If you haven’t realized this yet, I’m kind of a goal-setting freak.

Some people do New Year’s resolutions. That’s great, but I think you need to revisit your goals on a more consistent basis. Studies support me on that since 91% fail on their resolutions every year. That’s why for me I review my goals every 90 days.

Other people don’t bother to set goals. They choose – unconsciously at least – to rely on luck.

Let’s establish up front that goals are something more substantial than dreams or wishes.

They can start as dreams or wishes, but they have an action plan behind them that spells out how to convert a desire into something real.

Table of Contents

- What Are Financial Goals?

- 1. Have a Well-Stocked Emergency Fund

- 2. Get Out of Debt – Completely

- 3. Plan For Early Retirement

- 4. Create Multiple Income Streams

- 5. Have Enough – But Not Too Much – Insurance to Cover Contingencies

- 6. Be Able to Live on Less Than You Earn – No Matter What

- 7. End Any Addiction to Stuff That You May Have

- 8. Plan to Do Work That You Love

- 9. Get Comfortable Sharing Your Good Fortune

- 10. Plan to Leave Your Financial House in Order Upon Your Death

- Why Are Financial Goals So Important?

- What Are Some Examples of Good Financial Goals?

- What Is a SMART Financial Goal?

- What Are Some Good Examples of Financial Goals Using the SMART Goal Format?

- The Bottom Line – Good Financial Goals

That’s especially important when it comes to financial goals. Since they require regular investments of money and effort over a long period of time, you need to have a workable plan to bring them to reality.

Start by setting some financial goals. If you’ve never thought much about this, here are 10 good financial goals that everyone should make a priority in 2024.

10x Your Goals

What Are Financial Goals?

Financial goals are objectives that an individual or a business sets for their long-term and short-term financial success. They can include saving for retirement, paying off debt, building an emergency fund, increasing net worth, investing in the stock market, owning a home, and more.

Financial goals can vary from person to person depending on factors such as income level, existing debt or assets, life stage, and financial priorities. Setting and reaching financial goals is critical for gaining financial freedom and stability.

1. Have a Well-Stocked Emergency Fund

We normally think of having an emergency fund as being a short-term financial goal. And from a mechanical standpoint, that’s true. However, an emergency fund has important long-term benefits, which is why it’s one of the good financial goals that you should plan to achieve.

Here are just some of the benefits that a well-stocked emergency fund can provide you with throughout your life:

- It can take away a lot of the money worries that you have since you know that you will always have a reserve should you get into a tight spot.

- As is expected of an emergency fund, it will be there to cushion the blow in the event of a sudden emergency, such as a job loss or a large medical expense.

- It’s an important money management tool – if you can save money for an emergency fund, then you can save money for any financial goal that you have.

- It provides you with an intermediate funding source – a kind of halfway point between your paycheck and your investment accounts – that you can use so that you don’t have to disturb your long-term investments.

- Just having an emergency fund will make the wide swings in the stock market more emotionally tolerable, knowing that your survival isn’t at stake when the market falls.

When you consider all that comes from having a strong emergency fund, it should move it up the priority ladder a few rungs. Here are some of the top savings account options for your emergency fund. Currently, the highest rate is:

5.26%

Interest Rate

varies

Min. Initial Deposit

2. Get Out of Debt – Completely

The great thing about this goal is that anyone can do it, regardless of income or wealth level. And if you want to get the most out of your finances, it’s virtually a requirement that you get out of debt.

For the moment, let’s ignore the good-debt-versus-bad-debt debate. At some point in your life, all debt is bad debt and needs to be paid off. That includes the mortgage on your home. Although the purpose of that debt may be noble at the beginning, it’s no less a drag on your income than any other debt as time goes on.

There are more reasons to get out of debt than I can list here, but here are just a few of them:

- Getting out of debt means that you’ll have full control over your income – and that’s an incredible feeling

- It will leave you with more money for savings and investing – and even more for spending

- It will remove the asterisk from your finances – I make $X,000 per month, but $X00 has to go to pay my debts

- It will make it easier to quit a job you don’t like

- It will free your mind of the worry and stress that come with debt

Before starting my career, I fell into the debt trap. I had accumulated over $20,000 of student loan and credit card debt and I wasn’t slowing down anytime soon.

Thankfully, my girlfriend (now wife) helped me to see debt for what it really is – EVIL.

After we were married, it became both of our goals to become debt-free and never carry a credit card balance. I’m proud to say that after over 10 years of marriage, that’s a goal that we’ve stuck to.

Take that, Debt!

You can set all of the good financial goals that you want, but it will be difficult to achieve any of if you are carrying a significant amount of debt for the rest of your life.

If you have high-interest credit card debt or several different credit card bills to pay every month, it can make a lot of sense to take advantage of a 0% APR balance transfer offer as well.

The Chase Slate® card, for example, gives you a 0% APR for a full 15 months, and all without a balance transfer fee of any kind. With this offer, you could transfer several high-interest debts and save hundreds – or even thousands of dollars – over the introductory APR period.

3. Plan For Early Retirement

When I started as a financial advisor and finally grasped the concept of compound interest, I was determined to put myself in a situation where I could retire by the age of 50 if I wanted to. I don’t know if I’ll ever really retire, because I absolutely love what I do.

Even if you absolutely love what it is you do for a living, planning for early retirement is one of those top-rated good financial goals. A recent survey from LendEDU, suggests that 87% of millennials have an average of $26,475 or less stowed away for retirement.

Here’s why planning for retirement is crucial:

- Reaching your retirement goals may take longer than you think; if you plan to retire at 50 you’ll have plenty of time to make it by 65 in the event that you hit a few snags.

- Poor health could make early retirement a necessity – if you’ve planned and prepared to retire early, then you will be ready.

- Family circumstances often require more of your time, and early retirement will help you to have it

- Though you may not want to retire early, you may decide that you would like to downshift and not work so hard

- It’s better to be able to retire early and not need to than to need to retire early and not be able to

There’s one other advantage to planning to retire early, and it’s a big one. By working toward early retirement, you will be front-loading your retirement investment portfolio. That will give you a larger portfolio early, which will mean that you won’t have to work so hard saving for retirement later in life when doing so may be more complicated.

For me, that was opening a Roth IRA and maxing it out. My wife, too. In addition, I was putting as much money into my 401(k) as I could. Trust me. As a brand new financial advisor, I wasn’t making much but I still managed to prioritize my spending and save a significant amount.

Early in my career, I had witnessed too many couples in their 60s that hadn’t saved enough to retire at all, yet retire early. I made it a goal (and a mission) that I wouldn’t let that happen to me.

4. Create Multiple Income Streams

Even if you love your job, creating multiple income streams is a form of income insurance. For that reason alone, it needs to be on your list of good financial goals.

But here are even more reasons:

- One of those income streams could be the part-time cash flow that enables you to semi-retire at an early age.

- If you want to start your own business – but don’t want to quit your job – starting a side business could be the way to do it.

- The extra cash flow from any additional income stream could be used to help fund your retirement savings.

- It could also be used to help you pay off your debts.

- Several income streams could provide you with an income portfolio, which means that you’re not dependent on a single source of income – ever!

Reading Rich Dad, Poor Dad was a defining moment for me. Before then I was oblivious to the concept of having multiple streams of income. Over the years, I dabbled in many side hustles looking for “it”. That included a few multi-level marketing companies that proved to be a flop.

I eventually took a stab at real estate and also failed miserably. Many would perceive these as failures, but I view them more as valuable life lessons that eventually led me to start this blog. Now I have more than a few sites that yield over 6 figures per year. Not too shabby for a guy who had no web marketing experience before I started.

Give this goal some serious thought, even if you’ve never considered it before. It’s a goal that could open the door to a lot of other goals.

5. Have Enough – But Not Too Much – Insurance to Cover Contingencies

Insurance is something of a tough call. A lot of people don’t have nearly enough coverage, while many others are paying too much for the coverage that they have. Striking a balance between the two is another of those good financial goals.

Here are some strategies for striking that balance:

- Where life insurance is concerned, stick with term life insurance – it’s cheaper so you can buy as much as you need. Just make sure that you’re not buying so much life insurance that you’ll be worth more dead than you are alive; it’s just an expense you don’t need to carry.

- Unless mandated by state law, look into carrying the lowest level of auto insurance possible, particularly if you have a long history as a safe driver.

- Take the highest deductible you can on your health insurance, and make up the difference with an emergency fund that is large enough to cover that deductible – if you seldom use your health coverage, you’ll be way ahead of the lower premiums

Part of your goal should be to work with a knowledgeable insurance agent on a regular basis to make sure that you have just enough – but never too much – insurance coverage. Oh by the way, did I mention that I’m also a co-founder of an independent insurance agency?

6. Be Able to Live on Less Than You Earn – No Matter What

I’ve covered this topic in other articles, but it is well worth repeating here since it is one of the most necessary of all good financial goals. By learning to live on less than you earn – no matter what – you will always have plenty of income. That means that you’ll have plenty of income for savings, investments, and paying off debt.

It’s important to always be on the hunt to increase your income. But that strategy will only be effective to the degree that you are able to live on less than you earn so that you can put the difference to better use to improve your life.

7. End Any Addiction to Stuff That You May Have

This may not be a financial goal in and of itself, but it is an obstacle that will stand in the way of all good financial goals, no matter what they are.

An addiction to stuff can be like a financial parasite. A disproportionate amount of your income and financial reserves will go to pay for your need for stuff.

This will present several problems:

- Stuff needs to be stored, and as your pile of stuff grows, you will need an ever-larger space to store it. That will likely see you looking to buy a bigger house every few years, with all of the expenses that come with it.

- Stuff is a capital trap – it ties up your money, but generally provides no financial benefit.

- Any money that goes into stuff, is money that is not going into productive investments.

- While stuff can make you more comfortable, only income-producing or growth-oriented investments can improve your station in life.

- During times of financial turmoil, you may become obsessed with protecting and maintaining your stuff, which is not at all what you need to focus on.

- Stuff has a way of eating up time so that you have less of it to spend on more productive activities

I love this quote from Joshua Becker, author of Simplify: 7 Guiding Principles to Help Anyone Declutter Their Home and Life,

“Removing possessions begins to turn back our desire for more as we find freedom, happiness, and abundance in owning less. And removing ourselves from the all-consuming desire to own more creates an opportunity for significant life change to take place.”

If you even suspect that you may have an addiction to stuff, then make it a financial goal to end that addiction once and for all. Your life will go better if you do.

8. Plan to Do Work That You Love

Ultimately, the purpose of improving your finances should be to provide you with independence in your life. That means that it should afford you the ability to do what you want when you want. If that isn’t one of the good financial goals, then I don’t know what is.

A recent Gallup Poll suggests that engagement at work, defined as enthusiastic involvement and commitment at work, is at an all-time low with 79% just “watching the clock tick”. While that number was lower than in the past, it’s still been roughly 1/3 of Americans consistently. That means quite a percentage of the population is indifferent, or in some cases, downright miserable when it comes to their job.

Important

Over 79% of workers hate their jobs.

Getting out of debt, preparing for early retirement, developing multiple income streams, and ending your addiction to stuff, should clear the way for you to be able to do the kind of work that you really love. That should be true even if the work doesn’t pay nearly as much as you’re being paid now.

But that will be possible only if you have no debts to pay if you can live on less than you earn, and if you have a large investment portfolio to back you up.

Why is doing work that you love a worthy financial goal? Very few people will actually be retiring to the beach for a life of blissful nothing, no matter what you see on TV. If nothing else, it’s likely that you will work just as a matter of personal satisfaction – or an attempt to avoid boredom.

Since you will be working all of your life – one way or another – the work that you do shouldn’t just be about earning money. It should be something that makes you feel good about your life and good about the person you are.

9. Get Comfortable Sharing Your Good Fortune

If you can’t get comfortable sharing your good fortune with people who are less fortunate – perhaps out of fear that you will end up broke as a result – then money has complete control over your life. It doesn’t matter how much money you amass in your life, it should never control you.

There are numerous reasons why giving to others will be good for you:

- Letting go of money affirms your power over it – because you know that it will come back

- Giving to those in need makes you part of the solution in the world and not the problem

- Hoarding money is all about security – letting go of it is celebrating its value

- Giving to others just feels good – particularly the knowledge that you have the ability to do it

- Call it Karma, a higher power, what-goes-around-comes-around, or whatever you want, when you give you get – maybe not always in the form of money, but often in the form of friendship, personal satisfaction, or even help from others when you’re in need

Is giving one of those good financial goals? I think that if you look at many of the most famous wealthy people in the world, you will see a distinct pattern of giving to others along the way.

10. Plan to Leave Your Financial House in Order Upon Your Death

However you live your life, it should be a goal to make sure that your loved ones are left at least a little bit better off as a result of your life. That means not only making adequate provisions for those who are dependent upon your financial resources but also making sure that you don’t leave them with a financial mess to clean up.

Here are some steps you can take to leave your financial house in order upon your death:

- As discussed in #5, make sure that you have adequate insurance, particularly life insurance

- Make sure all of your debts are paid, and if there are any large or unusual ones, buy a term life insurance policy to pay off that debt upon your death

- Consider the impact of estate taxes, if your estate is large enough to be subject to them (insurance can cover that too)

- Discuss the financial implications of your death with your loved ones, to make sure that everyone understands what you want to do, and also so that you will consider any concerns or insecurities that they may have

- Make sure that you have set an example of good financial management for your loved ones – what they learn from you will benefit them for the rest of their lives, and probably more than any amount of money you could leave them

Reaching a point of financial independence in life has nothing to do with luck or magic. It’s simply a matter of setting good financial goals and having a concrete plan as to how you will achieve them. Once that plan is established, and working toward those goals becomes part of the habits that make your life what it is, achieving financial independence can almost seem as if it’s happening on automatic pilot.

But only if you make it happen.

Why Are Financial Goals So Important?

Financial goals are important because they help you plan for the future and give you something to work towards. By setting financial goals, you can make a roadmap to achieve your desired financial position in the future.

This can help you make informed decisions about how to allocate your resources and make the most of your financial opportunities. Financial goals can also provide a sense of purpose and direction and can help you stay motivated and on track to reach your financial objectives.

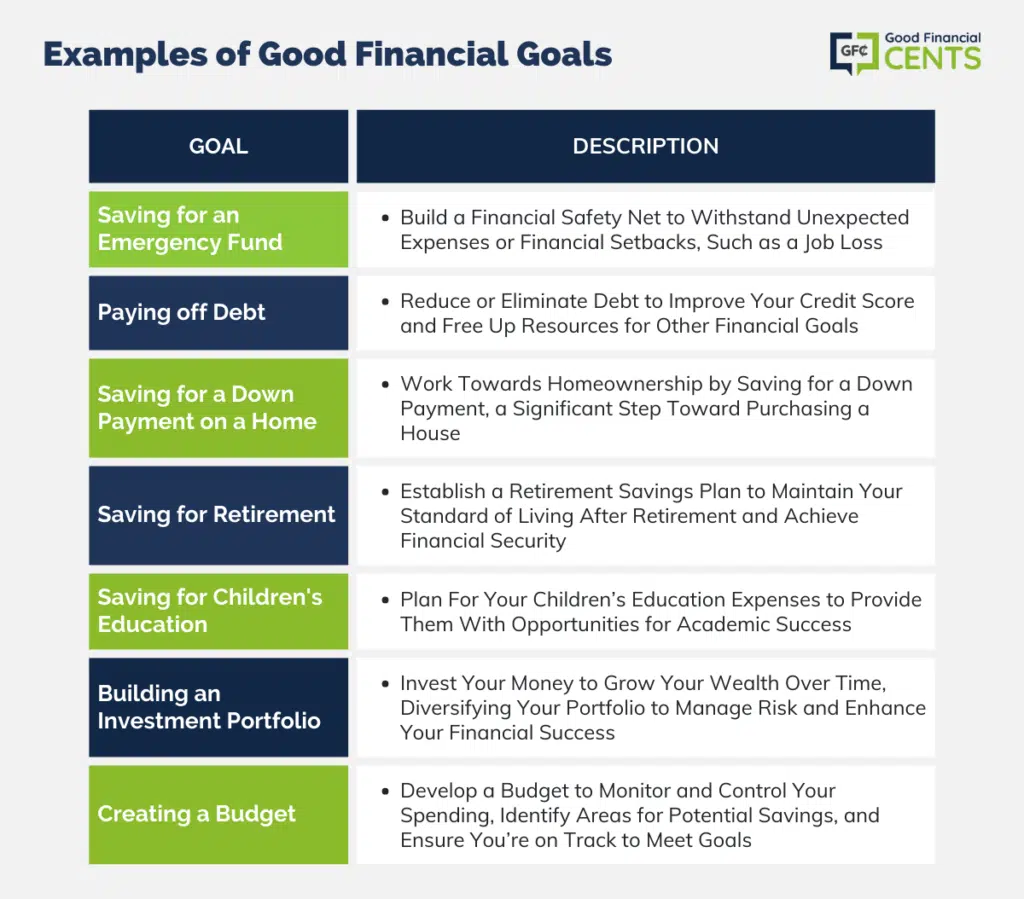

What Are Some Examples of Good Financial Goals?

We all have different backgrounds and are at different points in our life so our financial goals will all differ slightly. So your financial goals will be different than the next person. Here are some examples of financial goals you may set for yourself:

1. Saving for an emergency fund: This can help you weather financial storms, such as a job loss or unexpected expenses.

2. Paying off debt: Reducing or eliminating debt can help you improve your credit score and free up more money for other goals.

3. Saving for a down payment on a home: Owning a home is often a key financial milestone, and saving for a down payment is an important step towards achieving it.

4. Saving for retirement: Building a solid retirement savings plan can help you maintain your standard of living after you stop working.

5. Saving for your children’s education: Planning for your children’s education can help ensure that they have the opportunity to succeed in their studies.

6. Building your investment portfolio: Investing can help you grow your wealth over time, and building a diverse portfolio can help you manage risk and increase your chances of success.

7. Creating a budget: A budget can help you track your spending, identify areas where you may be able to cut back, and ensure that you are saving enough to reach your financial goals.

These are just a few examples of financial goals you may set for yourself.

While these are good financial goals, they are all missing one characteristic that is crucial: they aren’t specific enough.

If you want to achieve your financial goals they need to be listed in the format of a SMART goal.

What Is a SMART Financial Goal?

A SMART goal is a specific, measurable, attainable, relevant, and time-bound goal. The acronym “SMART” stands for these five characteristics, which are designed to help you set effective goals that are more likely to be achieved.

Here’s a brief overview of each characteristic:

| SMART Financial Goals | |

| Specific | A specific goal is clear, defined, and well-stated. It specifies exactly what you want to accomplish |

| Measurable | A measurable goal includes a way to track progress and measure success |

| Attainable | An attainable goal is realistic and achievable given your current resources and circumstances |

| Relevant | A relevant goal is important to you and aligns with your values and long-term objectives |

| Time-bound | A time-bound goal includes a specific deadline or timeline for completion |

By setting SMART goals, you can increase your chances of success and stay motivated as you work towards achieving your objectives.

What Are Some Good Examples of Financial Goals Using the SMART Goal Format?

Previously we looked at some good financial goals without using the SMART goal format. Let’s now look at some examples of good SMART financial goals:

- Specific: Save $10,000 for a down payment on a home within the next 5 years.

- Measurable: Contribute $200 per month to a retirement account for the next 25 years.

- Attainable: Pay off $5,000 in credit card debt within the next 12 months by making an extra payment of $500 per month.

- Relevant: Increase my credit score from 680 to 750 within the next 6 months by paying all bills on time and reducing my credit card balances.

- Time-bound: Save $2,000 for a family vacation within the next 18 months by cutting back on non-essential expenses and increasing my income through side hustles.

These are just a few examples of financial goals using the SMART goal format. The key is to make your goals specific, measurable, attainable, relevant, and time-bound, which can help you stay motivated and on track to achieve them.

The Bottom Line – Good Financial Goals

In conclusion, setting SMART financial goals is a key step toward achieving financial success. By making your goals specific, measurable, attainable, relevant, and time-bound, you can create a roadmap to help you achieve your financial objectives.

Whether you are trying to save for an emergency fund, pay off debt, or build your investment portfolio, setting SMART goals can help you stay motivated and on track to reach your desired financial position.

By setting and working towards your financial goals, you can take control of your finances and build a more secure and stable financial future.

Get the 10X Goal Cheat Sheet Here

When’s the last time you wrote down your goals? More importantly, when’s the last time you’ve revisited them?

Thank you very much for the useful tips to financial freedom.Good tips but some of them are almost impossible. For instance, very few people are able to be debt free, even billionaires!

Time can Buy Money but Money can never buy Time. Global Time Value Management is the World’s first organization, which let you convert Time into Money. The innovated iLight Algorithm of GLobal TVM perfectly measures the per minute value of money increased in real-time. The only aim of the iLight algorithm is to convert community members’ “Time Value Wallet” into “Money Making Machine”. GlobalTVM is the only Time based online trading platform, a new way to secure future financial portfolio. Take advantage of this great opportunity before it’s too late.

Here one can invest wealth without any risk because Time value never declines, always get more and more worth a great deal of money. The mission of globalTVM is to make sure that your Time converts to Money.

Thanks for the tips.I am always finding ways on how to save and budget. A little push can help.Thanks again for sharing.

Looks realy great! Thanks for the post.

Excellent article. I got good information about short term and long term goal of investment.

Thank you for this article. Just a quick question, could you share some of the multiple income streams that have worked for you(advise and recommend those suitable for beginners) and give tips on how to go about creating multiple income streams for some of your fans who live outside USA.

Thanks again Mr.Rose, I love your articles, they have really shaped my year!

Keep up the great job

At Joyce CPA LLC we are proud to provide high quality audit, review, compilation and tax services to small and medium size businesses.

Every clients stands as a real time partner to us, ensuring “Their success as Our success”.The level of personal assistance we serve is a result of our dedication towards advanced training, our Technical experience and financial intelligence.

We strive for excellence which is evident through our time and capital investment into continually progressing education, our cutting edge computer technology and our close knit bond with several clients.

Keeping a track of all your incomes and expenses is really a good way of meeting your financial goals. By keeping a track of spends an individual will come to know if there are any unnecessary expenses and can manage the finances accordingly.

Being able to live on less than you earn has gotten popular recently. I’ve seen quite a few post about doing that. Something else that might come in handy is to consult with a financial planner. That way, you can come up with a more refined plan on how to better manage your finances.

Keeping track of your spending and expenses is actually a good way to meet your financial goals. It’s quite true that addiction to stuff is what gets us into debt, so we have to be careful about our needs and wants. Also reviewing your insurance and Will at the end of year can help meet your goals. Thanks for Sharing Jeff.

Ending addiction to “stuff” can be so very powerful. This includes not just physical stuff like electronics and cars but also little things that we overlook on a daily basis such as a daily trip to the coffee shop and time suckers like Netflix and Facebook. If things seem too difficult to quit cold turkey, practicing in moderation can be the next best thing. For example, visit a coffee shop once a week instead of 5 times. It will feel like a special treat as well.

Well said Syed!

This is really a great list..! By setting financial goals, I feel it is important for us to create our vision of how to deal with it when we get to these goals. Let’s assume that one of your goals is to create a passive monthly income of $ 10,000 for his family. You can see how you feel, and other family members when they achieved this goal. Are all excited? Do you see anyone in this picture? If so, what do you say?

Hi Chris – Sounds good to me, having your family on board.

Thanks for this great list.

I think you need to add a critical item, disability insurance for loss of the ability to work. I got sick at 38 and could no longer work after the age of 47. I will be okay financially because I had saved, was debt free, and had purchased the most disability insurance I could get as long as I worked. Disability throws most people into bare subsistence or poverty, while adding lots of new medical expenses and need to hire help.

Disability insurance is expensive but critical. Women especially cannot ignore this as we are way more susceptible to many of the long-term disabling illnesses that start early like MS, lupus, rheumatoid arthritis, fibromyalfia, CFS, etc.

There’s some good solid advice in this article but it missed one thing that I think is crucial. Number 10, which talks about leaving your financial house in order, should include the importance of having a Will. Communicating with your loved ones is good but will carry no legal weight in the dispersal of your assets after your death.

I love that you included that we should all get rid of our addiction to stuff. Many people wouldn’t say that this was a goal that everyone should have, but I think it is! It’s our addiction to stuff that gets us in financial trouble in the first place!

Great list! You really covered all of it! I’m well on my way with this list, but lately I’ve really been focusing on eliminating stuff from my life as well as the need or craving for more stuff. Stuff comes with maintenance and upkeep and I am actually feeling physically less stressed with less stuff around! Plus appreciating the things that I really value so much more!

That’s a pretty darn good list! Like most people, I still have work to do on a few of these. Procrastination is so easy, especially when the need feels very far away. Took a health crisis for me got on the stick and create a will. And it took about 25 years, but I finally got to the point where I can focus my paid and volunteer work only on endeavors I feel passionate about. Accomplishing that very early in life would be awesome, but I couldn’t make it happen.

Great advice in this article! I agree with every one of these 10 goals. In regards to the multiple income streams, not only does it make great sense for financial reasons, but many of the most successful business ideas come from areas you are already familiar with. Therefore, your side gig may become a great opportunity to launch your dream business. Thanks for writing – great thoughts!

This was a fantastic article! I spent years paying the minimum on my student loans and racking up credit card debt, living way above my means and spending money I didn’t have. I’ve since changed my ways and will have my student loan paid off before the end of the year! I’m really looking forward to setting some new goals for myself once this one is complete — early retirement is sounding pretty good 🙂 To me, the most powerful thing about money is the freedom and choice it can give you when managed efficiently.

Great article! I think you are so right about the fact that getting your financial house in order can help make it so that you can focus on doing work that you love. That’s one of our big financial goals!!

Jeff – enjoyed the article. Can you clarify #5? You mention, “look into the carrying the lowest level of auto insurance possible.”

I am an independent insurance agent. I agree with you on helping people find the right balance of insurance. It’s easy to become ‘insurance poor’, but I couldn’t recommend anyone carry the lowest level of Bodily Injury/Property Damage Liabilty.

I could see where someone may want to raise their Comp & Collision deductible or remove Comp/Coll completely to save money.

@ Brandon That’s basically it. Just making sure they aren’t over insured and paying more for coverage they don’t need.

When calculating percent of income basics/lifestyle/savings…does the savings percentage include sink fund savings even though it may be earmarked for lifestyle? Trying to get my “extra” money prioritized and allocated and don’t want to cheat myself out of vacations now or retirement later.

Absolutely love #8. Work you love — whatever that happens to be, whether you can do it full-time or just part-time on the side — is a key aspect of financial success that I think many people miss. That’s a powerful position to be in, when you’re on track with other things financially (like early retirement) and you have the choice as to when you stop working.. but you choose not to because it truly makes you happy!

Good article here. It’s good to have a big goal to strive for when it comes to finances. For me, it’s getting done paying all these student loans I have. Once I’m done with that, I can work on some of the other goals listed in this article. Thanks so much for sharing!

I loved this article. We have became debt free and had a decent emergency fund and looks like WINTER aka Murphy has decided to try depleting it, but I refuse to let them win.

I want so bad to get into financial advising and planning, but unsure where to start. I love the idea of doing it as a side job until I see I can make good money at it. My husband income covers all our bills now and I would love to start my own business. I have a bachelors degree in Accounting. Where would you suggest starting?

I totally want to start another business but still figuring out what type of business to have. And it definitely helps to live within your means and buy only those that you need.