With inflation cooling to 3.4%, prices are rising at their fastest pace in 40 years. But you don’t have to be a victim because there are several ways to make money fast. And these can give you the ability to not only keep up with inflation, but even to move ahead of it.

In this guide, we will show you multiple ways you can either earn additional cash fast or cut your expenses. Either strategy can improve your cash flow instantly. And by implementing both, you may soon find yourself declaring victory over inflation, as well as taking control of your long-term financial life.

Table of Contents

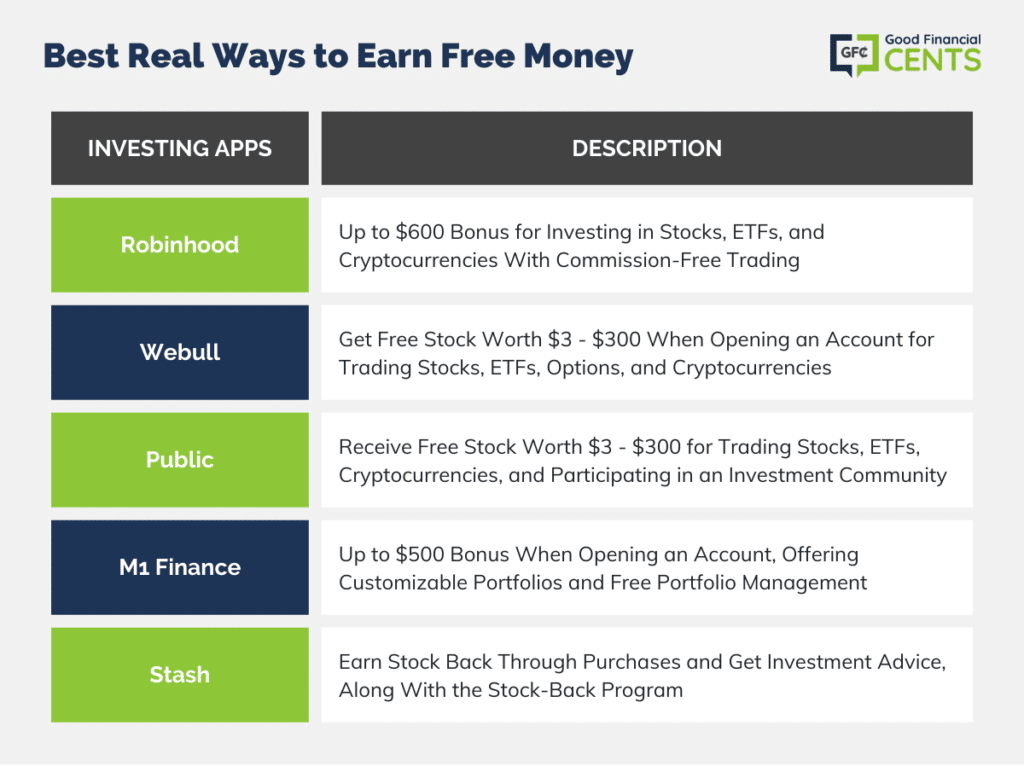

Best Real Ways to Earn Free Money

Investing is one of the best ways to put idle cash to work, generating an additional cash flow. That’s one of the best ways to earn “free” money. And don’t worry if you’ve never invested before since it is possible to begin investing for beginners.

Not only can you make money from your investing activities, but some investing apps will pay you in free stock just to open an account.

Robinhood

Robinhood is paying a new account bonus of up to $600. Your account must be approved by August 17, and your qualifying deposits must be made by September 16. You must also maintain your account balance through October 16 to receive the reward.

You’re free to invest the funds as soon as they are received, but you cannot withdraw the cash value for at least 30 days after receipt.

Meanwhile, Robinhood offers commission-free trading of individual stocks, exchange-traded funds (ETFs), and even cryptocurrencies. It’s an investment app where you can trade 24 hours a day, seven days per week. And as one of the biggest benefits for new investors, you can open an account and begin trading with as little as $1!

Webull

Webull pays a new account bonus in stock. You can earn free stock worth between $3 and $300 just for opening an account. Then, you can earn another bonus for making an initial deposit into your account. That free stock bonus will be worth anywhere from $7 to as much as $3,000.

Webull works much the same way as Robinhood. It’s an investment app that allows you to trade quickly and easily on a 24/7 basis. You can trade individual stocks, ETFs, and even options, commission free.

And like a growing number of investment apps, Webull also accommodates trading in cryptocurrencies. You can also open an account with no money, though you will be required to deposit funds to take advantage of the bonus and to begin investing.

Public

Public is another investment app that not only allows you to trade in stocks, ETFs, and cryptocurrencies, but also in artwork, non-fungible tokens (NFTs), and even collectibles. Public also offers you the ability to open an account with no money and to trade commission-free.

But where this app stands out is that it’s actually an investment community. Patterned after social media, Public provides participation in investment forums with other investors on the app.

Like the other investment apps on this list, Public also pays you a bonus to open a new account. When you open an approved account and deposit funds, you qualify to receive a free slice of stock. That slice can be worth between $3 and $300.

M1 Finance

M1 Finance has one of the most generous sign-up bonuses in the industry. If you open a new account and deposit at least $1,000, you’ll be eligible for a promotional credit of at least $30. But it’s a multitiered bonus that increases up to $500 for transferred balances of at least $50,000.

But beyond the bonus, M1 Finance is also one of the very best investment platforms in the industry. It’s actually a robo-advisor, which is an online, automated investment management service. That means once your portfolio has been created, it provides complete management of your account.

That includes reinvesting dividends and periodically rebalancing the account to maintain target investment allocations. And they perform these services completely free of charge.

One of the factors that makes M1 Finance unique among robo-advisors is that they provide comprehensive management of a portfolio you create yourself. You can put up to 100 individual stocks and ETFs in a portfolio and create as many portfolios as you like.

Stash

Stash is a unique investment service designed specifically for new and inexperienced investors. It acts as an investment advisory, providing you with investment and portfolio recommendations that you will implement yourself. But they also offer a host of tools that can help you accumulate the money you need to invest.

One of those tools is their Stock-Back program. When you make purchases using your Stash debit card at participating merchants, you can earn stock back in those companies between 0.125% and 5%, depending on the merchant. For example, if you make a purchase through Amazon, you’ll earn a slice of Amazon stock.

Stash does charge a monthly fee of between $1 and $9, depending on the service level you choose. For example, at $9 per month, you’ll get 2X stock with the Stock-Back debit card, as well as $10,000 in life insurance.

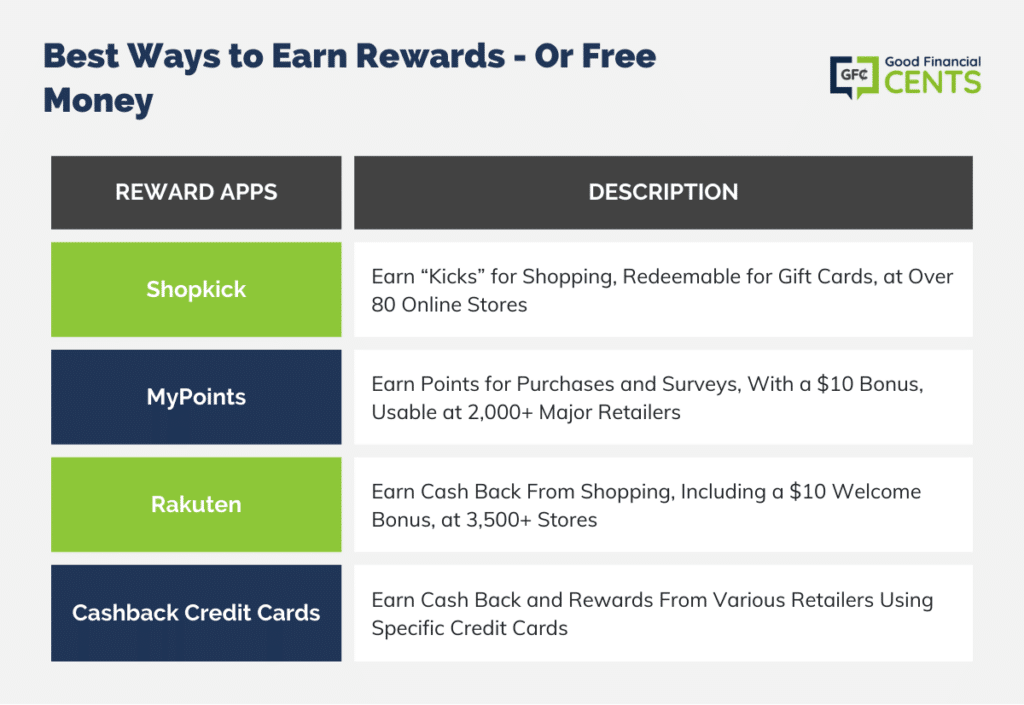

Best Ways to Earn Rewards—Or Free Money

Another way to make money fast is to take advantage of rewards. While many individual merchants offer rewards to preferred customers, there are rewards apps that enable you to earn those benefits from multiple vendors. The rewards can add up over time and become real money!

Shopkick

Shopkick is a cashback app that provides rewards when you shop at more than 80 online stores. But rather than providing actual cash, you instead earn gift cards for everyday shopping. You’ll accumulate reward points, referred to as “kicks,” which is at least partially where the company name comes from. Those points will then be redeemed for gift cards.

Gift cards are provided to popular retailers, like Amazon, American Eagle, Apple, Barnes & Noble, Starbucks, AMC Theaters, Sephora, Disney, Target, and Best Buy.

MyPoints

MyPoints enables you to earn points for purchases at more than 2,000 major retailers, including Walmart, Best Buy, Amazon, and Home Depot. The company claims members can get up to 40% back for purchases at participating merchants.

But MyPoints goes beyond rewards; it also pays you to participate in surveys. And if you sign up today, you get a $10 bonus for doing so.

Rakuten

Rakuten is probably the most popular cashback program overall. They give you an opportunity to earn cash back at more than 3,500 stores, which is pretty close to all of them, including major retailers, like Walmart, Kohl’s, Macy’s, Target, Old Navy, Lowe’s, and many more.

You can join in less than 30 seconds, then begin shopping through the Rakuten app, Rakuten.com, or through their browser extension. You’ll build rewards as you shop, then be paid by check or by PayPal. The company claims they’ve provided over $2 billion in cash back to more than 15 million members. And if you join now, you can even get a $10 Welcome Bonus.

Cashback Credit Cards

One of the most often overlooked ways to make money fast is to take advantage of cashback credit cards. It’s an opportunity to earn money while you shop, which is just about the easiest way to make it happen. You’ll be picking up extra money for doing what you were going to do anyway.

There are dozens of credit cards available that pay cashback rewards of 1% or more. The Chase Freedom Flex℠ pays 5% on gasoline purchases in the first year, up to $6,000 in total purchases. That’s on top of a $200 bonus just for spending $500 within the first three months of owning the card.

After that, you’ll continue to receive 5% cash back on revolving quarterly categories of up to $1,500 in total purchases per quarter.

Some cards pay generous rewards for specific purchase categories. Travel is a big example, so it’s worth checking out the best travel rewards credit cards. For example, the Capital One® Venture® Card pays 50,000 miles, worth $500, after spending $3,000 on the card within three months of owning the card. After that, you’ll earn double miles for every dollar you spend.

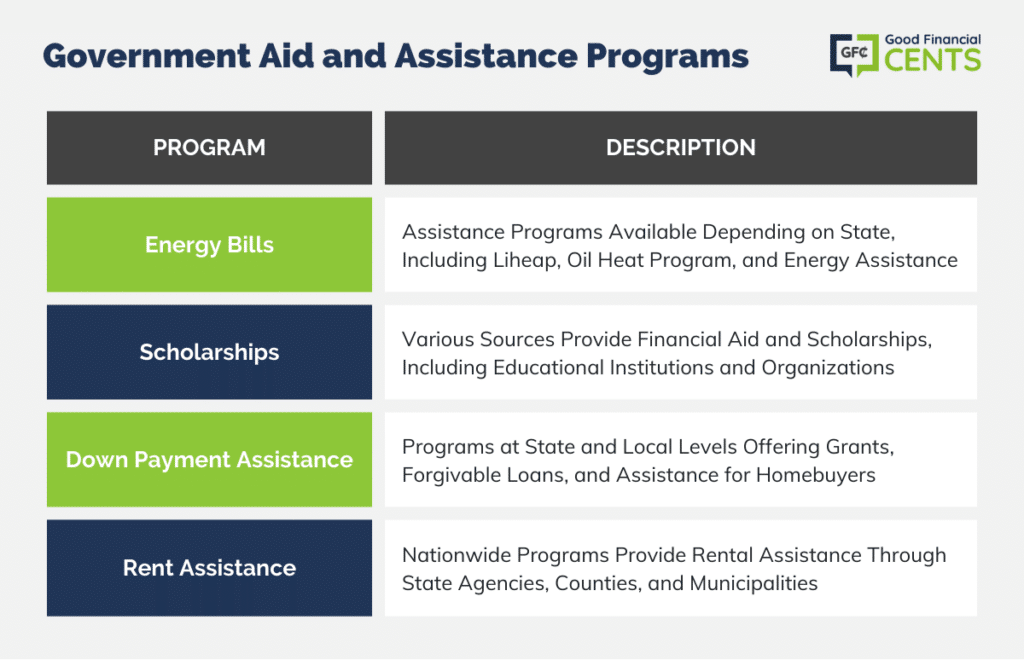

Government Aid

There are a number of government assistance programs available, which are generally provided to those who are struggling financially. But there are one or two that can provide extra cash even if you aren’t in dire straits.

Look for government assistance with any of the following:

Energy Bills

Most consumers may be unaware that they can get help paying their energy bills. Exactly which programs are available depends on your state of residence.

But according to the U.S. Department of Housing and Urban Development, some possibilities include the following:

- Low-Income Home Energy Assistance Program (LIHEAP): Fuel and weatherization assistance

- Citizens Energy Oil Heat Program: Discounted home heating oil for low-income households

- Community Action Agencies: Energy assistance programs

- Make Your Home More Energy Efficient

Be sure to check the available options in your own state.

Scholarships

Scholarships are available from many different sources. But be sure to start your search with a visit to StudentAid.gov, which is sponsored by the U.S. Department of Education.

Recommended sources on their website include the following:

- The financial aid office at a college or career school

- A high school counselor

- The U.S. Department of Labor’s FREE scholarship search tool

- Federal agencies

- Your state grant agency

- Your library’s reference section

- Foundations, religious or community organizations, local businesses, or civic groups

- Organizations (including professional associations) related to your field of interest

- Ethnicity-based organizations

- Your employer or your parents’ employers

- StudentAid.gov’s article on scholarship tips

- StudentAid.gov’s article on what to do if you need additional financial aid

Down Payment Assistance for Homebuyers

According to the website The Mortgage Reports, there are more than 2,000 down payment assistance programs nationwide. That doesn’t mean all 2,000 are available in your state, though it’s likely at least a few are. You can usually learn about available down payment assistance programs in your area from real estate agents and mortgage lenders.

Programs are provided at the state, county, and municipal levels, and provide different types of assistance. Programs take the form of outright loans, forgivable loans, and even down payment grants. These are usually coordinated with the Federal Housing Administration (FHA) loan programs, so it may be possible to purchase a home with no out-of-pocket down payment.

Be aware that down payment assistance programs typically have abundant fine print provisions. For example, income limitations are common. So is an owner-occupancy requirement.

And many will require repayment of assistance if you move from the property within a certain number of years. Be sure to be aware of any and all provisions under any assistance program you participate in.

Rent Assistance

You can get help finding rental assistance through the Consumer Financial Protection Bureau’s (CFPB) webpage, Find rental assistance programs in your area. The CFPB is another U.S. Government Agency and is an excellent place to start your search.

You can find programs by entering your state or territory of residence, or your tribe or tribal lands. The webpage currently shows over 500 rental assistance programs throughout the country. Some are offered by state agencies, while others are provided by counties and municipalities.

You should expect the amount of assistance to vary based on the agency’s program offerings, as well as your own specific level of need.

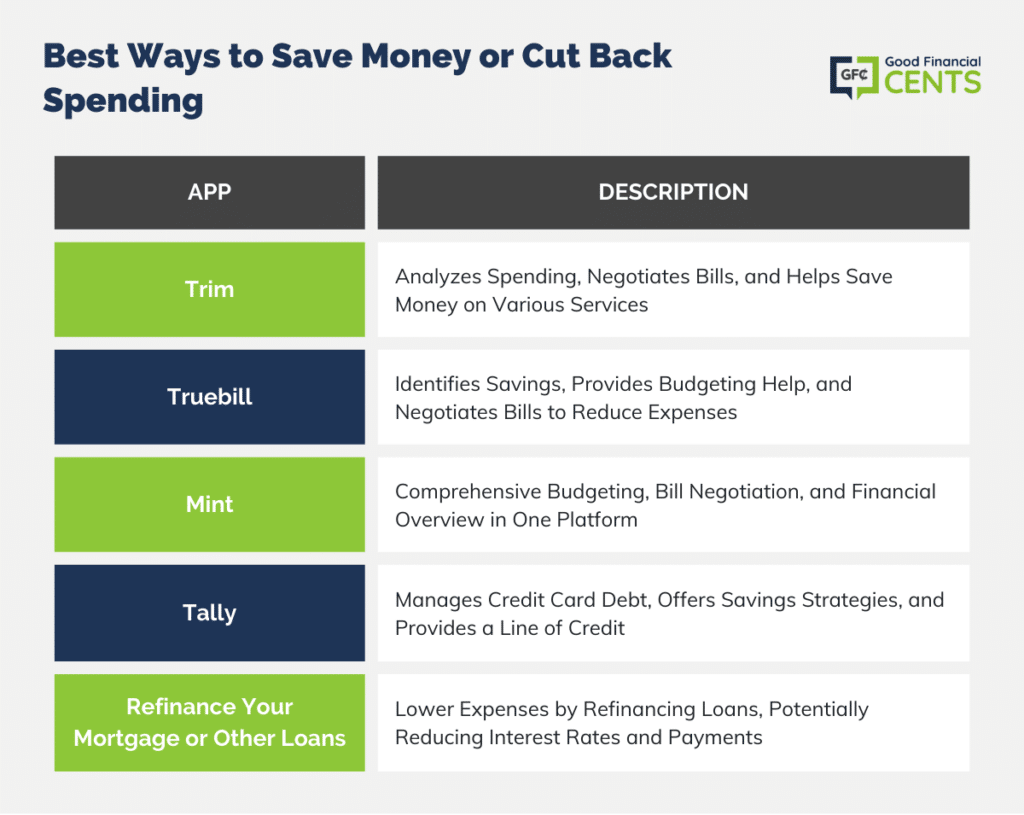

Best Ways to Save Money or Cut Back Spending

One of the best ways to “earn extra money” is to reduce your living expenses. No, you’re not earning money, at least not technically speaking. But you are reducing outgo, which is improving your cash flow. That’s simply income earned from a different direction.

Implementing a budget is one of the best ways to cut expenses. If you’ve never had one before, you’ll be surprised at how much you can save. Below are several budgeting apps to help you get the job done.

Trim

Trim is a service that analyzes your spending. It helps you find ways to save money. They advertise that users save an average of $620 from using the service. They do this by analyzing your spending patterns to find ways to save you money.

Meanwhile, Trim can also negotiate bills, like cable, Internet, and phone bills, as well as medical bills. They’ll also work to cancel old subscriptions. And they can even help you lower bank fees and the interest rates you’re paying on loans.

Most services are available free of charge. But they do charge 15% of your annual savings on negotiated bills.

Truebill

Truebill is a free budgeting service that will help you identify savings and, like other budgeting apps, will make recommendations where you can reduce spending. They also provide bill negotiation, as well as subscription cancellation services, to help you save more money. The service also provides credit score tracking and is used by more than 2 million people.

Mint

Mint is one of the most popular budgeting apps available. Not only does it provide comprehensive budgeting capabilities, but it’s also free to use. Mint does this by working as a financial aggregator.

When you connect each of your financial accounts to the app, it will provide you with a comprehensive look at your entire financial life in one place.

Not only will Mint provide you with budgeting capabilities to track and reduce your spending, but it will also help you renegotiate some of your bills. That includes, first and foremost, cable and Internet bills. But if that isn’t enough, they’ll also provide you with your free credit score, to help you gradually increase it to get better financing deals.

Tally

Tally is a credit-card-debt payoff app that claims to save $4,185 in interest in five years. It does this by enabling you to track all your credit card accounts in one place and provides different early payoff strategies.

And if you qualify, they may also provide you with a customized, low-interest line of credit. The line is designed to help you pay off your credit card debt twice as fast as you would by paying off your individual credit cards according to the original terms. The line of credit is available with an APR as low as 11.99%. There is a $300 annual fee, but it will be paid out of your credit line.

Refinance Your Mortgage or Other Loans

One of the best ways to reduce expenses is by lowering the interest rate on your debt. That’s tough to do right now with mortgages since interest rates have spiked in the past year. But it is possible to lower the interest you’re paying on other debts, particularly credit cards.

One of the best ways to do this is through personal loans. You can borrow between $1,000 and $100,000 on fixed-rate loans, with terms between three and five years, and sometimes longer.

By converting variable-interest-rate credit card debt, often exceeding 20%, into a single personal loan, you can drop that rate to as low as 2.49%. And since personal loans are for a specific term, your credit card debt will be gone by the end of the loan term.

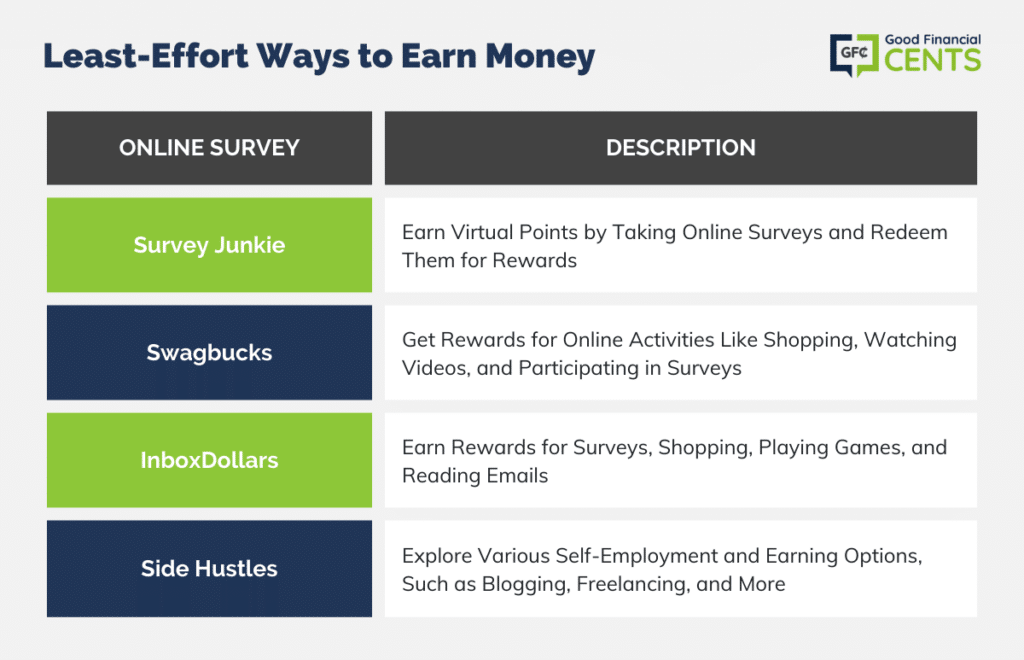

Least-Effort Ways to Earn Money

One of the best ways to earn extra cash is to make money from home. Who wouldn’t want an opportunity to do that?

But just about everyone can! One of the best ways to do that is by taking advantage of the best online survey sites. You’ll have the opportunity to earn cash and other rewards from the comfort of your own home.

Survey Junkie

Survey Junkie is perhaps the most popular online survey program there is. As the name implies, you can be paid to take online surveys. Companies conduct surveys to help them deliver better products and services.

As you complete surveys, you’ll earn virtual points. You can then redeem those points, either through PayPal or e-gift cards.

The amount you can earn will depend on the amount of time and effort you put into it, as well as the specific surveys you participate in. But they claim that by completing three surveys a day, you can earn as much as $40 a month.

Swagbucks

Swagbucks goes beyond online surveys and enables you to earn rewards for a wider variety of activities. For example, you can earn rewards points when you shop online, watch videos, surf the web, and yes, participate in surveys.

Your points can be redeemed for gift cards to your favorite retailers, like Amazon and Walmart. But you can also get cash back from PayPal. The company claims that nearly $750 million in rewards have been paid to its members.

InboxDollars

InboxDollars offers rewards for taking surveys, shopping, and even playing games. Surveys pay between $0.50 and $5, though some pay as much as $20. You can also earn cash back for online shopping, and even get paid to read emails—sent to you by InboxDollars. If that’s not enough, you can earn cash for grocery shopping!

Meanwhile, the company is paying an instant $5 sign-up bonus if you sign up for the service today.

Side Hustles

One of the very best ways to make money fast and consistently is by creating your own side hustle. Don’t underestimate yourself here; there are plenty of opportunities, and you might just come across the one that will work for you.

Space doesn’t permit covering each of these side hustles here. But you’ll find each discussed in some detail in dedicated articles here at Good Financial Cents:

- Best Self-Employed Jobs

- How to Start a Blog

- Hobbies That Make Money

- Become a Freelance Writer

- Small Business Ideas

- Selling Ebooks

- Become a Financial Coach

- Best Items for Garage Sale Flipping

- Make Money on Twitch

- Make Money on TikTok

- Make Money on Facebook

Bottom Line – Best Ways to Get Free Money or Rewards

There you have it – more than 20 strategies for how to get free money. Though none will enable you to quit your job and live on the new earnings, each has the potential to either increase your income or lower your expenses. And each has the potential to provide you with a benefit, ranging from a few dollars to a few hundred dollars per month.

How much you’ll get will depend on how many strategies you implement, how much time and effort you put into each, and what your specific financial needs are. But it’s always good to know that there are options to earn a quick buck, whenever it might be needed.

I am in need of financial assistance, I need some money to cover my mums funeral and the vet bills of 2 of mums rescued animals who have sadly passed away. I have tried most of the list above and haven’t gotten anything back, also I do not qualify for a loan. I even tried a GoFundMe still nothing. I am open to suggestions. Please

MOST PATHETIC COMMENT SECTION IVE EVER READ!!!!

YOURE ALL PEASANTS AND WILL DIE THAT WAY

you’re the best

How can i carryout a survey

I need money for medical

Single mom of 3. My son is 14 and my daughters are 12 and 10. I was just basically fired from my job due to closing Permanently from Covid… I’ve worked there for almost 10 years. Tips were how we got from check to check and yes I have to either pay for power or car insurance, I’ve been going as often as possible looking for a job but it’s hard to do that with three kids and no money to just drive around. if any One has it in their heart to please help my situation And send me free money, basically like a Grant. It would be greatly appreciated… I know my kids will say thank you for the food that’s going to be in the house and the supplies that they need to be prepared For homeschooling. I made too much money (57$ too much) Something about putting me in a different bracket …to qualify for food stamps And I’m afraid that with everyone home the power billlll will go up. I’m crying typing this I’ve never needed help. I’ve Never asked for anything. the world is a crazy place now and safe jobs are hard to come by. Plus, you really have to be careful for yourself and the ones you love

I need money

i need money to buit my house for family.. can any one halpme please????????????

pls I need money to support my kids for their school and also my family

I need money to meet up with some daily needs

Money

I need money for taking my kid back to school

Can you please send me more information about the resources available to me for making money online? Thank you!!

Please send me more info and do I have to have pay pal or do you send a check

I want free money to pay something for my family and help them

I need 70000.00 to buy the house that I am in.

I need money

I’m ready

How can I get free money

Thanks

Awesome

I need to start earning from online surveys

Am seeking support for my children am a single mother have three kids all not going to school am humbly requesting for support.

I use Ibotta and I love it! I’ve been using it for almost a year and have gotten $300 so far. It’s not something that will make you a lot of money but it’s enough to help a little here and there. It’s nice to get money back from things you normally buy anyway.

I need some money????????

I wnana make money easily n not use a credit card

Help Poor people to earn money Free from online

send mail

How it work

I like it

how do all dela with thata free cash

I need money

How do I get money to take care of stuff. All these online surveys are just a bunch of fake hacks and I need real money not fake play money from monopoly I’m about to lose everything and I’m backed up against the wall what can I do?

I will like to make some money

I need to make $1000 to bring home my boyfriend who is detained because of me & I’m on disability. I need legitimate ways of getting cash now. I’m tired of being solicited by scammers.

I want to get free money can you help me please

It contains online business without using money, it can help your finance, join it for yor good

i love it

i need money

I need money for my debts i m depress now

Yeah I’m really poor and try to get robux

I need money to start my own business please I have no job in my life

10000

It’s helpful for people

Enlightening

Hi my name is anees and I need some money please and thankyou

I like to make money

I LOVE CARRYING OUT THE SURVEYS, BUT MOST OF THE SURVEYS ARE NOT PAID FOR THOSE WHO ARE IN MY COUNTRY CAMEROON.

Can have 100000 money for my Family

nope

Can you itemize a list of what the money will be used for? Thanks!

I need me some money via bad I lost my job and I’ll I’m tired of being broke

I want to know how to get a online job or how to get free wifi and free Xfinity wifi and free gift cards aswell

BOI i want monnneeeeyyy! plz I need it

Love money

I just want money

I need sum money

Talking about all this, I can only laugh because i remember when I too was looking for ways on how to improve my credit score, I spent hours online, contacting people and watching vidoes, signing up here and there all to no avail until I stumbled upon Cyberdecoders00. i reached out to them via e mail on google, thats gmail and they got back to me rather quickly and before we exchanged a few messages, I gave them the go ahead to start working on my score and like magic, they dazzled me and shot my score higher than i even asked,raised by 100 points in 2 days and Its been all rosy since then, try them out, just a piece of advise, it worked for me.

Am I gonna get the ????

please help me..i really need money right now…and i dont know what to do 1 only need 30dolar

I need it I got kids that need food

I really love this site, makes you think positive in life.. thanks for.this

Can you please help me how can I get that money

I need money today because I can pay up all my debt in my bank

I think this is really cool and helpful for others to do this as well

Do you have some

I love this 411, thank you for all your research and hard work putting this together .

I have tried most of these postings, and to no avail in making ANY amount of $$$$$$.

I’d have better luck playing the lottery!!!!!!!

What site can be use to increase bank account balance

Hi Promise – Just check with some of the sites on this list, and add the money to your bank as you get it.

How

Okay I need a loan for $40,000 please help me for my bill and other stuff

Hi Tydina – Try a personal loan at a bank or credit union, or at a peer-to-peer lender, like Lending Club or Prosper.

i know

I need money for my medical expenses since I lost my job during Covid. Can any gurus help me to make money online before my illness become worse. Thank you.

That was helpful

Hello I been searching for an effective way to earn money while on parole to get me to a home an out of a nursing home I don’t belong in nursing homes trying to find effective ways get me paid an in a house create a life for myself I’m only 31with parole it’s hard have to tell parole officer before changing address and it has to be approved I just desire to move on to my road to success don’t know how kind of on my own in this all loved ones left me that was motivation enough to better myself

I love my money but my stupid mom thinks money can buy love

I will like to get free money

I am somewhat upset with Pinecone Research asking me address and birthdate plus other information and then rejecting me stating there were no openings,

I feel this is just another way of a company getting you a mailing list .

I want o make money fast so that I can pay my debts in 10 days amounting to $1000 I am from Zambia, Africa please anyone to help me with a job or money I don’t want to end up in jail.

Congrats on the redesign! It looks great!!! And love a good list of how to make money – it’s how I repay my law school debt (making more money on the side from blogging)!

Thanks Natalie, that means a lot!