The best robo-advisors use technology and algorithms to craft intelligent portfolios based on their customer’s risk tolerance and timeline. Many offer helpful online tools to help them determine their short-term and long-term goals. Better yet, they all have highly rated apps that make it easy to track investment returns and progress on a mobile device.

Perhaps even more importantly, the best robo-advisors provide a thoughtful and less expensive alternative to working with a traditional financial advisor. Where a regular financial advisor typically charges a 1% annual fee based on assets under management (AUM), robo-advisors can easily charge half of that or less.

Table of Contents

If you’re ready to invest in professional financial advice and you’re considering robo-advisors that provide automated investing online, read on to learn about our top picks.

Best Robo-Advisors for 2024: Our Top Picks

- Betterment: Best Overall

- SoFi Automated Investing: Best for Goal Planning

- Wealthfront: Best for Low Fees

- M1 Finance: Best for No Fees

- Personal Capital: Best for Free Tools

- Acorns: Best for Automated Investing

- Stash: Best All-In-One Option

Best Robo-Advisors — Reviews

Before you decide on a robo-advisor that can help you access investing, you should compare each of our top picks based on their pricing and features. The robo-advisor reviews below include an overview of each company and how they work.

We chose Betterment as the best robo-advisor overall due to their relatively low fees, their strong portfolio management services, and their easy-to-understand tiers of service.

For example, investors looking for a financial solution to help them save for the future can opt to pay 0.25% per year for a low-cost investing portfolio built and managed based on their priorities with features like portfolio rebalancing, dividend reinvestment, and auto-adjust. Advanced tax-loss harvesting is also included in this plan.

Investors who want more personalized assistance can choose to pay 0.40% per year for a premium investing plan that includes unlimited calls and emails with a team of financial advisors who can provide advice and answer questions. This tier of service also includes all the features of the lower-tier plan.

We also love the helpful and highly-rated mobile app Betterment offers, which helps customers monitor and track their investments on the go. Set up is easy, with a few questions around asset allocation, rather than the more common risk-assessment questionnaire.

While SoFi is best known for its student loan refinancing products, this company has expanded dramatically to include a robust investing platform and cash management tools. SoFi can help you build a portfolio without a management fee, and they offer benefits like automatic portfolio rebalancing and diversification.

While a robo-advisor at heart, SoFi does let you access their team of financial advisors any time you have questions or need advice. This company also offers DIY investing options and tools that can be complimentary to your automated portfolio. For example, you can use SoFi to invest in IPOs, cryptocurrency, and fractional shares of your favorite stocks.

Better yet, SoFi offers software that helps you make a plan to reach your goals, whether you are saving for retirement or a large purchase like a wedding or your first home. If you’re looking for alternatives to Betterment that help with goal planning, SoFi Invest Automated Investing is a solid option to consider.

We chose Wealthfront as our best option for low fees due to the fact they charge a flat annual fee of 0.25% for their intelligent portfolios and overall asset management services. You do need at least $500 to get started, but you’ll get features like daily tax-loss harvesting and automatic rebalancing. Just answer some questions and Wealthfront will create a portfolio for you made up of low-cost index funds that help you get where you want to be.

Wealthfront also offers many types of accounts within their plans, so you can use them to achieve any financial goal you have. For example, Wealthfront offers individual accounts joint accounts, trust accounts, traditional IRAs, Roth IRAs, SEP IRAs, and more.

M1 Finance is a unique investment firm that centers around “pies” — i.e., pie charts that represent your portfolios for different goals. You can customize your own pie with a mix of ETFs and individual stocks, which is unique for a robo-advisor. However, M1 Finance also offers “Expert Pies” that were curated by financial professionals based on various goals and investing timelines.

Unfortunately, M1 Finance does not offer tax-loss harvesting like many other services. There’s also a $100 account minimum ($500 if you’re opening an IRA) which isn’t huge, but it could be enough to prevent some new investors from getting in.

Finally, M1 Finance is not the best option to consider if you want access to live financial advisors. While you can call M1 Finance for customer service inquiries, you won’t get personalized investment advice through this app.

Personal Capital is definitely the most expensive and difficult-to-access online investment manager in this ranking. You need a minimum balance of $100,000 to open an investment account, and your annual fee will work out to 0.89% if you have less than $1 million in your portfolio.

Personal Capital also offers a range of features and services that make it a popular option. You can even get some of their tools within their free account, such as their retirement planning tool and their 401(k) fee analyzer tool. Personal Capital even offers a budgeting component that helps you track your household expenses and figure out where your money is going.

Acorns is unique from other robo-advisors for a few reasons, including their flat management fees. This online investment advisor charges a flat monthly fee of $3 or $5 depending on whether you want a personal plan or a family plan. Not only that, but Acorns connects with your checking account and automatically rounds up your spare change.

Over time, they use those small sums of money to invest in ETFs and even Bitcoin on your behalf. This makes Acorns a good option if you’re wondering how to invest in Bitcoin without tons of upfront research and work on your part.

In addition to traditional investment accounts, a program called Acorns Later also offers retirement accounts, including traditional IRAs, Roth IRAs, and SEP IRAs. Acorns also offers features like automatic portfolio rebalancing and automated investments each time your rounded-up change reaches a threshold of $5.

Stash is another online investment platform that offers a useful mobile app and a variety of plans to fit different sets of goals and needs. Customers can choose to pay $1 per month, $3 per month, or $9 per month for a Stash investment plan that includes investing access with a personalized portfolio as well as advice from qualified financial advisors and counselors.

Stash starts off with an investing plan for beginners that costs just $1 per month and includes investing access with its own portfolio, banking access, and a Stock Back Card that helps customers earn free stock as they use it for regular spending. The plan for beginners also comes with $1,000 in life insurance offered through Avibra.

While a mid-tier plan is also offered, the Stash + plan ($9 per month) offers the most robust selection of investment service features. Customers who are willing to invest this much will get a smart investing portfolio (including an account for two kids), professional financial advice, banking access, the Stock Back Card, and $10,000 in life insurance.

Robo-Advisors Guide

If you’ve been looking for the best long-term investments but you know you need help selecting the right investments for your portfolio, the best robo-financial advisors provide a low-cost and practical solution. Read on to learn more about the best robo-investment apps, how they work, and who they’re best for.

What Is a Robo-Advisor?

Generally speaking, a robo-advisor is an online wealth management platform that uses technology to help you construct an investment portfolio that makes sense for your timeline and goals. Robo-advisor services mimic those of traditional financial advisors, although online investment advisors lean on technology and algorithms to help select investments, and they do so at a lower cost overall.

Most robo-advisors also have a mobile app that helps you track your investments in one place. Robo investing can also give you access to perks like tax-loss harvesting, investing in fractional shares, portfolio balancing, and more, although the exact features you receive will depend on the account you choose.

Who Are Robo-Advisors Best for?

Robo-advisors are best for individuals and couples who want access to professional financial advice without having to deal with a human financial advisor.

After all, many financial professionals who call themselves “financial advisors” earn high commissions and advisory fees for selling financial products like insurance, mutual funds, and annuities.

Conversely, robo-advisors can cut through the hype to create personalized portfolios that are made up of investments that don’t earn the company a commission.

Robo-advisors also work well for consumers who want a hands-off, “set it and forget it” strategy to save for retirement and the future. Online wealth management platforms will do the grunt work for you to set up a customized portfolio, usually after you take the time to answer questions about your goals, your tolerance for risk, and your timeline for investing.

Are Robo-Advisors Legit?

Yes, robo-advisors are legitimate financial services that use algorithms to provide automated, algorithm-driven financial planning services. They are regulated by the same laws and regulations as traditional financial advisors and are generally considered a safe and legitimate way to invest and manage money.

Most Robo-advisors are required by law to be registered as investment advisers with the Securities and Exchange Commission (SEC) or state securities regulators, and as such, they are subject to regulatory oversight, including annual audits and compliance exams, which aims to ensure they are following all applicable laws and regulations.

Additionally, many robo-advisors are members of the Securities Investor Protection Corporation (SIPC), which provides limited protection to customers in case a broker-dealer fails. However, it’s important to note that SIPC protection does not cover losses due to market fluctuations or fraud.

This means: ALWAYS do your own due diligence, read the terms and conditions, and understand the risks before investing your money with any robo-advisor.

Pros and Cons of Robo-Advisors

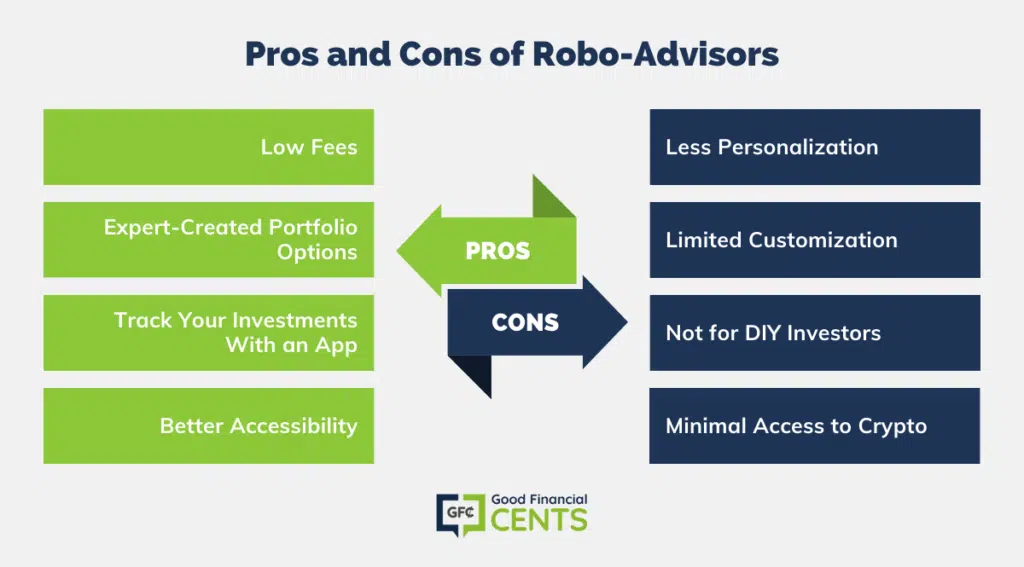

Robo-advisors offer an alternative to traditional financial planning, but these services still come with their share of pros and cons.

Pros & Cons

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Pros

Cons

Robo-Advisor Pros

- Low fees: By and large, robo-advisors charge much lower fees than traditional financial advisors. These lower fees can help you secure a higher return on your investments over time.

- Expert-created portfolio options: Instead of fumbling together your own investment strategy with limited time or research, robo-advisors make it easy to pay for professional assistance.

- Track your investments with an app: Unlike working with an old-school financial advisor, robo-advisors make it easy to track your investments and progress on your mobile device.

- Better accessibility: Where many human financial advisors only want to work with clients who have a high net worth, robo-advisors let you start investing with as little as $1 in some cases.

Robo-Advisor Cons

- Less personalization: A robo-advisor is not the best option if you want your financial professional to get to know your investment goals on a personal level.

- Limited customization: Some robo-advisors offer limited chances for customization, as well as limited types of accounts.

- Not for DIY investors: Robo-advisors are not the best option if you’re constantly trading stocks and investing in ETFs on your own and you prefer to keep doing so.

- Minimal access to crypto: If you’re looking for the best crypto exchanges, keep looking. Some robo-advisors offer crypto investments, but only on a limited basis.

Related: 4 Ways I’m Making Money with Crypto

Factors to Consider Before Choosing a Robo-Advisor

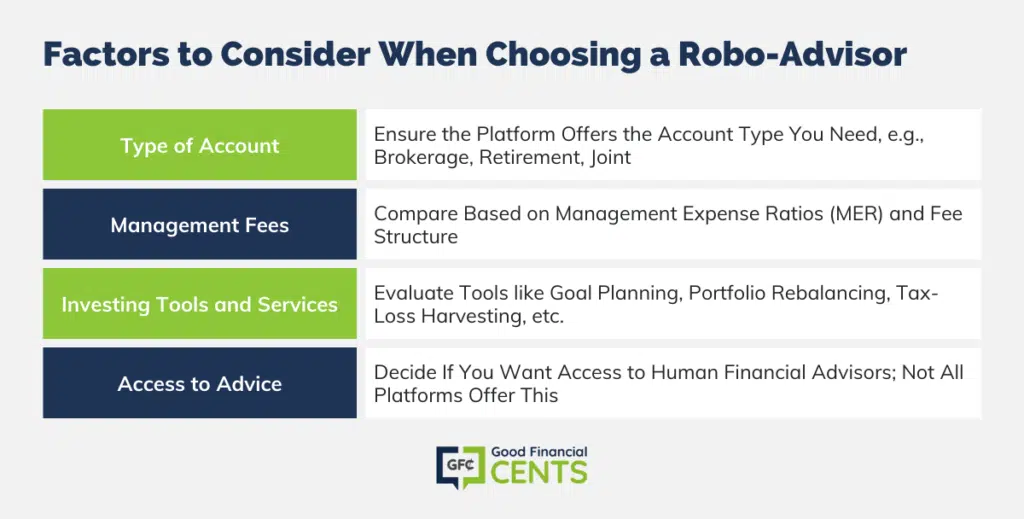

Before you choose a robo-advisor platform, you need to think about your personal finance goals, the type of account you want, and how much you want to pay for personalized advice. Keep the following factors in mind as you compare the best robo investors and all they have to offer.

- Type of account: Make sure you choose a robo-advisor that offers the type of account you want to open. Where some platforms only offer brokerage accounts, others offer various retirement accounts and taxable accounts or let customers open joint accounts.

- Management fees: Compare investment platforms based on their management expense ratios (MER), whether the fees are charged on a monthly basis or as a percentage of your investments.

- Investing tools and services: Compare platforms based on the tools they offer, whether they have goal-planning tools, portfolio rebalancing, tax-loss harvesting, or something else you want.

- Access to advice: Decide whether you want to speak with a human financial advisor at any point in the process. If so, many of the best robo-advisors offer this option, yet some do not.

Related: Best Short-Term Investments

How We Found the Best Robo-Advisors of 2024

To find the top robo-advisors of 2024, our methodology compared platforms based on factors such as services offered, fees, minimum account balance requirements, and app ratings. We only went with companies that have a 4-star rating or better for their mobile app, and we looked for platforms that have mostly positive user reviews.

When comparing factors like barriers to entry and fees, we sought out robo-advisors that offer low minimum balance requirements (or no requirements) and fees that make sense considering the services offered. Finally, we looked for robo-advisors that offer access to a broad range of investments, including stocks, bonds, ETFs, fractional shares, and more.

Summary of the Best Robo-Advisors of 2024

- Betterment: Best Overall

- SoFi Automated Investing: Best for Goal Planning

- Wealthfront: Best for Low Fees

- M1 Finance: Best for No Fees

- Personal Capital: Best for Free Tools

- Acorns: Best for Automated Investing

- Stash: Best All-In-One Option