How much money does it take to start an IRA? The easy answer is $0, but that won’t get you on your way to growing your money into retirement. The truth is, you can start an IRA with very little money.

The keys to really taking advantage of the power of Roth IRAs or Traditional IRAs are to understand your eligibility and the rules and to consistently add to your account over time.

IRAs are easy to start. Just open up a great online brokerage account. My personal favorite right now is M1 Finance.

Keep in mind that there are actually two main types of IRAs to consider, so make sure you understand which one you are eligible for.

Table of Contents

Which IRA Am I Eligible For – Traditional or Roth?

Virtually anyone can contribute to an IRA: Roth or Traditional. The most basic requirement is that you have earned income. The difference between the two is based on when you’ll pay taxes.

A traditional IRA allows you to grow your money tax-free over time. You won’t pay income taxes on your account until you begin taking distributions in retirement age or when you’re at least 59 ½.

You may be able to deduct your contributions on your taxes if you meet specific filing status and income requirements.

With a Roth IRA, on the other hand, you’ll contribute income that has already been taxed, so you don’t get a tax deduction right off the bat. Your money will grow tax-free, however, and you won’t have to pay income taxes on your account once you begin taking distributions in retirement.

Here is a tool to help figure out what type of IRA you’re eligible for:

Understanding Traditional vs Roth IRA

| TRADITIONAL IRA | ROTH IRA | |

| Contribution Limits | $7,000 Total Across All IRAs In 2024; If You Are Ages 50 And Older, You Can Contribute $8,000 | $7,000 Total Across All IRAs In 2024; If You Are Ages 50 And Older, You Can Contribute $8,000 |

| Who Can Contribute? | Anyone Who Earns an Income and Is Under the Age of 73 | Anyone Who Earns an Income |

| Do Income Caps Apply? | Income Caps Limit Who Can Deduct Contributions on Their Taxes Unless They Don’t Have a Retirement Plan Through Work | Income Caps Limit Who Can Contribute |

| How Do Taxes Work? | You’ll Pay Taxes on Distributions Once You Begin Taking Them in Retirement | Your Distributions Will be Tax-Free Once You Reach Retirement Age |

| Who Is This Account Best For? | Anyone Who Can Deduct Contributions and Wants to Reduce Their Taxable Income | Someone Who Wants Tax-Free Income in Retirement |

Heads Up:

How Much Money Does It Take To Start an IRA?

Now you know what type of account to open, so how much do you invest? Technically, you don’t need anything to open an IRA since the Internal Revenue Service (IRS) doesn’t set minimum contribution limits — only annual maximums.

However, individual brokerage firms have minimum requirements, and you want to employ a healthy contribution strategy to maximize rewards.

When it comes to your contributions, remember that the important thing is to just get started. Small amounts of money can add up over time, and from there, compound interest can do its magic and help your account balance balloon.

Here’s one way to think about it:

IRA Contribution Illustration

| IRA Monthly Contribution | IRA Annual Contribution |

|---|---|

| $5 | $60 |

| $10 | $120 |

| $25 | $300 |

| $50 | $600 |

| $100 | $1,200 |

| $200 | $2,400 |

| $500 | $6,000 |

| $541.67 | $6,500 |

Let’s say you’re 30 years old, and you contribute $100/month for a total of $1,200 a year to your Roth IRA. By the time you’re 67 and ready to retire, you’ll have saved $204,000 that won’t be subject to income taxes. That can go a long way to support a happy retirement.

Now that you understand the process a bit more figure out which brokerage firm to use for your IRA and how much you need to actually open an account and get the ball rolling.

Once your account is up and running, you can figure out how much to contribute regularly, whether that’s $100 per month or $100 per week.

How Much Does It Cost to Open an IRA?

The cost to open an IRA can vary depending on the financial institution or brokerage firm you choose. Some institutions may have no account opening fee, while others may charge a one-time fee or an annual fee. Some firms may also have minimum deposit requirements to open an account.

As an example, M1 Finance requires a $500 minimum investment in their Roth IRA. Depending on the mutual fund you choose, Vanguard requires at least $1,000 for their Target Retirement funds and up to $3,000 for their other funds.

In addition to account opening costs, there may be ongoing fees associated with an IRA account, such as annual maintenance fees or fees for certain transactions.

It is also important to note that while Traditional IRA or Roth IRA contributions may be tax deductible or not taxable, there are limits to how much you can contribute annually.

How to Start Investing in an IRA

1. Compare Online Brokerage Firms That Offer IRA Accounts

Different online brokerage firms have features that you’ll want to pay attention to. Some are better for hands-off investing, while others are better for those who want to get their hands dirty and really dig in.

Here are some of the things you should ask yourself when choosing a brokerage:

1. Would you rather be hands-on or hands-off with your account? A robo-advisor may take the burden off you when it comes to managing your investments.

2. What sort of investments do you want to buy? Pay attention to the limitations of the broker.

3. How much are you looking to invest off the bat? Fees and commissions can eat away at early earnings if the initial investment is too small.

Here are some of our favorite options:

Among the best brokerage accounts for beginners, we like M1 Finance for IRAs. You only need $100 to open an account with M1 Finance, which is a threshold most beginning investors can reach.

M1 Finance IRAs also come with no hidden fees, the option to invest in fractional shares, and a helpful mobile app that lets you monitor your account growth no matter where you are.

2. Fund Your Account

Now, it’s time to put the minimum amount in to fund your brand-new account. As previously mentioned, different brokerages have different minimum requirements, so

3. Select Your Investment Strategy

Your next step is building a system that will allow you to seamlessly build wealth over time. This means figuring out how much you can afford to invest in an IRA each month, but it also means choosing investments that will exist within your IRA.

Remember:

If you find you are able to deduct contributions to a traditional IRA because your employer doesn’t offer a retirement plan, you should strive to contribute as much as you can each month up to the $541.67 monthly (and $7,000 annual) limit.

That way, you’re building up retirement funds in a hurry while maximizing tax advantages.

If you opt for a Roth IRA instead, you won’t get any tax advantages now, but you will later on since you won’t have to pay income taxes on distributions once you reach retirement age.

Either way, the ultimate goal is striving to invest as much as you can each month up to account limits, and without harming your other financial goals.

In terms of selecting your portfolio, this component of your system depends a lot on which investment platform (brokerage firm) you choose to go with. If you choose an online broker and decide on stocks as a key part of your portfolio, you could benefit from dollar-cost averaging.

Here’s an example of dollar cost averaging into an individual stock with a fluctuating price:

Benefits of Dollar Cost Averaging

| Month | Share Price (In $) | Shares Bought |

|---|---|---|

| January | 15 | 3.3 |

| February | 13 | 3.8 |

| March | 12 | 4.2 |

| April | 14 | 3.6 |

| May | 13 | 3.8 |

| June | 12 | 4.2 |

| July | 13 | 3.8 |

| August | 14 | 3.6 |

| September | 16 | 3.3 |

| October | 16 | 3.1 |

| November | 17 | 2.9 |

| December | 16 | 3.1 |

| Total Shares | 42.7 | |

| Avg. Price Per Share | $14.25 | |

| Avg. Cost Per Share | $14.05 |

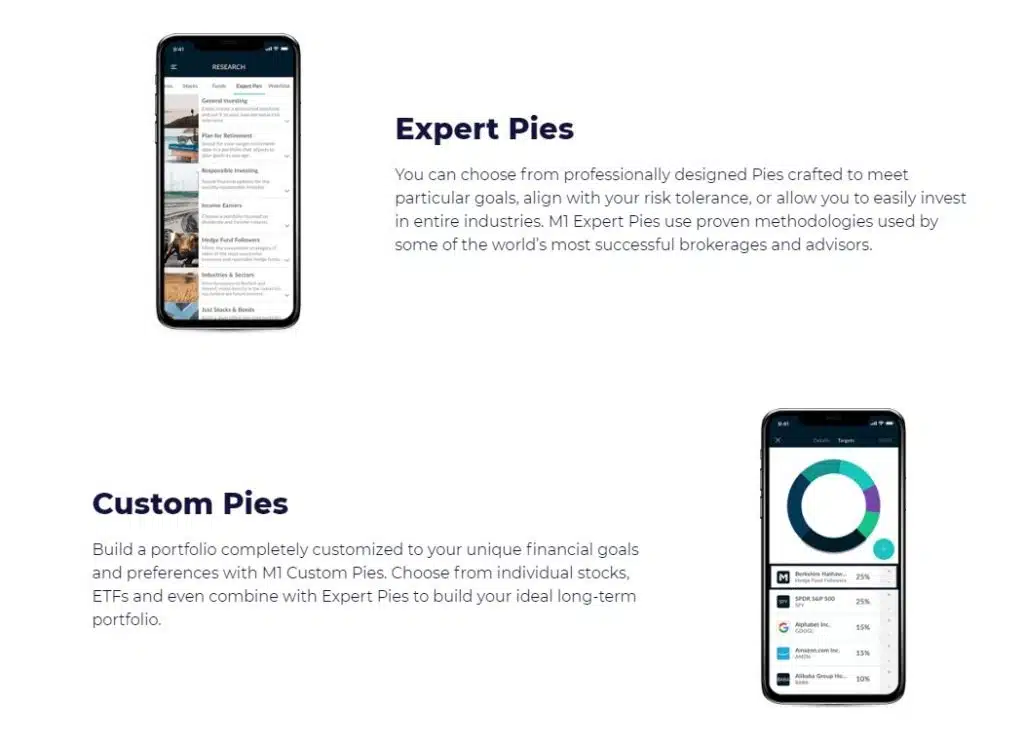

Some firms like M1 Finance let you set up “pies” of investments that are based on fractional shares.

With M1 Finance, you can build your own “pie” from more than 6,000 available stocks and funds, but you can also choose from “Expert Pies” that have been put together by in-house investment professionals.

That’s just one way this can work, but there are plenty of other ways to set up a portfolio depending on the firm you choose. For example, let’s imagine you decide to open an IRA with Betterment.

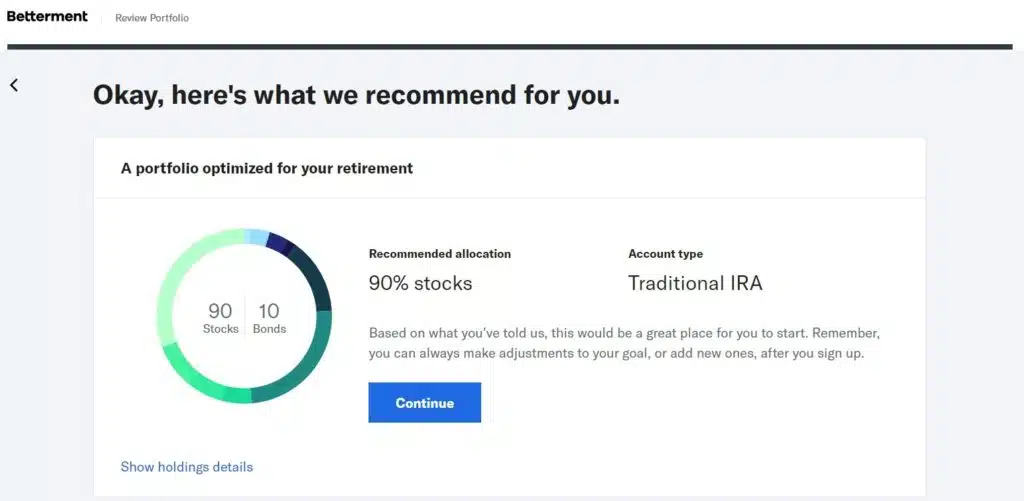

Betterment is a robo-advisor that helps you formulate an investment plan based on your age, your investing goals, and your risk tolerance. As a result, opening an IRA with Betterment is a breeze.

You’ll start by answering some basic questions about yourself, including your age, your income, and when you plan to retire. From there, Betterment will suggest a specific investment plan that is formulated to help you achieve your goals.

If you’re a knowledgeable investor who wants to select the stocks, bonds, ETFs, and other investments that live within your IRA, that’s perfectly okay, too.

Remember:

4. Make It Automatic

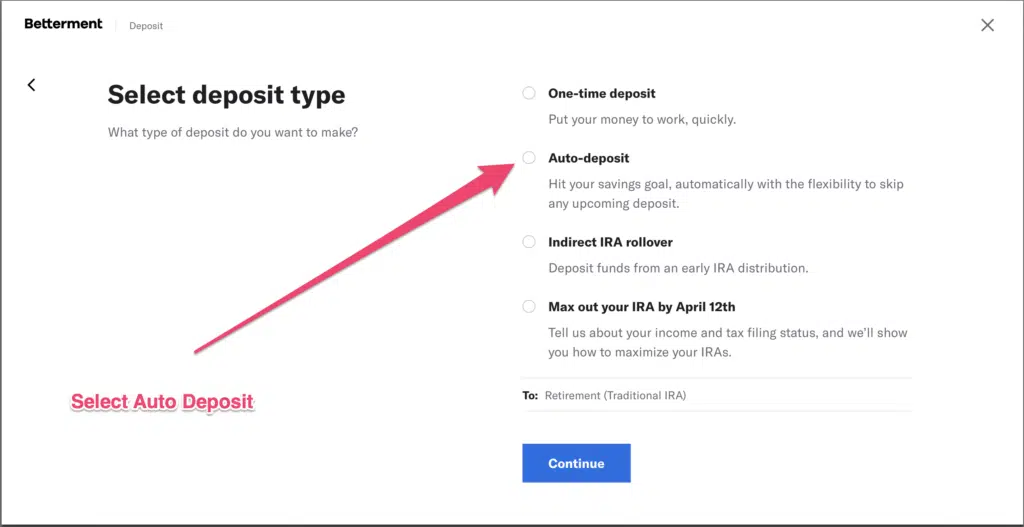

To help in your effort to contribute consistently and to remove some of the pressure, consider making your investments automatic with the click of a button.

Many of the top brokerage firms let you set up automatic investments through their mobile apps or online platforms, including Betterment’s example below.

5. Check In Regularly and Stay on Track

Part of the fun of putting away money for your future is watching it grow. Keep an eye on your portfolio to make sure you’re contributing the way you want to.

It can be tempting during tighter financial times to stop contributing, but you can always reduce your contribution amount depending on your circumstances and then change it back later.

Don’t worry about small fluctuations, and seek help from an advisor if necessary.

Know the IRA Rules

Whether you opt for a traditional IRA or a Roth IRA, you should know that plenty of rules dictate who can contribute, how much can be contributed each year, and whether contributions are tax-deductible.

With a Roth IRA, the rules are as follows:

- Roth IRA contributions are made with after-tax dollars, so they are not tax-deductible.

- Your money will grow tax-free until you reach retirement age, and you won’t pay income taxes on your distributions when you retire.

- You can remove contributions to your Roth IRA from your account at any time before age 59 1/2, but you cannot take out any earnings without a penalty until then.

- Married couples filing jointly can contribute the full amount to a Roth IRA, provided their modified adjusted gross income (MAGI) is below $240,000. Those with incomes between $230,000 and $240,000 can contribute a reduced amount. Those with incomes over $240,000 cannot contribute.

- Single tax filers can contribute the full amount to a Roth IRA provided their modified adjusted gross income (MAGI) is below $161,000. Those with incomes between $146,000 and $161,000 can contribute a reduced amount. Those with incomes over $161,000 cannot contribute.

With a traditional IRA, the rules are as follows:

- Money invested in a traditional IRA grows tax-free. However, you will pay income taxes on distributions once you reach retirement age.

- If you are covered by a retirement plan at work and you’re single, you can deduct contributions to a traditional IRA if your MAGI is below $77,000.

You can claim a partial deduction if your MAGI is between $77,000 and $87,000. For those with incomes over that amount, contributions cannot be deducted from your taxes.

- If you are covered by a retirement plan at work and you’re married and filing jointly, you can deduct contributions to a traditional IRA if your MAGI is below $123,000.

You can claim a partial deduction if your MAGI is between $123,000 and $143,000. For those with incomes over that amount, contributions cannot be deducted from your taxes.

- If you are single and don’t have a retirement plan at work, you can deduct the full amount of your contributions to a traditional IRA regardless of your income.

- If you’re married filing jointly and your spouse is covered by a retirement plan at work but you’re not, you can deduct the full amount if your MAGI is below $230,000.

Those with MAGIs between $230,000 and $240,000 can deduct a reduced amount. Anyone with a MAGI of $240,000 or higher cannot deduct IRA contributions on their taxes.

Summary of How Much to Start a Roth IRA

Opening an IRA is a great way to save more money for retirement and the future, and that’s true whether you opt for a traditional IRA or a Roth IRA. Just remember that each type of IRA has pros and cons, and you’ll need to consider your tax situation now and what it might look like later.

Still, you shouldn’t get so caught up in the rules and minutiae of these accounts that you fail to open one altogether. Do some basic research, then decide which brokerage firm will meet your needs the best.

From there, open an account and start contributing as much as you can. The rest of the details will work themselves out, but only if you get started.

Any feedback about ROTH IRA from Fidelity? I’d open a ROTH IRA with a little money ($100.00) but I don’t know if they are good as Bettermetn.

Hi WFG – It depends on what you want the account to do. Betterment is a straight robo-advisor. Fidelity offers the Fidelity Go robo advisor, but you can also do self-directed investing too. If DIY investing doesn’t interest you, Betterment might be better. But if you want to do any investing yourself, Fidelity may be the best choice. Both are good, you just have to decide which will work best for you.

My nephew is 30 and a first-time investor. I am suggesting a Roth IRA with a target date fund. He has about $50,000. Can he invest this whole amount into a Roth IRA upon opening ? All I am reading online is the limit per year for a contribution, not the initial opening.

Thank you for your help,

Hi CJ – The only way he can put all the money into the Roth IRA is if he does either a rollover from another Roth, or he does a Roth IRA conversion from non-Roth retirement accounts. If all the $50k is in taxable accounts, he’ll have to do $5,500 per year.

I wouldn’t recommend target date funds for him though. They have high fees and aren’t the most efficient investment, especially for someone who’s 30.

I have a vanguard from my job but I have been out on medical for the past three years and I want to open a Roth IRA. I do not receive any income from my job but I do receive disability from the army is there any way I could start a roth IRA. My vanguard still has me listed as employed at my job as I am what are my options if any?

Hi Lance – IRAs, even Roths, require earned income. Disability isn’t earned so it won’t be eligible. Sorry!

Can a foreign national put up a ROTH IRA?

Hi JM – You can if you have US earned income and a tax ID number.

So an Australian who lives and works solely in Australia can’t open an IRA account?

Hi Tyrone – Generally speaking that’s true. The tax benefits apply to US tax law, not Australia, so there may be no point anyway.

My daughter wants to roll over $1600 from a county job she had a few years ago. She is in a grad program now and will be looking for work in a year. Which progrma (roth or conventional IRA) should she start?

I’m in disability can I qualify for a Roth paying$50?

@ Analiza if you are on disability and have no other income, you will not be able to fund a Roth IRA.

If you are on disability you can certainly take what money you may have avail and start an ira,can’t you?? That way each month you could deposit more into it. ??

I need to make the plunge in investing, but its so scary to think about someone else handling my hard earned money for me. I am an avid saver. I always have been. I know I need to start a retirement account of some time, but I have heard so many horror stories, that I always put it off and leave my money sitting in a little local owned bank that draws next to nothing in interest rate. Then, something comes up, and the money is so easy to get to that I run and grab $500 or $1000 out to loan someone, or pay off a credit card that a ran up over vacation…Is this Roth IRA movement really a safe investing method? It sounds like I should do it. I’m 30 years old and have 3 kids nearing teen years. We have always done fine in life, but I have never felt secure about my future. Just like your post says, these guys actually start off lying to you in the first sentence when they say $1000 min, and its not the case..Any advise on where to start and how to make sense of whats hype and what could really help me retire one day or just have the financial freedom to help my kids when they get older and start planning for college.

@ Roxanne Check out a previous post where I talk about some of the Best Places to Open a Roth IRA.

A few personal favorites are Scottrade and Betterment. Scottrade is a legitimate do it yourself online brokerage but they do have an awesome customer service hotline to help their clients. I know, because I talked to them. 🙂 Their fees area also very reasonable; much cheaper than going to a local investment firm.

Betterment does the investing for you, you just convey to them what your risk profile is. They also have very reasonable fees.

Do you think a Roth is right for a person such as myself, where I own a small business that is thriving at the time, but could always do worse in the future? This is something that terrifies me, hence one of my reasons to save as much now as possible. The tax bracket I am in now, could always increase or decrease in the future. I guess one day I will also be looking at not having the kids at home, and then my taxes will rise as well. Am I still looking for a Roth with these thoughts in mind?

This is very enlightening. Many beginning investors believe they need thousands of dollars to start an IRA. Every little bit helps and people need to start somewhere.