If you have any inkling of wanting to become an entrepreneur, then you should be doing one simple thing.

What’s the simple thing? Reading.

Reading is said to be the spark behind creative thinking, and is one of the most predominant traits of individuals said to pertain to a level of “higher intelligence”.

Is the thought of gaining intelligence through reading actually viable? I believe that it is not intelligence that is gained through reading; rather it’s the exposure to other people’s thoughts and perception of events and processes that lead to you being better-rounded thinker.

Reading other people’s thoughts and ideas is the key ingredient to being successful in life (beyond being very naturally intelligent).

By reading through stories of people who were in similar situations to your own, and hearing their stories of success and how they perceived the difficulties along the way, you will be able to better separate yourself from your normal thought train and tackle a situation with more “proper” guidance.

I can’t tell how many times I’ve read a book by a successful entrepreneur or motivational speaker to immediately have a burning desire to apply some aspects of their success to my own life.

Don’t believe me? Ask my wife. She’ll be first to tell you how after I read Tim Ferriss’ 4-Hour Work Week, I wouldn’t shut up about it. Thanks to Tim, I hired my first VA (virtual assistant) and was able to free myself of several mundane details that I have from running this site.

Having diagnosed the process and benefits of reading, there are some books that have changed the way I have thought. They have also opened me up to some great ideas that I, and the majority of the world, would initially have thrown out as hogwash.

My favorite books that help characterize the process and more importantly mental game of becoming an entrepreneur are all listed below with a small synopsis of their content. (Note: If you’re looking for a good list of finance books check out this post.)

Top Must-Reads for Entrepreneurs

1. The 4-Hour Workweek by Timothy Ferris

Tim’s book takes the prize for the best book I’ve ever read that revolves around business and entrepreneurship. Ever.

I want my kids’ kids to read this book. This book provides a non-standardized idea of how to approach daily situations, and how to think of them with a new perspective. It also teaches you positive thinking to maximize your potential.

2. E-Myth by Michael Gerber

This is a clear stand-out for so many entrepreneurs.

According to Todd Tresidder of Financial Mentor, “This book will leave you absolutely clear on the difference between a real business and owning your own job. It will teach you the core principles that differentiate working ON your business vs. working IN your business. It will assure that when you climb the ladder to success it is actually leaning against the right wall. A simple story with a powerful message.”

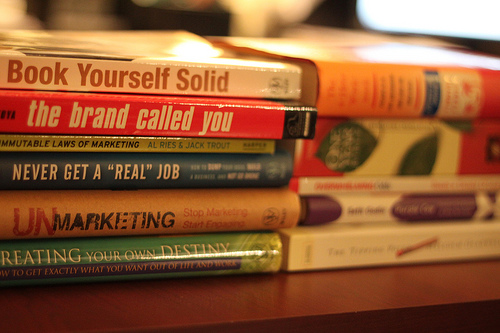

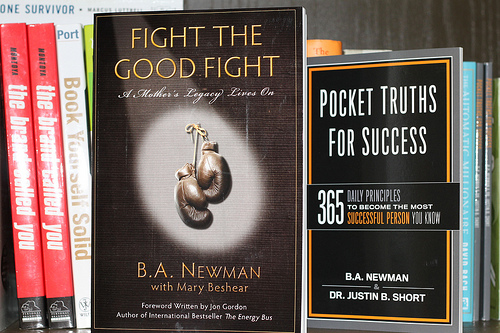

3. Book Yourself Solid by Michael Port

This book goes through an in-depth analysis of why it may be more important to market yourself as opposed to marketing your actual business. It also gives guidelines for how to attain more clients and raise your business profile.

What’s funny about this book is that it’s been on my shelf for years. I’m not even sure who recommended it, but it’s been a great addition to my reading library. When I asked fellow entrepreneur Matt Sapaula what books he would recommend, this was tops on his list.

I knew I had good taste 🙂

4. The Brand Called You by Peter Montoya

A great book that teaches you about how marketing your personal attributes can be more successful and important than marketing your business. This book really helped put into perspective how to differentiate myself from all the competition…like this blog 😉

I’ve been a huge fan of this book for years and recommend it to every new small business person that I encounter. As you can imagine, I was blown away when Peter called me out of the blue to tell me how he liked my blog and I was doing a tremendous job marketing myself.

I’m pretty sure he felt good when I told him that his book inspired me to create it.

5. UnMarketing by Scott Stratten

Yes, this book might be more marketing-related, but I couldn’t leave Scott out of this list. This book goes through the approach of viral marketing techniques and social media becoming the predominant source of profitable businesses.

What I like about Scott so much is that he’s just a real dude. It’s hard not to respect that about him. Plus he likes Pearl Jam. What else is there to say?

6. The Millionaire Messenger by Brendon Burchard

After surviving a devastating car accident, Brendon Burchard had a realization that he had both a purpose in life and a message to share with others.

This experience helped him realize that every single person has an important story and advice to share, and The Millionaire Messenger outlines what you have to do in order to achieve a sense of mastery over any subject and use your expertise to help others and attain financial and life success.

Now the “guru’s guru,” Burchard outlines the steps you can take in order to join the information marketplace by becoming a motivational speaker, coach, author, blogger, and consultant.

7. The Tipping Point by Malcolm Gladwell

This book is an in-depth look at the phenomenon of a small idea turning huge, and how the critical point is referred to as the “tipping point” by the author.

I was amazed at how the kid’s show Blues Clues was able to take the Sesame Street concept and blow it up. If you’re looking to grow your business with the same magnitude as Paul Revere galloping on his horse through the U.S. countryside, this book is an excellent read.

8. Overwhelming Odds by Susan and Denny O’Leary

This inspirational story of a man who is given overwhelming odds of failure, and the story of how he succeeded in life. I was so fortunate to meet Susan and Denny’s son John, and a small intimate gathering put on by the next author on the list.

John was involved in a horrible burning accident as a child that left him nearly for dead – the doctors telling his parents that he had a 1% chance to survive the night.

John survived and used that tragedy to inspire others to be better people and also better business leaders. If you need help in redefining your purpose in life, this is a must-read. Find out more about John and his professional speaking business at Rising Above.

9. Crush It by Gary Vaynerchuk

How can you not love Gary V? This guy is loud-mouthed, full of energy, and lives and breathes entrepreneurship. His book gives a guide on how to think successfully in life, as opposed to the ordinary how-to-be successful type of novel.

Favorite word of the book: Passion. <<<<YOU better have some passion if you’re going to Crush It!

10. Delivering Happiness by Tony Hsieh

How do you top selling a business for $265 million at the age of 24? How about selling another company for a mere $1.2 billion.

Even though I knew the outcome of the book (see the previous sentence where he sells the company for $1.2 billion), I was on pins and needles seeing how Zappos.com almost didn’t make it.

Think Tony was worried? Nah. He decided to go ahead with a scheduled trip to climb Mt. Kilimanjaro. Now that is an entrepreneur that has brass balls.

11. Fight The Good Fight by Ben Newman

I didn’t know what to think when a buddy of mine recommended this book to me. I have to say, I’m thankful that he did.

Fight the Good Fight shares the story of a son who loses his mother at a young age. Later on in life, his grandmother delivers a gift to his son that will change his life. Turns out his mother had kept a memoir of her life so that her kids could see the courage and inspiration she had – despite her illness.

I can’t remember the last time a book moved me the way that this book did. I’m thankful to have it as part of my reading library and excited to share it with others.

12. Industry Transformers by Dan Sullivan

You’ll hear more about Dan Sullivan here in a bit. This was a book that I couldn’t pass on, especially when I found out I could get it on my iPad for $12.99.

What makes this book so good for entrepreneurs? How about 10 interviews with 10 awesome entrepreneurs who have all developed their own Unique Process™ through the Strategic Coaching program (that I’m happily enrolled in).

If you ever wanted to know how an entrepreneur started from the ground up, how they learned from their mistakes and were able to fully capitalize on them then this is the read for you.

A few of my favorite interviews are with Phillip Tirone from 7 Steps to 720 Credit Score and Joe Polish from Pirahna Marketing. Both were well respected in their industries and were able to develop their own unique product that launched them into the stratosphere.

I’ve been fortunate to speak to Phillip directly a few times and I’ve been inspired by his continued drive as well as his love for his family.

For Financial Advisors

If you’re a financial advisor and looking to differentiate yourself from the crowd, another good book from Dan Sullivan is Unique Process Advisors. I’m more than halfway through the book and my wheels are already spinning.

13. Rich Dad, Poor Dad by Robert Kiyosaki

Many people feel that Kiyosaki is full of crap with his Real Estate riches and Cash Flow Quadrant. While I have to admit that much of his advice lately (for me, at least) doesn’t hold a lot of water, his book Rich Dad, Poor Dad was the first book that really got my entrepreneurship juices flowing.

This book tells a tale of two separate people and their life choices. It analyzes these choices to come to some type of conclusion on the more appropriate way to think. Thanks to his book I always knew there was and always will be something more.

14. Purple Cow by Seth Godin

This book teaches you how to re-market your existing business to satisfy the evolving business needs in an ever-changing world.

Thanks to Pat Flynn from Smart Passive Income for getting this book to me. Mike from Oblivious Investor also recommends this book in addition to The Dip and Tribes.

15. Enchantment by Guy Kawasaki

I was recently introduced to Guy Kawasaki and so glad I was! I had heard of Guy but didn’t really know much about his story. This “guy” just oozes success.

I immediately bought his new book Enchantment but also realized that I need to check out his other stuff, too. Another highly recommended book of his is Art of the Start.

Want a little more insight into how Guy Kawasaki’s mind works? Check out this witty quote of his:

“Don’t worry, be crappy. Revolutionary means you ship and then test… Lots of things made the first Mac in 1984 a piece of crap – but it was a revolutionary piece of crap.”

16. Never Get a Real Job by Scott Gerber

If you’re ready to ditch your crappy 9 to 5 job and branch out on your own, this is the book for you.

For a 26-year-old bootstrapping entrepreneur to stick it to the man to explore his own passions and make it makes this a must-read.

17. Steve Jobs by Walter Isaacson

Both Mac and PC users mourned the loss of a true American innovator when Steve Jobs succumbed to cancer in October 2011.

This biography, which was based upon over 40 personal interviews with Jobs himself and hundreds of interviews with those close to the founder of Apple, follows the incredible creative passion and drive of the man who wanted to “make a dent in the universe.”

If you want to better understand just how innovation and ambition are intertwined, this is a must-read.

18. The Dan Sullivan Question by Dan Sullivan

I joined the Strategic Coach program 3 years ago and I’ve been really excited to see what it has been able to do for me. Dan Sullivan the creator has written several books including this one.

19. ReWork by Jason Fried and David Heinemeier Hansson

Entrepreneurs can spend years writing their business plans, researching the competition, and chomping at the bit until they finally release their great idea. Or they can read this book.

How good is it? Heck, even Seth Godin says, “Ignore this book at your own peril”. Are you going to disagree with Seth?

20. Escape from Cubicle Nation by Pamela Slim

If you’ve ever dreamed of leaving the 9-to-5 slog to go into business for yourself, this book is for you.

Pamela Slim’s groundbreaking book was inspired by her blog of the same name (bloggers for the win!), and offers advice on both the emotional and practical issues of leaving the corporate world in order to launch a business.

Slim left her own corporate job as a training manager over a decade ago and has been blazing her own trail ever since. She draws on her own experiences to help readers make the leap from working for a paycheck to working for themselves.

21. The $100 Startup by Chris Guillebeau

This book is a great read for those interested in starting a microbusiness: a tiny one- or two-person operation that maximizes freedom and generates a modest living (around $50,000 per year).

Rather than focus on unending growth and leverage, as most entrepreneurship books do, Guillebeau advises creative people with a passion on how to create a business from that passion. The author likes to say this isn’t a book about entrepreneurship, but one about freedom.

22. Linchpin by Seth Godin

According to Godin, a linchpin is someone in an organization who is indispensable and simply cannot be replaced. We all know individuals like this.

The ones who come up with new ideas when everyone else is stumped and who enjoy the challenges of figuring out what to do when there are no precedents or rules to follow.

This book explains how to become a linchpin, whether you’re working in the corporate world or are self-employed. Not only does this promise you a lifetime of job security, it also ensures that you are always a master of your career and charting your own path.

23. The Pumpkin Plan by Mike Michalwicz

When Mike Michalwicz read about how pumpkin farmers grow their giant prize-winning pumpkins, he realized that their methods and process could apply to small-business owners, as well.

Just like pumpkin farmers, entrepreneurs need to plant the right seeds—that is, focus on the product that they can do better than anyone else, rather than trying to be everything to every customer.

Entrepreneurs need to weed out those customers who add no value and lavish attention on the ones who can help them grow, and the rewards will be as enormous as the giant pumpkins.

24. The Millionaire Fastlane by MJ DeMarco

In this book, MJ DeMarco takes aim at the accepted wisdom about building wealth: getting a good job, socking away 10% each year for retirement, pinching pennies, and waiting for feelings of wealth in retirement is an impoverished mindset that will leave settling throughout your life.

That is the slow lane.

Instead, DeMarco would like you to take the fast lane to wealth. Start a business that fills a need, and work your tail off for 5 to 10 years, and you will see incredible wealth in a short time. The fast lane isn’t an easy road, but it’s out there and it’s available to every entrepreneur.

25. From Good to Great by Jim Collins

Why do some companies never achieve anything better than mediocrity, while others make a leap from good enough to great?

This question bothered Jim Collins, so he analyzed over two dozen companies to determine what separated the merely good from those that improved from mediocrity to greatness.

What he found was shocking—from what types of leaders are necessary for achieving greatness to how discipline and an ethic of entrepreneurship work together to create a company culture.

Many of the important concepts Collins discovered fly in the face of what we assume to be true about business culture.

26. The Lean Startup by Eric Ries

The vast majority of startups fail, partially because entrepreneurs think that they need to learn what works by experiencing expensive failures. Eric Ries wants you to know that there is a way to build a sustainable business without constant trial and error until you stumble upon a winning formula.

With methods for rapidly learning and shortening development cycles, this book will help entrepreneurs on the cutting edge ways to quickly adapt and adjust in the early days.

27. Art of Start by Guy Kawasaki

This is a great how-to guide for anyone interested in starting their own business. Kawasaki covers everything from creating business a business plan to identifying your customer base to building your brand identity.

Each chapter starts with GIST (Great Ideas for Starting Things) and ends with FAQs, frequently avoided questions, to help you really understand the dos and don’ts. This book is full of useful hints and specific advice for any beginning entrepreneur.

28. EntreLeadership by Dave Ramsey

This book offers great insight, especially for the growing entrepreneur. With excellent tips on how to motivate and unify your employees and how to handle money to set your business up for success,

Ramsey offers practical, step-by-step guidance on how to grow your business in the direction you want it to go.

29. Do More Faster by Brad Feld and David Cohen

Brad Feld and David Cohen founded the program TechStars, a mentorship-driven startup accelerator.

After twenty-five years of seeing first-time entrepreneurs take their first steps, Feld and Cohen have identified some of the common issues startups will encounter, and offer proven advice for dealing with those issues.

30. Getting Things Done by David Allen

In the modern world, the old ways of organization and time management simply do not work anymore. David Allen has come up with a proven system for ensuring stress-free productivity.

While Allen does sometimes get a little over-complicated in both his system and his explanations, the basis of all of his procedures can be reduced to a one-page flow chart that can be pinned over your desk to remind you of the correct way of handling your to-do lists without going crazy.

| I also loved Allen’s Two-Minute Rule: if there is something that you must get done and it will take two minutes or less to complete, then just do it now, and free yourself from the constant nagging feeling of things undone. |

31. Built to Sell by John Warrillow

Many businesses are inseparable from their owners. It may feel gratifying to know that you are your business and vice versa, but it sure makes things tough when you want to take a vacation, step away from your business for a short time, or even sell your enterprise.

Warrillow enumerates the specific, actionable steps that entrepreneurs can take to ensure that their business is a valuable, sellable company that can thrive whether or not you’re at the helm.

32. If You Don’t Have Big Breasts, Put Ribbons on Your Pigtails by Barbara Corcoran

You may know Barbara Corcoran as the real estate expert on The Today Show, but long before she became a nationally known real estate mogul, she was a diner waitress who had failed at 22 different jobs.

But with a borrowed $1000 and the accumulated and hilarious wisdom from her mother, she was able to build a $4 billion business.

Not only is this book incredibly entertaining, it offers great advice on how to stand out from the crowd (hence the ribbons) and how to grow a business from the ground up.

33. Creating Your Own Destiny by Patrick Snow

I was pleasantly surprised when Patrick sent me a copy of his book completely unsolicited. This book is an inspirational learner of how to fulfill your personal dreams and how to find true happiness in life.

Think it’s silly to have big dreams? Think again. Patrick’s dream is to have an NFL team in Hawaii and is raising money to try and make that dream happen. Tell him that it’s stupid to dream big. I dare you.

34. Who Moved My Cheese by Dr. Spencer Johnson

Do you like chasing the cheese? Then this book is for you. 🙂

This short but enlightening parable addresses something that all entrepreneurs must embrace: change. How well do you deal with change? If not well, this book is for you.

35. Uncertainty by Jonathan Fields

If there’s one thing that all entrepreneurs share is an uncertain future. We all like to take risks and have faith in the world that things will work out.

Unfortunately, many people never get a chance to live out their dreams and passions because of the fear of uncertainty. This is what Jonathan Fields tackles in this awesome book. If that’s enough to check it out, watch this book trailer. It’s one of my personal favorites.

36. How to Win Friends and Influence People by Dale Carnegie.

There aren’t many books that can still give awesome and practical advice 6 decades after it was released. Of course, those other books aren’t written by Dale Carnegie.

Tim Ferriss has been quoted saying “Your network is your net worth”. Carnegie knew this and he showed you exactly build your network.

Glenn from Free From Broke and Mixergy CEO Andrew Warner both highly suggest this book. Turns out I forgot I even had this book (though I loaned it and never got it returned – Whew!)

37. Awaken the Giant Within by Tony Robbins

Tony Robbins has had such a positive effect on so many people.

Baker from Man Vs. Debt says reading this book, “Fundamentally changed my life. I read it while transitioning from poker into Real Estate and it shifted how I viewed myself and my life/business relationship. “

All of the above-listed books are great for anyone who would like to start their own business or is just looking for a release from the conformist thought process of the majority of Americans.

There are many differing viewpoints in the world today, and these books will give you some motivation as well as enlighten you on the thought process behind success.

Thank you for putting this list together! I have read 4 Hour Work Week, Rich Dad Poor Dad, and a few others are on my list. What would you suggest reading between Lean Startup, $100 Startup, or Crushing It?

Also, if you are interested here is a post I wrote where I explain my 5 top picks of business books! (similar to your list)

No, I’m not familiar with any of those three books, which is why they’re no t on the list.

Great list. But this is first time I have seen such a list that doesn’t include The Law Of Success Or Think And Grow Rich. Also The Compound Effect is a solid one. Brian Tracey’s The Psychology Of Selling…

My dad is a big reader of “practical” books. He gave me The Millionaire Next Doors/Millionaire Mind books and I really like those. He also recently gave me “Creating You & Co.: Learn to Think Like the CEO of Your Own Career” but I haven’t read it yet. Neither directly about being an entrepreneur but both seems to contain applicable finance and career advice for business.

I’ve read several of these books here. Your list reminds me of a few more that I’ve thought about reading and should put back on my list to read next. I especially enjoyed The Lean Startup, for those of us who are entrepreneurial thinkers. A book I recommend that shows how to practically implement Lean Startup methods is called ‘Running Lean’ by Ash Maurya. I recently read it and wrote a full review of it here: http://kevinkauzlaric.com/running-lean-book-review/

Interesting, I haven’t even heard of a lot of these. Definitely added a bunch of books to my must-read list. Thank you very much 🙂

Millionaire Next Door, Thomas Stanley and William Danko – while not entrepreneurial in the literal sense, the book provides wonderful insight to the fundamentals of financial success for most of us

PS — I am buying a new book, today because of this post.

thanks

You have my faves on here!!! You’ve listed so many goodies I can’t even pick which one I love the most.

And there are a bunch I have not read yet so now I have homework LOL

But I do have a question. How come most of my fave entrepreneurial books have been written by men? Nothing wrong with that, just an interesting observation.

Now that my kids are better sleepers I am making a list of books to read. Some of them that you have on the list look like great inspiration. By the way hiring someone to do the mundane stuff was a great move. I do that from time to time too.

Rich Dad, Poor Dad has influenced me a lot too. Great book. Awesome list. Will look up some of them.

D-oh! I just realized I have Unmarketing sitting on my shelf. And it’s a signed copy too. Thanks for the reminder about the book, I need to read it now.

Great list! I particularly like Malcolm Gladwell’s books because his observations makes me think. I have read The Millionaire Messenger, Rich Dad, Poor Dad, Steve Jobs, From Good to Great and Who Moved My Cheese. I highly recommend Jim Collins other books too.