The allure of early retirement is a powerful one. The promise of long, leisurely days free from the grind of the nine-to-five routine can be enticing, especially to those feeling the burnout of decades in the workforce. However, leaping into early retirement can be fraught with pitfalls that are often overlooked in the rosy glow of that dream. This comprehensive article aims to delve into what might be considered the biggest mistake of early retirement: failing to accurately plan and prepare for the financial, emotional, and psychological shifts that it brings.

Table of Contents

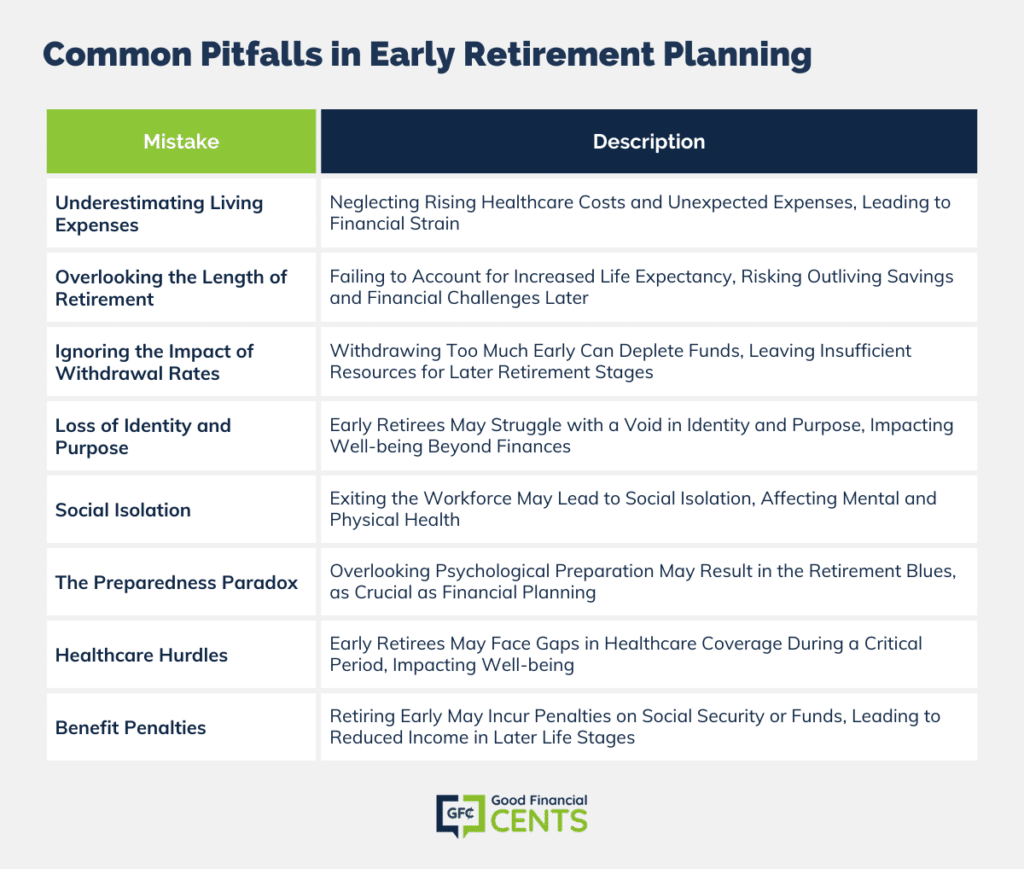

Mistakes of Early Retirement

- Underestimating Living Expenses: One of the most common blunders is underestimating the cost of living post-retirement. Early retirees might calculate their future expenses based on their current spending, neglecting the potential rise in healthcare costs, inflation, and the unexpected expenses that life invariably throws our way.

- Overlooking the Length of Retirement: A retiree at 55 could live another 30 years or more. Many early retirees fail to account for the longevity risk and outlive their savings. With medical advancements pushing life expectancy higher, the financial pool needs to be much larger than one might think.

- Ignoring the Impact of Withdrawal Rates: Safe withdrawal rates for traditional retirees may not be suitable for early retirees. Withdrawing too much too soon can lead to financial shortfall decades later, a time when returning to the workforce may not be feasible.

- Loss of Identity and Purpose: Work often provides more than a paycheck—it offers a sense of purpose and identity. Early retirees may struggle with a loss of professional identity, leaving a void that hobbies and travel can only partially fill.

- Social Isolation: Leaving the workforce can also mean leaving behind a significant source of social interaction. This change can lead to unexpected feelings of isolation and loneliness, which are detrimental to both mental and physical health.

- The Preparedness Paradox: Mental preparation for retirement is just as crucial as financial planning. Many early retirees focus on the financial aspects but neglect to psychologically prepare for the transition, leading to a phenomenon known as the retirement blues.

- Healthcare Hurdles: In many countries, healthcare is closely tied to employment. Early retirees may find themselves in a gap period where they are too young for government healthcare benefits and no longer covered by employer plans.

- Benefit Penalties: Retiring early can also mean significant penalties on social security benefits or retirement funds accessed before a certain age, leading to reduced income in the later stages of life.

Mitigation Measures

- A Solid Financial Plan: A thorough and realistic financial plan that includes a detailed budget, a conservative withdrawal strategy, and provisions for inflation and healthcare costs is crucial.

- An Identity Beyond Work: Building a strong sense of self that extends beyond professional achievements can help mitigate the loss of identity. Cultivating hobbies, volunteering, or even part-time work can fill the void left by a career.

- Building a New Network: Creating a new social network outside of work is essential. Community involvement, new hobbies, or travel can foster connections that replace those lost in the workplace.

- A Gradual Transition: Phasing into retirement by reducing hours or transitioning to part-time work can provide a smoother adjustment period, both financially and emotionally.

- Healthcare Planning: Securing private healthcare insurance or exploring health-sharing programs can bridge the gap until government benefits become available.

Conclusion

Retiring early is a significant life decision that shouldn’t be taken lightly. The biggest mistake of early retirement lies in the oversight of comprehensive preparation. It’s essential to acknowledge that this period of life involves more than just financial independence—it’s a multifaceted change that encompasses emotional, psychological, and social dimensions. By recognizing and planning for these challenges, the journey into early retirement can be as fulfilling as it is envisioned to be, free from the shackles of hindsight and regret.

I started a 72(t) distribution from my IRA this year at age 53 while I was unemployed. I’m now employed and want to roll over the balance of my IRA into my employer’s 401(k) plan. Am I locked into the remaining 72(t) distributions? Or by clearing out my IRA with the rollover am I relieved from taking further distributions?

Hi Goldie, Keeping in mind that I’m not a CPA, my understanding is that if you terminate the 72t distributions, the 10% penalty will apply retroactively to all distributions taken so far (as well as regular tax on the distributions. You need to consult with a CPA for how this will work in your specific circumstances though.

A little known IRS rule allows folks that retire early, starting at the age of 55, to take premature distributions from their employer sponsored plan while avoiding the 10% early withdrawal penalty

I thought you could only withdrawwithout penalty at age 59.5. Which rule permits withdrawal at age 55?

@ Gregg See the reference here: http://www.irs.gov/taxtopics/tc558.html It states,

That’s interesting, I never would have thought of just leaving my money in the 401(k). I suppose there is a breakeven point somewhere depending on how bad the 401(k) funds are where you are better off taking the 10% penalty and avoiding the bad mutual funds/heavy expenses. Ex. If you have more than X years until early retirement and can save 1% a year in fees, you are better off rolling over and taking the 10% early withdrawal penalty.

Thanks for the heads up. I recently quit my job and left my 401(k) at my old job. I was thinking about rolling it over to an Ira but now I know better. Great info.

Thanks for bringing that to light. Unfortunately I have a feeling the rules will change many times in the next 30 to 40 years when I eventually plan to fully retire…

Great Article! I never new about that sneaky 10% withdrawal fee. Thanks for the advice!