There’s been a lot of talk about inflation lately. While inflation, at its most basic, is an increase in prices, there are differences in the way that it is measured. You should pay attention to inflation since it represents an erosion of your buying power.

However, it does help to know how policymakers view inflation. It will give you a better idea of how to plan your finances more effectively. Two measures of inflation that you should pay attention are CPI and core inflation.

Table of Contents

CPI

The measure that is most often used to measure inflation in terms of consumers is the Consumer Price Index (CPI). Tens of thousands of items, in several categories, are tracked.

The basket of products of services is considered each month, and economists and statisticians look for trends. If the CPI rises, it is an indication that prices could be trending higher, with inflation on the rise.

Factors Affecting CPI

1. Supply and Demand Dynamics:

The basic economic principles of supply and demand play a significant role in influencing prices. When demand for a product increases or when supply decreases, prices tend to rise, contributing to higher CPI. Conversely, a surplus of goods or decreased demand can lead to price drops.

2. Global Events:

Natural disasters, political unrest, and other global events can disrupt supply chains, leading to scarcity of products and subsequent price increases. The global nature of modern economies means that these events can have far-reaching impacts.

3. Monetary Policy:

Central banks around the world use monetary policy tools, including adjusting interest rates and engaging in open market operations, to control inflation. These policy changes can directly influence CPI.

Core Inflation

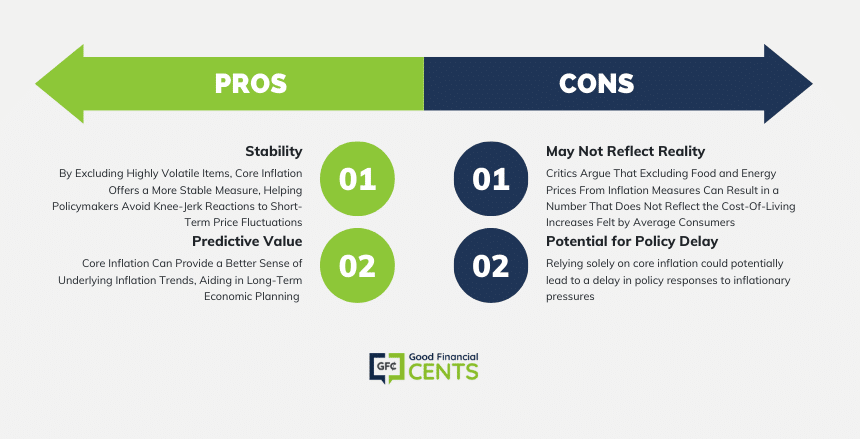

There is some controversy surrounding the use of CPI as a reliable measure of the real inflation rate. However, there might be even more controversy surrounding the use of core inflation in setting monetary policy.

The Federal Reserve, when it sets its benchmark interest rate and makes monetary and economic policy, considers the effects of inflation. While members of the Fed might consider CPI, core inflation is more frequently mentioned in policy announcements.

Core inflation is basically CPI but with the most volatile items broken out. Core inflation doesn’t include food and energy prices.

As a result, some argue that the use of core inflation actually hurts more than it helps, since rising food and energy prices are more likely to significantly impact the household budgets of most consumers.

You probably already know that food and energy prices often rise faster than other items — and they are prices likely to significantly impact your pocketbook.

Pros and Cons of Using Core Inflation

Tracking Your Personal Inflation

Understanding broad inflation measures is important, but tracking your own spending can provide tailored insights. By monitoring the prices of goods and services that constitute a significant portion of your personal budget, you can create your own personal inflation index.

Why Tracking Personal Inflation Matters

- Personal Relevance: Your personal inflation rate could be higher or lower than the national average, depending on your spending habits.

- Informed Decision-Making: A personal inflation index empowers you to make financial and investment decisions that are aligned with your specific situation.

The Relationship Between Inflation and Investments

Inflation erodes the real purchasing power of your money, making it a critical factor to consider in investment planning. Investments that yield returns below the inflation rate result in a loss of real wealth over time.

Tracking Your Own Inflation Trends

Instead of relying on the government to tell you what’s happening with inflation, you can actually track inflation on your own.

Take a look at what you normally spend money on. Choose a certain day each month to check the prices of these items and create your own measure. You can watch your personal inflation index for trends in prices.

If you use public transportation, gas prices aren’t going to figure heavily into your personal inflation measure. If you have a newborn and need to buy diapers, that measure will be an important part of your personal inflation measure.

You can compare your personal inflation measure to CPI and to core inflation. This will give you an idea of how accurate — how “real” — the wider statistics are for you. As you plan your finances, remember to consider the effect that inflation will have.

The inflation rate will erode your returns. If you’re earning 6% annually, but prices rise at 3% a year, you are only earning 4%. If your portfolio earns less than the rate of inflation, you are actually losing money in real terms.

Whether you follow CPI, core inflation, or use your own measure, you should pay attention to inflation. This will allow you to make decisions about what investments will help you beat inflation.

Strategies to Beat Inflation

- Diversification: A well-diversified portfolio can help protect against inflation.

- Real Assets: Investing in assets like real estate and commodities can provide a hedge against inflation.

- Treasury Inflation-Protected Securities (TIPS): These government bonds are specifically designed to protect against inflation.

Conclusion

Understanding inflation, CPI, and core inflation is integral to making informed financial decisions.

By complementing this knowledge with tracking your personal inflation trends, you can create a comprehensive strategy to preserve and grow your wealth despite inflationary pressures.

Stay informed, stay proactive, and ensure that your investments are positioned to beat inflation and secure your financial future.