According to a recent Gallup poll, more than half of American adults (61%) have money invested in the stock market.

Although the median holdings (amounts invested) vary based on age, income, and other demographic factors, it’s clear that Americans see the value of investing — even if their exposure is limited to a workplace 401(k).

If you have a fully-funded emergency fund and have an extra $1,000 that you don’t immediately need, you have a lot of options. Unfortunately, the sheer number of investment options to choose from can be overwhelming and downright confusing.

How to Invest $1,000

Table of Contents

- How to Invest $1,000

- #1: Build a Diversified Portfolio With Fractional Share Investing

- #2: Build a Micro Real Estate Portfolio

- #3: Let Dividends Pay Your Monthly Bills

- #4: Open a Roth IRA

- #5: Build Up a High-Yield Emergency Fund

- #6: Build a Portfolio With Low-Cost ETFs

- 7: Let a Robo-Advisor Invest on Your Behalf

- #8: Pay Off Debt

- #9: Invest in Yourself

- Your Investment Style

- The Bottom Line – Investing $1,000 Right Now in July 2024

- How to Invest $1,000 – Step by Step

That’s why I wanted to share some of my favorite ways to invest $1,000. Whatever decision you make, you should be proud of yourself for taking the time to be thoughtful with your money.

$1,000 might not seem like a lot to get started investing, but I assure you once you see the power of compounding interest, you’ll be blown away by how this simple action will rewrite your financial future.

#1: Build a Diversified Portfolio With Fractional Share Investing

Risk Level:

Although you can always invest in individual stocks, fractional share investing lets you purchase a fraction or “slice” of a stock you want.

This investing strategy lets you diversify your investments to the max, and invest in big-name stocks you couldn’t otherwise afford. For example, a share of Amazon (AMZN) stock is trading for over $3,000 as of this writing.

Where your $1,000 investment wouldn’t get you in the door with a single share, fractional share investing lets you invest your $1,000 into a slice of one Amazon stock.

This way of buying stock is perfect if you only have $100 to start investing, but it works well for investors who have $1,000 or $5,000 to invest, too.

How It Works:

Investing in fractional shares is as easy as investing in traditional stocks or ETFs. All you have to do is find a brokerage firm that allows fractional share investing. From there, you can research options and invest in the fractional share market at your own pace.

Where to Get Started:

Many online brokers offer real-time fractional share investing without charging commissions. Fractional shares can be as small as 1/1,000,000 of a share, so you can spread your $1,000 initial investment across hundreds of different companies.

Who It’s Best For:

Fractional share investing is a good option for anyone who wants to diversify their portfolio by investing in different companies.

#2: Build a Micro Real Estate Portfolio

Risk Level:

There are dozens of ways you can get started investing in real estate, but the easiest is through Fundrise. With just $500 (only half of the money you have to invest), you can make an initial investment.

You can use their starter portfolio, which puts your money into several different REITs and gives you instant diversification. Another solid option to check out is Realty Mogul.

How It Works:

Fundrise let you invest whatever money you have (in this case, $1,000) into real estate without having to become a landlord. Simply open an account, transfer some money to get started, and select a portfolio option that aligns with your appetite for risk and your goals.

Fundrise takes care of the grunt work of real estate management and finding new investments for you. As a side note, Fundrise investors earned an average platform return of 22.99% in 2021(3.49% in 2022 so far). You can check out my 4-year Fundrise returns here.

Where to Get Started:

If you’re looking for a quick and easy way to invest in real estate without having to manage buildings or having your investments diminished from fees, Fundrise is your go-to option. Learn more about investing with Fundrise.

Who It’s Best For:

Fundrise is an ideal investment option for consumers who want exposure to real estate markets without having to become a landlord or deal with individual properties.

I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own.

#3: Let Dividends Pay Your Monthly Bills

Risk Level:

What if you could get your cellular provider to pay your cell phone bill every month? That would be pretty sweet, right? Heck yeah, it would!

That’s exactly what could happen if you invested your $1,000 into a telecommunication stock such as Verizon or AT&T that both pay a salty dividend.

If you owned enough shares the dividend payments could cover your monthly bill so it’s like you’re getting your cell phone for free. Can you hear me now?

You could apply this to other monthly expenses such as your electricity bill, internet, gas, entertainment, and groceries.

Here are some examples of companies you probably pay for their service that has a stock that pays a dividend.

| SERVICE | COMPANY | DIVIDEND YIELD |

|---|---|---|

| Utilities | Duke Energy | 4% |

| Communications | AT&T | 5.68% |

| Groceries | Kroger | 1.44% |

| Gas | Exxon Mobil | 4.01% |

| Internet | Comcast | 2.3% |

| Fast Food | McDonald’s | 2.2% |

If you need a refresher on dividends, check out this article on how to invest and make money on dividends.

One of the easiest platforms to build a custom dividend portfolio is M1 Finance.

#4: Open a Roth IRA

Risk Level:

A Roth IRA is a type of investment account that lets you invest after-tax dollars for retirement. From there, your money can grow tax-free, and you can withdraw your funds without having to pay income taxes once you reach retirement age.

For 2024, the maximum contribution amount across IRA accounts is $7,000 for most people. However, individuals ages 50 and older can contribute up to $8,000.

How It Works:

Income caps limit who can contribute to a Roth IRA but note that contributions are phased out completely for single filers who earn more than $161,000 and married couples who earn more than $240,000.

Where to Get Started:

Eligible investors can open a Roth IRA with any brokerage account that offers this type of account. Some of the most popular brokerage firms that offer Roth IRAs include Betterment, Stash, M1 Finance, and TD Ameritrade.

Who It’s Best For:

Investing in a Roth IRA makes sense for anyone who’s saving for retirement or a future goal. This type of account is also ideal for anyone who wants to set up a tax-free income source for their retirement years. Learn more about the best investments for a Roth IRA.

#5: Build Up a High-Yield Emergency Fund

Risk Level:

If you want to earn some interest with your $1,000 but can’t afford to lose any of it, then a high-yield savings account is your best option. These deposit accounts offer better interest rates than what you’d get from your local brick-and-mortar bank.

How It Works:

These accounts won’t earn a lot of interest, but if they’re FDIC-insured there’s no chance of losing the money. You can also withdraw your cash at any time if you need it.

Where to Get Started:

The Save Better Rewards Savings offers one of the highest yields available (currently paying 5.26%) with a savings account today. You can even get the highest rate with no minimum deposit and no monthly maintenance fees.

Who It’s Best For:

Most people need to have some emergency savings in the bank. Still, this account is a good option for anyone who has $1,000 to invest but might need their money in the short term.

5.26%

Interest Rate

varies

Min. Initial Deposit

#6: Build a Portfolio With Low-Cost ETFs

Risk Level:

Exchange-traded funds (ETFs) have made it so much easier to diversify your portfolio. This type of investment is similar to a mutual fund in that you can purchase many different stocks in a single ETF.

How It Works:

ETFs let you purchase an assortment of stocks and other securities in one fell swoop. You can invest in ETFs with most of the major brokerage firms, and you can usually do so with low investment fees (or no fees).

Where to Get Started:

M1 Finance is one of the best options when it comes to purchasing ETFs. This investing platform offers over 1300 different ETFs that you can trade for free, which is really an amazing deal. Read my full M1 Finance Review.

Who It’s Best For:

Investing in ETFs can make sense for any investor. It’s even more beneficial for those with $1,000 to invest because ETFs let you diversify more than you could with individual stocks.

7: Let a Robo-Advisor Invest on Your Behalf

Risk Level:

Robo-advisors are technology platforms that use science and advanced algorithms to make investment decisions on your behalf. Due to the popularity of robo-advisors, Deloitte believes the robo-advisor industry might have as much as $16 trillion in assets under management (AUM) by 2025.

How It Works:

When you open an account with a robo-advisor, you typically start the process by answering an array of questions about your finances and your goals. From there, the robo-advisor uses computer algorithms to find the best investment options for your risk tolerance and your investment timeline.

Where to Get Started:

I almost always recommend Betterment as my top choice among robo-advisors due to their user-friendly and intuitive interface, their low fees, and their suite of other financial products. You can open an account with Betterment with no minimum balance requirement. Learn more in my Betterment review.

Who It’s Best For:

Robo-advisors are geared toward investors who want help figuring out which investments will work best for their portfolio.

#8: Pay Off Debt

Paying off debt is not usually what comes to mind when you’re thinking about investing your money but the stats don’t lie.

Americans’ debt load continues to increase year over year and while your mortgage rate may be low and you’ve had some of your student loans forgiven, the interest that you’re paying on your other debt is killing your ability to accumulate wealth.

Even though $1,000 may not have a significant impact on whittling down the amount of debt that you have, it’s a crucial and vital step toward achieving financial freedom.

I can’t express in words what it felt like when I finally paid off my student loans and credit cards that I had recklessly accumulated in school.

I can’t put a value on how free I felt.

Taking $1,000 and applying it towards your debt gets you one step closer to feeling the euphoria of being debt-free.

#9: Invest in Yourself

I know it may sound cliche but investing in yourself will ultimately give you the highest ROI or return on investment I know.

The first time that I ever heard this expression I didn’t really understand what it meant. As I began the path of traditional investing and surrounded myself with other successful business-savvy entrepreneurs I started to finally understand what investing in yourself really meant.

Starting small could be simply buying a book or buying a $20 course on Udemy. A larger investment could be attending that conference that you’ve been putting off every year or maybe it’s signing up for that business coach that your peers have spoken so highly about.

I can attest that all of these have had an impact on my personal and financial success and all of which were less than $1,000.

The larger investments in myself were business coaching programs and also high-ticket courses.

Courses have been given a bad rap lately primarily because of money-hungry gurus that are all interested in lining their pockets.

Set aside a good amount of $1,000 or more for courses that you think are well worth the effort. I’ve even created a few courses myself that have received praise and admiration for the information and value that they provided.

You can check out my two most recent courses “Passive Income Accelerator“ and “10x Goals Accelerator.”

If you pick the right course or coaching program, you can easily start making $1,000 per month.

Smart Investment Options for Your Initial $1,000

| Investment Option | Description |

|---|---|

| Fractional Share Investing | Diversify by Investing Small Amounts in Big-Name Stocks, Starting from $100. Commission-Free Trading |

| Micro Real Estate Portfolio | Invest in Real Estate with Just $500 Through Platforms Like Fundrise for Diversification |

| Dividends for Monthly Bills | Invest in Dividend-Paying Stocks (e.g., Verizon, AT&T) to Cover Monthly Expenses |

| Open a Roth IRA | Invest After-Tax Dollars for Retirement, with Tax-Free Growth. Various Brokerage Options Available |

| High-Yield Emergency Fund | Protect Your $1,000 with a High-Yield Savings Account Offering Better Interest Rates |

| Low-Cost ETF Portfolio | Easily Diversify with Low-Cost ETFs Through Platforms Like M1 Finance |

| Robo-Advisor Investment | Let Robo-Advisors Manage Investments Based on Your Goals and Risk Tolerance |

| Pay Off Debt | Use $1,000 to Reduce High-Interest Debt and Move Toward Financial Freedom |

| Invest in Yourself | Prioritize Self-Improvement With Books, Courses, Conferences, or Business Coaching for a High ROI |

Your Investment Style

Before you dump $1,000 (or any other sum) into an investment, spend time thinking about your investing style.

For the most part, your investing style is determined by considering:

- Timeline to Invest

- Whether You Need Easy Access to Your Money

- Appetite for Risk

- General Interest in Learning About Investing

If you want a third party to do most of the work for you, then there’s a good chance a robo-advisor, like Betterment, is what you need.

After all, Betterment charges low fees, yet uses technology to make smart investment decisions for you. You can open a Betterment account, set it up to be funded regularly, and (mostly) leave it alone.

If you’d rather spend your time and energy on your career or your hobbies, going this route is a good choice.

That said, some people prefer the do-it-yourself option. This can make sense if you want to learn more about investing by being hands-on so you become a better investor over time.

It’s also a sensible path if you just want to understand the inner workings of common investment strategies.

If you think you’d be better off as a DIY investor, then investing in ETFs with Fundrise might be better options.

The Bottom Line – Investing $1,000 Right Now in July 2024

No matter how you choose to invest $1,000, know you’re taking an important first step. The fact that you made it this far in this overview tells me you’re serious about making a smart investment. You’re leagues away from most people who don’t bother with investing until it’s far too late.

But there’s still work to do to ensure you find the best investment option for your needs and goals. Decide on your investing style and research all the options I listed in this guide. With some time and planning, your $1,000 can be primed for growth in no time.

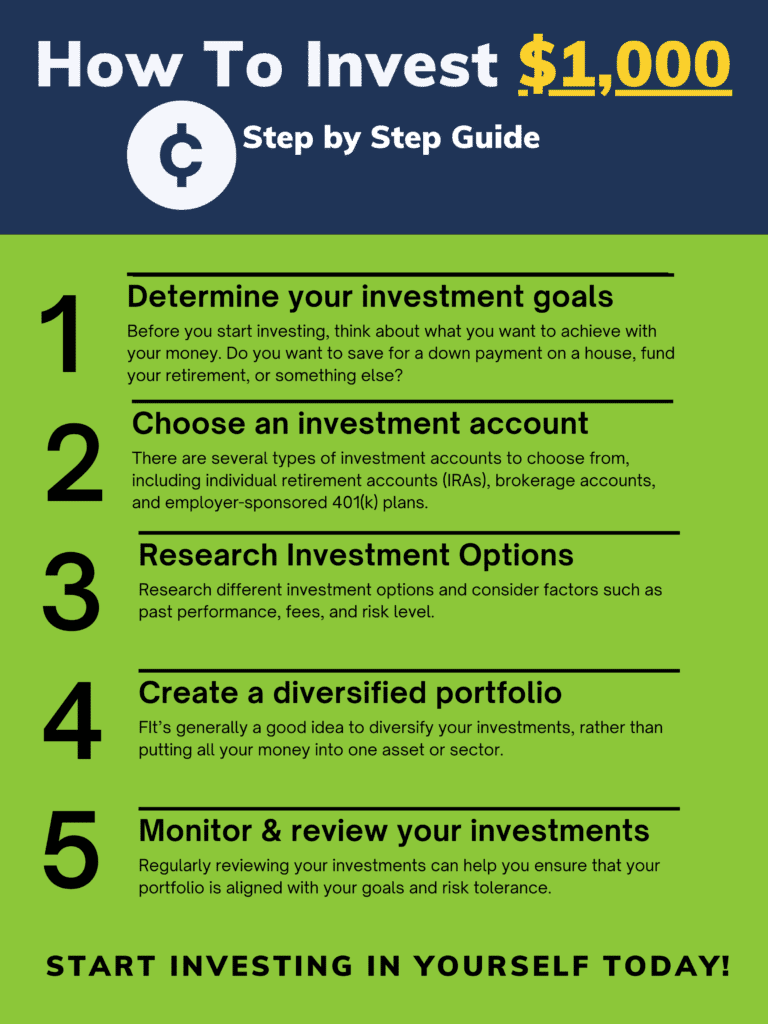

How to Invest $1,000 – Step by Step

Time needed: 1 hour and 30 minutes

How to Start Investing with $1,000

- Determine your investment goals

Before you start investing, think about what you want to achieve with your money. Do you want to save for a down payment on a house, fund your retirement, or something else? Your investment goals will help you decide where to allocate your funds.

- Choose an investment account

There are several types of investment accounts to choose from, including individual retirement accounts (IRAs), brokerage accounts, and employer-sponsored 401(k) plans. Consider factors such as fees, tax implications, and account minimums when deciding which account is right for you.

- Research investment options

Once you have an investment account set up, it’s time to decide what to invest in. You can invest in a variety of assets, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Research different investment options and consider factors such as past performance, fees, and risk level.

- Create a diversified portfolio

It’s generally a good idea to diversify your investments, rather than putting all your money into one asset or sector. A diversified portfolio can help reduce risk and increase the potential for long-term growth.

- Monitor and review your investments

Regularly reviewing your investments can help you ensure that your portfolio is aligned with your goals and risk tolerance. Consider reallocating your assets if necessary to maintain a balanced portfolio.

I don’t often comment. But when I do it’s to give an author accolades they deserve. You help give me confidence Jeff. Thanks.

#1 You did not include DCU. Digital Federal Credit Union. DCU.org

They allow 6% interest on the 1st $1000 of svings. 6.17% APY Check it out. I’ve been a member for almost 40 years.

I am not a big time investor by any means, how ever I am interested in doing low rise investing. Cannabis is what I been watching but I am not sure is this something I should be considering investing in. Would you share your honest opinions with me about this. Thank you in advance so very much.

Great article! I really enjoyed the wealth of knowledge shared. It was very easy to read and digest. I love the way you pull your audience in with the perfect verbage. This by far is information on that will change my life and the way I managed my money. Thanks

I am a 58 year old female disabled and a widow. My house and car is payed for and my adult child lives with me to pay household bills. I make a little over $1,200 a month and by the time I pay off all my bills it’s about $600 left over. I want to invest this money and draw a check every month off that investment. What can I do?

Thank you,

Leanne

Hi Leanne – You’ll have to begin building up your investments before you can begin making withdrawals. Given your age and limited income, I think you should sit down with an investment advisor – one recommended from trusted sources – to discuss your situation in some detail. It’s impossible to say on the web how you should best invest your money.

A well thought-out article in my opinion. Thank you Jeff for providing the intellectual community with such sound advice and prowess. As a beginner, I am thankful for what I have learned here.

You’re welcome Leo!

I think these are great resources to research. I know many people who will blow a thousand dollars because they don’t think they can invest it but this is proof that it can be done.

I like how you mention, change the way you think about investing- great point. Nothing is impossible.

I would like to know how to invest small amount of money so it can grow. I am 55 years old. Not too long before I retire. I do have 403b on my job and a Roth IRA outside of my job. I want to have money for college for my two last children. We have them wnenni was in my early 40s.

Please let me know how much more I can save for them for college

Lunnette

Hi Lunnette – I can’t give specific investment advice to you since I don’t know you or your specific situation. But please meet with a financial advisor who can determine your risk tolerance, as well as the amount of money you have, and the amount you’ll expect to need to pay for college.

Thanks for all the ideas and info! Just went to wealthfront and looks like they also charge a .25% fee now though 🙁

It’s hard for those with 1K to start in the Vanguard index funds as many require that 3K minimum!

.

Lots of options – thanks for sharing !

I love that there are so many tools these days that allow people to get started investing with smaller amounts of money.

This is such an important post. There are so many ways to make $1,000, but there are also so many ways to invest $1,000 that no one really talks about. Investing so your money grows is just as important as making money.

Jeff,

I listened to the podcast (first time) even though I am subscriber for your blog and I just wanted to say kuddos for the courage and the boldness to speak about your faith and encourage others to invest into their faith and/or church. In a world where many (of us) shy away from acknowledging the tremendous way in which our faith in Jesus (and our relationship with Him) gives us peace and psychological/spiritual rest which in turn affects the other parts of our lives. Thank you being so open and honest with money and thank you for your generosity sharing knowledge that can empower others!! We are a young couple about to buy our first home and interested in learning everything we can learn about investing in the right places to help us achieve financial stability. Keep up the great work! – Sarah

1. Instead of trying your hands on all sorts of wealth building, a person could better build one successful wealth building process be it passive investing, active stock investing or real estate

2. For all wealth building a common equating investment is in behavorial psychology, which is needed in almost all sorts of wealth building. If you have no idea what is confrimation bias, outcome bias, recency bias, disposition effect, the use of pre-commitment its time to make an early investment.

3. kids opening roth IRA is good, but active mutual funds? survivorship bias and track records of active funds have shown that instead of building wealth, a neglect of (1) will cause you to learn the wrong thing due to outcome bias.

Jeff, Thanks for the awesome video! This is my first time visiting your site, and I will now be a frequent visitor. lol The bloopers with you, your brilliant son and patient wife were A+++!

My husband and I are in the almost-50-couple’s shoes. I will be researching your site a little further. lol

These are the kinds of things that people never think of ahead of time. I think stuff like this should be taught in a kind of financial common sense class in high schools.

I agree, this should definitely be introduced in elementary school versus geometry. The likelihood of an individual needing geometry to survive over financial literacy I’m sure is scarce.

Any time you can turn your kids toys (truck, bunny, magician’s hat….) into a prop for a FINANCIAL VIDEO you score something like 25 bonus points. I’m not sure you can make them tax deductions….but it’s still a win. Fun video.

Good thing you included the video here…Thanks a lot!!

I didn’t understand it totally but all that I know is that its regarding about the retirement benefits and what so ever, And I need to share it with grand pa for additional ideas.

Nice sharing of informative video..Thanks for sharing..

I loved this rant because I think the same thing so often! I laughed out loud when I read the “with some magical bunnies on the side” because I imagined a couple on a beach with magical bunnies hopping around them. Great job!

I guess people don’t understand what saving up for retirement really means. They need to realize that retirement money is for the 25 odd years you will live without a steady paycheck.

@EverythingFinance Agreed.