As easy as it is to use credit cards to pay for unexpected expenses or anticipated major outlays, high interest rates can keep those loan balances outstanding for a long time. A better strategy may be to take a look at personal loans.

These are unsecured installment loans that are generally available for any purpose. Not only do they have lower interest rates, but at the end of the term, the loan is gone forever.

We compiled this list of the 10 best personal loans for 2024 to help you find the right one for you.

Table of Contents

Our Picks for Best Personal Loans of July 2024

Here are our picks for the 10 best personal loans for 2024, with more information on each provided in the summary reviews below:

- Credible: Best for Fair Credit

- LendingTree: Best for Comparison Shopping

- Fiona: Best for High Loan Amounts

- Marcus by Goldman Sachs: Best for Debt Consolidation

- SoFi: Best for Recent College Grads

- LightStream: Best for Home Improvement Loans

- Best Egg: Best Customer Service

- Payoff: Best for High Debt-To-Income ratios

- Upstart: Best for Limited Credit History

Best Personal Loans – Company Reviews

Credible: Best for Fair Credit

Minimum/Maximum Loan Amount: $600 to $100,000

APR Range: 7.49% APR – 35.99% APR

Fees: Varies by lender

Loan Terms: 24 to 84 months

Minimum Credit Score: 580

Credible isn’t a direct lender but an online loan marketplace. That means you can complete a single application on their website and receive personal loan offers from multiple lenders. Credible also offers mortgages, credit cards, student loans, and student loan refinances.

Because it’s an online loan marketplace, there are participating lenders who will make loans to borrowers with credit scores as low as 580.

That makes Credible the go-to personal loan source for people with fair or average credit. That’s important because people with lower credit scores are often those who most need personal loans.

But not only do they offer personal loans, mortgages, and credit cards, but also student loans and student loan refinancing.

Credible will pay you $200 if you can find a lower personal loan rate from another source. That practically guarantees they provide the lowest rates.

LendingTree: Best for Comparison Shopping

Minimum/Maximum Loan Amount: $1,000 to $100,000

APR Range: 4.37% to 35.99% APR

Fees: 0% to 10%

Loan Terms: 24 to 144 months

Minimum Credit Score: 585

LendingTree is another online loan marketplace offering personal loans for up to $100,000 with terms as long as 12 years. And like Credible, it’s also a source for mortgages, credit cards, and car loans.

Based on our search on the site, LendingTree has no fewer than 11 lenders providing personal loans. Not only does that include some of the biggest personal loan lenders in the industry, but also some of the lenders we’ve listed in this guide.

Fiona: Best for High Loan Amounts

Minimum/Maximum Loan Amount: $1,000 to $100,000

APR Range: 4.99% to 35.99% APR

Fees: Varies by lender

Loan Terms: 24 to 84 months

Minimum Credit Score: Varies by lender

Fiona is a financial services platform that offers personal loans for just about any purpose. You can borrow up to $100,000, with rates starting at 4.99% APR and terms ranging from 24 to 84 months.

Like Credible and LendingTree, Fiona is an online loan marketplace where you can get quotes from competing lenders by completing a single application.

Marcus by Goldman Sachs: Best for Debt Consolidation

Minimum/Maximum Loan Amount: $3,500 to $40,000

APR Range: 6.99% to 19.99% APR

Fees: None

Loan Terms: 36 to 72 months

Minimum Credit Score: 660

Marcus by Goldman Sachs may be the perfect personal loan source for debt consolidation. That’s because they offer terms ranging from 36 to 72 months, with current interest rates ranging between 6.99% and 19.99%. That will enable most borrowers to consolidate and eliminate credit cards with interest rates well above 20%.

Marcus by Goldman Sachs is also famous for its high-interest online savings accounts. That can be the perfect platform for both paying off all debt and accumulating fresh savings.

SoFi: Best for Recent College Grads

Minimum/Maximum Loan Amount: $5,000 to $100,000

APR Range: *8.99-25.81% APR

Fees: None

Loan Terms: 24 to 84 months

Minimum Credit Score: 680

*Personal Loan Disclaimer: Fixed rates from 8.99% APR to 25.81% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 05/19/23 and are subject to change without notice.

Not all applicants qualify for the lowest rate. The lowest rates are reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, your creditworthiness, your income, and a variety of other factors.

Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-6%, which will be deducted from any loan proceeds you receive. See Personal Loan eligibility details.

Not all applicants qualify for the lowest rate. The lowest rates are reserved for the most creditworthy borrowers.

Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including your creditworthiness, income, and other factors. See APR examples and terms.

Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by automatic monthly deduction from a savings or checking account.

The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Direct Deposit Discount: To be eligible to potentially receive an additional (0.25%) interest rate reduction for setting up direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A. or eligible cash management account offered by SoFi Securities, LLC (“Direct Deposit Account”), you must have an open Direct Deposit Account within 30 days of the funding of your loan.

Once eligible, you will receive this discount during periods in which you have enabled payroll direct deposits of at least $1,000/month to a Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements, to be determined at SoFi’s sole discretion.

This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a loan.

SoFi is practically synonymous with student loan debt refinancing, which was the original purpose of the company. But it has dramatically expanded its product menu to include other types of loans, including personal loans and credit cards.

They also offer comprehensive financial services, including investing, budgeting, banking, insurance, and credit scores. And if you’re one of the 3.5 million SoFi members, you may even have access to free financial advisors.

LightStream: Best for Home Improvement Loans

Minimum/Maximum Loan Amount: $5,000 to $100,000

APR Range: 2.99% to 19.99% APR

Fees: None

Loan Terms: 24 to 144 months

Minimum Credit Score: High, but not specified

LightStream is the online personal loan program for Truist Bank (formerly SunTrust). The company is a direct lender, offering personal loans up to $100,000 for just about any purpose.

They charge low rates with terms of up to 144 months. The ability to stretch your payments over 12 years can make LightStream the perfect source for a personal loan for home improvement.

However, LightStream is also on the higher end of the personal loan qualification spectrum. Their loans are designed for those with good or excellent credit, including no history of delinquencies.

They also require that you be well-established financially, and own real estate and financial assets.

Best Egg: Best Customer Service

Minimum/Maximum Loan Amount: $2,000 to $50,000

APR Range: 5.99% to 35.99% APR

Fees: 0.99% to 5.99%

Loan Terms: 36 or 60 months

Minimum Credit Score: 600

Best Egg has a strong reputation for customer service. The company has a Better Business Bureau rating of A+, which is the highest rating the agency provides.

Meanwhile, they also score 4.89 out of 5 stars among consumers reporting to the BBB. That’s extraordinary, considering consumers often harbor something less than positive feelings about their lenders.

Best Egg is a direct lender, with loans provided by New Jersey-based Cross River Bank. Though the minimum credit score requirement is 600, the company requires a minimum individual income of $100,000.

Payoff: Best for High Debt-To-Income ratios

Minimum/Maximum Loan Amount: $5,000 to $40,000

APR Range: 5.99% to 24.99% APR

Fees: 0% to 5%

Loan Terms: 24 or 60 months

Minimum Credit Score: 640

Payoff (now rebranded as Happy Money) is a direct online lender providing personal loans. But unlike other personal loan lenders, these loans are available only for debt consolidation. That may be why the company calls itself Payoff.

Loans are available in amounts up to $40,000, with rates as low as 5.99% APR. You’ll have a choice on the loan term of either 24 or 60 months. But expect to pay an origination fee as high as 5%.

The big advantage with Payoff is that they accept higher debt-to-income ratios. While most personal loan lenders will allow the ratio to go as high as 40% or 45%, Payoff will consider borrowers with a debt-to-income ratio as high as 50%.

Upstart: Best for Limited Credit History

Minimum/Maximum Loan Amount: $1,000 to $50,000

APR Range: 3.09% to 35.99% APR

Fees: 0% to 8%

Loan Terms: 36 or 60 months

Minimum Credit Score: 600

Upstart offers personal loans and other financing arrangements. That includes auto loan refinancing, medical loans, and home improvement loans. You can borrow as much as $50,000 with rates starting as low as 3.09% APR.

With a minimum credit score requirement of just 600, Upstart will be a good choice for borrowers with average or fair credit.

But the big advantage with Upstart is that they’ll consider borrowers with a limited credit history or even no credit history at all. However, if you fall into this category, it’s likely that loan amounts will be more limited.

Best Personal Loans of 2024

| LENDER | LOAN AMOUNT RANGE | APR RANGE | FEES | LOAN TERMS RANGE | MINIMUM CREDIT SCORE | FEATURES |

|---|---|---|---|---|---|---|

| Credible | $600 – $100,000 | 7.49% – 35.99% | Varies | 24 – 84 months | 580 | Online Loan Marketplace, Multiple Loan Offers |

| LendingTree | $1,000 – $100,000 | 4.37% – 35.99% | 0% – 10% | 24 – 144 months | 585 | Online Loan Marketplace, Multiple Lenders |

| Fiona | $1,000 – $100,000 | 4.99% – 35.99% | Varies | 24 – 84 months | Varies by lender | Online Loan Marketplace, High Loan Amounts |

| Marcus by Goldman Sachs | $3,500 – $40,000 | 6.99% – 19.99% | None | 36 – 72 months | 660 | Debt Consolidation, Favorable Loan Terms |

| SoFi | $5,000 – $100,000 | 8.99% – 25.81%* | None | 24 – 84 months | 680 | Diverse Financial Services, Member Benefits |

| LightStream | $5,000 – $100,000 | 2.99% – 19.99% | None | 24 – 144 months | High, not specified | Online Personal Loan Program, Low Rates |

| Best Egg | $5,000 – $40,000 | 5.99% – 24.99% | 0% – 5% | 24 – 60 months | 640 | Excellent Customer Service, Direct Lender |

| Payoff | $1,000 – $50,000 | 3.09% – 35.99% | 0% – 8% | 36 – 60 months | 600 | Debt Consolidation, High Debt-To-Income Ratios |

| Upstart | Up to $50,000 | 3.09% – 35.99% | 0% – 8% | Varies | 600 | Financing for Various Purposes, Inclusive Credit History Assessment |

Personal Loan Guide

What Is a Personal Loan?

A personal loan is an unsecured loan made by a bank, credit union, or online lender. Because it is unsecured, qualification is based entirely on your income, debt-to-income ratio, and credit history. After all, the lender has no collateral to seize if you fail to pay.

Lenders typically lend between $1,000 and $50,000 (or more). The loans usually have a fixed interest rate, a monthly payment, and terms of up to five years.

In most cases, there are no restrictions on how the proceeds are used or the loan purpose. They can be used to make major purchases, pay for upcoming events (such as weddings and vacations), or for debt consolidation.

People wondering how to get out of debt, especially a lot of credit card debt, often turn to a personal loan to consolidate their high-interest debt into a financial vehicle with a low-interest rate.

Further, a personal loan will give you the benefit of a single monthly payment. And because it has a specific term, you’ll eventually pay the debt off completely.

If you do, the real question is, Should I consolidate my debt? That’s because using a personal loan to pay off debt doesn’t actually eliminate the debt but rather consolidates several debts into a single loan.

How to Find the Best Personal Loans

Personal loans are available from financial institutions such as banks, credit unions, and online lenders. But while you may be able to get a low-interest personal loan from your bank or credit union, the loan amount may be limited to no more than a few thousand dollars.

Online lenders offer higher loan amounts and are generally more accommodating to those with lower credit scores. We’ve included lenders that will accept a credit score as low as 580. Many banks and credit unions set the minimum score much higher.

Even though personal loans are issued by many different lenders, the terms and conditions are remarkably similar from one loan to the next.

When comparing lenders, look for the small perks or differences between their offers, such as loan funding within the next business day or no late fees.

We favored lenders with low minimum credit score requirements, longer terms, higher maximum amounts, and few to no fees.

It’s important to understand how to get a personal loan approved. Personal loans can come in both unsecured and secured loan options.

The former means that you won’t have to put up an asset as a guarantee that you’ll repay the debt, while the latter type does require collateral such as a car or other high-value property.

If you choose an unsecured personal loan, lenders will be interested in the reason for the loan, even if there are few restrictions.

For example, the likelihood of approval is higher if you are taking out a debt consolidation loan because you will be paying off high-interest lines of credit rather than incurring new debt.

The lenders also look very closely at your income and credit to determine eligibility. You’ll need stable employment (or self-employment) and an income that will comfortably accommodate the new loan payment.

Lenders will usually accept a debt-to-income ratio of up to 40%. But some may allow it to be higher if you have excellent credit.

What is a good credit score? That really depends on the lender. But a really good credit profile is one that will get you the lowest personal loan interest rate possible. While 580 may be enough to get a loan, you may need to score well above 700 to get the best rate.

Part of having good creditworthiness will be maintaining a relatively low credit utilization ratio. That’s the amount you owe on your credit lines divided by your total credit limits. The lower the utilization ratio, the higher your credit score will be.

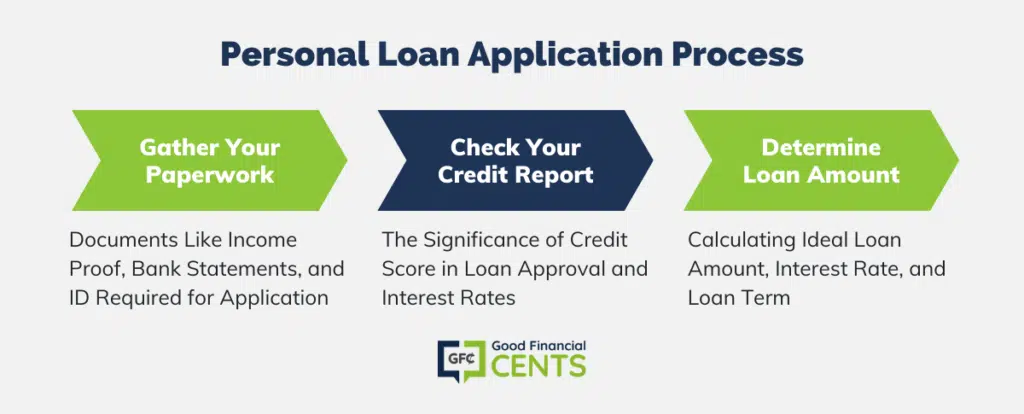

How to Apply for a Personal Loan

The application process for a personal loan is fairly straightforward.

- Gather Your Paperwork: You’ll likely need to provide proof of income, bank statements, proof of your U.S. citizenship, and a legal form of identification.

- Check Your Credit Report: Credit itself may be the single most important part of applying for a personal loan. While a higher credit score increases the likelihood of approval, it will also get you a lower interest rate. That’s important because interest rates have a wide range for personal loans.

Remember that your potential lenders will conduct a credit inquiry, so try to submit your applications around the same period to lessen the hit on your score.

- Determine How Much Money You Need to Borrow: Personal loan amounts usually top out at around $40,000 or $50,000, though a small number of lenders will go as high as $100,000. Do the math and see what interest rate you can afford and what your ideal loan term is.

As you can see from the list of lenders in this guide, the interest rate range is incredibly wide. It can be as low as 2.49% or as high as 35.99%.

When you complete your loan application with an online lender, you can get a rate quote in as little as a few minutes. You will need to submit supporting documentation for your income and other financial disclosures, but you can expect the loan to close and be funded within just a few days.

How to Prequalify for a Personal Loan

That’s as easy as going on the website of any of the online lenders we’ve included in this guide. You’ll complete a short online application, which will ask for basic information. You will be expected to supply your employment and income, as well as your estimated credit score range.

Based on that information, you’ll be presented with a loan scenario from the lender without a hard credit check. If you’re making an application with an online loan marketplace, you may get several loan offers.

Once you have the offer(s) in front of you, you can decide if you want to go ahead with the loan. If you do, the loan will usually be closed and funded to your bank account within a few days.

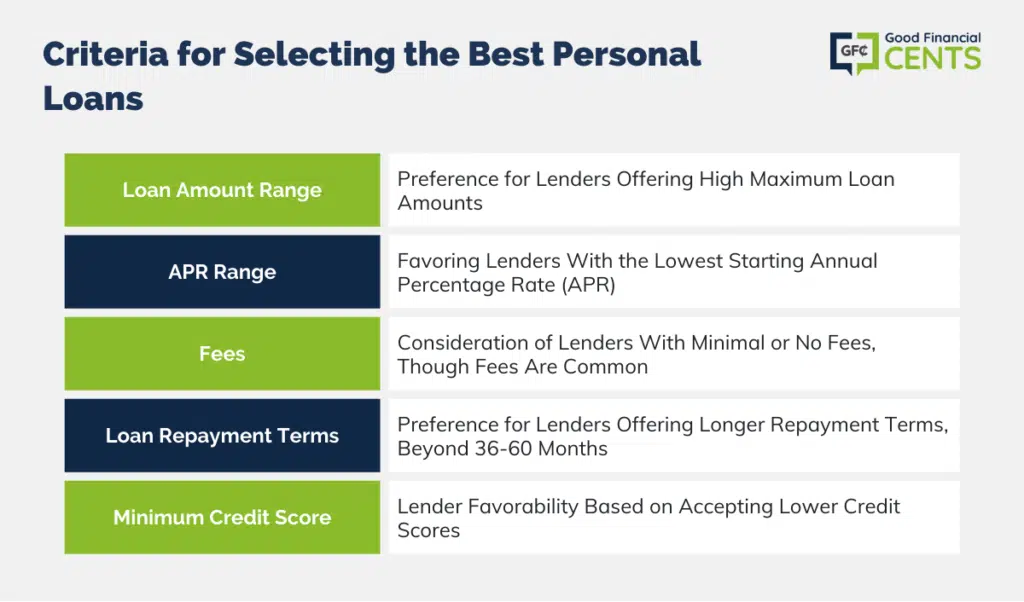

How We Found the Best Personal Loans

We used certain very specific criteria to come up with this list of the 10 best personal loans for 2024.

Those criteria include:

- Minimum/Maximum Loan Amount: We favored those lenders offering high maximum loan amounts.

- Annual Percentage Rate (APR) Range: Though the range is wide among personal lenders, we favored those with the lowest starting rate.

- Fees: Our preference was for lenders that charge no fees, but fees are not unusual among personal loan lenders.

- Loan Repayment Terms: Though the typical term is between 36 and 60 months, we leaned toward those lenders offering longer terms.

- Minimum Credit Score: The lower the credit score accepted, the more favorably we considered the lender.

We also considered the special features and niches each lender offers to their customers. Those are listed within the summary review for each.

Summary of the Best Personal Loans

One last time, here is our list of the 10 best personal loans for 2024:

- Credible: Best for Fair Credit

- LendingTree: Best for Comparison Shopping

- Fiona: Best for High Loan Amounts

- Marcus by Goldman Sachs: Best for Debt Consolidation

- SoFi: Best for Recent College Grads

- LightStream: Best for Home Improvement Loans

- Best Egg: Best Customer Service

- Payoff: Best for High Debt-To-Income ratios

- Upstart: Best for Limited Credit History

If you’re looking for financing for a project that’s too big for credit cards — or maybe you just want to get rid of your credit cards — a personal loan can be the perfect solution. Any one of the lenders reviewed in this guide will be an excellent choice.

Final Thoughts – 9 Best Personal Loans of 2024

Considering the high-interest rates associated with credit cards, personal loans emerge as a favorable option for managing unexpected expenses or major expenditures.

This compilation of the 9 best personal loans in 2024 showcases their value, offering lower interest rates and a chance to eliminate debt over the loan term.

Ranging from fair credit to limited credit history, these lenders cater to diverse needs. Features like comparison shopping, high loan amounts, and debt consolidation further enhance their appeal.

If you’re seeking financial flexibility beyond credit cards, these top personal loan providers offer reliable alternatives.

Leave a Reply