We’ve done the research, and this is our top list of best life insurance companies. To cut down on the confusion and save you time, we’ve come up with a list of the top 9 best life insurance companies – so you can get back to enjoying life knowing your loved ones will be taken care of.

Life insurance is a crucial component of any financial plan, and the best life insurance companies make it easy to secure coverage.

Whether you are considering inexpensive term life insurance with a generous death benefit, whole life insurance that builds cash value, or another type of permanent policy, the highest-rating life insurance companies have an easily understood application process and solid ratings from third parties and coverage you can trust.

You may be able to line up life insurance coverage within a few days and without any type of medical exam required. That said, it’s crucial to compare life insurance providers before you buy, especially since different companies have their own unique offerings.

Always Shop Around

If you’re ready to buy life insurance that can protect your family or cover your final expenses, read on to learn more about our top picks.

Our Picks for Best Life Insurance Companies

Table of Contents

To find the best life insurance companies on the market today, we compared them based on coverage options, rankings with agencies like J.D. Power, and corporate ratings for financial strength. The companies below made the cut:

- AIG: Best for Competitive Premiums

- Haven Life: Best for Quick Coverage

- Bestow: Best for No Medical Exams

- Health IQ: Best for Healthy Senior Citizens

- MetLife: Best for Group Life Insurance

- Legal & General: Best for Coverage Up to $10 Million

- Prudential: Best Broad Coverage Options

- Mutual of Omaha: Best Customer Service

- New York Life: Best Life Insurance and Investment Services

Best Life Insurance – Company Reviews

American International Group (AIG) is one of the largest insurance agencies in the world, and it’s able to offer broad life insurance options and affordable premiums as a result. Individuals can turn to this company to purchase affordable term coverage, universal life insurance, and guaranteed issues for their whole life. AIG even offers “return of premium” policies that refund the premiums you have paid once the term of your policy is up.

While AIG earned less than stellar ratings for customer satisfaction from J.D. Power, the company did receive an ‘A’ rating for financial strength from A.M. Best.

Haven Life operates under the umbrella of MassMutual, which is a well-known and highly-rated company within the insurance space. With a focus on offering affordable term coverage, Haven Life makes it easy to get a free quote online and without sharing your contact information.

Depending on your age and health, you may even be able to get no exam life insurance within a few days. You should know that the Haven Simple policy, which includes the Accelerated Death Benefit rider, is only available through 20-55.

Premiums through Haven Life can also be on the very affordable side. Using their online quote tool, we found that a 42-year-old woman in excellent health could secure a 20-year term policy worth $250,000 for as little as $24.01 per month.

As you compare providers in this space, you should note that Haven Life only offers term life insurance coverage. With that in mind, this company won’t work for your needs if you’re seeking whole life or other policies that build cash value that you can borrow against.

Although Bestow was just founded in 2016, this online insurer has made the process of getting term life insurance easier than ever before. Bestow only offers cheap term life insurance coverage, and you can only apply online since it doesn’t have brick-and-mortar locations. From there, you can get approved instantly for coverage with a no-exam policy.

How inexpensive can coverage options through Bestow be? Using the company’s online quote tool, we found that a 32-year-old woman in excellent health could secure a 30-year term life insurance policy worth $500,000 for as little as $28.08 per month.

Also, note that all policies offered by Bestow are through an A+ rated carrier and a trusted name in the industry. The policies offered by Bestow are provided by North American Company for Life and Health Insurance and Munich RE. That said, there are limits on the type of policy and the amount of coverage you can purchase through Bestow.

For example, coverage is only available for adults ages 18 to 59, and you can only buy up to $1.5 million in term life insurance coverage.

Health IQ is a life insurance marketplace that is tailored to senior citizens who are especially health-conscious. Individuals can apply for up to $100,000 in coverage up to the age of 85, and the company offers great rates for life insurance over 50. A terminal illness rider is also available to those who want to be able to access 50% of their death benefit if they become gravely ill.

As a life insurance marketplace, Health IQ does not offer policies directly. Instead, this company lets you compare policies with myriad top insurers like John Hancock, Prudential, Pacific Life, Transamerica, and more. Fortunately, Health IQ lets you compare pricing from multiple insurers in one place and all at once, helping you save time and money along the way.

MetLife is another well-known provider in the United States that offers term life insurance, whole life, universal life, variable life, and accidental death coverage. However, this company mostly focuses on offering group life insurance plans for employers, so all coverage types are not available for individual purchase.

MetLife has an A+ rating with A.M. Best, yet they also scored lower than average for customer service in J.D. Power’s 2022 U.S. Individual Life Insurance Study.

Legal & General is a highly-rated life insurance company that offers policies through two other companies they partner with, BannerLife and William Penn. Their coverage options include term life insurance policies and universal life. This provider stands out due to the fact they offer life insurance coverage in amounts up to $10 million, which is much higher than many of their competitors.

How much will you pay for coverage through Legal & General? Using their online quote tool, we found that a 42-year-old woman in excellent health could purchase a 30-year term life insurance policy worth $250,000 for less than $35 per month.

Also be aware that this company boasts an A+ rating from A.M. Best for its financial strength.

Prudential is easily one of the best life insurance companies out there based on the broad coverage options they have available. For example, potential policyholders can choose from several types of term life insurance: universal life insurance, indexed universal coverage, variable universal coverage, and survivorship universal life insurance.

One major benefit of Prudential is how easily the company lets you get a free quote for term life insurance online. Policies are also on the affordable side, with a 20-year term life insurance policy worth $500,000 starting at $37 per month for a 30-year-old woman in excellent health.

Currently, Prudential has an A+ rating for its financial strength from A.M. Best.

Mutual of Omaha has been serving customers in the life insurance arena for more than a century with coverage options that include term, whole life, universal life, and accidental death. Mutual of Omaha also offers life insurance coverage options for individuals up to the age of 85. Some policies do not require a medical exam, and the company makes getting a free quote online a breeze.

Policies from Mutual of Omaha can also be highly competitive in terms of pricing. In fact, a 30-year-old man in excellent health may be eligible for up to $250,000 in term life insurance coverage for 20 years for less than $15 per month, which is very affordable.

Mutual of Omaha has also received high ratings from third-party agencies, including the fifth spot out of more than 20 providers in J.D. Power’s 2022 U.S. Life Insurance Study. Mutual of Omaha also has an A+ rating for financial strength from A.M. Best.

New York Life Insurance Company was founded in 1841, so it is one of the oldest providers in the life insurance space. This company currently offers term life insurance, whole life, universal life, and variable life, and they make it easy to compare all of their life insurance products on their website. Unfortunately, New York Life does not make it possible to get a free quote or compare pricing online.

If you’re looking for life insurance and investments in one place, New York Life is definitely worth checking out. In addition to the types of life insurance they offer, customers can also lean on this company for help with annuities, mutual funds, ETFs, long-term care insurance, estate planning, and more. New York Life also has an A++ rating from A.M. Best for its financial strength, which is the best rating available. The company also does the underwriting for AARP’s life insurance program.

Life Insurance Guide

Before you purchase life insurance that your loved ones may have to rely on, it’s crucial to have a general understanding of how this insurance product works. Read on to learn more about the different life insurance options that exist and what to look for in the top life insurance companies.

How Does Life Insurance Work?

Life insurance can work differently depending on the type of coverage you select. For example, term life insurance policies offer a death benefit that becomes available if you pass away while your policy is in force.

However, various permanent life insurance policies build cash value — a living benefit that stays with the insurer when the policyholder passes away — or offers an investment component you can use for wealth planning purposes.

Either way, all policy options require premium payments, usually on a monthly basis. The premiums you’re asked to pay are based on factors such as your age, your health, how much coverage you want to purchase, and how long you want the policy to last. Depending on the coverage you apply for, you may or may not be asked to complete a medical exam.

Generally speaking, individuals purchase life insurance in order to provide their loved ones with a cash payment (e.g., death benefit) if they pass away. Life insurance policies with an investment component are also commonly used for estate planning purposes.

What Types of Life Insurance Policies Are Available?

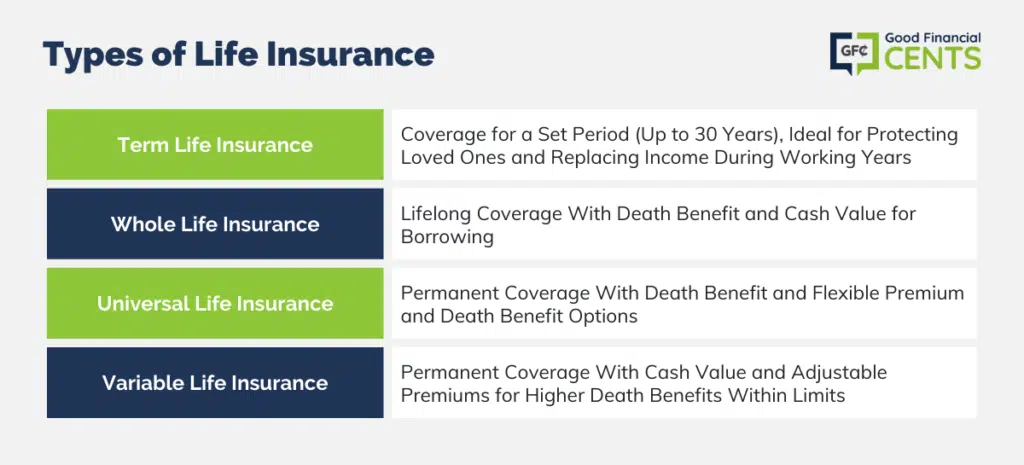

As you begin shopping around for life insurance, you should think long and hard about the type of life insurance coverage you want to shop for. There are many different types of life insurance, including term life insurance, whole life insurance, universal life insurance, and variable life insurance.

- Term life insurance is purchased to provide coverage for a specific period of time — also called a term — which usually lasts for up to 30 years. This type of coverage is typically best for people who want to protect their loved ones and replace their income during their working years.

- Whole life insurance lasts for your entire life instead of a specific term. This type of coverage provides a death benefit while building cash value you can borrow against.

- Universal life insurance is a type of permanent life insurance that provides a death benefit for your heirs while building cash value. This type of coverage is best for individuals who want some flexibility in their premiums and death benefit over time.

- Variable life insurance is another type of permanent coverage that builds cash value you can borrow against. Due to the way these policies are set up, consumers can decide when to pay higher premiums for a higher death benefit within a certain limit.

How Much Life Insurance Do I Need?

The best life insurance policy (and best company) for your needs can depend on an array of important factors such as how much you earn in your career, how much debt you have, how many dependents you have, and what you hope to accomplish with a policy.

For example, your life insurance needs may require more coverage during your working years and when you have kids at home. During the end of your career or during retirement, on the other hand, a basic life insurance policy with enough coverage to pay for your final expenses may be sufficient.

That said, many experts recommend having at least 10X to 20X your income in life insurance coverage while you still work. If you earn $75,000 per year in your job, for example, that would mean securing life insurance with a death benefit of $750,000 to $1.5 million. If you earn much more than that, you should probably look for the best $2 million term life insurance rates.

While this general rule of thumb can help you figure out where to start the process, you may need to purchase more coverage if you have significant debts or you have kids heading off to college in the future.

How Much Does Life Insurance Cost?

Cheap term life insurance can cost as little as $10 per month, but premiums for coverage can go up significantly from there. How much you’ll pay for life insurance will depend on your age, your health, and whether you’re buying term life insurance or permanent coverage.

It also depends on your age and the company you buy coverage from. However, a 30-year-old man in excellent health may have eligibility to purchase a 20-year term policy with $1 million in coverage from Bestow for as little as $43.50 per month.

Permanent life insurance, high-risk life insurance, and life insurance for seniors can cost significantly more, although the exact premiums you’ll pay depend on your age, your health, and various other factors.

Is Life Insurance Worth It?

Life insurance is worth it in every scenario, but that’s especially true for those who do not want to face the consequences of not having life insurance. If you can’t imagine how your family would pay bills or keep food on the table if you passed away, for example, you’ll want to make sure you have this important coverage in place.

Also, keep in mind that you don’t have to buy an expensive life insurance policy with all the bells and whistles. If you’re on a budget, you can focus on cheap term life insurance coverage with a basic death benefit only. You can also shop around and compare quotes to find the best deal.

Even if you can only afford enough life insurance to pay some of your bills and your final expenses, that’s definitely better than nothing.

On the flip side, buying enough life insurance coverage to pay your mortgage and your family’s living expenses for years to come can be the best gift you could ever give. If you can afford to buy enough life insurance to replace 10 to 20 years of your salary upon your death, this purchase will be well worth it in terms of the peace of mind you receive in return.

How We Found the Best Life Insurance Companies

When determining our methodology, we decided to consider several major factors that are unique to the life insurance industry. Not only did we compare ratings for financial strength from A.M. Best, but we also looked at customer service rankings from third parties like J.D. Power and complaints in the National Association of Insurance (NAIC) database.

Other factors we considered include available coverage options, the availability of online quotes, available rider options, and each company’s application process.

Ultimately, we aimed to include life insurance companies that offer above-average ratings from third parties, easy online quotes, and several coverage options available.

Summary of the Best Life Insurance Companies of July 2024

- AIG: Best for Competitive Premiums

- Haven Life: Best for Quick Coverage

- Bestow: Best for No Medical Exams

- Health IQ: Best for Healthy Senior Citizens

- MetLife: Best for Group Life Insurance

- Legal & General: Best for Coverage Up to $10 Million

- Prudential: Best Broad Coverage Options

- Mutual of Omaha: Best Customer Service

- New York Life: Best Life Insurance and Investment Services

Bottom Line – 9 Best Life Insurance Companies – Updated 2024

Choosing the right life insurance is vital to ensure financial stability for your loved ones in unforeseen circumstances.

There are different life insurance providers who each excel in specific areas, from competitive premiums to customer service.

Whether you’re considering term life, whole life, or another type of policy, these companies offer trustworthy coverage options. It’s essential to compare and understand each provider’s unique offerings to find the best fit for your needs.

Life insurance not only provides peace of mind but also lays the foundation for a comprehensive financial plan. Prioritize it, compare options, and select the best to safeguard your family’s future.

I put my money in an IUL with an annual contribution option for the premiums but now i want to bring my money out since i have reservations about an IUL, i noticed it wasn’t listed as available policies to consider in this article. Could you advice?

I really can’t Nnambi. Check with the issuer.

Does anyone know how to get general terms and conditions of insurance products, (e.g. life types) and supplementary (e.g. critical illness, hospital cash benefits, etc.) to be able to compare definition of risk covered as well as exclusions?

Hi Marc – There’s probably not single source. Mostly you have to get information from the companies individually and do your own comparison. That’s why it helps to work with an insurance broker who represents multiple companies.

I have read this blog completely by which I can say that this blog is very helpful. I have also write a blog about best life insurance company in usa at iinsurancee.com. If your are interested about this topic best life insurance company in usa then please read my blog at iinsurancee.com.

Thanks

This post is very incomplete. Northwestern Mutual is not even mentioned. NM is the HIGHEST rated company and has been for a long time. They have been ranked #1 for the longest time with AAA ratings. I’m surprised MassMutual isn’t mentioned either. This article may be directed to unhealthy people or people with smoking habits but not for the healthy people, NM, Mass, or NY Life is the way to go.

With the amount of mentions for Genworth, it would seem as though they might be sponsoring a portion of this article. Genworth is not worth working on the life insurance side of things anymore (besides servicing existing policies). They even made the mistake of getting into the LTC game and ended up losing due to the persistence of clients keeping the policies.

Hi Jon – The quality of an insurance company does depend on who’s doing the rating, and what the specific criteria are. It would be impossible to come up with a single list that would include all carriers in every category. I guess what I’m saying is that it would be impossible to construct a list that would satisfy everyone in all circumstances.

I put Nationwide Whole Life Insurance on my son 18 months before he committed suicide. I understood the policy must be in effect for 2 yrs before paying in full but you are at least due the premiums back. They continued to take premiums from my checking account two months after his death. It has been 5 months and they have not paid anything. They keep saying they need information that I know has been sent

I’m sorry for your loss JoAnn, and sorry for the hassle that you’re getting on this. I would contact the company and ask to speak with someone in management. If that doesn’t work, you might have to contact your state’s insurance commissioner. A brief letter, including copies of the suicide clause in the insurance policy and a death certificate should move this forward.

Many of these carriers are good carriers and rated highly, but do not base your decision on just ratings alone. For instance, the website doing the review of these companies has Genworth Financial listed as one of the best life insurance companies, do they know that Genworth stopped selling life insurance and annuities in 2016 and are only servicing old business? Be careful, work with someone local or at least someone that has knowledge on every company.

Initial quote (around $10/mo) was amazing, so I went on Haven’s site and filled out application (hated to do online, since so many companies are getting hacked). I’m a healthy 42 year old female. After filling out medical information, the quote was $27.50 per month for $100k minimal term life coverage and only temporary until a medical exam was performed. Maybe that’s a reasonable rate, but your article states no medical exam required. Also, I felt the initial quote was misleading.

Genworth is awful. They were just bought out by a Chinese holding company and have horrible insurance products and are poorly rated. This post is obviously just an advertisement for these companies. You can not be serious!

Hi Hunter – Did you have a bad experience with them? This list is actually based on third party ratings of the companies, so it’s more general in nature. That doesn’t prevent someone from having a bad experience.

This is an excellent post, Absolutely agree to these list of Insurance companies. Life insurance nowadays are very important to all of us, we don’t know what will happen tomorrow or the near future. thank you for sharing

Nice Sharing!

I was just looking your post about good life insurance company. You have briefly discussed about your ideas. I got the best advice from your post. You say that right life insurance matters in life. Keep it up!

Good helpful information. Life insurance really is important, I wish I didn’t wait so long to get it! Anyways, great info.

I am going to purchase Long Term Care Insurance (not Hybrid policy). Do you have a similar list of companies for LTC? Appreciate your work, thank you!

@ Jean Insurance companies that offer long term care insurance are changing frequently. Many top carriers that used to offer LTC policies are now out of the market. One company that still offers LTC insurance is Genworth. I’m not saying they are the best company but they have been offering the product for quite some time.

Feel free to contact our office if you would like a quote from them and other insurance companies to find you the best rate.

I am sure you have made a decision by this time on what LTC carrier to go with, but if not can give you some advice. We work with all of the major LTC carriers and the only two that I trust are Mutual of Omaha and Thrivent. The other carriers have taken huge rate increases. Rate increases are going to happen, it’s the nature of the game, but you need to look at the rate increase history and if you look at MOO you will see the largest ever taken with them is 28% (in some instances this is 100% less than others). If you look at Thrivent financial, you will see that they had a 59% rate increase in 2007 but they spread it out over 5 years and have not taken any since (pretty good when Genworth has policies that have been on the books for only 6 years and have taken 2 rate increases, one being 48%). Thrivent also has a 5 year rate lock guarantee, no other traditional carrier offers this. You can purchase Thrivent through non Thrivent agents, you just need find out where they are, typically Midwest and me specially, Sioux Falls, SD area. If you have any questions I would gladly help, I help protect people’s assets ever day with LTC and work with both traditional and hybrid products.

When it comes to LTC standalone policies, I wouldn’t trust any company except Northwestern Mutual. Their underwriting guidelines are the most strict. This, in turn, means that they are careful with who they insure so that when the time comes to pay the claims, they are able to do so. NM’s dividend is the highest payout in the industry due to their financial strength. Be careful when choosing an insurance carrier (for life, disability, long term care, etc), because the stronger the company, the better suited they are to pay a claim.

NewYork life shares the same amount of financial strength does Northwestern Mutual but, New York life has been around for a hundred and seventy two years and paying dividends for the last hundred sixty four years straight. Track record on that stands alone for itself. Northwestern Mutual hasn’t been around that long and hasn’t been paying dividends for that long. Also, you’ve paid the largest dividend in history but the dividend interest rate payout is different for every company so comparing that to what you just said is inaccurate. With our long-term care we have only increased our prices once in 2008. We have the most competitive long-term care plans in the market we even have a plan where you could pay in a lump sum or 10 years or 20 years and if you still don’t like the product will give you your money back.

Why would you want to go with Genworth when they just sold their business to China

Great list of insurance Insurance Companies. Thanks for sharing valuable information.

I was just looking for listings of the best life insurance companies in America. Your list ranking the top 10, was the most comprehensive. Super list of companies and helpful information too. I was not even aware that Haven was part of Mass Mutual . Thanks!

Thanks Eric!

Hi, thanks for this great article. I just recently obtained my LAH license in NYC and am looking to associate with a carrier that provides the best life insurance coverages, as well as voluntary supplemental benefits.

Do you think you can advise on this? I know there is the Aflac and Colonial Life, but how do their Supplemental benefit compare to other larger carriers?

Thanks

FYI, I am in the process of filing complaints against Banner Life with both my state’s and their state’s insurance regulators.

On two universal life policies (same product) taken out on the same person for the same amount at the same time they charged me over 30% more than my sibling (both policies had premiums fixed for the first ten years).

So at the end of ten years my sibling was able to surrender the policy and receive back roughly $75,000, but at that same time there was no cash value in the policy I held.

The insurance agent who sold those policies flat out told us they would never do business with Banner again.

Maybe they’re OK for term…