Is it really possible to buy stocks online for free?

The short answer is YES! Not that long ago, you could expect to pay $50 to trade a stock, but then “discount brokers,” powered by internet platforms, drove fees down to $6-$10 in the early 2000s.

Now, the industry has made another huge advancement with the advent of free online stock trading.

One caveat before we get started…if you’re looking for a place to buy stocks online for free for the purpose of day trading, none of these options are likely to work for you!

Most specifically, prohibit day trading or have built-in limits to prevent it.

Table of Contents

Best Free Stock Trading Brokers

Robinhood

Robinhood is a recently developed investment app that allows you to buy and sell stock commission-free.

In fact, the platform enables you to buy and sell more than 5,000 stocks, as well as exchange-traded funds. You can even trade options and cryptocurrencies commission-free.

Features

The app is available on Google Play for all Android devices running 5.0 Lollipop and newer. Available on iOS devices (10.0 or later) on the App Store. It’s compatible with iPhone, iPad, iPod touch, and Apple Watch.

If you open an account with Robinhood, be aware they do have a premium version. That’s their margin account, known as Robinhood Gold.

There, you’ll pay a flat monthly fee, as well as interest on large amounts borrowed.

Another big Robinhood feature is there is no account minimum balance required, making it perfect for investors with very limited capital.

Limitations

There are a couple of limitations to be aware of with Robinhood. The first is the app specifically prohibits day trading.

In fact, they may even interpret high-frequency trading as day trading and temporarily suspend your account.

While it may seem like a natural fit for a frequent trader or a day trader to go with a commission-free investment app, the practice is generally frowned upon.

The other limitation is not all securities are available for trading.

For example, they don’t permit trading in:

- foreign stocks

- select over-the-counter equities

- preferred stocks, and

- securities purchased on foreign exchanges

Similar to the directly purchased stock plans, Robinhood may be best suited to long-term investors, who prefer to buy stocks and then hold them for several years.

They’re also an excellent choice for new and small investors due to the combination of no fees and no minimum initial investment.

M1 Finance

M1 Finance is another investment app that has no fees. This means no monthly advisory or management fee and no trading fees.

Features

Instead of buying individual stocks, you create individual portfolios comprised of both stocks and exchange-traded funds (ETFs). They refer to these portfolios as “Pies.”

M1 offers more than 60 pie templates, but you’re free to create as many different pies as you choose.

For example, you can choose a pie based on investing in specific stocks, like the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google), around specific investment sectors, or for a certain purpose, like socially responsible investing.

You can choose not only the investments that will be held in a pie, but also the percentage allocation of each.

M1 permits you to buy fractional shares.

In that way, you can create a fully diversified pie with a relatively small amount of money. There is no minimum investment requirement; however, they do recommend a minimum of $500 to begin creating pies.

Once you’ve created your pie, M1 goes into robo-advisor mode and automatically manages your portfolio. This includes automatic re-balancing and dividend reinvesting.

Because you’re able to choose the specific investments in your pies and have the benefit of robo-advisor management, M1 is a hybrid between a robo-advisor and self-directed investing. M1 offers individual and joint taxable accounts, as well as traditional, Roth, rollover, and SEP IRAs.

M1 Finance is available for iOS and Android apps, and can be downloaded at Google Play or The App Store. Similar to Robinhood, M1 is not suitable for day trading or high-frequency trading due to the use of pies in your portfolio.

Limitations

The big downside to M1 is that the platform does not allow you to purchase individual stocks by themselves, opting instead for the “pies” approach described above.

You can read more in our M1 Finance review.

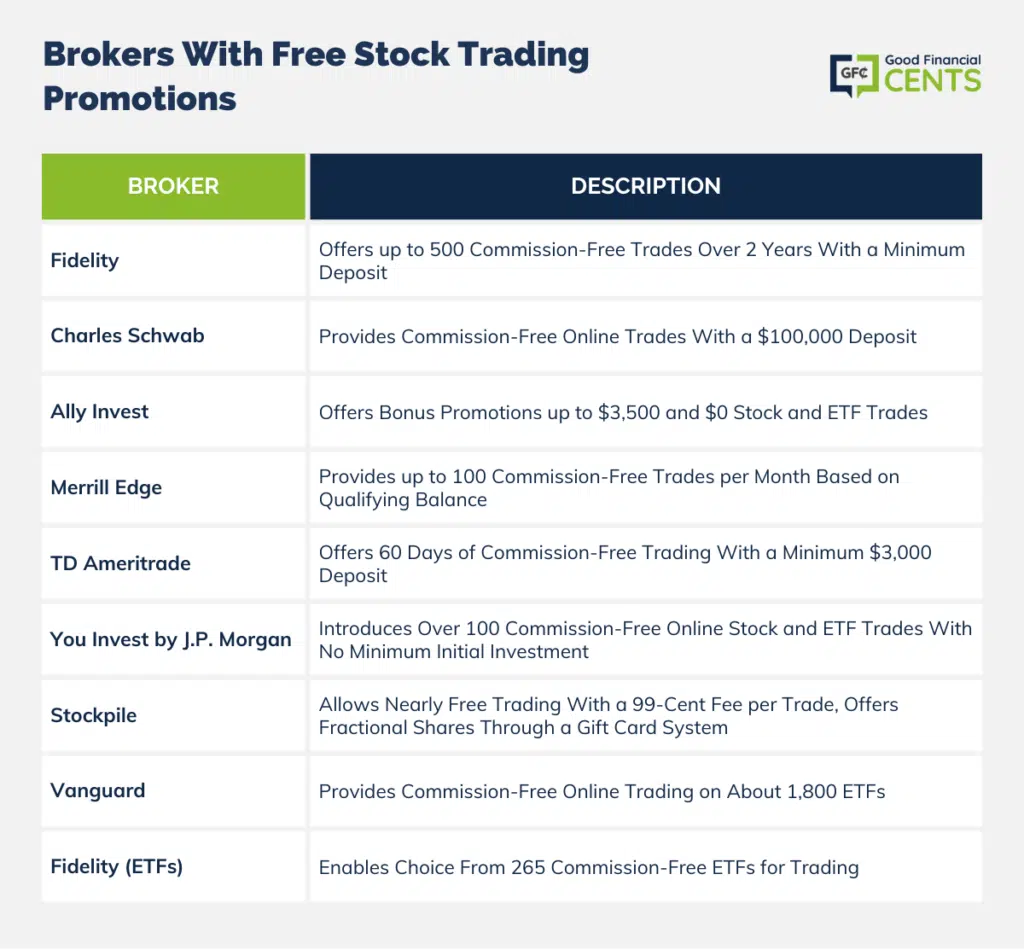

Brokers With Free Stock Trading Promotions

The large, well-known brokerage firms are not likely to offer the ability to buy stocks online for free.

But as a promotional offer, many do offer a limited number of free trades when you open a new account or meet other criteria.

The practice has gotten more common in recent years, and though you may not be able to count on a single broker offering free trades consistently, there are usually several offering the promotion at any given time.

For the most part, brokers that offer promotional free trades are better suited to larger investors who can make the high minimum deposit requirements to qualify.

They can also work for frequent traders since at least some of the offers are ongoing. Some current major brokers offering stocks online for free include:

Fidelity

Fidelity is offering up to 300 commission-free trades and giving you two years to use them. Actually, it’s a two-tiered offer.

When you fund a new or existing eligible account with between $50,000 and $99,999, you earn 300 commission-free trades. But when you fund the account with $100,000 or more, you get 500 free trades.

The fact that the free trades can be used over two years makes it a semi-permanent offer. After all, you can do a lot of trading in two years.

This is an excellent offer from Fidelity, considering it’s one of the top investment platforms available.

Their regular commission structure is just $4.95 per trade, putting them at the lower end of the broker commission scale.

Charles Schwab

Not to be outdone by Fidelity, its main competitor, Charles Schwab, is now also offering commission-free online trades.

To qualify, you’ll need to enroll in making a qualifying net deposit of $100,000 or more into your Schwab account.

Schwab also offers low everyday trading commissions of $4.95 per online equity trade.

Ally Invest

Ally Invest is offering a combination bonus promotion up to $3,500.

Now before you start getting too excited about the $3,500 cash bonus, understand it’s part of a tiered promotion schedule.

There are actually seven bonus tiers, based on the amount of the deposit or transfer as follows:

- $3,500 for $2 million or more

- $2,500 for $1 million to $1.99 million

- $1,200 for $500,000 to $999,900

- $600 for $250,000 to $499,900

- $300 for $100,000 to $246,900

- $200 for $25,000 to $99,900

- $50 for $10,000 to $24,900

Stock and ETF trades are $0. Read more in our Ally Invest review.

Merrill Edge

Merrill Edge is offering up to 30 commission-free trades each month through their Preferred Rewards Platinum Program. But you can also get up to 100 commission-free trades per month with their Platinum Honors Program.

You can also get a $150 cash reward for a net new asset balance of $20,000 or more, all the way up to $900 for a net new balance of $200,000.

You must have at least $50,000 in an eligible Bank of America personal checking account to qualify for the Preferred Rewards Platinum program, or $100,000 for the Platinum Honors two year period

Non-promotional trades are $6.95 per trade for automated phone trades.

TD Ameritrade

TD Ameritrade is offering commission-free trading for 60 days.

The offer is the most attainable by the major brokerages since you can get free trades with a deposit of as little as $3,000.

But like other brokerage platforms on this list, TD Ameritrade is also offering a cash reward of $100 if you deposit $25,000 or more, $300 if you deposit $100,000 or more, and $600 if you deposit $250,000 or more.

The free trades apply to online equity, ETF, and options trades. Regular trading on TD Ameritrade has a fee of $0. Get all the info on this platform in our TD Ameritrade review.

You Invest by J.P. Morgan

You Invest by J.P. Morgan is a brand new brokerage platform rolled out only this past summer. As an introductory offer, they are offering over 100 commission-free online stock and ETF trades.

There is a $0 minimum to start, and regular trading fees will be $2.95 per trade once you’ve completed your free trades.

Based on what the website says, the commission-free promotion will be offered on an annual basis.

Stockpile – Not Free, but Pretty Darned Close

Strictly speaking, Stockpile isn’t a platform to buy and sell stocks for free. But you can trade them for fees that make it a nearly free platform.

Stockpile is both an app and an online broker. Perhaps what they’re best known for are their gift cards. You can purchase one for either a flat amount or for the purchase of a specific stock or exchange-traded fund.

The gift cards can be redeemed on the Stockpile investment platform, where they can also be held and eventually sold.

The basic idea is you might have been able to give stock certificates as a gift years ago, but you can no longer. The gift cards are designed to replace those stock certificates.

And because the gift cards may be for flat amounts, like $50 or $100, Stockpile does permit fractional shares.

Stockpile enables you to purchase more than 1,000 stocks and 100 ETFs. Brokerage accounts have no minimum initial investment, and no ongoing account balance requirement.

There are also no monthly fees needed to maintain your account.

But let’s get to the nearly free part. If you want to buy or sell stock or an ETF, Stockpile charges just 99 cents per trade. It doesn’t matter how many shares you purchase or what the dollar amount is.

If you’re purchasing $10,000 of Apple stock, the 99-cent commission would be virtually invisible in the grand scheme of things.

One factor to be aware of is that Stockpile is not a full-service broker. They only offer stocks and ETFs, and only limited issues at that. You cannot trade mutual funds, bonds, options, or other investments on the platform.

There’s also no direct customer support, either by phone or live chat.

Vanguard and Fidelity – No Free Stocks, but Free ETFs

ETFs may not be stocks, but they are funds comprised of dozens or hundreds of stocks. And for that reason, we’ve included Vanguard and Fidelity free ETFs on this list.

Vanguard is offering commission-free online trading on about 1,800 ETFs for more than 100 different fund companies. What’s more, this isn’t a promotional offer. It’s what Vanguard does all the time.

Not to be outdone, Fidelity enables you to choose from 265 commission-free ETFs purchased online from both Fidelity (25 funds) and iShares (240 funds). And once again, this is an ongoing offer and not a promotion.

How to Buy Stocks Direct Through the Issuing Company

One of the purest ways to buy stocks online for free is through direct stock purchase plans.

They’re more commonly offered by very large companies, but they allow you to buy stock through their company, usually through the investor services department.

Some (but not all) companies offering direct stock purchase plans even repurchase stock when the time comes you want to sell. In that way, you’ll be able to both buy and sell stocks in individual companies commission-free.

Just as important, companies with direct stock purchase plans typically allow you to automatically reinvest dividends in new stock.

The programs are known as Dividend Reinvestment Plans, or more commonly, DRIPs.

Through these plans, you can reinvest dividends to buy more stock – also without paying a fee – and increase your position in the company. According to the website DirectInvesting.com, there are more than 600 large companies that offer direct stock purchase plans.

Most such companies will be easily recognizable, and include:

- 3M Company

- Bank of America

- Conoco Phillips

- Exxon Mobil

- General Mills

- Honeywell

- Johnson & Johnson

- Kellogg

- Morgan Stanley

- Raytheon

- Charles Schwab

- Sherwin-Williams

- US Steel

- W.R. Grace

- Xerox

Naturally, direct stock purchase plans are not suitable for high-activity trading. They’re designed for investors who are looking to buy stock in a particular company and hold it for the very long term.

They also make sense if you can’t buy round lots (100 shares) of stock. You may only be able to buy, say, 10 shares in the company.

Since you won’t have to pay a commission, and the company likely doesn’t have a share minimum, direct stock purchase plans are a perfect way to build a portfolio of odd lot stocks. You may be able to do it with several companies offering the plan.

Final Thoughts on Free Stock Buying

As you can see from this list, you really can buy stock for free, and most of these platforms are perfect for investors just getting started. However, as with anything, there is no free lunch. The best approach to using these platforms is to employ a buy-and-hold strategy and reduce your commissions.

Not only are there plenty of platforms where you can buy stocks online for free, but you can also buy ETFs, options, and even entire portfolios commission-free. You have to make sure you select the right platform to find what it is you want.

The main downside to these free platforms is that few of these methods would be suitable for high-frequency trading or day trading.

But for those who trade at a more ordinary rate, any of these options will allow you to trade commission-free on a regular basis.

If you’re just looking to buy some stocks or ETFs commission-free to hold for the long haul, try one or more of these platforms.

You can always do your high-frequency trading on other online stock broker platforms or maybe even dabble in some day trading on some of the bigger brokers on this list that offer ongoing free trades.