Online businesses rock.

Why? I’ll tell you why . . . .

You can run your online business from anywhere, and you actually don’t need a lot of money to start. There aren’t too many businesses that can boast those advantages!

But still, you’re going to need quite a bit of time and a little bit of money to start your online business.

It certainly takes more than a few minutes every day to get something awesome up and running. And it takes a little extra cash to really get things moving.

So today, I’d like to show you exactly how you can find the time and money to get your online business off the ground. Hang in there, we have a lot to cover.

Table of Contents

Motivate Yourself!

Don’t think that you can make a lot of money starting an online business? Think again. I certainly made a lot, and others have found quite a bit of success as well.

Take, for example, Steve’s wife from MyWifeQuitHerJob.com. She started an online store called Bumblebee Linens which replaced her salary of $100k within one year. Amazing. Check out my interview with Steve to learn more about how it was done.

Or take Ramit’s Zero to Launch online course. It had over 30,000 paying students. That’s big money, folks. In fact, it’s a great course you can take to learn how to start making some extra money on the side.

You might be thinking, “Okay, Jeff, this is all fantastic. But can I really do this stuff?”

Yes, you can, but you’re going to have to find your passion first.

For example, take my wife’s fitness program. My wife took one of her passions – working out – and turned it into a coaching program. Learn more about how my wife became a fitness coach. I know it will inspire you to take what you already enjoy doing and turn it into a business!

Find Time

Let’s tackle this big one first: finding time.

So, that means you’re doomed. Just joking.

What it really means is that you have to make time. What I mean by “make time” is that you have to either do what you’re already doing much faster than you’re already doing it, or you have to reduce the number of tasks you’re doing each day. I know, bad news, right?

Trust me, there’s a light at the end of the tunnel. Because I decided to focus on the right tasks instead of the ones that didn’t really produce profit for me, I was able to make over $1,097,757 blogging. Making time during my day for my blogging business paid off – big time.

I’m convinced that you can have similar results if you make time during the day for the right tasks. But how do you find this time during the day?

Yes, you already know that you either have to say “No” to stuff or you have to speed up what you’re doing, but what does that really look like from a practical standpoint?

Let’s explore some ways to find time.

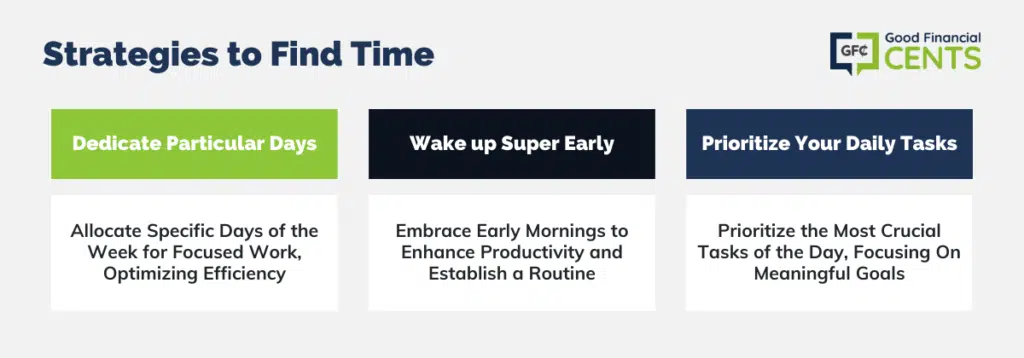

1. Dedicate Particular Days of the Week to Certain Kinds of Work

I absolutely love this idea. At my firm, Alliance Wealth Management, I spend a couple of days at the office doing the tasks that require my attention – I don’t spend my entire week there. Why? Because I realized early on that scheduling and focus are key components of success.

Perhaps right now, you’re working a full-time job, and when you get home, you’re absolutely drained. But maybe you really don’t have to work full-time – maybe you can get away with 30 hours per week instead of 40 hours per week. Imagine what you could build with that extra 10 hours per week!

Did someone say a thriving online business? Yes, I believe they did.

By having certain days of the week dedicated to building your online business, you’ll be able to focus and take advantage of the times of day when you have the most energy.

Many people, for example, find that they have the most energy to get work done in the earlier parts of the day – the morning and the early afternoon.

Working in the evening can be quite a chore when you’re drained from everything else you did that day. That’s why it’s a good idea to start your morning off right and work as early as possible – in my opinion.

That leads me to my next tip . . . .

2. Wake up Super Early

Don’t get me wrong. I wasn’t always an early bird.

But after I read The Miracle Morning by Hal Elrod, my life changed for the better.

You see, I used to work on my online business late at night. That’s when I did most of my blogging. But when I started having kids, I noticed that I would get off track and find myself scrolling through Facebook instead of focusing on my work. No good.

Hal’s book inspired me to try something different, so I started waking up super early. I now typically wake up at 5 a.m. Sometimes, I wake up even earlier.

Hal’s book isn’t just about waking up early, it’s about finding a routine. You could exercise, read some fiction, eat a healthy breakfast – you name it. The idea is that when you start the day strong, your workday becomes the best it can be.

Check out my podcast with Hal – you just might become an early bird too!

3. Prioritize Your Daily Tasks

I’d be willing to bet that you have quite a few things you do every day. Perhaps you often get to the end of your day and realize that you didn’t get everything that you wanted to get done. You’re certainly not alone – a lot of people are in that boat.

That’s why I recommend that you prioritize your daily tasks. But you don’t necessarily have to prioritize all of them; just focus on your five most important tasks in the day. This in itself is prioritizing these five tasks over the other things you have to do during the day and let me tell you, it works!

I call this the HIGH FIVE™. Which tasks should you choose for your HIGH FIVE™? Simple:

- Tasks that move the needle on your long-term goals, like starting an online business

- Tasks that you must get done today, or they won’t survive

Find Money

Okay, so you found some time and know how to focus on the right tasks at the right time. Now what?

It’s time to find some money, baby!

Like I said earlier, it usually doesn’t take much money to start an online business compared to a brick-and-mortar business.

However, if you’re selling tangible goods online, you’re still going to need quite a bit of money to start compared to selling ebooks or other information-based products.

So how do you find this money? There are so many ways. Let’s explore.

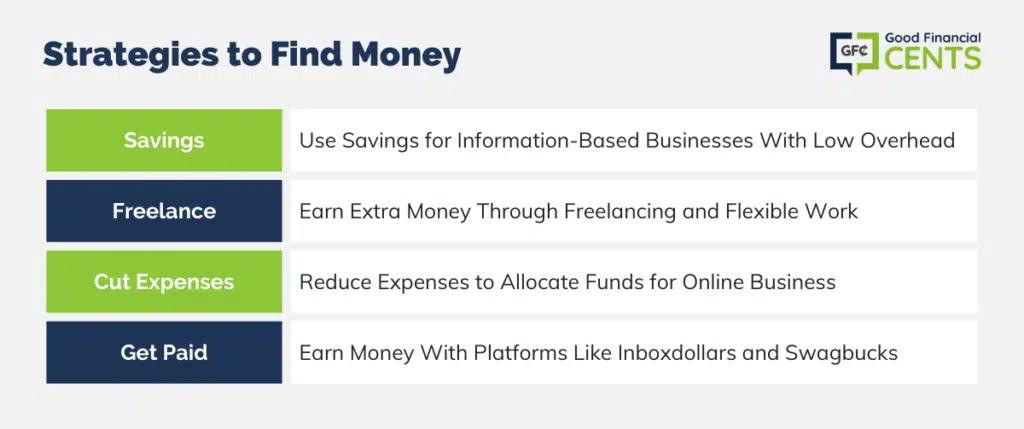

1. Use a Little Savings if Your Business Doesn’t Require a Lot of Overhead

If you’re planning on starting a business with information-based products like ebooks or online courses, I’d say you should go ahead and just use a little bit of your savings to get your online business off the ground.

If you’ve never explored the costs associated with starting an online business, prepare to be amazed. It costs so little most Americans can afford it, no problem.

You can get started for as little as $3.95 per month. That’s right, just $3.95 per month!

That will get you hosting, and everything else is pretty much optional. However, some of the optional expenses might be worth the money, so I’ll show you how to make some money for those expenses as well.

2. Start Freelancing

If you’re struggling to pay your bills, but you want to start a substantial online business, consider trying to make some money on the side.

A great way to do this is through freelancing – not being an employee. There’s a difference!

Freelancing has to do with working for multiple companies or people at the same time. It’s also largely identified by being able to set your own hours and your own rates.

This gives you greater flexibility to make some extra money on the side without sacrificing your employment at your regular job.

Freelancing is also great for those who seek services, too. Because freelancers aren’t employees, business owners don’t have to pay Social Security on behalf of the freelancer, and they also don’t have to pay for their healthcare.

When business owners hire freelancers, there’s much less regulation and paperwork to keep track of and file.

As you can see, freelancing is a great option for business owners and laborers alike. So what can you do as a freelancer?

There are a number of online freelance jobs:

- Writing

- Editing

- Website design

- Sales

- Accounting

- Data entry

- Tutoring

- Coaching

You can also get a job that requires more physical labor if that’s your thing. Here are some manual labor jobs that require some sweat:

- Mechanical work

- Dog walking

- Handyman work

- Furniture moving

You get the idea. Many of these jobs you can do on the side as you have time. Consider it! One of these ideas might become your online business – or it might be a means to getting your online business funded!

3. Cut Your Expenses

If you’re living paycheck to paycheck, you should consider cutting your expenses. There are a number of areas where you can aim to cut your expenses, and I’d like to focus on those now.

First, take a look at your recurring expenses. This might include cable TV subscriptions, cellular service, magazine subscriptions – anything that you get charged for every month. Many of these expenses can be cut down or completely eliminated.

Within a few months, by cutting these expenses, you’ll have enough money to pay for the hosting of your online business and also to pay some freelancers if you want some web design work done, for example.

But don’t just look at the small recurring expenses; look at the big ones too. How much are you paying for rent? Is it too much? Do you have too much space that really isn’t getting utilized? Perhaps you should downsize. It’s not a bad idea!

Also, take a look at your car payments. I drove my grandmother’s 1998 Chevy Lumina and arguably saved quite a bit of money. Drive used reliable cars. Interest payments are horrible – don’t go there!

In addition to taking a hard look at your recurring expenses, take a look at your regular, non-recurring expenses. What do I mean by “regular” expenses? These are those purchases that you might make every day or every other day but add up to a lot of money over the month.

For example, take a look at your eating-out expenses. Are you going out to eat every other day? Let’s say you spend just $25 when you go out to eat with your family – I’m being conservative here. Let’s also say that you’re going out to get every other day.

That comes to about $375 per month or $4,500 per year. Ouch. Cut back! Try going out to eat perhaps once per week on the weekends – that’s much more reasonable.

4. Get Paid for Stuff You Already Do

Yes, you can get paid for stuff you’re already doing. I’m going to share an awesome tip that will bring in some cash. Are you ready? One word . . . .

InboxDollars. InboxDollars allows you to earn free cash by searching using their search engine. Yep, it’s as easy as that.

When you sign up, you’ll also get a free $5 bonus. It’ll probably take you some time to earn a decent amount of money, but for something that only takes a few minutes to sign up for, it’s a great deal.

You can also make some money by doing surveys, answering polls, and playing games with Swagbucks.

Give these two websites a shot, and you’ll be making enough to probably cover your hosting and have a little extra left over for any other areas of the online business you want to fund.

Want some more tips on how to make money? Read 21 Ways to Make $100 Fast.

It’s Time to Start Your Online Business!

Alright, I showed you how to find the time and money to start your online business. Now it’s time to actually get started! And don’t worry, I have you covered.

Blogging is a great way to make money online without having to cough up a lot of money. I’ve seen a great deal of success in blogging, and now I’d like to teach you how to do it – free of charge.

Read How to Start Your Own Blog. You’ll be up and running in nearly no time.

Now take a leap and go start your online business!

Want to learn about other ways to make money?

I think prioritization is key. It is important to focus on the right things so you can grow your business.

There is not enough time in the day to do everything so we have to make sure to focus on the tasks that are the most important.

For starting an online business I think those are: driving traffic, blogging, building relationships, and nailing your selling position.

Time and money are the two things people usually say are what holds them back from starting a business. Honestly, I think it’s motivation. Most people have time they just don’t use it wisely.

Really great tips, Jeff. Personally, the time management aspect of starting a business is key for me. Dedicating certain days / time to get things done is critical to my success. Also, freelance writing was how I initially made money with my blog so I could then spend money on it. I didn’t feel right spending my personal money on it because I’m so focused on student loan debt. But freelance writing has made that possible.

Natalie, love your points here. Did you struggle with time management when you first started? Did it prevent you from starting for a while? I’m considering creating a course around helping very busy people make best use of their limited time to start an online business. Did you ever look into something like that back when you started your business?

Motivation is huge. Getting over that initial hump can be the hardest part of the whole process. My wife runs a design service through Etsy and she talked about doing it for at least a year before she got started. Once she did, it took off right away, and multiple times she said that her only regret was not having started sooner!