Lots of people dream of working from home. Others want to find some sort of side venture to earn extra money that will fit well with either their current job or their lifestyle.

There’s a way to roll all those benefits into one package, and that’s by becoming a virtual assistant.

If you currently hold a traditional job, you may not be entirely aware of virtual assistants and what they do.

But with the Internet and more jobs and services being performed online, virtual assistants are becoming more common among the work-at-home set.

You can become one of them if you learn how to make it happen.

Table of Contents

- What Is a Virtual Assistant

- Popular Virtual Assistant Niches

- Make a List of the Skills You Have to Offer as a Virtual Assistant

- How Much You Can Earn as a Virtual Assistant

- Where to Find Virtual Assistant Gigs

- The Real Payoff – Finding Your Own Clients

- How to Market Your Virtual Assistant Services

- Final Thoughts on How to Become a Virtual Assistant

What Is a Virtual Assistant

A virtual assistant is someone who provides specific skills and services to clients and employers, usually on a contract basis.

In most virtual assistant situations, you’ll be working from home on your home computer. But it may also be possible you’ll do some on-site work for local clients.

One of the major advantages of being a virtual assistant is that you’re not limited geographically. Because of the Internet, you can work with clients across the country and even internationally.

In most cases, you’ll be given specific assignments, and you’ll need to complete them according to client specifications, as well as within any necessary deadlines.

Though the client may provide you with a general outline or template for an assignment, you’ll have a considerable amount of latitude as to exactly how the job is done.

How do you become a virtual assistant? Let’s take it one step at a time.

Popular Virtual Assistant Niches

In truth, the types of work virtual assistants provide are practically unlimited.

Since you’ll be working primarily with small businesses and the self-employed, the possibilities include any job or task the client is either unable to perform or simply chooses to sub out to a specialist. As a virtual assistant, you’ll be that specialist.

The most popular niches are either administrative or technical in nature.

Administrative Virtual Assistant Niche

On the administrative side, typical jobs and tasks include:

- data entry

- email correspondence

- making or taking phone calls

- bookkeeping

- doing research

- providing customer service

Technical Services Virtual Assistant Niche

Among technical services, possibilities include:

- graphic design

- website management

- social media management

- marketing

- writing

- technical support

That’s just a list of the more general skills that are in demand. But to get a more detailed list of ideas, you can visit virtual assistant web platforms – a few of which we’ll list in a little bit – and just browse through the skills and tasks clients are looking to fill.

Make a List of the Skills You Have to Offer as a Virtual Assistant

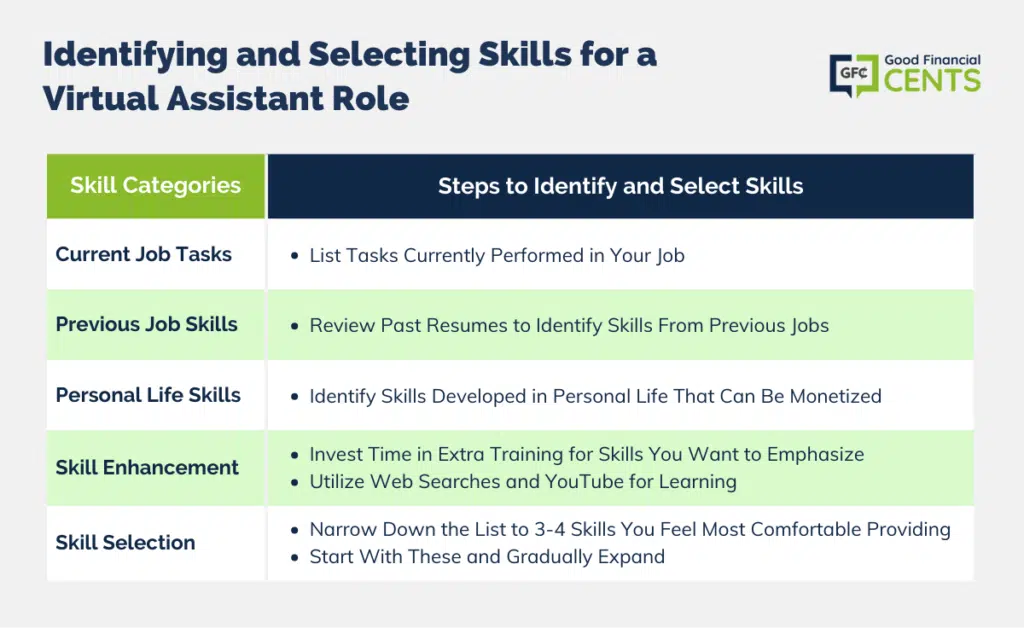

If you want to become a virtual assistant, the first order of business is to make a list of any possible skills you have to offer.

You can choose to provide a single skill, a small number of related skills, or even offer to do any type of task you feel capable of doing. It’s completely up to you.

But start with that list of skills. First, list all the tasks you perform in your current job.

Next, review your latest resume and make a list of skills you’ve performed in previous jobs or careers.

Finally, don’t forget to include any skills you developed in your personal life that you may be able to sell to clients for a fee.

Don’t worry that you’re not a certified expert in any particular skill. As long as you can perform it at a reasonable level and you’re willing to do so, it’s almost certain you’ll find clients who will pay you to do it.

If there are any particular skills you want to emphasize, but you don’t feel you’re proficient enough, invest some time getting extra training.

That can be as easy as doing a web search to find the fine points of a particular skill. And for what it’s worth, YouTube is an excellent source of information on almost any skill you can think of.

Once you have your list of skills, narrow it down to those you feel most comfortable providing. You may identify a dozen or more but focus on three or four only.

If you start working with those skills, you can eventually expand into providing services based on other skills. As a newbie, you’ll want to start slow and small and grow as you go forward.

How Much You Can Earn as a Virtual Assistant

It’s almost impossible to give a concrete idea as to how much you can earn as a virtual assistant. Part of the limitation is the method of payment. While some jobs may pay you on an hourly basis, most will pay you by the task.

For example, a client may pay you a flat fee to write a business letter or proofread a document. When you’re first starting out, you may need to accept whatever the payment is.

But you’ll be able to increase your fees as you and your clients become more comfortable with one another and as your client base builds.

It can be difficult to know what the charge is when you’re first starting out but be prepared to negotiate. Ask the client if you can review the assignment before settling on a fee.

It may be best to set your initial price a little on the high side so you’ll have some negotiating room. But again, as you become more experienced and gain more clients, pricing will come more easily. Just think of it as part of the learning curve.

As to specific numbers, you may find yourself starting out at something like $10 or $12 per hour for administrative tasks and $25 to $50 per hour for more technical work.

But if that seems insufficient, remember that you’ll be working from home, and you can increase your fees as you gain more experience. Gaining client references will also help you to charge higher fees in the future.

Where to Find Virtual Assistant Gigs

Usually, the best way to start out as a virtual assistant is to use one or more of the popular virtual assistant websites.

They specialize in matching virtual assistants with potential clients. You’ll typically need to register on the website and then apply for assignments as they come up.

Examples of virtual assistant websites include:

Virtual assistant websites are an excellent way to launch your career because they offer a ready marketplace for potential clients.

But you should also understand that the arrangement creates heavy competition among other virtual assistants competing for business.

Clients will naturally be wanting to work with virtual assistants who charge the lowest fees. That can put you in a bidding war that will severely limit your income. For that reason, you should only use virtual assistant websites when you’re first starting out.

The Real Payoff – Finding Your Own Clients

Though you may start out using virtual assistant websites to find work, you’ll need to eventually become a true freelancer. That means not only will you provide the work, but you’ll also get your own clients.

This will, of course, add marketing to the virtual assistant workload. But once you do, you’ll have greater control over the services you provide and the clients you work with. Even more important, you’ll have greater flexibility in the fees you charge for your work.

If you plan to make being a virtual assistant a permanent income source, you’ll need to think of yourself as part worker and part entrepreneur.

The worker part is providing the actual services, but marketing is where you’ll have to release your inner entrepreneur. The payoff will be well worth the effort.

As you learn to find your own clients and move away from virtual assistant websites, you’ll become a freelance virtual assistant, which is where being a virtual assistant converts from a source of some extra cash to a full-time occupation or even a lucrative side business.

Don’t worry if you’ve never marketed your services to clients in the past. It’s an acquired skill, and the only way to learn it is by doing it.

How to Market Your Virtual Assistant Services

Fortunately, there are more ways to market your skills than ever before.

One of the best ways is by offering your services to people by word-of-mouth. Develop an informal 15 to 20-second speech in which you tell people what you do, then ask them if they know anyone who’s looking for your services.

It will help if you have business cards to leave with them as a reminder.

If you’re not comfortable promoting your services face-to-face, you can email local businesses. Do a web search and find small businesses that are likely to need the services you provide.

And find out who the decision-maker is (it’s usually on their website), and send a brief one or two-paragraph email offering your services.

Building your own website is another excellent idea. It’s not so much that people will flock to your website to use your services, but more that a website acts as social proof of both your existence and your abilities as a professional.

You can build a simple website using templates provided by WordPress, or other services, like Wix.

Other methods you can try include offering your services through social media, printing up a one-page brochure and mailing it to small businesses, or even responding to ads on Craigslist.

Craigslist presents interesting opportunities for virtual assistants to find clients. It’s become the new national classified ads, and small businesses often place ads looking for specific help.

If you’re going to use Craigslist, you don’t need to be limited by your own area. You can go to Craigslist for large cities, like New York, Chicago, and Los Angeles, and respond to ads in those markets as well.

Final Thoughts on How to Become a Virtual Assistant

Probably the best advice to give to anyone who’s contemplating becoming a virtual assistant is to always treat it as a business. That can be harder to do than it sounds.

In a very real way, being a virtual assistant is a casual arrangement. You’ll have a lot of flexibility as to the type of work you do, the clients you accept, and the day-to-day scheduling.

That is, of course, a huge advantage – but it’s also the potential downfall. If you treat the arrangement too casually, you’ll fail to build the kind of trust and reputation you’ll need to turn being a virtual assistant into a permanent income source.

Your clients are paying you to do very specific jobs that they need to have completed. You’ll need to be aware of deadlines, as well as the necessity to deliver high-quality work. It will take a dedicated effort to accomplish both.

But it may help if you understand that both your availability and the quality of your work are your real stock in trade.

A lot of people work as virtual assistants now, so you’ll need to stand out. The way to do that is to develop a reputation for delivering what you promise, and what your clients expect.

You’ll need to build that kind of trust, both to get repeat business from existing clients, as well as referrals for future business.

Treat being a virtual assistant as the business that it truly is, and you can grow it to whatever level your time and talents will allow.

Thank you for your informative information.

This gives me a very good idea, as I am already working from home and need something extra to do.