According to a recent Lending Club report, 62% of Americans lived paycheck-to-paycheck in September 2023, unchanged from a year earlier. Also, one-third of American consumers report not saving any money.

But what does it mean to live paycheck-to-paycheck, and how does a person break the cycle?

In this article, I’ll answer that question, but I’ll also show you how to save $1000 while living paycheck-to-paycheck, so you can begin to live within your means.

I’ve been in your shoes and know there’s a way out.

What Is the Meaning of Paycheck-to-Paycheck?

Table of Contents

- What Is the Meaning of Paycheck-to-Paycheck?

- How to Save Your First $1,000

- 1. Open a Separate Bank Account for Savings

- 2. Earn Money in Your Free Time

- 3. Stop Paying Crazy-High Interest Rates

- 4. Start a Side Hustle

- 5. Refinance Your Pesky Student Loans

- 6. Lower Your Mortgage Payment

- 7. Download Apps for Cash

- 8. Negotiate Your Auto Insurance Rates, and Save Big

- Start Saving Now….and Don’t Let Anyone Stand in Your Way

- Final Thoughts on Saving Money While Living Paycheck to Paycheck

Living paycheck-to-paycheck is an expression that describes a situation where a person’s entire income must be used to cover expenses, leaving little to no room for savings or discretionary spending. It’s a cycle that will repeat itself until you can either increase your income, reduce your expenses, or both. Someone in this situation may only be a layoff or missed paycheck away from not being able to cover the necessities of life, such as groceries or rent.

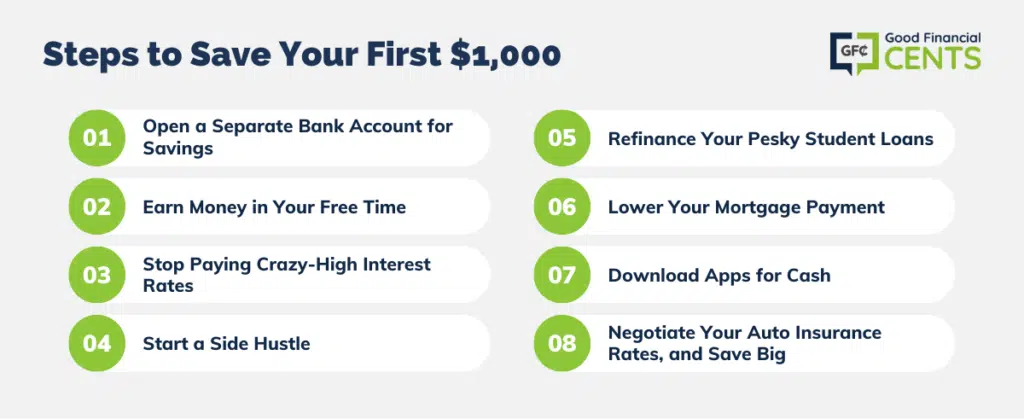

If you have found yourself in a similar position, or you’re in one right now, you know how difficult and hopeless it can feel. If you’re tired of living paycheck to paycheck, here are eight steps to save your first $1,000 and be on your way to breaking the cycle.

How to Save Your First $1,000

If you’re running out of money all the time, you need a lifeline. For most people, breaking the paycheck-to-paycheck cycle involves a) earning more money, b) spending less money, or c) a little of both.

With a few simple strategies, you could even save up your first $1,000. In addition to building a savings cushion for a rainy day, it’s money you could use to cover surprise bills or bail you out in an emergency.

It all starts with you and the steps you take to change your life. Here are eight ways to start saving $1,000 when saving anything seems impossible.

1. Open a Separate Bank Account for Savings

Saving money is hard enough, especially when you don’t have a dedicated account just for savings. The good news is you can open a savings account and get paid for doing so!

Chase offers bank account promotions that will have you on your way to saving your first $1,000 with little effort. For example, with a Chase Premier Plus Checking account, you’ll earn $300 as a new customer just for opening an account and setting up direct deposit.

Some fees apply to Chase accounts, but there are plenty of ways to bypass them.

2. Earn Money in Your Free Time

If you have some spare time during the day or evening, you could earn small sums of money as a way to get ahead. Several websites will pay you to take surveys or complete simple tasks using your home computer.

Once you sign up, you can usually earn $10 – $30 just by answering questions or rating products or services! Some companies will even pay you to watch videos or print coupons at home!

One of my personal favorites is Inbox Dollars. This website will pay you to watch videos, answer questions, and even surf the web.

Here are some other paid survey websites you can try out:

You won’t get rich with paid survey sites, but remember that this is only a first step towards making extra money. The advantage of these sites is that you can get started right now and start to earn money within minutes. To maximize your earnings, sign up for several sites at once.

For further reading, here is my review of the 11 best online survey sites.

3. Stop Paying Crazy-High Interest Rates

If you’re living paycheck-to-paycheck and trying to dig yourself out of credit card debt, you can kill two birds with one stone by refinancing your high-interest debt into a new card with a lower interest rate.

This way, you’ll save on interest AND lower your monthly payment. By paying less interest each month, you’ll get out of debt faster, too.

One of my favorite balance transfer credit cards is Discover. With this card, you’ll get 18 months with 0% APR plus 1-5 percent cash back on everything you buy. A balance transfer fee does apply, but the card will never charge an annual fee.

If you’re drowning under high-interest credit card debt, consider giving a balance transfer card with zero percent interest a try. You can read about other balance transfer cards here.

4. Start a Side Hustle

One way to change your lifestyle is to find ways to earn more money. If you can’t get overtime or pick up extra shifts at work, picking up a side hustle could be your best bet.

The best side hustle ideas provide a decent income without too much hassle or stress. Hopefully, you can find a hustle that’s also flexible enough to let you keep up with your family and work commitments.

One of the most flexible side hustles is driving for a company like Uber or Lyft. With a decent car and a smartphone, you can earn up to $20 per hour driving people around town or to the airport. Driving for a rideshare company is easy and stress-free, and it doesn’t require a big financial commitment, either.

Lyft is offering a guaranteed $1,000 to become a driver.

It’s part of a program called Earnings Guaranteed. According to the Lyft website, the promotion says drivers will earn a guaranteed amount within a specific time frame.

If the driver does not make the guaranteed amount within the time frame, Lyft will cover the difference!

Don’t have a car? No problem! HyreCar is a marketplace for car rentals prequalified to drive with Uber and Lyft!

5. Refinance Your Pesky Student Loans

The average Class of 2023 graduate left school with more than $37,338 in student loans and correspondingly large monthly payments. Those monthly payments can eat away at your paycheck and make getting ahead much harder.

Since you can’t discharge student loans in bankruptcy, they’ll never disappear until you pay them off. The good news is it may be possible to refinance your loans into a new loan with a lower interest rate and monthly payment.

While you may lose some protections if you refinance federal loans with a private lender, you could save a ton of money with a simple refinance.

| Company | Cash Bonus | |

|---|---|---|

| Credible | Up to $750 Cash Bonus | Refi Now! |

| Splash Financial | $500 Cash Bonus | Refi Now! |

| SoFi | $200 Cash Bonus | Refi Now! |

| Earnest | $500 Cash Bonus | Refi Now! |

6. Lower Your Mortgage Payment

While it’s easy to assume your mortgage payment is set in stone, this couldn’t be further from the truth. While interest rates have been rising, depending on your situation, you may still be able to refinance your home loan and save cash every month.

Imagine having a $150,000 mortgage over thirty years at 6 percent. If you count just principal and interest, your monthly mortgage payment is likely around $899.

Now, let’s say you refinance your mortgage into a new thirty-year loan at 4 percent APR. Overnight, your principal and interest payment will drop to $716. That’s more than $180 in savings every month!

7. Download Apps for Cash

Some apps will pay you just to download them – or to surf the web as you usually would. This strategy may not lead to a life-changing amount of money, but your earnings can increase over time.

Here are a few apps I love:

Rakuten: Formerly known as Ebates, Rakuten lets you earn cash back when you shop online. Not only can you earn 10 percent back or more for purchases you make at online stores like Macy’s and Kohl’s, but you can earn free money for shopping at Walmart.com and Amazon.com, too.

Acorns: Acorns helps you save money by rounding up every purchase you make. Whether you’re paying bills or shopping, you can accumulate small sums of money over time.

Over the long haul, your earnings can accumulate in a big way. You can sign up with Acorns here using my exclusive link.

iBotta: iBotta is a rebates app that will give you cashback on your grocery purchases. You earn free cash for signing up and downloading the app ($5), and you earn money for things you do every day. It’s easy, and it’s free!

8. Negotiate Your Auto Insurance Rates, and Save Big

Most people assume that their auto insurance is a fixed payment, but this couldn’t be further from the truth. Once you’ve been with a company for a while – even without any claims – they tend to raise their rates. If you fail to shop around every year or every few years, you could pay a lot more for insurance than you need to.

As a former financial advisor, I would always advise my clients to shop around for auto and even homeowner’s insurance at least once every year. In the worst-case scenario, you’ll find out the coverage you already have is an awesome deal. But, most of the time, you’ll find you can save money by switching providers without sacrificing coverage.

Check out our list of the best auto insurance companies, or select your state below for today’s best rates.

Allstate and Liberty Mutual for competitive rates that can help you lower your monthly payments today. Getting a quote is easy – and it’s free.

Start Saving Now….and Don’t Let Anyone Stand in Your Way

While saving up $1,000 when you’re living paycheck-to-paycheck is hard, any of the strategies on this list can help you get there.

Imagine if you could find a way to save a few hundred dollars every month while also boosting your earnings. Over time, the little changes you make can add up in a big way!

Final Thoughts on Saving Money While Living Paycheck to Paycheck

Tired of living paycheck-to-paycheck? Remember that there’s no “right” or “wrong” way to fix your financial situation, which is why anything on this list can work. My best advice is to pick a few options on this list, run with them, and not let anyone impede your progress. The sooner you start working toward financial freedom, the better off you’ll be.