Need to earn money within a day or a few hours?

Maybe you need to fill up your gas tank so you can get to work, or perhaps you have bills that need to be paid before your next check comes in.

Either way, it’s easy to stress out when your bank balance is oh-so-dangerously close to $0. And if you’re stressing over that, be comforted in the fact you’re not alone. According to CNBC, 63% of Americans are living paycheck to paycheck.

Fortunately, there are plenty of ways to make money quickly, either by making money at home or using your skills and expertise to earn cash. Some of the best ways to earn money quickly require creative thinking and hard work, yet others require hardly any effort.

Sure, you want to learn how to invest to feel financially secure later in life, but that will have to wait. If what you need is cash you can spend right away, consider these 21 ways to earn money within a day, a week, or a few months of time.

What Are the Best Ways to Make Money Fast?

Table of Contents

- What Are the Best Ways to Make Money Fast?

- 1. Work as a Freelancer & Earn Money Online

- 2. Build a Digital Real Estate Portfolio

- 3. Create and Sell Homemade or Digital Items on etsy.com

- 4. Sell Stock Photos Online

- 5. Start a Home Organization Business

- 6. List Your Home on Airbnb or Host Experiences

- 7. Work as a Virtual Assistant

- 8. Help Install Christmas Lights for the Holidays

- 9. Complete Home-Based Tasks Through Taskrabbit or Amazon Mechanical Turk

- 10. Answer Questions on justanswer.com

- 11. Become a Financial Coach

- 12. Become a Rideshare Driver

- 13. Deliver Food or Groceries

- 14. Take Care of Pets Through rover.com

- 15. Babysit Kids

- 16. Take Inventory of Your Items and Sell Stuff You No Longer Want

- 17. Sell Used Electronics You Don’t Need Anymore

- 18. Sell Off Unused Gift Cards

- 19. Take Surveys Online

- 20. Open a New Checking or Savings Account

- 21. Donate Plasma

- The Bottom Line – Making Money Fast

- Frequently Asked Questions (FAQs) on How to Make Money Fast

First off, you should know about the ways you can use your creativity and skill to earn money on the side. Some of these hustles can help you earn money within a day, yet others will require work to build up streams of passive income that can change your life.

1. Work as a Freelancer & Earn Money Online

Potential Money: $5 to $500 or more per gig

Have a skill you can use on the internet? You’ll have an opportunity to make extra money online. Currently, according to Zippia.com, over 36% of the U.S. population does some sort of freelance work.

If you have any skill that translates into work you can do online, you can find freelance gigs and start earning extra cash right away. This is true with freelance writing, graphic design, programming, or even helping others get their business organized.

You can use all kinds of platforms to start freelancing, including Fiverr. This platform lets you pick up easy work that offer a starting pay of $5, but you can use it to build up your portfolio and work your way up to higher-paying gigs over time.

Other platforms that facilitate gigs for freelancers include Upwork, Freelancer.com, and FlexJobs, to name a few. You can almost always create an online profile for free, and the amount of good money you can earn through freelance work is limited by how much time you want to put in.

2. Build a Digital Real Estate Portfolio

Potential Money: Unlimited

While you can invest in digital real estate that someone else has already built, building your own brand can be considerably more lucrative over time. Building a digital real estate portfolio can mean starting a blog to creating and nurturing an affiliate marketing site. However, digital real estate can also come in the form of a monetized TikTok account, an Instagram account, or even a heavily followed gaming account on Twitch.

I’m not shy about the fact this website has helped me earn millions of dollars over the last decade. Also, be aware that starting a blog isn’t that difficult or expensive but that there will be a major learning curve as you sharpen your online skills.

For the most part, it just takes time to learn all the ins and outs of running a digital real estate empire and monetizing every aspect of your brand. Like anything else, though, the first step to earning money online with your own website is getting started and seeing where the journey takes you.

Related: How To Start A Blog From Scratch And Make It Work

3. Create and Sell Homemade or Digital Items on etsy.com

Potential Money: Unlimited

If you love making homemade items or have a genuinely creative mind, you can make money the easy way by making items and selling them on Etsy.com.

Your homemade items could be anything from customized floor mats to unique Christmas ornaments or home decor and graphic design prints. The sky’s the limit when it comes to items you can make and sell, and the amount of cash you can make depends on your craft, the items you’re selling, and the market demand.

While Etsy does charge a small listing fee (20 cents per listing) and takes a percentage of each sale you make (6.5% of the total order amount), your start-up costs for this gig could be minimal. You can also boost your income over time by growing your audience and your sales.

The best part about Etsy is that you can start small and see what happens. You can also experiment with different items you make to see which sell fastest and with the largest profit margin.

4. Sell Stock Photos Online

Potential Money: $1 per Photo and Up

If you have a good camera and an eye for detail, consider taking stock photos and selling them to websites like ShutterStock or iStockPhoto. Websites like these need new photos they can market and sell to potential clients over time, yet they don’t necessarily want to take the photos themselves.

What kind of photos can you sell? Stock photos can be almost anything, but the best sellers tend to be generic photos of nature, roads, cars, and families.

The key to succeeding in this gig is taking a ton of generic photos to apply to a range of situations. From there, you can see which ones sell and tailor your approach to what works the best.

5. Start a Home Organization Business

Potential Money: $100 per gig and up

If you love to organize and want to earn some fast cash on the side doing something you’re good at, consider starting your own home organization business.

Home organizers are often getting paid $100 or more for each gig they take. You can use your skills and experience to help people organize their homes, garages, or office space.

While you can create and pass out flyers or advertise your business with platforms like Facebook Marketplace, you can also offer home organization on platforms like Care.com. This platform lets you set your own rates, and you can create a job posting or apply to jobs that others post.

6. List Your Home on Airbnb or Host Experiences

Potential Money: $15 per Booking and Up

If you live in a tourist area or another place that people frequently visit, you can market and sell all kinds of unique experiences to travelers who want to explore. You can host walking or food tours in your area, or you can teach people about something you know, such as gardening or glassblowing.

Examples of unique Airbnb experiences from a simple search include flying lessons in the Chicago area, in-person farm tours, and a fun campfire experience with cows to keep you company. A guy I know (Martin Dasko of Studenomics) even hosts coffee-drinking tours in his hometown, which people book and pay for regularly.

If you can come up with any kind of fun event people will pay for, you can host it with Airbnb and earn some easy cash along the way.

7. Work as a Virtual Assistant

Potential Money: $20 to $50 an Hour or More

If you’re looking for an awesome self-employed job opportunity you can do from home and you have plenty of online skills, consider working as a virtual assistant. People who work in this gig do many different online tasks for their clients, including writing newsletters, editing content, answering emails, and creating graphics. Most virtual assistants also juggle a handful of clients that assign them different tasks, and they can work flexible hours that fit with the rest of their life.

While the amount you can earn as a virtual assistant varies, most charge $20 per hour or more. According to Zip Recruiter they average $34/hour. Virtual assistants with the highest skill level can even charge $50 to $75 per hour. I can go up from there.

To find work as a virtual assistant, you can look for gigs on websites like Fiverr, Upwork, and FlexJobs.

8. Help Install Christmas Lights for the Holidays

Potential Money: Varies

Are you physically fit and enjoy rooftop views? You can find work installing Christmas lights around the holidays.

How much you can charge will vary depending on where you live, consumer demand, and the size of the homes that need decoration, yet you should be able to set a pricing floor of at least $100 for up to two hours of work.

How do you find side work installing holiday lights and decor?

Pass out flyers in neighborhoods where your target customers reside, or post an ad on Craigslist or Facebook Marketplace.

The best part? You can start this side hustle with almost no upfront investment if you have a ladder, or you can use your client’s ladders when you book a gig.

9. Complete Home-Based Tasks Through Taskrabbit or Amazon Mechanical Turk

Potential Money: Unlimited

TaskRabbit and Mechanical Turk are online platforms connecting you with all kinds of gigs that can lead to extra income. Examples of gigs you can get through these platforms include assembling IKEA furniture, hanging flat-screen televisions, or doing data entry work.

You can even help people move furniture or complete basic handyman tasks. When earning quick cash with either site, your best bet is to create a profile and search for work in your area to see what fits.

10. Answer Questions on justanswer.com

Potential Money: $2,000 to $7,000 per Month

If you’re a professional with a significant amount of expertise in a subject, you can make extra money online by answering questions using a website called JustAnswer.

This online platform says that some of their top experts earn $2,000 to $7,000 per month from home, and they accomplish this entirely by answering the questions paid users send their way.

The best part about this app is that you can work as little or as much as you want. You can also complete all the work at home and on your own time, and you can make money doing what you love.

What kind of experts does JustAnswer look for? Many of their questions go to professionals like doctors, lawyers, and veterinarians, but nearly any expert can use the platform.

11. Become a Financial Coach

Potential Money: $150 to $250 per Hour

If you’re interested in personal finance and want to turn your hobby into profits, you can also consider becoming a financial coach. Financial coaches don’t have the same educational requirements as financial advisors, so breaking your way into this industry is easier. That said, financial coaches are not legally allowed to offer investment advice. Instead, coaches help their clients with tasks like tracking their spending, getting on a budget, and planning for their long-term financial goals.

In other words, a financial coach with 20 clients they meet monthly could earn $3,000 to $5,000 per month (or $36,000 to $60,000 per year) with this gig. That’s quite a bit of money for a business with minimal start-up costs, but you will have to market yourself and find a way to get your first several clients to trust you.

12. Become a Rideshare Driver

Potential Money: $20 per Hour or More

If you have a reliable car and you want to earn money driving people around, signing up as a driver for Uber or Lyft makes a ton of sense. Both rideshare platforms have minimum requirements for vehicles you can drive, but your car will likely qualify if it’s relatively newer, clean, and safe.

With Uber, for example, your car needs to be 15 years old or newer, have four doors, and be free of major cosmetic damage or missing parts. Drivers also have to have a clean driving record and insurance on their cars.

How much you earn driving for Uber or Lyft can vary by quite a bit, yet the average seems to start at around $20 per hour. That said, drivers can earn much more during “surge pricing,” during peak travel times, or special events. Drivers for both platforms also get tips, so their earnings can fluctuate based on the generosity of their customers and how friendly and helpful they are.

13. Deliver Food or Groceries

Potential Money: $20 per Hour or More

Another gig that’s always hiring comes in the form of food delivery. Of course, we’re talking about delivering food and other purchases through platforms like DoorDash, GrubHub, or Postmates. You can even sign up to shop for groceries through platforms like Instacart and Shipt, which let you earn an hourly wage plus tips.

These side gigs let you work the hours and days you prefer, so you can set your schedule around your regular job and other responsibilities. Most food delivery drivers also earn $20 per hour or more, although pay can vary depending on the platform, the gig, and the tips you receive over time.

14. Take Care of Pets Through rover.com

Potential Money: $29 per Night or More

If you love animals and want to earn cash taking care of cats, dogs, and other pets, consider setting up a profile on a platform called Rover. This online platform can help you set up your own small business walking pets, feeding pets, or caring for them overnight in your home. Nightly stays can easily help you earn $29 to $50 per pet, and dog walking or feeding gigs can pay $20 or more.

This gig is also incredibly flexible since you can set up your availability and choose your work days through Rover.com’s online platform. You can also set minimum requirements for pets or be somewhat picky about the kinds of pets you’ll watch or care for. If you’re willing to take care of pets with poor health that need medicine administered or special care, you can increase your rates.

15. Babysit Kids

Potential Money: $15 per Hour or More

Maybe you love kids a lot more than you love people’s pets. In that case, you can look for babysitting gigs in your local area or find them through Care.com. While how much you’re paid will vary depending on the job, how many kids you watch, and where you live, you can easily earn $15 per hour and up with babysitting gigs.

While setting up an online profile can help you find this type of work, you may have better luck reaching out to people in your network. Tell people you know you’re looking for babysitting work or set up a job posting in Facebook groups you already belong to. Chances are good that, with some time and effort, you’ll find all kinds of people who need help with childcare in your area.

The best part about babysitting is that you typically get paid the day you do the job. You could babysit for a few hours and then walk away with cash.

16. Take Inventory of Your Items and Sell Stuff You No Longer Want

Potential Money: Varies

People may be willing to pay for the brand-name clothing you no longer wear, the treadmill you haven’t been on for years, or the antiques you inherited but don’t know much about. The key here is finding items you can sell, figuring out how much they’re worth, then posting them on reselling platforms.

Once you have sold off your own unwanted items, you can also consider flipping items from garage sales and thrift stores for profit. While any item you can sell for more than you bought it can work in this realm, some of the best items to flip for profit include brand-name sneakers, antiques, electronics, household appliances, and children’s toys.

The key to making money flipping items is doing your research upfront and knowing how much you can pay for something while still turning a profit. With time and experience, you’ll also find out which items sell the fastest and for the most money.

17. Sell Used Electronics You Don’t Need Anymore

Potential Money: Varies

You can also sell or trade in old, unwanted electronics for cash. Some of the best items to sell for money include phones, iPods, fitness trackers, tablets, and laptops, but any high-demand electronics will work.

While you can sell these items on any of the platforms we mentioned already (i.e., Facebook Marketplace, Craigslist, etc.), websites like ItsWorthMore, Decluttr, and Gazelle specialize in buying these items and may offer more cash than you can get selling on your own. Generally speaking, you’ll share details about your item and get an instant offer. However, you’ll have to mail them to each platform so they can be inspected, leaving you waiting weeks before you get your money.

Therefore, it may be better to sell your items yourself first. If you can sell your electronics on Facebook Marketplace, for example, you can meet the buyer in person and walk away with cash.

18. Sell Off Unused Gift Cards

Potential Money: Varies

Like most people, you probably have a stack of unused gift cards around your house. Some of them were likely given to you as a gift, but they aren’t doing you any good if they’re sitting in a drawer collecting dust.

Fortunately, you can sell used gift cards online using websites like Craigslist, Facebook Marketplace, or eBay. You can also use a website called CardCash to sell unwanted gift cards to popular stores. While this website will take a cut of your gift card balance to make a profit, you still get the chance to earn quick and easy money, and you can get paid via PayPal, ACH transfer, or a check in the mail.

19. Take Surveys Online

Potential Money: $3 to $10 per Hour or More

If you have free time to kill and you want to do something mindless to earn some extra cash, consider checking out the best online survey sites. A survey app (like Survey Junkie) will pay you money to answer simple survey questions, take online quizzes, or watch videos they post, and you can get paid via PayPal or with gift cards in most cases.

While you won’t earn a ton of money taking online surveys, you can easily earn $3 per hour or more by completing simple tasks from the comfort of your home. That’s easy money.

Some popular online survey sites include Survey Junkie, Swagbucks, Inbox Dollars, LifePoints, Vindale Research, Google Opinion Rewards, and Global Test Market. Another option called UserTesting.com even lets you get paid to give your opinions on advertisements and consumer-focused marketing strategies.

The best part? You can use several online survey sites at once, and you can do a lot of the “work” on your mobile device. This means you could be earning part-time income on your phone while you lay in bed or watch television at night.

20. Open a New Checking or Savings Account

Potential Money: $200 or More

If you have a certain amount of start-up capital and want to earn free money you can access in a few months, consider opening a new bank account. Start a checking or savings account that comes with a big, fat bank bonus.

Most bank bonuses require you to keep a specific amount of money on deposit for a few months, set up a qualifying direct deposit, or both, but you can earn anywhere from $200 to $500 for meeting their minimum requirements and keeping your account open for several months.

For example, Chase lets new customers earn $200 when they open a new Chase Total Checking account and set up a qualifying direct deposit within 90 days. However, you do have to keep a minimum amount of money on deposit or meet direct deposit requirements each month to avoid monthly service fees.

21. Donate Plasma

Potential Money: $50 to $100

If you have some time to kill and you’re not scared of needles, you can donate plasma and get some cash in return. Most plasma donation centers pay anywhere from $40 to $100 for your first donation, and your earnings typically stay fairly constant. However, donating plasma only takes a few hours, and you don’t have to do anything other than sit there and wait.

You can also donate plasma regularly to build up a regular income stream. Generally speaking, most people can donate twice every seven-day period or up to eight times per month. If you get paid $50 each time you donate, this hustle could help you bring in an extra $400 in cash every 30 days.

The Bottom Line – Making Money Fast

There are so many ways to earn extra income that it’s hard to keep track, but it’s important to remember that you can do more than one simultaneously.

For example, you could sell unwanted items in your home, donate plasma, and pick up odd jobs on Fiverr, all within the same week. You could even do all those tasks while watching someone’s dog and setting up an Etsy store to sell homemade crafts.

None of these will help you get rich over the long term. Instead, they can help you earn money quickly to buy groceries, pay bills, or cover unexpected expenses.

The good news is that most of these ideas make it easy to get started right away. The longer you wait to earn money in your spare time, the harder you’ll have to work.

Frequently Asked Questions (FAQs) on How to Make Money Fast

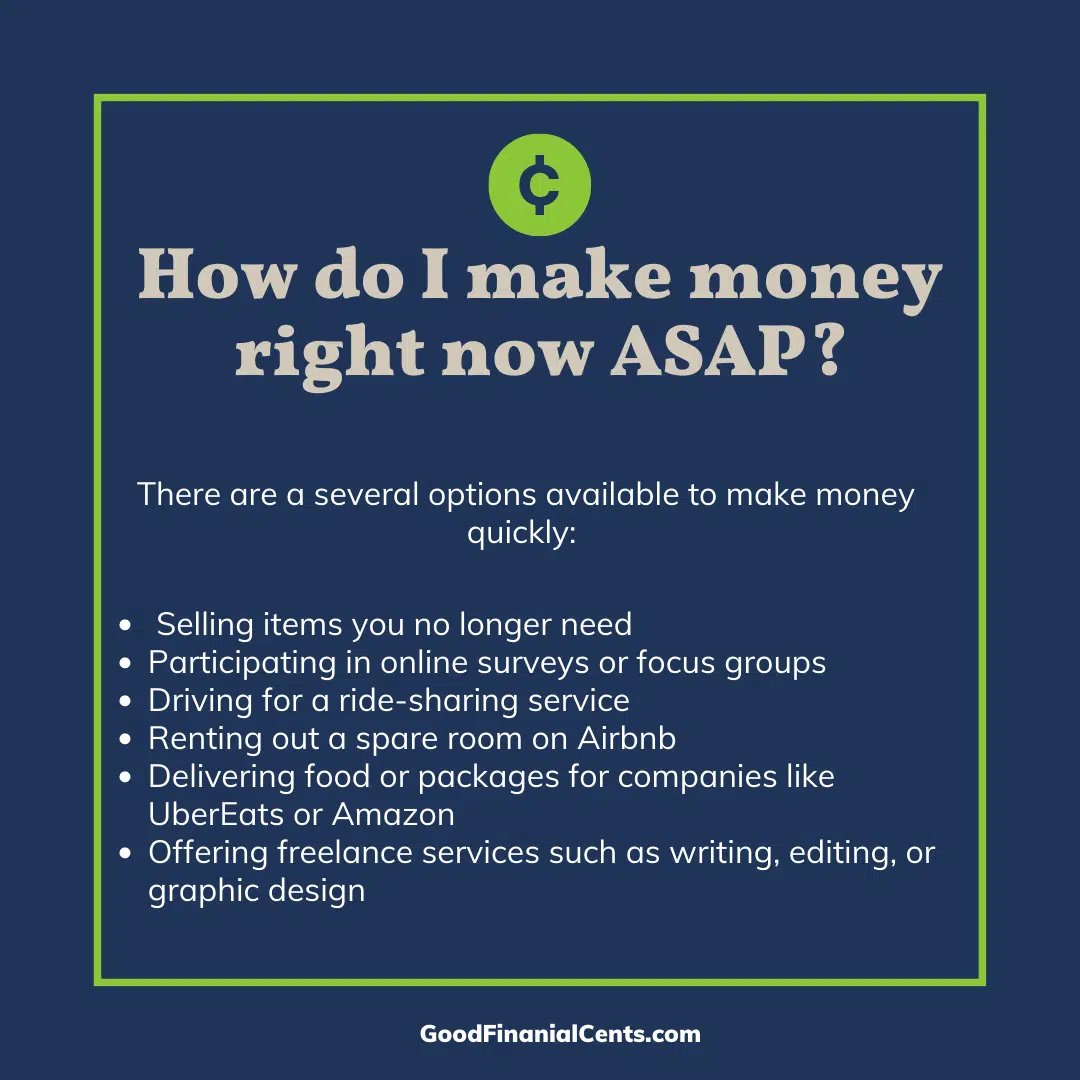

There are several options available to make money quickly:

-Selling items you no longer need or use

-Participating in focus groups

-Driving for a ride-sharing service

-Renting out a spare room on Airbnb

-Delivering food or packages for companies like UberEats or Amazon

-Offering freelance services such as writing, editing, or graphic design

-Investing in stocks or real estate

-Starting a small business or side hustle

If you’re short on time and need money right away, however, completing online surveys (like Survey Junkie), delivering groceries, or selling plasma may be the best option.

There are a few ways that you can make extra money in a short amount of time. You could offer to do side jobs for people in your neighborhood or start a small business doing something you’re good at. Other options include offering your services as a pet sitter, babysitter, or house-sitter.

Alternatively, you could also try to sell some of your belongings online or through a garage sale. Whatever route you choose, set aside enough time to complete the task and be productive!

There are several ways to make quick money at home. One option is to sell your stuff you no longer need online or through online marketplaces like eBay, Amazon, or Facebook Marketplace.

You can also offer pet-sitting, yard work, or house-cleaning services. Additionally, you could start a small business, become a virtual assistant, or work from home for a company that allows telecommuting.

Yes, there are many legitimate ways to make money online. Some examples include starting an e-commerce business, selling products through online marketplaces like Etsy or Amazon, or offering online services such as graphic design or writing. Online surveys, focus groups and remote data entry are also great options to make money from home.

I believed that my job was enough. I found this video and it changed my life! I was starting to see real opportunities manifest.

awesome!

Nice article 🙂 I see you have a lot of ways where you share your apartment and similar but what about the way to share your unused internet traffic? Im doing it right now and I use Honeygain for it. So, it makes me around $30 per month just by leaving this app running on my devices background. Plus, you can always use extra $5 coupon secret5 to add some extra earnings

in some cases if your hardrive cannot handle it it will fry your computers motherboard just an fyi not a safe process for your laptops at least not hp laptops

Thanks! Right now Im searching for a some kind of ways to make money online so this is very helpfull for me cause im BROOOKE. But I would like to share thing that I found recently – Honeygain. So, it makes me around $30 per month just by leaving this app running on my devices background. Basically this is an app that lets you sell your unused internet traffic via it. Plus, you can always use extra $5 coupon secret5 to add some extra earnings

Do you have any tips on how to convert a private label rights (PLR) ebook into

a saleable product without a lot of editing?

If it’s PLR you’ll have to make some edits to the ebook to not violate any trademark issues with the vendor you purchased it from.

wow Jeff, that is one heck of a list…

A lots of options for sure and probably a little scary for the beginner to try and decide on a direction.

Tell Jeff, as an online worker have you even come across or considered buying into a ‘built for you’ business?

Just asking because I have worked very hard to make a different online, but it’s slow work and sometimes I am tempted.

Cheers

carl

I went over this site and I believe you have a lot of great information, bookmarked

(:.

I am so grateful that large sum of money is now coming to me continually.

Thanks..GOD bless you sir.

Good strategies but still so old

Is there a place to sign up for giving talks about your life experiences to groups? For example, I am the mother of four special needs children and I think I could help moms new to things by sharing my experiences.

Hi Debera – I don’t know of any off hand, but try Googling it using different word combination. If you don’t find any, that may be a sign to start one yourself! You’ve got a lot to offer.

Start a blog girlfriend, you can really help people. From there you can share that you are available for speaking engagements. Also, YouTube….create your channel and help the world. Good luck!

With so many options to help you make money, only a person who is not determined can claim there are no ways to make money fast. Many of these are worth trying, thanks.

Thanks for sharing. Since you’re short on time, go online right away. Use groups on social media and public classifieds to sell everything you don’t need (bonus: you’re decluttering your home and getting a head start on spring cleaning). If you take clear photos and can write a few lines of fetching the copy, you could have hundreds or even thousands of dollars’ worth of offers by the end of the day.go to Home Jobs by Mom.

It’s also a good time to take advantage of the gig economy. Can you play an instrument, repair clocks, tutor someone in math, plan a party, paint signs, repair decks, or write calligraphy? Think far and wide about what you’re good at, and write an ad for yourself. Chances are, someone out there needs your expertise, no matter how small or inconsequential you consider your talents to be.

Thanks Adil!

What if you cannotdo anything and you have no time to develop the skills? Is it truly too late?

If you can’t do anything, then I guess you can’t do anything. Maybe you can later when you have more time.

Get and read the book ‘Strengths Finder’. It will help you identify your strengths so that you can determine what you are good at. Everyone, even you can do something. Have faith in your abilities.

Although there is some demand for every specialty, and at almost every skill level, one needs to look no further than this comment section to realize that people are no longer qualified, at an entry level, to proofread, edit, or write.

There is a reason people seek out those with, what used to be, a standard level of grammar comprehension. Again, browsing through any comment section easily illustrates that a high school level of education does not produce this, at least not in the U.S. anymore.

Well said, Scott!

You mentioned here a great big list of all the money making methods. I don’t think out left out anything. Thanks for such a post.

Thanks for this article, some tips are not bad indeed – but you will make only small money with it.

If you are serious with making money online, check my site (alex-dahlgren.com) learn my method, practice it, master it -> bank hard!

Alex Dahlgren

That’s true Alex, but we’re only talking about $100, and making it fast. This article is for people who only need a little bit of money in a hurry.

A good source of extra income is Power Lead System. Monthly charge of total $53 you get an all encompassing virtual Marketing Training in a box. You get lead capture and landing page templates you can edit. Auto responders, hosting, video training, email campaigns with a complete contact manager, virtual postcards, email swipes, everything all for just $53 per month. It’s $30 plus an optional Affiliate program for $23 that pays monthly residuals. long with the Affiliate you get a professional marketing system called Endless Leads by Max Steingart, no charge, it retails for $500, it’s yours while a member. You have to check this unbelievable web marketing system out. You will be impressed. All for less than $2 per day.

The best way so far to earn money is to gain some knowledge on a specific field and get a decent and stable job:) But this post is interesting to look at.

This is a very good read and I just bookmarked this page for further reading and reference.

There is a site named Helping Neighbor where you can easily make money! Register to become a Helper, setup your email alerts for the types of jobs you can complete in the areas you prefer so that you can receive paying project requests. Check them out at https://helpingneighbor.com/how-it-works/

I would love to get paid to and help someone out

I am very good with cleaning houses and will do laundry

Nicely laid out. However, the one thing I cannot stand with articles like these is putting words like “fast” in the title.

There is absolutely nothing fast about getting a part time job. Earning gift cards and such on sites like Swagbucks, and Inbox dollars is also anything but fast.

When lists like these are made you should use realistic options people can actually do NOW for money. Most of these are just fillers, you were better off making a smaller list of more useful suggestions that actually work “fast”.

If you would have bought a 100 dollars worth of bitcoin 5 years ago you would be a millionaire, here is another opportunity that many people don’t know about check it out

Great read, always looking for extra cash, Love your tips! I agree with you, Looking forward to seeing your notes posted. The information you have posted is very useful. Keep going on, good stuff.

Thank you for this valuable information. I have enjoyed reading many of the articles and posts contained on the website, keep up the good work and hope to read some more interesting content in the future.

Wow, I hadn’t heard of SwagBucks before. That’s so interesting! Online surveys also sound like a decent way to make some extra pocket money. I’ve had a fair bit of luck making extra money on Fiverr offering blogging services too.

I would recommend adding Upwork to that list. It’s a service like Fiverr but you can generally charge more and potentially make a living from it.

Great ideas and perfect for someone trying to pay down debt.

Hi jeff, this article was really helpful as a college student I can really use some extra cash other than my pocket money. Keep sharing such stuff.

I definitely need to look into selling off some of my unused stuff. I only have a small apartment so it’s time for a purge to make some more room I think. Plus it’ll make it look neat and tidy with less stuff!

This is great list of methods for money making!

I definitely agree with your message, starting small and making your way up is an effective way to make money, although it’s more of a long-term goal.

Thanks for sharing this article.

These idea are very nice because these idea is very useful for be a rich these are shortcut but the condition is you have to work hard and smarter

Recently I’ve been selling a bunch of old stuff on eBay. I had 3 spare smartphones (all Androids) lying around, so I got rid of them for $100-$200 each. Not bad at all.

Overall good ideas, but we need to define the idea of ‘fast 100 bucks. Swagbucks is pretty slow as an income resource and it would take a while, not to mention selling stock photos is not something you do in 2 days. I tried this 4 years ago with my close to pro’ photos and it took days to set up a small portfolio there with some outstanding work and yet made no sells.

Wow. This is a long list. Really like the way you put this together. I may have to give some of these a try, but renting out my bathroom may not be for me. I can image a few awkward conversations revolving around that!

We started renting out our spare bedrooms on airbnb and we’re really surprised to see how much demand there was.

So many on this list and they’re SO MANY MORE! A lot of these are little things like “Move Furniture” that your Grandma would pay you $5 for, but other things to like buy/sell website domains (maybe not fast) to creating templates for website companies.

Basically, any little thing you hate doing or know others hate doing, can be an opportunity to side-hustle to make some extra cash.

Awesome list, but let’s grow it over time!

These are awesome ways to earn quick cash. People often get carried away “trying” to earn money. The key is truly not to focus on “trying” to earn money. The key is to COMMIT to the small actionable steps to earn money. Know the big picture, but live by the small actionable steps.

Will take some time working through such an informative list, especially when finding what works for you is so important. Thanks for your hard research work in providing such useful content. Personally I prefer Blogging and Writing, publishing my own Products and eBooks.

Working as a business mentor, I get asked far too often by my liking about how to make quick money. Worse still, the amount people talk with about is not 100 buck its 1000’s of them!

Try make quick cash how would get my cash without problems how make quick cash what I need to do get the cash

How do you. Get fast cash

While I do agree with most of your money making tips, I have to strongly disagree with selling your blood.

I’ve been a blood donor for a few years now and donating blood too often can damage your health. Men can donate blood once every 3 months and women, once every 6 (I don’t know about regulations other areas, but they take things seriously over here).

I do love your last tip though 🙂 I used to smoke almost a pack a day and what actually motivated me to quit was money!

I know most people quit because they put their health first. I tried quitting for health related reasons a few times, and successfully failed!

However, when I realized how much money I actually spent on cigarettes, I was more motivated than ever to quit for good! 😀

Nice points By reading and applying this anyone can make money it would be so easy for everyone all because of you. Thank you so much for such wonderful blog.

Thanks for this article, some tips are not bad indeed – but you will make only small money with it.

If you are serious with making money online, check my site, learn my method, practice it, master it -> bank hard!

Alex Dahlgren

There are some good ideas in this post.

But the best option for me and everyone is affiliate marketing.

Sure it can be tricky when starting out.

Its not a sure fast cash method, but in the long run, if you build sites, get traffic (using traffic methods), if you learn and try hard you can make a lot of money.

Jeff Great post. Thank you for all the info, most helpful. I have recently started affiliate marketing. By copying a guy who has proven his ability many times over, it was a no-brainer to learn how to start affiliate marketing. I am already seeing results, it’s a great feeling.

Can you please tell me more about affiliate marketing? I have been researching but I am having a hard time figuring out how to get started! Thank you!

Hi Danielle – I presume you have a website or blog? If so, the easiest way to start is by signing up for an affiliate site, like Commission Junction. They represent hundreds of companies offering affiliate programs. But you can also contact companies directly, preferably those who’s products and services you actually use. Most company’s have affiliate programs now, so you can try signing up that way. They’ll give you a coded link to place on your site that will credit you for the sale when a reader clicks through to their site and makes a purchase.

If your looking for ways to make a quick buck, then most likely your probably broke and need it. The first one posted about signing up for chase doesn’t gel considering the fine print says you have to keep a minimum if $1500 in your account daily

Very thorough and interesting list! I really loved this post and wanted to thank you for sharing, very helpful. I am fortunate enough to make a full-time income and support my family working from home, and I know many others who do as well. One thing I have realized working from home and making money online for years now is that the more people you genuinely help, the more money you end up making. Helping others to succeed will in turn create you a large following of loyal customers. If you have a loyal customer base and followers, you then have the perfect target audience for your business.

I couldn’t agree more Marco!

i am taking a chance to prove myself, that of course, i can take my parents for haj if i get succeed from this work and get a lot of money and full proof myself that i never give up till my whole entire life from doing any type of working.

Jeff PERFECT! Wonderful post. Thank you for all the great data. Just the info I need to really evaluate my situation and goals. THANKS! Can’t wait to read all the others to come

MySurvey.com doesn’t pay out in cash. Maybe it used to but now it only offers points that are ‘equivalent’ to a certain amount of cash that can only be spent on items their partners sell….

I earn around 5-10 dollars a month by downloading apps on my phone and playing a couple games. It will not make you rich but I got a free $100 this past year for about 8 minutes a day of my time.

That’s about 48 cents an hour

GREAT then you have every solicitor with in a 5 thousand mile radius and more, hitting you up.

Some of these tips I haven’t seen before so thanks for that! I’m super impressed! I found this app through Google Play called Stow that I think should be included on this list. You can rent out unused space for others to store stuff in and make money from it! Kinda like AirBnB for storage. I absolutely love it! Their website is Stow.io I think

Thanks for the tip Natalia, that sounds like a good addition. Have you actually tried it? And if so, how did it work out?

Hey, I’m a 16 year old boy who is looking to donate some blood. Do any of you know where i can donate in Northern Ohio?

Hi Caleb – Not off hand, but you should Google it, or better yet, ask for recommendations from your doctor or the local hospital. Also, being a minor, you will likely need your parents permission.

How about sell your house and buy a fixer upper? I suggest getting one that needs minimal work in the kitchen and bath so on a weekend you can do the demo and remodel. You don’t want key parts of your house out of commission too long. Flooring, fixtures, landscaping, painting can be done as money and time allows.

Hi Andy – That would be good if you are prepared to invest a year or so of your time and effort. We’re going for fast on this list, and fix-and-flip usually isn’t fast. But it’s a good suggestion for someone who has the time to invest, and wants to make a lot more than $100.

This is a great list Jeff. One penny saved is one penny earned. Thank you for listing 1010 ways to make money fast. I would like to add something to what you have already told. Fiverr is a more than a 5 USD thing now. With standard and premium gigs feature been implemented, some graphic designers are making more than 100 USD a design. Even the web designers and copywriters can really make good amount of money in very short time with very less effort.

Hey Jeff,

The 101st choice is probably my favorite. If you need to save money quickly, you can get it easily by giving up smoking, drinking or even snack cakes and soda! You can easily save $1000 this way.

And the most common fallback option: selling stuff…why not make it a game, make money and downsize your house at the same time? It’s win-win.

Create a habit of selling one thing a week, and up it by one each week. One thing the first week, two the second, and so on…

You’ll get more efficient at selling things, whether eBay, Amazon or Facebook yard sale pages, and you’ll be increasing your sales income each week.

It’s all about putting in the work. Take action and get it done!

Cheers,

Kalen

Hi Kalen – What you’re describing is making the pursuit of extra money a lifestyle – I like it! There are chances to make some extra money all around if you keep your eyes and ears open.

Jeff have you ever considered adding something on price comparison sites for selling your used stuff? One of the fastest 100 bucks I have made so far was just from old textbooks and dvds on price comparison sites that give you the best offers. I know Bonavendi.com is a good but im sure there are others. Anyway would be interesting to see your take on the matter, the other ideas I found really creative though. Thanks for the read brother

Hi Bryan – Thanks for the suggestion and link. That is an excellent way to make money, and maybe I’ll cover it in a future post. Of course, it will be part of a list of several similar opportunities, like this article is.

This is a A+ website with great information to help you get on the right track with your money!

Very nice information about 100 Ways to Make $100 Fast and this is such a very nice blog and One of the best and easiest ways to make money fast is by selling what you have – or that you can acquire on the cheap. It also has a secondary benefit in that it keeps the clutter in your life to a minimum.

You can make money to buy groceries if you put some effort into programs such Inbox Dollars and Swagbucks as long as you are consistent. I tried the Amazon Mechanical Turk and became frustrated making pennies on end. That was a couple of years ago, so I don’t know how or if they’ve changed much since then.

That’s often true Shanetta. But you’ll never get anything out of any of these without putting in a serious effort. None fall into the get-rich-quick category, but just for some extra money.

One word. InboxDollars. It worked.

Amazing list, I think the easiest way to make additional income without any talent is to rent out a room. Having a roommate is not that bad and your wallet will thank you!

That’s true, just make sure you collect security upfront and have the rent paid in advance. Boarders can be a transient lot and can disappear at any time! Also be sure to do a background check! The tenant will be living in your house with you, and you need to know if there might be any problems.

Tenants sounds good, but can be a toxic problem as I recall before of one studying Religion and Ministry somewhere and claimed to be clean and laid back, but came to light by another tenant he stayed with to have a bad temper, bad attitude and never clean up his own dishes and have his stuff scattered in living room without first discussing with his roommate and always asked other roomie for rides and money as a moocher and would get pushy if his roomie refused as unable to at times.

These are legitimate problem tenants even if they have no history of violence, misconduct nor anything illegal.

Selling blood….there are very few companies that buy your blood. #1 reason being MANY people willing to sell their blood are not the type of people you want to receive their blood, ie drug addicts (not everyone). And if you can find a company willing to buy your blood you can only give it every 56 days (for whole bood). The most common blood product that is bought is plasma and you can only do that every 28 days (in New York state …which won’t buy blood anyways).

Plasma in KY can be given twice a week. They were paying me $60 a week for it. I am not a drug addict. I used the money to pay for gas to go to college. The downside, you can’t donate blood and plasma at the same time. I did not get paid for my blood, but I like to donate it.

Do you known where I can go to donat blood in California .

i just found your blog this morning, recommended by a friend jim hrbek. im glad he steered me here, i enjoy positive, uplifting and informative people. so thanks (i listed to a podcast on the way to work this morning too, with the shirt guy for compete everyday). im looking forward to seeking some new money waters to wade in from your experience.

I love and have talked a number of times about #18. If you are able to work just 1 hour of overtime a week it is like giving yourself a 2.5% raise. Who wouldn’t love that!

That’s #20 just to let you know 🙂

Jeff, Bookoo.com would be another great website to add. Akin to Craigslist, but far less creeps and scams 🙂 We have users that make good money selling their stuff. Just thought you might want to add it to the list. Let me know if you have nay questions.

I have cleaned house, done dog sitting and sold items I no longer need. I have complimented my retirement income by about $ 1000 a year paying for a plane ticket, rental car, bed and breakfast, food and attraction tickets for a 3 to 4 day trip. It gives me something to really look forward to. I always pay taxes on the service income I make. Always give value.

,

I’m Marie,

“And I have enjoyed every bit of this post , the comments are very helpful… Sincerely thank you all because I am looking for work at home with my mom these days having cancer.. Trying to find the time to spend with my parents is not always easy any more.. Well Happy Saturday everyone…!!! 🙂

Disagree with the photography idea. It may seem easy but there are those of us who have spent, in my case 10 + years learning the light, the technical aspects, the right way to pose… we have to keep pushing our prices higher because there are more people starting to eat away at the client base by undercutting…. and we’re trying to make money and feed families too. It only hurts an industry to undercut. Sorry. Good list otherwise, don’t do it as an expense to others.

Krystal, I understand what you are saying, but I have made money selling pictures online, and I am no pro. I can get great pictures of wildlife, tropical landscapes, and many things that other photographers may not be able to get. Should I not do this, so that other photographers can? I am also trying to pay bills and run a household. It seems that raising prices could eliminate some of your future clients. I occasionally get calls because someone can’t or won’t pay $250-$500 for someone to take pictures of their family on the beach. I also give them the CD of all of their photo’s, which many photographers won’t do.

Word! Just because you aren’t a professional doesn’t mean you can’t have a good amount of talent in a subject. If you can provide quality services to people who can’t or don’t want to pay high professional prices, then go for it! That’s the free market right there. You have just as much right to try and make money for yourself and your family from your talents as professionals do.

I’m really torn here. As a writer, I sympathize with you. I’ve looked again and again into freelancing, and consistently find that the rates other people are willing to work for make it an insulting waste of my time. (Like, $10/hour is what a 15-year-old babysitter makes, not a professional writer.) On the other hand, you really can’t ask others to not compete with you. On the plus side, in my (limited) experience, you do get what you pay for most of the time. My sister had a less-expensive wedding photographer, and she was definitely less than happy with the results. So …

One man’s trash is another man’s treasure. This is ever present in the sneaker world. I am an avid sneaker collector and a huge part of the culture is buying and selling your sneakers to keep updating your stock with your current favorites. I use a website called Kixify to buy and sell some of my sneakers and it is just like Ebay or Craigslist. Whenever I need money for whatever reason, I always look to see if I have a pair of shoes I am no longer in love with and willing to sell.

I am a little late posting this, busy due to the holiday season. I love finding ways to make extra money. I have been using ebay for about a year, and sometimes make as much as I do at my job. My regular job is doing things for people that they cannot or don’t want to do for themselves. I am a personal assistant, house sit for people who own beach houses, clean out and organize closets and entire houses. The bonus to organizing closets is that they don’t want what they clean out, so I can sell it on ebay too 🙂

How about reading tarot/oracle cards for donations, practicing reiki (alternative energy healing) for donations, performing massage for donations, or busking (public musical performance) for donations?

Great list… or shall I say great “rated PG” list.

Somebody should make a “100 illegal ways to make money” fast list. That should be exciting and fun.

Great tips! And I have to say, they work. When I was in Colorado I needed cash, so I put an ad out for house cleaning and picked up two nice steady paying gigs.

I had no experience in cleaning houses, but I was able to write the ad that spoke to my experience in other areas and my dependability.

Just think outside the box and put your plan in action!

A very well-researched article! Where I live, a quick and easy way to make cash is to teach home tuition to primary schools children. Teachers here aren’t that good so parents are always eager to get children extra help. And parents don’t even care if you have a relevant degree or not. You just need to read the child’s textbook and repeat everything the teacher taught at school and make the kid do his or her homework. How simple for us and how sad for the education system 🙂

Great list! I bet this took a while to compile, a nice level of detail and new ventures I had never heard of before.

One side project idea I like to make more money is the photography idea. My fiance are getting married next year and had trouble finding someone that would do the job for less the $3000.

I have tried the mystery shopping strategies, but found the amount of time required to fill out the DETAILED reports prohibitive for the amount money they are paying out.

Great list. My husband and I usually opt for selling our junk. It’s two birds with one stone: declutter and some extra cash. We recently had a yard sale and were surprised that we were able to bring in a couple hundred dollars on items we thought would never sell.

To add to your list, flip electronics. For example, I know a few friends who pre-ordered the new PS4 and then sold new for a hundred dollars more. Yes, there’s the upfront cost and there’s the risk of not being able to sell, but it works really well for some people.

i have used about 10 of these ideas prior to finding your site and i thank you for your more intense list great job for helping us find more ways to make money.

I love lists like these. My wife and I have done several of these things including babysitting, selling stuff on ebay or amazon, and we just recently had a yard sale (when the weather was better). Great list of tips.

Awesome and very complete list of ways to make extra cash. I’m checking some of these ideas out. Trying to save money for a trip next summer that I was “told” I couldn’t go on because we’re paying off debt. Hello! I just got a huge motivation to kick it up a notch! 😉

Great message, Jeff. When I look at big goals, or even incremental goals, I like to break them down into bite size bits. Earning $100,000 a year seems difficult in many situations, but it seems easier when you break it down to $8,350 a month, or roughly $280 a day. Sure, that is aggressive for many salaries, but there are many ways to fill the gaps with side income, owning a small business, consulting, freelance work, etc. The same concept works for any number or goal you want to reach. Find out where you are, and what it will take to reach the next step. It’s much more attainable when you make incremental goals.

My dream is to generate a passive income that is large enough for me to pursue a music career. By the way, I love the video blogs, they’re really awesome!

I used to want a Porsche cabriolet until I could buy one. I realized I didn’t really want an asset that would depreciate. I like having my money work for me. It is part of my value system that helped me achieve financial freedom at 38 years old (28 years ago)!