Exchange-traded funds, better known as ETFs, have become a staple of stock market investing in recent years.

If you’re an investor, chances are you’re holding one or more ETFs in your portfolio.

In this guide, we’re going to look at exactly what ETFs are, how they work, the benefits and risks, where to trade them, and how much you should have invested in them.

Table of Contents

What Are ETFs?

ETFs are often confused with mutual funds. And they are quite similar, at least in the most general sense.

Each is a fund that holds a portfolio of stocks, bonds, or other securities.

While mutual funds selected specific stocks, with the hope of outperforming the general market, an ETF is built to match a specific market index.

It’ll match the index, but it will never either outperform it or underperform it. For this reason, ETFs are often referred to as passive investing.

As of 2023, there were 2,934 ETFs in the US alone. That’s an increase of nearly 50% in just five years.

There’s a good reason for that expansion. Since ETFs are primarily index-based, it’s a perfect way for both individual and institutional investors to invest in markets without needing to concern themselves with individual stock selection.

How Do ETFs Work?

With ETFs, the fund will invest in a portfolio of stocks designed to match the corresponding index.

However, since an index will change only infrequently, ETFs rarely trade stocks. A mutual fund, on the other hand, will trade individual stocks much more frequently.

A particularly aggressive mutual fund may have a portfolio turnover of greater than 100%. That means the entire portfolio is being traded at least once a year.

However, it’s precisely because of the lack of frequent trading that ETFs are less expensive to invest in than mutual funds. Because they don’t have a lot of trading activity, expense ratios are generally some small fraction of 1%.

Unlike mutual funds, they don’t charge load fees, which are sales or redemption charges that can be between 1% and 3% of the value of the fund.

Another advantage ETFs have is that they trade on major financial markets, with trading commissions comparable to stocks.

For example, you may be able to purchase $100, $1,000, or $10,000 worth of a particular ETF for as little as $0 with some brokers like Ally Invest.

This means you will be purchasing an entire portfolio of stocks or other securities for just a few dollars.

Types of ETFs

At least part of the popularity of ETFs has to do with their versatility. They can be adapted to just about any investment purpose.

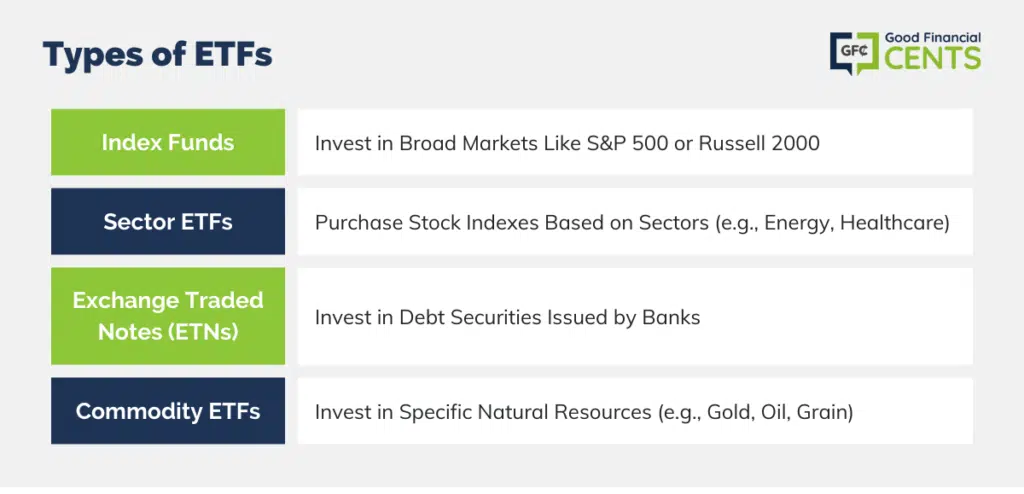

Various general types of ETFs include:

Index funds

These are ETFs that invest in broad markets, like the S&P 500 or the Russell 2000. Examples include Vanguard 500 Index Fund Investor Shares (VFINX) and Schwab S&P 500 Index Fund (SWPPX).

When you buy into one of these funds, you own a small piece of every company stock in that index.

Sector ETFs

ETFs can be used to purchase stock indexes based on sectors, such as energy or healthcare. Examples include the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and Vanguard Health Care Index Fund (VHT) ETFs.

You can also invest in ETFs tied to emerging markets, specific countries, or even industry specializations, like pharmaceuticals.

Exchange Traded Notes (ETNs)

These are ETF cousins that invest in debt securities, typically issued by banks.

They’re mainly for income generation, and they’re used to create portfolios of high-interest securities that might not be available to small investors.

Commodity ETFs

These are funds that can invest in specific natural resources, such as gold, oil, or grain.

An example is the SPDR Gold Shares (GLD), which is the largest gold ETF in the world. This is a way to invest in gold without needing to take physical possession of the metal.

These are just a few examples of the types of ETFs that are available. There are also ETFs for bonds, or specific investment styles, or market capitalizations (large, medium, or small-cap stocks).

There are even what are known as inverse ETFs, which enable investors to profit from declines in the underlying market.

The Benefits of ETFs

ETFs have a long list of benefits, including:

- Trading Fees: Inexpensive to buy and sell.

- Cost: ETFs have very low expense ratios.

- Easy Trading: They can be bought and sold like stocks.

- Minimums: There are generally no fund minimums; they can be purchased in any denomination.

- Accessibility: They enable a small investor to invest in an entire portfolio of stocks with just a few dollars.

- Diversification: You can create a balanced portfolio by investing in a small number of ETFs. For example, you can create a portfolio with ETFs in the S&P 500, foreign developed stocks, emerging market stocks, bonds, US Treasury securities, commodities, and even real estate.

- Low Taxability: Since they don’t trade components stocks often, they don’t generate taxable capital gains the way mutual funds do.

- Quick Trading: When bought or sold, they settle on the same day. This is unlike mutual funds which settle after the close of the market.

- Versatility: ETFs can be used to invest in even exotic asset classes, like specific countries or upstart industries.

Risks of ETFs

The benefits of ETFs are far more numerous than the risks. But that doesn’t mean ETFs are risk-free.

There may be fewer risks, but they’re substantial.

You’ll Never Outperform the Market

This is actually an advantage for many investors who are content to simply match the performance of the market.

But if you’re hoping to do the Warren Buffett thing and outperform the market over the long term, you’ll never do it with ETFs. They’re simply not designed to do that.

You Can Lose Money in ETFs

Simply put, when the financial markets fall, so do ETF values. Since ETFs are tied to the underlying market, they’re virtually guaranteed to decline when the market does.

There May Be a Widespread Perception That ETFs Are Risk-Free

It’s often implied that ETFs are relatively risk-free. That’s certainly true compared to individual stocks and mutual funds.

Either of those investments could easily underperform the market, causing you to lose a lot of money.

But since ETFs track the market, they’ll seldom fall more than the general market does.

So from a purely market standpoint, ETFs are less risky than stocks and mutual funds.

But there may also be an unjustified public perception that ETFs are risk-free. The first ETF was launched in 1993, so they’ve barely been around for 25 years.

But they’ve really exploded in popularity since the last stock market crash in 2008-2009. Given that the market has risen almost steadily over the past 10 years, there may be a perception that ETFs can only go up.

They may decline less than individual stocks and mutual funds, but yes, they can and will decline if the underlying market falls.

But that’s a situation a lot of investors haven’t experienced up to this point, at least not to any significant degree.

How to Invest in ETFs

ETFs have become so common that you can invest in them through nearly every investment platform or vehicle.

Here are just some of the examples:

Betterment

Robo-advisors are practically built for ETFs. Investments are managed based on modern portfolio theory (MPT), which stresses the importance of asset allocation over individual securities selection. The emphasis is on proper portfolio allocation.

Betterment is one of our top picks for ETFs, as you can see in our Betterment Review.

ETFs are tailor-made for this type of investment model. Using just a few ETFs, a robo-advisor can create a portfolio of stocks, bonds, real estate, and even commodities. They can invest in each asset class using a single dedicated index-based ETF for each class.

M1 Finance

Virtually all brokerage firms enable you to buy and sell ETFs.

For example, investment giants Fidelity and Charles Schwab offer ETFs at $4.95 per trade, and they’re the largest brokers in the industry.

However, M1 Finance will charge you no trading fees to invest in over 3,000 available ETFs. They will also let you purchase fraction shares in ETFs, meaning you can buy as little as $1 in an ETF if you want.

TD Ameritrade

TD Ameritrade has more than 300 commission-free ETFs for you to invest in. While this is much less than M1Finance, TD Ameritrade also lets you purchase into pretty much any ETF for the low fee of $0 a trade.

This will give you MANY more options for a low price. If you are looking to have the most options, then TD Ameritrade is your top option.

How to Invest in ETFs

| PLATFORM | DESCRIPTION |

|---|---|

| Betterment | Robo-Advisors Tailor ETF Portfolios Based on Mpt for Proper Asset Allocation |

| M1 Finance | Offers Over 3,000 ETFs With No Trading Fees; Allows Fractional Share Purchases |

| TD Ameritrade | Provides Access to 300+ Commission-Free ETFs; Also Offers Low-Cost Trading for Any ETF |

Even Traditional Human Investment Advisors Have Gotten Into the ETF Act

If your money is invested with an investment advisory service using traditional human investment management, it’s certain that at least some of your money is invested in ETFs.

With investment management becoming increasingly automated, ETFs are now taking the place of mutual funds and stocks in portfolios of all kinds.

Entire market segments can be covered using ETFs, and they can be traded just as easily and inexpensively as individual stocks.

How Much Should You Invest in ETFs?

If you’re a small- to medium-sized investor, you should have most of your portfolio invested in ETFs. That will certainly be the situation if you invest through a robo-advisor.

But even if you have a self-directed investment account, your portfolio should be built on a foundation of exchange-traded funds.

You might build what is sometimes known as a core portfolio. That’s a basic portfolio that incorporates all the typical major asset classes.

50% of your portfolio could be invested in ETFs covering the following broad asset categories:

- US stocks

- International developed countries’ stocks

- International emerging market stocks

- US bonds

- Foreign bonds

- Real estate

This is a typical robo-advisor portfolio allocation. You can cover all six asset classes with just six ETFs, one for each asset class.

Depending on your investment preferences, you may also want to diversify into specific sectors. You can add ETFs for commodities, specific industry sectors, high-yield bonds, and even emerging industries.

With your core of ETFs covering the major asset allocations, you can dedicate the balance of your portfolio to true self-directed investing. That can include individual stocks, mutual funds, options, or real estate investment trusts.

Investing in ETFs – Bottom Line

ETFs not only provide the broadest possible market exposure, but they’ll do so in a way that’s lower risk than the other asset types.

ETFs may have come out in the 1990s, but they’re clearly one of the biggest investment trends of the 21st century.

If you haven’t invested in any up to this point, you need to give them a very serious look.

I agree with your synopsis of the ETF market. In addition to your points made above I often find ETFs are an easier way for the general public to enter the stock market without devoting significant amounts of time researching individual stocks in order to try and make better returns than the market and often fall short. Most persons time is better off spent focusing on their strengths and reinvesting their time into themselves or their business as the return on this type of investment will eclipse any stock market return.