Some of today’s hottest stocks come at a steep price that can make it difficult to get started in investing. If you want to buy stock in Google, Facebook, or Tesla, for example, you’ll have to pony up several hundred dollars just to buy a single share.

To be clear, you can often open an investing account with a major brokerage firm with $0. The problem is, how do you actually invest your initial nest egg when the stocks you want to buy are beyond your reach?

The answer for many beginning investors is “fractional shares.”

What Are Fractional Shares?

Fractional shares are a type of investment that lets you invest with a small amount of money. With fractional shares, you can buy a “piece” or a “slice” of a stock instead of a full share.

Fractional shares can come about after a stock split, from dividend reinvestment plans (DRIPs), or from other actions that businesses take.

However, some of the top online brokerage firms also buy full shares or fractional shares and sell a percentage to their customers. This lets investors buy into stocks that are primed for growth, but they cannot afford otherwise.

According to Robinhood, a free investing platform that sells fractional shares, investors can expect to purchase fractional shares that are as small as 1/1,000,000 of a share. Fractional shares from Robinhood can be purchased for as little as $1 as a result.

Acorns is another investing platform that lets you build wealth through what they call “micro-investing,” which is just another name for fractional shares.

With Acorns, you link your credit and debit cards to your account, and Acorns rounds up your purchases and sets aside your spare change.

Once you have $5 in your account, the money gets invested in a portfolio of your choosing, which typically includes fractional shares.

Like other types of investments, you can buy or sell fractional shares over time. This means you can continue adding to your arsenal of fractional shares to build long-term wealth or sell fractional shares to lock in gains.

Benefits of Fractional Shares

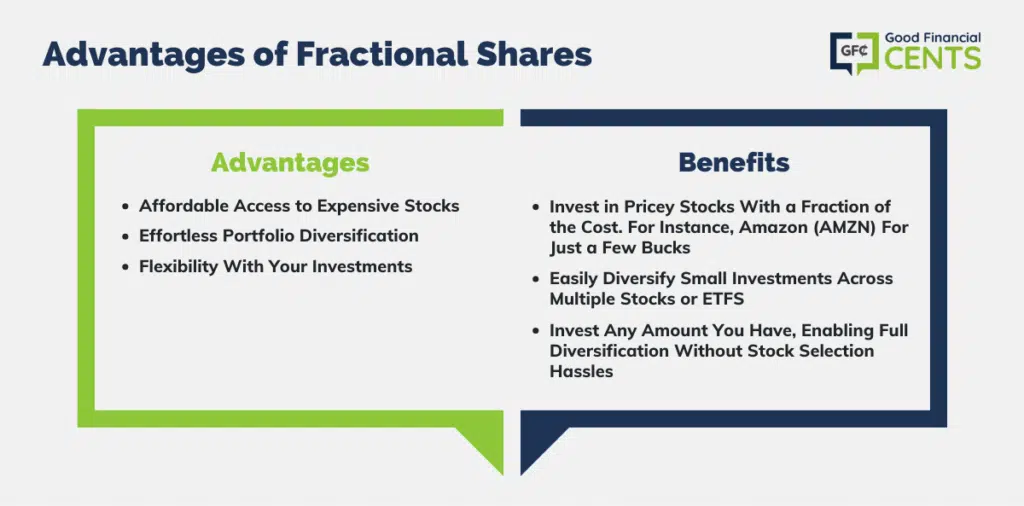

Why would you want to buy a portion of a stock in the form of a fractional share? Here are some of the main advantages.

1. Invest in Popular Stocks With Little Money Upfront

The main advantage of fractional shares is the fact that you can “buy in” more expensive stocks without coming up with the total amount for one full share.

For example, Amazon stock (AMZN) is trading at $3,118.06 as of this writing, but fractional shares can let you invest in Amazon for a few bucks with the right platform.

2. Diversify Your Portfolio With Ease

Fractional shares also make it considerably easier to diversify. After all, you can take an initial investment amount of $100 and spread it across multiple stocks or ETFs using fractional shares.

Without this option, diversifying small amounts of money across multiple investments becomes significantly harder.

3. Invest What You Have

Fractional shares let you invest with whatever amount you have. If you have $500 or $1,000 in cash to get started, for example, fractional shares let you invest the entire amount and diversify in the process.

Without fractional shares, you would be stuck figuring out which exact stocks to buy that would be close to your initial investment amount.

Disadvantages of Fractional Shares

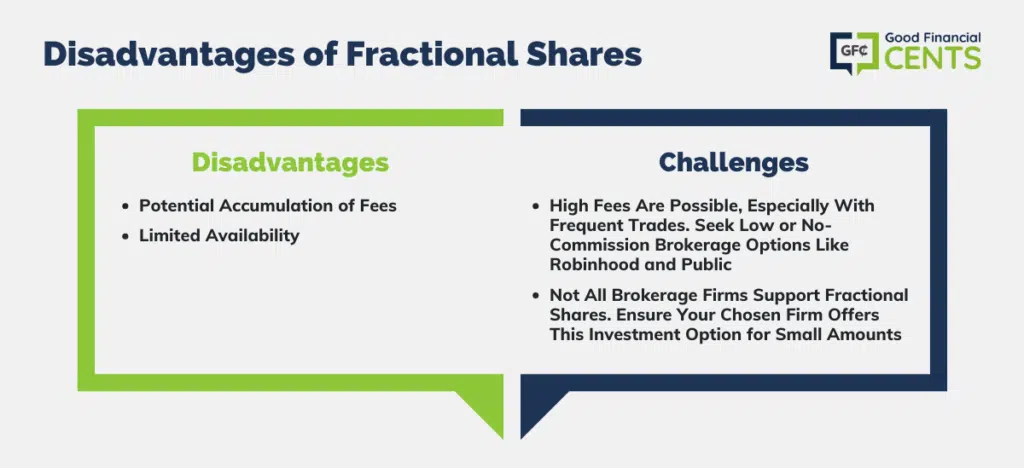

Although investing in fractional shares might seem like a no-brainer, there are plenty of issues you might run into along the way. Consider these downsides before integrating fractional shares into your investment plan.

1. Fees Can Add Up Quickly

One potential downside of fractional shares is the fact that you could potentially rack up a lot in fees. This is especially true if your brokerage firm charges commissions and you wind up making a lot of trades.

Before investing in fractional shares, look for a brokerage account with low or minimal trading fees. In terms of which brokerage firms stand out, Robinhood and Public are good options for commission-free stock trading.

2. Not As Widely Available

Not all brokerage firms offer fractional shares. For example, you can’t open a brokerage account with Vanguard and buy fractional shares directly from its platform.

If you want to invest small amounts of money and buy portions of stock at a time, you’ll have to choose among brokerage firms that offer fractional shares as an investment.

When It Makes Sense to Invest in Fractional Shares

Investing in fractional shares makes sense if you’re a beginning investor who only has a small amount of money to get started.

You can open an investment account and begin buying fractional shares for as little as a few dollars. When you can afford to, you can always graduate to buying full shares of your favorite stocks later on.

Make sure to research brokerage firms that allow fractional shares, keeping in mind factors like investment options, investing tools, and fees.

Where to Invest in Fractional Shares

Plenty of brokerage firms let you invest in fractional shares, although each one works a little differently. Before investing in fractional shares, compare all of the best platforms that offer this option.

Robinhood

Robinhood can be a solid choice for fractional share investing since it offers commission-free trading. You can invest in fractional shares of thousands of stocks for as little as $1, and you can use the app to make real-time trades.

Robinhood is also free of minimum account balance requirements, so you can begin investing without having to build up a large amount of cash.

Acorns

Acorns is a little different because it helps you invest by rounding up your purchases and setting aside small amounts of change on your behalf. Once you begin building savings with Acorns, it helps you invest using small sums of money.

There’s no minimum account balance required to open an Acorns account, though to invest, your round-ups need to reach a $5 minimum. Investing plans for individuals costs $1 or $3 per month.

Public

Public also offers commission-free trading, fractional share investing starting at $5, and a helpful mobile app.

This platform also has a social media element that helps you learn to invest and learn alongside others with similar interests as you. There are no minimum account requirements to get started, either.

Stockpile

Stockpile is another platform that makes it easy to buy fractional shares, although this brokerage is geared toward people who want to give stock as gifts.

According to Stockpile, you can choose from thousands of stocks and invest with as little as $5. You can also receive your investment in the form of a gift card, which you can give out for the holidays, birthdays, or any other special occasion.

The Bottom Line – Fractional Shares: Buying Guide

Buying fractional shares makes a ton of sense if you have little money upfront to invest or even if you just want to diversify.

After all, having hundreds or thousands of slices of individual stocks can leave you considerably more diversified than owning just a few whole shares.

If you’re hoping to invest soon and want to get started right away, plenty of online brokerage firms offer fractional share investing with no commissions and no (or minimal) fees. Make sure to compare all the best investing apps and platforms before you decide.