He was supposed to be my success story.

I talked to so many young people about investing, but the lessons never “clicked” for the majority of them.

I’m not sure why it was different this time, but it was.

It was over 12 years ago, and I had just spoken to some local high school seniors gearing up for graduation. I talked at length about investing, mutual funds, compounding interest, and the Roth IRA.

This wasn’t the first time I had spoken at our local high school, so unfortunately I knew what to expect.

I expected to see blank stares, kids whispering to their friends, and a whole lot of indifference.

But for this young kid, it was different. He was paying attention. He was actually listening.

At the end of my talk, this smart young man approached me and asked for my business card. He said he was excited about the idea of investing and wanted to start putting in $50 a month.

There was no way that I was going to badger him and make him invest, so I gave him my business card and put it on him to contact me.

Low and behold, he did. And unlike other kids his age, he was working part-time at a local cellphone provider and could actually afford to invest $50 a month.

When I ran the numbers for him and showed him what $50 a month could grow to over the next 30 and 40 years, we both became excited about his future.

Fast forward six to nine months, and it got even more exciting. Why? Because he started to increase the amount of cash he was investing every month.

Starting out, he increased it to a $100 investment per month. After that, he boosted it up to $150, then $200. At that point, a combination of things happened.

First of all, he bounced around with a few different jobs after college and struggled to decide on a career. Worse, he got scared. Even though we talked in great detail about how he didn’t need this money right now, he was still freaked out when the market began to drop.

So, instead of sticking with his monthly contributions to his Roth IRA, my prize student quit. He went cold turkey. Even though I drove the idea of what he could potentially have decades down the line home, he didn’t have the same fire in his eyes as he did when we first met.

That 18-year-old kid is now a 30-year-old man. And when you look at where he should be in his Roth IRA, you can tell he’s not even close. Worse, he’s taken some distributions over the years. The last time I checked, he had just under $ 3,000 – a far cry from where he should be.

I’m not sure what made me think of this young man again, but it got me curious to think where he would be if he kept at it.

Using one of our mutual fund databases, I was able to go back and input what it would have looked like had he invested the $50 a month until now.

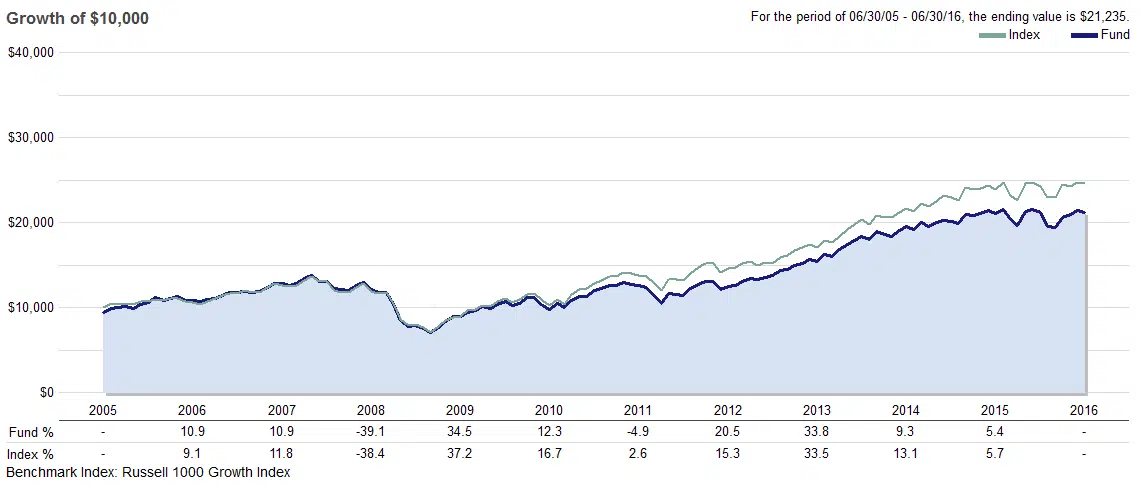

Here are a few examples. Before we look at these examples, here is a snapshot of the mutual fund he initially started with. This mutual fund at the time was one of the top in its category. As you can see now, it has performed below average these last few years.

Table of Contents

The Numbers

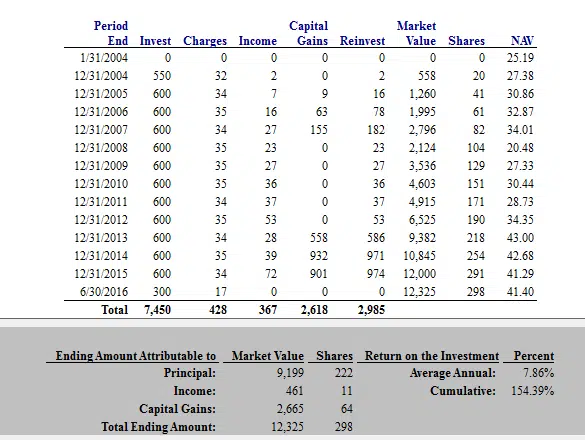

In this first example, we’re assuming this young investor was putting in $50 a month and continued to do so until his 30th birthday.

By investing just $50 a month by the time he was age 30, he would’ve accumulated $12,325. That’s not bad for a price that’s the equivalent of a gym membership every month.

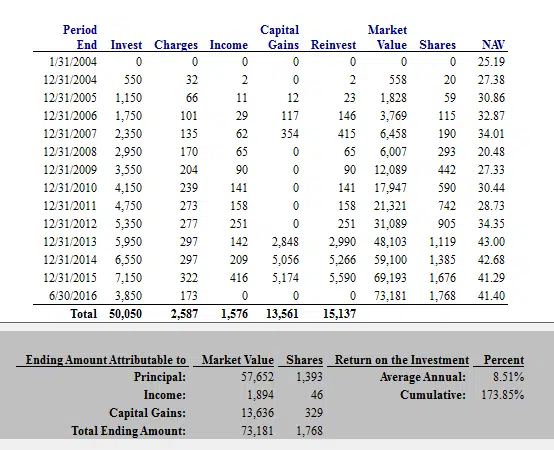

In the next example, I tried to mimic what it might look like if he continued down the path he was on. If you recall, he started off at $50 a month but was able to increase that for the first couple of years.

In this example, I’m assuming that he started at $50 a month and then increased that by $50 a month each year. So, by the time he was thirty years old, he was putting in $7,150 per year.

Note:

So, in this example, his investment would’ve grown to $73,181. This represents 24 times more than what he currently has, just if he would’ve stayed the course.

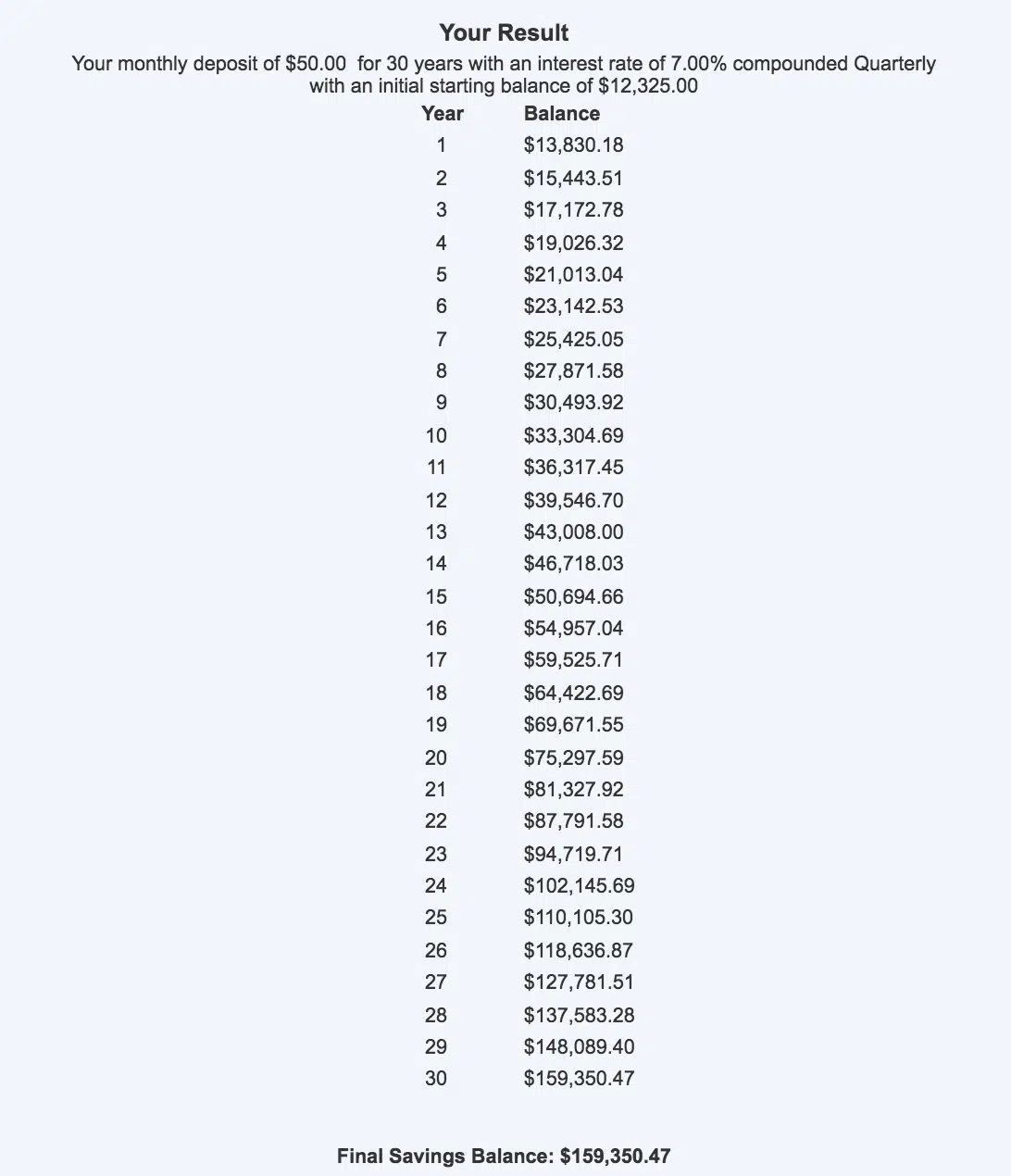

So, in the first example, had he continued with the $50 a month all the way to age 30 and then up to age 60, his ending value would have been $159,350.47. Not bad.

Still, I had some difficulty trying to show what would happen if he increased it to $50 a month every year for the next 30 years.

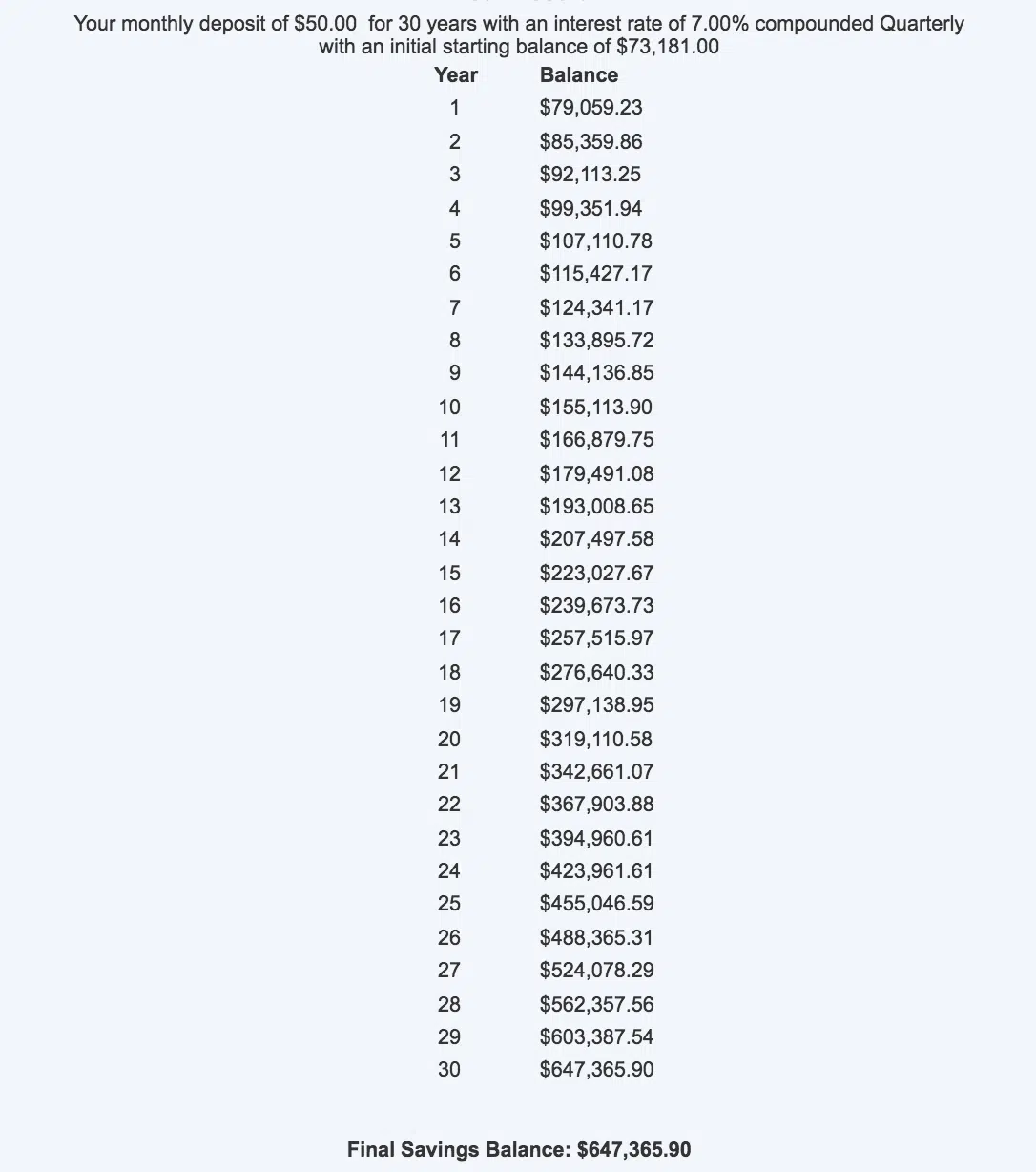

For the sake of simplicity, for the next calculation, we’re going to extend the second calculation of him increasing $50 a month every year up until the age of 30, then make it a flat $50 a month for the next 30 years.

Even at that amount, and with a 7% return on his money, his final balance at age 60 would have been $647,365.90.

Wow.

$647,365.90.

Can you believe it?

There are so many lessons to be learned here. Let’s dive in.

5 Lessons From a $647,365.90 Investing Mistake

First of all, I’m not trying to shame my friend here. Like many would-be investors, he started out with the right idea. Then life happened, just like it does for the rest of us. Even though he made some mistakes, he was likely just rolling with the punches like anyone else would do.

Another positive for my former student is that he is still only thirty years old. Even though he missed out on some serious growth until now, he still has time – time to start over, time to reignite his passion for investing, and time to turn things around.

But what can you learn from this? Trust me, there are a slew of lessons here that anyone can apply. Let’s start at the beginning.

Lesson #1: Compound Interest Is Magic

There’s a reason compound interest is referred to as the “eighth wonder of the world.” With enough time and with compounding, even small amounts of money can help you grow fabulously rich! To get compounding on your side, however, you need to start investing early – real early.

The example I shared in this story illustrates the magic of compound interest perfectly. With compounding, money grows on its own and compounds continually without your help.

And when you keep investing month after month, the value of your investments can grow and expand in ways you wouldn’t believe.

Remember:

If you want to see how compound interest could work in your favor, play around with a compound interest calculator on your own. What you find might astound you.

Lesson #2: You Have to Invest for the Long-term!

Here’s another important lesson you can gain from this story: If you want to grow wealthy, you have to invest for the long term. My prize student allowed himself to become “spooked” by a fluctuating stock market. Worse, he took distributions from his Roth IRA along the way.

No matter what, you can’t let the markets get you down. To grow your wealth and net worth, you have to keep investing every month no matter what – even if the market drops, if you don’t feel like it, or when you’re scared.

If you let fear and life get in the way, you’ll miss out on years of growth that could help you grow rich.

Lesson #3: Even a Sub-Par Investment Choice Can Help You Grow Rich When Time Is on Your Side.

One really amazing thing about the story I shared above is that my former student’s Mutual Fund wasn’t even doing that great. As I mentioned already, its performance was only so-so.

This just goes to show how taking a long-term approach can help you grow wealthy regardless of whether you make the optimal choice. Every time, investing in something will leave you better off than if you had invested in nothing at all.

Because so many people fear investing and making the wrong choices, this lesson is important. Remember, when you’re investing for the long haul, the worst mistake you can make is sitting on the sidelines.

Lesson #4: Investing in a Roth IRA Means Tax-Free Money Later

Remember how my student invested the bulk of his funds in a Roth IRA account at first? Because investments made into a Roth IRA are after-tax, your money grows tax-free.

Even better, you don’t have to pay income taxes on distributions from a Roth IRA once you reach retirement age. Does it get any better than that?

If my friend had continued throwing money into his Roth IRA, he would have a huge nest egg of tax-free money to draw from in retirement. Can you imagine how freeing that would feel? Can you imagine the sense of security that would bring?

If you think your “future self” might want some tax-free cash, the time to get started is now. As long as you qualify, you can open a Roth IRA and start investing right away.

Lesson #5: Automate Your Finances, Then Leave Them Alone

The final lesson is another big one. Consider the same scenario above, but imagine my student had automated everything.

Instead of manually investing his money each month, let’s say he set up automatic deposits into his investment account. And because his investments were automatic, let’s pretend he forgot about them and left them alone.

Obviously, my student would be much better off if that were the case. If he had automated his finances and left them alone, he would be so much better off.

If you’re worried about stressing over the markets or getting off track for any reason, automating your finances can help. Once you choose long-term investments and set up automatic deposits, you can move on with your life and let your investments and compound interest do the rest.

Final Thoughts: 30-Year-Old’s $647,365 Foolish Mistake

It’s fairly common to hear about investing mistakes. On the evening news or among friends, you might hear stories of people who lost huge amounts of cash in real estate or business deals or by betting on a single stock.

Those stories are definitely worth hearing, but they don’t go far enough. In reality, the biggest investing mistake you can make is not investing at all.

No matter what you do, you have to stick with it for the long haul and get out of your own way. And if you ever need a reminder, all you need to do is run the numbers. As illustrated above, the numbers don’t lie.

This post originally appeared on Forbes.