Table of Contents

What Is Empower (Formerly Personal Capital)?

So, while these advisors can certainly be excellent, they’re mostly unreachable unless you have millions of dollars to invest.

What’s more, these wealth advisors aren’t really there to teach you how to put together a budget. They strictly manage your money.

Empower to the rescue.

I know what you’re thinking. “Okay, great, but why should I trust these new guys?” I’ve got to be honest with you. There were two words I saw on Empower’s website that made my heart skip a beat.

Those two words? Are you ready?

Fiduciary Obligation

Here’s a copy straight from their website:

Objective Advice: The sorry truth is that bankers and brokers are motivated to help themselves, not you. They are salespeople paid to push products, earning commissions and kickbacks when they do. In stark contrast, Empower is an investment advisor. We accept a fiduciary obligation to act in your best interest, and our advice must be aimed at making money for you, not for us.

This is absolutely key with any financial advisor you talk to, whether in person or online. Fiduciary duty means the party has a legal obligation to put their interests above their own.

Whereas normal brokers get paid commissions by getting you to churn your investments over and over (which costs you thousands of dollars in lost percentages here and there), Empower is putting a requirement on themselves to put your interests above theirs.

This is huge!

Seriously, there are major points for Empower from me on this one.

How Empower Works

Empower offers a free version and a premium version that features direct investment management. Whichever version you use, your account is actually held by Pershing Advisor Solutions, which acts as a trustee for your account.

The Free Version

With the free version, you get full use of the Empower platform as well as a free consultation from a financial advisor.

That advisor will give you a personalized analysis of your investments and recommendations as to what you can do with your portfolio. Your financial advisor can be contacted by phone, email, or by online chat.

In fact, the only feature that differentiates the free version from Empower’s premium product is its personalized portfolio management.

Other than that, the free version includes all of the many features and benefits that are available on the platform, including the ability to aggregate all of your financial accounts, the 401(k) analyzer, objective investment advice and investment check-ups, real-time financial dashboard, and access via the mobile app.

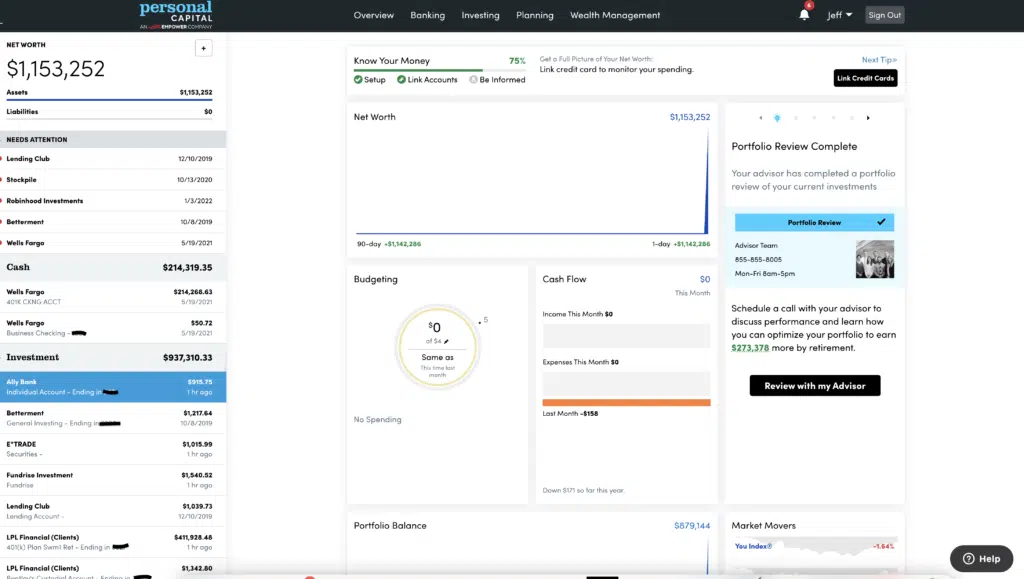

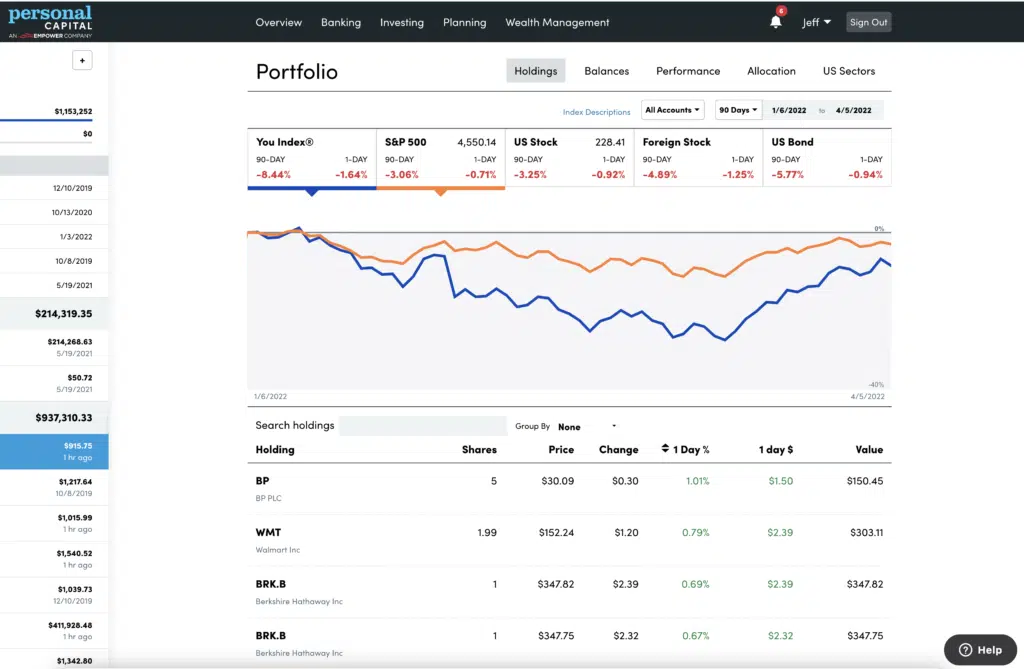

To show you how comprehensive their free platform is, take a look at this screenshot of their Portfolio Review from my free account:

This is just the “Holdings” tab on this feature. You can also get information on your performance and asset allocation. I can’t stress enough how valuable this information is for all types of investors – beginner or seasoned.

The Premium Version

Also known as their Wealth Management program, Empower’s premium program includes active management of your investment portfolio.

Like other similar products, they first determine your risk tolerance, personal preferences, and investment goals. Using that evaluation, they then create a portfolio tailored to fit within those parameters.

The fee structure for this service is as follows:

- 0.89% of the first $1 million

- 0.79% of the first $3 million

- 0.69% of the next $2 million

- 0.59% of the next $5 million

- 0.49% on balances over $10 million

These fees are quite reasonable when compared with fees of 1% to 2% that are customarily charged by active investment management services.

The fees apply only to the assets you have under management at Empower and not to other investments that may be aggregated on the site, such as your 401(k) plan.

And that’s it. There are no additional fees. Empower does not charge trading, commission, administrative, or any other types of investment fees. Your only cost is the annual, all-inclusive percentage that applies to your portfolio level.

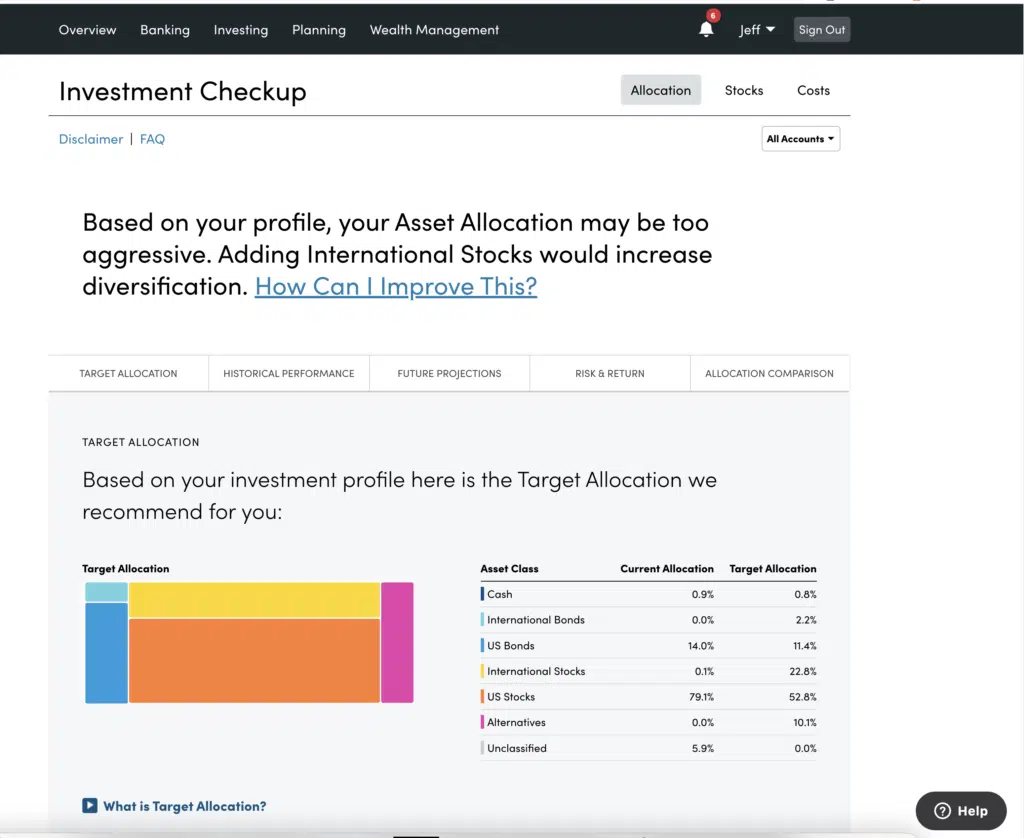

Investment Strategy

Empower uses Modern Portfolio Theory (MPT) to manage your portfolio. MPT focuses less on individual security selection and more on diversification across broad asset classes. Those asset classes include:

- US Stocks (Which Can Include Individual Stocks)

- US Bonds

- International Stocks

- International Bonds

- Alternative Investments (Including ETFs and Commodities)

- Cash

Though Empower makes use of funds in constructing your portfolio, they may also include up to 100 individual securities in order to avoid being too heavily concentrated in a small number of companies.

I also discovered through my review that Empower uses an integrated investment approach to managing your investments, which is a pretty unique feature. This means that they factor in all of your investment holdings – including those not managed by Empower – in managing your portfolio.

For example, though they don’t manage your 401(k) account, your 401(k) allocations will be considered when making decisions about your investments that are actually managed by Empower.

Review of Empower Tools and Benefits

There is a long list of tools and benefits in using Empower. Some of the more interesting ones include:

The Investment Checkup

This tool analyzes your investment portfolio and gives a risk assessment of it to make sure that your level of risk is consistent with your goals.

This will help you to create an asset allocation that will get you where you need to go with your investments. Here’s a screenshot of their Investment Checkup from my Empower dashboard:

401(k) Fund Allocation

This tool can be used to analyze your employer-sponsored 401(k) plan, even though it is not under the direct management of Empower.

It can be used to help you with your asset allocation, at least based on the investment options that your plan includes. This is an excellent tool since most 401(k) plans don’t have any kind of investment management advice.

Retirement Planner

You can often find retirement planners or retirement calculators on various sites throughout the Internet. But what better place than to have it available where you also have all of your investment accounts listed?

Empower’s Retirement Planner allows you to run numbers on your retirement to make sure that you will be prepared when the time comes.

It allows you to incorporate major changes in your life into your retirement planning, such as the birth of a child or saving for college.

Net Worth Calculator

Since Empower aggregates all of your financial accounts on the same platform, they can also provide you with ongoing monitoring of your net worth.

This will enable you to get the most comprehensive view of your financial situation since it not only takes into account your assets but also your debts.

Net worth is the best single indicator of your overall financial strength, and this will give you an opportunity to track it.

Cash Flow Analyzer

Though our focus in this article has been primarily on the investment side of Empower, it’s important to recognize that it also includes a budgeting capability.

The Cash Flow Analyzer tracks your income and expenses from all sources, letting you know where you’re spending money (or spending too much of it), which will help you to make adjustments that will improve your overall budget.

Mobile App

Empower’s mobile app is a free feature that can be downloaded on Apple iPhone, iPad, Apple Watch, and Android. The mobile version has everything that is available on the desktop platform.

It will enable you to track your investment portfolio, as well as your banking and credit card activity while you’re on the go.

Tax Optimization

Empower uses tax optimization in the management of your portfolio. This feature is available to premium Wealth Management clients, and not if you are using the free version.

They use several tactics as part of tax optimization. For example, they include income-producing investments in tax-deferred accounts, while growth-oriented investments – that have the benefit of lower capital gains taxes – are held in taxable accounts.

In addition, they don’t use mutual funds but instead use exchange-traded funds with a mix of individual stocks since stocks can be easily bought and sold for tax-loss harvesting.

And speaking of tax-loss harvesting, they use this strategy to sell losing stocks, which offsets the gains on the sale of winning stocks. This strategy minimizes the negative impact on your investment portfolio from income taxes.

Site Security

Empower uses bank-level, military-grade encryption on the platform. They also perform ongoing third-party security audits to test their systems. They also use device authentication so that each device you link your account to must first be authenticated in order to be used.

Crash Test Your Portfolio

Investing expenses and taxes are the two things you can absolutely count on within the investing world. You can’t rely on gains every year, but you can guarantee you will be taxed and you will pay expenses.

That makes reducing those expenses one of two ways you can control your investing destiny.

Thankfully, Empower realizes this and offers you a really great tool to analyze the cost of your investments.

Where this gets interesting is you can do an analysis of your employer’s 401 (k) plan (as discussed above) to discover whether your plan is amazing, just okay, or terrible when it comes to costs.

You might be the person to go to HR to reveal just how expensive your plan is, lay out a new plan that would cut costs for everyone, and end up getting a promotion just for running a cost analysis.

Even if you don’t get promoted to head investment advisor for your employer, at the very least, you’ll save your own retirement from exorbitant fees. And that’s a huge win we can all settle for.

Is Empower for Me?

The idea of wealth management means you need to have wealth to manage. If you’re struggling to get out of debt, that’s okay, but Empower probably isn’t the best fit for you.

In that case, Mint might be a better option, and you can see a full comparison in my complete Personal Capital vs Mint review.

However, if you are building up your retirement assets and want to be able to maximize your nest egg without gambling on penny stocks, then you should definitely sign up for the service.

All of the features, aside from the personalized portfolio management, are absolutely free, so there’s really no reason not to give them a try.

Final Thoughts – Empower (Formerly Personal Capital) Review – Managing All Your Investments in One Place

In the quest for a tool that offers both financial consolidation and insightful investment analysis, Empower (formerly Personal Capital) emerges as a frontrunner.

Unlike its competitors, Empower provides an all-in-one solution, ensuring users can monitor their entire financial spectrum while also gaining objective investment advice.

With many financial advisors charging exorbitant rates, Empower offers a more accessible alternative without compromising on quality. Their fiduciary obligation demonstrates a commitment to prioritize users’ financial interests above all else.

This dedication to transparency and accountability not only distinguishes Empower from many in the market but also earns it high commendation for its genuine dedication to the user’s financial growth.

How We Review Brokers and Investment Companies:

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends.

Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations. This hands-on approach, combined with our independent research, forms the basis of our evaluation process.

After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Empower (formerly Personal Capital) Review

Product Name: Empower - Personal Capital

Product Description: Personal Capital is a financial advisor and investment management company. They provide services such as wealth management, retirement planning, and portfolio management.

Summary

Empower, originally known as Personal Capital, offers a comprehensive suite of financial tools that help users track and manage their finances. Its primary features include a dashboard that gives an overview of all assets, liabilities, and investments, a budgeting tool to track and categorize spending, and an investment checking tool that provides insights into one’s portfolio. The platform prides itself on its intuitive user interface, ensuring that both novices and seasoned financial experts can navigate and utilize its features with ease.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- The App Is Free to Use

- User-Friendly Interface

- Provides a Comprehensive Overview of Your Financial Situation

- Offers a Variety of Tools to Help You Manage Your Finances

Cons

- Limited Features

- Investment Management Fees

- Limited Access to Advisors

- Limited Investment Options

- Potential Conflicts of Interest

I like PC a lot BUT when accounts stop updating they are painfully slow fixing issues. For example, one of my my credit cards stopped updating in April and going into the 5th month they have yet to fix the issue. It’s very annoying. They claim it’s their aggregator but Mint hasn’t skipped a beat synchronizing the same account. Moreover, the exact same issue occurred once before and it took them many months back then to have the issue resolved. So it’s not my first rodeo with their poor technical support.

That’s frustrating!

I’m so glad that this kind of app can be downloaded on our mobile! We just did a Personal Capital Review too and I wish I would have found it sooner. It’s amazing how they can break everything down and analyze your 401 (k) funds.

I wholehaeartedly agree with Rebecca saying: I know financial institutions will cover it if they are hacked and your money is taken. Would they cover this or would Personal Capital? I’m just been weary of giving my passwords to a third-party source

HOPEFULLY SOMEONE WILL PROVIDE AN ANSWER.

@Sadie

Not sure if this helps, but here’s more about Personal Capital’s security: https://www.personalcapital.com/safety-and-security

That doesn’t help at all. I’ve been following this company for over a year, and I have not seen a single review of its security that does anything other than parrot the company’s assurances. The company asks for ALL the credentials necessary to log into ALL of a person’s financial accounts. It’s not a question of “trust” in the company or its founders: I have to assume that sooner or later it will get hacked, and ask what the fallback protections are. I don’t see any. Although many people tell me the company has read-only access, the company itself doesn’t say that, and there’s nothing “read only” about the credentials they ask for. This is a massive security risk, as far as I’m concerned, and until they address it I wouldn’t go within a mile of this service.

Recommend Personal Capital identify recommended PC requirements. I signed up only to learn Windows VISTA is not acceptable. Also identified I was using unacceptable Browser though IE9.

Hi Jeff! Thanks for this review! Do you know if Personal Capital has a way for financial planners to monitor their client’s portfolios alongside the client? And if not, do they plan to allow for that as Balance Financial does?

@ Shannon

The client could give their planner their login credentials so they could monitor it all. I do have one client that did that with me.

The only downside for advisors is that Personal Capital also has internal advisors that are essentially competition. That’s something I’ve considered but their interface is too slick to not let people take advantage of it.

I’m not familiar with Balance Financial.

I started using a UK version of Mint, but found that it didn’t really have the functionality that I needed and the freedom that Excel gives me.

However, personal capital looks like it has loads more really interesting features. “Crash test your portfolio” looks like a very interesting functionality.

I’m a big fan of RIAs for their fiduciary obligation to put my interests first. But Personal Capital seems pretty groovy for people who don’t use them for their RIA services (like me for example).

They seem to shine where other aggregators and personal finance website fall down, which is on the investment side of things. I’ve always ignored the investing component of Mint because it wasn’t useful, but Personal Capital is the opposite. Great investment tools, but poor day-to-day financial management.

If you or anyone else wants a Personal Capital supplement to the solid info you have here, my write-up might be helpful too: http://valueofsimple.com/personal-capital-review/

Yes, that helps.

Thanks!

Kevin,

Nice video and Personal Capital is a good concept. However, what happens if your Personal Capital account is hacked and they clear out your accounts? I know financial institutions will cover it if they are hacked and your money is taken. Would they cover this or would Personal Capital? I’m just been weary of giving my passwords to a third-party source.

Thanks, Rebecca

@ Rebecca Personal Capital is just for viewing purposes only. If someone were to hack your account, yes they could see your personal information, but they couldn’t do anything with it.

Personal Capital also uses multiple levels of security and multi-factor authentication when you sign in making it extremely difficult for hackers to get in.

Hope that helps!

If they hack your personal capital account they have 100% all of your passwords AND some of your security question answers. These are all of the things stored in your Personal Capital account (to allow updating).

Plain and simple, you are completely at risk and must trust them not to get hacked (just as we trusted target, sony, etc.).

Brilliant graphics and very easy to follow. I’d say your first video is a success!

Thanks, Mike! Should have more like this in the future. Even if I have to tape a flashlight to my desk to light up my face 😉

Thanks for sharing! The interface looks great, and it’s nice to have the option to get advice from a financial advisor, albeit for a fee. But the list of accounts that can be added is still quite limited, so I would have to add a lot of holdings manually. I think for now I’m stuck with HelloWallet until Personalcapital.com expands their account access 🙁

I am also using Mint to track my investments though I know that there is something missing from its features. I would like to try this one and let me see how it works compared with Mint. Thanks for sharing!

I remembered you reviewed Portfolio Monkey earlier. How do you compare these two websites? In my opinion, I think personal capital is more easy to use. In fact, I just did my portfolio review with pc 2 days ago. I will keep using of to review my investment semi-annually to see if rebalancing is needed.

@ Nicole I think Personal Capital is a far superior product. The big difference between them and Portfolio Monkey (as of now) is that PC is attempting to lure youf investment advisory business. So they want to make sure there free platform is “legit”. PM is still a completely free program that is currently not trying to make money. It’s a great tool, but my fear is that they’ll eventually shut down shop.