We all get busy and let the “little things” slip through the cracks sometimes.

This, however, wasn’t a little thing. In the hustle and bustle of the holidays, building a new home, a second child on the way (and now here) a “little” bill was overlooked and wasn’t paid.

Table of Contents

This wasn’t my Direct TV bill or the electricity bill… It was my annual premium for my 30-year term life insurance policy! (gasp).

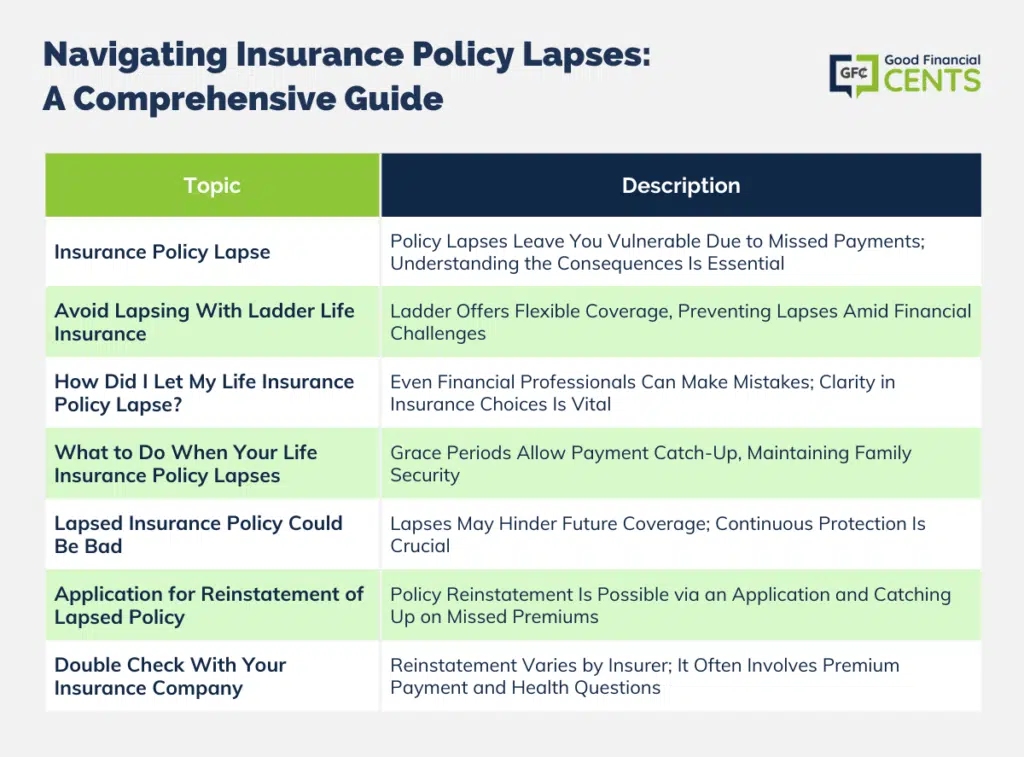

Insurance Policy Lapse

A month had passed before I realized that my insurance policy had lapsed. Frantically, I called the insurance company to find out what my options were.

In case you ever let any different types of life insurance policy lapse, here’s what you need to know.

Avoid Lapsing With Ladder Life Insurance

A payment slipping through the cracks is one reason your policy might lapse, but it isn’t the only one.

Sometimes individuals run into unexpected hits like job loss or the expense of caring for a sick loved one and find themselves unable to afford the policy premiums they originally agreed to.

Enter the dynamic life insurance policy. With a life insurance company like Ladder, there’s no need to default on payments.

If you find your policy is too much to bear, or conversely, you need more in force, you can adjust your life insurance policy to meet your changing needs.

Laddering down your coverage, as the company refers to it, can help make your premiums more manageable and keep your policy in force whatever life brings your way.

How Did I Let My Life Insurance Policy Lapse?

I know what you’re thinking. He’s a CERTIFIED FINANCIAL PLANNER™ professional and he let his life insurance policy lapse?

Right now I have 3 separate term life policies. When my wife and I first got married we purchased a $250k 30-year term life policy on myself.

My initial intention was to let the $250k lapse, although I later decided to just keep them all. I told my wife of my intent, but she thought that I meant to let the $500k policy lapse. Whoops!

Note: Here’s my post that discusses how much life insurance you should buy.

What to Do When Your Life Insurance Policy Lapses

So, your policy has lapsed, now what do you do?

Insurance Policies Have Grace Periods

When I called the insurance company, I learned through the recording that they have a grace period. When you pay your premiums regularly, your policy remains “in force,” but when you miss a payment, your life insurance company is required to give you a 31-day “grace period” in which to catch up.

At the end of the grace period, if you haven’t submitted your back premiums to the life insurance company, your policy will lapse.

This is basically what happened to me. I was fortunate to be in a financial position where there wasn’t a real problem letting the policy lapse. I had plenty of other coverage to take care of my wife and kids.

Even if I had to go through the medical exam again, I know that I would still have received a preferred rate because of my excellent health. (Working out and eating healthy pays off!) Don’t let my luck fool you. Be sure to stay on top of your life insurance policies.

Lapsed Insurance Policy Could Be Bad

Many of the top-rated insurance companies, when offering life insurance coverage to an individual, don’t check to see if the individual has had coverage before, or if that coverage has lapsed.

Some life insurance companies do check to see if you’ve had coverage lapses in the past.

If you have, they may choose not to offer coverage to you in the future, which means you’ll have a very hard time finding the protection you and your family need, even if you’re able to better afford it than you were in the past.

Application for Reinstatement of Lapsed Policy

When your policy lapses, I learned that it isn’t necessarily the end of the world for your life insurance protection. I was informed that you can request an application for reinstatement.

(You can see the picture of the application above). I simply had to answer a few health-related questions and enclose the check for the missed premium amount.

Double Check With Your Insurance Company

Each life insurance company handles the reinstatement process differently, but in general, you’ll be asked to pay all of your back premiums, and you’ll only have about five years within which to request a reinstatement. As long as your health status hasn’t changed, reinstatement can be very simple.

Final Thoughts on Policy Relapse

If your health has changed, however, it may not be possible to have your old policy reinstated – another reason to be sure that you keep the policies you have in force.

Policyholders must be vigilant in safeguarding their interests. Policy relapse can be a significant setback, especially for those whose health conditions have shifted over time. Reinstating an old policy under such circumstances can prove challenging, underscoring the imperative of maintaining active policies. The consequences of a lapse could lead to higher premiums, less favorable terms, or even outright denial of coverage.

My dad bought a life insurance policy from United life insurance company back in 1997 which is now named kemper life insurance, he forget about the policy I assume, he died in 2012 and they found my new address this November they sent me a letter stating he has a payout and I need to make a claim, I thought wow ok I’ll make a claim but the policy they say only for 300.00 dollars, should I look into the company to see if that’s a fair amount after all these years. Thank you

My term life insurance policy lapsed because I questioned the change in premium and the change of certificate number and wanted to be sure I knew which policy I was paying. there had been over a period of years several policies with this administrator. I requested a reinstatement but the administrators of the plan, which I had paid into regularly for over 30 years, have refused to reinstate me. On the phone, I was told by a pleasant rep that they had sent a reinstatement to me with an invoice, which I did not receive, possibly because they neglected to put my apt # in the address and it was never delivered to me. So they terminated me for a 2nd time. Every appeal I have made with courtesy and documentation and full explanations, signed and scanned, followed by calls, and ultimately all I get from them is a form letter that the carrier denied my request. But the carrier said they wouldn’t do that, that it is up to the administrator. It isn’t a huge amount of money left in this term policy but it’s become a matter a principal. It seems unethical, unprofessional, uncaring, and poorly managed and I wonder how many others have faced the same negligence as I with this company.

I pay my mums life policy which she had with old Mutual for +/-15 years and same has lapsed

due to financial problems and i have tried to re-instate but was’nt successful.

I instructed bank to to double debit but unfortunately bank took an amount of R 17000 from my account which i did not arrange with them as the bond always goes off my husband’s account.

I don’t know what to do please help.

Hi Mercia – You need to speak with a local attorney who might be able to help. It looks like you’re not in the US, so there’s no advice I can give.

My mailing address has changed I haven’t been getting my mail on a regular basis my life insurance has lapsed I need to reinstate my old address is 15336 falling waters rd Wmspt md my new address is 14621 Falling Waters Rd Wmspt md I would like a new bill sent to me so I can reinstate my life insurance Thank you Dee Griffith

Hi Dee – Contact the company and see what the process is. But most will allow you to reinstate the policy if you make up the missing payments. Of course, if it’s been a year since you made the last payment, they may have other requirements, like medical qualification.

I started a Policy for my son in about 1987 with Prudential Insurance company at £25 per month. I got divorced in 1995 and unfortunately one of the things that suffered was paying the monthly premiums. Is there any way I can trace the payments made as it seems unreasonable for Prudential to keep those years of paying into a Policy because I allowed it to lapse the money is lost.

Hi Alan – The fact that you mentioned the premium payment in pounds tells me you’re a resident of the UK. You’ll have to check with the insurance laws there, specifically those in place back in 1995. You’ve got some serious research to do!

I HAVE UNIVERSAL LIFE POLICY BUT I WAS TOLD NEW YORK LIFE AGENT I NEED TO BUY WHOLE LIFE POLICY BUT AGENT SOLD ME WRONG POLICY WHEN I KNOW THEN MY MONTHLY PRIMERS GO UP I ASK TO AGENT WHAT GOING ON WHY MY PAYMENT GO HIGH THEN I STOP TO PAY MINTHLY PRIMERS THEN COMPANY SEND ME LETTER YOUR POLICY HAS BEEN LAPSE I PAID REGULAR AUGUST 2012 TO JAN 2017 NOW I ASK TO COMPANY GIVE ME MY MONEY BACK MY AGENT TOLD ME NO MINEY BACK PLEASE HELP ME

would love to help but nothing I can really do. I would suggest you contact your state’s insurance commissioner about the matter.

What are the lapses of credit card ? Help me guys

Hi Alvin – I’m guessing you mean lapses due to an invalid credit card. You should be able to put a new card on file for the payment, then make up any missed payments to reinstate the policy.

I had accidental life insurance for almost 20 years. I accidentally let it lapse my question is I was told that my life insurance company is supposed to give me some money back on all the money I have given them is that true. I had a policy on both me and my Husband for 35,000 each thank you

Hi Lois – It depends on what the policy says. Read the “fine print” and see if it says that. If it does, contact the company and remind them of that provision.

I have coverage through Liberty National Life Insurance. I have 2 policies. Both for 50,001. One for my daughter and one for my youngest son. My oldest son passed with cancer and his policy was with them also but was less in value. I bought the policy in January 2010. My daughter was 5 and my son was 2. The policy lapsed in Aug. 2013 on the 2 policys in question. Due to a mess up from the (NEW) agent they sent out to open a new policy on my nephew when he came to live with me.. I had moved and wanted to switch the auto draft from my old checking acct to a new bank that was local. The old one I kept open but had no bank near me. When the new agent tried to send it all in he messed it up. Conveniently enough he didn’t mess up the auto pay for my son that pasted. But, the other 2 policies I have been trying to get them to let me pay the reinstatement fees. It clearly states in the policy I have 5 years. That time will end in August. There first excuse was we have no agent’s in your area. Then when I drove to the closest office to file my clothes as claim for my son that passed they told me they couldn’t find the policy. Well I’ve struggled since 2015 mentally because my husband died on my birthday.We had no coverage on him. My grandfather died on Thanksgiving that year. My son was diagnosed with cancer Jan 2, 2016. My son’s step mom died on July 3, 2016. My step dad died July 26, 2016. Then my son passed a day after my Birthday Nov 18, 2016. Last but not least my step mom passed on Jan 27th, 2017. With all that said, my life has been a get up and do what I can till the last couple of months. I’ve started to find myself and realized I have no coverage on my other two and they are fighting me. I have the 2800.00 that it will cost to reinstate it but they want me to take a whole life for 20k for each child and that will equal the amount I was paying before per child. Daughter’s policy was 14.92. Sons policy was 15.96. No they are trying to say some other stuff that makes absolutely no sense. Something about the policy being over 50k would cause me some type of tax issue. I ask for more info on what they are talking about but he said he will have to get it to me. I simply told him just to reinstate me before he left. That was after 2 hours of listening to him telling me they couldn’t find the policy numbers. So I sent him receipts from online with policy numbers. Then today he said, “can you take a picture of the policy where it states that you have 5 years to reinstate?” Why don’t they want my money??? Most people would love someone giving them money. I just didn’t want to loose the 3 and a half years I have in it. Plus after they reinstate the policys I will only owe 12 more years instead of 20. Am I being unrealistic.??? Any advice is appreciated. Thanks in Advance

Hi Tammie – You’ve got a real mess on your hands. I’d start by sending that explanation to your state insurance commissioner. Getting them involved might get the insurance company to cooperate. But I do think you’ll have to find the provision that allows you to reinstate for up to five years. You should include that in your letter to the insurance commissioner. If you don’t have that, you may not have much of a case. The better course then would be to start two new policies with a new company, one with a better reputation.

Hi this is what happened: i mistakenly joined some policy about 3months back. It was a mistake so i stopped deposing money into my account..because i was scared they’ll take it. They sent me a text saying my policy has lapsed..so does this mean they will not take my money??? BTW im a student

Probably not. Since the policy is lapsed, there’s no account to take payments for. If you want to reinstate it, contact them and see what the procedure is. You’ll have to pay all past due premiums if they do.

My parents been paying for term insurance and on the day he died we received a letter stating he insurance policy has lapse and they been paying for many years. He been in and out of hospital and nursing homes. The day he died we received a letter stating the policy has lapse. I think the insurance company was aware of his condition. My mom forward the payment for Dec. 2017 and they returned it with no explanation. January payment was mailed, and it was also return. I called the agent and his said they policy had expired, we received no notification that the policy had expired. What can I do?

Hi Dashie – See my response to Daphne on this page.

My parents been paying for term insurance and on the day he died we received a letter stating he insurance policy has lapse and they been paying for many years. He been in and out of hospital and nursing homes. The day he died we received a letter stating the policy has lapse. I think the insurance company was aware of his condition. My mom forward the payment for Dec. 2017 and they returned it with no explanation. January payment was mailed, and it was also return. I called the agent and his said they policy had expired, we received no notification that the policy had expired. What can I do?

Hi Daphne – Without seeing the policy, I’m thinking it may be a term policy, and the term expired. If so, your parents would have had to renew it. If they didn’t specifically do that, it may have lapsed. But you may want to discuss the situation with an attorney if you think they let the policy lapse. If you do, be sure to bring the policy with you, as well as evidence of the attempted premium payments.

I moved to another country and I failed to pay my monthly premiums for 3 consecutive months. I did not receive any grace period notice. Will my application for reinstatement be approved so I can pay all my past due premiums, continue paying and make my policy remains in force/active and claim for death benefits in the future? Please enlighten. Thank you. More power.

Hi Priscilla – Since it’s only been three months, call the company and see what the procedure is. There may not be any provision in the policy itself for reinstatement, but they may agree to it as long as you pay the back premiums. Just hope that they don’t require you to medically qualify, which may be the case.

Hi, my dad was in the military for 22 years, he had a policy through AFBA that he let lapse and passed a year and a half later. He had the policy for 17 years is there nothing that can be done?

Hi Kristy – Unfortunately not. You may approach them and request a return of the premiums paid, but it’s unlikely they’ll pay the face amount of the policy, particularly since so much time has passed. I wish I could tell you otherwise.

hi i would like to know that if a person has disclosed medical conditions in a policy upon commencement and reinstatement like high blood pressure,diabetes and if the outcome of the death was congestive cardiac failure (CCF) and chronic kidney failure(CKF) which i think the above two risk factors (HBP) and diabetes which can be the direct cause or is related to the death then can a claim be denied due to that these pre existing conditions were non disclosed upon reinstatement which that CHF and CKF was the direct cause of death and.I kindly await for your response.Thank u.

That’s a complicated scenario Lance. You should consult with an attorney in your state who specializes in insurance. There’s a lot going on there, and from the tone of your comment, I’m guessing the claim has been denied.

How long will it take before my life Insurance policy cancel after I stop paying ?

Hi Thadeus – Most policies contain language that they will cancel for non-payment after 30 days. Some will allow you to reinstate after that (up to a certain limit) but then they’ll require that you make up the missing payments. Others will require you to requalify at a new rate, which is basically making you buy a new policy.

My life insurance policy is lapsed and I paid renewal premium after 38 days through online payment so it will get revived ?

Hi Dikshit – It’s up to the insurance company. Some will reinstate after 30 days, some will go longer. Give them a call and make sure your policy is still in force. They may renew it, but require that you submit to a medical exam.

I have a life insurance police with minimum 2 years surrender value. but I paid for 1year and 2months. I want to terminate the policy because it has lapse for some years due to lack of payment of premium ( I was out of work for a long time and cannot afford to pay the premium again.

Please will the insurance company pay me back my principal accumulated premium and other benefits?

Thanks,

Henry Adedapo

Hi Henry – It’s very, very unlikely you’ll be able to get your money back at this point. If it was a term policy there isn’t any money to be returned. But if it’s a cash value policy, the cash value was probably used to pay more premiums, and is now gone. Unfortunately, since a few years have passed, there’s really nothing you can do.

When a whole life policy lapses will the current cash value be paid or is it lost due to the lapse?

Hi Steve – The cash value will be tapped to pay the premiums. Once the cash value is used up, the policy will lapse completely. If they do allow reinstatement, you will be required to pay the missing premiums out of pocket to bring the policy current. But if the lapse is beyond a certain permitted time frame, you may have to submit to a medical exam, and then charged a higher premium, based on your age and health condition.

Unbeknownst to me, my mother took out two whole life insurance policies when she was 74. They are now held through Jackson. She is now 91 and allowed one policy to lapse a couple of months. Her agent advised we attempt to reinstate, which we did with his help. After waiting two months for a decision and providing more health information, they have now denied her request to reinstate citing she doesnt qualify for the premium the policy was issued at. . She has invested $70,000 already into this $174K policy which is just gone!! Although 91, she is basically healthy, lives alone, still drives, and only has typical ailments of most elderly people much younger than her. We feel Jackson is just seizing any opportunity to cut her loose. Do we have any recourse??

Hi Carrie – You can try sending a letter to you state insurance commission, describing the situation, with a cc to Jackson. You can also speak with an insurance attorney to see what your options are (they’re a bit different in each state). Many policies have a lapse policy, that allow you to reinstate by paying the past due premiums. But I suspect that what they did was fully legal, so don’t be surprised if it doesn’t end well. $70,000 paid in 17 years – was it a cash value policy or term?

I just started going over some old paper finding. My husbands whole life insurance since 2007. I let it lapse in Nov. 2013 just forgetting due to my husbands illness. He passed on the 9th of Jan 2014. I contacted the Protective Life Ins.. Customer service told me to bad so sad. She could not give me any information because it was terminated. I could not recover any premium paid. Is there any other way to get my premium?

Hi Irene – Unfortunately since the policy lapsed your options are limited. I’d write the insurance commissioner in your state to see what your options on. Sometimes if you “shake the trees” you can get things to happen. Be sure to disclose/provide evidence of your husband’s illness and death. You’re only talking about a two month window, and that MAY count for something.

My father has been paying into an insurance policy for over 30yrs. I am not sure if it’s term, life, or what. But we recently found ano unmailed yearly payment. It was due Feb.2017. We mailed it as soon as it was discovered on June 16th 2017. Can anyone tell me what Nationwide does in situations like this. My father has suffered health issues in the past few years. He will probably be hard to get reinsured.

Hi Rachel – Since it’s only been a few months they might reinstate the policy if you send in payments for all of the intervening months. Basically, you’ll be bringing the policy up to date. But before doing that, check with the company to make sure they’ll agree to the reinstatement.

We had life insurance for my wife and paid with out a hitch for 9 years. My wife became ill in December 2016 I took time of work to look after her. I took my eye of the ball reguards banked Nguyen and January and febuarys payments did not come out of bank. They said they contacted me but anything addressed to my wife did not open. Said letter sent cancelling policy again did not see this . Wife passed away on the 24/5/17 coumpany wont pay can’t pay of mortgage etc is anything I can do. Wrote all this down to insurance coumpany don’t want to loose our home. Need help at wits end suffering depression with loss of my wife then all this. Alan

Hi Alan – I’d discuss this with the bank so that you know exactly what happened. I’d also get a letter of explanation from the bank, then forward it to your state insurance commissioner and ask for help. They may contact your insurance company and force them to look into it. There are no guarantees this will work, but it’s worth a try.

I am trying to replace a policy that lapsed. When Life insurance companies advertise you can by insurance with no medical exam is that a scam or is it real.

I know they ask medical questions but is it the law to come out and draw blood and take a urine sample. How do they know what type of health the person is in?

@Diane It is a real thing. You can read more about no exam life insurance here.

In short, they know because they’ll ask you some basic health questions over the phone. Depending on how you respond to them will determine if you get approved.

Also, no exam policies usually cost more than your basic term policies as you are paying for convenience.

I took out a policy on my ex-husband over 15 yrs. ago. Recently my daughter needed help with my grandson and I went out of state to help her. The policy lasped on April 3, 2017, I called the insurance office on April 7, 2017, I was told the policy would have to be reinstated and to talk with my agent. The agent informed me that my ex would have to take a physical

to be reinstated. He is now 70 and in pretty good health but,

I’m sure they will say he didn’t pass, after reading all the above comments. The agent told me that I have $30K in the policy. I would like to know what are the non forfeiture options, and Reduce paid up policy options. Which my agent didn’t bother to tell me about. If either of these options are worth pursuing and will he have to take a physical with the non forfeiture or Reduced Paid Up Policy or Extended term Policy. I’m not familiar with any of the 3.

Please advise.

@Diane I’m sorry to hear that about your term policy lapsing. I’m not sure why your life agent didn’t bother to tell you about the other options. Maybe he was waiting to see if your ex-husband could get his current policy reinstated?

Regarding the other options, it’s just a matter of requesting illustrations from your agent (or any other life insurance agent) to see what other options are available. There’s no cost to do this so it’s something you should consider.

My father bought me a policy through New York Life when I was a teenager. When he passed away in 2011 I stopped paying the premiums because they said the policy was under my name but he was the policy owner so there were a bunch of hoops that I had to jump through in order to cash out my own policy (more than just obtaining a death certificate). They told me if I stopped making payments, they would just deduct the premiums from the cash value of the policy until it zeroed out and then they would just void the policy altogether (which I was fine with because I have a different policy through my employer).

My mom received a letter from New York Life last month saying that they (NYLife) took out a loan to pay the overdue premiums and I now owe them over $5,000. Is that legal? Neither one of us gave any consent to them to take out any loan. Was the person I talked to at New York life a couple of years ago wrong in saying that the loan would just be voided after lack of payment?

Hi Tony – What a mess! You may need to contact a lawyer to investigate that. But there may also be language in the policy that allows them to do just that. If the policy doesn’t give them that right, then you should contact the company and let them know you didn’t authorize it, then go to your state insurance commission if that doesn’t work.

My father’s term life insurance lapsed due to non-payment in August of 2016 he was hospitalized at the time and has now passed away as of February of 2017 is there anything that we can do.. I have read that the insurance company may work with us perhaps not if I understand the unilateral contract please advise

@Alan The best thing you can do is contact the life insurance and explain the situation. If you don’t get an answer you like, try calling back and speaking to someone else.

AAA refused to honor the policy. I will never deal business with AAA Company.

My dad had a whole life policy for many years that lapse a couple years ago because his financial status changed. I have since then got him new insurance that I make sure is auto deducted from my account to ensure no issues occur. My question is can my dad get his paid premiums refunded back to him from that lapsed policy?

Thanks

It’s extremely doubtful Latosha. Life insurance companies may return premiums paid on an active policy if they determine that the cause of death was related to an undisclosed illness, injury or health condition (without paying the death benefit), but they don’t do it for lapsed policies. That’s because the policy was in force during the time that he paid the premiums, so he had the benefit of the protection during that time. Sorry this isn’t the answer you’re looking for!

I have been in this insurance over two years missed two payments and it lapsed shouldn’t they pay if something happen and just take out what’s owed

My grandmother had term life insurance on my mother. Both are deceased, my grannie died i n 2006 and my mother 2013. The policy lapsed in 2006, and my brother and I knew nothing of the policy until our mom died. I called the insurance company and they said we couldn’t recover any of the monies that my grannie made. Is this true and legal.

Unfortunately it is Angela. There is usually a grace period within which you can reinstate the policy, but seven years is well outside that window. Insurance companies can terminate a life insurance policy for non-payment of premiums.

I just reading up on life insurance I worked for a major clothing manufacture had life insurance though the company was with employed from1984- 1998….I paid the life insurance every pay period was not offered, that original policy. Can I still do anything!!!!

Even if the policy had lapsed 4 years ? she didnt realize that it had and when I figured it out was like Feb15th 2010 I called the agent he said she would have to pay something like nearly 1000.00 and that is all she got a month on social security, she took sudden ill in march and died april 4th 2010 before we could get them paid, and she had some kind of premium wavior on that policy, they wouldnt pay and Im pretty sure she should have been covered to some extent.

Dear Michael,

I purchased a 20 Year-Term-Life Insurance in May 21, 2002 and we forgot to check the policy. Recently, when I got back to Los Angeles, California on business trip, I contacted Jackie Fong, who worked for AAA Life Insurance, on January 15, 2016 and found out that our mother’s life insurance policy has lapsed in August 2015. As a result, I contacted the agent on several occasions suggesting that we would be happy to back-pay for all the months that we had missed the payments to keep the life insurance policy current. She, then, advised me that our mother will have to re-take the blood test, urine, and EKG exam in order to keep the policy current.

On April 1, 2016, AAA Life Insurance representative, Jackie Fong notified us that our mother reinstatement application has been declined due to medical record. We have done all we could by complying to AAA Life Insurance’s policy and the news of the policy being denied to reinstate has made us believe that things are kind of getting out of proportion provided that in 2002 my mother was able to pass the health checks. As of recent days, our mother didn’t qualify for the health exam because of her age and subsequently her health status has changed and subtle change like that should be aware and taken into consideration. Basically, AAA declined her policy because of her age and medical record. She is 14 years older now than she was in 2002.

Who should I contact?

Where can I file to protect senior citizen?

How do I file for fraud?

Any suggestions would be helpful. Thank you.

What happens when a person allows their life insurance policy laspse and then passes away? Can they receive the money that was paid into the policy?

@ Robyn

For a term policy, there is no cash value so there would be no money passed onto your beneficiaries.

If you have some sort of permanent policy (whole life, universal life, etc) then your heirs would receive the cash value.