Are you wondering about how much you’re going to need to be saved for when you retire?

It’s a common question that a lot of people have, young and old.

Some of the more common variations that I get on this question are, What is the amount of income that I’m going to need in retirement? or, How do I figure out what my retirement income needs are going to be?

It’s a tough question, but the toughest part about answering it is that there is no clear-cut answer. There is no universal formula, some general mathematical rule of thumb, or some magic number that you need.

And that is what makes financial planning an ongoing process. It’s not just a one-time, quick, snap-shot solution where, “Okay, bam! This is how much money you’re going to need and you’re all good.”

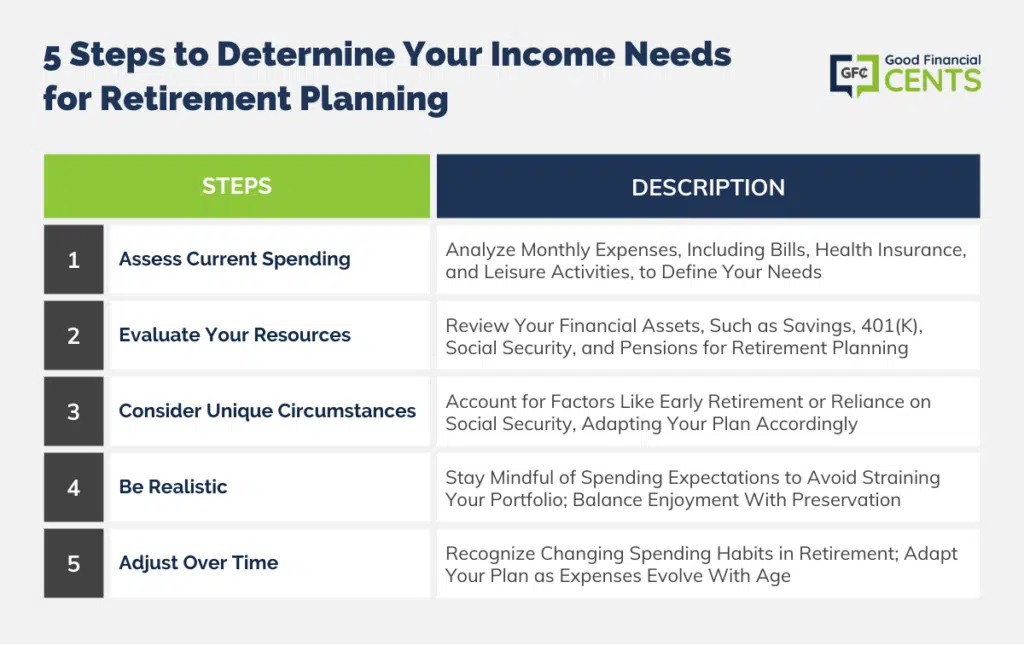

Here are a couple of the different items that you need to consider when you’re trying to figure out what your retirement income needs are going to be.

Table of Contents

Pay Your Bills

First and foremost, you have to figure out what your needs are, meaning how much you need each month to pay the bills.

How much do you need to take care of your health insurance if you still have a house payment, if you still have debt, if you want to do vacations? It all comes down to trying to identify that. That’s tough for a lot of people because a lot of us do not budget.

A lot of us don’t have a good sense of knowing exactly where our money is going each month. If you don’t have a good handle on your budget, then trying to identify your income needs is almost impossible.

How Do You Do It? You can try to shoot from the hip, which a lot of my clients try to do. But I make them go home, sit down, and start looking at where all their money is going per month.

What are the things that they have to have each month to buy? Without doing that inventory, without doing that research into their own lives, it makes it tremendously difficult to try to figure out what their retirement-income needs are going to be.

That is the first step and, I assure you it’s probably the hardest because a lot of people don’t do it. They just don’t take the time to figure that out.

Show Me What You’re Working With

The second step is that you have to figure out what you’ve got to work with:

- How Much Have You Saved?

- How Close Are You to Receiving Social Security?

- Do You Have Any Pensions?

All those factors come into play when trying to identify what your retirement income needs are going to be.

For example, I have clients who actually go back and figure out what their income need is as far as paying the monthly bills and having a little extra to play and do the things that they want to do, so that gives us a sense of where we need to be. Then we take a look at what they’ve got.

Have They Retired Early?

I have some clients who retire at 55, 58, and 60 so there is a little bit more pressure on their retirement assets, their 401(k)s, and their pensions to be able to get them that retirement income.

We don’t have social security to lean on, so that requires a little bit more creativity. I have other clients who retire after the Social Security age. Some take early retirement at 62, and some continue to work until they are 65 (or 66).

When we have that extra paycheck coming in per month, that gives us a little more freedom and flexibility to try to decipher what the income might be.

That’s why it’s so tough. It’s not a clear-cut answer. You hear a lot of general rules of thumb where whatever 70%-80% of your current income in your working years is how much you’re going to need in your retirement years.

Sometimes that is the case, but sometimes it’s not. Going back to income needs, what about health insurance? Is that something that you’re going to have, or are you already on Medicare so it’s not that much of an issue? There are a lot of factors like that that come into play.

Let’s Be Real

The other thing is just being realistic as far as your spending expectations. I have some clients who come to me, and we do all this planning to where we’ve got everything lined up. We’ve identified their needs.

We have all their retirement information together, so we’ve identified how much they are going to be drawing out per month. Then a few months into it, they get a little spend happy, and they start wanting to buy things, buy “toys”, do this, and take trips.

All of a sudden, they are causing a strain on their retirement portfolio, so we have to have a come-to-Jesus meeting and I address the issue,

“Hey, this was the plan when we first started, now why are we deviating? Why are we all of a sudden buying things that initially weren’t on our plan?”

You just have to be very conscious of that. I don’t want my clients to think they can’t spend their money. It is their money. They worked their whole life to have that, but you have to be careful. You have to be cautious and just be very aware of how much you’re spending and how fast you’re spending it.

One of the most important components of creating a retirement plan is having an accurate evaluation of yourself and just knowing your habits, and how things may be as soon as retirement comes.

Retirement: The Early Years

Going back to that rule of thumb as far as the 70%-80%, typically what I’ve seen is this: In the first couple years of retirement, it’s like the kid who has been stuck in class all day long and it’s sunny outside.

They’ve been looking at the playground. They can see the sun. They see the jungle gyms. They’re ready to be set loose, and they want to go play and be free.

That’s what it’s like for many of my retiree clients: once they hit retirement, they’re like that kid who’s been set free. They’re out on recess. They get to play, get to do these things they’ve been waiting to do for so long.

They’re ready to go. They’re ready to play and have fun, so in those first couple of years, they’ll spend a little bit more doing the trips that they want to do, buying the toys that they’ve put off for so many years.

Now they feel that they’re entitled to do that, and they are, so let them do it.

Then as they get older, as maybe health conditions don’t allow them to do the travel as they did when they first retired, they’ll tend to spend a lot less than they did in their first years.

Whereas the first couple of years maybe you do fall in that rule of thumb of spending 70%-80% of your working year’s income, but after a certain point you don’t travel as much because you’ve done everything you wanted to do and are just content to stay around home spending time with the grandkids and just doing a lot of staycations where you’re just enjoying that time with your family.

Thus, you’re not spending nearly as much, and it kind of balances out.

Get Your Best Retirement Income Possible

Those are some of the steps that you need to do in the beginning first, identify what you’re actually going to need per month to live off of, to spend, and to do the things that you have to do just to get by.

Then, you’re going to need to identify what you’ve got to work with, with your 401(k) and your savings and pensions, and when social security is going to play in.

Then finally, you just have to know yourself and know your spending habits and how that’s going to affect your income in your retirement years.

Final Thoughts on How to Determine Your Income Needs For Retirement Planning

There’s no one-size-fits-all answer to the question of income needs. It hinges on a multitude of factors, including your current expenses, savings, and retirement age.

By meticulously evaluating these elements, you can construct a tailored retirement plan. Yet, be vigilant of spending habits. Initially, retirement might resemble a playground of dreams, but as time progresses, expenditures may fluctuate.

Flexibility and self-awareness are paramount. Ultimately, the pursuit of your best retirement income necessitates a dynamic strategy that evolves with your circumstances and desires, ensuring a fulfilling and financially secure retirement journey.

Hi Jeff, I have recently started reading your blog and wanted to ask a question about retirement planning. I am a young professional about 1 year out of college. My current employer does not offer any sort of retirement benefits like my husband’s employer does, but I know it is important that I start saving for retirement at a young age. The problem is- I have no idea where to start. It was so easy with my husband’s retirement planning, because his employer had everything set up and all we had to do was decide what percentage of his paychecks to put into his retirement fund. When thinking about starting a retirement fund on my own, where do I start? Thanks so much. I really enjoy your blog!

@Austin

Glad you like the blog. I hope you continue to find it helpful. The first place I would direct you to start saving for retirement is the Roth IRA. It’s usually where I direct all younger investors to start. Tour around the blog and you’ll find tons of information on it. Let me know if you have more questions.