, is enough to score $750 in travel through the Chase Ultimate Rewards portal, $500 in cash back, or $500 in high dollar gift cards.

Best of all, you can transfer Chase points to many of the top airline and hotel rewards programs, including Marriott, IHG Rewards, Southwest Airlines, United Airlines, Hyatt, British Airways, and others.

You also get double points for travel and dining.

Chase Freedom® – Best Cash Back Credit Card

If you’re looking for an awesome cash-back credit card with no annual fee, look no further than the Chase Freedom® card.

This card offers 5x points on your first $1,500 in spending in categories that rotate every quarter, plus 1x points on all other purchases.

Once you start racking up points, you can redeem them for cash back or gift cardsor use them to shop directly on Amazon.com.

Your points will never expire, and this card never charges an annual fee.

Best of all, you can pair this card with the Chase Sapphire Preferred® Card and pool your points for access to all of the travel perks offered through Chase Ultimate Rewards.

You also get a $150 signup bonus after you use your card for $500 in purchases within three months of account opening.

Chase Slate® – Best 0% APR and Balance Transfer Credit Card

When it comes to 0% APR balance transfer cards, the Chase Slate® card cannot be beaten.

With this card, you’ll have access to 0% APR for a full 18 months – plus no balance transfer fees on balances moved during the first 60 days.

Since most balance transfer cards charge a fee equal to 3% of your balance, this benefit is huge!

Since the 0% introductory APR is good on both balance transfers and purchases, this is also the perfect card to use for a large purchase you want to pay down over time.

In addition, this card comes with no annual fee and no penalty APR.

Ink® Business Preferred Credit Card – Best Business Credit Card

The Ink® Business Preferred Credit Card offers the most lucrative deal for business owners.

With this card, you’ll earn 100,000 Chase Ultimate Rewards points after you spend just $8,000 on the card within three months of account opening.

Since these points are the same points you earn with the Chase Sapphire Preferred® Card, you can use them the same way.

Best of all, you can transfer these points to top travel partners like Hyatt, Marriott, IHG, Ritz Carlton, Southwest Airlines, United Airlines, British Airways, and more.

The potential to earn a lot of points is obvious when you consider this card’s earnings structure and how it could work in your favor.

With this card, you’ll earn 3x points per $1 spent in select categories like travel and dining and 1 point per $1 spent on all other purchases.

If you spend a lot of money within this card’s bonus categories, the number of points you can earn is out of this world!

Citi® Diamond Preferred® – Best Low-Interest Credit Card

While the Citi® Diamond Preferred® card is also a stellar option for balance transfers, it currently offers the best long-term low-interest period on the market.

With this card, you’ll score 0% APR on balance transfers for the first 12 months.

While there are lots of low-interest credit cards on the market, this card’s 12-month introductory 0% APR has pushed it to the top of its class.

If you plan on carrying a balance, having 18 months with 0% APR is an amazing deal.

Getting this card is especially smart if you need to make a balance transfer and want to enjoy 18 months with 0% APR on purchases as well.

Keep in mind, however, that a balance transfer fee does apply.

Discover it® Student Cash Back – Best Student Credit Card

The Discover it® for Students offers the perfect combination of credit card benefits for college students – the ability to build credit over time, plus the prospect of rewards.

Students who sign up for this card will have the opportunity to build their credit with the protection of a low credit limit.

And while you learn how to handle credit responsibly, you can earn cash-back rewards!

You can build a rock-solid credit history while using your rewards to earn cash back and watch your credit score improve when you receive a free FICO score on your monthly statement.

Right now, this card doles out 5x points on the first $1,500 spent in categories that rotate every quarter, plus 1x points on all other purchases. The best part is this card comes with no annual fee.

Citi®/ AAdvantage® Platinum Select® MasterCard® – Best Airline Credit Card

If you’re looking for an airline credit card that’s ideal for both domestic and international travel, the Citi®/ AAdvantage® Platinum Select® MasterCard® is the best offer out there.

With this card, you’ll earn 50,000 American Airlines miles after you spend just $2,500 within the first three months of account opening.

To put things in perspective, that’s more than enough for two round-trip domestic flights!

This card also gets you priority boarding on American flights and a free checked bag for you and your companions on domestic itineraries.

The best part is the $95 annual fee is waived the first year, giving you 12 months to try out the benefits before you pay a dime.

Getting the Most Out of Your Credit Card

The type of credit card you choose will play a huge role in how you use it.

However, getting the most out of your card is easiest if you’re able to follow a short list of simple rules.

Whether you’re after cash back, travel rewards, or a 0% balance transfer offer, here’s how you can get the most out of your credit card:

Use Your Credit Card Like Cash

The key to getting the most out of your credit card is learning to use it as a tool – not a crutch!

To accomplish this goal, you’ll want to treat your credit card like cash – as in, never use your card for anything unless you have the cash in the bank.

If you truly want to treat your card like cash, you’ll also get in the habit of paying your balance in full frequently.

This can be done more than once per month and even once per week if you want.

As long as your charges are matched with cash in the bank, and you use that cash to pay off your balance, you’re in good shape.

Check-in With Online Account Management Frequently

One tip that can help you stay on track is learning to utilize your credit card’s online account management tools.

Most of the time, simply logging into your account is the fastest way to figure out whether you are staying on budget, how much money you have left, and how much you have spent.

If you check in every few days, you’ll also be in the best position to treat your card like cash over the long run.

Each time you check in with your account, you can also pay your balance off completely.

Never Pay Interest

We know we’re really harping on this, but it’s for good reason.

No matter what, you shouldn’t pay interest on your credit card purchases.

When you pay credit card interest, you’re not doing yourself any favors, and you’re certainly not earning any “rewards.”

Paying your card off all the time is the best way to stay out of debt and avoid paying interest.

Avoid credit card interest like the plague, and your finances will be much better off.

Maximize Bonus Categories

Some of the top cards offer up to 5x points on purchases in certain categories, but that won’t do you any good if you don’t remember.

To maximize these bonus categories, you’ll want to go out of your way to use your card for extra points whenever you have the chance.

Keep a list of your cards and the bonus categories they include, and stay organized.

Also, make sure you’re looking at all your cards and their perks before you make a large purchase. With so many points on the line, you’ll want to select the right card every time.

Don’t Spend More to Earn More Points

Earning points is awesome, but spending more than you planned is pretty lame.

Don’t use credit card rewards as an excuse to spend more, and don’t let your rewards goals outshine your long-term financial goals.

The best way to use credit cards is to use them in conjunction with a monthly budget.

Set a certain amount of money aside in each budget category and use your credit card to fulfill those spending plans – but don’t spend a penny more.

Remember, you’re not really benefitting if you’re buying stuff you don’t need or spending more than you planned.

Learn About Your Card’s Special Perks

While credit card rewards are the obvious benefit many cards offer, some special perks are far more valuable than many realize.

Perks that fall into this category include things like primary auto rental insurance, trip cancellation/interruption insurance, extended warranties on purchases, price protection, and zero fraud liability.

To get the most out of your card, you need to know exactly what it offers and how to use it.

The best way to do this is to read your card’s full terms and conditions, taking special care to notice and remember any special programs that you could use down the line.

And if you’re afraid you’ll forget, write it down!

Bottom Line – Best Credit Card Offers for 2024

In today’s financial scene, credit cards are like your Swiss Army knife for all sorts of stuff, whether it’s jet-setting around the globe, running your biz, or hitting the books.

Now, I know it might feel like you’re drowning in a sea of options, but here’s the deal: to really make these cards work for you, you gotta know what each one brings to the table and use ’em smartly.

Think of them as your trusty tools. Keep an eye on your online accounts, don’t let that interest pile up, and hey, don’t go crazy splurging just for those bonus perks.

Sure, racking up rewards and points can be pretty tempting, but you’ve gotta keep your financial game strong. Be in the know, make savvy choices, and master all the tricks your card has up its sleeve. That way, you’ll score the sweetest benefits without messing up your money game.

Credit Card FAQs

Will opening a new credit card hurt my credit?

When you consider how the FICO scoring method works, you’ll see that 10 percent of your credit score is determined by “new credit.”

Each time you open a new account or receive a hard inquiry on your credit report, your credit score could take a small tumble.

However, any movement to your credit score caused by new credit is usually just temporary.

The most important contributing factors to your credit score are your payment history (35 percent) and the amounts of money you owe, which is also known as your utilization (30 percent).

If you pay your bills on time and keep your utilization low – or at zero – your credit should remain in good shape whether you open a new credit card account or not.

What happens when you close an old credit card?

Just like opening a new credit card can temporarily ding your credit score, closing an old one can do the same.

That’s because your credit history is another determining factor of your credit score.

When you close old accounts, you effectively shorten your credit history, which could make your score drop a few points in a short amount of time.

If you want to lengthen your credit history as much as possible, keep your oldest, no-fee lines of credit open as long as possible.

The average length of your credit history is all that matters, and keeping those old accounts open can help.

Can both spouses get the same rewards card?

If you want to double the number of rewards you earn via signup bonuses, the best thing you can do is get your spouse involved.

Both you and your spouse (or partner) can sign up for the exact same rewards credit cards and earn a signup bonus.

This is a huge benefit since it essentially means you can earn double the rewards.

If it makes the process easier, you can also add each other as authorized users on each other’s accounts.

This is often the best way to meet a minimum spending requirement; with both spouses using their card for bills and regular expenses, it’s much easier to meet most minimum spending requirement thresholds.

Do I have to pay taxes on credit card rewards?

While you do have to pay taxes on any bank signup bonuses you earn that are worth more than $600, credit card rewards are currently treated as a rebate and not taxable thus far.

Because of the complex way they are doled out and distributed, there has been no effort by state or federal governments to track or tax the rewards you earn yet, either.

For the moment, it appears you can maximize your rewards without filing any paperwork with the tax man.

Make sure to enjoy it while you can, but keep in mind that this could change at any time.

What kind of credit score do I need to get a rewards credit card?

The best rewards credit cards are only available to those with good or excellent credit.

Because of this, you’ll generally need a score of 720 or more to qualify for the top credit offers.

If you’re unsure where you stand when it comes to your credit score, the Consumer Financial Protection Bureau (CFPB) offers a resource that shows you how to get a copy of your credit report once every year for free.

The opinions of commenters below are not approved or commissioned by the bank advertiser or this website.